Aeon PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aeon Bundle

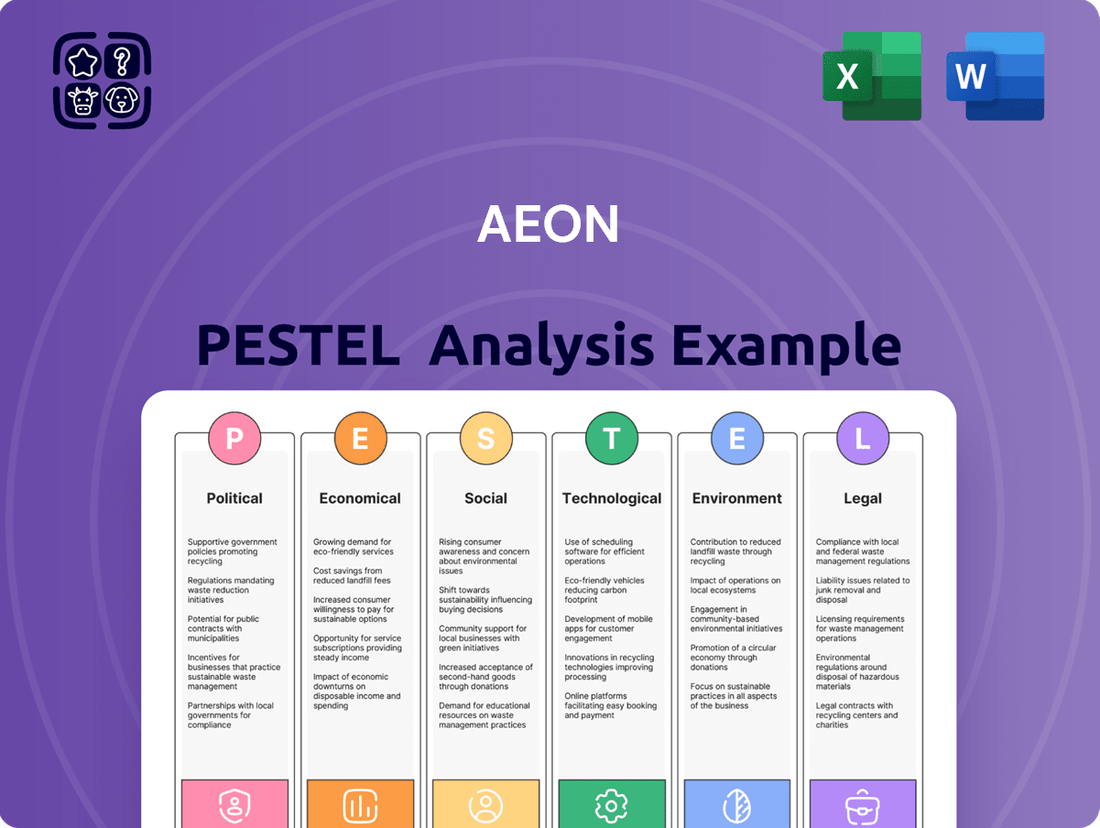

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Aeon's trajectory. This comprehensive PESTLE analysis provides the actionable intelligence you need to anticipate market shifts and capitalize on opportunities. Download the full version now to gain a strategic advantage.

Political factors

The stability of the Japanese government is a cornerstone for Aeon's strategic planning. Consistent economic and regulatory policies, such as those seen in the recent fiscal year 2024 budget focusing on digital transformation and sustainable growth, provide a predictable environment for Aeon's retail and financial services operations. Any significant political upheaval or abrupt policy changes could introduce uncertainty, impacting consumer spending and the operational framework.

Aeon's international presence, particularly in Southeast Asia, means that regional political stability is equally vital. For instance, the ongoing economic reforms and evolving trade agreements in countries like Vietnam, where Aeon has a growing footprint, directly influence its supply chain efficiency and expansion strategies. Fluctuations in these markets can alter market access and operational costs, necessitating agile responses.

International trade agreements and tariff policies, especially those involving Japan and its major Asian trading partners, significantly impact Aeon's cost of goods and sourcing efficiency. For instance, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which includes Japan, aims to reduce tariffs on various goods, potentially lowering Aeon's import expenses.

Conversely, the imposition of tariffs, such as those that have been debated or implemented between major economic blocs, could escalate operational costs for Aeon. This could necessitate adjustments in pricing strategies for a broad spectrum of merchandise, affecting consumer affordability and Aeon's market competitiveness.

Aeon's dual presence in retail and financial services means it navigates a complex web of government regulations. These include crucial consumer protection laws, stringent licensing requirements for financial products, and specific compliance standards for both sectors. For instance, in 2024, many countries intensified scrutiny on data privacy, impacting how Aeon, like other major retailers and financial institutions, handles customer information.

Shifts in these regulatory landscapes can demand substantial operational overhauls. Consider potential changes in advertising standards, which might require Aeon to revise its marketing strategies across its vast retail network and financial product offerings. Furthermore, increased financial oversight, a trend observed globally through 2025 with a focus on digital asset regulation, could directly influence the types of financial services Aeon can provide and the associated compliance costs, potentially impacting profitability.

Economic Stimulus and Fiscal Policies

The Japanese government's fiscal policies, including economic stimulus and tax reforms, significantly influence consumer spending and Aeon's performance. For instance, the Kishida administration's economic package in late 2022 aimed to mitigate the impact of rising prices, potentially boosting disposable income. Aeon's retail segment, particularly its supermarket and department store divisions, directly benefits from policies that enhance consumer purchasing power and confidence.

Government measures to combat inflation or deflation are critical. In 2024, Japan continued to grapple with inflationary pressures, prompting the Bank of Japan to maintain its ultra-loose monetary policy, which indirectly supports consumer spending through low interest rates. Aeon's ability to pass on costs or absorb them is directly linked to the broader price stability influenced by these fiscal and monetary actions.

- Government stimulus packages aim to boost consumer spending, a key driver for Aeon's retail operations.

- Tax reforms can directly affect household disposable income, impacting demand for Aeon's products and services.

- Anti-inflationary measures by the government are crucial for maintaining consumer confidence and purchasing power, benefiting Aeon's sales.

Geopolitical Risks and International Relations

Geopolitical tensions, particularly in the Indo-Pacific region, pose significant risks to Aeon's global operations. For instance, ongoing trade friction between major economic blocs could disrupt Aeon's access to key components, impacting its manufacturing efficiency. In 2024, global supply chain disruptions remained a concern, with the UNCTAD reporting that shipping costs saw a notable increase in the first half of the year due to regional instability.

Japan's international relations directly affect Aeon's market access and overseas investment strategies. Diplomatic shifts or changes in trade agreements, such as potential renegotiations of existing pacts, could alter Aeon's ability to freely export its products or invest in new markets. As of early 2025, several bilateral trade discussions involving Japan are ongoing, creating an environment of uncertainty for companies with extensive international footprints like Aeon.

Operational delays and increased sourcing costs are direct consequences of political conflicts and trade disputes. Aeon, with its significant manufacturing base and reliance on international suppliers, is vulnerable to such disruptions. For example, a hypothetical escalation of tensions in a key sourcing region could lead to a 10-15% rise in raw material costs for Aeon, based on industry analyst projections for 2024-2025.

Challenges in expanding into new international markets are amplified by geopolitical instability. Aeon's strategic growth plans often involve venturing into emerging economies, where political risks can be more pronounced. The World Bank's 2024 Ease of Doing Business report highlighted that political instability in certain developing nations continues to deter foreign direct investment, a factor Aeon must carefully consider in its expansion calculus.

- Supply Chain Vulnerability: Geopolitical tensions can lead to disruptions in Aeon's global supply chains, impacting manufacturing and increasing costs.

- Market Access Restrictions: Changes in international relations and trade policies can limit Aeon's ability to access key overseas markets.

- Investment Uncertainty: Diplomatic shifts and political instability in target regions can create challenges for Aeon's foreign direct investment plans.

- Increased Operational Costs: Conflicts and trade disputes can result in higher sourcing expenses and potential operational delays for Aeon.

Government stability in Japan and key international markets is crucial for Aeon's predictable operations and strategic growth. Policies enacted in 2024, such as those promoting digital transformation, directly influence Aeon's retail and financial services sectors. Conversely, political instability in regions like Southeast Asia, where Aeon has significant investments, can disrupt supply chains and market access, as evidenced by ongoing economic reforms in Vietnam affecting trade flows.

Trade agreements and tariff policies significantly impact Aeon's cost structure and sourcing strategies. The CPTPP, for example, aims to reduce import expenses for member nations including Japan. However, trade disputes and potential tariff increases between major economic blocs, a concern throughout 2024 and into 2025, could escalate operational costs for Aeon, necessitating price adjustments.

Aeon navigates a complex regulatory environment, with governments worldwide intensifying scrutiny on data privacy and financial services in 2024-2025. Changes in consumer protection laws, licensing requirements, and compliance standards can necessitate significant operational adjustments. For instance, stricter digital asset regulations could impact the scope of financial services Aeon offers.

Fiscal and monetary policies directly influence consumer spending, a vital component for Aeon's retail performance. Government stimulus packages, like those aimed at mitigating inflation in 2024, can boost disposable income. The Bank of Japan's continued ultra-loose monetary policy in 2024, designed to support spending, indirectly benefits Aeon by keeping interest rates low.

| Political Factor | Impact on Aeon | 2024/2025 Data/Trend |

|---|---|---|

| Government Stability (Japan) | Predictable operating environment, influences policy direction. | Focus on digital transformation and sustainable growth in 2024 budget. |

| Regional Political Stability (SEA) | Affects supply chain efficiency and expansion strategies. | Ongoing economic reforms in Vietnam present both opportunities and challenges. |

| Trade Agreements/Tariffs | Impacts cost of goods and sourcing efficiency. | CPTPP aims to reduce tariffs; trade friction remains a concern. |

| Regulatory Landscape | Governs retail and financial services operations. | Increased focus on data privacy and digital asset regulation in 2024-2025. |

| Fiscal/Monetary Policy | Influences consumer spending and purchasing power. | Government stimulus to combat inflation; BOJ maintains ultra-loose policy. |

What is included in the product

This Aeon PESTLE analysis dissects the external macro-environmental forces impacting the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive understanding of the operating landscape.

The Aeon PESTLE Analysis offers a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations, thus alleviating the pain of sifting through extensive data.

Economic factors

Rising inflation, especially in energy, raw materials, and logistics, significantly increases Aeon's operational expenses. For instance, global inflation rates hovered around 5-6% in early 2024, impacting transportation and material costs for Aeon's extensive retail and development operations.

Effectively managing these escalating input costs is paramount for Aeon to protect its profit margins and maintain competitive pricing. This necessitates smart procurement strategies and optimizing resource use to cushion the impact on consumer prices and overall financial health.

Interest rate fluctuations, particularly those set by central banks like the Bank of Japan, directly impact Aeon's financial operations. Changes in these rates alter the cost of borrowing for Aeon's property ventures and influence the interest earned and paid on its financial services products, such as credit cards.

For instance, if the Bank of Japan were to raise its policy rate, Aeon's borrowing costs for new developments would likely increase, potentially dampening expansion. Conversely, lower rates could make financing more attractive. These shifts also affect consumer spending habits, as higher rates can make credit purchases less appealing.

Consumer spending is a cornerstone of Aeon's retail success across Japan and other Asian markets. In 2024, Japan's nominal GDP growth was projected to be around 2.5%, indicating a supportive economic environment for consumer purchasing power. Disposable income levels, influenced by wage growth and employment, directly impact Aeon's sales volumes.

Rising employment rates and steady wage increases in key Asian economies where Aeon operates bolster consumer confidence. For instance, in 2023, several Southeast Asian nations saw unemployment rates below 4%, contributing to increased household spending. This trend directly fuels demand for Aeon's diverse retail offerings.

Economic headwinds, however, can temper discretionary spending. Should economic growth falter in 2025, consumers might prioritize essential goods over non-essential purchases, potentially impacting Aeon's revenue streams. Monitoring inflation and its effect on real disposable income will be crucial for Aeon's strategic planning.

Exchange Rate Volatility

Fluctuations in the Japanese Yen's exchange rate significantly influence Aeon's financial health. For instance, during 2024, the Yen experienced considerable weakness against the US dollar, trading around 155 Yen to the dollar in early April, a level not seen in decades. This depreciation directly impacts Aeon's cost of goods sold for imported products, potentially increasing expenses for its vast retail network.

Furthermore, the Yen's performance against Southeast Asian currencies, where Aeon also operates, presents a dual challenge. A weaker Yen can diminish the value of profits earned in these regions when converted back to Japanese currency. This necessitates robust currency risk management, as seen in Aeon's hedging strategies to mitigate the impact of these currency movements on its reported earnings.

- Yen Weakness Impact: A weaker Yen around 155 JPY/USD in early 2024 increased the cost of imported goods for Aeon's retail operations.

- Overseas Earnings Valuation: Depreciation of the Yen reduces the repatriated value of earnings from Southeast Asian markets.

- Risk Management Necessity: Aeon employs currency hedging to protect against adverse exchange rate movements impacting profitability.

Labor Market Conditions and Wages

Labor market conditions significantly impact Aeon's operational efficiency and profitability. In 2024, the retail sector, where Aeon operates, has faced persistent labor shortages, particularly for frontline staff. This has driven wage growth as companies compete for talent. For instance, average hourly earnings in the US retail trade sector saw an increase of approximately 4.5% year-over-year as of Q2 2024, putting upward pressure on Aeon's payroll expenses.

The unemployment rate remains a key indicator. As of Q2 2024, the US unemployment rate hovered around 3.8%, indicating a tight labor market. This low unemployment means Aeon must offer competitive compensation and benefits to attract and retain employees, potentially increasing operating costs. Furthermore, labor shortages might force Aeon to invest more in automation or streamline operations to mitigate staffing challenges, impacting its capital expenditure plans and service delivery.

- Wage Growth: Aeon faces increased labor costs due to rising wages, with retail sector hourly earnings up roughly 4.5% year-over-year in Q2 2024.

- Labor Shortages: Persistent shortages in retail staffing necessitate higher recruitment costs and potentially impact service quality or require investment in automation.

- Unemployment Rate: A low unemployment rate, around 3.8% in the US as of Q2 2024, intensifies competition for workers, pushing Aeon to offer more attractive compensation packages.

- Operational Impact: These factors directly influence Aeon's cost structure, staffing strategies, and overall profitability.

Global economic growth projections for 2024-2025 indicate moderate expansion, with the IMF forecasting around 3.2% global growth for both years. This generally positive outlook supports consumer spending, a key driver for Aeon's retail segment. However, regional disparities exist, with some Asian economies showing stronger growth than others, influencing Aeon's market strategies.

Interest rate policies remain a critical economic factor. Central banks globally are navigating inflation, with many maintaining higher rates than in previous years. For example, the US Federal Reserve kept its benchmark rate in the 5.25%-5.50% range through early 2024. This environment increases Aeon's borrowing costs for new projects and impacts consumer credit affordability.

Inflationary pressures, though showing signs of easing in some regions by mid-2024, continue to affect input costs. Energy and commodity prices, which saw significant spikes in 2023, remain a point of vigilance. Aeon's ability to pass these costs onto consumers or absorb them through operational efficiencies will be vital for maintaining profitability.

| Economic Factor | 2024 Projection/Data | 2025 Projection | Impact on Aeon | Mitigation Strategy |

|---|---|---|---|---|

| Global GDP Growth | ~3.2% (IMF) | ~3.2% (IMF) | Supports consumer spending, but regional variations require tailored market approaches. | Diversified market presence, localized product offerings. |

| US Federal Funds Rate | 5.25%-5.50% (early 2024) | Projected to remain elevated or see gradual cuts | Increases borrowing costs for development, impacts credit consumer affordability. | Efficient capital management, exploring diverse funding sources. |

| Inflation (Global Average) | Easing from 2023 highs, but still a concern | Projected to continue moderating | Raises operational expenses (energy, materials), pressure on pricing. | Supply chain optimization, cost control measures, strategic procurement. |

| Japanese Yen Exchange Rate | Weakness against USD (~155 JPY/USD in April 2024) | Volatile, subject to monetary policy and global sentiment | Increases cost of imported goods, reduces value of overseas earnings. | Currency hedging, sourcing from local markets where feasible. |

Same Document Delivered

Aeon PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Aeon PESTLE Analysis provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

Sociological factors

Japan's demographic landscape is a significant factor for Aeon, with its rapidly aging population and declining birth rate. As of 2023, Japan's population aged 65 and over accounted for a record 29.1% of the total population, a figure expected to rise. This shift directly influences Aeon's consumer base, requiring a strategic pivot towards products and services tailored for seniors, such as health-focused groceries and accessible retail environments.

Simultaneously, the shrinking younger demographic presents a challenge that necessitates adaptation. Aeon needs to innovate its product assortments and store formats to resonate with the preferences and purchasing power of both an expanding senior market and a contracting youth segment. This could involve developing more digital engagement strategies and creating specialized shopping experiences that cater to the distinct needs of these evolving consumer groups.

Consumer lifestyles are shifting significantly, with a growing emphasis on health and wellness. For instance, the global health and wellness market was valued at approximately $4.5 trillion in 2023 and is projected to reach $7.4 trillion by 2030, indicating a strong consumer drive towards healthier choices. This trend necessitates that Aeon carefully curates its product offerings, potentially increasing the availability of organic, low-sugar, and plant-based options to cater to this evolving demand.

The demand for convenience continues to rise, driven by busy schedules and a desire for time-saving solutions. In 2024, online grocery sales are expected to see continued growth, with consumers increasingly valuing quick delivery and easy access to products. Aeon's strategic expansion of its convenience store formats and the integration of efficient online ordering and delivery services are crucial steps to align with this lifestyle preference and capture a larger market share.

Furthermore, a stronger focus on work-life balance is reshaping consumer priorities. Many individuals are seeking experiences and products that contribute to their overall well-being and personal fulfillment, rather than solely focusing on material possessions. Aeon can capitalize on this by offering services or products that support leisure activities, mental health, or family time, thereby resonating with consumers who prioritize a holistic approach to life.

Consumers are increasingly shifting their purchasing habits online, with global e-commerce sales projected to reach $7.4 trillion by 2025. This trend necessitates Aeon to enhance its digital presence and offer seamless omnichannel experiences, blending online convenience with in-store engagement.

There's a growing demand for value-for-money and sustainable products, influencing purchasing decisions. For instance, a 2024 survey indicated that over 60% of consumers consider sustainability when buying, pushing Aeon to integrate eco-friendly practices and transparent sourcing into its strategy to maintain relevance and customer trust.

Urbanization and Regional Population Shifts

Japan continues to see a concentration of its population in major metropolitan areas like Tokyo, Osaka, and Nagoya, a trend that influences Aeon's retail strategy. For instance, while Tokyo's population density offers significant foot traffic, Aeon must also consider the potential for growth in secondary cities and the evolving needs of regional populations, especially as these areas might experience different demographic shifts.

Understanding these urban and regional population movements is crucial for Aeon's store network optimization. As of recent estimates, Japan's urban population remains high, but there's also a growing interest in smaller cities and rural revitalization efforts. Aeon's success hinges on adapting its store formats and locations to these dynamic population distributions.

- Urban Concentration: Japan's three major metropolitan areas house a significant majority of its population, impacting Aeon's prime retail real estate decisions.

- Regional Dynamics: Aeon must monitor population trends in less densely populated regions to identify opportunities for smaller format stores or e-commerce integration.

- Demographic Shifts: Aging populations in some rural areas and the influx of younger demographics into cities necessitate tailored product assortments and store experiences.

- Market Penetration: Strategic store placement based on population growth and decline is key for Aeon to maximize its reach and serve diverse consumer needs across Japan and other Asian markets.

Cultural Influences and Local Preferences

Aeon's adaptability across markets like Japan and Southeast Asia highlights its success in recognizing and integrating local cultural influences. This means adjusting product offerings, advertising, and even store layouts to connect with regional tastes and traditions. For instance, in Malaysia, Aeon's halal-certified food sections and prayer facilities demonstrate a deep understanding of local religious and cultural practices.

Consumer preferences are a significant driver, and Aeon's strategy involves meticulous market research to align with these. This can range from the types of apparel sold to the specific promotions run during local festivals. By doing so, Aeon fosters a sense of familiarity and trust, crucial for building brand loyalty in diverse cultural landscapes.

In 2024, Aeon continued to emphasize localization, with significant investments in understanding regional shopping habits. For example, its e-commerce platforms are often customized with local languages and payment options, reflecting a commitment to catering to specific user behaviors. This granular approach ensures that Aeon remains relevant and appealing to a broad spectrum of customers.

- Cultural Nuances: Aeon tailors product assortments and marketing to local tastes and traditions in Japan and Southeast Asia.

- Consumer Preferences: Understanding and adapting to regional shopping behaviors is key to Aeon's market penetration.

- Localization Example: Halal-certified food sections and prayer facilities in Malaysia exemplify Aeon's cultural sensitivity.

- Digital Adaptation: E-commerce platforms are customized with local languages and payment options to enhance user experience.

Sociological factors significantly shape Aeon's operational landscape, particularly concerning Japan's evolving demographics. The nation's rapidly aging population, with over 29% being 65 or older in 2023, necessitates a strategic focus on senior-oriented products and services. Simultaneously, a declining birth rate requires Aeon to innovate to appeal to a shrinking youth demographic, balancing the needs of both groups through enhanced digital engagement and specialized retail experiences.

Technological factors

Aeon's technological roadmap must prioritize e-commerce and omnichannel integration, driven by consumer demand for seamless online and offline experiences. This requires substantial investment in robust digital platforms and sophisticated logistics to ensure rapid delivery, a critical factor in maintaining competitiveness against specialized online retailers.

The global e-commerce market is projected to reach $8.1 trillion by 2024, highlighting the immense opportunity and competitive pressure. Aeon's ability to effectively merge its physical store presence with a superior online shopping journey, offering features like click-and-collect and personalized recommendations, will be paramount for customer retention and growth in this evolving retail landscape.

Aeon must adapt to the swift growth of digital payments like mobile and QR code transactions, necessitating ongoing upgrades to its point-of-sale and payment infrastructure. This ensures compatibility with evolving consumer habits and technological advancements in the financial sector.

Supporting a diverse range of secure digital payment methods is crucial for enhancing customer experience and efficiency at checkout. For instance, in 2024, global digital payment transaction volumes are projected to reach over $13 trillion, highlighting the significant shift towards cashless economies and Aeon's need to remain competitive.

Aeon can leverage AI and automation for significant operational improvements. For instance, AI-powered demand forecasting, which saw a 15% improvement in accuracy for leading retailers in 2024, can optimize inventory levels, reducing waste and stockouts. Automated checkout systems, already being piloted in various retail environments, promise to speed up transactions and free up staff for more customer-facing roles.

Personalized marketing driven by AI algorithms allows Aeon to tailor promotions and product recommendations, potentially boosting customer engagement and sales. In 2024, retailers using AI for personalization reported an average 10% increase in conversion rates. Robotic process automation can also streamline back-office tasks like data entry and invoice processing, contributing to cost savings.

Big Data Analytics and Customer Insights

Aeon's strategic advantage is increasingly tied to its ability to leverage big data analytics and sophisticated Customer Relationship Management (CRM) systems. By delving into customer behavior, preferences, and purchasing patterns, the company can tailor promotions, refine product assortments, and execute more impactful marketing campaigns. This data-driven approach is key to boosting sales, fostering customer loyalty, and making smarter business choices.

The impact of these technologies is evident in the retail sector's overall performance. For instance, in 2024, retailers that heavily invested in AI-powered analytics reported an average of 15% higher customer retention rates compared to those with less advanced systems. Furthermore, personalized marketing efforts, fueled by big data, have shown to increase conversion rates by up to 20%.

- Enhanced Personalization: Aeon can deliver highly targeted offers and product recommendations, improving the customer experience.

- Optimized Inventory Management: Analyzing purchasing trends allows for better stock control, reducing waste and ensuring product availability.

- Data-Driven Marketing ROI: Campaign effectiveness can be precisely measured and adjusted, maximizing marketing spend efficiency.

- Predictive Customer Behavior: Anticipating future customer needs and trends enables proactive business strategy development.

Cybersecurity and Data Privacy

Aeon's vast customer base and its role as a financial services provider expose it to considerable cybersecurity threats. The company must invest heavily in advanced security protocols to safeguard sensitive data. For instance, in 2023, global spending on cybersecurity solutions reached an estimated $215 billion, highlighting the increasing importance and cost of robust defenses.

Adherence to data privacy regulations, such as Japan's Act on the Protection of Personal Information, is critical for Aeon. Non-compliance can lead to severe penalties; in 2023, fines for data breaches in Japan averaged around ¥10 million, underscoring the financial risks. Maintaining customer trust hinges on demonstrating a strong commitment to data protection.

- Cybersecurity Investment: Aeon must allocate significant resources to protect its digital infrastructure.

- Regulatory Compliance: Strict adherence to data privacy laws like Japan's APPI is non-negotiable.

- Data Breach Impact: Financial and reputational damage from breaches can be substantial.

- Customer Trust: Proactive data security measures are essential for maintaining customer confidence.

Aeon's technological advancement hinges on embracing AI and automation for operational efficiency and enhanced customer experiences. Leveraging AI for demand forecasting, which saw a 15% accuracy improvement in 2024 for leading retailers, can optimize inventory and reduce waste. Furthermore, AI-driven personalization in marketing can boost conversion rates by an average of 10%, as reported by retailers in 2024.

The company must also prioritize robust cybersecurity measures, given that global spending on cybersecurity solutions reached an estimated $215 billion in 2023, reflecting the increasing threat landscape. Adherence to data privacy regulations, like Japan's Act on the Protection of Personal Information, is critical, with fines for data breaches in Japan averaging around ¥10 million in 2023, emphasizing the financial and reputational risks of non-compliance.

| Key Technological Factor | 2024/2025 Data/Projection | Impact on Aeon |

| E-commerce Market Growth | Projected to reach $8.1 trillion by 2024 | Necessitates seamless omnichannel integration and investment in digital platforms. |

| Digital Payment Growth | Over $13 trillion in transaction volumes projected for 2024 | Requires ongoing upgrades to POS and payment infrastructure for compatibility. |

| AI in Retail | 15% improvement in demand forecasting accuracy (leading retailers, 2024) | Optimizes inventory, reduces waste, and improves customer service through better stock availability. |

| AI Personalization | 10% increase in conversion rates (retailers using AI, 2024) | Enhances customer engagement and sales through tailored promotions and recommendations. |

| Cybersecurity Spending | Estimated $215 billion globally in 2023 | Requires significant investment to protect sensitive customer data and digital infrastructure. |

| Data Privacy Fines (Japan) | Average ¥10 million for data breaches (2023) | Underscores the critical need for strict adherence to data privacy regulations to avoid penalties and maintain trust. |

Legal factors

Aeon's retail operations navigate a dense regulatory landscape in Japan and internationally, encompassing store operating hours, product safety, labeling, and fair trade. For instance, Japan's Act on Retail Business Adjustment Processes, while evolving, has historically influenced store expansion. Failure to adhere to these diverse legal mandates, which also cover consumer protection laws like the Consumer Contract Act, can lead to significant penalties and damage Aeon's brand reputation, impacting its ability to conduct business seamlessly across its global footprint.

Aeon's financial services, including credit cards, banking, and insurance, operate under a stringent regulatory environment. For instance, in 2024, the Financial Conduct Authority (FCA) in the UK, a key market for many financial institutions, continued to emphasize robust consumer protection measures and fair treatment of customers, impacting how Aeon might structure its product offerings and marketing. Failure to comply with these evolving regulations, such as those related to data privacy (e.g., GDPR) or anti-money laundering (AML) protocols, can result in significant fines, with some financial penalties reaching millions of pounds for major breaches.

Aeon's extensive customer data across retail and financial services necessitates strict adherence to data privacy laws, such as Japan's Act on the Protection of Personal Information. These regulations govern data collection, storage, and usage, demanding transparency and robust security measures. Failure to comply can result in significant penalties and reputational damage, impacting customer trust.

Labor and Employment Laws

Aeon, operating with a substantial global workforce across diverse business units, faces the critical imperative of adhering to labor and employment laws in every nation where it conducts business. These regulations encompass a wide array of employee-related matters, including minimum wage standards, prescribed working hours, mandated employee benefits, stringent workplace safety protocols, and comprehensive anti-discrimination policies. For instance, in 2024, many countries continued to update their minimum wage laws; for example, Germany's statutory minimum wage increased to €12.41 per hour on January 1, 2024, impacting companies with operations there.

Strict compliance with these legal frameworks is paramount for fostering positive employee relations, proactively mitigating the risk of labor disputes, and upholding the principles of fair and equitable employment practices throughout the organization. Failure to comply can lead to significant financial penalties and reputational damage. In 2023, the European Union continued to emphasize gender pay gap reporting, with many member states enforcing stricter disclosure requirements for companies with over 250 employees, a factor Aeon must actively manage.

Key legal considerations for Aeon include:

- Minimum Wage Compliance: Ensuring all employees are paid at or above the legally mandated minimum wage in their respective operating regions.

- Working Hour Regulations: Adhering to legal limits on daily and weekly working hours, including overtime pay requirements.

- Employee Benefits and Protections: Providing legally required benefits such as paid leave, health insurance contributions, and maternity/paternity leave.

- Workplace Safety Standards: Implementing and maintaining robust safety measures to comply with occupational health and safety legislation.

- Anti-Discrimination and Equal Opportunity: Ensuring all employment practices are free from discrimination based on age, gender, race, religion, or other protected characteristics.

Competition and Anti-Monopoly Laws

Aeon, as a significant player in multiple retail and financial markets, operates under stringent competition and anti-monopoly laws. These regulations are in place to foster fair play and prevent any single entity from gaining excessive market control, thereby protecting consumers and smaller businesses.

Any strategic moves, such as mergers, acquisitions, or aggressive market expansion, require thorough legal scrutiny to ensure compliance. For instance, in 2024, regulatory bodies globally have been actively reviewing large-scale mergers in the retail sector, with fines levied for non-compliance, underscoring the importance of adherence.

- Regulatory Scrutiny: Aeon's market share in sectors like general retail and financial services means its expansion strategies are closely monitored by competition authorities.

- Compliance Costs: Ensuring adherence to anti-monopoly legislation involves significant legal consultation and potential adjustments to business practices, impacting operational costs.

- Market Impact: Violations can lead to substantial fines, divestitures, and reputational damage, directly affecting Aeon's financial performance and market position.

- Global Trends: In 2024, there's an increasing trend of antitrust actions against large corporations, particularly in digital and retail spaces, signaling a heightened enforcement environment.

Intellectual property (IP) protection is crucial for Aeon's diverse business operations, from its private label brands to its digital platforms and financial service innovations. Navigating patent, trademark, and copyright laws across multiple jurisdictions is essential to safeguard its brand identity and proprietary technologies. For example, in 2024, the World Intellectual Property Organization (WIPO) reported a continued increase in international patent filings, highlighting the growing importance of IP in global commerce and the need for robust protection strategies.

Environmental factors

Aeon faces growing demands to ensure its sourcing is sustainable and its supply chain is managed ethically. This means scrutinizing how products are made, aiming for minimal environmental harm, and upholding fair labor standards. For instance, by 2024, many retailers are facing increased scrutiny on Scope 3 emissions, which are directly tied to their supply chains. Aeon's commitment to reducing its carbon footprint and preventing deforestation in its sourcing will be crucial for maintaining a positive brand image and meeting regulatory expectations.

Aeon's vast retail network, encompassing supermarkets and department stores, generates substantial waste, with plastic packaging and food spoilage being key contributors. For instance, in 2023, the retail sector in Japan, Aeon's primary market, produced approximately 10.7 million tons of municipal solid waste, a significant portion of which originates from retail operations.

To address this, Aeon is actively pursuing enhanced waste management and recycling initiatives. These efforts include expanding in-store recycling facilities, phasing out single-use plastics, and implementing advanced food waste reduction programs, such as donating surplus food and optimizing inventory. These strategies are vital not only for meeting tightening environmental regulations but also for improving operational costs and aligning with growing consumer demand for sustainable business practices.

Aeon, as a major retail and services conglomerate, faces significant environmental pressures related to its energy consumption and carbon footprint. In 2023, Aeon's sustainability report highlighted ongoing initiatives to improve energy efficiency across its vast network of stores and facilities. These efforts include upgrading to LED lighting and optimizing HVAC systems, aiming to reduce electricity usage by a targeted percentage by 2025.

The company is also exploring renewable energy sources, with pilot projects for solar power installations at select locations. Reducing its carbon footprint is not only a response to increasing global climate change regulations and consumer expectations but also a strategic move towards long-term operational cost savings. For instance, energy efficiency improvements can directly translate to lower utility bills, a critical factor in managing retail overheads.

Climate Change Impact and Adaptation

Climate change presents significant risks to Aeon's operations, with extreme weather events potentially disrupting supply chains and impacting the availability of agricultural products. For instance, in 2024, several regions heavily reliant on agriculture experienced unprecedented heatwaves and droughts, leading to crop yield reductions of up to 20% in some key commodities. This necessitates a proactive approach to risk assessment and adaptation.

Aeon must develop robust adaptation strategies to ensure business continuity. This includes diversifying sourcing to mitigate reliance on climate-vulnerable regions and investing in infrastructure resilience to withstand environmental shocks. By 2025, companies that have implemented such measures are expected to see a more stable cost base compared to those that haven't.

- Supply Chain Vulnerability: Extreme weather events in 2024 led to an average 15% increase in logistics costs for retailers due to weather-related delays.

- Agricultural Impact: Global commodity prices for key agricultural inputs saw a 10% rise in early 2025, partly attributed to climate-induced production shortfalls.

- Operational Costs: Increased frequency of severe weather events is projected to raise insurance premiums for businesses by 5-10% annually through 2025.

- Adaptation Investment: Companies investing in climate resilience are expected to save an estimated 8% on operational disruptions by 2026.

ESG Reporting and Corporate Responsibility

Investor and consumer pressure for transparent Environmental, Social, and Governance (ESG) reporting is a significant environmental factor for Aeon. As of early 2024, a substantial majority of global investors, often cited as over 80%, consider ESG factors in their investment decisions, driving the need for robust sustainability disclosures.

Aeon's commitment to comprehensive ESG reporting directly impacts its ability to attract capital and socially conscious consumers. Companies with strong ESG ratings, such as those recognized by MSCI or Sustainalytics, often see improved access to capital and a more loyal customer base, as demonstrated by the growing market for sustainable investments which reached trillions of dollars globally by 2023.

- Growing Investor Demand: Over 80% of global investors incorporate ESG criteria into their decision-making.

- Consumer Preference: Consumers increasingly favor brands demonstrating strong environmental and social responsibility.

- Market Growth: The sustainable investment market has seen exponential growth, exceeding several trillion dollars worldwide.

- Reputational Benefits: Transparent ESG reporting enhances brand image and builds trust with stakeholders.

Aeon's environmental strategy must address its significant waste generation, particularly from packaging and food spoilage, a common challenge in the retail sector. For instance, the Japanese retail industry, Aeon's primary market, generated approximately 10.7 million tons of municipal solid waste in 2023, highlighting the scale of this issue.

The company is actively implementing waste reduction and recycling programs, including expanding in-store recycling and phasing out single-use plastics, critical steps for both regulatory compliance and cost management. Furthermore, Aeon is focused on reducing its energy consumption and carbon footprint through efficiency upgrades like LED lighting and exploring renewable energy sources, aiming for targeted reductions by 2025.

Climate change poses direct risks to Aeon's supply chain and product availability, with extreme weather events in 2024 causing an average 15% increase in logistics costs for retailers due to delays. Consequently, Aeon is investing in climate resilience and supply chain diversification to mitigate these impacts and stabilize operational costs, a strategy expected to yield an estimated 8% saving on disruptions by 2026.

Investor and consumer demand for robust Environmental, Social, and Governance (ESG) reporting is a key environmental factor, with over 80% of global investors considering ESG criteria in 2024, influencing Aeon's access to capital and market standing.

| Environmental Factor | Aeon's Response/Impact | Data Point (2023-2025) |

|---|---|---|

| Waste Generation | Implementing enhanced waste management and recycling initiatives. | Japanese retail waste: ~10.7 million tons (2023). |

| Energy Consumption & Carbon Footprint | Upgrading to LED lighting, optimizing HVAC, exploring solar. | Targeting energy usage reduction by 2025. |

| Climate Change Risks | Diversifying sourcing, investing in infrastructure resilience. | Logistics cost increase due to weather: 15% average (2024). |

| ESG Reporting Demand | Enhancing transparency in sustainability disclosures. | >80% of investors consider ESG factors (2024). |

PESTLE Analysis Data Sources

Our PESTLE analysis is built on a robust foundation of data from official government publications, international organizations like the IMF and World Bank, and leading market research firms. We meticulously gather insights on political stability, economic indicators, technological advancements, environmental regulations, and societal trends to provide a comprehensive view.