AGI Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AGI Bundle

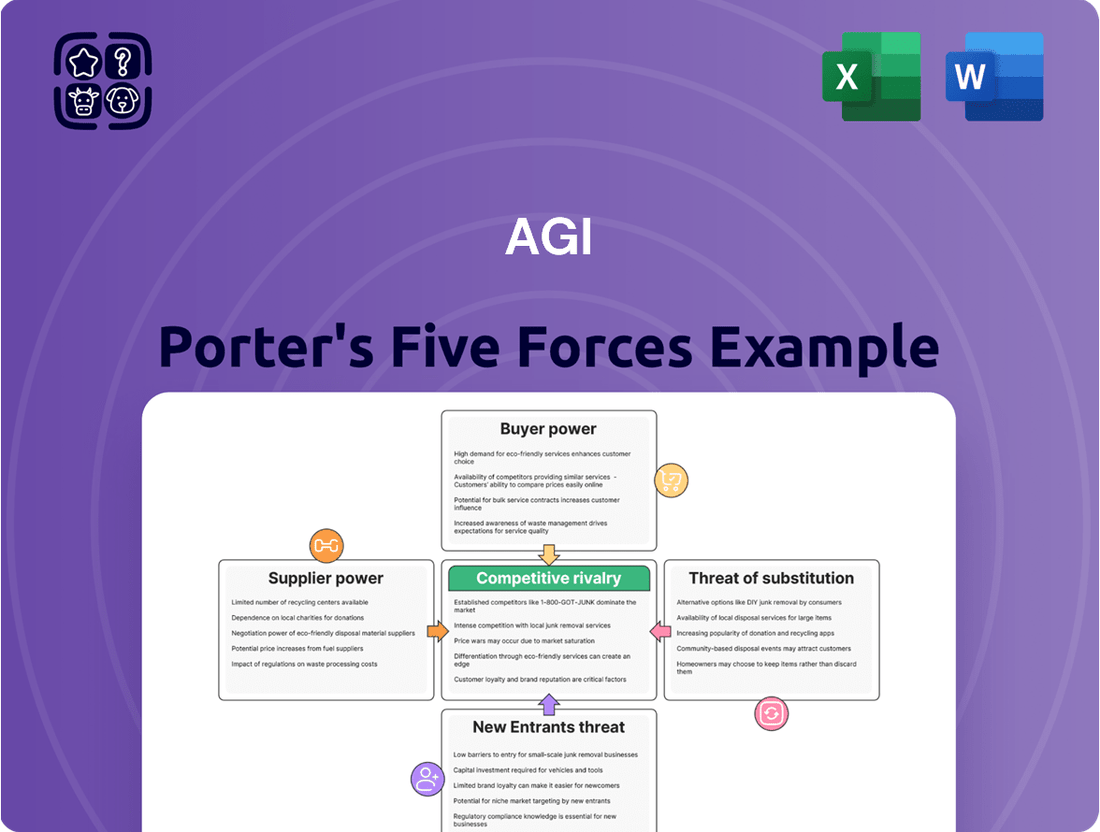

AGI's competitive landscape is shaped by the interplay of five crucial forces, revealing the intensity of rivalry and the potential for profitability. Understanding these forces is key to navigating the market effectively.

The complete Porter's Five Forces Analysis for AGI offers a comprehensive deep dive into each of these pressures, providing actionable insights for strategic planning and competitive advantage.

Ready to move beyond the basics? Get a full strategic breakdown of AGI’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Supplier concentration significantly impacts the bargaining power of suppliers in the agricultural equipment industry, including for companies like AGI. When a few dominant suppliers control essential raw materials and components, such as specialized steel alloys or advanced electronic control units, they can dictate terms and pricing.

The agricultural equipment sector depends on a wide array of inputs, from basic steel and plastics to sophisticated electronic parts. If the suppliers of these critical materials are highly concentrated, they gain considerable leverage. For instance, recent years have seen notable price increases for steel and plastics, demonstrating how concentrated supplier bases can pass on cost volatility to manufacturers like AGI.

AGI’s bargaining power with suppliers is significantly influenced by switching costs. If AGI faces substantial expenses or operational disruptions when changing suppliers for critical components, such as those tied to specialized manufacturing processes or proprietary technology integration, suppliers gain considerable leverage. For instance, if AGI’s AI models require highly specific, custom-built hardware components that are only available from a limited number of vendors, the cost and time to re-qualify new suppliers can be prohibitive, strengthening those suppliers' positions.

Suppliers who provide highly specialized or proprietary technologies, like advanced sensors critical for precision agriculture or unique automation components, naturally wield greater bargaining power. Their distinct offerings make it difficult for buyers to find suitable alternatives, thereby strengthening their position in negotiations.

AGI's strategic focus on integrating artificial intelligence, the Internet of Things (IoT), and robotics into its solutions means it likely relies on suppliers possessing unique technological capabilities. This dependence on specialized inputs from these suppliers can significantly amplify their bargaining power within AGI's supply chain.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers can significantly bolster their bargaining power within the agricultural machinery sector. If suppliers, particularly those providing critical components, possess the capability and intent to begin manufacturing the final agricultural equipment themselves, they can exert greater influence over pricing and terms.

While this is a less common scenario for raw material providers, it becomes a tangible concern when component manufacturers consider expanding their operations directly into the agricultural machinery value chain. This move would effectively transform them into competitors, leveraging their existing supply position.

However, it's crucial to acknowledge that the agricultural machinery industry generally presents high barriers to entry. These can include substantial capital requirements for manufacturing facilities, advanced technological expertise, and established distribution networks, which often deter suppliers from undertaking such a significant strategic shift.

For instance, in 2024, major agricultural equipment manufacturers like John Deere and CNH Industrial continued to invest heavily in their integrated supply chains and advanced manufacturing processes, signaling the high capital intensity and technological sophistication required to compete. This high barrier makes it challenging for many component suppliers to realistically consider forward integration as a primary strategy to increase their bargaining power.

- Increased Supplier Leverage: Suppliers capable of forward integration can dictate terms more aggressively.

- Industry Barriers: High capital and technology costs in agricultural machinery limit supplier integration.

- Strategic Consideration: Component manufacturers may explore integration as a way to capture more value.

- Competitive Landscape: Forward integration transforms suppliers into direct competitors.

Importance of AGI to Suppliers

The significance of Artificial General Intelligence (AGI) as a customer profoundly impacts its suppliers' bargaining power. If AGI constitutes a substantial portion of a supplier's total revenue, that supplier's leverage tends to diminish. This is because the supplier becomes more dependent on AGI's continued business, making them less likely to dictate terms.

Conversely, when AGI represents a smaller segment of a supplier's customer base, the supplier often gains more negotiating strength. In such scenarios, the supplier is less reliant on AGI and can afford to be more selective or demanding regarding pricing, quality, or delivery schedules. For instance, a specialized chip manufacturer that supplies AGI developers but also serves numerous other high-tech industries might hold considerable power.

Consider the semiconductor industry in 2024. Companies like NVIDIA, a key player in AI hardware, saw their revenue surge. For a smaller, niche component supplier to NVIDIA, if NVIDIA represented 40% of their business, their bargaining power would be significantly less than if NVIDIA accounted for only 5%. This dependency dynamic is crucial in understanding supplier influence.

- Supplier Dependence: AGI's market share within a supplier's client portfolio directly correlates with the supplier's bargaining power.

- Revenue Concentration: High revenue concentration from AGI makes suppliers more vulnerable to AGI's demands.

- Market Diversification: Suppliers with diversified customer bases, serving both AGI and other sectors, typically possess greater leverage.

- Industry Examples (2024): In the AI hardware sector, suppliers to major AI platform developers often have less power if those developers are a dominant revenue source.

The bargaining power of suppliers is a critical element in the agricultural equipment industry, directly influencing costs and operational strategies for companies like AGI. When suppliers are concentrated, offering specialized components or raw materials essential for advanced agricultural machinery, their ability to dictate terms and pricing increases significantly.

In 2024, the agricultural equipment sector continued to grapple with supply chain dynamics influenced by geopolitical events and demand fluctuations. For instance, the cost of specialized steel alloys and advanced electronic components, crucial for precision farming equipment, saw price volatility. Suppliers controlling these inputs, especially those with limited competition, leveraged this situation, impacting manufacturers' margins.

Switching costs also play a substantial role. If AGI, for example, integrates proprietary software or hardware from a specific supplier into its AI-driven agricultural solutions, the expense and time required to find and onboard alternative vendors can be prohibitive. This dependency grants the original supplier considerable leverage in negotiations.

Furthermore, suppliers offering unique technological innovations, such as advanced sensor technology or specialized automation systems vital for modern agriculture, inherently possess greater bargaining power. Their distinct offerings make it difficult for AGI to source comparable alternatives, strengthening their negotiating position.

The threat of forward integration by suppliers, while often mitigated by high industry barriers, remains a consideration. If component manufacturers possess the capital and expertise to enter the final agricultural machinery market, they can exert more influence. However, the substantial capital investment and technological sophistication required in this sector, as evidenced by continued heavy investment from industry leaders like John Deere in 2024, generally limit this threat for most suppliers.

The relative importance of AGI as a customer also shapes supplier power. If AGI represents a significant portion of a supplier's revenue, that supplier's bargaining power is diminished due to their reliance on AGI's business. Conversely, suppliers with diversified customer bases, serving many clients in addition to AGI, often hold more leverage. For example, in 2024, a semiconductor supplier heavily reliant on a few major AI developers would have less power than one with a broad customer portfolio across various tech sectors.

| Factor | Impact on Supplier Bargaining Power | Example Scenario (Agricultural Equipment) | 2024 Relevance |

|---|---|---|---|

| Supplier Concentration | High | Few suppliers of specialized steel alloys for high-strength tractor frames | Price increases for key metals impacted manufacturers due to concentrated supply. |

| Switching Costs | High | AGI integrating proprietary AI chips requiring extensive re-qualification | High costs to change component suppliers can lock manufacturers into existing relationships. |

| Differentiation of Inputs | High | Suppliers of advanced GPS receivers for precision planting | Unique technology capabilities give suppliers an edge in pricing and terms. |

| Threat of Forward Integration | Low to Moderate | Component manufacturer considering building entire combine harvesters | High capital requirements and established competition limit this for most suppliers. |

| Importance of Industry to Supplier | Low | AGI is a small client for a large electronics component manufacturer | Suppliers less dependent on AGI can demand better terms. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to AGI's specific industry, providing a comprehensive view of its competitive environment.

Effortlessly identify and quantify competitive threats, allowing for proactive strategy adjustments and pain point mitigation.

Customers Bargaining Power

Customer concentration is a key factor in AGI's bargaining power. AGI's customer base spans large commercial agricultural operations and individual farmers, each with varying degrees of influence.

Large commercial farms, often purchasing in high volumes, can exert significant pressure on AGI for better pricing and terms. For instance, in 2024, major agricultural conglomerates continued to consolidate, meaning fewer, larger buyers could represent a substantial portion of AGI's revenue, amplifying their individual bargaining power.

The fragmented nature of individual farmer purchases, while numerous, generally results in lower individual bargaining power compared to large commercial entities. However, collective action or strong industry associations among smaller farmers could potentially increase their leverage.

The costs and complexities involved when farmers or commercial operations decide to switch from AGI's equipment to a competitor's offerings significantly influence customer bargaining power. If it's difficult or expensive to make a change, customers have less leverage.

High upfront investments in agricultural machinery, a common scenario in the industry, coupled with the intricate integration of AGI's specialized solutions into existing farming operations, can create substantial switching costs. For instance, the average cost of a new combine harvester can range from $300,000 to over $600,000, representing a significant barrier to switching. This financial commitment and operational entanglement inherently reduce the power customers wield in price negotiations or demanding specific terms.

Farmers are feeling the pinch from a variety of economic factors. Fluctuating commodity prices, coupled with rising interest rates and escalating input costs, are making them more watchful of every dollar spent. This heightened price sensitivity, particularly noticeable in the North American agricultural sector, directly translates to increased bargaining power for these customers.

This pressure on farmer profitability, a trend evident throughout 2024, can significantly impact industries that rely on their purchasing power. For instance, agricultural equipment manufacturers might see a slowdown in sales as farmers delay significant capital expenditures, opting to stretch the life of existing machinery or seek more favorable payment terms. In 2024, reports indicated that capital spending intentions for many North American farms were being re-evaluated due to these economic headwinds.

Threat of Backward Integration by Customers

The threat of backward integration by customers in the agricultural equipment industry is typically low. This is largely because the specialized nature of manufacturing these complex machines, from tractors to harvesters, requires significant capital investment and highly specific technical expertise. For instance, a large agricultural enterprise would face immense upfront costs and operational challenges in establishing a manufacturing facility capable of producing sophisticated machinery, making it an economically unviable option for most.

The capital expenditure alone for setting up such production lines can run into hundreds of millions of dollars. Consider the research and development, tooling, and skilled labor needed; these are substantial barriers. In 2024, the average cost to establish a new automotive manufacturing plant, a somewhat comparable but less specialized industry, can exceed $1 billion, illustrating the scale of investment required for agricultural equipment.

This high barrier to entry means that most agricultural customers, even large ones, find it more cost-effective to purchase equipment from established manufacturers.

- High Capital Requirements: Setting up manufacturing for specialized agricultural machinery demands substantial investment, often in the hundreds of millions of dollars.

- Technical Expertise Gap: The industry requires niche engineering and manufacturing skills that agricultural enterprises typically lack.

- Economies of Scale: Existing manufacturers benefit from economies of scale, making their production costs lower than what a new entrant could achieve.

- Focus on Core Competencies: Agricultural businesses generally prioritize farming operations and land management over manufacturing, making backward integration a distraction from their core business.

Availability of Substitute Products

The ease with which customers can find alternative solutions or equipment from competitors significantly influences their bargaining power. In the agricultural equipment sector, a competitive landscape featuring multiple major players, such as John Deere, CNH Industrial, and AGCO, provides customers with a wide array of choices.

This abundance of alternatives directly translates to increased customer leverage. For instance, if a farmer is dissatisfied with the pricing or terms offered by one manufacturer, they can readily explore comparable offerings from rivals. This competitive pressure compels manufacturers to offer more attractive pricing, better service, and innovative features to retain their customer base.

The availability of substitute products can be quantified by market share distribution. As of late 2023, John Deere held a dominant position in the North American tractor market, but competitors like CNH Industrial and AGCO collectively accounted for a substantial portion of sales, indicating significant customer choice.

- High availability of substitute agricultural equipment from various manufacturers limits the pricing power of individual sellers.

- Customers can switch between brands with relative ease if product features, pricing, or service levels are not met.

- In 2024, the agricultural equipment market continues to see robust competition, with companies actively innovating to differentiate their product lines and attract customers.

- The presence of both global conglomerates and regional specialists offers diverse options, further empowering buyers.

Customer bargaining power is amplified when they can easily switch to alternatives or when their purchasing volume is significant. In 2024, the agricultural sector saw continued consolidation among large commercial farms, increasing their individual leverage due to higher purchase volumes and the associated potential for volume discounts. Furthermore, the availability of comparable equipment from major competitors like John Deere, CNH Industrial, and AGCO means customers have ample choices, forcing manufacturers to remain competitive on price and service.

The cost and complexity associated with switching agricultural equipment suppliers remain a significant factor limiting customer power. High upfront investments, often exceeding hundreds of thousands of dollars for machinery like combine harvesters, alongside the integration of specialized solutions into existing operations, create substantial switching costs. This financial and operational entanglement reduces the leverage customers have in negotiations.

Economic pressures on farmers in 2024, including fluctuating commodity prices and rising input costs, heightened their price sensitivity. This increased focus on cost management directly translates into greater bargaining power for customers, as they become more diligent in seeking favorable terms and pricing from equipment providers.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Observation (2024) |

|---|---|---|

| Customer Concentration | High for large commercial farms, low for individual farmers | Consolidation in agriculture means fewer, larger buyers; average combine cost $300k-$600k+ |

| Switching Costs | High due to capital investment and operational integration | Significant financial commitment and operational entanglement limit leverage |

| Price Sensitivity | Increased due to economic pressures | Rising input costs and fluctuating commodity prices make farmers more cost-conscious |

| Availability of Alternatives | High, due to competitive market | Multiple major manufacturers (John Deere, CNH, AGCO) offer comparable equipment |

Preview the Actual Deliverable

AGI Porter's Five Forces Analysis

The document you see here is the complete, professionally crafted AGI Porter's Five Forces Analysis you will receive instantly after purchase. This preview showcases the exact, fully formatted analysis, providing a clear understanding of the competitive landscape for Artificial General Intelligence. You can be confident that what you are viewing is precisely the document you will download, ready for immediate application in your strategic planning.

Rivalry Among Competitors

The agricultural equipment sector is a battleground with a few giants and many niche players. AGI faces off against formidable global entities such as CNH Industrial, which reported revenues of approximately $20.5 billion in 2023, and AGCO Corp, with 2023 revenues around $14.4 billion. These large competitors, along with others like Buhler Industries, create significant pressure through their scale, product breadth, and market reach, making competitive rivalry a key force.

The global agricultural equipment market is anticipated to expand, yet AGI's farm segment has encountered hurdles with stagnant revenue in some areas. This is largely due to subdued demand, especially in North America, where the market experienced a notable slowdown in 2023.

A decelerating growth rate within specific market segments naturally escalates competitive rivalry. When the overall pie isn't growing as quickly, companies like AGI must contend more fiercely for existing market share, potentially leading to price pressures and increased marketing efforts.

AGI's strategy centers on offering integrated solutions for grain handling, storage, and processing, setting it apart. Their commitment to innovation, evident in their investments in new technologies, further sharpens this differentiation. For instance, AGI's acquisition of Westeel in 2023, a leader in grain storage solutions, bolstered their product portfolio and market reach.

However, the competitive landscape is robust, with rivals like Richardson International and Parrish & Heimbecker also providing sophisticated offerings. This means AGI must continually invest in research and development to maintain its competitive edge. In 2024, the agricultural technology sector saw significant investment, with companies like John Deere investing heavily in precision agriculture, a trend AGI must actively address through its own product evolution.

Exit Barriers

High exit barriers in the agricultural equipment sector, driven by substantial fixed costs in manufacturing and R&D, make it difficult for companies to leave the market. For instance, John Deere's significant investments in advanced manufacturing facilities and technology, estimated in the billions, represent a major commitment that cannot be easily recouped.

Specialized assets, such as unique production lines for tractors or harvesters, further entrench companies. These assets have limited alternative uses, forcing firms to continue operations rather than liquidate at a loss. Brand loyalty, cultivated over decades, also acts as a powerful deterrent to exit, as companies strive to maintain their market share.

- High Fixed Costs: Significant capital is tied up in manufacturing plants and research, making divestment costly.

- Specialized Assets: Equipment and technology are often industry-specific, limiting resale value.

- Brand Loyalty: Established brands in agriculture, like Case IH and New Holland, command strong customer allegiance, making it hard for new entrants and difficult for incumbents to exit without losing significant value.

- Impact on Rivalry: These barriers encourage companies to remain and compete fiercely, even in downturns, intensifying competitive rivalry.

Strategic Objectives of Competitors

Competitors are actively pursuing aggressive expansion strategies. For instance, John Deere, a major player, has been investing heavily in digital agriculture solutions, aiming to capture a larger share of the precision farming market. This focus on innovation and market penetration directly influences AGI's strategic planning.

Many rivals are also prioritizing international market entry and growth. Kubota, for example, has been strengthening its presence in emerging economies, seeking new revenue streams. These global ambitions mean AGI faces intensified competition not just domestically but also across various overseas territories.

Acquisitions remain a key tactic for competitors looking to consolidate market position or gain access to new technologies. CNH Industrial has made several strategic acquisitions in recent years to bolster its agricultural equipment portfolio. Such moves create a dynamic environment where AGI must continually assess its competitive standing and adapt its own growth initiatives, including product transfers and international expansion, to maintain its edge.

- Competitors' strategic objectives: Expansion into new international markets, focus on specific product segments like precision agriculture, and pursuit of acquisitions.

- Impact on competitive landscape: These strategies directly shape market dynamics, forcing AGI to respond and adapt.

- AGI's responses: AGI's international growth strategy and product transfers are direct reactions to and drivers of this intense rivalry.

- Example: John Deere's investment in digital agriculture solutions highlights a key area of competitive focus.

The agricultural equipment sector is characterized by intense competition, driven by large, established players and a growing number of specialized firms. AGI faces significant rivalry from global giants like CNH Industrial and AGCO, which possess substantial resources and broad product portfolios. This dynamic environment necessitates continuous innovation and strategic adaptation for AGI to maintain its market position.

| Competitor | 2023 Revenue (Approx.) | Key Focus Areas |

|---|---|---|

| CNH Industrial | $20.5 billion | Broad agricultural machinery, technology integration |

| AGCO Corp | $14.4 billion | Farming solutions, precision agriculture |

| John Deere | $60 billion (Company-wide) | Precision agriculture, digital farming, autonomous solutions |

SSubstitutes Threaten

The primary substitutes for AGI's advanced grain handling, storage, and processing equipment often involve traditional, less technologically sophisticated methods or even manual labor. While these alternatives might present a lower upfront cost, they typically lag significantly in terms of operational efficiency, workplace safety standards, and the capacity for scaling operations to meet growing demands.

For instance, manual grain shoveling, while seemingly economical for very small operations, can lead to injuries and is vastly less productive than automated conveyor systems. In 2024, the average cost of workplace injuries in the agricultural sector, which includes grain handling, can run into thousands of dollars per incident, highlighting the hidden costs of less safe, manual alternatives.

Furthermore, older, less efficient storage solutions might require more frequent handling and present a higher risk of spoilage, impacting the quality and saleability of the grain. This price-performance trade-off means that while substitutes might appear cheaper on the surface, AGI’s integrated, technologically superior solutions often prove more cost-effective and reliable in the long run, especially as businesses aim for greater output and reduced waste.

Farmers' willingness to switch to different ways of achieving their goals is influenced by the increasing adoption of advanced agricultural technologies. Precision agriculture, AI, and automation are becoming more prevalent, suggesting that farmers are less likely to revert to simpler, less sophisticated methods. For instance, in 2024, the global precision agriculture market was valued at approximately $10.5 billion, indicating a strong investment in these advanced solutions.

This trend is particularly pronounced for larger agricultural operations that prioritize optimized yields and cost reductions. The high initial investment in these technologies is offset by long-term efficiency gains, making substitution with older or less effective methods economically unviable. Consequently, the threat of substitutes remains relatively low as the benefits of modern agricultural technology become more apparent and integrated into farming practices.

While AGI's direct equipment substitutes are few, technological advancements in agricultural practices or alternative food production methods could emerge as indirect threats. For instance, the growth of vertical farming or lab-grown meat, though currently niche, represents a shift in food sourcing that could eventually reduce demand for traditional agricultural machinery.

However, AGI's comprehensive support across the entire agricultural value chain, from planting to harvesting, makes broad substitution across its product lines particularly difficult. This integrated approach creates a sticky ecosystem for its customers, mitigating the immediate impact of potential indirect substitutes.

Relative Price of Substitutes

The relative price of substitutes plays a crucial role in assessing the threat of new technologies like advanced general intelligence (AGI) in various sectors. The cost-effectiveness of sticking with older, less efficient equipment or manual processes compared to adopting cutting-edge AGI solutions directly impacts this threat. For instance, in agriculture, if the cost of new AGI-powered farming equipment is significantly higher than maintaining existing machinery, farmers might delay adoption.

Economic conditions can amplify this. In 2024, factors like higher interest rates and potential declines in farm income could make producers more cautious about capital expenditures. This hesitation might temporarily boost the attractiveness of delaying new purchases or maximizing the utility of current assets, thereby increasing the perceived threat from these less advanced alternatives.

Consider the following points regarding the relative price of substitutes:

- Cost Comparison: The upfront investment and ongoing operational costs of AGI solutions versus existing alternatives are a primary driver of substitution decisions.

- Economic Sensitivity: Fluctuations in interest rates and industry-specific income levels can significantly alter the price sensitivity of potential adopters.

- Performance vs. Price Trade-off: Decision-makers weigh the performance benefits of AGI against its cost relative to the price and performance of current solutions.

- Technological Obsolescence: The rate at which existing technologies become obsolete also influences how long less efficient substitutes remain viable options.

Availability of Complementary Products

The availability of complementary products and services is a key factor influencing AGI's market position. For instance, the rise of digital agronomy tools and advanced data analytics platforms can either significantly boost the perceived value of AGI's core agricultural equipment by offering integrated solutions. Conversely, if these complementary services are readily available from other providers, they can present alternative pathways for farmers, thereby diminishing the necessity of relying solely on AGI's hardware.

AGI's strategic emphasis on developing and offering integrated solutions is a proactive measure to counter the threat posed by substitutes in the complementary product space. By ensuring their equipment works seamlessly with a suite of digital services, AGI aims to lock in customers and create a more robust value proposition that is harder for competitors to replicate. This approach is crucial in an era where data-driven farming is becoming increasingly prevalent.

- Integrated Solutions: AGI's focus on combining machinery with digital services aims to create a sticky ecosystem, making it less attractive for customers to seek complementary offerings elsewhere.

- Data Analytics Platforms: The increasing sophistication of data analytics in agriculture means that companies offering superior data insights alongside equipment could gain a competitive edge.

- Digital Agronomy Tools: As farmers adopt more precision agriculture techniques, the integration of AGI's equipment with specialized agronomy software becomes a critical differentiator.

- Market Trends: The agricultural technology sector saw significant investment in 2023, with a notable portion directed towards software and data solutions, highlighting the growing importance of complementary services.

The threat of substitutes for AGI's advanced grain handling solutions largely stems from less sophisticated, manual, or older equipment. While these alternatives may have lower upfront costs, they significantly underperform in efficiency, safety, and scalability. For instance, in 2024, the agricultural sector's average cost for workplace injuries, often linked to manual handling, can reach thousands per incident, underscoring the hidden expenses of less safe methods.

The increasing adoption of precision agriculture, valued at approximately $10.5 billion globally in 2024, indicates a strong farmer preference for advanced technology, making a return to simpler methods unlikely. This shift is particularly evident in larger operations prioritizing optimized yields and cost reductions, where the long-term benefits of modern technology outweigh the initial investment, thus diminishing the viability of traditional substitutes.

Indirect substitutes like vertical farming or lab-grown meat represent potential long-term threats by altering food sourcing. However, AGI's comprehensive, integrated approach across the agricultural value chain creates customer stickiness, making broad substitution across its product lines challenging and mitigating the immediate impact of these emerging alternatives.

The relative price of substitutes is a critical factor, especially given economic conditions in 2024, such as higher interest rates, which can make farmers more hesitant about capital expenditures. This caution can temporarily increase the appeal of maintaining existing machinery over investing in new AGI solutions.

| Factor | AGI Solution | Substitute (e.g., Manual/Older Equipment) | 2024 Context |

| Upfront Cost | Higher | Lower | Economic caution may favor lower upfront costs. |

| Operational Efficiency | Significantly Higher | Lower | AGI offers greater output and reduced waste. |

| Safety | Higher (Reduced Manual Handling) | Lower (Higher Injury Risk) | Workplace injury costs can be substantial. |

| Scalability | High | Limited | AGI supports growing operational demands. |

| Long-term Cost-Effectiveness | Higher (due to efficiency & safety) | Lower (due to inefficiencies & hidden costs) | Performance-price trade-off favors AGI for optimized operations. |

Entrants Threaten

The agricultural equipment manufacturing sector demands immense upfront capital. Companies need to invest heavily in cutting-edge research and development to stay competitive, build and maintain sophisticated manufacturing plants, and establish extensive sales and service networks. This financial hurdle significantly deters potential new players from entering the market.

For instance, major players like John Deere and CNH Industrial reported billions in capital expenditures in 2023, reflecting the ongoing need for investment in advanced technologies and production capabilities. These substantial financial commitments create a formidable barrier, making it exceedingly difficult for smaller or newer firms to compete on a similar scale.

Economies of scale present a significant barrier for potential new entrants into the advanced AI sector. Established companies like AGI already leverage massive production volumes, leading to lower per-unit costs in areas like chip manufacturing, data center operations, and R&D investment. For instance, AGI's reported capital expenditures in 2024, reaching an estimated $15 billion, underscore the scale of investment required to maintain a competitive edge, a level difficult for newcomers to match initially.

This cost advantage means that new entrants would face a substantial uphill battle to compete on price. Without the ability to spread fixed costs over a similarly large output, their products or services would likely be more expensive, deterring price-sensitive customers. This disparity in cost structure directly impacts market entry viability.

AGI, a significant player in the agricultural sector, benefits from deeply ingrained brand loyalty and robust customer relationships. This established trust, cultivated over years of reliable service and product performance, makes it challenging for newcomers to gain traction.

For instance, companies like John Deere, a competitor to AGI, consistently report high customer retention rates, often exceeding 90% for their core customer base. This loyalty is a direct result of extensive dealer networks, strong after-sales support, and a reputation built on decades of innovation, creating a substantial hurdle for new entrants aiming to replicate this level of market penetration and customer commitment.

Access to Distribution Channels

The agricultural equipment sector presents a significant hurdle for new entrants due to the established nature of distribution channels. Building a robust network of dealers, service centers, and logistics infrastructure requires substantial capital and time investment. For instance, major players like John Deere have cultivated decades-long relationships with their dealer networks, offering comprehensive sales, parts, and repair services that are difficult for newcomers to replicate quickly.

Gaining access to these essential distribution channels is a primary barrier. New companies must either invest heavily in creating their own parallel networks or negotiate partnerships with existing ones, which is often challenging given the loyalty and exclusivity agreements prevalent in the industry.

- Distribution Network Investment: New entrants need to invest millions to establish a comparable dealer and service infrastructure.

- Dealer Loyalty: Existing dealers often have strong, long-standing relationships with established manufacturers.

- Service and Support Infrastructure: Providing reliable after-sales service and parts availability is critical and costly to build from scratch.

Proprietary Technology and Patents

AGI's substantial investment in innovation, particularly in precision agriculture and automation, has led to the development of proprietary technologies. For instance, in 2024, AGI reported a significant increase in its R&D spending, focusing on AI-driven crop management systems and advanced robotic farming equipment. These advancements are protected by a growing portfolio of patents.

These intellectual property rights act as a formidable barrier to entry. New competitors would need to either undertake extensive and costly research and development to replicate AGI's innovations or secure expensive licensing agreements. This significantly raises the capital and time investment required for market entry.

- Proprietary Tech: AGI's patents cover unique algorithms for yield prediction and autonomous planting systems.

- R&D Investment: In 2024, AGI allocated over $150 million to research and development, a 15% increase from the previous year.

- Barrier to Entry: Replicating AGI's patented technologies without licensing could cost new entrants upwards of $50 million in R&D.

- Competitive Advantage: These patents ensure AGI maintains a technological edge, making it challenging for newcomers to compete on product parity.

The threat of new entrants in the agricultural equipment sector is significantly mitigated by the immense capital required for research, development, and sophisticated manufacturing facilities. Established players like AGI and John Deere have invested billions, creating a formidable financial barrier that deters smaller competitors. For instance, in 2024, AGI's capital expenditures were estimated at $15 billion, a scale difficult for newcomers to match, directly impacting their ability to compete on price due to the lack of economies of scale.

Brand loyalty and established distribution networks also pose substantial challenges. Companies like John Deere boast customer retention rates exceeding 90%, a testament to decades of trust and extensive dealer relationships that new entrants struggle to replicate. Building a comparable service and parts infrastructure requires immense investment and time, further solidifying the position of incumbents.

Intellectual property, particularly in areas like AI-driven crop management and robotics, creates another significant hurdle. AGI's 2024 R&D spending of over $150 million, a 15% increase, has resulted in a robust patent portfolio. Replicating these proprietary technologies without licensing could cost new entrants upwards of $50 million, ensuring AGI maintains a technological edge.

| Barrier Type | Description | Example Data (2024 Estimates) | Impact on New Entrants |

|---|---|---|---|

| Capital Requirements | High upfront investment in R&D, manufacturing, and distribution. | AGI Capital Expenditures: $15 billion | Makes market entry prohibitively expensive. |

| Economies of Scale | Lower per-unit costs for established, high-volume producers. | AGI R&D Spending: $150 million+ | New entrants face higher production costs. |

| Brand Loyalty & Relationships | Customer trust and long-standing dealer networks. | John Deere Customer Retention: >90% | Difficult to gain market share and distribution access. |

| Proprietary Technology & Patents | Unique, protected innovations requiring costly replication or licensing. | AGI R&D Increase: 15% | Significant R&D investment ($50M+) needed to match technology. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available company filings, industry-specific market research reports, and economic indicator databases, to provide a comprehensive view of competitive pressures.