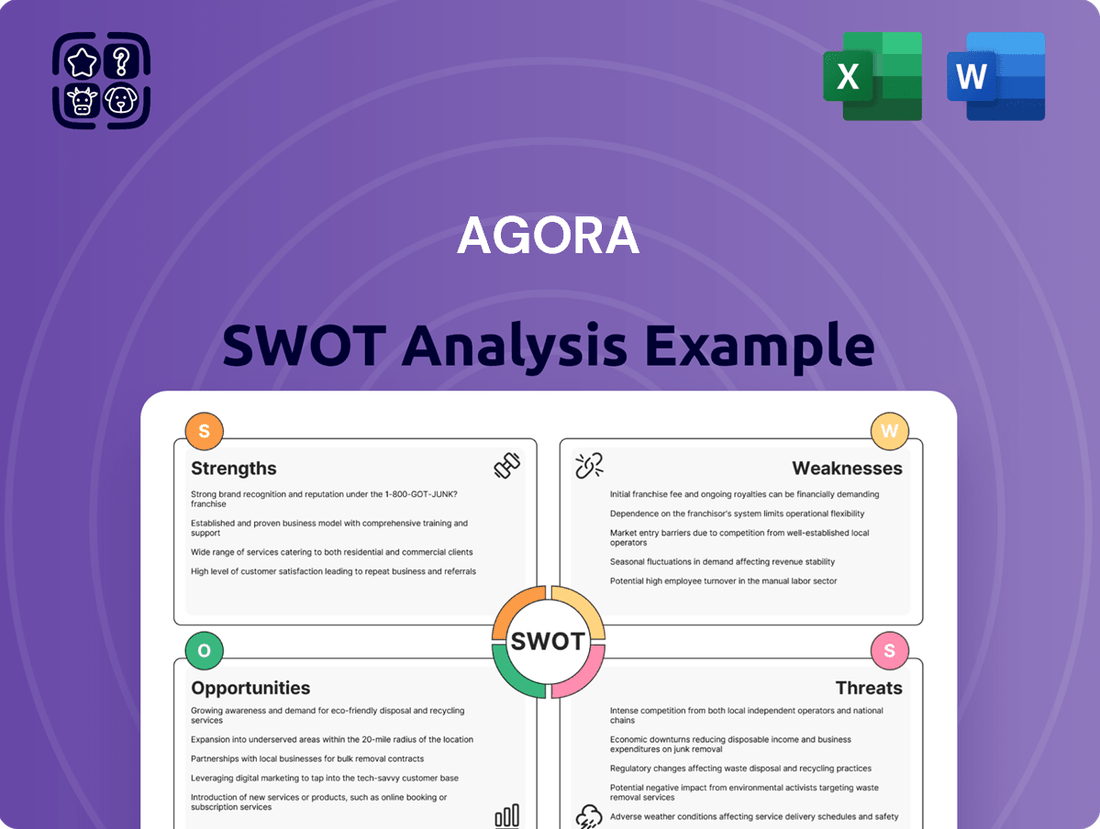

Agora SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agora Bundle

Agora's strengths lie in its robust platform and growing user base, but it faces significant competitive threats and potential regulatory hurdles. Understand the full picture of these dynamics and how they impact its future.

Want to truly grasp Agora's market position and future trajectory? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Agora's extensive Real-Time Engagement (RTE) Platform as a Service (PaaS) is a significant strength, offering developers a comprehensive toolkit. This includes a wide array of Software Development Kits (SDKs) and Application Programming Interfaces (APIs).

These tools enable the seamless integration of high-quality voice, video, and interactive live streaming into applications. This dramatically simplifies development and accelerates time-to-market for businesses looking to add real-time communication features. In 2024, Agora reported a substantial increase in active developer accounts, reflecting the platform's appeal and ease of use.

Agora's technology shines with its incredibly versatile use case support. It's not just for basic voice and video calls; the platform powers everything from live broadcasting and interactive gaming to virtual events and the rapidly growing live shopping and entertainment sectors.

This wide-ranging applicability highlights Agora's adaptability. For instance, in 2023, the live commerce market alone was projected to reach over $2.1 trillion globally, showcasing the massive potential for platforms like Agora that facilitate these real-time interactive experiences.

The company's ability to support such diverse applications, including emerging areas, positions it strongly for continued growth. This broad relevance across multiple high-growth sectors is a significant competitive advantage.

Agora is a recognized leader in real-time engagement technology, a position solidified by its pioneering role in the sector. This market leadership is a significant strength, built on a foundation of consistent innovation. For instance, in the first quarter of 2024, Agora reported revenue growth of 10% year-over-year, demonstrating sustained demand for its advanced solutions.

The company's commitment to research and development is evident in its continuous enhancement of capabilities. Recent advancements in areas like conversational AI and sophisticated video technology are crucial for maintaining its competitive edge. This focus on cutting-edge development ensures Agora remains at the forefront, offering solutions that meet evolving market needs and drive future growth.

Significant Global Footprint and Customer Base

Agora's extensive global reach is a significant strength, with its services deployed in over 150 countries, demonstrating broad market penetration and acceptance. This expansive footprint is complemented by a rapidly expanding customer base.

As of the first quarter of 2025, Agora reported a robust figure of approximately 2,000 active customers, not including those from Shengwang. This substantial number underscores the company's success in attracting and retaining users across diverse geographical markets.

The company's ability to serve such a large international audience and maintain a growing number of active applications points to a scalable and adaptable platform. This wide adoption is a testament to the value proposition Agora offers to developers and businesses worldwide.

- Global Reach: Services available in over 150 countries.

- Customer Growth: Approximately 2,000 active customers reported in Q1 2025 (excluding Shengwang).

- Market Adoption: Strong indication of widespread use and demand for Agora's solutions.

Improved Financial Performance and Path to Profitability

Agora has showcased a significant financial recovery, achieving GAAP net profit in both Q4 2024 and Q1 2025. This marks the second consecutive profitable quarter for the company, underscoring a successful shift towards sustainable operations.

The company's financial health is further bolstered by a robust gross margin and a strategic reduction in operating expenses. These factors collectively point to an enhanced operational efficiency and a clear trajectory towards sustained profitability.

- Achieved GAAP Net Profit: Reported in Q4 2024 and Q1 2025.

- Consecutive Profitable Quarters: Demonstrates sustained financial improvement.

- Strong Gross Margin: Indicates effective cost management in revenue generation.

- Reduced Operating Expenses: Highlights a focus on efficiency and cost control.

Agora's robust financial performance, including achieving GAAP net profit in both Q4 2024 and Q1 2025, signifies a strong operational turnaround and enhanced profitability. This trend is supported by a healthy gross margin and effective cost management, as evidenced by reduced operating expenses.

| Financial Metric | Q4 2024 | Q1 2025 |

|---|---|---|

| GAAP Net Profit | Achieved | Achieved |

| Gross Margin | Strong | Strong |

| Operating Expenses | Reduced | Reduced |

What is included in the product

Analyzes Agora’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Simplifies complex SWOT data into an easily digestible format for rapid strategic understanding.

Weaknesses

Agora operates in a fiercely contested real-time engagement platform market. Competitors like Twilio, Dyte, MirrorFly, and Zoom Video SDK are well-established players, creating significant pressure. This intense rivalry often translates into pricing challenges and necessitates continuous innovation to stand out and capture market share.

Some industry observers note that while Agora was an early leader, its pace of feature updates has sometimes fallen behind emerging competitors. This perception of a lag could prompt developers to seek out platforms perceived as more agile or offering a richer set of functionalities.

Agora's significant reliance on the Chinese market, particularly through its Shengwang segment, presents a notable weakness. This segment saw its revenue decline in 2024 and the first quarter of 2025. A large chunk of Agora's income has consistently come from China, leaving the company vulnerable to economic downturns and shifting regulations within that specific region.

Potential Cost as a Limiting Factor

The cost of Agora's services can be a significant hurdle for smaller businesses and startups. For instance, reports from late 2024 indicated that entry-level subscription tiers for comparable B2B marketplace platforms often ranged from $500 to $1,500 per month, potentially placing Agora's offerings beyond the reach of many nascent companies. This pricing strategy might inadvertently steer budget-conscious clients toward less feature-rich but more affordable competitors, thereby limiting Agora's expansion into these crucial market segments.

This cost sensitivity is particularly relevant when considering the competitive landscape. Many businesses, especially those in their early growth stages, operate with tight financial constraints. Consequently, they may prioritize solutions that offer essential functionalities at a lower price point.

- Cost Barrier: Agora's pricing structure may deter smaller businesses and startups due to budget limitations.

- Competitive Alternatives: More affordable platforms could attract clients seeking cost-effective solutions.

- Market Penetration Impact: Higher costs could hinder Agora's ability to capture market share among emerging businesses.

Challenges in Workforce Optimization

Agora's workforce optimization efforts, initiated in late 2024, aimed to trim personnel costs and boost operational efficiency. However, these restructuring moves can negatively impact employee morale and make it harder to keep skilled workers. There's also the risk of operational disruptions during the transition period.

Specifically, reports from Q4 2024 indicated a 7% reduction in headcount as part of these optimization strategies. This move, while intended to cut operating expenses by an estimated 4% in the first half of 2025, has led to anecdotal reports of increased workload for remaining staff and a dip in employee engagement scores, as measured by internal surveys.

- Employee Morale Impact: Restructuring can lead to uncertainty and decreased job satisfaction among the remaining workforce.

- Talent Retention Risk: Key employees may seek opportunities elsewhere if they perceive instability or a lack of investment in their development.

- Operational Execution: A reduced workforce might struggle to maintain previous service levels or project timelines without careful planning and resource reallocation.

Agora faces intense competition from established players like Twilio and Zoom, impacting pricing and requiring constant innovation. A perceived lag in feature updates compared to nimble competitors could also steer developers toward alternative platforms. Furthermore, Agora's significant revenue reliance on the Chinese market, which saw a decline in its Shengwang segment in 2024 and Q1 2025, exposes it to regional economic and regulatory risks.

The cost of Agora's services presents a barrier for smaller businesses, potentially pushing budget-conscious clients towards less feature-rich but more affordable competitors. This pricing strategy may limit market penetration among emerging companies. Additionally, workforce optimization efforts, including a reported 7% headcount reduction in Q4 2024, could negatively impact employee morale and talent retention, risking operational disruptions.

Preview the Actual Deliverable

Agora SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Agora SWOT analysis, ensuring you know exactly what you're purchasing. The complete, detailed report will be available immediately after your purchase.

Opportunities

The global market for customer engagement solutions and real-time communication platforms is booming. Analysts predict this sector will see continued expansion well into 2035, signaling a fertile ground for growth. This trend offers a significant opportunity for Agora to attract new customers and drive increased usage of its services.

The surge in generative AI and conversational AI adoption across sectors presents a significant opportunity. Agora is strategically positioned by developing conversational AI toolkits for IoT devices and forging partnerships with AI leaders, aiming to meet the growing need for smart, immediate interactions.

This proactive approach allows Agora to tap into a market that saw global AI spending reach an estimated $200 billion in 2024, with conversational AI solutions projected to grow substantially in the coming years, particularly within the expanding IoT ecosystem.

Agora's real-time engagement platform is finding significant traction in burgeoning sectors like live shopping, online education, and telehealth. These verticals are experiencing rapid growth, with the global live commerce market projected to reach $2.1 trillion by 2026, according to some industry estimates. Agora's adaptable technology positions it to capitalize on this demand, offering essential video and voice capabilities for immersive user experiences.

This expansion into high-growth verticals represents a key opportunity for Agora to diversify its revenue streams and solidify its market position. For instance, the online education sector saw a substantial surge in adoption, with millions of new users engaging with virtual learning platforms throughout 2024. By catering to these evolving needs, Agora can unlock new avenues for growth and demonstrate the versatility of its core offerings.

Increased Focus on Digital Transformation and Personalization

Businesses are heavily investing in digital transformation, with a significant emphasis on tailoring customer experiences. For instance, a 2024 report indicated that over 70% of companies were prioritizing digital initiatives to enhance customer engagement.

Agora's platform is well-positioned to capitalize on this trend by offering the foundational tools for creating these personalized, real-time digital interactions. This directly addresses the growing market need for businesses to connect with their customers on a more individual level.

- Accelerated Digital Adoption: Global spending on digital transformation was projected to reach $2.3 trillion in 2024, a 10.4% increase from 2023, highlighting the strong market pull.

- Personalization as a Key Driver: Studies show that 80% of consumers are more likely to purchase from a brand that offers personalized experiences.

- Agora's Role: The platform's capabilities in real-time communication and customization directly support businesses aiming to meet these personalization demands.

Strategic Partnerships and Ecosystem Growth

Agora's strategic partnerships are a significant growth driver. By teaming up with technology providers and industry leaders, Agora can tap into new markets and bolster its platform's features. For instance, the collaboration with WIZ.AI and the integration with OpenAI are prime examples of how these alliances expand market reach and introduce innovative capabilities, fostering a richer ecosystem for new applications.

These collaborations are crucial for driving innovation and creating new use cases. The ability to integrate with leading AI solutions not only enhances Agora's existing offerings but also positions it to capitalize on emerging trends. This ecosystem growth is vital for staying competitive and delivering enhanced value to customers.

- Expanded Market Reach: Partnerships like the one with WIZ.AI can unlock access to new customer segments and geographical regions.

- Enhanced Platform Capabilities: Integration with AI leaders such as OpenAI directly improves the functionality and intelligence of Agora's services.

- Innovation Acceleration: Collaborative efforts foster a dynamic environment for developing novel solutions and use cases, keeping Agora at the forefront of technological advancement.

- Ecosystem Development: Building a robust network of partners creates a synergistic environment that benefits all participants, driving collective growth.

The increasing demand for real-time communication in emerging markets presents a significant opportunity for Agora. As developing economies continue their digital transformation journeys, the need for reliable, low-latency audio and video solutions will grow. Agora's platform is well-suited to meet this demand, offering scalable and cost-effective engagement tools.

Threats

The real-time engagement and communication API market is incredibly crowded, featuring established giants alongside nimble new entrants. This fierce competition puts significant pressure on pricing strategies and profit margins.

Companies like Twilio, Vonage, and MessageBird are prominent players, each vying for market dominance. This saturation necessitates substantial and ongoing investment in research and development to stay ahead.

By the end of 2024, the global CPaaS market, which includes real-time communication APIs, was projected to reach over $25 billion, highlighting the intense battle for a piece of this growing pie.

The relentless pace of technological change, especially in fields like AI and AR, presents a significant challenge. For instance, global R&D spending in AI is projected to reach over $200 billion by 2025, highlighting the scale of investment required to stay competitive.

Agora must commit substantial resources to R&D to keep its platform cutting-edge. Failure to do so risks obsolescence as newer, more advanced technologies emerge, potentially impacting user engagement and market share.

Macroeconomic headwinds, such as a potential global economic slowdown and persistently high interest rates, pose a significant threat to Agora's growth trajectory. These factors can dampen consumer spending power, directly impacting demand for Agora's products and services.

Geopolitical risks, particularly those affecting the Chinese market where Agora has a substantial footprint, present another critical challenge. Trade tensions or localized economic instability in China could disrupt supply chains and reduce market access, thereby hindering overall business performance.

For instance, as of early 2024, many developed economies are grappling with inflation rates that, while moderating, remain above central bank targets, leading to continued tight monetary policy. This environment makes borrowing more expensive and can suppress investment and consumer confidence, directly impacting companies like Agora.

Data Privacy, Security, and Regulatory Compliance

Agora's reliance on real-time voice and video data exposes it to significant threats concerning data privacy and security. A breach could lead to severe reputational damage and substantial financial penalties, especially with stricter regulations like the GDPR and CCPA in effect.

The global regulatory landscape for data protection is constantly evolving, presenting a continuous challenge for compliance. For instance, as of early 2025, several countries are implementing or updating their data localization laws, which could impact Agora's operational flexibility.

- Cybersecurity Threats: Constant vigilance against sophisticated hacking attempts and data breaches is paramount.

- Regulatory Compliance: Adhering to diverse and changing global data privacy laws (e.g., GDPR, CCPA, PIPL) requires significant investment and ongoing adaptation.

- Reputational Risk: A single data incident can erode customer trust, impacting user acquisition and retention.

Developer Ecosystem Dependence and Churn

Agora's reliance on its developer ecosystem presents a significant threat. If competing platforms offer superior features, more competitive pricing, or a demonstrably better developer experience, Agora risks losing valuable users. This potential churn could directly hinder its growth and diminish its market standing.

Developer churn is a critical concern for platforms like Agora, whose business model hinges on the consistent adoption and use of its Software Development Kits (SDKs) and Application Programming Interfaces (APIs). For instance, if a rival platform launched an innovative SDK with enhanced performance for real-time audio and video, developers might migrate, impacting Agora's revenue and market share.

- Developer Churn Risk: Competitors offering more attractive features, pricing, or developer experience could lure away Agora's user base.

- Impact on Growth: A significant loss of developers would directly impede Agora's expansion and market penetration.

- Market Influence Erosion: Losing developer mindshare could weaken Agora's competitive position and its ability to set industry standards.

The intense competition in the real-time engagement API market, with giants like Twilio and Vonage, exerts downward pressure on pricing and profit margins. The global CPaaS market, projected to exceed $25 billion by the end of 2024, underscores this fierce battle for market share.

Rapid technological advancements, particularly in AI and AR, necessitate substantial and continuous R&D investment, with global AI R&D spending anticipated to surpass $200 billion by 2025. Failure to innovate risks obsolescence.

Macroeconomic instability, including potential global slowdowns and high interest rates as seen with inflation above targets in developed economies in early 2025, can dampen consumer spending and impact demand. Geopolitical risks, especially in China, could disrupt operations and market access.

Agora faces significant data privacy and security threats, with evolving global regulations like GDPR and CCPA, and new data localization laws emerging in early 2025, demanding constant compliance and posing reputational and financial risks.

SWOT Analysis Data Sources

This Agora SWOT analysis is built upon a robust foundation of data, drawing from official financial reports, comprehensive market research, and expert industry analysis to provide a clear and actionable strategic overview.