ADP SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ADP Bundle

ADP's market position is strong, leveraging its established brand and extensive client base to maintain a leading edge in payroll and HR solutions. However, understanding the nuances of its competitive landscape and potential technological disruptions is crucial for navigating future growth.

Want the full story behind ADP's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

ADP stands as a titan in the human capital management (HCM) sector, boasting over 1.1 million clients spread across more than 140 countries. This immense global footprint isn't just about numbers; it translates into significant economies of scale, allowing ADP to operate more efficiently and offer competitive pricing. The sheer volume of data generated from this vast client base is a powerful asset, fueling the development of sophisticated AI capabilities and reinforcing its market dominance.

The company's financial performance underscores its leadership, with revenues reaching approximately $20.6 billion in fiscal year 2025. This substantial revenue figure highlights ADP's established market position and its ability to consistently capture a significant share of the global HCM market. Such scale provides a robust foundation for continued investment in innovation and expansion.

ADP's strength lies in its comprehensive and integrated Human Capital Management (HCM) solutions, covering payroll, talent management, time tracking, and benefits administration. This all-in-one approach simplifies complex HR processes for businesses of all sizes. In 2024, ADP reported a 9% increase in revenue for its Employer Services segment, highlighting the strong demand for its integrated offerings.

ADP consistently delivers strong financial results, showcasing steady revenue growth and profitability. For fiscal year 2025, the company reported a 7% increase in revenues, reaching $20.6 billion, and a 9% rise in net earnings to $4.1 billion. This robust financial health, further evidenced by a 9% increase in adjusted EBIT to $5.3 billion, fuels ongoing investment in innovation and strategic initiatives.

High Client Retention and Switching Costs

ADP enjoys a significant advantage due to high client retention, largely driven by the substantial switching costs associated with its payroll and human capital management (HCM) software. These systems are so deeply integrated into a client's day-to-day operations that moving to a competitor becomes a complex, expensive, and time-consuming endeavor.

This stickiness is clearly demonstrated by ADP's impressive revenue retention figures. For the decade leading up to 2024, ADP's employer services revenue retention consistently averaged around 91%. This high rate is a testament to the value clients perceive and the difficulty they face in migrating away.

The benefit of such high retention is a predictable and stable recurring revenue stream. This recurring revenue is particularly valuable because it comes with a low marginal cost, as the initial investment in onboarding and system integration has already been made.

- Deep Integration: ADP's software is embedded in core business processes, making it difficult and costly to replace.

- High Retention Rate: Averaging 91% employer services revenue retention through 2024, showcasing client loyalty.

- Recurring Revenue: This high retention translates into a consistent and reliable income stream.

- Low Marginal Cost: Once clients are onboarded, the cost to serve them is minimal, boosting profitability.

Advanced AI Integration and Innovation

ADP's commitment to advanced AI integration is a significant strength, particularly with its proactive incorporation of generative AI into its Human Capital Management (HCM) platforms. This focus is designed to enhance user experience through predictive analytics, anomaly detection, and tailored recommendations, directly impacting operational efficiency for its clients.

The company's innovation is clearly demonstrated by the September 2024 launch of its Lyric platform. This new offering utilizes generative AI and boasts support for payroll processing in over 75 countries, highlighting ADP's global reach and technological forwardness. Furthermore, ADP Assist, an AI-driven client interface, has been recognized with innovation awards in both 2024 and 2025, underscoring the practical value and cutting-edge nature of its AI solutions.

- AI-Powered HCM Enhancements: Predictive analytics, anomaly detection, and personalized recommendations are being embedded into ADP's core HCM offerings.

- Lyric Platform Launch (September 2024): Leverages generative AI for global payroll in over 75 countries, signifying a major step in international HR tech.

- Award-Winning ADP Assist: Recognized for innovation in 2024 and 2025, this AI client-facing tool demonstrates tangible advancements in client support.

ADP's extensive global reach, serving over 1.1 million clients in more than 140 countries, provides unparalleled economies of scale. This vast network fuels its ability to invest heavily in AI and data analytics, reinforcing its market leadership. The company's robust financial performance, with fiscal year 2025 revenues reaching $20.6 billion and net earnings of $4.1 billion, underscores its stability and capacity for innovation.

ADP's integrated HCM solutions, covering payroll, talent management, and benefits, simplify complex HR functions for businesses. This comprehensive approach is highly valued, as evidenced by a 9% revenue increase in its Employer Services segment in 2024. The company's strong client retention, consistently around 91% for employer services revenue through 2024, highlights the deep integration of its systems and the high switching costs for clients, ensuring a predictable recurring revenue stream with low marginal costs.

The strategic integration of advanced AI, including generative AI, into its HCM platforms is a key differentiator. The September 2024 launch of the Lyric platform, supporting global payroll in over 75 countries, and the award-winning ADP Assist client interface (recognized in 2024 and 2025) demonstrate ADP's commitment to cutting-edge technology and enhanced client experience through predictive analytics and personalized recommendations.

| Metric | Value (FY2025) | Significance |

|---|---|---|

| Global Clients | 1.1+ million | Demonstrates extensive market penetration and economies of scale. |

| Revenue | $20.6 billion | Indicates strong market share and financial stability. |

| Net Earnings | $4.1 billion | Highlights profitability and capacity for reinvestment. |

| Employer Services Revenue Retention (through 2024) | ~91% | Shows high client loyalty and the stickiness of its services. |

| Lyric Platform Launch | September 2024 | Represents a significant advancement in global payroll with generative AI. |

What is included in the product

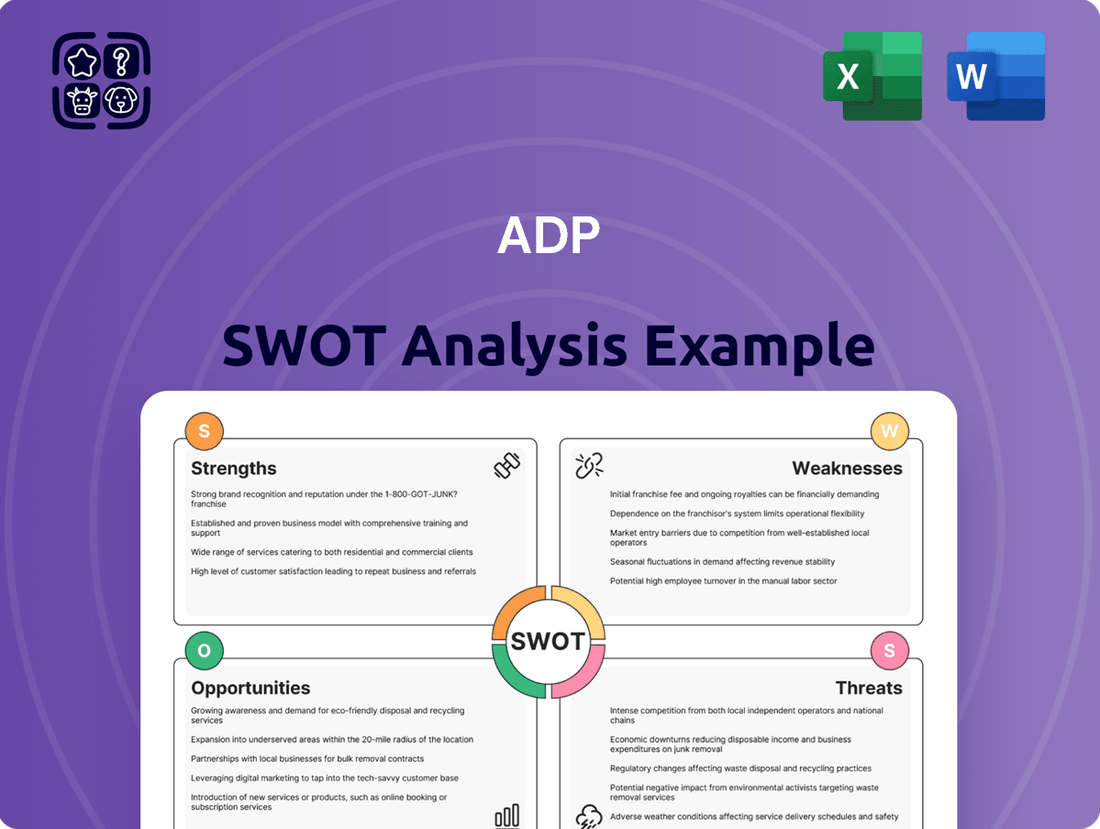

Analyzes ADP’s competitive position through key internal and external factors, identifying strengths, weaknesses, opportunities, and threats.

Offers a clear, structured framework to identify and address strategic weaknesses and threats, alleviating the pain of uncertainty.

Weaknesses

Many core Human Capital Management (HCM) services, like payroll processing and benefits administration, are seen as fairly similar across different providers. This standardization can make it tough for ADP to stand out, potentially leading to lower product differentiation.

The competitive landscape is crowded, with numerous players offering similar solutions. This intensifies pressure on ADP to constantly innovate and improve its services to keep its edge and maintain market share. For instance, in 2024, the HCM market is projected to reach over $50 billion, highlighting the intense competition.

A notable weakness for ADP is its substantial reliance on interest income generated from client funds. This revenue stream, which contributed significantly to their financial performance, particularly during periods of elevated interest rates, also introduces considerable sensitivity to monetary policy shifts. For instance, if interest rates were to decrease, as has been a concern in some economic forecasts for 2024-2025, this income source could shrink, directly impacting ADP's profitability and potentially requiring adjustments to their business model to mitigate such risks.

Acquisitions, such as the reported October 2024 deal for WorkForce Software, while strategically beneficial for expanding ADP's human capital management suite, introduce significant integration hurdles. These can manifest as operational friction, as disparate systems and cultures must be harmonized, potentially delaying the realization of expected cost synergies. For instance, integrating a new platform might require substantial IT investment and retraining, impacting short-term profitability.

Vulnerability to Cybersecurity Threats

As a major custodian of sensitive employee data, ADP faces significant cybersecurity risks. A ransomware attack on a partner in September 2024, which exposed Broadcom employee data, underscores the persistent threat of data breaches. This vulnerability necessitates continuous investment in and enhancement of robust security measures across ADP's entire operational ecosystem to protect client information.

The company's reliance on third-party vendors and partners introduces an extended attack surface. A breach at any point in this supply chain, as demonstrated by the Broadcom incident, can have direct repercussions on ADP's reputation and client trust. Maintaining stringent security standards for all partners is therefore critical for mitigating these risks.

- Cybersecurity Risk: ADP handles vast amounts of sensitive employee and financial data, making it a prime target for cyberattacks.

- Third-Party Vulnerabilities: Incidents like the September 2024 ransomware attack on a partner exposing Broadcom employee data highlight risks extending through ADP's supply chain.

- Reputational Damage: A significant data breach could severely damage ADP's reputation and erode client confidence, impacting future business.

- Regulatory Scrutiny: Cybersecurity failures can lead to substantial fines and increased regulatory oversight, adding to operational costs and complexity.

Complexity of Large-Scale Platform Migrations

Migrating clients to new, advanced platforms, a key strategic move for ADP, presents a significant challenge. While these platform upgrades promise long-term benefits, the transition period can be disruptive. This disruption may temporarily impact client retention and profitability as clients navigate the changes and potentially reassess their needs. For instance, during the 2023 fiscal year, ADP continued its platform modernization efforts, which, while crucial for future growth, required substantial resource allocation and meticulous execution to mitigate any adverse client experiences.

The complexity of managing these large-scale migrations demands considerable investment in technology, training, and support. Ensuring a smooth transition for a diverse client base, each with unique requirements and existing systems, is a delicate balancing act. This ongoing process requires careful planning and execution to minimize churn and maintain client satisfaction throughout the migration journey. ADP's commitment to these platform enhancements underscores a strategic focus on future efficiency and client value, even with the inherent complexities of such large-scale operational shifts.

- Platform Modernization Costs: Significant capital expenditure is required for developing and implementing new, scalable platforms.

- Client Disruption: Migrations can lead to temporary service interruptions or require clients to adapt to new workflows, potentially causing dissatisfaction.

- Talent and Resource Strain: Executing complex migrations demands specialized IT skills and project management resources, which can strain internal capabilities.

- Competitive Reassessment: The migration period offers clients an opportunity to evaluate alternative solutions from competitors, increasing retention risk.

ADP's reliance on interest income from client funds, a significant revenue driver, makes it vulnerable to interest rate fluctuations. Economic forecasts for 2024-2025 suggest potential rate decreases, which could directly impact ADP's profitability. Furthermore, the company faces substantial integration challenges with its acquisitions, such as the reported October 2024 deal for WorkForce Software, which can lead to operational friction and delayed synergy realization. The ongoing platform modernization efforts, while crucial for future growth, also present a challenge in managing client transitions smoothly, potentially impacting retention and requiring significant resource allocation.

| Weakness Category | Specific Challenge | Potential Impact | Relevant Data/Event |

|---|---|---|---|

| Revenue Sensitivity | Reliance on interest income from client funds | Reduced profitability during periods of declining interest rates | Economic forecasts for 2024-2025 anticipate potential interest rate decreases. |

| Integration Complexity | Harmonizing systems and cultures post-acquisition | Operational friction, delayed cost synergies, short-term profitability impact | Reported October 2024 acquisition of WorkForce Software. |

| Client Migration Challenges | Managing transitions to new platforms | Temporary service disruption, potential client dissatisfaction, increased retention risk | Ongoing platform modernization efforts throughout fiscal year 2023. |

Full Version Awaits

ADP SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering the same professional structure and insights.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment, ensuring you receive the entire, unedited report.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail and ready for your strategic planning.

Opportunities

The human capital management (HCM) software market is booming, with cloud-based solutions leading the charge. This surge is fueled by companies embracing remote and hybrid work, needing flexible HR tools. The global HCM market is expected to reach over $40 billion by 2027, presenting a significant opportunity for ADP to capture new clients and enhance its service portfolio.

ADP can significantly grow by entering new regions, especially in Asia-Pacific and Latin America, where the need for Human Capital Management (HCM) solutions is on the rise. For instance, the HCM market in Asia-Pacific is projected to reach $16.5 billion by 2027, showing substantial room for expansion.

Furthermore, focusing on the small and mid-size business (SMB) sector offers a compelling opportunity, as this segment is anticipated to grow faster than the large-enterprise market. In 2024, the global SMB IT spending is expected to increase by 7.5%, highlighting the growing demand for scalable HCM solutions.

The relentless progress in Artificial Intelligence, especially generative AI, presents a significant opportunity for ADP to refine its services. This technology can automate routine processes, deliver more profound analytical insights, and elevate the overall employee experience for ADP's clients.

By continuing to invest in AI capabilities, such as predictive analytics for workforce trends and intelligent onboarding solutions, ADP can solidify its market position. For instance, in 2024, companies heavily investing in AI saw an average revenue increase of 15%, highlighting the tangible benefits of such technological integration.

Strategic Partnerships and Acquisitions

ADP can significantly boost its market position and service breadth through strategic alliances and targeted acquisitions. This approach allows for the integration of specialized functionalities and the consolidation of market share, as seen with the acquisition of WorkForce Software, which bolstered ADP's human capital management capabilities.

These moves are crucial for staying competitive in the evolving HR technology landscape. For instance, ADP's commitment to expanding its capabilities through acquisitions is a key element of its growth strategy.

The company's ongoing investment in integrating acquired technologies aims to create a more robust and comprehensive offering for its clients. This strategy is expected to drive further revenue growth and enhance customer retention by providing a one-stop solution for payroll, HR, and benefits administration.

Looking ahead, ADP's pursuit of strategic partnerships and acquisitions is likely to focus on areas such as AI-driven HR solutions, advanced analytics, and specialized compliance services. These efforts will ensure ADP remains at the forefront of HR technology innovation.

Focus on Employee Experience and Well-being

The increasing focus on employee experience and well-being presents a significant opportunity for ADP. By developing and enhancing solutions that cater to personalized employee journeys, stress management, and overall health, ADP can significantly boost client engagement and productivity. For instance, a 2024 survey indicated that 70% of employees feel that well-being programs positively impact their job satisfaction.

ADP can leverage this trend by offering integrated platforms that provide:

- Personalized benefits enrollment and management: Tailoring options to individual needs.

- Tools for mental health support: Resources for stress reduction and access to counseling services.

- Wellness program integration: Facilitating participation in fitness challenges and health assessments.

- Data analytics on employee sentiment: Providing clients with insights into workforce morale and well-being trends.

ADP can capitalize on the expanding global HCM market, particularly in emerging regions like Asia-Pacific, which is projected to reach $16.5 billion by 2027. The company also has a significant opportunity in the growing SMB sector, with IT spending expected to rise by 7.5% in 2024. Furthermore, integrating AI, especially generative AI, can automate processes and enhance analytical insights, as companies investing in AI saw a 15% revenue increase in 2024.

Threats

ADP faces significant challenges from established competitors like Paychex and Workday, as well as a growing number of specialized HR tech startups. This crowded landscape intensifies the battle for customer acquisition and retention. For instance, in 2024, the HCM market is projected to reach over $30 billion globally, with vendors constantly vying for a larger slice of this expanding pie through aggressive pricing and feature development.

The sheer number of players means ADP must continually invest in innovation to differentiate its offerings and avoid commoditization. This pressure can impact profit margins as the company may need to offer competitive pricing or enhanced services to maintain its market position against agile, often more niche, competitors who can respond quickly to evolving client needs.

The relentless march of technology, especially in areas like artificial intelligence and automation, presents a significant challenge for ADP. If the company doesn't adapt quickly to new innovations, it risks falling behind.

Competitors are constantly rolling out more sophisticated or budget-friendly solutions. For instance, the global AI market was valued at approximately $200 billion in 2023 and is projected to grow substantially, indicating a dynamic landscape where staying ahead requires continuous investment in research and development.

ADP's market share could be threatened if its own product development and R&D efforts aren't as cutting-edge as those of its rivals. Failing to innovate means potentially losing clients to companies offering more advanced, integrated, or cost-effective human capital management platforms.

ADP faces increasing threats from a growing landscape of global data privacy regulations. Compliance with frameworks like the EU's GDPR, which carries fines up to 4% of global annual revenue, demands constant adaptation of their services and operational procedures. Failure to navigate these evolving requirements, which are becoming more stringent worldwide, could lead to significant penalties and damage client trust in their handling of sensitive payroll and HR data.

Economic Downturns and Labor Market Volatility

Macroeconomic uncertainty and labor market volatility pose a significant threat to ADP. As a company whose revenue is directly linked to employment levels and payroll processing volumes, a widespread economic downturn can lead to reduced demand for its human capital management (HCM) solutions. For instance, if businesses scale back hiring or face closures, ADP's core service offerings are impacted.

The impact of economic slowdowns is often reflected in employment figures. In late 2023 and early 2024, while the US labor market remained relatively resilient, concerns about potential recessions persisted, which could translate to slower job growth or even job losses. This directly affects ADP's revenue streams, as fewer employees mean fewer payrolls to process and potentially less need for comprehensive HCM services.

Specific threats include:

- Reduced Client Spending: During economic uncertainty, businesses may cut discretionary spending, including on HR technology and services, impacting ADP's growth.

- Lower Payroll Volumes: A decline in overall employment directly reduces the number of payroll transactions ADP processes, affecting fee-based revenue.

- Increased Client Churn: Struggling businesses might seek cheaper alternatives or consolidate services, leading to higher client attrition rates for ADP.

Third-Party and Supply Chain Risks

ADP's reliance on a network of third-party vendors and partners exposes it to significant supply chain risks, particularly concerning cybersecurity. A disruption or breach within this ecosystem, such as a cyberattack on a key service provider, could directly impact ADP's operations and client data security. For instance, the 2024 Broadcom cyberattack highlighted how vulnerabilities in a supplier's infrastructure can cascade, potentially affecting numerous downstream businesses and their sensitive information.

These external dependencies introduce vulnerabilities that could compromise ADP's reputation and client trust. A failure in a critical vendor's service, whether due to a cyber incident or operational breakdown, could lead to service interruptions for ADP's clients, impacting payroll processing or HR functions. This underscores the importance of robust vendor risk management and due diligence to mitigate potential fallout.

The interconnected nature of modern business means that a security lapse at even a single, seemingly minor, third-party vendor can have far-reaching consequences. For a company like ADP, entrusted with highly sensitive employee and financial data, maintaining the security and reliability of its entire supply chain is paramount. This requires continuous monitoring and stringent security protocols across all partner relationships.

ADP faces intense competition from established players and agile HR tech startups, driving a need for continuous innovation to avoid commoditization and maintain market share in a global HCM market projected to exceed $30 billion in 2024.

Rapid technological advancements, particularly in AI and automation, pose a threat if ADP fails to adapt quickly, risking obsolescence against competitors leveraging these innovations. The global AI market, valued around $200 billion in 2023, highlights the pace of change.

Increasingly stringent global data privacy regulations, such as GDPR with potential fines up to 4% of global annual revenue, demand constant adaptation and compliance, posing a significant risk if not managed effectively.

Macroeconomic instability and labor market fluctuations directly impact ADP’s revenue, as reduced employment levels and payroll volumes, a concern throughout late 2023 and early 2024, can lead to lower demand for its services.

ADP's reliance on third-party vendors introduces cybersecurity and operational risks, as a breach or failure within its supply chain, exemplified by incidents like the 2024 Broadcom cyberattack, can compromise client data and service continuity.

SWOT Analysis Data Sources

This ADP SWOT analysis is built upon a robust foundation of data, incorporating ADP's official financial filings, comprehensive market research reports, and expert industry analysis to provide a well-rounded and actionable assessment.