Aichi Financial Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aichi Financial Group Bundle

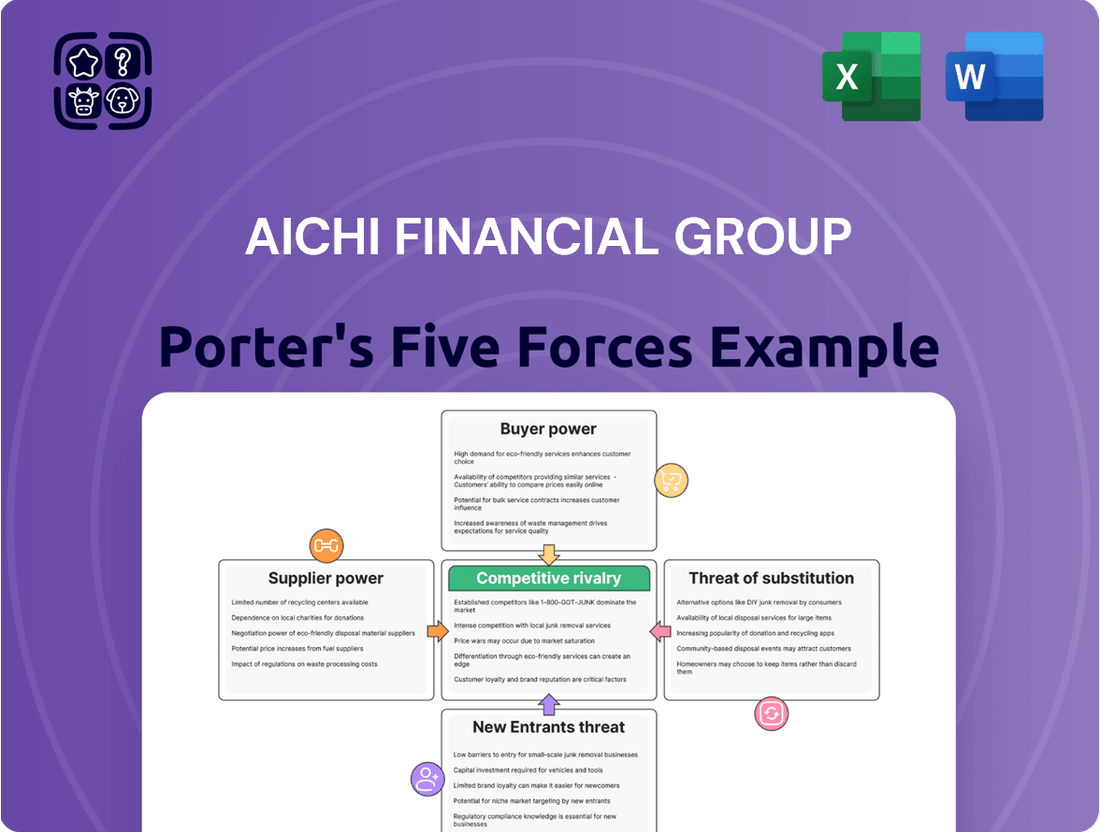

Aichi Financial Group navigates a complex landscape shaped by powerful competitive forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Aichi Financial Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Individual and corporate depositors serve as the primary suppliers of funds for Aichi Financial Group. Due to the vast and fragmented nature of the depositor base, numbering in the millions across Japan, their individual bargaining power remains inherently low. However, collectively, these deposits, which in 2024 represented a significant portion of the bank's funding, form the essential foundation for its lending capacity. While individual impact is minimal, the overall stability and volume of these deposits are crucial for the bank's operational health and profitability.

Aichi Financial Group secures significant funding from institutional investors and other financial institutions within the wholesale market. These large-scale suppliers hold more concentrated power compared to individual depositors, often enabling them to negotiate more favorable terms. The bank's reliance on this crucial funding stream grants these providers moderate bargaining power. This power is notably influenced by prevailing interest rates, such as the Federal Reserve’s target range, which stood at 5.25%-5.50% through early 2024, and overall market liquidity conditions, directly impacting the cost of funds for banks.

Aichi Financial Group relies on external vendors for crucial core banking software and IT infrastructure, alongside specialized financial technology. While established providers like FIS or Temenos hold significant market share, the burgeoning fintech sector and cloud-based solutions are expanding options. The global fintech market, valued at over $300 billion in 2024, fosters competition among suppliers. This diversification, with increasing adoption of multi-cloud strategies by banks, effectively mitigates the bargaining power of any single technology supplier.

Low Power of Employees

While skilled employees are vital for Aichi Financial Group's operations and customer service, their individual bargaining power remains relatively low. The supply of qualified personnel in Japan's financial sector is generally adequate, with a stable talent pool. However, collective bargaining, particularly through established unions, can influence wages and working conditions. For instance, the average monthly contractual cash earnings for employees in Japan's finance and insurance sector increased by 2.3% year-on-year in April 2024, reflecting some upward pressure.

- Japan's financial sector saw a 2.3% year-on-year increase in average monthly contractual cash earnings as of April 2024.

- The unemployment rate in Japan's finance and insurance industry remained low at approximately 1.5% in early 2024, indicating a generally stable labor market.

- Unionization rates in Japan, while modest compared to some Western nations, still provide a collective voice for employee concerns.

- Aichi Financial Group's ability to attract and retain talent in a competitive market hinges on competitive compensation and benefits, despite individual power being low.

High Power of Regulators

Government and financial regulatory bodies, such as Japan's Financial Services Agency (FSA), act as a unique and powerful supplier for Aichi Financial Group. They supply the essential license to operate and dictate stringent rules, including capital requirements that banks must adhere to. This includes compliance with Basel III frameworks, which continue to evolve in 2024, shaping global banking standards. Their power is absolute and non-negotiable, significantly influencing the bank's operational strategies and financial performance.

- FSA Japan sets non-negotiable operational licenses and compliance mandates.

- Strict capital adequacy ratios, like those under Basel III in 2024, are enforced.

- Regulatory compliance costs significantly impact bank profitability.

- Non-compliance can lead to severe penalties and operational restrictions.

Aichi Financial Group faces varied supplier power, with individual depositors holding low influence despite their collective volume. Institutional investors exert moderate power, influenced by market rates like the Federal Reserve’s 5.25%-5.50% range in early 2024. Technology vendors have mitigated power due to the expanding $300 billion global fintech market in 2024.

Employees generally have low individual power, though collective bargaining and a 2.3% rise in Japan's finance sector wages by April 2024 show some influence. Government regulators, such as Japan’s FSA enforcing Basel III in 2024, wield absolute, non-negotiable power over operations.

| Supplier Type | Bargaining Power | Key 2024 Data Point |

|---|---|---|

| Individual Depositors | Low | Millions of fragmented accounts |

| Institutional Investors | Moderate | Fed Rate: 5.25%-5.50% (early 2024) |

| Technology Vendors | Moderate to Low | Fintech Market: >$300B (2024) |

| Employees | Low (Individual), Moderate (Collective) | Japan Finance Wage Growth: 2.3% (April 2024) |

| Government Regulators | Absolute | Basel III Compliance (Evolving 2024) |

What is included in the product

This analysis of Aichi Financial Group dissects the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes within its specific operating environment.

A clear, one-sheet summary of all five forces—perfect for quick decision-making by Aichi Financial Group executives.

Instantly understand strategic pressure with a powerful spider/radar chart, simplifying complex competitive landscapes for Aichi Financial Group.

Customers Bargaining Power

Large corporate clients of Aichi Financial Group possess significant bargaining power, frequently demanding substantial loans and a comprehensive suite of financial services. Their considerable transaction volumes, often exceeding 100 billion JPY in lending for some major Japanese regional banks in 2024, enable them to negotiate highly favorable interest rates and reduced fees. This power is amplified by the readily available alternative financing options from megabanks and other regional competitors. Consequently, the departure of even a single major corporate client can notably diminish the bank's profitability, impacting net interest income which remained a key focus for Japanese regional banks in 2024.

Individual customers hold moderate bargaining power, especially for standard services like deposits and small loans from Aichi Financial Group. Although switching costs for basic banking services are relatively low, factors such as established relationships, convenience, and the perceived hassle of changing banks often limit their willingness to switch. The recent merger of Aichi Bank and Chukyo Bank on October 1, 2024, forming Aichi Financial Group, aims to significantly increase their regional market share. This unified presence seeks to enhance their competitive standing and potentially temper individual customer power through a broader service offering and strengthened local footprint in Aichi Prefecture.

The rise of online and neo-banks significantly boosts customer bargaining power for Aichi Financial Group. Customers now have more choices and transparent information, allowing them to easily compare interest rates, fees, and service quality digitally. For instance, by early 2024, digital-only banks had already captured a notable share, with many consumers actively using their platforms for daily banking needs. This increased transparency means Aichi must offer attractive digital services and competitive pricing. To remain competitive, Aichi Financial Group needs to invest in seamless digital experiences, as over 60% of consumers globally prioritize digital channels for banking interactions.

Low Power for Specialized Services

For specialized financial services, such as bespoke trust management or high-level business consulting, customers often possess lower bargaining power. This dynamic is particularly evident when Aichi Financial Group has cultivated unique expertise or an unparalleled reputation in niche areas within Aichi Prefecture. The limited availability of truly comparable alternatives for such sophisticated services further diminishes customer leverage. For instance, in 2024, the demand for highly tailored financial advice in Japan continues to outpace readily available expert providers, especially for complex estate planning and corporate restructuring, where specialized knowledge commands a premium.

- Aichi Financial Group's unique expertise in areas like trust services reduces customer options.

- High-level business consulting in Aichi Prefecture benefits from the group's strong reputation.

- Limited comparable alternatives for specialized financial services enhance Aichi's pricing power.

- Customer bargaining power is low for bespoke solutions due to scarcity of expert providers.

High Power in a Highly Competitive Market

The Japanese banking sector, particularly in a major economic hub like Aichi Prefecture, is highly competitive, empowering customers. This intense competition among regional banks, megabanks like Mitsubishi UFJ Financial Group, and other financial institutions naturally enhances the bargaining power of customers. Customers can leverage this competitive landscape to demand better terms, higher service quality, and more innovative products, especially as banks vie for market share in a low-interest-rate environment.

- Japanese banks face pressure from declining net interest margins, averaging around 1.1% in 2024.

- Customers benefit from diverse offerings, including competitive mortgage rates, which saw the average 10-year fixed rate at approximately 1.8% in early 2024.

- Digital banking adoption, nearing 70% of the population in 2024, further enhances customer choice and convenience.

- The number of major regional banks consolidating or forming alliances reflects the intense competition for customer deposits and loans.

Aichi Financial Group faces varied customer bargaining power; large corporate clients leverage high transaction volumes and market competition to demand favorable terms, with some loans exceeding 100 billion JPY in 2024. The rise of digital banking, with nearly 70% of the Japanese population adopting it by 2024, further empowers customers through increased transparency and choices. Conversely, customers seeking highly specialized services, such as bespoke trust management, have lower bargaining power due to Aichi's unique expertise and limited comparable alternatives in 2024. The overall competitive landscape in the Japanese banking sector, driven by low net interest margins around 1.1% in 2024, enhances customer leverage across many segments.

| Customer Segment | Bargaining Power | Key Factors in 2024 |

|---|---|---|

| Large Corporates | High | Significant transaction volume (100B JPY+ loans), alternative financing |

| Individual Customers | Moderate | Low switching costs, Aichi FG merger for market share |

| Digital Banking Users | High | Increased choices, 70% digital adoption in Japan |

| Specialized Services | Low | Unique expertise, limited comparable alternatives |

Full Version Awaits

Aichi Financial Group Porter's Five Forces Analysis

This preview showcases the complete Aichi Financial Group Porter's Five Forces Analysis, offering a deep dive into the competitive landscape of the financial services industry. You're looking at the actual, professionally written document that will be yours to download and utilize immediately after purchase. This comprehensive analysis meticulously details the bargaining power of buyers, the threat of new entrants, the intensity of rivalry among existing competitors, the threat of substitute products or services, and the bargaining power of suppliers within the sector. The insights provided are ready for immediate application, ensuring you receive the exact, valuable information presented here.

Rivalry Among Competitors

Aichi Financial Group faces intense rivalry from Japan's megabanks like Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Banking Corporation (SMBC), and Mizuho Financial Group. These institutions, with market capitalizations well into the tens of trillions of Japanese Yen as of early 2024, command vast resources and offer a comprehensive suite of financial services. Their national and global footprints allow them to capture large corporate clients and provide sophisticated products, exerting significant competitive pressure on regional banks. For example, MUFG reported consolidated net business profits exceeding JPY 2.6 trillion for the fiscal year ending March 2024, showcasing their immense scale and competitive capacity.

Aichi Financial Group faces intense rivalry from numerous regional banks deeply embedded within Aichi Prefecture and neighboring areas. These competitors often leverage decades-long community ties and established customer relationships to maintain their market share. The competitive pressure is so significant that Japan's regional banking sector continues to see a trend of consolidation, with several mergers and acquisitions occurring even in 2024, aiming for greater operational efficiency and market dominance amidst a shrinking population and low-interest rate environment.

Aichi Financial Group experiences strong competitive rivalry from non-bank financial institutions, such as securities firms, insurance companies, and leasing companies. These entities often offer specialized services like investment products, loans, and insurance, directly overlapping with the bank's core offerings. For instance, non-bank lenders in Japan have continued to expand their market presence into 2024, intensifying pressure. This dynamic creates a more fragmented and competitive landscape for financial services, requiring Aichi to constantly adapt its strategies.

Rivalry in Digital and Fintech Services

The competitive landscape for Aichi Financial Group is intensely shaped by digital transformation and the rise of fintech innovation. They face rivalry from traditional banks significantly enhancing their digital offerings, alongside agile, purely digital players providing user-friendly financial solutions. Investing in and effectively deploying new technologies is a crucial competitive differentiator, as seen with over 75% of global consumers now preferring digital banking channels in 2024. The ability to offer seamless mobile experiences and instant services is paramount.

- Global fintech market projected at $324 billion in 2024.

- Digital banking adoption reached 78% of adults in 2024 in some key markets.

- Investment in AI and machine learning in finance surged by 30% in 2024.

- Neobanks captured 15% of new customer acquisitions in 2024.

Merger as a Strategy to Enhance Competitiveness

The very formation of Aichi Financial Group, through the 2024 merger of Aichi Bank and Chukyo Bank, is a strategic move to strengthen its competitive position within the financial landscape. By combining their resources, customer bases, and branch networks, the new entity aims to achieve greater economies of scale, which is vital for profitability in a competitive market.

This consolidation enhances its market share in Aichi Prefecture, allowing it to compete more effectively against larger rivals and boost its regional influence. As of March 2024, the group reported total assets reflecting its strengthened position.

- Enhanced market share in Aichi Prefecture.

- Achieved greater economies of scale.

- Strengthened competitive stance against larger banks.

- Combined branch network and customer base.

Aichi Financial Group faces intense competitive rivalry from Japanese megabanks, with MUFG reporting over JPY 2.6 trillion in net business profits for fiscal year 2024, and from regional banks amidst ongoing 2024 consolidation trends. Non-bank financial institutions and the rise of fintech, including digital banking adoption reaching 78% in some key markets in 2024, further intensify pressure. Aichi's 2024 merger was a strategic move to enhance its market share in Aichi Prefecture and achieve greater economies of scale. The global fintech market is projected at $324 billion in 2024, highlighting the evolving competitive landscape.

SSubstitutes Threaten

Financial technology companies and digital payment platforms pose a substantial threat of substitution to Aichi Financial Group. Services like peer-to-peer lending, robo-advisors, and mobile payment apps offer compelling alternatives to traditional banking products. These digital substitutes often boast greater convenience and lower fees, appealing particularly to a younger, more tech-savvy demographic. For instance, global mobile payment transactions are projected to exceed $12 trillion in 2024, indicating a significant shift away from conventional methods. This rapid adoption underscores the competitive pressure on established financial institutions.

While various fintech solutions are emerging, the threat of substitutes to Aichi Financial Group's core banking services, like holding insured deposits and providing large-scale commercial loans, remains notably low. The inherent trust and robust regulatory oversight, including FDIC insurance up to $250,000 per depositor, are significant advantages traditional banks possess. New entrants find it challenging to quickly replicate this established security and compliance infrastructure. Consequently, for most individuals and businesses, traditional banks continue to be the primary choice for these essential financial needs, maintaining strong market dominance in 2024.

Larger corporate customers frequently bypass traditional bank financing from entities like Aichi Financial Group by directly accessing capital markets. This long-standing substitute allows companies to raise funds through bond or stock issuances, offering an alternative to bank loans. For instance, global corporate bond issuances remained robust in 2024, demonstrating strong market liquidity. The increasing ease and competitive cost of direct capital market access significantly influence demand for Aichi Financial Group's corporate lending services, posing a continuous threat to its market share.

Emergence of Crowdfunding Platforms

The emergence of crowdfunding platforms poses a growing threat of substitution to Aichi Financial Group's traditional lending services. These online platforms allow businesses, particularly startups and SMEs, to secure capital directly from a broad base of individual investors, bypassing conventional bank loans. While still a niche market compared to mainstream financing, the global crowdfunding market size reached an estimated $17.2 billion in 2024, demonstrating its increasing viability as an alternative for project financing.

- Global crowdfunding market value is projected to exceed $19 billion by 2025.

- Equity crowdfunding secured over $4 billion in 2024 for SMEs.

- Debt crowdfunding platforms facilitated over $6 billion in loans in 2024.

- Crowdfunding platforms offer faster access to funds for small businesses.

Insurance Products as a Substitute for Savings

Insurance products offering investment or savings components present a significant substitute threat to Aichi Financial Group's traditional savings accounts. These products, such as unit-linked insurance plans or endowment policies, directly compete for individuals' long-term savings. This competition can divert substantial funds that might otherwise be deposited with Aichi, impacting its deposit base and liquidity. For instance, global insurance premiums for life insurance, which often include savings elements, were projected to grow by 2.2% in 2024, indicating strong competition for Aichi's core savings offerings.

- Insurance products with savings components directly compete with traditional bank deposits.

- These products attract long-term savings by combining protection and wealth accumulation.

- Global life insurance premiums were projected to grow by 2.2% in 2024, highlighting market competition.

- This diversion of funds can reduce Aichi Financial Group's deposit base.

Aichi Financial Group faces substitute threats from fintech, capital markets, crowdfunding, and insurance products. Digital platforms offering mobile payments and robo-advisors, with global mobile payment transactions projected to exceed $12 trillion in 2024, challenge traditional banking. Corporations increasingly access capital markets directly, while crowdfunding, valued at $17.2 billion in 2024, provides alternative financing. Insurance products with savings components also divert funds, impacting Aichi's deposit base.

| Substitute Category | 2024 Market Data | Impact on Aichi |

|---|---|---|

| Mobile Payments | >$12 Trillion (projected) | Reduced traditional transaction volume |

| Crowdfunding | $17.2 Billion (market size) | Alternative for SME financing |

| Corporate Bonds | Robust Issuances | Bypasses bank lending for corporates |

Entrants Threaten

The Japanese banking sector is highly regulated, posing significant hurdles for new entrants. Obtaining a banking license from the Financial Services Agency (FSA) demands substantial capital, often hundreds of billions of yen, alongside a robust compliance framework. These stringent requirements make it exceptionally difficult for new entities to establish themselves as full-fledged banks in 2024, limiting competition for established players like Aichi Financial Group.

High capital requirements represent a formidable barrier for new entrants into the financial services sector, directly impacting the competitive landscape for Aichi Financial Group. Regulators mandate substantial capital adequacy, such as the Basel III framework, which requires banks to hold significant Common Equity Tier 1 capital. As of 2024, large financial institutions often maintain CET1 ratios well over 10% to meet regulatory and market expectations. This necessitates billions in upfront investment, effectively deterring many potential competitors from entering the market.

Aichi Financial Group benefits from deep-rooted customer loyalty and strong brand recognition across its local communities, a significant barrier for new entrants. Established banks, like those comprising Aichi, often see low customer churn, with only about 3-5% of retail banking customers switching providers annually in 2024. New financial service providers face substantial hurdles, needing to invest heavily in brand building and trust. This inherent customer stickiness, driven by convenience and perceived security, makes it challenging for newcomers to acquire market share efficiently.

Limited Access to Distribution Channels

New entrants into the Japanese regional banking sector face significant hurdles in establishing distribution channels. Building a new physical branch network from scratch or developing a highly effective digital platform to compete with incumbents requires substantial capital and time. Aichi Financial Group, through the combined strength of Aichi Bank and Chukyo Bank, possesses an extensive and well-established branch network across its core market, totaling 225 branches as of March 2024.

- New entrants face high capital expenditure for physical branches.

- Developing competitive digital channels demands significant investment.

- Aichi Financial Group's 225 branches provide a substantial barrier.

- Established customer trust and brand recognition are difficult to replicate quickly.

Increasing Threat from 'Challenger Banks' and Foreign Entrants

Despite existing barriers, Aichi Financial Group faces a rising threat from new entrants, particularly agile challenger banks and foreign financial institutions. These entities often leverage innovative business models, targeting specific niches or utilizing advanced technology to offer services more efficiently than traditional players. Japan's financial landscape, particularly following the 'Big Bang' reforms, has further eased entry for foreign firms. This competitive environment, evident in 2024 with increased digital banking adoption, means established groups like Aichi Financial Group must adapt to stay ahead.

- New digital banks continue to gain traction, with some reporting significant user growth in Japan during 2024.

- Foreign financial institutions are increasingly exploring market entry, leveraging their global scale and tech capabilities.

- Regulatory shifts from the 'Big Bang' reforms facilitate easier market access for innovative fintech players.

New entrants into Japan's banking sector face high regulatory and capital hurdles, alongside Aichi Financial Group's deep customer loyalty and extensive 225-branch network as of March 2024. Despite these barriers, agile digital banks and foreign financial institutions pose a rising threat, leveraging innovation and eased market access. This evolving landscape compels established players like Aichi to adapt to new competitive dynamics.

| Barrier Type | Key Metric (2024) | Impact on New Entrants |

|---|---|---|

| Regulatory Capital | CET1 ratios often >10% | Requires billions in upfront investment |

| Distribution Network | Aichi's 225 physical branches | High CapEx for new branch setup |

| Customer Loyalty | Retail churn 3-5% annually | Difficult to acquire market share |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Aichi Financial Group leverages data from their annual reports, investor presentations, and Japanese financial regulatory filings. We also incorporate industry-specific data from reputable sources like the Japan Financial Services Agency and market research reports on the Japanese banking sector.