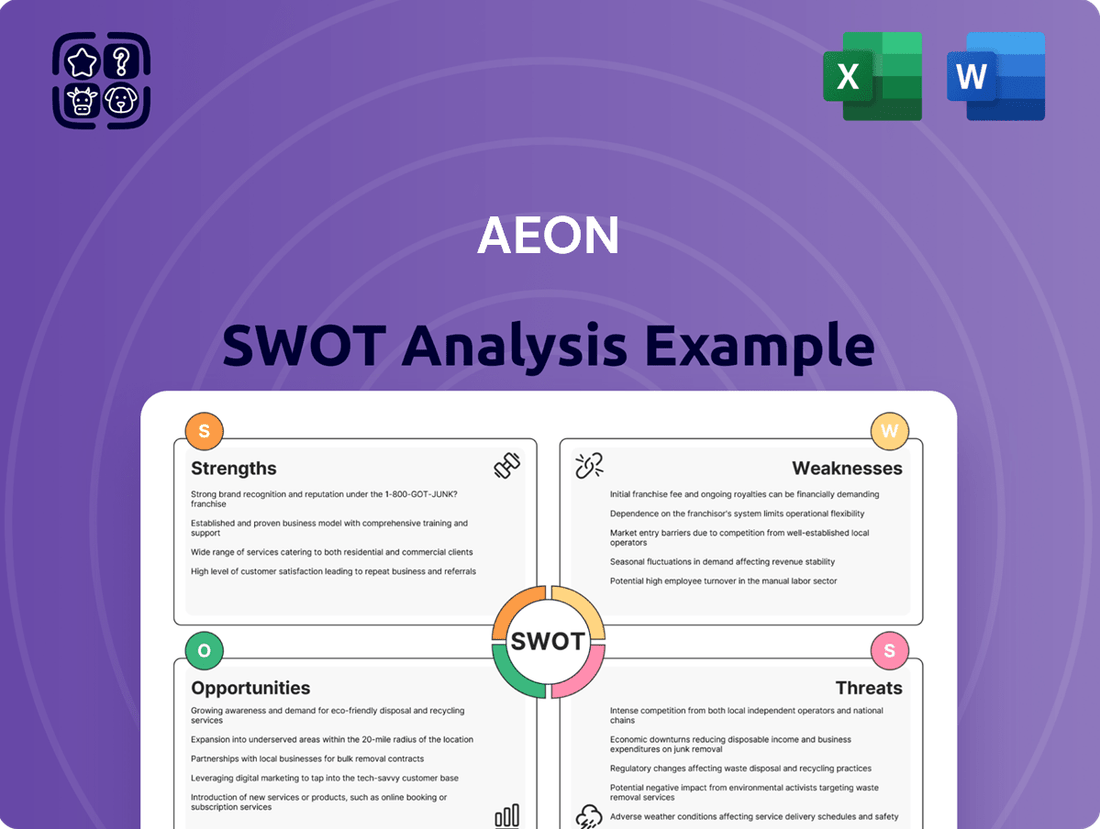

Aeon SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aeon Bundle

Aeon's strengths lie in its established brand and extensive retail network, but it faces significant competitive pressures and evolving consumer preferences. Understanding these dynamics is crucial for navigating the market effectively.

Want the full story behind Aeon's strategic advantages and potential vulnerabilities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Aeon's significant strength lies in its extensive and diversified retail network. Operating across Japan and key Asian markets like Vietnam and Malaysia, Aeon manages a broad spectrum of retail formats, including general merchandise stores, supermarkets, and convenience stores. This vast physical footprint ensures widespread customer accessibility.

Further bolstering this is Aeon's diversified business model. Beyond core retail, the company strategically engages in financial services, property development, and specialized retail ventures. This multi-faceted approach caters to a wide array of customer needs, fostering robust customer loyalty and creating valuable cross-selling opportunities, as evidenced by its integrated shopping mall experiences.

Aeon CO., LTD. demonstrated robust financial health, achieving record-high consolidated operating revenue, operating profit, and ordinary profit for the fiscal year ending February 29, 2024. Profit attributable to owners of the parent also saw a significant increase, underscoring the company's operational efficiency and market strength.

The company's strategic direction is clearly articulated in its medium-term management plan (FY2021-FY2025). Key initiatives include accelerating digital transformation, fostering unique value creation, enhancing health and wellness services, developing integrated 'AEON Living Zones,' and expanding its footprint in Asian markets, all designed to drive sustained growth.

Aeon's strong commitment to digital transformation is a key strength, evidenced by its strategic focus on enhancing customer experiences and operational efficiency through technology.

The launch of AEON Digital Bank in Malaysia in May 2024, offering Islamic digital banking services and utilizing AI for customer value maximization, highlights this forward-thinking approach.

This digital push aligns with Japan's growing e-commerce market, which is expected to see substantial growth, fueled by increasing mobile shopping and cashless payment adoption, positioning Aeon favorably within these trends.

Strategic International Expansion, particularly in Southeast Asia

Aeon's strategic international expansion, particularly in Southeast Asia, represents a significant strength. The company views Vietnam as its second most crucial market after Japan, demonstrating a clear commitment to growth in this region. Aeon is actively increasing its business investments in Vietnam, with ambitious plans to launch new shopping malls, department stores, supermarkets, and specialty shops across the country in 2025.

Furthermore, Aeon is bolstering its presence in Malaysia by expanding its retail footprint and undertaking store revitalizations. New store openings are slated for the close of 2025, and the AEON Mall Seremban 2 is scheduled for expansion completion by 2027. This focused approach on high-growth Asian markets is key to diversifying Aeon's revenue streams and mitigating its dependence on the more saturated Japanese market.

- Vietnam Focus: Identified as the second most important market after Japan, with significant investment planned for 2025.

- Malaysian Expansion: Retail footprint growth and store revitalizations are underway, with new openings and mall expansions planned through 2027.

- Revenue Diversification: Strategic investments in Southeast Asia reduce reliance on the mature Japanese market.

- Growth Potential: Targeting high-growth Asian economies for increased market share and profitability.

Robust Sustainability and Community Engagement Initiatives

Aeon's dedication to sustainability is a significant strength, with ambitious goals for environmental impact reduction. The company is on track to achieve 50% renewable energy usage in its Japanese operations by March 2024, surpassing its 2030 target. This commitment extends to minimizing disposable plastics and food waste, reinforcing its responsible business practices.

Furthermore, Aeon actively engages with local communities through various development programs and partnerships. This focus on community building not only strengthens its social license to operate but also cultivates robust customer loyalty and a positive brand image. Such initiatives are crucial for long-term value creation and resilience in the evolving retail landscape.

- CO2 Emission Reduction Targets: Aeon has set clear goals for lowering its carbon footprint.

- Renewable Energy Adoption: Expected to reach 50% renewable energy use in Japanese stores by March 2024.

- Waste Minimization: Focused efforts on reducing disposable plastics and food waste across operations.

- Community Investment: Significant investment in local partnerships and development programs to enhance brand reputation and customer loyalty.

Aeon's extensive retail network across Japan and Southeast Asia, encompassing diverse formats from supermarkets to department stores, ensures broad customer reach and accessibility. This strong physical presence is complemented by a diversified business model that includes financial services and property development, fostering customer loyalty and cross-selling opportunities.

Financially, Aeon demonstrated remarkable performance, achieving record-high consolidated operating revenue, operating profit, and ordinary profit for the fiscal year ending February 29, 2024. Profit attributable to owners of the parent also saw a substantial increase, reflecting enhanced operational efficiency.

The company's strategic focus on digital transformation, exemplified by the launch of AEON Digital Bank in Malaysia in May 2024, positions it well within the growing e-commerce landscape. Aeon's commitment to sustainability, including its goal of 50% renewable energy usage in Japanese operations by March 2024, further strengthens its brand reputation and long-term viability.

Aeon's strategic international expansion, particularly in Vietnam and Malaysia, is a key driver of future growth, aiming to diversify revenue streams and capitalize on high-growth Asian economies.

| Metric | FY2024 (Ending Feb 29, 2024) | FY2023 (Ending Feb 29, 2023) |

|---|---|---|

| Consolidated Operating Revenue | ¥8,568.6 billion | ¥8,207.4 billion |

| Operating Profit | ¥343.5 billion | ¥273.8 billion |

| Ordinary Profit | ¥378.3 billion | ¥303.9 billion |

| Profit Attributable to Owners of Parent | ¥279.1 billion | ¥208.3 billion |

What is included in the product

Analyzes Aeon’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex SWOT data into actionable insights, reducing the burden of interpretation for busy teams.

Weaknesses

Aeon's significant reliance on the Japanese domestic market, despite its global reach, presents a notable weakness. Japan's demographic trends, including an aging population and a low birth rate, contribute to a mature and slowly growing retail sector. For instance, Japan's retail sales growth has hovered around 1-2% annually in recent years, a modest figure that caps Aeon's expansion potential within its home base.

This overdependence exposes Aeon to the vulnerabilities of the Japanese economy. A slowdown in domestic consumer spending or economic stagnation directly impacts Aeon's top-line performance. While Aeon has diversified into areas like financial services and real estate, the core retail operations remain heavily weighted towards Japan, limiting its ability to fully capitalize on faster-growing international markets.

Aeon navigates a highly competitive retail landscape, contending with specialized retailers, other major conglomerates, and the burgeoning e-commerce market. This intense rivalry demands continuous innovation and strategic adjustments to maintain market share.

The increasing consumer preference for online shopping and curated, specialized retail experiences presents a significant hurdle for Aeon's traditional general merchandise store model. In 2024, global e-commerce sales are projected to reach over $6.3 trillion, underscoring the scale of this digital shift that Aeon must actively address.

Aeon faces a significant challenge in keeping pace with rapidly changing consumer demands. Japanese shoppers now prioritize smooth online-to-offline integration, competitive pricing, and tailored product selections. For instance, in 2024, a significant portion of Japanese retail sales are expected to be influenced by digital channels, forcing Aeon to invest heavily in its e-commerce capabilities and in-store technology.

The company must continually update its retail models and digital approaches to satisfy these shifting expectations. As consumers grow more budget-conscious, they demand greater value for their money, putting pressure on Aeon to optimize its cost structures and enhance its product offerings to remain competitive in the dynamic Japanese market.

Operational Efficiency and Cost Pressures

Aeon, despite its robust financial performance, faces significant headwinds in operational efficiency. The retail industry, particularly in 2024 and projecting into 2025, is grappling with persistent inflation, which has driven up costs for everything from energy to raw materials. For instance, electricity prices in key markets where Aeon operates have seen notable increases, impacting store operating expenses.

Maintaining profitability across Aeon's extensive network of diverse retail formats and services presents a continuous challenge. Optimizing complex supply chains and rigorously managing expenses are crucial for Aeon to counteract these rising operational costs. This includes addressing potential logistics bottlenecks that could further inflate costs and impact delivery times.

- Rising Inflation: Consumer Price Index (CPI) figures indicate continued inflationary pressures in major economies, directly impacting Aeon's input costs.

- Energy Costs: Projections for 2024-2025 suggest elevated global energy prices, a significant operational expense for brick-and-mortar retail.

- Supply Chain Volatility: Geopolitical events and global demand fluctuations continue to create unpredictable logistics challenges, potentially increasing Aeon's distribution costs.

Potential for Slower Growth in Certain Segments

Aeon's diversified business model, while a strength, also presents a weakness. Some segments, particularly older mall formats and certain urban business models (OPA), are showing signs of slower growth. This sluggishness stems from a combination of factors, including a lack of timely business model reforms and evolving market preferences that have impacted their cash flow generation capacity.

This uneven performance across its portfolio means that not all of Aeon's ventures are expanding at the same pace. For instance, while newer, digitally integrated retail formats might be thriving, some of the legacy physical store formats could be lagging behind. This disparity necessitates careful resource allocation and strategic planning to address underperforming areas.

- Segment Performance Discrepancy: Older mall formats and some OPA segments are exhibiting slower growth compared to newer, more adaptable retail concepts within Aeon's portfolio.

- Impact of Market Dynamics: Changing consumer behavior and market trends are directly affecting the revenue streams of less adaptable segments, leading to reduced cash flow.

- Need for Restructuring: Several underperforming segments may require substantial investment and strategic restructuring to regain competitiveness and align with current market demands.

Aeon's substantial reliance on its domestic Japanese market, despite its global presence, is a key weakness. Japan's demographic challenges, such as an aging population and a low birth rate, are contributing to a more mature and consequently slower-growing retail sector. For example, Japan's retail sales growth has been modest, typically in the 1-2% range annually in recent years, which inherently limits Aeon's potential for significant expansion within its home market.

This overdependence makes Aeon particularly vulnerable to fluctuations in the Japanese economy. Any slowdown in domestic consumer spending or broader economic stagnation directly impacts Aeon's overall financial performance. While the company has diversified into areas like financial services and real estate, its core retail operations remain heavily concentrated in Japan, potentially hindering its ability to fully leverage opportunities in faster-growing international markets.

Aeon operates within a fiercely competitive retail environment, facing strong competition from specialized retailers, other large business groups, and the rapidly expanding e-commerce sector. This intense rivalry necessitates continuous innovation and strategic adjustments to maintain its market share and relevance.

The increasing consumer shift towards online shopping and a preference for more curated, specialized retail experiences poses a significant challenge to Aeon's traditional general merchandise store model. Global e-commerce sales are projected to exceed $6.3 trillion in 2024, highlighting the substantial digital transformation that Aeon must actively address.

Aeon faces the considerable challenge of adapting to rapidly evolving consumer preferences. Japanese consumers are increasingly prioritizing seamless online-to-offline integration, competitive pricing, and highly tailored product selections. In 2024, digital channels are expected to significantly influence a large portion of Japanese retail sales, compelling Aeon to make substantial investments in its e-commerce capabilities and in-store technology to meet these changing expectations.

The company must continuously update its retail models and digital strategies to satisfy these shifting demands. As consumers become more budget-conscious, they demand greater value, placing pressure on Aeon to optimize its cost structures and enhance its product offerings to remain competitive in Japan's dynamic retail landscape.

Despite its generally strong financial standing, Aeon encounters significant operational efficiency challenges. The retail sector, particularly in 2024 and looking ahead to 2025, is contending with persistent inflation, which has driven up costs across the board, from energy to raw materials. For instance, electricity prices in key operating regions for Aeon have seen notable increases, directly impacting store operating expenses.

Maintaining profitability across Aeon's extensive and diverse network of retail formats and services is an ongoing challenge. Optimizing complex supply chains and diligently managing expenses are critical for Aeon to effectively counteract these rising operational costs. This includes addressing potential logistics bottlenecks that could further inflate costs and negatively affect delivery times.

| Weakness Category | Specific Issue | Impact/Context |

|---|---|---|

| Market Dependence | Over-reliance on Japanese Market | Japan's mature retail sector with 1-2% annual growth limits expansion potential. |

| Competitive Landscape | Intense Retail Competition | Facing specialized retailers, conglomerates, and e-commerce growth, requiring constant innovation. |

| Evolving Consumer Behavior | Shift to Online & Specialized Retail | Global e-commerce projected over $6.3 trillion in 2024; need to adapt to digital-first preferences. |

| Operational Costs | Rising Inflation & Energy Prices | Increased input costs (e.g., electricity prices) impacting profitability in 2024-2025. |

Same Document Delivered

Aeon SWOT Analysis

The preview you see is the actual SWOT analysis document you'll receive upon purchase, offering a transparent look at the quality and content. This ensures you know exactly what you're getting before you buy. Unlock the full, detailed report immediately after checkout.

Opportunities

Aeon is strategically targeting high-growth Asian markets, with Vietnam identified as a primary focus. By 2025, Aeon plans to significantly expand its footprint in Vietnam by introducing new retail formats and hiring a substantial number of employees, signaling a strong commitment to this burgeoning economy.

The company's growth ambitions extend beyond Vietnam to other ASEAN nations and select regions within China. Through substantial investments and the development of new shopping malls, Aeon aims to capture a larger market share, which is projected to drive considerable revenue increases.

The burgeoning e-commerce landscape in Japan and across Asia offers a substantial growth avenue for Aeon. By expediting its digital transition and refining its online presence, Aeon can tap into this expanding market.

Integrating advanced technologies like AI and data analytics allows Aeon to gain deeper insights into consumer preferences, enabling personalized marketing campaigns and more efficient supply chain management. This digital push also facilitates the creation of a cohesive omnichannel shopping experience.

Aeon's foray into digital banking services further strengthens its customer engagement strategy, opening up new avenues for service expansion and value generation within its digital ecosystem.

Aeon can leverage the growing consumer desire for distinctive shopping journeys and tailored products. By developing exclusive private-label brands and innovative retail concepts like 'AEON Living Zones,' which integrate shopping with community and lifestyle elements, the company can foster stronger customer relationships and draw in new demographics. This strategic shift toward experience-centric retail mirrors a broader industry trend where department stores are evolving into vibrant community hubs.

Sustainability and ESG Initiatives as a Competitive Advantage

Aeon's robust dedication to sustainability, evidenced by its ambitious goals in renewable energy adoption and waste reduction, presents a clear opportunity. For instance, by 2025, Aeon aims to source 50% of its electricity from renewable sources, a target that resonates with a growing consumer base. This focus not only strengthens its brand image but also opens doors to sustainability-linked financing, potentially lowering capital costs.

Leveraging these initiatives can attract a significant segment of environmentally aware customers, a trend clearly visible in consumer spending patterns. Reports from 2024 indicate that over 60% of consumers actively seek out brands with strong environmental, social, and governance (ESG) credentials. By exceeding its stated targets, Aeon can solidify its position as a leader in responsible retail.

This commitment translates into tangible market advantages:

- Enhanced Brand Reputation: Aligning with consumer values boosts trust and loyalty.

- Customer Acquisition: Attracting environmentally conscious demographics.

- Financial Incentives: Access to favorable financing tied to ESG performance.

- Market Differentiation: Standing out from competitors with a weaker sustainability profile.

Strategic Partnerships and Acquisitions

Aeon's strategic move to acquire a stake in a Vietnamese finance company in 2024 highlights its proactive approach to growth through partnerships. This aligns with its broader strategy of forming alliances within the life insurance sector, aiming to leverage these collaborations for market penetration and enhanced service portfolios. Such ventures are crucial for expanding Aeon's reach in dynamic emerging markets, bolstering its presence in both retail and financial services.

These strategic alliances offer significant opportunities for Aeon. By partnering, Aeon can gain access to new customer bases and distribution channels, particularly in regions experiencing rapid economic development. For instance, its 2024 investment in Vietnam's financial sector could unlock substantial growth potential, tapping into a market projected to see continued expansion in financial services. This expansion is key to diversifying revenue streams and mitigating risks associated with reliance on single markets.

- Market Entry: Facilitates quicker and more cost-effective entry into new, high-growth emerging markets like Vietnam.

- Service Expansion: Allows Aeon to broaden its product and service offerings, especially in the life insurance and broader financial services sectors.

- Synergistic Growth: Partnerships can lead to shared resources, expertise, and customer insights, driving mutual growth and operational efficiencies.

- Competitive Advantage: Strengthens Aeon's market position by creating a more robust and diversified business model, especially against competitors in fast-evolving economies.

Aeon's strategic expansion into high-growth Asian markets, particularly Vietnam, presents a significant opportunity for revenue and market share gains. The company's commitment to increasing its footprint by 2025, coupled with investments in new retail formats and malls, positions it to capitalize on the region's economic dynamism. Furthermore, Aeon's expansion into digital channels and services, including e-commerce and digital banking, taps into evolving consumer behaviors and offers new avenues for customer engagement and value creation.

Aeon's focus on sustainability, aiming for 50% renewable energy sourcing by 2025, aligns with growing consumer demand for ESG-conscious brands, potentially enhancing its reputation and attracting environmentally aware customers. Strategic partnerships, such as its 2024 investment in a Vietnamese finance company, provide accelerated market entry and synergistic growth opportunities in emerging economies. These alliances can broaden Aeon's service offerings and strengthen its competitive position.

Threats

The escalating competition from e-commerce giants like Amazon and Rakuten in Japan directly challenges Aeon's traditional retail model. These online platforms offer vast selections and often aggressive pricing, which can divert customers from Aeon's physical stores. In 2024, Japan's e-commerce market was projected to reach over ¥23 trillion, highlighting the significant scale of this threat.

Consumers are increasingly prioritizing convenience and value, leading to a growing preference for online purchases. This shift means Aeon faces pressure to enhance its own digital offerings and logistics to match the speed and competitive pricing expected by shoppers, a move that requires considerable capital investment to stay relevant.

Global economic uncertainties, including persistent inflation and rising energy prices, pose a significant threat to Aeon's performance. These factors directly erode consumer purchasing power, potentially dampening demand for Aeon's offerings.

The weakening yen, while potentially beneficial for inbound tourism and foreign investment, presents a dual-edged sword. It can curb domestic consumer spending on international goods and services, impacting Aeon's international business strategies and potentially leading to reduced spending by Japanese citizens abroad.

Furthermore, Aeon faces challenges from inflation-linked rental agreements, which could increase operating expenses. Concurrently, tenants may experience shrinking gross margins due to inflationary pressures, potentially impacting their ability to meet rental obligations or invest in their businesses, thereby affecting Aeon's revenue streams.

Japan's demographic landscape, marked by an aging population and a declining birth rate, poses a significant long-term challenge for retailers like Aeon. This trend suggests a contracting consumer base and a shift in spending habits, impacting overall market demand.

While the older demographic is increasingly embracing e-commerce, Aeon must proactively adjust its product assortment, service models, and marketing communications to resonate with this evolving consumer segment. For instance, by mid-2024, over 60% of Japanese seniors were reported to be online shoppers, indicating a clear opportunity for digital engagement.

Supply Chain Disruptions and Logistics Issues

The retail sector, including Aeon, faces significant risks from supply chain disruptions. These can result in empty shelves and higher prices for consumers. For Aeon, with its extensive operations and varied product range, these issues directly impact how efficiently it can run and how much profit it makes.

Aeon's own projections highlight the potential for logistics challenges to hinder operational performance. For instance, a report from S&P Global Market Intelligence in early 2024 indicated that global shipping costs saw a notable increase, driven by factors like rerouting in the Red Sea, which directly affects import expenses for retailers.

- Stock Shortages: Disruptions can lead to a lack of popular items, frustrating customers and impacting sales.

- Increased Costs: Higher shipping fees and potential need for expedited transport drive up the cost of goods sold.

- Operational Inefficiency: Delays in receiving inventory can disrupt store operations and inventory management.

- Reputational Damage: Persistent availability issues can erode customer loyalty and brand perception.

Regulatory Changes and Data Security Concerns

Aeon's global operations mean it must navigate a complex web of evolving regulations, from consumer protection in Europe under GDPR to financial compliance in Asia. Changes in these laws, particularly around data privacy and digital transactions, could necessitate costly adjustments to its business model and technology infrastructure. For instance, a significant update to data breach notification laws in a key market could impact Aeon's reporting obligations and incident response protocols.

The increasing reliance on digital platforms amplifies the threat of data security breaches. Cyberattacks remain a persistent danger, with the global cost of data breaches projected to reach $10.5 trillion annually by 2025, according to Cybersecurity Ventures. A successful breach could severely damage Aeon's reputation, erode customer trust, and lead to substantial financial penalties, impacting its operational continuity and future growth prospects.

- Regulatory Scrutiny: Aeon faces potential fines and operational disruptions due to non-compliance with diverse international data privacy laws like GDPR and CCPA.

- Cybersecurity Risks: The company is vulnerable to data breaches, with the average cost of a data breach in 2024 reaching $4.73 million globally, impacting customer trust and financial stability.

- Compliance Costs: Adapting to new financial regulations and consumer protection mandates across its operating regions requires significant ongoing investment in legal and technological resources.

Intensifying e-commerce competition, particularly from giants like Amazon, poses a significant threat to Aeon's traditional retail model, with Japan's e-commerce market projected to exceed ¥23 trillion in 2024. This shift necessitates substantial investment in digital capabilities to meet evolving consumer expectations for convenience and value.

Global economic headwinds, including inflation and energy price volatility, directly impact consumer purchasing power, potentially reducing demand for Aeon's products. Furthermore, the weakening yen can dampen domestic spending on imported goods and services, affecting Aeon's international business strategies.

Demographic shifts in Japan, characterized by an aging population and declining birth rates, signal a contracting consumer base and altered spending habits, impacting overall market demand. While seniors are increasingly online, Aeon must adapt its offerings and communication to cater to this growing segment, with over 60% of Japanese seniors reportedly being online shoppers by mid-2024.

Supply chain disruptions remain a critical threat, leading to stock shortages and increased costs, with global shipping costs seeing a notable increase in early 2024 due to factors like Red Sea rerouting. Aeon's extensive operations are particularly vulnerable to these issues, impacting efficiency and profitability.

| Threat Category | Specific Threat | Impact on Aeon | Supporting Data/Fact |

|---|---|---|---|

| Competition | E-commerce Dominance | Loss of market share, pressure on pricing | Japan e-commerce market projected > ¥23 trillion in 2024 |

| Economic Factors | Inflation & Weakening Yen | Reduced consumer spending, higher operating costs | Global shipping costs increased early 2024 |

| Demographics | Aging Population | Contracting consumer base, changing spending patterns | >60% of Japanese seniors online shoppers (mid-2024) |

| Operational | Supply Chain Disruptions | Stock shortages, increased costs, operational inefficiency | Red Sea rerouting impacting shipping costs |

SWOT Analysis Data Sources

This Aeon SWOT analysis is built upon a robust foundation of diverse data sources, including the company's official financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded and data-driven perspective for accurate strategic evaluation.