Agora Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agora Bundle

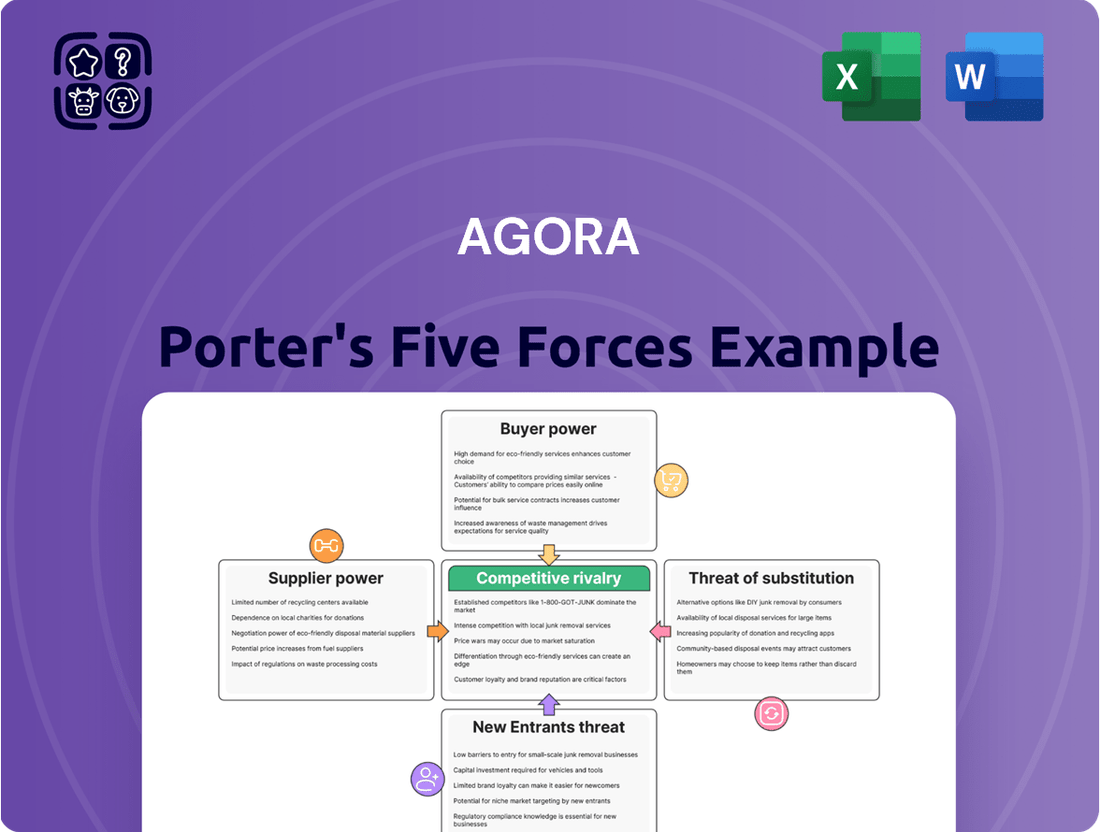

Agora's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the ever-present threat of new entrants. Understanding these dynamics is crucial for any strategic decision.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Agora’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Agora, as a provider of Real-Time Engagement (RTE) Platform as a Service (PaaS), is significantly dependent on major cloud infrastructure providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. These providers are critical for Agora's ability to scale its operations and ensure low-latency performance across the globe, directly influencing its cost of revenues.

The bargaining power of these cloud giants is substantial. For instance, a notable increase in cloud service pricing or a shift in their service agreements could directly translate to higher operational expenses for Agora. This was evident in Agora's Q2 2024 results, where cost of revenues rose, partly due to increased bandwidth and co-location expenses, underscoring the impact of these foundational service costs.

Agora's core business, providing real-time voice, video, and live streaming, critically relies on specialized bandwidth and network providers. These suppliers are essential for delivering the low-latency, high-quality infrastructure that underpins seamless global engagement experiences for Agora's users.

The specialized nature of these network services, particularly for demanding real-time applications, can grant suppliers significant bargaining power. This leverage is amplified if alternative providers are scarce in specific regions or unable to meet Agora's stringent performance benchmarks, as seen in the reliance on global internet backbones.

Agora's own Software-Defined Real-Time Network (SD-RTN™) highlights the importance of these partnerships. In 2024, the global cloud networking market, which includes these specialized providers, was valued at approximately $30 billion and is projected to grow substantially, indicating the increasing demand and potential supplier influence within this sector.

The scarcity of highly skilled real-time communication talent significantly boosts supplier bargaining power. Developing and maintaining advanced Real-Time Engagement Platform as a Service (RTE PaaS) like Agora's demands expertise in audio/video processing, network optimization, and distributed systems. This limited talent pool allows these specialists to command higher salaries and better benefits, directly impacting Agora's operational costs.

Agora's innovation and expansion, including ventures into conversational AI, are directly tied to its capacity to attract and retain this specialized workforce. For instance, the demand for AI/ML engineers with real-time processing experience saw a surge in 2024, with average salaries for such roles often exceeding $150,000 annually in major tech hubs. This high demand for niche skills means these engineers hold considerable leverage.

Proprietary Software and Hardware Components

Agora's reliance on proprietary software and hardware components can significantly influence supplier bargaining power. If critical underlying technologies, such as specialized codecs or unique hardware accelerators, are sourced from a limited number of vendors with few substitutes, these suppliers gain leverage. This dependence can translate into higher input costs for Agora and potentially constrain its ability to innovate or adapt its platform quickly, especially as it integrates advanced features like conversational AI, which often requires specialized software dependencies.

For instance, in 2024, the semiconductor industry, a key supplier of hardware components, experienced continued supply chain pressures and price volatility for advanced chips, impacting the cost of hardware integration for technology companies. This situation highlights how specialized hardware needs can empower suppliers.

- Supplier Leverage: Dependence on unique software libraries or hardware components grants suppliers increased pricing power.

- Cost Implications: Limited alternatives for proprietary inputs can lead to higher operational expenses for Agora.

- Innovation Constraints: Reliance on specific vendor technologies may slow down the integration of new features or limit platform flexibility.

- AI Dependencies: The push for advanced features like conversational AI introduces new potential dependencies on specialized software providers.

Emergence of AI Model and Data Providers

Agora's foray into conversational AI introduces new, powerful suppliers: developers of large language models (LLMs) and specialized AI training data. These entities are crucial for Agora's real-time, voice-based AI capabilities.

The bargaining power of leading LLM providers is likely to be significant. For instance, in 2024, the demand for advanced AI models continued to surge, with companies like NVIDIA reporting substantial revenue growth driven by AI chip demand, indirectly reflecting the value and scarcity of cutting-edge AI infrastructure and models.

Agora's reliance on these specialized suppliers could influence its innovation pace and operational costs. The cost of accessing and integrating top-tier LLMs, coupled with the need for proprietary or curated datasets, presents a key consideration for Agora's AI strategy.

- Emergence of Critical AI Suppliers: Agora now depends on LLM developers and AI data providers for its conversational AI engine.

- Substantial Supplier Power: Leading AI model developers can exert considerable influence due to high demand and the specialized nature of their offerings.

- Impact on Agora's Operations: Supplier bargaining power can affect Agora's feature development, cost structure, and overall AI solution pricing.

- Market Dynamics in 2024: The AI sector saw continued intense competition for talent and resources, strengthening the position of established AI infrastructure and model providers.

Agora's reliance on cloud infrastructure providers like AWS, Azure, and Google Cloud grants these suppliers significant bargaining power. Their ability to influence pricing and service terms directly impacts Agora's cost of revenues, as seen in rising bandwidth and co-location expenses reported in Q2 2024.

Specialized network providers are also critical, with their leverage amplified by the scarcity of alternatives capable of meeting Agora's stringent low-latency performance demands. The global cloud networking market, valued around $30 billion in 2024, reflects the growing importance and potential supplier influence in this sector.

Furthermore, the limited pool of talent skilled in real-time communication and AI development empowers these specialists, driving up operational costs for Agora as they compete for expertise. For example, AI/ML engineers with real-time processing experience commanded salaries exceeding $150,000 annually in major tech hubs in 2024.

Finally, dependence on proprietary software and hardware components from a few vendors, such as specialized codecs or advanced chips, gives these suppliers considerable pricing power and can constrain Agora's innovation speed. The semiconductor industry's supply chain pressures in 2024 exemplify how hardware needs can empower suppliers.

| Key Supplier Group | Agora's Dependence | Supplier Bargaining Power Factor | 2024 Market Insight | Impact on Agora |

| Cloud Infrastructure Providers (AWS, Azure, GCP) | Essential for scaling and global low-latency performance | High (few dominant players) | Global Cloud Computing Market projected to exceed $1 trillion | Increased operational costs, potential service limitations |

| Specialized Network Providers | Critical for real-time, high-quality engagement | High (specialized needs, regional scarcity) | Global Cloud Networking Market ~ $30 billion | Higher input costs, potential innovation constraints |

| Skilled Real-Time/AI Talent | Needed for platform development and AI integration | Very High (limited talent pool) | AI/ML Engineer salaries > $150k/year in tech hubs | Increased labor costs, talent acquisition challenges |

| Proprietary Software/Hardware Vendors | Key components for platform functionality | High (limited substitutes) | Semiconductor supply chain pressures and price volatility | Higher component costs, slower feature integration |

What is included in the product

This analysis dissects the competitive landscape for Agora by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors.

Gain immediate clarity on competitive pressures with a visual representation of each force, simplifying complex market dynamics.

Customers Bargaining Power

Agora's customers, developers and businesses seeking real-time engagement features, benefit from a highly competitive Real-Time Engagement Platform as a Service (RTE PaaS) market. This abundance of alternatives significantly bolsters their bargaining power.

Key competitors offering similar functionalities include Dyte, MirrorFly, Twilio, Vonage, VideoSDK, ZEGOCLOUD, and Zoom Video SDK. For instance, Twilio reported over 275,000 active customer accounts as of Q4 2023, highlighting the vast customer base and potential for switching.

This broad selection empowers customers to meticulously compare features, pricing structures, and levels of support across various providers. Consequently, this competitive landscape places considerable pressure on Agora to consistently offer compelling value and maintain competitive pricing to retain its customer base.

The bargaining power of customers in the real-time communication API market is influenced by relatively low switching costs for initial integration. Developers can often integrate Software Development Kits (SDKs) and Application Programming Interfaces (APIs) from various providers with relative ease, allowing them to experiment before making a long-term commitment.

This ease of initial integration means customers can readily compare offerings, potentially testing several communication API providers for new projects. This accessibility naturally lowers the barrier to entry for switching, as the upfront effort to try a new service is minimal.

However, the landscape shifts once these APIs are deeply embedded and scaled within an application's architecture. The significant effort required to re-architect and redeploy applications can then substantially increase switching costs, making it more challenging for customers to move away from an established provider.

Customers, especially those who use services like Agora’s for high-volume applications such as live streaming or online gaming, tend to be very sensitive to price. As real-time engagement becomes more common, these users will naturally look for ways to cut costs without sacrificing the quality of their experience.

Agora's business model directly links revenue to how much customers use its services. This means that if competitors offer lower prices, it can put pressure on Agora’s average revenue per customer, potentially impacting overall profitability.

Ability of Customers to Develop In-House Solutions

Customers, especially large enterprises or those with strong technical capabilities, can significantly influence pricing and terms by developing their own real-time communication solutions. This 'build versus buy' scenario leverages in-house expertise and resources, often utilizing open-source frameworks like WebRTC or general cloud infrastructure. For instance, a large financial institution might opt to build its secure internal communication platform rather than relying on a third-party Platform-as-a-Service (PaaS) provider if the cost savings and customization benefits are substantial.

This ability to create proprietary systems directly impacts the bargaining power of customers. If a PaaS provider’s pricing becomes uncompetitive or their service doesn't meet specific needs, customers can choose to develop their own alternatives. This threat of substitution is a powerful negotiation tool, forcing providers to remain competitive in both cost and feature offerings. In 2024, the increasing maturity of cloud-native development tools and the availability of skilled developers make in-house solution development a more viable option for a broader range of companies.

The drive for highly customized solutions further amplifies this bargaining power. Customers seeking unique functionalities or tighter integration with existing systems may find off-the-shelf PaaS solutions inadequate. Developing in-house allows for unparalleled control over features, security protocols, and data management, making it an attractive option for businesses with stringent requirements. This capability can lead to significant cost reductions for the customer over the long term, especially when factoring in the flexibility and scalability of a custom-built system.

- In-house development reduces reliance on third-party PaaS providers.

- Technical expertise and resource availability are key enablers for customers building their own solutions.

- The 'build vs. buy' decision empowers customers by providing a viable alternative to external services.

- Customization needs often drive customers towards developing proprietary real-time communication infrastructure.

Demand for Customization and Specific Features

The growing demand for tailored real-time engagement solutions empowers customers. Developers and businesses actively seek highly customizable platforms with specific features to set their applications apart. This trend allows clients with unique needs, like advanced AI integrations or distinct user interface elements, to influence Agora's product development roadmap. For instance, Agora's strategic investments in areas such as conversational AI directly address these evolving customer expectations, demonstrating a commitment to meeting specialized requirements.

Customers in the real-time engagement platform market possess significant bargaining power due to the availability of numerous alternatives and the potential for in-house development. This power is amplified by price sensitivity and the desire for customized solutions, forcing providers like Agora to offer competitive pricing and adaptable features.

The competitive landscape is robust, with companies like Twilio reporting over 275,000 active customer accounts in Q4 2023, indicating a large pool of potential alternatives for developers. This broad market choice allows customers to easily compare offerings, putting pressure on providers to deliver superior value and pricing to retain business.

While initial integration costs are often low, allowing for easy experimentation with different providers, the costs associated with deep integration and scaling can increase switching barriers. Nevertheless, the option to build proprietary solutions, especially with the maturity of cloud-native tools in 2024, remains a potent negotiation tactic for customers.

| Factor | Impact on Bargaining Power | Supporting Data/Observation |

|---|---|---|

| Market Competition | High | Numerous PaaS providers like Dyte, MirrorFly, Twilio, Vonage, VideoSDK, ZEGOCLOUD, Zoom Video SDK. |

| Switching Costs | Low (initial), High (deep integration) | Ease of SDK/API integration vs. re-architecting scaled applications. |

| Price Sensitivity | High | Customers seek cost reductions without sacrificing quality, especially for high-volume use cases. |

| In-house Development Threat | High | Availability of skilled developers and cloud tools makes building proprietary solutions viable. |

| Customization Needs | High | Demand for tailored features influences product roadmaps and provider offerings. |

Preview the Actual Deliverable

Agora Porter's Five Forces Analysis

This preview showcases the complete Agora Porter's Five Forces Analysis, offering a detailed examination of competitive forces within your target market. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and readiness for your strategic planning.

Rivalry Among Competitors

The Real-Time Engagement Platform as a Service (RTE PaaS) market is a crowded space, featuring many companies offering similar tools for voice, video, and live streaming. This means Agora faces stiff competition from established names like Twilio and Vonage, as well as emerging players such as ZEGOCLOUD and MirrorFly.

This high level of rivalry necessitates continuous innovation from Agora to stand out and keep customers engaged. For instance, while Twilio reported $4.79 billion in revenue for 2023, demonstrating its scale, the need for differentiation in features and pricing is paramount for all participants.

The real-time engagement (RTE) Platform-as-a-Service (PaaS) market is a hotbed of technological evolution, particularly with the increasing integration of artificial intelligence (AI), augmented reality (AR), and virtual reality (VR) into live experiences. This constant push for advancement means competitors are perpetually launching new functionalities, reducing delays, and boosting their capacity to handle more users and data.

Agora itself is actively demonstrating this commitment to innovation. In 2024, they rolled out a new Conversational AI Engine, a significant step in enhancing user interaction within real-time applications. Furthermore, they released a specialized toolkit designed for Internet of Things (IoT) devices, underscoring their strategy to remain a leader in cutting-edge RTE solutions.

In the rapidly evolving Real-Time Engagement Platform as a Service (RTE PaaS) market, intense price competition is a defining characteristic. With numerous providers offering similar core functionalities, customers have the power to easily compare pricing structures, exerting downward pressure on rates for companies like Agora. This creates a challenging environment where maintaining profitability requires a sharp focus on cost efficiency and value delivery.

Beyond just price, the RTE PaaS landscape is marked by a constant pursuit of feature parity. Most platforms offer a baseline set of essential capabilities, making it difficult for any single provider to gain a significant advantage solely through standard features. This necessitates a strategic approach where companies must not only match competitor offerings but also innovate to introduce unique value propositions that resonate with specific customer needs and differentiate them in a crowded market.

Global and Regional Market Dynamics

Agora's competitive rivalry is shaped by its global reach and its distinct position within the significant China market via Shengwang. This dual focus necessitates navigating both broad international competition and the specific dynamics of regional players, particularly in China where local competitors often hold strong market share.

The global e-commerce market, including areas where Agora operates, continues its robust expansion. For instance, in 2024, global e-commerce sales were projected to reach approximately $6.3 trillion, with North America and Asia Pacific identified as primary drivers of this growth. This rapid expansion intensifies rivalry as more players enter and existing ones vie for increased market share.

- Global E-commerce Growth: Expected to exceed $6.3 trillion in 2024, fueling intense competition.

- Key Growth Regions: North America and Asia Pacific are critical battlegrounds for market dominance.

- China Market Specifics: Shengwang faces unique regional competitors and regulatory landscapes, distinct from global operations.

- Diverse Competitive Pressures: Agora must contend with varied competitive intensities and strategies across different geographical markets.

Focus on Developer Experience and Ecosystem

The real-time engagement (RTE) Platform-as-a-Service (PaaS) market thrives on developer satisfaction. Companies like Twilio, Vonage, and MessageBird emphasize their user-friendly interfaces, extensive API libraries, and readily available SDKs. For instance, Twilio's developer-first approach has been a cornerstone of its growth, with millions of developers actively using its platform. Agora must continue to invest in its developer experience, offering clear documentation and intuitive tools to onboard new users quickly.

Competitors are actively promoting their low-code and no-code solutions, aiming to simplify integration and reduce development time. This strategy allows businesses to implement real-time features with minimal coding expertise. Agora's competitive advantage hinges on its ability to provide a robust yet accessible platform that caters to both seasoned developers and those new to real-time communication technologies. In 2024, the demand for faster deployment cycles in the RTE sector is a significant driver for adopting these simplified integration methods.

Fostering a vibrant developer ecosystem is paramount. This includes active community forums, readily available sample code, and responsive support channels. A strong community can significantly reduce a developer's learning curve and provide valuable peer-to-peer assistance. Agora's commitment to nurturing this ecosystem, perhaps through hackathons or developer grants, will be key to attracting and retaining talent, directly impacting its market share.

Agora's ability to offer seamless integration with existing workflows and applications is a critical differentiator. Competitors often tout their pre-built connectors and integrations with popular business tools. For example, many platforms offer integrations with CRM systems or collaboration suites, streamlining the adoption process. By providing flexible and straightforward integration capabilities, Agora can reduce friction for businesses looking to embed real-time communication features.

- Developer Experience Focus: Competitors like Twilio and Vonage prioritize comprehensive documentation and easy-to-use SDKs, which are crucial for attracting and retaining developers in the RTE PaaS market.

- Low-Code/No-Code Solutions: The market trend in 2024 shows a strong emphasis on simplified integration through low-code and no-code offerings, enabling faster deployment of real-time features.

- Ecosystem Growth: A thriving developer community, supported by forums and readily available resources, is vital for reducing onboarding friction and fostering platform adoption for companies like Agora.

- Seamless Integration: Agora's competitive edge is strengthened by its capacity to offer smooth integration with existing business tools and workflows, mirroring competitor strategies that reduce adoption barriers.

The competitive rivalry in the Real-Time Engagement Platform as a Service (RTE PaaS) market is intense, characterized by a crowded field of providers offering similar functionalities. This necessitates constant innovation and differentiation for companies like Agora to maintain market share and customer loyalty.

Key players such as Twilio and Vonage, with significant revenue bases like Twilio's $4.79 billion in 2023, set a high bar. The market is further segmented by specialized regional competitors, particularly in China where Agora's Shengwang operates, adding another layer of competitive pressure.

The drive for feature parity is relentless, with competitors frequently launching new capabilities. For example, the integration of AI, AR, and VR into live experiences is a major trend, pushing companies to continuously enhance their offerings to stay ahead.

The global e-commerce market's expansion, projected to exceed $6.3 trillion in 2024, fuels this rivalry as more businesses seek real-time communication solutions, creating a dynamic and challenging environment for all participants.

SSubstitutes Threaten

Developers have the option to build real-time communication functionalities from the ground up using general cloud services such as Amazon Interactive Video Service (IVS) or other media processing tools from major cloud providers. This approach demands more development time and technical skill, but it grants developers enhanced control and the ability to tailor solutions precisely to their unique needs.

These more generic cloud offerings serve as a significant substitute for developers who prefer to manage their own infrastructure rather than depend on a specialized Platform-as-a-Service (PaaS) provider. For instance, while a specialized PaaS might offer pre-built chat features, a developer could leverage AWS IVS to stream video and build their own chat overlay, potentially saving costs for high-volume, low-latency applications.

Open-source WebRTC frameworks like LiveKit present a significant threat of substitution for companies relying on proprietary real-time communication solutions. These frameworks allow developers to build custom, in-browser communication features, bypassing the need for third-party platforms. This can lead to substantial cost savings, as evidenced by the growing adoption of open-source technologies across the tech landscape, with many companies reporting reduced infrastructure expenses.

Traditional video conferencing and messaging platforms present a significant threat of substitution. For many businesses and individuals, readily available solutions like Zoom Workplace, Microsoft Teams, and Google Workspace offer a convenient alternative to integrating real-time communication features directly into their own applications. These platforms, while lacking the deep customization of Agora's SDKs, effectively meet basic needs for video calls, meetings, and group messaging without the requirement for custom development, impacting potential adoption of more integrated solutions.

In-House Development and Proprietary Solutions

Well-resourced companies, particularly large tech firms, can develop their entire real-time communication infrastructure internally. This includes everything from media servers to the software development kits (SDKs) used by developers. For instance, in 2024, major cloud providers and social media giants continued to invest heavily in their proprietary communication technologies, aiming for greater integration and control.

This in-house development, though costly and time-intensive, offers a significant advantage by removing dependence on external vendors. It grants complete ownership of intellectual property and the ability to craft highly customized features, making it a potent substitute for third-party real-time communication solutions.

The threat is amplified by the sheer scale and engineering prowess of these companies. Their ability to innovate rapidly and tailor solutions precisely to their needs can outpace the offerings of specialized communication platform providers.

- Internal Development Costs: Companies undertaking in-house development often face substantial upfront investment in engineering talent, infrastructure, and ongoing maintenance.

- Control and Customization: Building proprietary systems allows for unparalleled control over features, security, and data, enabling unique user experiences.

- Intellectual Property: In-house solutions mean all IP remains within the company, preventing reliance on external licensing and potential IP disputes.

- Competitive Advantage: Companies with unique, internally developed communication tools can differentiate themselves in the market, offering features not available from third-party providers.

Alternative Engagement Models (Non-Real-Time)

Some applications, particularly those focused on community building or information sharing rather than immediate transactions, can thrive on non-real-time engagement. Think about online forums or even email newsletters; they connect users without requiring instant responses. This can divert demand from platforms that prioritize real-time interaction.

For instance, consider the growth of asynchronous communication tools. In 2024, the global market for collaboration software, which often includes asynchronous features, was projected to reach over $60 billion, indicating a significant user base that values these alternative engagement models. This suggests that users may opt for these less immediate but still effective communication channels, potentially reducing the perceived necessity of real-time engagement features in other applications.

- Asynchronous platforms like Reddit and Discord continue to grow, offering alternative engagement models.

- The demand for real-time interaction can be partially met by asynchronous communication, diverting potential users.

- The broader customer engagement platform market is expanding, offering diverse solutions beyond real-time interaction.

The threat of substitutes for real-time communication solutions is significant, encompassing both readily available platforms and the option for in-house development. Companies like Zoom and Microsoft Teams offer convenient, albeit less customizable, alternatives for basic communication needs. In 2024, the continued investment by major tech firms in proprietary communication infrastructure further highlights the viability of internal solutions.

Open-source frameworks also provide a powerful substitute, enabling developers to build custom solutions and potentially reduce costs. For instance, many companies report infrastructure savings by adopting open-source technologies. Furthermore, the rise of asynchronous communication tools, with a global collaboration software market projected to exceed $60 billion in 2024, indicates a user preference for alternative engagement models that can divert demand from real-time solutions.

| Substitute Type | Key Characteristics | Example | Impact on Real-Time PaaS |

|---|---|---|---|

| Off-the-shelf Platforms | Convenient, less customization, meets basic needs | Zoom Workplace, Microsoft Teams | Reduces need for integrated solutions |

| In-house Development | High control, customization, IP ownership, high initial cost | Major tech firms building own infrastructure | Eliminates reliance on third-party providers |

| Open-Source Frameworks | Customizable, cost-saving potential, developer control | LiveKit, WebRTC frameworks | Offers alternative to proprietary SDKs |

| Asynchronous Communication | Non-immediate engagement, community focus | Online forums, email newsletters | Diverts demand from real-time interaction |

Entrants Threaten

The threat of new entrants into the real-time engagement platform market is significantly mitigated by the immense capital required for infrastructure. Establishing a global network, data centers, and specialized hardware for low latency and high availability demands substantial upfront investment. For example, Agora's proprietary SD-RTN™ Network represents a considerable financial commitment.

The development and ongoing maintenance of a sophisticated real-time engagement platform demand a high degree of technical complexity. This includes mastery of audio/video encoding, intricate network protocols, robust distributed systems, and the creation of cross-platform SDKs. The market for engineers possessing this specialized, niche knowledge is notably tight, presenting a significant hurdle for any new player aiming to enter.

For instance, companies like Zoom, a leader in this space, invest heavily in R&D, with their operating expenses for research and development reaching $1.3 billion in their fiscal year ending January 31, 2024. This substantial investment underscores the specialized talent and continuous innovation required, making it difficult for newcomers to quickly build comparable capabilities and compete on a technological level.

Incumbent players like Agora have invested heavily in building strong brand recognition and cultivating vast developer communities around their Software Development Kits (SDKs) and Application Programming Interfaces (APIs). This deep-seated trust and readily available, comprehensive documentation significantly ease adoption and scaling for their existing customer base.

New entrants must surmount the considerable hurdle of establishing similar credibility and attracting a critical mass of developers. Creating a supportive ecosystem from scratch is a time-consuming and capital-intensive endeavor, presenting a significant barrier to entry.

For instance, in 2024, companies with established developer relations often see higher adoption rates. A study by Developer Relations Company indicated that 65% of developers prefer to work with platforms that have active communities and extensive support resources, a testament to the power of these established ecosystems.

Regulatory Hurdles and Compliance Requirements

Navigating the complex web of global regulations presents a significant barrier for new entrants into the real-time engagement platform market. Companies must contend with stringent data privacy laws, such as GDPR in Europe and similar frameworks emerging worldwide, alongside evolving content moderation requirements. For instance, Agora's operations in China are subject to specific national regulations, highlighting the need for localized compliance strategies.

The financial and operational investment required to achieve and maintain compliance across multiple jurisdictions is substantial. New players must allocate considerable resources to legal counsel, technology infrastructure for data security, and ongoing monitoring of regulatory changes. This can deter smaller or less capitalized entrants, thereby protecting established players like Agora.

- Data Privacy Compliance: Significant investment in GDPR, CCPA, and other regional data protection laws is essential.

- Content Moderation: Adherence to diverse national standards for acceptable content and user safety is critical.

- Cross-Border Operations: Understanding and complying with varying telecommunications and cybersecurity laws globally adds complexity.

- Regulatory Evolution: The dynamic nature of these regulations necessitates continuous adaptation and resource allocation.

Integration of Advanced Technologies like AI

The integration of advanced technologies like AI significantly raises the threat of new entrants in the Real-Time Engagement (RTE) Platform-as-a-Service (PaaS) market. Companies like Agora are increasingly embedding AI for features such as conversational AI, real-time translation, and intelligent content moderation. This means newcomers must possess not only robust core real-time capabilities but also a sophisticated AI strategy and the technical prowess to integrate advanced AI models, thereby escalating the entry barrier.

For instance, Agora's strategic investments in conversational AI highlight this technological arms race. New entrants are compelled to develop or acquire deep AI expertise to remain competitive. This technological sophistication is crucial for offering differentiated features that resonate with customers seeking more intelligent and automated communication experiences.

- AI Integration as a Barrier: New entrants must invest heavily in AI development and integration, increasing upfront costs and time-to-market.

- Agora's AI Focus: Agora's emphasis on conversational AI signals a market trend that new players must follow to avoid being left behind.

- Technical Sophistication Required: The ability to seamlessly integrate complex AI models is becoming a prerequisite for viability in the RTE PaaS space.

The threat of new entrants into the real-time engagement platform market is significantly diminished by high capital requirements for infrastructure and specialized technical expertise. Companies like Agora have established global networks and proprietary technologies, demanding substantial upfront investment and niche engineering talent that is difficult for newcomers to replicate quickly.

Porter's Five Forces Analysis Data Sources

Our Agora Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial statements, industry-specific market research reports, and expert commentary from trade publications.