Aier Eye Hospital Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aier Eye Hospital Group Bundle

Curious about Aier Eye Hospital Group's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse service offerings stack up in the market, highlighting potential growth areas and established revenue streams.

Don't miss out on the full picture! Purchase the complete BCG Matrix report to uncover detailed quadrant placements for each of Aier Eye Hospital Group's services, offering actionable insights into where to invest for maximum impact and how to optimize existing operations.

Gain a competitive edge with our comprehensive analysis. The full BCG Matrix provides a strategic roadmap, enabling you to make informed decisions about resource allocation and future growth opportunities within the dynamic eye care industry.

Stars

Aier Eye Hospital Group's aggressive global expansion, highlighted by its July 2024 acquisition of the UK's Optimax Group and continued organic growth, firmly places it in the 'Star' category of the BCG Matrix. This strategic move into new, developing markets for ophthalmic services signals significant growth potential.

The company has set an ambitious target: overseas markets are expected to contribute 30% of its total revenue within the next five years. This objective underscores Aier's commitment to establishing itself as a dominant force in the international eye care sector.

Aier Eye Hospital Group's commitment to myopia prevention and control positions it strongly within the BCG matrix. This area is a significant growth driver, evidenced by their leadership in a national key research and development project in China. The increasing global prevalence of myopia, especially in children and adolescents, underscores the vast market potential for these services.

The company's strategic focus on scientific research and talent development in myopia management reinforces its competitive edge. For instance, by 2024, Aier has established numerous myopia prevention and control centers across China, aiming to serve millions of young individuals. This proactive approach taps into a critical public health concern, offering substantial market share opportunities.

Advanced refractive surgery services, including LASIK and SMILE, represent a strong "Star" for Aier Eye Hospital Group. This segment consistently shows high growth potential, driven by increasing patient demand for vision correction.

Despite a slight slowdown in growth in the second quarter of 2025, attributed to broader macroeconomic headwinds, Aier has successfully maintained stable average prices for these procedures. This stability, coupled with ongoing service optimization, underscores the robust market demand and Aier's leading position in this specialized field.

Integration of AI in Eye Care

Aier Eye Hospital Group is actively integrating Artificial Intelligence (AI) into its diagnostic and treatment services, showcasing a commitment to innovation. This includes AI-powered slit lamps for enhanced cataract detection and advanced retinal cameras for identifying various retinal issues.

This strategic adoption of cutting-edge technology aims to significantly improve both efficiency and accuracy in patient care. For instance, AI algorithms can analyze retinal images with remarkable speed and precision, potentially spotting subtle signs of diseases like diabetic retinopathy earlier than traditional methods.

The group's focus on AI-driven solutions positions it favorably to attract patients seeking the most advanced eye care available. This forward-looking approach is a key driver for future growth, as it differentiates Aier in a competitive market by offering superior diagnostic capabilities and personalized treatment plans.

- AI-powered diagnostics for conditions like cataracts and retinal diseases.

- Enhanced efficiency and accuracy in patient consultations and treatment planning.

- Attracting tech-savvy patients seeking advanced and precise medical solutions.

- Driving future growth through technological leadership in eye care.

Comprehensive Ophthalmic Research and Development

Aier Eye Hospital Group's dedication to comprehensive ophthalmic research and development is a cornerstone of its strategy, placing it at the vanguard of eye care innovation.

This commitment extends from fundamental research into the intricate mechanisms of eye diseases to rigorous clinical trials, fostering a continuous stream of novel treatments and cutting-edge technologies. For example, in 2023, Aier invested significantly in R&D, with a focus on areas like myopia control and age-related macular degeneration, aiming to solidify its position in high-growth segments of the eye care market.

- Scientific Commitment: Aier actively pursues basic research into the underlying causes of various ophthalmic conditions.

- Clinical Advancement: The group conducts extensive clinical trials to validate and refine new treatment modalities and surgical techniques.

- Innovation Pipeline: This R&D focus ensures a robust pipeline of advanced services and proprietary technologies, crucial for maintaining a competitive advantage.

- Market Leadership: By investing in R&D, Aier aims to lead in emerging high-growth areas within the global eye care industry.

Aier Eye Hospital Group's aggressive global expansion, including the July 2024 acquisition of the UK's Optimax Group, and its focus on high-growth areas like myopia prevention and AI-driven diagnostics, solidify its position as a 'Star' in the BCG Matrix.

The company's ambitious goal for overseas markets to contribute 30% of revenue within five years highlights its strong growth potential. Furthermore, Aier's commitment to R&D, evidenced by significant investments in 2023 for myopia control and age-related macular degeneration, ensures a pipeline of advanced services.

By 2024, Aier had established numerous myopia prevention centers in China, targeting millions of young individuals, and continues to lead in advanced refractive surgery, demonstrating consistent demand and market leadership.

AI integration in diagnostics, such as AI-powered slit lamps and retinal cameras, enhances efficiency and accuracy, attracting tech-savvy patients and driving future growth.

What is included in the product

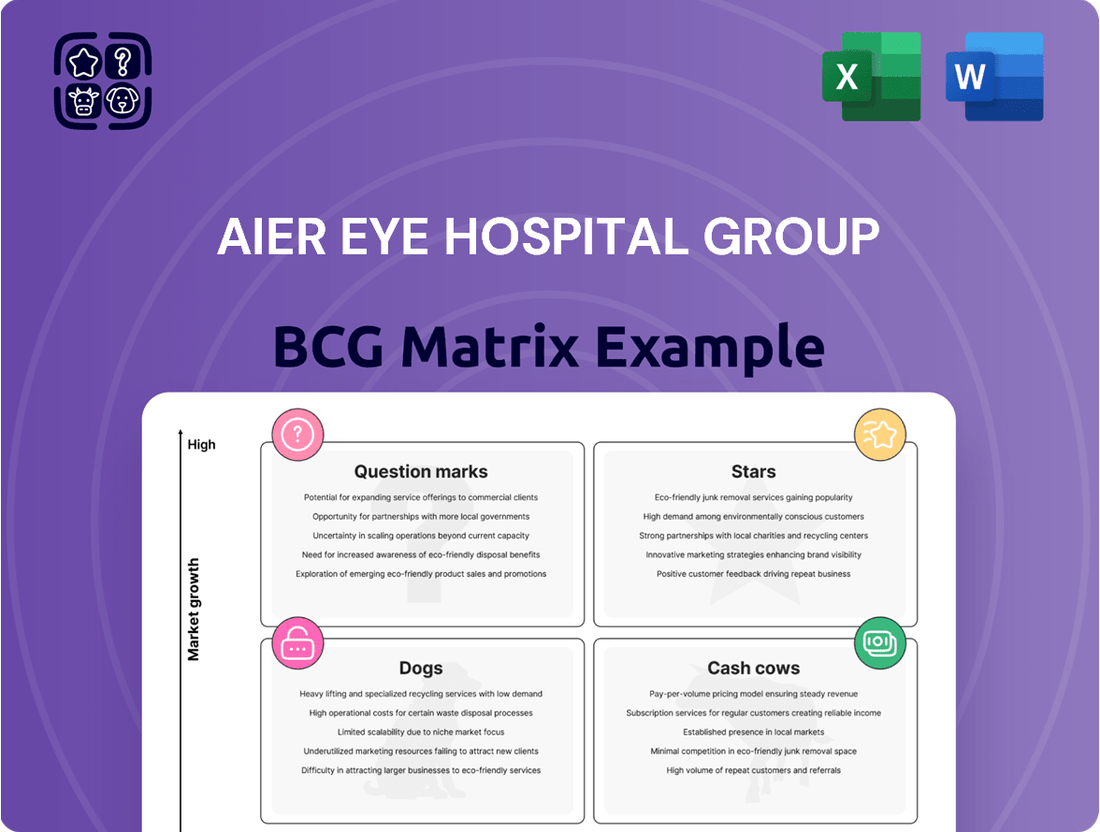

The Aier Eye Hospital Group BCG Matrix analyzes its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

A clear BCG Matrix visualizes Aier Eye Hospital Group's portfolio, easing strategic decision-making by highlighting growth and market share.

This simplified analysis helps pinpoint underperforming units and allocate resources effectively, alleviating the pain of inefficient investment.

Cash Cows

Aier Eye Hospital Group's extensive domestic hospital network, featuring 352 hospitals and 229 eye care clinics by the end of 2024, positions it firmly within the Cash Cows quadrant of the BCG Matrix. This substantial footprint across China captures a significant share of a mature and stable domestic market for general ophthalmic services.

The sheer volume of facilities ensures a consistent and predictable revenue stream, fueled by a broad and recurring patient base. This robust operational infrastructure generates substantial cash flow, essential for funding other ventures within the group.

Cataract diagnosis, treatment, and surgery form the bedrock of Aier Eye Hospital Group's service offerings, acting as significant cash cows. These fundamental procedures cater to a consistent and high-volume demand, especially with an aging global population, ensuring a stable revenue stream. For instance, in 2023, Aier Eye Hospital Group reported that cataract surgeries were a primary driver of its revenue, contributing substantially to its overall profitability.

Glaucoma management and treatment at Aier Eye Hospital Group represent a significant cash cow. This segment, much like cataract services, is a foundational offering that caters to a chronic eye condition, guaranteeing a consistent influx of patients who need continuous care and therapeutic interventions.

The persistent nature of glaucoma ensures a reliable revenue stream with minimal need for extensive promotional spending. In 2024, Aier Eye Hospital Group reported that its glaucoma services contributed a substantial portion to its recurring revenue, demonstrating the stability and predictable income this area generates.

Established Brand Reputation and Patient Trust

Aier Eye Hospital Group's established brand reputation and deep patient trust, cultivated over more than two decades, position its core services as significant cash cows. This trust is a direct result of their consistent delivery of quality care, leading to a loyal patient base that fuels recurring revenue streams. The group's expansion to become the world's largest eye hospital chain underscores this strong market standing.

This established trust translates into predictable and stable cash flow, minimizing the need for aggressive marketing or new service development to maintain revenue. Aier’s consistent patient referrals are a testament to their brand equity, ensuring a steady demand for their established treatments. For instance, in 2023, Aier Eye Hospital Group reported a revenue of approximately ¥20.4 billion RMB, with a significant portion attributed to these core, trusted services.

- Strong Brand Equity: Over 20 years of operation have solidified Aier's reputation for reliable eye care.

- Patient Loyalty: Trust leads to repeat business and consistent referrals, a hallmark of cash cow products.

- Stable Revenue Generation: Core services provide predictable cash flow, requiring minimal reinvestment for growth.

- Market Leadership: As the world's largest eye hospital chain, Aier benefits from economies of scale and brand recognition.

Medical Optometry Services

Aier Eye Hospital Group's Medical Optometry Services are a cornerstone of its business, acting as a significant cash cow. These services, encompassing the diagnosis and management of a wide array of eye conditions, generate a consistent and predictable revenue stream. Their broad appeal across diverse patient demographics ensures high facility utilization, solidifying their role as a reliable income generator for the group.

The comprehensive nature of these optometry services means they are not a one-off transaction but rather foster ongoing patient relationships. This translates into recurring revenue as patients return for follow-up care and management of chronic eye diseases. For instance, Aier Eye Hospital Group reported total revenue of approximately RMB 15.07 billion in 2023, with its core medical services forming the bulk of this figure. The steady demand for managing conditions like glaucoma and diabetic retinopathy underpins the cash cow status of these offerings.

- Foundational Revenue: Medical optometry services provide a stable and recurring income base for Aier Eye Hospital Group.

- Broad Patient Appeal: Catering to various eye diseases attracts a wide demographic, ensuring consistent service demand.

- Facility Utilization: These services drive regular use of Aier's extensive healthcare facilities.

- Financial Stability: The predictable nature of medical optometry contributes significantly to the group's overall financial health and cash flow.

Aier Eye Hospital Group's established network, comprising 352 hospitals and 229 clinics by the close of 2024, firmly places its general ophthalmic services within the Cash Cows quadrant. This extensive reach captures a significant share of a mature domestic market, ensuring a consistent revenue stream from a broad and recurring patient base.

Cataract diagnosis, treatment, and surgery are prime examples of these cash cows, catering to high-volume, consistent demand, particularly with an aging population. In 2023, cataract surgeries were a primary revenue driver for Aier, contributing substantially to its profitability.

Glaucoma management also serves as a robust cash cow. The chronic nature of this condition guarantees a steady influx of patients requiring continuous care, leading to predictable and stable income with minimal promotional expenditure. Aier's glaucoma services represented a substantial portion of its recurring revenue in 2024.

The group's strong brand equity, built over two decades, fosters patient loyalty and repeat business, further solidifying its core services as cash cows. As the world's largest eye hospital chain, Aier leverages economies of scale and brand recognition to maintain stable revenue generation from these foundational offerings.

| Service Category | BCG Quadrant | Key Characteristics | 2023 Revenue Contribution (Approx.) |

| General Ophthalmic Services (Network) | Cash Cow | High market share, mature market, stable demand | Significant portion of ¥20.4 billion RMB total revenue |

| Cataract Services | Cash Cow | High volume, recurring, driven by aging population | Primary revenue driver |

| Glaucoma Management | Cash Cow | Chronic condition, continuous care, predictable revenue | Substantial portion of recurring revenue (2024) |

| Medical Optometry | Cash Cow | Broad appeal, ongoing patient relationships, facility utilization | Core of RMB 15.07 billion total revenue (2023) |

What You See Is What You Get

Aier Eye Hospital Group BCG Matrix

The BCG Matrix for Aier Eye Hospital Group that you are previewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, devoid of watermarks or demo content, is ready for immediate strategic application. You can confidently expect the same detailed breakdown of Aier's business units, categorized by market share and growth rate, to be delivered directly to you. This preview ensures transparency, showcasing the professional quality and actionable insights contained within the complete report.

Dogs

Underperforming acquired clinics, while representing a strategic growth avenue for Aier Eye Hospital Group, can be categorized as Dogs in the BCG Matrix. These entities often exhibit low market share within their specific geographic areas and low growth potential, especially if they are experiencing financial difficulties. For example, Laiyang Aier Eye Hospital reported a net loss for the period ending December 31, 2023, illustrating the cash-consuming nature of some recent acquisitions.

Hospitals situated in areas with sluggish economic expansion or facing fierce local rivalry might be considered 'Dogs' within Aier Eye Hospital Group's BCG Matrix. These facilities, even within Aier's generally robust performance, could find it challenging to boost their growth or capture a larger slice of the market in less vibrant locales. Careful oversight is crucial to prevent them from becoming financial drains.

Outdated or less differentiated services at Aier Eye Hospital Group could be considered Dogs in the BCG Matrix. These are services or technologies that have become commoditized or are less distinct from competitors in mature markets. For instance, if Aier offers routine eye exams or basic cataract surgeries that are widely available from many providers, these services might struggle to command premium pricing.

Such offerings could lead to Aier breaking even or consuming resources without generating substantial returns. In 2023, the eye care market saw increased competition, with many smaller clinics offering similar services. If Aier’s older service lines haven't been updated with advanced technology or unique patient experiences, they risk becoming cost centers rather than profit drivers.

Inefficiently Managed Satellite Clinics

Inefficiently Managed Satellite Clinics are the Dogs in Aier Eye Hospital Group's BCG Matrix. These smaller, less integrated facilities often struggle to achieve economies of scale, leading to higher operational costs per patient compared to their revenue generation. For instance, some of these clinics might have patient volumes that are significantly lower than the group's benchmark, perhaps seeing only 20% of the patient numbers of a flagship hospital, while still incurring substantial overheads.

These clinics contribute minimally to the group's overall profitability and can even become a drain on resources. Their lack of strategic integration means they miss out on centralized management efficiencies, bulk purchasing power, and shared marketing efforts that benefit larger Aier facilities.

- Low Patient Volume: These clinics may serve fewer than 50 patients per week, a stark contrast to Aier's major hospitals which can handle over 300.

- High Operational Costs: Their cost-to-revenue ratio could be as high as 90%, compared to a more efficient 60% in well-managed units.

- Limited Profitability: They might contribute less than 1% to the group's total net profit, despite representing a small percentage of the total clinic count.

- Strategic Disconnect: These units often operate in isolation, failing to leverage Aier's brand reputation or referral networks effectively.

Services Highly Susceptible to Policy Changes

Certain services within Aier Eye Hospital Group are highly susceptible to policy changes, potentially impacting their position in the BCG Matrix. These services are often deeply intertwined with government regulations and medical insurance reimbursement structures. For instance, services heavily reliant on specific medical insurance reimbursement rates that could face unfavorable adjustments are particularly vulnerable.

Policy shifts, such as those affecting volume-based procurement (VBP) programs or broader medical insurance payment reforms, can exert significant pressure on revenue growth and profit margins. This makes some of these services less viable and potentially shifts them towards the question mark or even dog category if profitability erodes significantly. For example, changes in VBP for certain ophthalmic consumables could directly reduce the per-procedure profitability for related surgical services.

- Dependence on Reimbursement Rates: Services where a substantial portion of revenue comes from fixed reimbursement rates are at risk if these rates are lowered by policy changes.

- Impact of VBP Programs: Services utilizing medical supplies subject to volume-based procurement can see their margins squeezed if VBP terms become less favorable.

- Regulatory Uncertainty: Services operating in areas with frequent or unpredictable policy adjustments face higher operational risk.

- Sensitivity to Healthcare Reform: Any broad healthcare reforms that alter patient access or payment mechanisms can disproportionately affect specific service lines.

Underperforming acquired clinics, particularly those in economically stagnant regions or facing intense local competition, can be classified as Dogs within Aier Eye Hospital Group's BCG Matrix. These units, like the Laiyang Aier Eye Hospital which reported a net loss in 2023, often exhibit low market share and limited growth prospects, acting as cash drains.

Outdated service lines, such as routine eye exams or basic cataract surgeries that have become commoditized, also fall into the Dog category. In a market with increasing competition, as seen in 2023, these services risk becoming cost centers if not differentiated through technology or patient experience.

Inefficiently managed satellite clinics, characterized by low patient volumes and high operational costs, represent another segment of Dogs. These clinics, potentially seeing only 20% of the patient numbers of flagship hospitals with cost-to-revenue ratios nearing 90%, struggle to contribute meaningfully to profitability and often operate in isolation.

Services heavily reliant on government policies, such as those affected by changes in medical insurance reimbursement rates or volume-based procurement programs, can also become Dogs. For instance, shifts in VBP for ophthalmic consumables directly impact the profitability of related surgical services, increasing their risk profile.

| Category | Example within Aier Eye Hospital Group | Market Share | Market Growth | Financial Performance (Illustrative) |

|---|---|---|---|---|

| Dogs | Underperforming acquired clinics (e.g., Laiyang Aier Eye Hospital) | Low | Low | Net Loss (as of Dec 31, 2023) |

| Dogs | Outdated service lines (e.g., commoditized routine eye exams) | Low | Low | Break-even or low profit margin |

| Dogs | Inefficiently managed satellite clinics | Low | Low | High cost-to-revenue ratio (e.g., 90%) |

Question Marks

Aier's exploration into highly specialized, cutting-edge ophthalmic sub-specialties beyond its core offerings could represent potential 'Question Marks' in the BCG Matrix. These nascent areas, while potentially high-growth, likely have low initial market share and require significant investment in research, technology, and specialized personnel before they can become profitable. For instance, Aier might be investing in areas like gene therapy for inherited retinal diseases or advanced AI-driven diagnostic tools for complex ocular conditions. The success of these ventures will hinge on their ability to scale and gain traction in a competitive landscape, much like a new product needing to prove its market viability.

Early-stage international ventures in new markets for Aier Eye Hospital Group, while part of an overall 'Star' international strategy, could be classified as 'Question Marks'. These nascent ventures, particularly in markets with distinct regulatory or cultural environments, demand significant capital infusion to build brand recognition and secure market share. Their immediate profitability remains uncertain, necessitating careful strategic planning and sustained investment.

Aier Eye Hospital Group’s investment in advanced gene therapy for retinal diseases places these initiatives firmly in the Question Mark quadrant of the BCG Matrix. This reflects the high scientific promise and potential for future market growth, contrasted with current low market penetration.

These experimental treatments demand substantial research and development and extensive clinical trials, leading to significant cash consumption. For instance, the global gene therapy market was valued at approximately $12.5 billion in 2023 and is projected to grow at a CAGR of over 15% through 2030, indicating substantial future potential but also the high upfront investment required.

The long-term, uncertain payoffs characteristic of Question Marks mean these ventures require careful strategic management and a willingness to accept risk. Aier Eye Hospital Group's commitment here signals a strategic bet on emerging technologies that could redefine treatment paradigms for debilitating eye conditions.

New Digital Health Platforms for Eye Care

Aier Eye Hospital Group's new digital health platforms for eye care, like telemedicine or AI-driven diagnostic tools, represent a strategic move into a rapidly expanding market. These ventures, while promising, typically fall into the 'Question Mark' category of the BCG matrix. This is because they require substantial upfront investment in technology and infrastructure, and their future market share and profitability are still uncertain.

The development and deployment of these platforms address a growing market trend, with the global digital health market projected to reach over $600 billion by 2027. For Aier, this means significant capital expenditure is needed for R&D, software development, and cybersecurity measures. User adoption strategies are also crucial for success, as demonstrated by the challenges many digital health startups face in acquiring and retaining patients.

- High Investment Needs: Developing advanced digital eye care platforms demands significant financial resources for technology, data security, and specialized personnel.

- Market Uncertainty: While the digital health market is growing, the specific success and market penetration of Aier's new platforms remain to be proven, placing them in the 'Question Mark' quadrant.

- Potential for Growth: If successful, these platforms could capture a substantial share of the burgeoning telemedicine and digital health market, offering high growth potential.

- Operational Challenges: Ensuring seamless integration with existing services, regulatory compliance, and effective patient engagement are key hurdles for these new initiatives.

Unproven Partnerships for Technology Development

Aier Eye Hospital Group's pursuit of unproven partnerships for technology development positions them in the 'Question Marks' quadrant of the BCG Matrix. These ventures, like the collaboration with Alcon to advance all-light plastic surgery in China, represent significant potential for high growth driven by cutting-edge innovation.

However, the inherent uncertainty surrounding the market adoption and ultimate financial success of these novel technologies means substantial investment is required without immediate guaranteed returns. For instance, while specific financial details for the Alcon partnership's early stages are not publicly disclosed, similar R&D intensive collaborations often see initial outlays of tens of millions of dollars over several years before market viability is confirmed.

- High Investment, Uncertain Returns: Partnerships focused on novel ophthalmic technologies require significant capital for research, development, and initial market penetration, with success far from guaranteed.

- Strategic Innovation Focus: These collaborations are crucial for Aier Eye Hospital Group's long-term strategy, aiming to establish leadership in emerging medical technology sectors.

- Market Adoption Risk: The success of these unproven technologies hinges on their acceptance by both medical professionals and patients, a factor that can be difficult to predict.

- Potential for Future Stars: If successful, these 'Question Marks' could transition into 'Stars', generating substantial revenue and market share for Aier Eye Hospital Group in the future.

Aier Eye Hospital Group's ventures into emerging ophthalmic technologies, such as gene therapy or advanced AI diagnostics, are classic 'Question Marks'. These require substantial investment for research and development, with uncertain market adoption and future returns. For example, the global gene therapy market, valued around $12.5 billion in 2023, is expected to grow significantly, but initial investments are high.

Similarly, new digital health platforms, while tapping into a market projected to exceed $600 billion by 2027, demand considerable capital for technology and user acquisition. These initiatives, including telemedicine and AI tools, face operational challenges and market uncertainty, making their long-term success a question mark.

Unproven partnerships for technology development, like collaborations for novel surgical techniques, also fall into this category. These require significant upfront funding with no guarantee of market success, though they hold the potential to become future 'Stars'.

| Initiative Type | Market Growth Potential | Investment Requirement | Market Share Uncertainty | BCG Quadrant |

| Gene Therapy R&D | High (e.g., Gene therapy market growth) | High | High | Question Mark |

| Digital Health Platforms | High (e.g., Digital health market size) | High | High | Question Mark |

| Novel Tech Partnerships | Variable (depends on tech) | High | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix for Aier Eye Hospital Group is built on comprehensive financial disclosures, detailed market research on the ophthalmology sector, and official company reports to provide a clear strategic overview.