Aeria Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aeria Bundle

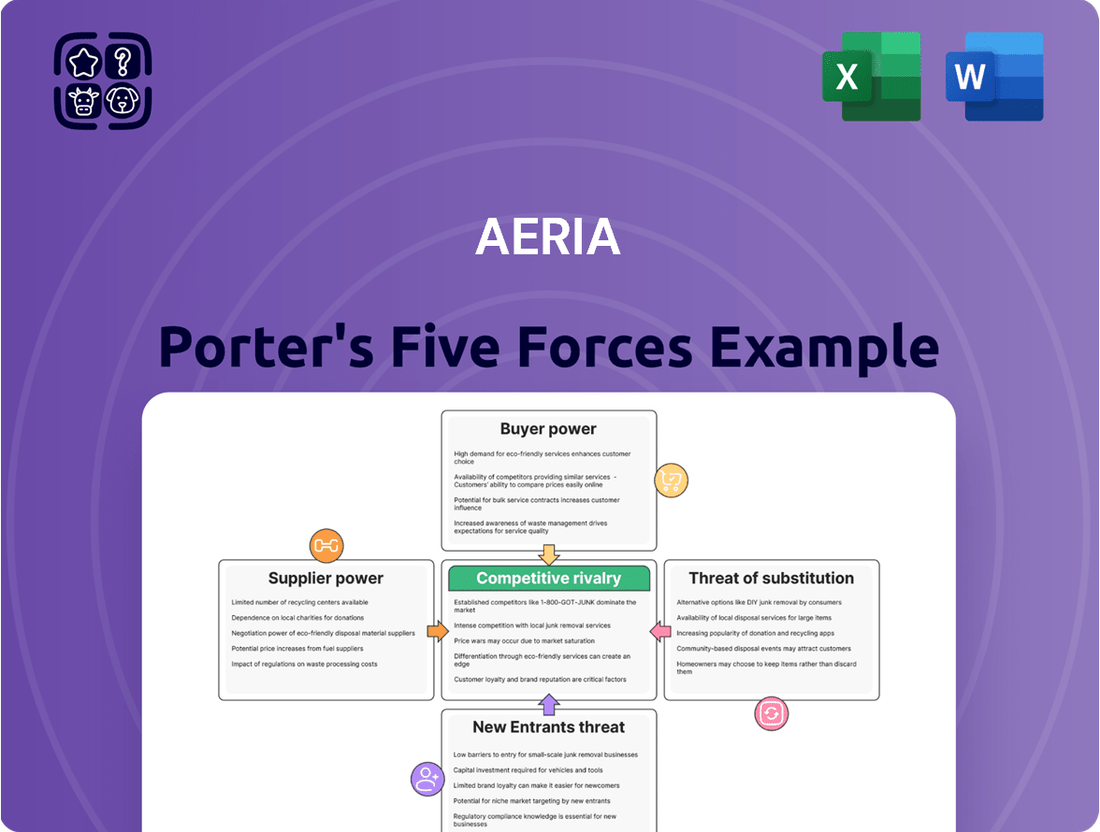

Aeria's competitive landscape is shaped by five key forces: the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for Aeria's strategic planning and market positioning.

The complete report reveals the real forces shaping Aeria’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Aeria Corporation, a key player in online and mobile gaming, is heavily dependent on specialized game engines, development tools, and middleware. The market for these essential components, particularly industry-standard engines like Unity and Unreal Engine, is often dominated by a limited number of providers.

This concentration grants these suppliers considerable leverage. High switching costs, coupled with the critical nature of these tools for producing high-quality games, mean that Aeria faces significant challenges if it needs to change its development platform. For instance, the global game engine market was valued at approximately $4.5 billion in 2023 and is projected to grow, underscoring the immense value and reliance on these providers.

The growing integration of artificial intelligence within game development tools further strengthens the bargaining power of these specialized software providers. Companies that offer AI-powered solutions for asset creation, scripting, or optimization can command premium pricing, as they provide a distinct competitive advantage in the rapidly evolving gaming landscape.

Aeria's reliance on Apple and Google for distributing its mobile games grants these platform holders substantial bargaining power. They dictate crucial terms like revenue splits, often taking a significant percentage, and control app store policies, acting as gatekeepers to Aeria's customer base. This dependency means Aeria has limited leverage in negotiating these terms.

The situation might see shifts with regulations like the EU's Digital Markets Act (DMA), which began implementation in November 2022. This act intends to curb the dominance of major tech platforms, or 'gatekeepers,' by mandating they permit alternative app distribution channels. If successful, this could dilute the bargaining power of Apple and Google by offering Aeria more avenues to reach players.

The gaming industry, especially in development and IT, relies heavily on specialized skills. Think game designers, programmers, artists, and experts in AI and AR. The demand for these professionals, particularly those adept at cutting-edge tech like AI, is high.

This scarcity of talent translates into significant bargaining power for individual employees and specialized development studios. They can negotiate better salaries, benefits, and project conditions, impacting the overall cost structure for game publishers.

For instance, in 2024, the average salary for a senior game programmer in North America could range from $120,000 to $180,000 annually, reflecting the premium placed on these specialized skills.

Influence of Payment Gateway Providers and Ad Networks

Aeria's reliance on payment gateway providers and mobile ad networks for its in-app purchases and advertising monetization strategies grants these suppliers significant bargaining power. Their fees, operational reliability, and the breadth of their network directly influence Aeria's profitability and its ability to attract new users.

For instance, payment gateway fees can range from 1.5% to 3.5% of transaction value, directly cutting into Aeria's revenue. Similarly, ad networks dictate the revenue share from ad impressions, with effective CPMs (Cost Per Mille) varying widely based on network quality and audience targeting. In 2024, the global digital advertising market was projected to reach over $600 billion, highlighting the scale of these networks and their influence.

- Payment Gateway Fees: These can represent a substantial cost, impacting the net revenue from each in-app purchase.

- Ad Network Revenue Share: The percentage of advertising revenue Aeria retains is determined by the ad network's terms.

- Network Reach and Quality: The effectiveness of monetization is tied to the number of users reached and the quality of engagement facilitated by these suppliers.

- Reliability and Uptime: Disruptions in payment processing or ad delivery can lead to lost revenue and user frustration.

Hardware and Infrastructure Providers for IT Solutions

Aeria Corporation's reliance on hardware and infrastructure providers for its IT solutions means these suppliers can wield significant bargaining power. For instance, the demand for specialized AI-ready data center capacity, a critical component for advanced computing, has surged. This demand is driving up costs and potentially limiting Aeria's options if key suppliers have few competitors or if Aeria has high switching costs.

The growing adoption of Equipment-as-a-Service (EaaS) models further shifts power towards these providers. Companies like Dell Technologies, for example, are increasingly offering flexible consumption models for their hardware, which can lock customers into specific ecosystems. In 2024, the global cloud infrastructure services market reached an estimated $300 billion, highlighting the scale and importance of these providers, and the potential leverage they possess.

- High demand for specialized IT hardware: The need for AI-optimized servers and networking gear creates scarcity and strengthens supplier leverage.

- Cloud infrastructure dependence: Aeria's reliance on major cloud providers like AWS, Azure, or Google Cloud means these entities have considerable influence over pricing and service terms.

- EaaS models: The shift to service-based hardware procurement can increase switching costs for Aeria, enhancing supplier bargaining power.

- Limited supplier alternatives: In niche areas of advanced IT infrastructure, the number of capable providers may be restricted, concentrating power.

Suppliers to Aeria Corporation, particularly those providing specialized game engines, development tools, and critical IT infrastructure, hold significant bargaining power. This leverage stems from market concentration, high switching costs for Aeria, and the essential nature of these inputs for game development and operations.

The dependence on a few key providers for essential software, like game engines, and for distribution platforms such as Apple and Google, allows these suppliers to dictate terms, including revenue splits and policy compliance. This concentration is further amplified by the increasing demand for AI-integrated development tools, which adds to the value proposition and pricing power of these specialized providers.

The scarcity of highly skilled talent in game development and IT also empowers individual professionals and specialized studios, enabling them to negotiate higher compensation and favorable project terms, thereby increasing Aeria's operational costs.

| Supplier Type | Key Dependence | Impact on Aeria | Example Data (2024) |

|---|---|---|---|

| Game Engine Providers | Core development tools | High switching costs, pricing leverage | Global game engine market valued at ~$4.5 billion (2023) |

| Platform Distributors (Apple/Google) | App store access, user acquisition | Revenue share dictates, policy control | App store commissions can be up to 30% |

| IT Infrastructure Providers | Cloud services, AI hardware | Increased costs, potential vendor lock-in | Global cloud infrastructure market projected to exceed $300 billion (2024) |

| Payment Gateways/Ad Networks | Monetization of in-app purchases and ads | Transaction fees, revenue share agreements | Payment gateway fees typically 1.5%-3.5% of transaction value |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Aeria's position in the gaming industry.

Instantly identify and mitigate competitive threats with a comprehensive overview of all five forces, enabling proactive strategic adjustments.

Customers Bargaining Power

The sheer volume of entertainment alternatives puts significant pressure on Aeria. In 2024, the global gaming market alone was projected to reach over $200 billion, with a substantial portion driven by mobile and online segments. This vast market means players have countless options beyond Aeria's portfolio, from AAA console titles to free-to-play mobile games and even non-gaming entertainment like streaming services.

This abundance of choice directly translates to a higher bargaining power for customers. If Aeria's games don't offer compelling content, a fair pricing structure, or an engaging user experience, players can readily divert their time and money to competitors. For instance, the rise of subscription-based gaming services in 2024 provides an accessible way for consumers to sample a wide variety of games without significant upfront investment, further amplifying their ability to switch.

The bargaining power of customers in the digital content space, particularly online and mobile gaming, is significantly amplified by low switching costs. For instance, a vast majority of free-to-play mobile games allow players to transition to a competitor's offering with minimal friction. This ease of movement means customers aren't heavily invested in a single platform or game, readily exploring alternatives if a better experience or value proposition emerges.

While some digital games feature in-game purchases, the financial commitment for an individual player is often less substantial compared to industries with high upfront costs or long-term contracts. This reduced investment further empowers customers, as the perceived loss from switching is minimal. In 2024, the global mobile gaming market was valued at over $90 billion, a testament to the sheer volume of players, many of whom can easily shift between titles, keeping providers on their toes.

In the free-to-play and mobile gaming market, customer bargaining power is significantly amplified by price sensitivity. Many players expect to access content without upfront cost, relying instead on optional in-app purchases or ad-supported models. This creates a strong incentive for customers to compare offerings and seek out the best value, directly impacting Aeria's pricing strategies.

For instance, the global mobile gaming market generated an estimated $92.2 billion in revenue in 2023, with a substantial portion coming from free-to-play titles. This vast market means consumers have numerous alternatives, making them acutely aware of pricing for virtual goods or premium features. If Aeria's in-game purchases are perceived as too expensive, players can easily switch to competing games that offer similar experiences at a lower cost or entirely for free.

User-Generated Content (UGC) Platforms and Community Influence

The growing influence of user-generated content (UGC) platforms and vibrant online gaming communities significantly amplifies the bargaining power of customers. Players' collective voice, expressed through reviews, social media engagement, and content creation, can directly shape a game's trajectory. For instance, in 2024, community-driven feedback led to substantial updates in several popular titles, demonstrating the power of organized player sentiment to demand specific features and bug resolutions.

- Community Demand Drives Development: Players can rally to request new content or specific gameplay adjustments, influencing developer priorities.

- Negative Feedback Amplification: Widespread negative reviews or social media campaigns can deter potential new players and impact sales.

- Influence on Game Longevity: Active communities often contribute to a game's sustained relevance and player retention through shared experiences and content.

Demand for Personalized and Engaging Experiences

Modern gamers, especially in the mobile gaming arena, are increasingly seeking out experiences that are tailored specifically to them and offer a high level of engagement. This trend means customers have more sway because they can easily shift their attention to games that better cater to their evolving tastes and preferences.

This demand for personalization puts significant pressure on companies like Aeria to constantly innovate and refine their game development and content delivery strategies. For instance, the global mobile gaming market was valued at approximately $184 billion in 2023 and is projected to reach $272 billion by 2027, highlighting the immense scale and the competitive nature driven by player expectations.

- Rising Player Expectations: Gamers actively seek unique, personalized content and deeply immersive gameplay.

- Customer Power: The ability for players to easily switch to more engaging or personalized alternatives strengthens their bargaining position.

- Innovation Imperative: Aeria must continuously adapt its offerings to meet these evolving player demands to retain its customer base.

- Market Dynamics: The substantial growth in the mobile gaming sector underscores the importance of player-centric development.

Customers possess significant bargaining power due to the vast array of entertainment choices available, particularly in the gaming sector. The global gaming market, projected to exceed $200 billion in 2024, offers players numerous alternatives, from AAA titles to free-to-play mobile games and even streaming services, making it easy for them to switch if Aeria's offerings are not compelling or competitively priced.

Low switching costs further empower customers, as transitioning between games, especially free-to-play mobile titles, involves minimal friction. This ease of movement means players are not heavily invested and will readily explore better experiences or value propositions, a trend amplified by subscription services offering broad access in 2024.

Price sensitivity is another key factor, with many players expecting free access to content and opting for optional in-app purchases. This necessitates competitive pricing for virtual goods and premium features, as customers can easily find similar experiences at lower costs or for free, as evidenced by the over $90 billion global mobile gaming market in 2024.

The collective voice of customers, amplified through online communities and user-generated content, significantly influences game development and company strategies. In 2024, community feedback directly led to major updates in popular games, demonstrating players' ability to demand specific features and bug resolutions, thereby increasing their leverage.

| Factor | Impact on Aeria | Supporting Data (2024 Projections/Estimates) |

|---|---|---|

| Abundance of Entertainment Alternatives | Reduces customer loyalty, increases price sensitivity. | Global Gaming Market: >$200 billion |

| Low Switching Costs | Customers can easily move to competitors with better value or experience. | Prevalence of free-to-play mobile games with minimal player investment. |

| Price Sensitivity & Value Seeking | Pressures pricing strategies for in-game purchases and premium features. | Mobile Gaming Market (2024 Estimate): ~$95 billion (significant portion from F2P) |

| Community Influence & Feedback | Can dictate development priorities and impact game success through reviews and social media. | 2024: Community-driven updates common in popular titles. |

Preview Before You Purchase

Aeria Porter's Five Forces Analysis

The preview you see is the exact, professionally written Aeria Porter's Five Forces Analysis you will receive immediately after purchase. This comprehensive document, detailing the competitive landscape of Aeria, is ready for your immediate use without any placeholders or modifications. You are looking at the actual analysis, ensuring complete transparency and immediate value upon completion of your transaction.

Rivalry Among Competitors

The global gaming market, especially mobile, is incredibly crowded. Thousands of developers, from massive companies to tiny indie studios, are all trying to get players to download and spend money on their games. This intense competition means companies constantly need fresh ideas and engaging gameplay to stand out.

In 2024, the mobile gaming sector alone is projected to generate over $107 billion in revenue, highlighting the massive opportunity but also the fierce battle for a piece of that pie. With so many games launching each week, capturing and retaining player attention is a continuous challenge, pushing publishers to invest heavily in marketing and continuous game updates.

The online and mobile gaming industry, where Aeria operates, is a hotbed of rapid innovation and very short product lifecycles. This means companies must constantly churn out new content, features, and even entirely new games just to keep players interested and prevent them from flocking to competitors. For instance, the average lifespan of a successful mobile game can be as short as 18-24 months before engagement significantly drops.

This relentless pace of development intensifies rivalry as companies like Aeria are forced into a continuous cycle of investment in R&D and marketing to stay relevant. Failure to innovate quickly can lead to rapid market share erosion. In 2024, the global mobile gaming market was projected to reach over $107 billion, underscoring the immense pressure to capture and retain a piece of this lucrative, yet fast-moving, pie.

The mobile gaming market is incredibly crowded, with millions of titles vying for attention. Companies like Aeria Porter must invest heavily in aggressive marketing and user acquisition to stand out. This often involves substantial spending on advertising across various digital channels, including social media, gaming websites, and app store placements.

These intense campaigns drive up the cost of acquiring a new player. For example, in 2023, average user acquisition costs in the mobile gaming industry continued to climb, with some genres seeing costs exceed $5 per install. This makes it particularly challenging for smaller studios to compete with larger, well-funded publishers who can sustain these high acquisition expenditures.

The battle for visibility extends to app store optimization and influencer marketing, where companies pay to ensure their games appear prominently. This constant push for downloads and engagement creates a highly competitive environment where continuous marketing innovation is crucial for survival and growth.

Presence of Large, Established Global Players

Aeria faces intense competition from large, established global gaming companies. These giants possess significant financial backing, allowing them to invest heavily in game development, marketing, and user acquisition. For instance, in 2024, major players like Tencent and Sony continued to dominate the market, with Tencent's gaming revenue alone reaching tens of billions of dollars annually, showcasing their immense scale and resource advantage.

These established entities often command well-known franchises with built-in fan bases, giving them a substantial head start in capturing market share. Their broad marketing reach, amplified by significant advertising budgets, makes it difficult for smaller companies to gain visibility. For example, a new title from a major publisher can easily command millions in pre-launch marketing, overshadowing independent releases.

- Resource Disparity: Global leaders have access to capital far exceeding that of mid-sized competitors, enabling aggressive expansion and R&D.

- Franchise Power: Established IP provides immediate brand recognition and a loyal player base, reducing customer acquisition costs.

- Marketing Dominance: Large budgets allow for extensive advertising campaigns across multiple platforms, ensuring high visibility.

- Economies of Scale: Established players benefit from lower per-unit costs in development, distribution, and operations due to their sheer volume.

Cross-Platform and Esports Competition

The increasing prevalence of cross-platform gaming, allowing play across PC, console, and mobile devices, significantly heightens competitive rivalry. This trend forces game developers to optimize for diverse hardware and operating systems, increasing development costs and complexity. For instance, in 2024, the global gaming market was projected to reach over $200 billion, with a substantial portion attributed to games supporting cross-platform play, demonstrating its market importance and competitive impact.

The burgeoning esports sector adds another layer of intense competition. Games with robust esports ecosystems, featuring professional leagues, tournaments, and substantial prize pools, attract and retain large, engaged player bases. Companies are compelled to invest heavily in supporting these competitive scenes to remain relevant. By mid-2024, the esports market was estimated to generate over $1.5 billion in revenue, underscoring the financial stakes and competitive pressure within this segment.

- Cross-Platform Reach: Games like Fortnite and Call of Duty: Warzone, which support cross-platform play, have captured massive player audiences, demonstrating the strategic advantage of broad accessibility.

- Esports Investment: Major publishers are dedicating significant resources to developing and promoting esports titles, recognizing their role in player acquisition and long-term engagement.

- Market Differentiation: Companies must now consider not only traditional game sales but also their ability to foster thriving competitive communities as a key differentiator.

- Player Retention: The dual forces of cross-platform compatibility and strong esports offerings are critical for retaining players in an increasingly crowded digital entertainment landscape.

Competitive rivalry in the gaming sector, where Aeria operates, is exceptionally fierce due to a crowded marketplace and rapid innovation cycles. Companies must continually invest in new content and marketing to capture player attention, facing high user acquisition costs, which exceeded $5 per install in some mobile genres in 2023.

Established global giants like Tencent and Sony, with billions in annual revenue, leverage massive financial backing, well-known franchises, and extensive marketing budgets to maintain dominance. This resource disparity makes it challenging for smaller competitors to gain visibility and market share.

The rise of cross-platform gaming and the lucrative esports market further intensify competition. Games offering seamless play across devices and strong competitive ecosystems, like Fortnite, attract vast audiences, compelling developers to invest heavily in these areas to remain relevant and retain players.

| Key Competitive Factors | Description | 2023/2024 Impact |

| Market Saturation | Thousands of games compete for player attention. | High marketing spend needed to stand out. |

| User Acquisition Costs | Increasing costs to acquire new players. | Exceeded $5/install in some mobile genres in 2023. |

| Established Players | Large companies with significant financial and IP advantages. | Tencent's gaming revenue in tens of billions annually. |

| Cross-Platform & Esports | Trend towards multi-device play and competitive gaming. | Esports market revenue projected over $1.5 billion by mid-2024. |

SSubstitutes Threaten

Aeria's online and mobile games face a substantial threat from a wide range of alternative digital entertainment choices. Services like Netflix, YouTube, Spotify, and TikTok directly compete for consumers' limited leisure time and discretionary spending. In 2024, global spending on digital entertainment, excluding gaming, is projected to reach hundreds of billions of dollars, highlighting the intense competition for user attention.

These substitutes offer diverse experiences, from passive video consumption to active social interaction, all vying for the same audience. The accessibility and often lower perceived cost of many of these platforms make them a compelling alternative to paid or time-intensive gaming. For instance, the sheer volume of content available on platforms like YouTube means users can find endless free entertainment, directly impacting the demand for Aeria's offerings.

Beyond digital alternatives, traditional forms of entertainment like television, movies, books, and various outdoor or social activities also serve as substitutes for Aeria's gaming offerings. While Aeria focuses on digital content, these traditional options still represent alternative ways for consumers to spend their time and money, diverting attention from gaming.

For instance, global spending on video games reached an estimated $184.4 billion in 2023, but this figure competes with the significant entertainment budgets allocated to other sectors. The global box office generated $31.5 billion in 2023, and book sales continue to be substantial, indicating that consumers have diverse entertainment preferences and spending habits that can draw away from digital gaming.

The gaming market presents a wide array of experiences, from quick, casual mobile games to deeply immersive AAA titles on consoles and PCs. This diversity means players can easily switch between different types of games based on their available time and desired engagement level. For instance, a player might opt for a casual mobile game during a short commute instead of a lengthy PC session.

This substitutability directly impacts the threat of substitutes. A player looking for a quick distraction might choose a free-to-play mobile game over a paid, time-intensive console game. In 2024, the mobile gaming sector continued its dominance, with revenue projections indicating strong growth, demonstrating the accessibility and wide appeal of these more casual experiences as substitutes for traditional gaming platforms.

Emerging Technologies and Content Formats

New technologies like virtual reality (VR) and augmented reality (AR) are creating immersive entertainment options that could draw users away from traditional gaming. For instance, the global VR market was valued at approximately $28 billion in 2023 and is projected to grow significantly, indicating a rising availability of these alternative experiences.

Advanced AI is also enabling new forms of content creation, potentially offering engaging alternatives to existing digital games. This technological shift means that what consumers consider entertainment is constantly expanding, presenting a dynamic threat to established platforms like Aeria's.

Aeria's significant investments in IT solutions, reported to be in the hundreds of millions in 2023, are crucial for staying competitive but also underscore the rapid pace at which new substitutes emerge and require ongoing innovation to counter.

- VR/AR Market Growth: The VR market reached roughly $28 billion in 2023, signaling a substantial and growing alternative entertainment sector.

- AI-Driven Content: AI's capability to generate novel content poses an evolving threat by offering new forms of engagement.

- Aeria's IT Investment: Aeria's substantial IT spending in 2023 highlights the continuous need to adapt to emerging technological substitutes.

'Gamification' in Non-Gaming Applications

The threat of substitutes for Aeria Porter's core offerings is amplified by the rise of gamification in non-gaming sectors. Many applications, from fitness trackers to productivity tools, now integrate reward systems, leaderboards, and progress tracking to boost user engagement. This can offer a similar sense of accomplishment and entertainment, potentially diverting user attention and time away from traditional gaming experiences.

For instance, by mid-2024, platforms like Duolingo reported over 600 million registered users, many drawn to its gamified language learning approach. Similarly, fitness apps often see high retention rates due to their competitive elements and virtual rewards. These trends suggest that users may find comparable satisfaction and engagement through these alternative, gamified experiences, thereby reducing the perceived need or desire for dedicated gaming applications.

- Gamified Engagement: Non-gaming apps increasingly use reward systems and leaderboards to retain users.

- Substitute for Leisure: These features can offer a sense of achievement and entertainment, partially replacing gaming time.

- Market Penetration: Platforms like Duolingo, with over 600 million users by mid-2024, demonstrate the broad appeal of gamified learning.

- Reduced Gaming Demand: The availability of engaging gamified alternatives can decrease the demand for traditional gaming products.

The threat of substitutes for Aeria's gaming products is significant due to the vast array of digital and traditional entertainment options available. These alternatives compete for consumers' limited leisure time and disposable income, offering diverse experiences that can be perceived as equally or more appealing than gaming.

The sheer volume and accessibility of content on platforms like YouTube and streaming services mean users can find endless free or low-cost entertainment, directly impacting demand for paid gaming experiences. In 2024, global spending on digital entertainment, excluding gaming, is projected to exceed hundreds of billions of dollars, underscoring the intense competition for consumer attention.

Furthermore, the rise of gamification in non-gaming applications, such as fitness and educational apps, provides engaging alternatives that offer similar rewards and a sense of accomplishment, potentially diverting users from dedicated gaming platforms.

| Substitute Category | Examples | 2023/2024 Data Point |

|---|---|---|

| Digital Entertainment (Non-Gaming) | Streaming Services (Netflix, YouTube), Music Apps (Spotify), Social Media (TikTok) | Global digital entertainment spending (ex-gaming) projected to reach hundreds of billions in 2024. |

| Traditional Entertainment | Movies, Television, Books, Outdoor Activities | Global box office revenue reached $31.5 billion in 2023. |

| Gamified Non-Gaming Apps | Fitness Trackers, Language Learning Apps (Duolingo) | Duolingo reported over 600 million registered users by mid-2024. |

| Emerging Technologies | Virtual Reality (VR), Augmented Reality (AR) | Global VR market valued at approximately $28 billion in 2023. |

Entrants Threaten

The mobile gaming market, particularly for simpler titles, exhibits relatively low barriers to entry. The widespread availability of user-friendly game development software and accessible distribution platforms significantly reduces the initial investment needed to create and launch a basic mobile game. This democratization of game creation means that even individuals or small teams can enter the market.

The prevalence of the free-to-play (F2P) model further lowers the financial hurdle for new entrants. Developers can publish games without requiring upfront purchases from players, focusing instead on in-app monetization strategies. This approach allows for rapid market penetration and user acquisition, even with limited marketing budgets, contributing to market saturation.

In 2023, the global mobile gaming market generated an estimated $90 billion in revenue, with a significant portion coming from F2P titles. This massive market size, while attractive, also attracts a large number of new entrants annually, intensifying competition for player attention and revenue.

Developing AAA game titles, particularly those with cutting-edge graphics, complex gameplay, or robust online multiplayer capabilities, demands substantial capital. For instance, the development budget for major AAA games in 2024 can easily exceed $200 million, encompassing everything from advanced engine development to extensive asset creation and quality assurance.

Beyond financial outlay, these projects necessitate highly specialized teams with expertise in areas like game design, programming, 3D modeling, animation, and AI. The sheer technical skill and manpower required to produce a polished, high-fidelity gaming experience acts as a significant deterrent for potential new entrants lacking these resources.

Furthermore, a substantial marketing budget is crucial to ensure visibility and adoption in a crowded market. Launching a new AAA title often requires tens of millions of dollars in advertising and promotional campaigns, a cost that can be prohibitive for smaller studios or newcomers aiming to compete at the highest level.

New entrants to the mobile app market grapple with securing visibility and user acquisition, often finding themselves competing against established app stores and companies with substantial marketing budgets. For instance, in 2024, the average cost to acquire a new user for a mobile app can range from $2 to $5, a figure that can escalate significantly for competitive genres.

Building a substantial user base and achieving high download numbers without robust intellectual property or considerable financial backing presents a formidable barrier. Many successful apps in 2024 leverage network effects and pre-existing brand loyalty, making it difficult for newcomers to gain traction through organic growth alone.

Brand Recognition and Established User Bases

Aeria Porter benefits from significant brand recognition and established user bases, cultivated through years of operation. New entrants face the daunting task of building trust and loyalty, requiring substantial investment in marketing and player acquisition to even approach the scale of incumbents.

For instance, in the highly competitive gaming industry, companies like Aeria often boast millions of registered users. In 2023, major gaming platforms reported user engagement metrics that are incredibly difficult for newcomers to replicate, highlighting the barrier posed by existing customer relationships.

- Established Brand Equity: Aeria's brand is a valuable asset, fostering immediate recognition and trust among potential customers.

- Loyal Customer Base: Years of service have cultivated a dedicated community of players who are less likely to switch to unfamiliar platforms.

- High Acquisition Costs for New Entrants: Start-ups must invest heavily in marketing and promotions to attract attention and onboard new users, often facing diminishing returns.

- Network Effects: Existing platforms often benefit from network effects, where a larger user base makes the platform more attractive to new users, further entrenching incumbents.

Regulatory Landscape and Compliance Costs

The gaming sector faces a dynamic regulatory environment, especially concerning player safety, data privacy, and how games make money through things like loot boxes or in-game purchases. For instance, in 2024, several countries continued to debate or implement stricter rules around these monetization tactics, potentially increasing the cost of doing business. New companies entering the market must understand and adhere to these intricate legal requirements, which can translate into significant upfront compliance expenses, thereby deterring potential new competitors.

These compliance costs can be a substantial hurdle. For example, implementing robust age verification systems or ensuring transparent data handling practices, as mandated by regulations like GDPR or similar frameworks being developed globally, requires investment in technology and legal expertise. These aren't minor expenses; they can easily run into hundreds of thousands or even millions of dollars for a new studio, effectively raising the barrier to entry.

- Evolving Regulations: Gaming laws are constantly changing, impacting player protection and monetization.

- Data Privacy: Adherence to strict data privacy laws adds significant compliance burdens.

- Monetization Scrutiny: Practices like loot boxes face increasing regulatory oversight and potential bans.

- Compliance Costs: Navigating these legal frameworks requires substantial financial investment, acting as a deterrent.

The threat of new entrants in the mobile gaming space is moderate. While the low cost of developing simple games and the prevalence of free-to-play models lower the initial barrier, the significant capital required for AAA titles, coupled with high user acquisition costs and strong brand loyalty of incumbents like Aeria, presents substantial challenges.

The regulatory landscape also adds complexity, with evolving rules on player safety and data privacy necessitating significant compliance investments for newcomers. These combined factors create a nuanced entry environment.

| Factor | Impact on New Entrants | Example/Data (2023-2024) |

|---|---|---|

| Development Costs (Simple Games) | Low | User-friendly software and platforms reduce initial investment. |

| Development Costs (AAA Games) | High | Budgets can exceed $200 million in 2024. |

| User Acquisition Costs | High | Average cost per user can range from $2 to $5 in 2024. |

| Brand Loyalty/Network Effects | High Barrier | Incumbents like Aeria have millions of users and established trust. |

| Regulatory Compliance | High Cost | Stricter data privacy and monetization rules increase upfront expenses. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Aeria leverages data from company investor relations sites, competitor announcements, and industry research reports to thoroughly assess competitive rivalry and the threat of new entrants.