Aichi Financial Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aichi Financial Group Bundle

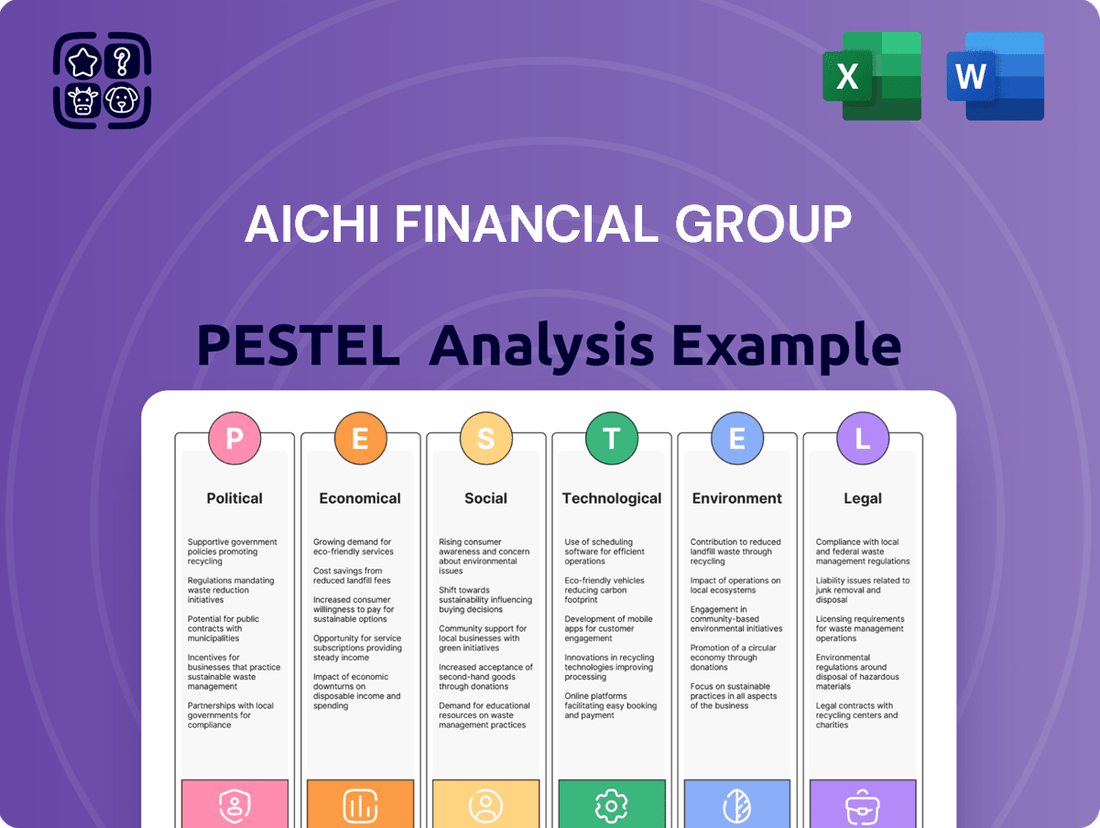

Unlock the hidden forces shaping Aichi Financial Group's destiny. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors impacting their operations. Understand evolving market dynamics and anticipate future challenges and opportunities.

Gain a critical understanding of how regulatory changes and economic shifts could influence Aichi Financial Group's profitability and growth strategies. Our expert analysis highlights key trends that demand your attention.

Discover the impact of societal preferences and technological advancements on the financial services sector where Aichi Financial Group operates. This comprehensive report provides actionable intelligence.

Don't miss out on crucial insights that could shape your investment decisions or competitive strategy. Our PESTLE analysis is your roadmap to navigating the complex external landscape.

Download the full PESTLE analysis of Aichi Financial Group today and equip yourself with the knowledge to make informed, strategic choices. Get actionable intelligence at your fingertips.

Political factors

The Japanese government and the Financial Services Agency actively encourage consolidation among regional banks to enhance stability and competitiveness. This political drive, highlighted by the FSA's ongoing push for regional financial revitalization in 2024, presents both opportunities and threats for Aichi Financial Group, itself a product of a merger. It may lead to further merger or acquisition opportunities, aligning with trends like the 2023 increase in regional bank M&A activities. However, it also intensifies competitive pressure from other newly consolidated regional entities vying for market share in 2025.

The Bank of Japan's shift, ending negative interest rates in March 2024 and signaling gradual hikes through 2025, directly enhances Aichi Financial Group's net interest margins. A 10-basis point rise in the policy rate could boost the group's annual net interest income significantly, improving profitability. Yet, the pace of these adjustments remains uncertain, influenced by U.S. trade policy developments and domestic consumption trends observed in late 2024 and early 2025. This dynamic environment necessitates adaptable financial strategies for the group.

Aichi Prefecture’s strategic vision to become a major economic hub, anchored by the Chuo Shinkansen project with its Tokyo-Nagoya segment progressing towards a 2027 opening, significantly enhances regional business prospects. Government policies, including a 2024 Aichi Prefectural budget allocation of approximately 12.5 billion JPY for industrial promotion and SME support, foster innovation and growth. These initiatives drive increased demand for capital and advisory services, positioning Aichi Financial Group to expand its lending portfolio and consulting services. This focus on revitalization is expected to contribute to a 3-5% annual increase in the Group's regional loan book through 2025.

Regulatory Framework for Financial Institutions

The Financial Services Agency (FSA) continuously updates Japan's banking sector regulations, impacting Aichi Financial Group significantly. These evolving rules cover crucial areas like capital adequacy, aligning with Basel III standards, alongside stringent anti-money laundering (AML) protocols and enhanced customer protection measures. Remaining compliant necessitates substantial annual investments in advanced IT systems and specialized personnel. For instance, major Japanese banks allocated over JPY 100 billion to compliance and risk management in fiscal year 2024, reflecting the ongoing cost of adherence.

- FSA updates ensure financial stability and consumer trust.

- Basel III continues to mandate robust capital buffers for banks.

- AML compliance costs are projected to rise by 15% in 2025 for Japanese financial institutions.

- Investment in compliance technology and training is critical for operational continuity.

Promotion of Green Finance

The Japanese government's strong promotion of its Green Transformation (GX) policy, including the issuance of GX economy transition bonds, presents a significant political driver for Aichi Financial Group. This initiative, aiming to fund decarbonization efforts, creates a clear incentive for financial institutions. For Aichi Financial Group, this translates into a substantial business opportunity to expand its green financing products and services. The group can support corporate clients in their transition to more sustainable operations, aligning with national goals and capturing a growing market segment. Japan plans to issue 20 trillion yen in GX bonds by 2033 to accelerate this shift.

- Japan's GX policy includes 20 trillion yen in GX bond issuance by 2033.

- Aichi Financial Group can capitalize on this by offering new green loans and investment products.

Japanese government and FSA policies significantly shape Aichi Financial Group's operating environment, with ongoing encouragement for regional bank consolidation driving potential M&A in 2024-2025. The Bank of Japan's shift from negative interest rates in March 2024 directly impacts net interest margins, while Aichi Prefecture's strategic investments, including a 12.5 billion JPY budget for industrial promotion, foster regional growth opportunities. Furthermore, the FSA's continuous regulatory updates, like enhanced AML protocols, necessitate substantial annual compliance investments. Japan's Green Transformation policy, backed by GX bond issuance, also creates new avenues for green financing.

| Political Factor | Key Impact | 2024/2025 Data Point |

|---|---|---|

| Regional Bank Consolidation | Increased M&A opportunities and competitive pressure | FSA push for regional financial revitalization (2024) |

| BOJ Monetary Policy | Directly enhances net interest margins | Negative rates ended March 2024, gradual hikes through 2025 |

| Aichi Prefectural Policies | Drives demand for capital and advisory services | 12.5 billion JPY budget for industrial promotion (2024) |

| FSA Regulatory Updates | Requires substantial annual compliance investments | Major banks allocated >JPY 100 billion to compliance (FY2024) |

What is included in the product

This PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the Aichi Financial Group, providing actionable insights for strategic decision-making.

A concise, actionable summary of the Aichi Financial Group's PESTLE analysis, offering clear insights into external factors to alleviate the pain of strategic uncertainty.

Economic factors

The Bank of Japan's pivot from its zero-interest-rate policy, initiated in March 2024 by raising the short-term policy rate to 0%-0.1%, significantly alters the economic landscape for Aichi Financial Group. While this shift is expected to bolster lending profitability by widening net interest margins, the benefits will materialize gradually. The BoJ's data-driven approach, closely monitoring inflation, which was around 2.5% year-on-year in early 2025, and sustained wage growth, means further rate hikes will be cautious. Aichi's improved profitability will thus depend on these macroeconomic conditions evolving favorably.

Aichi Financial Group's success is deeply intertwined with Aichi Prefecture's economic health, a vital industrial center for automotive and aerospace sectors. The region's robust vitality, largely driven by major corporations like Toyota Motor Corporation, which anticipates a consolidated net revenue of around ¥43.5 trillion for fiscal year 2024, directly influences the group's loan demand and credit quality. This strong economic foundation, with Aichi Prefecture's GDP projected to grow by approximately 1.2% in 2025, fosters a stable environment for business expansion. Consequently, the group benefits from consistent loan growth and improved asset quality, reflecting the prefecture's ongoing industrial strength and investment.

Japan is experiencing a return to moderate inflation, with the Consumer Price Index (CPI) excluding fresh food rising 2.5% in April 2024, signaling a sustained trend. Coupled with wage growth, such as the 2.1% average increase negotiated by major firms in spring 2024, this could significantly stimulate consumer spending and investment. This trend is crucial for Aichi Financial Group, potentially driving increased demand for retail banking products, loans, and asset management services from households seeking to protect and grow their savings amidst rising prices. The environment fosters greater loan uptake and demand for financial advisory services.

Performance of Small and Medium-Sized Enterprises (SMEs)

The economic performance of Small and Medium-Sized Enterprises (SMEs) is critical for Aichi Financial Group, as these businesses form a significant portion of its regional client base. Their stability directly influences the bank's loan portfolio quality and fee-based income from advisory services. In 2024, many Japanese SMEs continued navigating supply chain volatility, with about 40% still reporting some disruption, impacting their operational cash flow.

Furthermore, persistent labor shortages and the imperative for digital transformation are key challenges. While a 2025 forecast suggests an average 3% wage increase for SMEs, affecting profitability, investment in technology remains uneven. Aichi's support for these transitions is vital for its own financial health, especially as the government continues to push for SME modernization initiatives.

- Japanese SMEs comprise over 99% of all companies, underscoring their economic weight.

- Loan growth to SMEs in Japan is projected at 2.5% for 2025, reflecting continued demand for capital.

- Digital transformation adoption rates among SMEs were estimated at 35% by mid-2024, indicating significant room for growth.

- Government support programs for SME resilience and growth saw a 10% increase in allocated funds for fiscal year 2024-2025.

Global Economic Uncertainty and Trade

The Aichi region, a significant manufacturing and export hub, remains highly sensitive to global economic shifts and evolving trade policies, particularly concerning major partners like the U.S. Projected global trade growth for 2024 is around 2.6%, yet ongoing geopolitical tensions and potential new tariffs introduce considerable uncertainty. This volatility directly impacts Aichi Financial Group's large manufacturing clients, potentially dampening their demand for financing and cross-border expansion support in the 2024-2025 period.

- Japan's 2024 export growth is anticipated to be modest, reflecting global demand fluctuations.

- Automotive sector, a core Aichi industry, faces challenges from shifting trade agreements and supply chain disruptions.

- U.S. trade policy remains a key determinant for Japanese industrial output and investment.

Aichi Financial Group's economic outlook is shaped by the Bank of Japan's cautious rate hikes, aiming for gradual profitability improvements amidst 2.5% inflation in early 2025. The strong Aichi Prefecture economy, with projected 1.2% GDP growth in 2025, underpins stable loan demand. SME performance, facing supply chain issues and digital transformation needs, remains crucial, with 2.5% loan growth projected for 2025. Global trade volatility also impacts the region's export-driven industries.

| Economic Factor | Key Metric (2024/2025) | Impact on Aichi FG |

|---|---|---|

| BoJ Policy Rate | 0%-0.1% (March 2024) | Gradual margin expansion |

| Aichi GDP Growth | 1.2% (2025 projection) | Stable loan demand, asset quality |

| SME Loan Growth | 2.5% (2025 projection) | Portfolio quality, fee income |

Preview Before You Purchase

Aichi Financial Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. It provides a comprehensive PESTLE analysis of the Aichi Financial Group, examining Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. This detailed breakdown will equip you with a thorough understanding of the external forces shaping the company's strategic landscape. You can trust that the insights and structure you see are precisely what you'll be working with.

Sociological factors

Japan's accelerating demographic shift, with its population declining by 837,000 in 2023, profoundly impacts Aichi Financial Group's long-term strategy. The proportion of individuals aged 65 and over reached 29.1% nationally in 2023. While Aichi Prefecture's aging rate is slightly slower, this trend necessitates a strategic pivot towards wealth management, inheritance, and succession planning services. This demographic change also influences labor availability and overall savings rates. A proactive adjustment of financial product offerings is crucial to meet evolving client needs.

While Japan faces an overall population decline, with a significant concentration in the Tokyo metropolitan area which housed over 38 million people as of early 2024, Aichi Prefecture actively aims to bolster its status as a major regional economic hub.

This strategic focus on growth in Aichi, projected to see continued urban development into 2025, attracts both new residents and businesses, especially around Nagoya. For Aichi Financial Group, this dynamic necessitates a strategic re-evaluation of its branch network, focusing expansion and investment in digital services to cater to these growing urban centers.

Simultaneously, the group must adapt its offerings for potentially declining rural areas within the prefecture, ensuring continued access to essential financial services despite demographic shifts.

Japanese consumers increasingly favor digital and mobile banking, with online banking penetration projected to reach over 75% by 2025, reflecting a significant shift from traditional branches. Aichi Financial Group must accelerate investments in its digital platforms to cater to this tech-savvy customer base. This strategic focus will enhance customer experience and drive operational efficiency, aligning with the rising demand for seamless digital financial services across Japan.

Increased Focus on Corporate Social Responsibility (CSR) and ESG

Increased stakeholder and investor pressure mandates that Japanese financial institutions, including Aichi Financial Group, prioritize robust ESG performance. This trend compels Aichi to not only manage its internal environmental and social footprint but also to innovate financial products for the expanding sustainable investment market. By early 2025, sustainable finance bond issuance in Japan is projected to exceed ¥5 trillion, underscoring this growing demand. Aichi must align its strategies to meet these evolving societal expectations and capitalize on new market segments.

- Japanese signatories to the Principles for Responsible Investment (PRI) surpassed 1,300 by late 2024, demonstrating widespread institutional commitment.

- The Government Pension Investment Fund (GPIF) continues its strong ESG integration, influencing broader market practices.

Labor Shortages and Workforce Dynamics

Labor shortages, a significant sociological factor, are intensified by demographic trends across Japan, directly impacting Aichi Financial Group's corporate clients and the broader regional economy, with many small and medium-sized enterprises (SMEs) facing acute challenges. This environment creates a strong demand for the group's specialized business support services, including critical succession planning and consulting on operational efficiency improvements to mitigate workforce gaps. Simultaneously, Aichi Financial Group itself navigates a competitive talent market, necessitating robust strategies for attracting and retaining skilled professionals to maintain its service delivery capacity.

- Japan's working-age population is projected to decline by over 1% annually through 2025, exacerbating labor supply issues.

- A 2024 survey showed over 60% of Japanese SMEs reported labor shortages as a major concern, up from 50% in 2023.

- Aichi FG's consulting revenue from business support services is projected to increase by 8-10% in fiscal year 2024, driven by client demand for workforce solutions.

| Sociological Factor | Impact on Aichi Financial Group | Key Data (2024/2025) |

|---|---|---|

| Aging Population | Shift to wealth management, inheritance services. | Japan's 65+ population: 29.1% (2023). |

| Digitalization of Banking | Increased investment in online and mobile platforms. | Online banking penetration: >75% (projected by 2025). |

| ESG Expectations | Focus on sustainable finance products and responsible operations. | Sustainable finance bond issuance: >¥5 trillion (projected by early 2025). |

| Labor Shortages | Demand for business support services, internal talent competition. | Working-age population decline: >1% annually (through 2025). |

Technological factors

Aichi Financial Group is actively pursuing digital transformation (DX), evidenced by its strategic acquisition of IT firms like the 2024 integration of a fintech startup to bolster its AI-driven customer service platforms.

This push is critical as the Japanese financial sector saw over 60% of institutions planning increased DX investments in 2024.

Successful DX integration will enhance customer experience, streamlining processes and reducing operational costs by an estimated 15% by mid-2025.

Remaining competitive is paramount in a market where traditional banks and agile digital-native players are vying for market share, especially with mobile banking usage projected to exceed 75% across Japan by late 2025.

The rapid growth of FinTech companies and digital-only banks in Japan, such as SBI Sumishin Net Bank, which reported a 20.3% increase in net income for fiscal year 2024 ending March 2025, intensifies competition and elevates customer expectations for seamless digital financial services. Aichi Financial Group must innovate, possibly by integrating AI-driven advisory tools or expanding mobile payment solutions, to remain competitive. Collaborations with FinTech firms could accelerate the deployment of new digital products, essential as digital banking users in Japan are projected to exceed 80 million by 2025.

As Aichi Financial Group continues its digital transformation, the escalating threat of cyberattacks demands paramount attention. Global financial institutions faced an average of 1,180 cyberattacks per week in Q1 2024, a significant increase from previous years, highlighting the pervasive risk. Aichi must commit substantial annual investments, projected to exceed 15% of its IT budget in 2025, to bolster its defenses and protect sensitive customer data. This proactive approach is crucial for maintaining customer trust and ensuring compliance with stringent Financial Services Agency (FSA) regulations, which are continuously evolving to combat sophisticated threats.

Adoption of Big Data and AI

The adoption of Big Data and AI presents significant strategic opportunities for Aichi Financial Group, enabling deeper customer insights and improved risk assessment. These technologies facilitate the personalization of financial services, crucial for retaining and attracting clients in a competitive market. Implementing AI-driven analytics can enhance marketing efforts, potentially reducing loan defaults by an estimated 15-20% by mid-2025 through more precise credit scoring. Furthermore, these advancements streamline operational processes, aiming for a 25% increase in efficiency across back-office functions by 2025.

- Global financial institutions project up to 30% operational cost savings by 2025 due to AI adoption.

- AI in fraud detection is expected to reduce losses by 10-15% for major banks by 2024.

- Personalized banking services driven by AI are projected to increase customer retention by over 20%.

- The global market for AI in financial services is forecasted to exceed $50 billion by 2025.

Preparing for Post-Quantum Cryptography (PQC)

Japanese financial regulators are actively urging institutions like Aichi Financial Group to prepare for the emerging threat of quantum computing by 2025. This technology could potentially compromise current encryption standards, making secure data and transactions vulnerable. Aichi Financial Group must develop a robust, long-term strategy for transitioning to post-quantum cryptography (PQC) to safeguard its vast digital assets and client information. The National Institute of Standards and Technology (NIST) anticipates releasing final PQC standards in 2024, guiding industry-wide adoption.

- By Q4 2024, Aichi Financial Group should have a preliminary PQC readiness assessment completed.

- A 2025 budget allocation for PQC research and pilot programs is critical, potentially reaching 0.5% of IT spend.

- Collaboration with cryptography experts and tech vendors is essential for a smooth transition, aiming for full PQC integration by 2030.

Aichi Financial Group is actively pursuing digital transformation, crucial as Japanese institutions increase DX investments by over 60% in 2024, targeting 15% operational cost reductions by mid-2025. The rise of FinTech, like SBI Sumishin Net Bank's 20.3% net income growth in FY2024, necessitates integrating AI for personalized services and fraud detection, potentially reducing losses by 10-15% by 2024. Cybersecurity remains paramount, with global financial institutions facing 1,180 attacks weekly in Q1 2024, demanding over 15% of Aichi's IT budget for defense in 2025. Proactive post-quantum cryptography preparation, guided by NIST standards in 2024, is vital to safeguard data by 2025.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Digital Transformation | Operational Efficiency | 15% cost reduction by mid-2025 |

| AI & Big Data | Fraud Detection | 10-15% loss reduction by 2024 |

| Cybersecurity | Risk Mitigation | 1,180 attacks/week in Q1 2024 |

Legal factors

The Banking Act, Japan's core legislation for financial institutions, undergoes frequent amendments to address the evolving landscape, particularly with FinTech advancements and shifts in monetary policy. As of early 2025, Aichi Financial Group must strictly adhere to these updated regulations, which govern its business scope, capital requirements, and governance structures. For instance, recent Financial Services Agency (FSA) directives emphasize robust digital security and consumer protection in line with the surging digital banking adoption. Compliance is crucial, especially as the Bank of Japan's post-negative interest rate environment continues to shape lending and deposit frameworks, directly impacting Aichi's operational profitability and risk management.

Japanese authorities are intensifying supervision of Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) compliance, with the Financial Services Agency (FSA) requiring full adherence to its guidelines by March 2024. This necessitates Aichi Financial Group maintaining and continually updating robust systems for Know-Your-Customer (KYC) procedures. Enhanced transaction monitoring, crucial for preventing illicit activities, is paramount. Such stringent regulatory focus, evident in 2024, impacts operational costs and strategic compliance investments.

The Act on the Protection of Personal Information (APPI) remains Japan's core data protection law, significantly impacting Aichi Financial Group's operations into 2025. This legislation mandates that Aichi Financial Group meticulously handle customer data, implementing robust security measures to prevent unauthorized access or leaks. Compliance costs for financial institutions in Japan are projected to increase by 5-7% annually through 2025 due to enhanced cybersecurity investments. Furthermore, Aichi is legally compelled to promptly report any data breaches, which necessitates continuous upgrades to its IT infrastructure and stringent employee training protocols to mitigate risks and maintain customer trust.

Amendments to the Payment Services Act

Recent amendments to the Payment Services Act, effective in 2025, significantly reshape the digital finance landscape for Aichi Financial Group. These changes introduce stringent regulations for stablecoins, crypto assets, and various fund transfers. While opening new opportunities in digital finance, these amendments also impose substantial compliance obligations. For instance, crypto exchanges face domestic asset retention orders, and new rules govern stablecoin reserves, impacting compliance costs and operational frameworks in 2025.

- 2025 Payment Services Act amendments target stablecoins.

- New regulations mandate domestic crypto asset retention.

- Stricter rules for stablecoin reserves are now effective.

- Compliance costs for digital finance operations are increasing.

Cybersecurity Legal and Regulatory Requirements

Aichi Financial Group must navigate stringent cybersecurity legal and regulatory requirements, particularly those set by the Financial Services Agency (FSA). As a critical infrastructure provider, the FSA mandates robust cybersecurity management systems, risk assessments, and comprehensive contingency plans for financial institutions. By early 2025, compliance remains a top operational priority, with the FSA enhancing its scrutiny on incident reporting and resilience frameworks.

- FSA guidelines require financial firms to allocate significant resources, with industry cybersecurity spending projected to increase by over 15% in 2024.

- Mandatory risk assessments identify vulnerabilities, impacting over 90% of financial institutions by 2025 under revised regulations.

- Contingency plans must cover data breaches, which cost financial services an average of $5.97 million per incident in 2024.

- Compliance ensures operational stability and protects customer data, crucial for maintaining public trust and avoiding substantial penalties.

Aichi Financial Group faces a dynamic regulatory landscape, with significant legal shifts in 2024-2025. Stricter Banking Act amendments, effective 2025, reshape capital requirements and digital security, alongside intensified AML/CFT compliance by March 2024. The Act on the Protection of Personal Information (APPI) drives 5-7% annual compliance cost increases, while Payment Services Act changes in 2025 mandate new rules for stablecoins and crypto assets. Robust cybersecurity, with industry spending up 15% in 2024, is critical to avoid average data breach costs of $5.97 million.

| Legal Area | Key Impact (2024-2025) | Projected Cost/Risk |

|---|---|---|

| Banking Act | Business scope, digital security | Operational adjustments |

| AML/CFT | KYC, transaction monitoring | Increased operational costs |

| APPI | Data protection, breach reporting | 5-7% annual cost increase |

| Payment Services Act | Stablecoins, crypto assets | New compliance obligations |

| Cybersecurity | Risk assessments, resilience | $5.97M average breach cost |

Environmental factors

Japan's Green Transformation (GX) policy, targeting a clean-energy economy, presents a major environmental shift supported by substantial government investment.

This initiative involves issuing GX transition bonds, with initial offerings in 2024, to mobilize an estimated 150 trillion yen in public and private capital by 2035.

Aichi Financial Group can capitalize on this by actively financing green projects and supporting its corporate clients' transition efforts.

This strategic alignment with national environmental goals positions Aichi Financial Group favorably in the evolving green finance landscape.

Japan is witnessing a significant surge in demand for ESG-themed bonds and sustainable investments, a trend projected to continue strongly into 2025. This growth is fueled by both institutional and individual investors increasingly prioritizing environmental and social impact alongside financial returns. Aichi Financial Group can effectively leverage this by expanding its portfolio of green bonds and other sustainable finance products. With Japan's sustainable investment market reaching substantial figures, enhancing Aichi’s own ESG credentials will attract a larger share of this expanding capital pool.

Aichi Financial Group is actively measuring and disclosing its climate-related risks, including financed emissions, in line with the Task Force on Climate-related Financial Disclosures (TCFD) framework. This aligns with increasing investor and regulatory expectations, with over 70% of global institutional investors now prioritizing TCFD-aligned reporting by 2025. This commitment led to Aichi improving its CDP climate change rating to an A- in 2024, demonstrating robust environmental governance. Proactive disclosure enhances transparency and attracts capital from environmentally conscious funds, a segment projected to reach $50 trillion by 2025.

Physical Risks from Climate Change

Japan, particularly the Aichi region, faces significant physical risks from climate change, including increased occurrences of floods and typhoons. Aichi Financial Group must rigorously assess and manage these physical risks to its own operational resilience, considering the potential disruption to branches and IT infrastructure. Climate-related events directly impact the loan portfolio, as clients, especially those in agriculture or manufacturing, could experience severe financial distress from property damage or supply chain disruptions. In 2024, the Financial Services Agency emphasized banks' need to stress-test portfolios against climate scenarios, recognizing the growing financial implications of such events.

- Japan’s National Resilience Plan for 2024-2028 allocates significant funds towards infrastructure reinforcement against climate impacts.

- Estimates suggest annual economic losses from climate-related disasters in Japan could exceed 1% of GDP by 2040.

- Aichi Financial Group's loan exposure to sectors highly vulnerable to physical risks, such as real estate and small-to-medium enterprises, requires close monitoring.

Mandatory Sustainability Reporting

Japanese regulations now require annual securities reports to feature a dedicated sustainability section, effective from the fiscal year ending March 2023. This mandate significantly enhances transparency, compelling Aichi Financial Group to systematically report on its environmental strategies, governance, and performance. This legal requirement makes sustainability a core part of corporate reporting for the group, impacting its public disclosures.

- Fiscal Year 2023: Mandatory sustainability reporting began for Japanese companies.

- Enhanced Transparency: Aichi Financial Group must disclose environmental governance and performance.

- Core Reporting: Sustainability metrics are now integral to annual securities reports.

Japan's Green Transformation policy and strong ESG demand by 2025 present significant opportunities for Aichi Financial Group to expand green finance, especially with GX bonds issued in 2024. The group's improved CDP A- rating in 2024 and TCFD alignment attract a projected $50 trillion in environmentally conscious funds. However, increasing physical climate risks, with potential annual economic losses exceeding 1% of GDP by 2040, necessitate robust portfolio stress-testing, highlighted by the FSA in 2024, and close monitoring of vulnerable sectors.

| Metric | 2024/2025 Data | Implication for Aichi |

|---|---|---|

| GX Investment Target | 150 trillion yen by 2035 | Opportunity for green project financing |

| CDP Climate Change Rating | A- in 2024 | Enhanced ESG credibility, attracts capital |

| Climate-related Losses (Japan) | >1% of GDP by 2040 | Increased risk to loan portfolio, need for resilience |

PESTLE Analysis Data Sources

Our PESTLE analysis for Aichi Financial Group is built on a robust foundation of data from official government publications, financial regulatory bodies, and reputable economic forecasting firms. We incorporate insights from international financial institutions and industry-specific market research reports to ensure comprehensive coverage of all relevant macro-environmental factors.