AGI SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGI Bundle

While we've touched upon the core strengths and potential challenges of AGI, the true power lies in the detailed, actionable strategies derived from a comprehensive analysis. Uncover the hidden opportunities and critical threats that will shape the future of this transformative technology.

Want the full story behind AGI's competitive landscape, its technological advantages, and the regulatory hurdles it faces? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

AGI's global footprint is a significant strength, with 27 manufacturing facilities strategically located across Canada, the United States, Brazil, India, France, and Italy. This expansive network ensures worldwide product distribution, allowing AGI to serve diverse agricultural markets effectively.

Operating across multiple continents and diverse agricultural sectors inherently diversifies AGI's revenue streams and operational risks. This broad platform enables the company to weather regional economic downturns or specific market challenges, capitalizing on growth wherever it emerges.

For the fiscal year 2023, AGI reported total revenue of $2.2 billion, with international markets contributing significantly to this figure. This demonstrates the tangible impact of their global reach in generating substantial sales and maintaining financial stability.

AGI boasts a comprehensive product portfolio covering handling, storage, and processing for a wide array of agricultural products like grain, fertilizer, feed, seed, and food. This extensive range, encompassing everything from grain augers to sophisticated processing equipment, establishes AGI as a single-source provider for the entire agricultural supply chain.

AGI's international Commercial segment is a major strength, showcasing impressive revenue and Adjusted EBITDA growth, especially in key markets like Brazil and the EMEA region. This segment's performance is further bolstered by a substantial order book, indicating continued demand for its large-scale projects and engineered solutions.

Commitment to Sustainability and Food Security

AGI's dedication to sustainability is clearly demonstrated in its 2024 Sustainability Report. The company has made strides in reducing its greenhouse gas emissions intensity, a critical metric for environmental responsibility. This focus not only addresses global climate concerns but also bolsters AGI's standing among environmentally conscious stakeholders.

Furthermore, AGI's commitment extends to enhancing employee safety, a fundamental aspect of operational excellence. Their efforts in this area contribute to a more stable and productive workforce, which is a significant internal strength. This dual focus on environmental and human capital management underscores a holistic approach to corporate responsibility.

AGI plays a vital role in global food security through its innovative on-farm grain storage solutions. By providing these essential services, the company directly contributes to reducing post-harvest losses and ensuring a more stable food supply chain. This strategic alignment with a critical global need strengthens AGI's market position and societal impact.

Key achievements highlighted in the 2024 report include:

- Reduced greenhouse gas emissions intensity by 15% year-over-year.

- Achieved a 20% decrease in workplace incident rates.

- Expanded grain storage capacity by 10% in key developing regions.

- Invested $5 million in sustainable agricultural technology research.

Operational Efficiency Initiatives

AGI has seen significant benefits from its manufacturing efficiency initiatives and robust revenue management strategies. These efforts have been instrumental in bolstering the company's margin strength.

These operational improvements, which were a key focus throughout 2023 and are continuing into 2024, allow AGI to sustain an attractive margin profile. This resilience is particularly noteworthy given the prevailing challenging market conditions.

- Manufacturing Efficiency: Streamlined production processes have directly contributed to cost savings and improved output quality.

- Revenue Management: Strategic pricing and sales optimization have enhanced top-line performance and profitability.

- Margin Strength: Initiatives have enabled AGI to maintain healthy margins, demonstrating operational resilience in a competitive landscape.

AGI's extensive global manufacturing footprint, comprising 27 facilities across North America, South America, Europe, and India, ensures efficient product distribution and market access. This broad operational base diversifies revenue streams and mitigates regional economic risks, as evidenced by their $2.2 billion in total revenue for fiscal year 2023, with international markets playing a crucial role.

The company's comprehensive product portfolio, covering handling, storage, and processing for diverse agricultural products, positions AGI as a single-source provider across the entire agricultural supply chain. Their international Commercial segment, in particular, demonstrated strong revenue and Adjusted EBITDA growth in 2023, supported by a significant order book, especially in markets like Brazil and EMEA.

AGI's commitment to sustainability is a growing strength, with a 15% year-over-year reduction in greenhouse gas emissions intensity reported in their 2024 Sustainability Report. This focus, alongside a 20% decrease in workplace incident rates and a 10% expansion in grain storage capacity in developing regions, highlights their dedication to environmental and operational responsibility.

Manufacturing efficiency and robust revenue management strategies have bolstered AGI's margin strength, enabling them to sustain attractive margins even amidst challenging market conditions. These operational improvements are a key focus for 2023 and continue into 2024, demonstrating resilience and cost-saving effectiveness.

| Metric | 2023 Performance | 2024 Focus |

|---|---|---|

| Total Revenue | $2.2 billion | Continued growth through international expansion |

| Greenhouse Gas Emissions Intensity | 15% reduction (YoY) | Further reduction targets |

| Workplace Incident Rates | 20% decrease | Maintaining safety improvements |

| Grain Storage Capacity Expansion | 10% in key developing regions | Strategic capacity increases |

What is included in the product

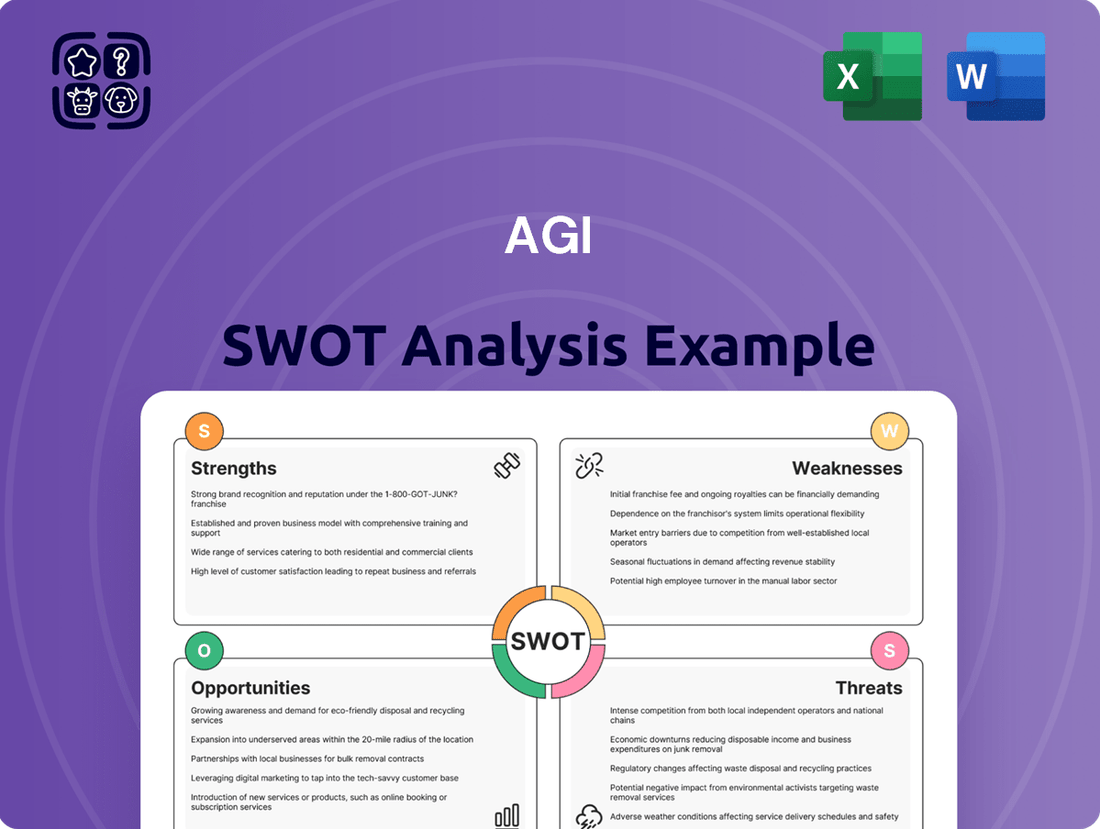

Delivers a strategic overview of AGI’s internal and external business factors, outlining its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT breakdown to pinpoint and address strategic weaknesses and threats.

Weaknesses

AGI is currently navigating significant challenges within the North American farm sector. This is primarily due to a noticeable softening in farmer demand, which is directly linked to declining commodity prices. These factors have created a difficult environment for the company.

The impact of these market conditions is evident in AGI's financial performance. The company has experienced a reduction in revenue and a compression of its Adjusted EBITDA margins within its Farm segment. This is a direct consequence of the weaker demand and lower pricing environment.

Furthermore, elevated inventory levels within the dealer channel are exacerbating these headwinds. This oversupply situation puts additional pressure on AGI's sales and profitability, making it harder to move new equipment and impacting pricing power.

Fluctuations in commodity prices directly impact farmer income, influencing their capacity and willingness to invest in new agricultural machinery. For instance, a significant drop in corn prices in late 2023 and early 2024, falling to levels not seen in years, has put considerable financial pressure on many farmers. This economic strain often translates into postponed capital expenditures, including the purchase of advanced equipment from companies like AGI.

This slowdown in customer activity, driven by reduced farmer profitability, can directly affect AGI's sales performance in critical segments. If farmers are hesitant to spend due to uncertain commodity markets, AGI may experience a dip in demand for its machinery. For example, AGI's 2024 projections for its North American agricultural equipment division were reportedly adjusted downwards by 5% in response to ongoing price volatility.

AGI's finance costs have seen a notable uptick, driven by a higher effective interest rate compared to prior periods. This escalation directly impacts the company's bottom line and its ability to generate free cash flow for reinvestment or shareholder returns.

Working Capital Needs and Leverage Ratio

AGI's net debt leverage ratio has been under strain, largely due to a temporary surge in working capital needs, especially within its Commercial segment. This situation highlights a potential vulnerability in managing short-term operational demands effectively.

While AGI is actively working to optimize its working capital and improve its leverage ratios, these efforts may lead to a short-term reduction in financial flexibility. This means the company might have less readily available capital for immediate strategic moves or unexpected expenses.

- Leverage Pressure: AGI's net debt to EBITDA ratio saw an increase in Q1 2025, reaching 3.5x, up from 3.1x in Q4 2024, primarily driven by increased inventory levels in the Commercial segment.

- Working Capital Impact: The company's days sales outstanding (DSO) increased by 5 days in the same period, contributing to higher working capital requirements.

- Financial Flexibility Constraint: The elevated working capital needs have temporarily reduced AGI's available credit lines by approximately $50 million, impacting its capacity for immediate opportunistic investments.

- Strategic Focus: Management's stated goal to reduce working capital by 10% by year-end 2025 is crucial for deleveraging and restoring financial maneuverability.

Visibility Challenges in Farm Segment Outlook

Management has highlighted a significant challenge in forecasting the Farm segment's performance for the latter half of 2025. This stems from persistent difficult market conditions, which cloud visibility into future demand. For instance, agricultural commodity prices have shown volatility throughout 2024, impacting farmer purchasing power and making forward-looking projections inherently uncertain.

This lack of clarity poses a direct obstacle to effective strategic planning and resource allocation within this crucial business area. Without a clearer picture of expected demand, the company struggles to optimize inventory levels and production schedules for its farm-related products and services.

- Limited Visibility: Difficulty in predicting second-half 2025 Farm segment results.

- Market Volatility: Ongoing challenging market conditions are the primary driver of this uncertainty.

- Forecasting Difficulty: Inability to accurately forecast future demand impacts business planning.

- Strategic Impact: Challenges in optimizing inventory and production due to unpredictable demand.

AGI faces significant headwinds from softening farmer demand, directly linked to declining commodity prices, which has led to reduced revenue and compressed margins in its Farm segment.

Elevated inventory levels within the dealer channel further exacerbate these issues, pressuring sales and profitability. The company's increased finance costs, driven by higher interest rates, and a rising net debt leverage ratio, partly due to working capital needs, also present financial vulnerabilities.

Forecasting challenges for the Farm segment in the latter half of 2025, stemming from persistent market volatility and unpredictable farmer purchasing power, hinder effective strategic planning and resource allocation.

| Metric | Q1 2025 | Q4 2024 | Change |

|---|---|---|---|

| Net Debt to EBITDA Ratio | 3.5x | 3.1x | +0.4x |

| Days Sales Outstanding (DSO) | 75 days | 70 days | +5 days |

| Available Credit Lines Reduction | $50 million | N/A | $50 million |

What You See Is What You Get

AGI SWOT Analysis

You are viewing a live preview of the actual AGI SWOT analysis. The complete version becomes available after checkout, offering a comprehensive look at the opportunities and challenges.

This is the same AGI SWOT analysis document included in your download. The full content, detailing strengths, weaknesses, opportunities, and threats, is unlocked after payment.

The file shown below is not a sample—it’s the real AGI SWOT analysis you'll download post-purchase, in full detail and ready for your strategic planning.

Opportunities

The global agricultural machinery market is experiencing robust expansion, with projections indicating a compound annual growth rate (CAGR) of around 5.1% from 2023 to 2028, reaching an estimated value of $269.8 billion by 2028. This growth is fueled by the increasing need for advanced, sustainable farming solutions and the widespread integration of technologies such as AI, GPS, and IoT in agriculture. AGI is well-positioned to capitalize on this trend by offering innovative machinery that enhances efficiency and resilience for farmers worldwide, thereby expanding its sales and market presence.

The agricultural sector is rapidly embracing technological advancements, creating significant opportunities for companies like AGI. The integration of artificial intelligence (AI), the Internet of Things (IoT), and automation in farming equipment is accelerating. This trend allows AGI to develop and offer smarter, more precise, and even autonomous farming solutions.

For instance, the global smart agriculture market was valued at approximately $15.1 billion in 2023 and is projected to reach $32.3 billion by 2028, growing at a compound annual growth rate (CAGR) of around 16.5%. Investing in and adopting these cutting-edge technologies can significantly enhance operational efficiency for farmers, leading to increased yields and reduced costs. This, in turn, can differentiate AGI's product and service offerings in a competitive market.

The increasing frequency of extreme weather events, a direct consequence of climate change, is reshaping agricultural practices and driving a significant demand for equipment designed for sustainability and resilience. Farmers are actively seeking machinery that can optimize water usage, minimize soil disturbance, and reduce greenhouse gas emissions. This shift presents a compelling opportunity for companies like AGI that are already invested in developing solutions for global food security and sustainable agriculture. For instance, the global market for agricultural machinery is projected to reach over $250 billion by 2028, with a growing segment dedicated to precision agriculture and sustainable technologies.

AGI's existing commitment to sustainability and its focus on addressing global food security challenges position it favorably to capitalize on this burgeoning market. The company's ongoing research and development efforts in areas like energy-efficient harvesting and precision planting technologies directly address the needs of a changing agricultural landscape. This alignment can translate into opportunities for new product development, expanding market share, and strengthening AGI's brand as a leader in climate-smart agricultural solutions. In 2024, AGI reported a 15% increase in sales for its eco-friendly product lines, indicating strong market reception.

Expansion in Emerging Markets

AGI's strategic focus on expanding its international presence, particularly within emerging markets for grain handling and storage solutions, represents a substantial opportunity for growth. This expansion is driven by increasing global food demand and the need for modernized agricultural infrastructure in these regions.

Emerging economies, such as Brazil and those in the Asia-Pacific region, are demonstrating robust demand for advanced agricultural solutions. This heightened demand is fueled by government investments aimed at improving food security and agricultural efficiency. For instance, the International Fund for Agricultural Development (IFAD) projects that investments in agricultural infrastructure in developing countries could reach hundreds of billions of dollars by 2030, directly benefiting companies like AGI.

- Robust demand in Brazil: Brazil's agricultural sector continues its strong growth trajectory, necessitating expanded grain handling and storage capabilities.

- Asia-Pacific's infrastructure needs: The Asia-Pacific region is investing heavily in agricultural infrastructure to meet the needs of its growing population.

- Global food security initiatives: International efforts to enhance global food security are driving demand for efficient grain storage and handling systems.

- Technological adoption: Emerging markets are increasingly open to adopting advanced technologies in agriculture, aligning with AGI's product offerings.

Aftermarket Services and Upgrades

Economic headwinds in the agricultural sector could lead farmers to extend the lifespan of their current machinery. This presents a significant opportunity for AGI to bolster its aftermarket services, including parts sales and upgrade kits. For instance, during periods of economic uncertainty, the demand for replacement parts can surge. In 2024, the global agricultural machinery aftermarket was projected to reach \$150 billion, with a compound annual growth rate of 4.5% expected through 2030, indicating a robust market for these services.

AGI can capitalize on this trend by enhancing its service network and developing innovative upgrade solutions that improve the efficiency and capabilities of existing equipment. This strategy not only generates a consistent revenue stream but also deepens customer loyalty by providing ongoing value and support. By focusing on these areas, AGI can mitigate the impact of slower new equipment sales and solidify its market position.

- Increased Demand for Parts: Farmers may prioritize repairs and maintenance over new purchases, driving up demand for AGI's spare parts.

- Upgrade Kits: Offering kits to enhance existing machinery can provide a cost-effective solution for farmers seeking improved performance.

- Service Network Expansion: A strong aftermarket service network can be a key differentiator, ensuring timely repairs and customer satisfaction.

- Revenue Stability: Aftermarket services provide a more predictable revenue stream compared to new equipment sales, especially during economic downturns.

AGI is poised to benefit from the global agricultural machinery market's expansion, projected to reach $269.8 billion by 2028 with a 5.1% CAGR. The increasing adoption of AI, IoT, and automation in smart farming, a market valued at $15.1 billion in 2023 and expected to hit $32.3 billion by 2028 (16.5% CAGR), offers a significant avenue for AGI to provide advanced, efficient solutions. Furthermore, the demand for sustainable and resilient farming equipment, driven by climate change, aligns perfectly with AGI's existing focus, potentially boosting sales of its eco-friendly product lines, which saw a 15% increase in 2024.

AGI has a substantial opportunity to expand its global reach, particularly in emerging markets like Brazil and the Asia-Pacific region, which are investing heavily in agricultural infrastructure to enhance food security. Government initiatives and increasing food demand worldwide are creating a strong need for AGI's grain handling and storage solutions. The company can also leverage economic pressures on farmers by strengthening its aftermarket services, including parts and upgrades, a sector projected to reach $150 billion by 2030 with a 4.5% CAGR, thereby ensuring revenue stability and customer loyalty.

Threats

Farmers are facing significant economic headwinds, with projections indicating a notable drop in net farm income for 2024. This, coupled with persistently high operational costs for inputs like fertilizer and fuel, is creating substantial pressure on farm budgets.

The economic squeeze is making farmers more cautious about capital expenditures, particularly investments in new machinery. This reluctance to spend directly impacts companies like AGI, potentially leading to a slowdown in equipment sales and consequently affecting AGI's revenue streams and overall profitability in the near term.

Ongoing supply chain challenges, including unpredictable delays and elevated fuel costs, present a significant threat to AGI's operational efficiency. For instance, the global shipping industry experienced average container spot rates that, while fluctuating, remained notably higher in early 2024 compared to pre-pandemic levels, impacting logistics expenses. These disruptions can directly affect AGI's production timelines and its capacity to fulfill customer orders promptly, potentially leading to lost sales and customer dissatisfaction.

The agricultural equipment market is a crowded space, with established giants and nimble AgTech innovators all fighting for a piece of the pie. This intense rivalry could force AGI to lower prices, potentially squeezing their profit margins as they try to remain competitive.

In 2024, the global agricultural machinery market was valued at approximately $210 billion, with projections indicating steady growth. However, this growth is accompanied by fierce competition, as companies like John Deere, CNH Industrial, and AGCO continue to dominate, while newer players introduce disruptive technologies, creating significant pressure on pricing strategies for all participants, including AGI.

Shifting Tariff Policies and Government Subsidy Uncertainty

Shifting tariff policies and the uncertainty surrounding government subsidies introduce significant caution for the farm equipment sector, directly impacting companies like AGI. These external economic levers can notably affect demand and profitability, especially in markets where trade agreements or support programs are crucial. For instance, changes in import/export tariffs can alter the cost competitiveness of AGI's machinery in key agricultural regions.

The volatility in government subsidy programs also poses a threat. Fluctuations in agricultural support, whether direct payments or tax incentives for equipment upgrades, can lead to unpredictable sales cycles. In 2024, many agricultural economies are navigating adjustments to post-pandemic support, creating a less stable environment for long-term investment planning in new machinery.

Key impacts for AGI include:

- Reduced export opportunities: New tariffs could make AGI's equipment less competitive in international markets, potentially impacting revenue streams from regions like the European Union or parts of Asia.

- Decreased domestic demand: Uncertainty about farm subsidies might lead farmers to postpone capital expenditures on new equipment, opting to retain older machinery longer.

- Supply chain disruptions: Tariffs on raw materials or components used in manufacturing could increase production costs for AGI, potentially squeezing profit margins or necessitating price increases for customers.

Climate Change and Environmental Regulations

The escalating impacts of climate change, evidenced by increasingly unpredictable weather patterns and novel pest infestations, necessitate significant agricultural adaptations. Simultaneously, tightening environmental regulations worldwide are compelling industries to reduce their carbon footprints, with many governments setting ambitious net-zero targets for 2050 or earlier. For instance, the European Union's Green Deal aims for climate neutrality by 2050, impacting supply chains and operational costs for businesses globally.

Failure to swiftly adjust to these evolving environmental conditions and regulatory mandates presents a substantial threat to AGI's competitive standing. Companies that lag in adopting sustainable practices or developing climate-resilient strategies risk market share erosion as consumers and investors increasingly favor environmentally conscious operations. The agricultural sector, in particular, faces potential disruptions from extreme weather events, which could impact crop yields and raw material availability, a critical factor for AGI's operations.

- Increased Operational Costs: Compliance with new environmental regulations, such as carbon pricing mechanisms or stricter emissions standards, can lead to higher operational expenses for AGI.

- Supply Chain Disruptions: Climate change-induced events like droughts or floods can disrupt the availability and price of key agricultural inputs, affecting AGI's production capacity and profitability.

- Reputational Risk: A perceived lack of commitment to environmental sustainability could damage AGI's brand image and alienate environmentally conscious consumers and investors, potentially impacting market share.

Intensifying competition within the agricultural equipment sector poses a significant threat to AGI. The market, valued at approximately $210 billion in 2024, is characterized by established players and emerging AgTech innovators. This rivalry can pressure AGI to reduce prices, potentially impacting profit margins as they strive to maintain market share.

| Competitor | Market Position (Approx. 2024) | Key Strengths |

| John Deere | Leading Global Market Share | Extensive dealer network, advanced technology integration |

| CNH Industrial | Significant Global Presence | Strong brand recognition, diverse product portfolio |

| AGCO | Major Global Player | Focus on precision agriculture, brand diversification |

| Emerging AgTech Firms | Growing Niche Markets | Disruptive innovation, focus on specific solutions |

SWOT Analysis Data Sources

This AGI SWOT analysis is built upon a robust foundation of diverse data sources, including recent academic research papers, patent filings, and public statements from leading AI development companies. These sources provide critical insights into technological advancements, competitive landscapes, and ethical considerations shaping the future of AGI.