ADP Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ADP Bundle

ADP's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the constant threat of new entrants. Understanding these dynamics is crucial for anyone looking to navigate the human capital management industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore ADP’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for ADP is generally low, primarily because the company relies on a broad and competitive market for its technology infrastructure, software, and specialized services. This diverse supplier landscape means no single vendor can typically dictate terms due to ADP's significant purchasing volume and established partnerships.

ADP's bargaining power of suppliers is somewhat limited due to the standardized nature of many of its technological inputs and services. The availability of multiple alternative providers for components like cloud infrastructure or basic software solutions means ADP isn't overly reliant on any single supplier. This allows them to negotiate favorable terms or switch providers if pricing or service levels become less attractive.

ADP's bargaining power with suppliers is bolstered by its relatively low switching costs for generic technology components. While initial integration of new systems can require investment, ADP's robust internal technical expertise and the modular design of its Human Capital Management (HCM) solutions allow for easier transitions between providers of similar technologies. This flexibility means ADP is not overly reliant on any single supplier for non-specialized tech, giving it leverage in price and service negotiations.

Backward Integration Potential

ADP, as a significant player in the technology sector, possesses the capability to develop certain components or services internally. This potential for backward integration acts as a strong deterrent against suppliers attempting to exert excessive pricing power.

The credible threat that ADP could bring production in-house limits the bargaining power of its suppliers. They are aware that ADP might choose to become a competitor in their specialized market if terms become unfavorable.

For instance, if a key software component supplier were to significantly increase prices, ADP could invest in developing a comparable solution internally. This strategic option ensures ADP is not overly reliant on any single external provider.

In 2024, many large technology firms like ADP have demonstrated increased investment in internal R&D and manufacturing capabilities, signaling a growing trend of self-sufficiency to manage supply chain risks and costs.

- Backward Integration Capability: ADP's status as a technology company enables in-house development of critical components.

- Supplier Leverage: This potential limits suppliers' ability to dictate terms due to the threat of ADP becoming a competitor.

- Strategic Advantage: ADP can mitigate risks associated with price hikes or supply disruptions by developing solutions internally.

Strategic Partnerships vs. Commodity Suppliers

ADP navigates a spectrum of supplier relationships, from those providing standard services to strategic partners offering specialized technology. While many commodity suppliers have limited bargaining power, ADP's scale and consistent demand can still influence terms.

However, in areas requiring advanced capabilities, such as cutting-edge AI or sophisticated data analytics, ADP might partner with niche technology providers. In these instances, the supplier's unique intellectual property and specialized expertise can grant them a degree of leverage. Despite this, ADP's substantial market presence and its role as a significant client often temper this power, allowing for continued negotiation on favorable terms.

- Strategic Partnerships for Innovation: ADP's pursuit of advanced AI and analytics capabilities necessitates collaboration with specialized technology firms, potentially increasing supplier leverage in these specific domains.

- ADP's Negotiating Strength: Even with specialized suppliers, ADP's significant market share and substantial purchasing volume provide a strong counterbalancing force in negotiations.

- Commodity Suppliers' Limited Power: Suppliers of more commoditized services typically face lower bargaining power due to the availability of multiple alternatives and ADP's ability to switch providers with relative ease.

ADP's bargaining power with suppliers is generally robust due to its scale and the competitive nature of the technology market. The company's ability to leverage its significant purchasing volume and the availability of alternative providers for many of its needs limits the influence any single supplier can exert. This is particularly true for standardized components and services, where switching costs are relatively low.

While ADP can develop some capabilities in-house, mitigating supplier reliance, it also engages with specialized providers for advanced technologies. In 2024, the trend for large tech companies like ADP to invest in R&D further solidifies their position, allowing them to potentially bring more functions in-house if supplier terms become unfavorable. This strategic flexibility is key to maintaining favorable negotiations.

| Supplier Type | ADP's Bargaining Power | Key Factors |

|---|---|---|

| Standard Technology Components (e.g., cloud infrastructure) | High | Multiple vendors, low switching costs, ADP's scale |

| Specialized Software/AI Services | Moderate to High | Unique IP, but tempered by ADP's market presence and potential for in-house development |

| General Business Services (e.g., office supplies) | High | Commoditized market, numerous providers |

What is included in the product

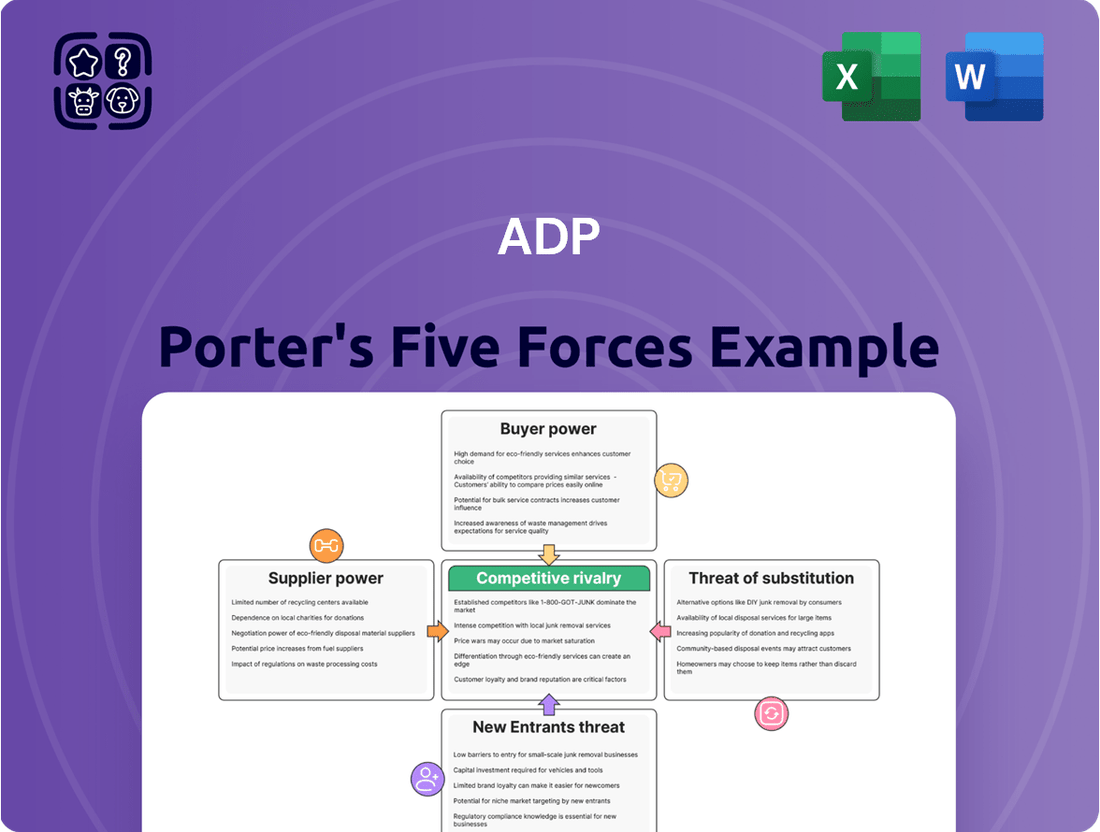

Examines the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes, specifically for ADP's market position.

Effortlessly identify and mitigate competitive threats by visually mapping the intensity of each of Porter's five forces, allowing for proactive strategy adjustments.

Customers Bargaining Power

The bargaining power of ADP's customers is typically moderate, largely due to the significant switching costs involved. When a business fully integrates ADP's extensive human capital management (HCM) suite, encompassing payroll, talent management, and benefits administration, moving to a different provider becomes a complex and expensive undertaking.

These high switching costs stem from the need to migrate substantial volumes of sensitive employee data, retrain staff on new systems, and the inherent risk of operational disruptions during the transition. For instance, a mid-sized company might spend tens of thousands of dollars and weeks of internal resources to switch payroll providers alone, making continued use of ADP more appealing.

ADP's extensive reach across over 140 countries, serving everyone from small startups to massive multinational corporations, significantly dilutes the bargaining power of any single customer. This wide distribution means no one client holds an overwhelming sway over ADP's business.

While major enterprise clients naturally represent larger contracts, their individual impact on ADP's overall revenue is managed by the sheer breadth of the customer pool. This diversification is a key factor in limiting the leverage individual customers can exert.

HR and payroll services are absolutely crucial for any business to run smoothly. Companies depend on these functions for accuracy, staying compliant with regulations, and operating efficiently. This makes them hesitant to switch providers just to save a little money, as disruptions can be costly.

ADP's integrated solutions are so vital that clients are unlikely to compromise on the quality of these essential services for lower prices. The mission-critical nature of payroll and HR means that reliability and compliance are paramount, outweighing minor cost considerations for most businesses.

This deep reliance on core services significantly reduces customer sensitivity to small price fluctuations. For instance, in 2024, businesses continued to prioritize seamless payroll processing and HR compliance, with many reporting that the cost of errors or non-compliance far exceeded the expense of a premium service provider like ADP.

Availability of Alternatives (but with caveats)

While the Human Capital Management (HCM) software market is crowded with options from giants like Workday and SAP SuccessFactors, as well as specialized vendors, the sheer breadth and integration of ADP's solutions present a unique challenge for customers seeking direct substitutes. This complexity, combined with ADP's long-standing brand recognition and extensive service infrastructure, often means that finding an exact replica of ADP's offering is not straightforward for buyers.

The bargaining power of customers is somewhat tempered by the difficulty in finding a perfect, all-encompassing alternative. For instance, while a company might find a competitor strong in payroll processing, they may lack ADP's integrated capabilities in areas like talent management or benefits administration. This fragmentation of competitor strengths means that switching providers can often involve piecing together multiple solutions, which can be costly and administratively burdensome.

- Market Saturation: Numerous HCM providers exist, offering a wide array of functionalities.

- ADP's Integrated Strength: ADP's comprehensive suite, covering payroll, HR, benefits, and talent, is difficult for competitors to fully replicate.

- Switching Costs: High costs associated with data migration, system integration, and employee retraining can deter customers from switching.

- Customer Loyalty: ADP's established reputation and service quality foster customer retention, reducing the immediate impact of alternative availability.

Data-Driven Insights and Value-Added Services

ADP is enhancing its value proposition by offering data-driven insights and advanced services, moving beyond traditional HR functions. Tools like predictive analytics and AI-powered solutions, such as ADP Assist, aim to provide clients with strategic advantages.

These enhanced capabilities can reduce customer price sensitivity by demonstrating tangible benefits and strategic value, making ADP a more indispensable partner. For instance, ADP’s 2024 financial reports highlight increased investment in AI and analytics, signaling a strategic pivot towards value-added services that differentiate them from competitors.

- Data-Driven Insights: ADP leverages vast datasets to offer predictive analytics for workforce planning and talent management.

- AI-Powered Tools: Solutions like ADP Assist automate complex HR tasks and provide real-time guidance, improving efficiency.

- Enhanced Value Proposition: These services position ADP as a strategic partner, not just a service provider, potentially reducing client churn.

- Reduced Price Sensitivity: By offering unique, value-added capabilities, ADP can command premium pricing and lessen the impact of competitor pricing pressures.

The bargaining power of ADP's customers is generally moderate, significantly influenced by the substantial switching costs associated with their comprehensive Human Capital Management (HCM) solutions. Businesses often find it complex and expensive to migrate sensitive employee data, retrain staff, and manage operational disruptions when considering a change.

ADP's vast global presence and diverse client base, serving businesses from small startups to large multinationals, inherently limits the leverage any single customer can wield. This broad market penetration means that no individual client's demands can disproportionately impact ADP's overall business strategy or pricing.

The mission-critical nature of HR and payroll services means clients prioritize reliability and compliance over minor cost savings. For example, in 2024, the cost of payroll errors or regulatory non-compliance for businesses far outweighed the expense of using a premium provider like ADP, reinforcing customer reliance on dependable solutions.

While the HCM market offers many alternatives, ADP's integrated suite, covering payroll, talent, and benefits, is difficult for competitors to fully replicate. This complexity, coupled with ADP's established brand and service infrastructure, makes finding an exact substitute challenging for many buyers.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Reasoning |

|---|---|---|

| Switching Costs | Lowers Customer Power | High costs for data migration, retraining, and potential operational disruption when switching HCM providers. |

| Customer Diversification | Lowers Customer Power | ADP serves over 140 countries, with no single client dominating revenue, diluting individual customer leverage. |

| Service Criticality | Lowers Customer Power | Payroll and HR are essential, mission-critical functions where reliability and compliance outweigh minor price differences. 2024 data shows businesses prioritize seamless operations. |

| Integrated Solutions | Lowers Customer Power | ADP's comprehensive HCM suite is difficult for competitors to match, making direct substitution complex and costly. |

What You See Is What You Get

ADP Porter's Five Forces Analysis

This preview showcases the complete ADP Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the payroll and HR services industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate utility for your strategic planning.

Rivalry Among Competitors

The human capital management (HCM) market is incredibly crowded, with a vast number of companies vying for market share. This intense competition means ADP constantly needs to innovate and differentiate itself to stand out.

ADP contends with major established players such as Workday, Oracle, and SAP SuccessFactors, which offer comprehensive HCM suites. Beyond these giants, mid-market focused providers like UKG Pro, Dayforce, Paylocity, and Paycom also present significant competition, often with specialized features or pricing models that appeal to specific customer segments.

The landscape is further fragmented by a multitude of smaller, niche HR technology startups that focus on specific functions like recruitment, onboarding, or employee engagement. Even accounting software providers, such as QuickBooks, offer basic payroll services, adding another layer of competition, particularly for smaller businesses.

Competitive rivalry within the HR technology sector, impacting companies like ADP, is significantly amplified by the relentless pace of technological innovation, especially in artificial intelligence and machine learning. This dynamic forces constant evolution to maintain market position.

Competitors are pouring substantial resources into AI-driven solutions spanning recruitment, talent management, payroll automation, and sophisticated predictive analytics. For instance, in 2024, the global HR tech market was projected to reach over $38 billion, with AI adoption being a key growth driver, compelling all industry participants, including ADP, to invest heavily in R&D to enhance their platforms and remain competitive.

The global Human Capital Management (HCM) software market is a significant arena, with projections indicating robust growth. This expansion naturally fuels intense competition as established players and emerging companies battle for market dominance. For instance, the HCM market was valued at approximately $22.5 billion in 2023 and is expected to reach over $38 billion by 2028, demonstrating a compound annual growth rate (CAGR) of around 11%.

ADP, a major player, operates within this dynamic environment. The sheer size of the total addressable market (TAM) for HCM solutions means that even with its strong presence, there's ample opportunity for rivals to gain traction. This competitive pressure compels companies like ADP to employ aggressive strategies, focusing on client acquisition and upselling existing accounts to maintain and grow their market share.

Pricing Pressure and Feature Commoditization

The HR technology landscape sees increasing competition, particularly as core functionalities like basic payroll mature. This maturity can lead to significant pricing pressure, as more providers enter the market offering similar services. For instance, in 2024, the global HR tech market was projected to reach over $38 billion, with a substantial portion attributed to payroll and benefits administration, areas where differentiation can be challenging.

Competitors frequently employ aggressive pricing strategies or offer bundled solutions to attract customers. This forces established players like ADP to continuously articulate and demonstrate the superior value and seamless integration of their more comprehensive HR suites. The commoditization of basic HR functions means that ADP must highlight its advanced analytics, compliance support, and broader talent management capabilities to justify its pricing and retain market share.

- Intensified Competition: The growing number of HR technology vendors creates a crowded market, especially for foundational services.

- Pricing Sensitivity: Mature HR functionalities, such as basic payroll processing, are susceptible to price wars among competitors.

- Value Proposition: ADP must emphasize the integrated benefits and advanced features of its full-service offerings to counter aggressive pricing from rivals.

Client Retention and Switching Costs as a Barrier

ADP benefits from strong client loyalty, with its Employer Services segment boasting an impressive retention rate of approximately 91%. This high rate suggests that once clients are integrated into ADP's Human Capital Management (HCM) systems, they are less likely to switch.

The significant switching costs involved in migrating complex HCM systems create a substantial barrier for existing clients. These costs can include data migration, retraining staff, and potential disruption to payroll and HR operations, making it economically unfeasible for many to change providers.

- High Client Retention: ADP maintains an average client retention rate of around 91% in its Employer Services segment, demonstrating customer stickiness.

- Switching Cost Barrier: The substantial costs and operational complexities associated with migrating HCM systems discourage clients from switching to competitors.

- Reduced Rivalry Impact: While competitive rivalry to win new clients is intense, high switching costs effectively dampen the impact of this rivalry on ADP's existing customer base.

The competitive rivalry in the HCM market is fierce, driven by numerous players from large enterprises to niche startups. This intense competition, fueled by rapid technological advancements, particularly in AI, compels companies like ADP to continuously innovate and differentiate their offerings to retain and attract clients.

Major competitors such as Workday, Oracle, and SAP SuccessFactors offer comprehensive HCM suites, while mid-market providers like UKG Pro and Paylocity present specialized solutions. The market is further fragmented by smaller firms focusing on specific HR functions, and even basic payroll services from accounting software add to the competitive pressure, especially for small businesses.

The global HR tech market, projected to exceed $38 billion in 2024, sees significant investment in AI-driven solutions, forcing all participants, including ADP, to invest heavily in R&D. This dynamic environment, characterized by aggressive pricing and bundled solutions, necessitates that ADP clearly articulate the superior value and integration of its broader HR suites, highlighting advanced analytics and compliance support to counter commoditization of basic HR functions.

SSubstitutes Threaten

For many small businesses, handling HR and payroll internally using manual processes or basic accounting software presents a viable substitute to sophisticated Human Capital Management (HCM) solutions like those offered by ADP. This approach can be cost-effective for very small operations. For instance, a 2024 survey indicated that approximately 40% of businesses with fewer than 20 employees still manage payroll primarily through spreadsheets or basic accounting tools.

However, as a company scales, the inherent complexities of payroll, tax compliance, benefits administration, and labor laws become significant challenges. The administrative burden and the potential for costly errors or penalties associated with in-house management often outweigh the initial cost savings. This growing complexity drives businesses to seek more robust, integrated HCM solutions, making in-house management a less sustainable substitute for larger or rapidly growing organizations.

Generic business software, like spreadsheets or basic accounting tools, can offer a rudimentary substitute for certain functions of comprehensive Human Capital Management (HCM) platforms. For instance, a small business might manage payroll using a spreadsheet, a function ADP also provides. However, these general solutions lack the depth of features, seamless integration, and regulatory compliance critical for most organizations.

While these basic tools might suffice for the simplest tasks, they fall far short of the specialized capabilities offered by dedicated HCM providers like ADP. These generic options do not offer the robust payroll processing, benefits administration, time tracking, talent management, or compliance reporting that are core to ADP's value proposition. The limitations become particularly apparent as businesses grow and their HR needs become more complex, requiring sophisticated, integrated solutions.

The threat from these substitutes is generally low for mid-sized to large enterprises. While the market for basic software is vast, its utility as a true substitute for a full-suite HCM solution is minimal. ADP's focus on scalability, integration, and compliance in areas like tax filing and labor law adherence creates a significant barrier for generic software to overcome, especially considering that in 2024, businesses are increasingly prioritizing efficiency and risk mitigation through specialized platforms.

Professional Employer Organizations (PEOs) present a significant threat of substitution for ADP's Employer Services segment. These entities co-employ a business's workforce, taking on a comprehensive suite of HR functions like payroll, benefits administration, and compliance. For businesses wanting a deeply integrated, outsourced HR solution, a PEO can be a compelling alternative to ADP's offerings. The PEO market is substantial, with industry reports indicating over 900 PEOs operating in the U.S. and serving more than 200,000 businesses, managing approximately $246 billion in wages as of recent estimates.

Consulting Services and HR Outsourcing

The threat of substitutes for ADP's core Human Capital Management (HCM) software is moderate. Businesses may choose to engage specialized HR consulting firms or dedicated outsourcing providers for specific functions like recruitment, benefits administration, or compliance, rather than adopting a comprehensive HCM suite. These external services can fulfill particular HR needs, acting as substitutes for ADP's advisory or specialized support services, though they generally do not replace the fundamental technology platform for payroll and integrated HR functions.

For instance, in 2024, the HR outsourcing market continued its robust growth, with many companies opting for niche providers. A significant portion of businesses, particularly small to medium-sized enterprises (SMEs), might find it more cost-effective to outsource payroll processing or specific talent acquisition tasks to specialized firms rather than investing in a full-scale HCM solution like ADP's. This can be seen as a viable alternative for companies that have less complex HR needs or are looking for highly specialized expertise in a particular area.

- Niche HR Outsourcing: Specialized firms offering services like payroll processing, benefits administration, or recruitment can be a substitute for integrated HCM platforms for specific functions.

- HR Consulting: External consultants can provide strategic HR advice or operational support, substituting for ADP's advisory services without requiring a full software adoption.

- Cost-Effectiveness for SMEs: Smaller businesses may find it more economical to use standalone outsourcing services for specific HR needs rather than a comprehensive HCM suite.

- Focus on Core Competencies: Companies might outsource non-core HR functions to specialized providers to focus on their primary business operations, indirectly reducing the perceived need for an all-in-one HCM solution.

Emerging Technologies and Niche Solutions

The HR technology landscape is rapidly evolving, with specialized AI tools emerging for recruitment, learning, and employee wellness. These niche solutions can offer a fragmented threat, as companies might choose best-of-breed options over integrated suites, potentially challenging ADP's comprehensive offering, particularly for specific functionalities.

For instance, consider the growth in AI-powered recruitment platforms that can automate candidate sourcing and screening. In 2024, the global AI in HR market was projected to reach significant figures, indicating a strong demand for these specialized tools.

- AI in recruitment: Tools that automate candidate sourcing and screening are gaining traction.

- Specialized L&D platforms: Companies are investing in platforms focused on specific skill development.

- Employee wellness apps: Niche solutions addressing mental and physical health are becoming popular.

- Fragmented adoption: Businesses may integrate multiple specialized tools rather than a single comprehensive suite.

The threat of substitutes for ADP's comprehensive Human Capital Management (HCM) solutions is primarily driven by two categories: in-house management of HR functions and specialized outsourcing providers. While basic in-house management using spreadsheets or accounting software is a viable substitute for very small businesses, its effectiveness diminishes significantly as companies grow due to increasing complexity and compliance risks. For instance, in 2024, around 40% of businesses with fewer than 20 employees still relied on manual or basic tools for payroll.

Professional Employer Organizations (PEOs) represent a more direct substitute, offering a co-employment model that handles a broad spectrum of HR responsibilities. With over 900 PEOs in the U.S. serving more than 200,000 businesses, this segment poses a notable competitive threat. Additionally, niche HR outsourcing firms and HR consultants offer specialized services that can substitute for specific ADP functions, appealing to businesses seeking cost-effectiveness or targeted expertise, particularly within the growing HR outsourcing market of 2024.

The emergence of specialized AI-driven HR tools for recruitment, learning, and wellness also presents a fragmented substitute threat. Companies might opt for best-of-breed solutions over integrated suites, challenging ADP's comprehensive offering. The global AI in HR market's projected growth in 2024 underscores the increasing demand for these specialized, often AI-powered, alternatives.

| Substitute Type | Description | Target Segment | 2024 Relevance/Data Point |

|---|---|---|---|

| In-house Management (Basic Tools) | Manual processes, spreadsheets, basic accounting software for payroll and HR tasks. | Very small businesses (<20 employees) | ~40% of businesses <20 employees used these in 2024. |

| Professional Employer Organizations (PEOs) | Co-employment model handling payroll, benefits, compliance, and other HR functions. | Small to mid-sized businesses seeking comprehensive HR outsourcing. | Over 900 PEOs in U.S., serving >200,000 businesses. |

| Niche HR Outsourcing/Consulting | Specialized firms for payroll, benefits admin, recruitment, or strategic HR advice. | SMEs and companies needing specific HR expertise. | Growing HR outsourcing market in 2024. |

| Specialized AI HR Tools | AI-powered platforms for recruitment, learning & development, employee wellness. | Companies seeking best-of-breed solutions for specific HR functions. | Significant projected growth for AI in HR market in 2024. |

Entrants Threaten

The threat of new companies entering the comprehensive Human Capital Management (HCM) solutions market is generally considered moderate to low. This is largely due to the significant financial hurdles involved.

Building a sophisticated, reliable, and compliant HCM platform, akin to what ADP offers, demands a considerable outlay of capital. This includes substantial investments in cutting-edge technology infrastructure, extensive software development, and continuous research and development efforts. For instance, the growing integration of artificial intelligence (AI) into HCM solutions necessitates ongoing innovation and significant R&D spending, potentially costing millions annually.

New entrants into the payroll and human capital management sector face substantial challenges due to the intricate and dynamic nature of global labor laws, tax codes, and data privacy regulations. Successfully navigating these complexities requires specialized knowledge and significant investment in compliance infrastructure.

ADP's extensive experience and robust systems, which facilitate compliance in over 140 countries, serve as a formidable barrier to entry for potential competitors. This established compliance framework is a critical differentiator, making it difficult for newcomers to match ADP's global reach and regulatory adherence.

For instance, the General Data Protection Regulation (GDPR) in Europe and similar privacy laws worldwide necessitate sophisticated data handling capabilities. Companies entering this market must demonstrate a high level of compliance to gain customer trust and avoid severe penalties, a hurdle ADP has already cleared.

The threat of new entrants in the HR and payroll sector is significantly mitigated by ADP's formidable brand recognition and deeply ingrained trust. Having operated globally for over seven decades, ADP has cultivated a reputation for reliability and expertise, making it difficult for newcomers to gain traction.

Building comparable credibility in a field that handles sensitive payroll and employee data requires substantial time and investment. New competitors must not only offer competitive features but also convince businesses that their operations are as secure and dependable as ADP's, a hurdle that has proven difficult for many in the past.

Network Effects and Ecosystem Development

ADP benefits significantly from powerful network effects. As more clients join and utilize ADP's platform, the value for all users increases due to a larger pool of data and enhanced functionalities. This creates a virtuous cycle where growth begets more growth.

The company has cultivated an extensive ecosystem of partners and seamless integrations with a wide array of business systems, from HR and payroll to benefits administration and financial management. This deep integration makes it challenging for clients to switch away, fostering high customer retention. For instance, ADP's integrations often span across numerous third-party applications critical to daily business operations.

New entrants face a formidable barrier in replicating ADP's established and comprehensive ecosystem. Building a comparable network of integrations and achieving the same level of client adoption and data synergy would require substantial time, investment, and strategic partnerships. The sheer breadth of ADP's integrations, supporting thousands of different software combinations, underscores this difficulty.

- Network Effects: ADP's platform value grows with each additional client and integration, making it more attractive as it scales.

- Ecosystem Stickiness: Deep integrations with numerous business systems create high switching costs for clients, locking them into ADP's services.

- Barrier to Entry: Replicating ADP's vast partner network and seamless integration capabilities presents a significant challenge for potential new competitors.

Talent Acquisition and Retention

New entrants face substantial hurdles in acquiring and retaining the specialized technical talent needed for developing, maintaining, and innovating sophisticated Human Capital Management (HCM) solutions. This demand for skilled professionals is particularly acute in areas like AI-driven payroll processing and advanced HR analytics.

ADP's established market presence and strong brand recognition provide a significant advantage in attracting top-tier talent. For instance, in 2024, ADP was recognized as one of the top employers for tech professionals, enabling them to secure candidates with expertise in cloud computing and data science, crucial for competitive HCM offerings.

- High Demand for Specialized Skills: The HCM sector requires professionals proficient in cloud infrastructure, cybersecurity, AI, and data analytics.

- Competitive Compensation Packages: Established companies like ADP can offer more attractive salary and benefits packages, making it difficult for new entrants to compete.

- Brand Reputation and Career Growth: ADP's long-standing reputation and clear career progression paths are powerful draws for ambitious talent.

- Talent Wars in Tech: The broader tech industry's intense competition for skilled workers further exacerbates the challenge for new HCM players.

The threat of new entrants into the Human Capital Management (HCM) market, particularly for comprehensive solutions like ADP's, is generally low to moderate. This is primarily due to the substantial capital requirements for developing and maintaining sophisticated, compliant platforms. Significant investments in technology, R&D, and navigating complex global regulations create high barriers for newcomers.

ADP's established global compliance infrastructure, covering labor laws and data privacy across 140+ countries, acts as a strong deterrent. For instance, adherence to regulations like GDPR requires robust data handling, a costly undertaking for new entrants. Furthermore, ADP's decades-long brand recognition and cultivated trust make it difficult for new players to gain market acceptance and secure sensitive client data.

Network effects and a deeply integrated ecosystem further solidify ADP's position. As more clients and partners join, the platform's value increases, creating stickiness and high switching costs. Replicating ADP's extensive partner network and seamless integrations across thousands of business systems demands considerable time, investment, and strategic alliances, presenting a significant challenge for emerging competitors.

The competition for specialized talent in areas like AI and data analytics also favors established players like ADP. In 2024, ADP's recognition as a top employer for tech professionals underscores its ability to attract and retain skilled individuals, a crucial advantage in the competitive HCM landscape.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating financial reports from publicly traded companies, industry-specific market research from leading firms, and government economic indicators to provide a comprehensive view of competitive dynamics.