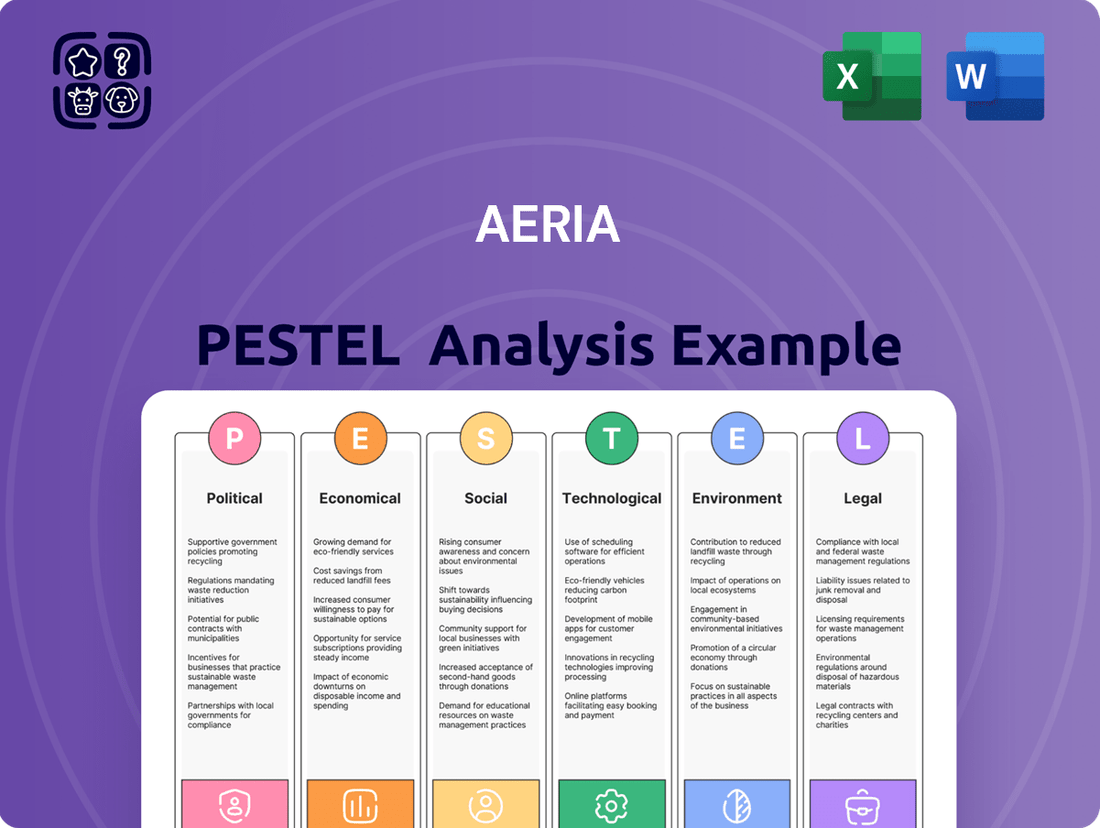

Aeria PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aeria Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping Aeria's trajectory. Our comprehensive PESTLE analysis provides the deep market intelligence you need to anticipate challenges and seize opportunities. Download the full version now to gain a strategic advantage and make informed decisions.

Political factors

Governments worldwide are intensifying their focus on the digital content sector, with online gaming facing particular scrutiny. This includes potential regulations around mechanics like loot boxes and in-game purchases, as well as content censorship. For instance, in 2024, several European countries, including Belgium and the Netherlands, continued to classify certain loot box systems as gambling, impacting game developers' revenue models.

These evolving policies directly influence Aeria Corporation's game design choices, monetization approaches, and the need for ongoing compliance across various national legal landscapes. Adapting to these diverse regulatory frameworks, which can range from age restrictions to data privacy mandates, is crucial for maintaining market access and operational stability.

Global data privacy regulations, like the EU's GDPR, are becoming increasingly stringent, creating significant compliance challenges for companies like Aeria. These rules impact how user data can be collected, processed, and stored, directly affecting Aeria's ability to conduct targeted marketing and leverage data analytics. Failure to comply can result in hefty fines; for example, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Geopolitical shifts and evolving trade policies significantly influence Aeria Corporation's international operations. For instance, the ongoing trade disputes between major economic blocs, particularly those impacting technology sectors, could lead to increased tariffs on digital services or outright market access restrictions. In 2024, the global trade landscape saw continued volatility, with some nations implementing protectionist measures that could directly affect Aeria's cross-border publishing revenue streams.

Restrictions on cross-border data flows, a growing concern in 2024 and projected to intensify, pose a direct challenge to Aeria's digital publishing model. Data localization requirements in key markets can fragment Aeria's operations, increasing compliance costs and potentially limiting the reach of its content. This trend, coupled with potential tariffs on digital services, could see a significant portion of Aeria's projected 2025 international revenue being impacted by these regulatory hurdles.

Government Support for the IT and Tech Sector

Governments worldwide are increasingly recognizing the strategic importance of the IT and tech sectors, implementing policies to stimulate innovation and growth. For instance, in 2024, many nations continued to offer R&D tax credits and grants specifically targeting technology companies. Aeria Corporation, with its diverse IT solutions beyond its gaming origins, is well-positioned to leverage these initiatives, potentially reducing operational costs and accelerating the development of new services.

These supportive measures can take various forms, aiming to create a favorable ecosystem for technological advancement.

- Government grants for AI and cybersecurity research: Many countries are allocating significant funds to these critical areas, offering direct financial support for projects.

- Tax incentives for tech startups and scale-ups: Policies designed to encourage investment and reduce the tax burden on young, innovative tech firms are common.

- Support for digital infrastructure development: Investments in high-speed internet and cloud computing facilities benefit all tech companies, including Aeria.

- Public-private partnerships for innovation hubs: Collaborative efforts between government and industry foster environments for shared learning and technological breakthroughs.

Political Stability in Key Operating Regions

Political stability in Aeria Corporation's key operating regions is a critical factor. Instability, civil unrest, or abrupt policy changes in areas with a substantial user base or operational footprint can introduce significant risks. For instance, a sudden imposition of internet restrictions in a major market like India, which saw significant digital growth in 2024, could directly impact Aeria's service delivery and revenue streams. Such disruptions can hinder consumer spending on digital services and even invite direct government intervention, thereby affecting business continuity and market predictability.

The potential for political upheaval directly influences Aeria's operational environment.

- Geopolitical Tensions: Increased geopolitical tensions in regions like Southeast Asia, a growing market for digital services, could lead to unpredictable regulatory changes impacting Aeria's operations.

- Regulatory Uncertainty: Sudden shifts in data privacy laws or content moderation policies, as seen in evolving digital regulations across the EU in 2024, can create compliance challenges and operational costs for Aeria.

- Government Intervention: Direct government intervention, such as the blocking of specific platforms or services due to political disputes, could severely disrupt user access and Aeria's market presence.

- Economic Impact: Political instability often correlates with economic downturns, reducing discretionary spending on digital services and impacting Aeria's growth prospects.

Government scrutiny of online gaming mechanics, such as loot boxes, continues in 2024, with several European nations classifying them as gambling. This directly impacts Aeria's game design and monetization strategies, necessitating compliance with diverse national regulations. Furthermore, stringent data privacy laws like GDPR, with potential fines up to 4% of global revenue, demand careful data handling, affecting targeted marketing and analytics capabilities for companies like Aeria.

What is included in the product

The Aeria PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company's operating landscape. This comprehensive review provides actionable insights for strategic decision-making and risk mitigation.

Aeria's PESTLE Analysis offers a clear, summarized version of complex external factors, making it easy to reference during meetings and reducing the pain of sifting through raw data.

Economic factors

Global economic growth is a major driver for Aeria Corporation. When economies are expanding, people generally have more disposable income, making them more likely to spend on entertainment like online games and mobile content. For instance, the IMF projected global growth to be around 3.2% in 2024, a slight slowdown from 2023 but still indicating a generally positive economic environment.

Conversely, economic slowdowns or recessions can significantly impact Aeria's revenue. During tough economic times, consumers tend to cut back on discretionary spending, which includes entertainment. This can lead to lower engagement with Aeria's games and reduced spending on in-game purchases or subscriptions, directly affecting their bottom line.

Persistent inflation throughout 2024 and into early 2025 directly impacts Aeria Corporation by escalating operational expenses. Costs for essential services like cloud server maintenance, crucial software licenses, and competitive talent acquisition are seeing noticeable increases. For instance, global inflation rates averaged around 5.5% in major economies in 2024, a figure that translates to higher expenditures for Aeria's infrastructure and human capital.

These rising costs present a strategic dilemma for Aeria. To maintain profitability, the company may need to implement price hikes on in-game purchases or subscription tiers. However, such adjustments carry the risk of alienating existing players and deterring new user acquisition, especially in a competitive gaming market where price sensitivity is a factor. Alternatively, absorbing these increased costs would directly compress Aeria's profit margins, impacting overall financial performance.

Currency exchange rate volatility presents a significant challenge for Aeria Corporation, especially as it expands its global footprint. Fluctuations directly affect the reported value of international earnings when translated back into Aeria's primary reporting currency. For instance, a strengthening domestic currency would diminish the value of revenues earned in weaker foreign currencies.

These shifts also impact Aeria's operational costs. If the company relies on international talent or services, a depreciating reporting currency would make these expenses more costly. In 2024, for example, major currency pairs like EUR/USD saw notable swings, with the euro experiencing periods of both appreciation and depreciation against the dollar, directly influencing the cost of business for companies with significant transatlantic operations.

Competition and Pricing Dynamics in Digital Entertainment

The digital entertainment and IT solutions sectors are intensely competitive, forcing companies like Aeria to constantly adapt. Competitors are employing aggressive pricing and novel business models, making it crucial for Aeria to deliver exceptional value to keep users and clients engaged. For instance, the global gaming market, a significant segment within digital entertainment, was projected to reach $229 billion in 2023 and is expected to grow, highlighting the scale of competition.

Aeria must contend with a landscape where innovation is rapid and customer loyalty can be fleeting. This necessitates a continuous focus on differentiating its offerings and maintaining competitive pricing. The IT solutions market is equally dynamic, with established tech giants and agile startups alike vying for market share, often through strategic partnerships and acquisitions to expand their service portfolios.

- Intense Market Saturation: Numerous companies offer similar digital entertainment and IT services, leading to price wars and reduced profit margins.

- Rapid Technological Advancements: Competitors are quick to adopt new technologies, requiring Aeria to invest heavily in R&D to remain relevant.

- Evolving Consumer Expectations: Users demand increasingly personalized experiences and seamless integration across devices, putting pressure on service providers to innovate constantly.

- Globalized Competition: Aeria faces rivals not only domestically but also from international players, many of whom benefit from lower operational costs or government support.

Investment Climate and Access to Capital

The investment climate significantly impacts Aeria Corporation's strategic options. For instance, as of mid-2024, global interest rates, while showing signs of stabilization in some regions, remain elevated compared to the low-rate environment of the early 2020s. This can increase the cost of borrowing for Aeria's expansion or R&D projects. Venture capital funding, a crucial source for gaming and tech companies, saw a notable slowdown in early 2024 after a boom period, with deal volumes and valuations adjusting downwards. This tightening in the venture capital market could make it more challenging for Aeria to secure external funding for ambitious new game developments or significant IT infrastructure upgrades.

Aeria's access to capital is directly tied to these broader economic trends. A robust investment climate, characterized by investor confidence and readily available capital, would enable Aeria to more easily finance its growth strategies, such as pursuing strategic acquisitions or investing heavily in next-generation gaming technologies. Conversely, a less favorable environment, marked by higher borrowing costs or reduced venture capital appetite, might force Aeria to scale back its strategic initiatives or rely more heavily on internal cash flows. For example, the average Series A funding round in the gaming sector in early 2024 was reportedly around $10-15 million, a figure that might need careful consideration for Aeria's project financing needs depending on the scale.

- Interest Rate Environment: Global benchmark interest rates, such as the US Federal Funds Rate, were hovering around 5.25%-5.50% in mid-2024, impacting the cost of debt financing.

- Venture Capital Activity: While specific data for Aeria's sector varies, overall venture capital investment in technology and gaming saw a recalibration in early 2024, with a greater focus on profitability and sustainable growth.

- Investor Sentiment: General market sentiment towards growth stocks and the tech sector influences the availability and cost of equity capital for companies like Aeria.

- Acquisition Financing: The cost and availability of capital for mergers and acquisitions are critical for Aeria's inorganic growth strategies, directly affected by overall market liquidity.

Economic factors significantly shape Aeria Corporation's performance. Global economic growth influences consumer spending on discretionary items like entertainment, with the IMF projecting 3.2% global growth for 2024. Inflation, averaging around 5.5% in major economies in 2024, increases Aeria's operational costs, potentially forcing price adjustments that risk alienating customers.

Currency volatility directly impacts Aeria's international earnings and operational expenses, as seen with significant swings in major currency pairs like EUR/USD during 2024. The competitive landscape, with a global gaming market projected to reach $229 billion in 2023, demands constant innovation and value delivery from Aeria.

The investment climate, characterized by elevated interest rates around 5.25%-5.50% for the US Federal Funds Rate in mid-2024 and a recalibration in venture capital activity, affects Aeria's ability to finance growth and R&D. Investor sentiment towards tech and gaming stocks also influences the cost and availability of equity capital.

| Economic Factor | Impact on Aeria | 2024/2025 Data/Projection |

|---|---|---|

| Global Economic Growth | Influences consumer discretionary spending on entertainment. | IMF projects 3.2% global growth for 2024. |

| Inflation | Increases operational costs (servers, software, talent). | Average 5.5% in major economies (2024), impacting Aeria's margins. |

| Currency Exchange Rates | Affects value of international earnings and cost of foreign services. | Notable volatility in EUR/USD (2024) impacts transatlantic operations. |

| Investment Climate (Interest Rates) | Increases cost of debt financing for expansion/R&D. | US Federal Funds Rate around 5.25%-5.50% (mid-2024). |

| Investment Climate (Venture Capital) | Impacts availability of external funding for growth initiatives. | Recalibration in VC activity in tech/gaming sectors (early 2024). |

Preview the Actual Deliverable

Aeria PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Aeria PESTLE Analysis provides a detailed examination of the external factors impacting the company. You’ll gain valuable insights into the political, economic, social, technological, legal, and environmental landscape surrounding Aeria.

Sociological factors

Consumer tastes in online and mobile content are in constant flux, with significant shifts occurring towards particular game genres, preferred platforms, and evolving monetization strategies. For instance, the mobile gaming market saw hyper-casual games continue their strong performance through 2024, capturing a substantial share of downloads, while live-service models and cross-platform play gained further traction, indicating a demand for persistent engagement and broader accessibility.

Aeria Corporation needs to stay keenly attuned to these dynamic trends. The increasing popularity of subscription-based content and the growing influence of influencer-driven game discovery in 2024 highlight the need for adaptable content strategies. Failing to align with these evolving preferences, such as the move towards more social and community-focused gaming experiences, could significantly impact Aeria's ability to maintain audience engagement and market relevance.

Aeria's potential user base is significantly shaped by evolving demographics. For instance, the global population aged 65 and over is projected to reach 1.5 billion by 2050, a trend that could influence demand for Aeria's services, particularly if accessibility features are prioritized. Conversely, younger generations, who are digital natives, represent a core demographic for engagement.

Understanding how these diverse age groups interact online is key. In 2024, global internet penetration stood at approximately 66%, with higher rates among younger demographics. This means tailoring content and platform features to resonate with varying levels of digital literacy and preferences across age segments will be crucial for maximizing user engagement.

Societal views on gaming are evolving, with concerns around excessive screen time and the impact of in-game purchases influencing player behavior and attracting regulatory attention. For instance, a 2024 report indicated that over 60% of parents express some level of concern regarding their children's gaming habits.

Aeria Corporation must actively manage its corporate image in light of these perceptions. Implementing responsible gaming practices, such as clear spending limits and educational resources on healthy play, can foster a more positive community relationship and mitigate potential backlash.

Influence of Online Communities and Social Media

Online communities and social media are powerful forces in the gaming world, directly impacting how popular games become and how engaged players remain. Aeria Corporation actively uses these channels for marketing campaigns, fostering a sense of community around its titles, and engaging directly with its players. As of early 2024, platforms like Twitch and YouTube continue to be dominant, with Twitch viewership seeing a significant increase in hours watched for gaming content year-over-year, underscoring the importance of streaming platforms in game discovery and sustained interest.

Aeria's success hinges on a robust social media strategy and skilled community management. For instance, a well-executed campaign on TikTok or Instagram can generate viral buzz, driving player acquisition and retention. By mid-2024, influencer marketing, particularly through gaming streamers, is expected to continue its upward trajectory, with brands allocating substantial budgets to collaborations that reach targeted demographics effectively. This direct interaction builds loyalty and provides invaluable feedback for game development and updates.

The influence of these digital spaces is undeniable:

- Shaping Game Popularity: Online communities and streaming platforms are key drivers in a game's lifecycle, often determining its mainstream appeal.

- Player Engagement: Direct interaction through social media fosters a sense of belonging and encourages ongoing participation.

- Marketing and Feedback: Aeria leverages these channels for cost-effective marketing and to gather real-time player sentiment.

- Emerging Trends: The rise of short-form video content on platforms like TikTok is creating new avenues for game promotion and community building.

Work-Life Balance and Leisure Time Trends

Societal shifts towards prioritizing work-life balance are significantly influencing how individuals allocate their time, including for leisure activities like online gaming. In 2024, reports indicate a growing demand for flexible work arrangements, with an estimated 30% of the global workforce having access to remote work options, a trend that continued to expand through early 2025. This increased flexibility means consumers are seeking entertainment that can be seamlessly integrated into diverse daily routines, rather than demanding large, dedicated blocks of time.

The diversification of leisure activities also presents a challenge and opportunity for companies like Aeria Corporation. With more options available, from streaming services to new forms of social media, capturing consumer attention requires content that is both engaging and easily accessible. Aeria must therefore continuously adapt its offerings to remain competitive in a crowded entertainment landscape, ensuring its products fit into varied consumer lifestyles.

- Increased Remote Work: Approximately 30% of the global workforce had remote work options by 2024, a figure projected to grow.

- Leisure Time Allocation: Consumers are increasingly seeking flexible entertainment that fits into fragmented schedules.

- Content Diversification: Aeria must compete with a wide array of digital entertainment options for consumer attention.

- Lifestyle Integration: Strategies need to focus on making entertainment accessible and adaptable to evolving consumer lifestyles.

Societal views on gaming are evolving, with concerns around excessive screen time and in-game purchases influencing player behavior and attracting regulatory attention. A 2024 report indicated that over 60% of parents express some level of concern regarding their children's gaming habits, highlighting the need for responsible gaming practices. Aeria Corporation must actively manage its corporate image and foster a positive community relationship by implementing clear spending limits and educational resources on healthy play.

Technological factors

Rapid technological advancements are reshaping the gaming and IT infrastructure landscapes. Cloud computing, for instance, saw global public cloud spending reach an estimated $266 billion in the first half of 2024, a significant increase from the previous year. This growth fuels more sophisticated game development and scalable IT solutions.

Artificial intelligence (AI) is another key driver, with AI in gaming projected to reach $10.4 billion by 2027, impacting everything from NPC behavior to personalized player experiences. Aeria Corporation's ability to integrate AI into its game development and IT services will be crucial for staying competitive.

Furthermore, virtual and augmented reality (VR/AR) technologies are maturing, with the global VR/AR market expected to surpass $100 billion by 2025. Aeria's investment in these immersive technologies can unlock new revenue streams and provide unique, engaging experiences for its user base and clients.

The relentless advancement in smartphone hardware, with processors becoming significantly more powerful and displays offering higher resolutions, directly influences how Aeria's mobile games can be designed and experienced. For instance, the average global smartphone processor speed has seen a substantial increase year-over-year, enabling more complex graphics and smoother gameplay. This evolution is critical for Aeria to ensure its content remains competitive and engaging.

Operating system updates, such as those from Apple and Google, frequently introduce new features and APIs that Aeria can leverage to enhance its mobile offerings. These updates often optimize battery usage and improve security, factors that directly impact user satisfaction and retention. Staying current with these platform developments, including the growing adoption of 5G technology which offers much lower latency and higher speeds, is essential for delivering a seamless and immersive experience for Aeria's players.

The cybersecurity threat landscape is constantly evolving, with threats becoming more sophisticated and pervasive. For Aeria Corporation, a company deeply embedded in IT solutions, this means continuous investment in advanced cybersecurity technologies is not just a recommendation, but a necessity. Protecting user data, intellectual property, and operational integrity is paramount for maintaining user trust and ensuring regulatory compliance.

In 2024, the global average cost of a data breach reached an all-time high of $4.45 million, according to IBM's Cost of a Data Breach Report. This escalating cost underscores the critical need for robust cybersecurity measures. Aeria's commitment to staying ahead of these threats, by adopting technologies like AI-driven threat detection and zero-trust architecture, will be crucial for its continued success and reputation in the market.

Data Analytics and Business Intelligence Tools

The increasing sophistication of data analytics and business intelligence tools is a significant technological factor for Aeria Corporation. These platforms allow for a much deeper understanding of how users interact with Aeria's games and IT services. For instance, by analyzing vast datasets, Aeria can identify popular game mechanics, predict player churn, and tailor content for better engagement. This granular insight is crucial for optimizing monetization strategies, ensuring that Aeria can effectively leverage its user base.

In 2024, the global business intelligence market was valued at approximately $27.5 billion, with projections indicating continued strong growth. This trend highlights the widespread adoption and recognized value of these tools across industries. For Aeria, this means access to increasingly powerful and cost-effective solutions for data analysis. The ability to process and interpret complex information quickly is a competitive advantage, enabling more agile responses to market shifts and user preferences.

Leveraging these technologies directly impacts Aeria's operational efficiency and decision-making processes. By automating data collection and analysis, Aeria can free up resources to focus on strategic initiatives rather than manual data handling. This technological capability is essential for:

- Personalized User Experiences: Tailoring game content and service offerings based on individual user data.

- Market Trend Identification: Spotting emerging patterns in gaming and IT sectors to inform product development.

- Operational Optimization: Streamlining internal processes and resource allocation based on performance metrics.

- Monetization Strategy Refinement: Identifying the most effective ways to generate revenue from Aeria's diverse portfolio.

Emerging Technologies in Content Creation and Distribution

New technologies are fundamentally changing how content is made and shared. Blockchain, for instance, is enabling new ways to own digital assets through NFTs, which saw a significant surge in market activity, with over $1 billion in sales in early 2024 alone. Procedural content generation is allowing for the creation of vast, dynamic virtual worlds, and advanced streaming tech is making high-quality, real-time delivery more accessible than ever.

Aeria Corporation must actively assess and potentially adopt these advancements. Integrating technologies like AI-powered content creation tools could streamline production, while exploring blockchain for digital collectibles might open up novel revenue streams. By staying ahead of these technological shifts, Aeria can foster innovation and deepen user interaction.

The impact on the market is substantial:

- NFT Market Growth: The global NFT market is projected to reach $200 billion by 2027, indicating a strong demand for verifiable digital ownership.

- AI in Content Creation: Tools like Midjourney and Stable Diffusion have demonstrated the power of AI in generating visual content, with user adoption rates climbing rapidly in 2024.

- Streaming Technology Advancements: 5G deployment is enhancing streaming capabilities, supporting higher resolutions and lower latency, crucial for immersive experiences.

Technological factors are critical for Aeria's growth, with cloud spending hitting an estimated $266 billion in H1 2024 and AI in gaming projected for significant expansion. VR/AR market growth, expected to exceed $100 billion by 2025, offers new avenues for Aeria's immersive experiences.

Advancements in smartphone hardware enable more sophisticated mobile game design, while OS updates and 5G adoption are vital for seamless user experiences. Cybersecurity remains paramount, with data breaches costing an average of $4.45 million in 2024, necessitating robust protective measures.

Sophisticated data analytics tools, valued at approximately $27.5 billion in 2024, allow Aeria to gain deep user insights for personalized content and optimized monetization. Emerging technologies like NFTs, with over $1 billion in sales in early 2024, and AI content generation tools present further opportunities for innovation and revenue diversification.

| Technology Area | 2024/2025 Data Point | Impact on Aeria |

|---|---|---|

| Cloud Computing | Global public cloud spending: $266 billion (H1 2024) | Enables scalable IT solutions and sophisticated game development. |

| Artificial Intelligence (AI) | AI in gaming projected: $10.4 billion by 2027 | Enhances NPC behavior, personalization, and content creation. |

| Virtual/Augmented Reality (VR/AR) | Global VR/AR market: Expected to surpass $100 billion by 2025 | Opens new revenue streams and engaging user experiences. |

| Cybersecurity | Global average cost of data breach: $4.45 million (2024) | Requires continuous investment in advanced security for trust and compliance. |

| NFTs | NFT market activity: Over $1 billion in sales (early 2024) | Potential for novel revenue streams through digital asset ownership. |

Legal factors

Aeria Corporation's success hinges on safeguarding its intellectual property, encompassing unique game designs, proprietary software code, and original creative assets. Strong legal protections, including copyright, trademark, and patent laws, are fundamental to deterring unauthorized use and preserving Aeria's competitive advantage in the dynamic digital content sector.

In 2024, the global digital content market, a key area for Aeria, was valued at over $2.2 trillion, highlighting the immense value and vulnerability of creative works. The Digital Millennium Copyright Act (DMCA) in the United States, for instance, provides critical tools for online copyright enforcement, which Aeria utilizes to protect its digital game assets from piracy.

Aeria Corporation navigates a complex web of consumer protection laws, particularly concerning digital goods and in-game transactions. These regulations, which vary by region, mandate clear communication regarding pricing, virtual item drop rates, and subscription terms. Failure to comply can lead to significant penalties; for instance, in 2024, the EU's Digital Services Act enforcement actions have increasingly targeted companies for opaque business practices.

Maintaining transparent terms of service and fair refund policies is crucial for building user trust and mitigating legal risks. In 2025, reports indicate a rise in consumer complaints related to unfair digital sales practices, highlighting the importance of clear disclosure of monetization mechanics. Aeria must ensure its user agreements are easily understood and adhere to evolving consumer rights legislation globally to avoid costly litigation and regulatory scrutiny.

Aeria Corporation, with its global development and operational teams, must navigate a complex web of labor laws. This includes adhering to regulations on employment contracts, minimum wage, working hours, and employee benefits, which vary significantly by country. For instance, in 2024, the average minimum wage in OECD countries saw an increase, reflecting a trend towards better worker compensation.

Ensuring compliance is not just a legal necessity but a strategic advantage for Aeria. Companies that prioritize fair labor practices and competitive benefits, such as robust health insurance and retirement plans, are better positioned to attract and retain top talent in a competitive market. This also safeguards against costly legal disputes and reputational damage.

Antitrust and Competition Law Compliance

Aeria must meticulously adhere to antitrust and competition laws across its operations, from strategic partnerships and acquisitions to everyday market strategies. This is crucial to avoid any perception or reality of monopolistic behavior or unfair market dominance, especially given the dynamic nature of the gaming and IT industries.

The gaming sector, in particular, has seen significant consolidation. For instance, Microsoft's acquisition of Activision Blizzard, valued at approximately $68.7 billion, closed in late 2023, highlighting the scale of M&A activity and the heightened scrutiny from regulatory bodies like the FTC and the European Commission.

Aeria's compliance efforts should focus on several key areas:

- Merger and Acquisition Scrutiny: Ensuring all proposed acquisitions undergo thorough legal review to demonstrate they do not substantially lessen competition.

- Partnership Agreements: Structuring collaborations to prevent exclusivity clauses that could stifle innovation or exclude competitors.

- Pricing and Distribution: Maintaining fair pricing strategies and open distribution channels to avoid anti-competitive practices.

- Market Conduct: Proactively monitoring its market position and business practices to preemptively address any potential antitrust concerns raised by regulators globally.

Specific Gaming and IT Sector Licensing and Compliance

Aeria Corporation's operations in the gaming and IT sectors necessitate adherence to a complex web of regional and service-specific licensing. For instance, operating online gaming platforms often requires permits related to digital distribution, payment processing, and potentially, if applicable, gambling regulations. As of 2024, many jurisdictions are refining their digital asset and online service regulations, meaning Aeria must stay abreast of evolving legal frameworks to ensure continuous compliance.

Compliance extends to critical areas like data center operations and user data protection, which are governed by stringent laws such as GDPR in Europe or CCPA in California. Failure to comply can result in significant fines; for example, GDPR violations can reach up to 4% of global annual revenue or €20 million, whichever is higher. Aeria's commitment to these regulations is paramount for maintaining trust and operational integrity.

- Gaming Licenses: Obtaining necessary licenses for game distribution and operation in key markets is crucial.

- Data Protection: Strict adherence to data privacy laws like GDPR and CCPA is essential for IT services.

- Age Ratings: Compliance with age rating systems for gaming content ensures responsible product rollout.

- Cybersecurity Standards: Meeting industry-specific cybersecurity mandates for IT infrastructure is non-negotiable.

Aeria must navigate evolving intellectual property laws, particularly concerning digital content and software. In 2024, the global intellectual property market continued to grow, underscoring the importance of robust protection strategies for Aeria's game designs and code. Compliance with consumer protection laws, including clear terms of service and fair refund policies, is vital to maintain user trust and avoid penalties, as seen with increased enforcement of digital sales regulations in the EU.

Antitrust and competition laws are critical, especially given the trend of consolidation in the gaming industry; for example, major acquisitions like Microsoft's $68.7 billion deal for Activision Blizzard in late 2023 faced significant regulatory scrutiny. Aeria's adherence to data privacy regulations, such as GDPR with potential fines up to 4% of global revenue, is paramount for maintaining operational integrity and user trust in 2025.

Environmental factors

Data centers, the backbone of online gaming and IT services like those offered by Aeria Corporation, are massive electricity consumers. In 2024, global data center energy consumption was estimated to be around 1.5% of total worldwide electricity usage, a figure projected to rise as demand for digital services grows. This significant energy draw means Aeria faces increasing pressure to improve efficiency and reduce its carbon footprint.

The escalating focus on environmental, social, and governance (ESG) factors means Aeria's IT infrastructure's energy efficiency is under greater scrutiny. For instance, by 2025, many regions are expected to implement stricter regulations on data center power usage effectiveness (PUE) ratios, potentially increasing operational costs for companies that don't adapt. This environmental factor directly impacts Aeria's corporate responsibility image and its bottom line.

Aeria Corporation, despite its digital focus, generates electronic waste (e-waste) from its IT infrastructure, including servers and other hardware. As of 2024, global e-waste generation is projected to reach 61.3 million metric tons, a significant increase from previous years, highlighting the growing environmental challenge.

Implementing robust e-waste management, such as responsible disposal and recycling of servers, is crucial for Aeria to meet evolving environmental regulations and maintain a positive corporate image. In 2023, the European Union's Waste Electrical and Electronic Equipment (WEEE) directive continued to set stringent standards for e-waste collection and recycling rates.

Investor and consumer pressure for corporate social responsibility (CSR) and environmental sustainability is significantly shaping business operations. For instance, by the end of 2024, over 70% of global institutional investors were reportedly integrating ESG (Environmental, Social, and Governance) factors into their investment decisions, a trend expected to continue its upward trajectory into 2025.

Aeria Corporation's strategic adoption of sustainability initiatives, such as transitioning to renewable energy sources for its data centers or championing eco-friendly IT lifecycle management, can directly bolster its brand reputation. This focus on environmental stewardship is increasingly crucial for attracting and retaining environmentally conscious customers and investors, with a growing segment of consumers in 2024 indicating a willingness to pay a premium for sustainable products and services.

Impact of Climate Change Policies on Operations

Government initiatives to mitigate climate change, such as carbon pricing mechanisms and stricter energy efficiency standards, are increasingly shaping the business landscape. For a company like Aeria, these policies can directly influence operational expenditures and necessitate adjustments in infrastructure development and capital investment strategies.

Adapting proactively to evolving environmental regulations is paramount for Aeria's sustained financial health and its ability to maintain regulatory adherence. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), which began its transitional phase in October 2023, will impose costs on imports of carbon-intensive goods, potentially impacting Aeria's supply chain and manufacturing costs if not managed effectively.

- Increased Operational Costs: Carbon taxes or emissions trading schemes can raise the cost of energy and raw materials, impacting Aeria's profitability. For example, the average EU Emissions Trading System (ETS) allowance price in early 2024 hovered around €60-€70 per tonne of CO2, a significant factor for energy-intensive industries.

- Infrastructure Investment: Aeria may need to invest in greener technologies or upgrade existing facilities to meet new energy efficiency mandates or emissions reduction targets, affecting its capital expenditure plans.

- Supply Chain Resilience: Policies affecting suppliers' environmental performance could necessitate diversification or collaboration to ensure a stable and compliant supply chain.

Resource Scarcity and Supply Chain Resilience

While Aeria Corporation's core business is software, the broader IT ecosystem it operates within is susceptible to environmental impacts on hardware. Resource scarcity, such as rare earth minerals crucial for electronics, can lead to price volatility and availability issues. For instance, disruptions in the supply of semiconductors, often linked to geopolitical events or natural disasters affecting manufacturing hubs, directly impact the cost and accessibility of the hardware Aeria's clients rely on for their IT solutions.

Aeria must ensure its supply chain for necessary hardware and infrastructure is resilient. This involves understanding the environmental risks associated with key component sourcing and manufacturing locations. For example, increased demand for cloud computing, a service Aeria may provide or integrate, necessitates robust data center infrastructure, which in turn relies on a stable supply of servers and networking equipment. Disruptions to this supply, potentially caused by extreme weather events impacting manufacturing or logistics, could hinder Aeria's ability to deliver services.

- Semiconductor Shortages: The global semiconductor shortage, exacerbated by factors including environmental concerns and increased demand, significantly impacted the IT hardware market throughout 2021-2023, with lingering effects into 2024.

- Rare Earth Mineral Dependence: The IT industry's reliance on rare earth minerals, often mined in regions facing environmental scrutiny and potential regulatory changes, presents a long-term risk to hardware costs and availability.

- Climate Change Impacts: Extreme weather events, predicted to increase in frequency and intensity due to climate change, pose a direct threat to manufacturing facilities and global logistics networks essential for hardware supply chains.

Aeria Corporation's operations, particularly its data centers, are significant energy consumers, contributing to environmental concerns. Global data center energy consumption in 2024 was approximately 1.5% of total worldwide electricity usage, a figure expected to climb. This necessitates a focus on energy efficiency and reducing carbon footprints to meet rising ESG expectations and potential regulations regarding power usage effectiveness (PUE) by 2025.

The company also faces the challenge of electronic waste (e-waste), with global generation projected to hit 61.3 million metric tons in 2024. Responsible disposal and recycling are critical for compliance with directives like the EU's WEEE, which sets stringent collection and recycling standards.

Investor and consumer demand for sustainability is a powerful driver, with over 70% of global institutional investors integrating ESG factors into decisions by the end of 2024. Aeria's adoption of renewable energy and eco-friendly IT lifecycle management can enhance its brand reputation and appeal to environmentally conscious stakeholders.

Government policies aimed at climate change mitigation, such as carbon pricing, directly influence Aeria's operational costs and infrastructure investment strategies. The EU's Carbon Border Adjustment Mechanism (CBAM), in its transitional phase since October 2023, could also impact supply chain costs.

| Environmental Factor | Impact on Aeria | 2024/2025 Data/Trend |

|---|---|---|

| Energy Consumption & Efficiency | Increased operational costs, regulatory compliance pressure | Data centers consume ~1.5% of global electricity; stricter PUE regulations anticipated by 2025. |

| Electronic Waste (E-waste) | Need for responsible disposal, compliance with regulations | Global e-waste projected at 61.3 million metric tons in 2024; EU WEEE directive sets recycling standards. |

| Climate Change & Government Policy | Potential for increased operational costs (carbon taxes), need for infrastructure investment | EU ETS allowance prices ~€60-€70/tonne CO2 (early 2024); CBAM implementation impacting supply chains. |

| Resource Scarcity & Supply Chain | Risk of price volatility and availability issues for hardware | Semiconductor shortages impacting IT hardware market (lingering effects into 2024); reliance on rare earth minerals. |

PESTLE Analysis Data Sources

Our PESTLE analysis is built on a robust foundation of data from official government publications, reputable international organizations, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors.