PT Adaro Energy Indonesia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PT Adaro Energy Indonesia Bundle

Uncover the critical external forces shaping PT Adaro Energy Indonesia's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks create both challenges and opportunities for this energy giant. Gain the strategic foresight needed to navigate this dynamic landscape and make informed decisions. Download the full PESTLE analysis now to unlock actionable intelligence and fortify your market strategy.

Political factors

Indonesia's government, particularly under the new presidential term, is pivoting its energy strategy. A key focus is ensuring energy supply for industrial downstreaming projects and developing a robust carbon trading market. Concurrently, the nation reaffirms its commitment to achieving net-zero emissions by 2060, with an ambition to reach this goal even sooner.

However, this ambitious vision is met with a pragmatic adjustment in short-term renewable energy targets. The previously set goal of 23% renewable energy share by 2025 has been recalibrated downwards to a range of 17-19%. Similarly, the target for 2030 has been revised to 19-21%. This recalibration could influence the speed at which diversified energy companies, such as PT Adaro Energy Indonesia, can transition away from coal.

The Indonesian House of Representatives approved significant amendments to the Mining Law in February 2025, with additional refinements introduced in March 2025. These legislative changes are designed to streamline access to the nation's abundant mineral resources, fostering greater domestic processing and value addition.

A key objective of these amendments is to incentivize foreign investment, particularly within the burgeoning green industries sector. This strategic move aims to position Indonesia as a hub for sustainable resource development.

Furthermore, the updated Mining Law places a strong emphasis on domestic market obligations for mining companies. This ensures that a substantial portion of extracted resources serves internal industrial needs before export, supporting national economic growth and self-sufficiency.

Recent legal shifts, notably Law No. 2 of 2025, underscore a strong commitment to prioritizing domestic mineral and coal utilization. This legislation mandates that mining permit holders must fulfill national demand before engaging in exports, directly impacting companies like PT Adaro Energy Indonesia. This policy aims to secure resources for domestic industries.

The law explicitly prioritizes the needs of state-owned enterprises (SOEs) in crucial sectors such as power generation and energy supply. For Adaro, this means a potential shift in sales focus, with a greater obligation to supply domestic power producers, which could influence its export volumes and international sales strategies for coal.

In 2024, Indonesia's domestic coal consumption reached approximately 150 million tonnes, primarily driven by the power sector. Adaro Energy, a significant contributor to this domestic supply, will likely face increased pressure to allocate a larger portion of its production to meet these SOE requirements, potentially impacting its export revenue streams.

Climate Pledges and International Partnerships

Indonesia's commitment to climate action, particularly through the Paris Agreement and the Just Energy Transition Partnership (JETP), signals a strategic shift towards lower-carbon energy sources. The JETP, a multi-billion dollar initiative, aims to facilitate Indonesia's transition away from coal. For instance, the JETP committed an initial US$20 billion in public and private finance towards this goal, with a focus on accelerating renewable energy deployment and improving energy efficiency.

However, the energy landscape in Indonesia remains complex, with ongoing discussions and potential adjustments to coal phase-out timelines creating a degree of uncertainty. While the long-term vision is clear, the pace of implementation and the balance between existing coal infrastructure and new renewable investments are subject to evolving policy signals. This dynamic can influence investor confidence and strategic planning for companies like PT Adaro Energy Indonesia.

These international climate pledges and domestic policy pronouncements directly impact PT Adaro Energy Indonesia's strategic direction. The company is navigating a period where its traditional coal business faces increasing scrutiny, while opportunities in renewable energy and downstream diversification are becoming more prominent. The effectiveness of international partnerships in supporting this transition will be a key factor in shaping Indonesia's energy future.

- Paris Agreement Commitment: Indonesia aims to reduce greenhouse gas emissions by 29% by 2030 compared to a business-as-usual scenario, or 41% with international support.

- JETP Funding: The Just Energy Transition Partnership aims to mobilize a total of US$20 billion in public and private financing over five years to support Indonesia's clean energy transition.

- Energy Mix Goals: Indonesia has set targets to increase the share of renewable energy in its national energy mix, though the exact timelines and the role of coal in the interim are subject to ongoing policy debate.

Regulatory Consistency and Investment Certainty

While Indonesia's government is working to improve regulatory consistency for investors, mixed signals on fossil fuel subsidies and renewable energy goals can create uncertainty. For instance, the ongoing debate around the future of coal power plants, despite stated renewable energy targets, presents a challenge for long-term investment planning in the energy sector.

The political climate in 2024 and into 2025 is heavily influenced by the new administration's economic priorities. There's a clear directive to boost returns from the vital mining sector, which directly impacts companies like PT Adaro Energy Indonesia. Simultaneously, efforts to strengthen the Indonesian Rupiah through more stringent fiscal management will shape the broader economic and regulatory environment.

- Policy Ambiguity: Inconsistent communication regarding energy transition, impacting long-term project viability.

- Fiscal Strengthening: Government focus on maximizing mining sector revenue and currency stability.

- Investment Climate: Reforms aim for predictability, but mixed policy signals can deter foreign direct investment.

The Indonesian government's energy policy is recalibrating, with a focus on downstream industrialization and carbon trading markets, while still aiming for net-zero emissions by 2060. However, short-term renewable energy targets have been adjusted downwards, with the 2025 goal now between 17-19% and 2030 at 19-21%, potentially slowing the transition for companies like Adaro Energy.

Recent amendments to the Mining Law in early 2025 prioritize domestic resource utilization, especially for state-owned enterprises in energy supply. This means Adaro Energy may need to dedicate more coal to domestic power generation, impacting its export strategy. In 2024, Indonesia consumed around 150 million tonnes of coal domestically, with Adaro being a key supplier.

Indonesia's international climate commitments, including the Paris Agreement (aiming for 29% emissions reduction by 2030) and the Just Energy Transition Partnership (mobilizing $20 billion for clean energy), highlight a move towards lower-carbon sources. Despite these pledges, policy signals around coal phase-out timelines remain somewhat uncertain, creating a complex operating environment for energy firms.

The political landscape in 2024-2025 emphasizes maximizing mining sector revenue and fiscal strengthening, which could lead to increased government oversight and domestic resource allocation mandates for companies like Adaro Energy. While reforms aim for investment predictability, mixed policy signals on fossil fuels versus renewables can create investor uncertainty.

What is included in the product

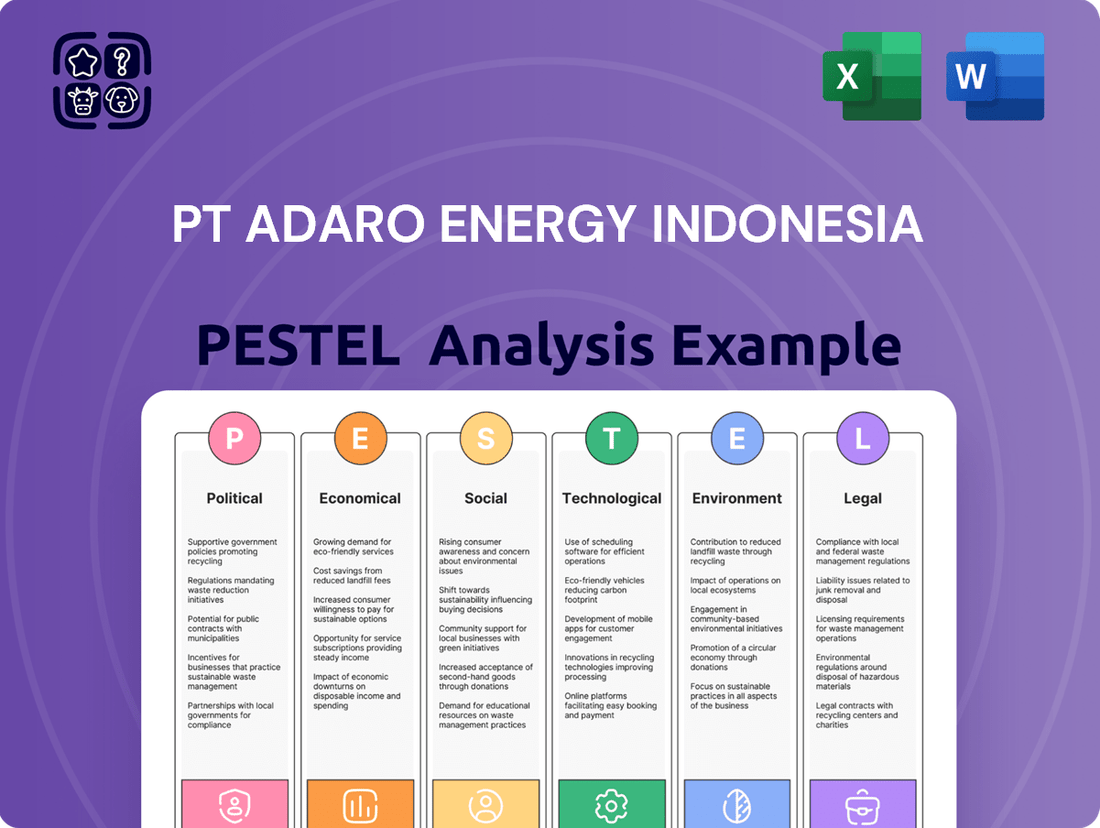

This PESTLE analysis of PT Adaro Energy Indonesia explores how political stability, economic growth, social trends, technological advancements, environmental regulations, and legal frameworks shape its operational landscape.

It provides a comprehensive overview of external factors, identifying potential risks and strategic opportunities for the company's future growth.

A concise, PESTLE analysis for PT Adaro Energy Indonesia provides a clear overview of external factors, acting as a valuable tool to proactively address potential challenges and inform strategic decision-making.

Economic factors

Global coal prices have experienced significant volatility. Despite robust demand in 2024, a general weakening trend has emerged, directly impacting PT Adaro Energy Indonesia's revenue as a major producer. This fluctuation underscores the sensitivity of Adaro's financial performance to external market forces.

Looking ahead to 2025, global coal demand is anticipated to hold steady. However, the persistence of price swings remains a key concern, posing potential challenges to Adaro Energy's profitability and its operational EBITDA margins. Careful management of these market dynamics will be crucial for sustained financial health.

PT Adaro Energy Indonesia is strategically shifting its business focus, aiming to move away from thermal coal by 2030. This transition involves substantial capital investment as Adaro diversifies into metallurgical coal, a growing metals business centered around an aluminum smelter, and significant expansion into large-scale hydropower projects.

This diversification is designed to build a more resilient and balanced business portfolio, lessening the company's reliance on a single commodity. For instance, in 2023, Adaro announced a partnership to develop a green industrial park with a focus on aluminum smelting, signaling a tangible step in this new direction.

The financial commitment for these diversification efforts is considerable, reflecting the long-term vision. Adaro's investment in new ventures, such as the planned hydropower projects, underscores the capital-intensive nature of this strategic pivot, aiming for sustainable growth beyond its traditional coal operations.

Inflation and interest rates in Indonesia significantly shape PT Adaro Energy Indonesia's operating expenses and its ability to secure funding for expansion. While the precise effects on Adaro aren't explicitly stated, a predictable economic climate is vital for its substantial industrial undertakings.

Indonesia's inflation rate stood at 3.02% year-on-year in April 2024, a slight increase from 3.05% in March 2024, according to Statistics Indonesia. The benchmark interest rate, BI Rate, was maintained at 6.25% as of April 2024 by Bank Indonesia, signaling a cautious approach to monetary policy.

Domestic Energy Demand and Industrialization

Indonesia's economy is on a growth trajectory, fueled by a rising population and increasing industrial activity. This expansion naturally translates into a higher demand for energy. Coal remains a cornerstone of this demand, especially for powering the nation's steam power plants, which are crucial for meeting electricity needs. Adaro Energy, as a major coal producer, benefits significantly from this consistent domestic market, which offers a stable foundation for its operations amidst the broader global energy transition efforts.

The ongoing industrialization means sectors like manufacturing and infrastructure development will continue to rely heavily on energy. For instance, in 2023, Indonesia's industrial sector was a significant contributor to its GDP growth. This sustained domestic consumption underpins Adaro's business model, providing a predictable revenue stream. Despite global shifts towards renewables, the immediate future still sees a substantial role for coal in powering Indonesia's development.

- Indonesia's population is projected to reach over 278 million by 2025, driving increased energy consumption.

- Coal accounted for approximately 60% of Indonesia's primary energy mix in recent years, highlighting its continued importance.

- The Indonesian government aims to increase the share of renewable energy to 23% by 2025, but coal's dominance in the near-term is undeniable.

- Adaro Energy reported significant domestic sales volumes in its 2023 financial results, underscoring the strength of its home market.

Foreign Investment and Green Industries

The Indonesian government is actively promoting foreign investment, with a specific focus on developing its green industries and enhancing mineral processing capabilities. This strategic push aims to boost economic growth and value addition within the country.

Adaro Energy Indonesia's strategic diversification into sectors such as aluminum smelting and hydropower directly supports these national objectives. By aligning with government priorities, Adaro is well-positioned to attract additional foreign capital and forge valuable partnerships.

In 2024, Indonesia continued its efforts to attract foreign direct investment (FDI), with the manufacturing sector, including mineral processing, showing strong interest. For example, FDI in manufacturing reached approximately $17.1 billion in the first half of 2024, underscoring the government's success in this area.

Adaro's expansion into aluminum smelting, a key component of mineral processing, directly benefits from this policy environment. Similarly, investments in hydropower projects contribute to the nation's renewable energy targets, a critical aspect of the green industry initiative.

- Government Incentives: Indonesia offers tax holidays and other incentives for foreign investors in priority sectors like green industries and mineral processing.

- Adaro's Diversification: Adaro's move into aluminum smelting and hydropower aligns with Indonesia's industrialization and renewable energy goals.

- FDI Trends (2024): Indonesia saw significant FDI inflows in manufacturing, signaling positive investor sentiment towards its industrial development agenda.

- Green Industry Focus: The government's commitment to developing green industries encourages investments in sustainable energy and environmentally friendly production processes.

Indonesia's economic growth, projected to be around 5% in 2024 and 5.1% in 2025 according to the World Bank, fuels a consistent domestic demand for energy, particularly coal. This domestic market provides a stable revenue base for PT Adaro Energy Indonesia, even as global coal prices experience volatility. The nation's ongoing industrialization and infrastructure development further solidify the demand for energy resources.

Inflation in Indonesia remained relatively stable, with a year-on-year rate of 3.02% in April 2024, while the benchmark interest rate was held at 6.25% by Bank Indonesia as of April 2024. These economic conditions influence Adaro's operational costs and financing strategies for its ambitious diversification plans.

PT Adaro Energy Indonesia is navigating a strategic shift, divesting from thermal coal by 2030 and investing heavily in metallurgical coal, aluminum smelting, and hydropower. This diversification aligns with Indonesia's goals to boost value addition in mineral processing and expand its renewable energy capacity, aiming for 23% renewables in the energy mix by 2025.

Foreign direct investment in Indonesia's manufacturing sector, including mineral processing, showed strength in 2024, with approximately $17.1 billion in the first half of the year. Adaro's ventures into aluminum smelting and hydropower are well-positioned to capitalize on government incentives and attract further investment, contributing to the nation's green industry development.

| Economic Factor | 2024 Projection/Data | 2025 Projection | Impact on Adaro Energy | Source/Note |

| Indonesia GDP Growth | ~5.0% | ~5.1% | Drives domestic energy demand, supporting stable revenue. | World Bank |

| Indonesia Inflation Rate | ~3.02% (April 2024) | Stable/Moderate | Affects operating costs and investment financing. | Statistics Indonesia |

| BI Rate (Interest Rate) | 6.25% (as of April 2024) | Maintained/Slightly Adjusted | Influences cost of capital for diversification projects. | Bank Indonesia |

| Foreign Direct Investment (FDI) - Manufacturing | ~$17.1 billion (H1 2024) | Continued Inflow | Supports Adaro's diversification into mineral processing and green industries. | Ministry of Investment/BKPM |

| Renewable Energy Target | Target of 23% by 2025 | Target of 23% by 2025 | Adaro's hydropower investments align with national green energy goals. | Indonesian Government |

Preview the Actual Deliverable

PT Adaro Energy Indonesia PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of PT Adaro Energy Indonesia delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain insights into the regulatory landscape, market dynamics, and societal influences shaping Adaro's operations. The file you’re seeing now is the final version—ready to download right after purchase, offering a complete strategic overview.

Sociological factors

Indonesia's push towards an energy transition, focusing on cleaner sources, presents significant societal hurdles. The nation's reliance on coal, a major employer, means a move away from it could lead to job losses in regions heavily dependent on mining. For instance, in 2023, coal mining contributed a substantial portion to Indonesia's employment figures, though specific numbers for direct job displacement due to transition are still emerging.

Ensuring a just transition is paramount. This involves developing strategies to retrain coal industry workers and foster new economic opportunities in renewable energy sectors. The government's commitment to developing geothermal and solar power, as outlined in its 2025 energy targets, aims to absorb some of this workforce, but the scale of retraining and community support required is immense.

Moreover, the social impact extends to community development and economic diversification in coal-reliant areas. Without proactive measures, regions heavily invested in coal could face economic decline and social unrest. Initiatives focused on building local capacity in renewable energy installation and maintenance are crucial for mitigating these risks and ensuring equitable growth.

PT Adaro Energy Indonesia's operations are deeply intertwined with community engagement and land use, particularly in light of evolving regulations. The upcoming 2025 Mining Law amendments are expected to impose more stringent requirements on how land is utilized for mining activities, directly impacting Adaro's operational footprint and expansion plans.

Social responsibility for Adaro necessitates meaningful involvement of local communities and indigenous peoples in their mining endeavors. This includes ensuring fair benefit sharing and respecting traditional land rights, which is becoming increasingly critical for maintaining a social license to operate.

As of early 2024, Adaro's commitment to community development is evidenced by substantial investments in local infrastructure and social programs, aiming to foster positive relationships and mitigate potential conflicts arising from land use. For instance, their community programs in South Kalimantan have focused on education and health, areas directly influenced by the presence of mining operations.

The Indonesian labor market is undergoing a significant transformation, driven by technological advancements and the energy transition. PT Adaro Energy Indonesia, like many in the sector, faces the challenge of equipping its workforce with skills relevant to more technologically advanced mining operations and burgeoning renewable energy projects. This shift necessitates a proactive approach to identifying and addressing skill gaps.

To navigate these evolving labor market dynamics, Adaro must prioritize investment in comprehensive training and development programs. Such initiatives are crucial not only for ensuring a capable workforce that can operate new technologies effectively but also for fostering positive labor relations by demonstrating commitment to employee growth. For instance, by 2025, the demand for specialized skills in areas like data analytics for mine optimization and renewable energy project management is projected to rise significantly, impacting operational efficiency.

Public Perception and ESG Expectations

Public perception and expectations around Environmental, Social, and Governance (ESG) performance are significantly shaping the operational landscape for companies like PT Adaro Energy Indonesia. There's a growing demand from both the public and investors for greater accountability regarding environmental impact, social responsibility, and corporate governance. This scrutiny is particularly intense for companies heavily reliant on fossil fuels, such as coal mining.

Adaro's strategic initiatives to diversify its energy portfolio and its stated commitments to reducing greenhouse gas emissions are therefore paramount. These efforts are not just about compliance but are critical for maintaining its social license to operate. Successfully navigating these expectations is key to attracting and retaining responsible investment in the evolving energy sector. For instance, in 2023, Adaro announced plans to develop new renewable energy projects, signaling a shift in response to these ESG pressures.

- Increased Investor Demand for ESG: Global sustainable investment assets are projected to reach $50 trillion by 2025, highlighting the financial imperative of strong ESG credentials.

- Public Scrutiny on Emissions: Coal companies face mounting pressure from environmental groups and the public regarding their carbon footprint, with events like COP28 in late 2023 emphasizing the need for a global energy transition.

- Adaro's Diversification Strategy: Adaro aims to increase the contribution of non-coal revenues to 50% by 2025, a move directly addressing ESG concerns and public perception.

- Social License to Operate: Maintaining community trust and support is vital, especially in regions where mining operations are concentrated, influencing long-term operational stability.

Regional Disparities and Development

Economic development stemming from mining activities, such as those undertaken by PT Adaro Energy Indonesia, can inadvertently widen regional disparities. While large-scale operations generate significant revenue, benefits may not always trickle down evenly to all local communities, leading to uneven growth patterns across different regions within Indonesia. This unevenness is a common sociological challenge in resource-rich nations.

Government initiatives are increasingly focused on mitigating these disparities by creating opportunities for smaller, local businesses and stakeholders. These policies often aim to ensure that the economic gains from mining are more broadly distributed, fostering inclusive growth. For instance, policies might encourage local content in supply chains or provide easier access to capital for regional enterprises.

The potential inclusion of religious groups and universities in mining ventures reflects a strategic effort to enhance social equity and broaden the base of economic participation. By involving diverse societal segments, there's an aim to create a more equitable distribution of mining revenues and foster community development through education and local religious institutions. This approach seeks to address historical imbalances and promote social cohesion.

- Regional Disparities: Mining's economic impact can lead to uneven development across different Indonesian regions, with some areas benefiting more than others.

- Government Intervention: Policies are being implemented to support smaller, local players in the mining sector to ensure broader economic benefit distribution.

- Social Equity Focus: Initiatives to involve religious groups and universities in mining reflect a drive for greater social equity and wider economic participation.

- Inclusive Growth: These efforts aim to channel mining revenues into community development, education, and local enterprises, fostering more balanced regional progress.

Societal expectations for corporate responsibility are intensifying, pushing companies like PT Adaro Energy Indonesia to demonstrate tangible contributions beyond core operations. As of early 2024, community development programs remain a focal point, with investments in education and health infrastructure in areas like South Kalimantan aiming to build goodwill and secure a social license to operate. The Indonesian government's continued emphasis on a just energy transition by 2025 also means societal acceptance of new energy sources, like solar and geothermal, is crucial for companies like Adaro shifting their portfolios.

The evolving Indonesian labor market, influenced by technological advancements and the energy transition, presents both challenges and opportunities for Adaro. By 2025, there's a projected rise in demand for specialized skills in areas such as data analytics for mine optimization and renewable energy project management. Adaro's commitment to upskilling its workforce through comprehensive training programs is vital for adapting to these changes and maintaining operational efficiency.

Public and investor demand for strong Environmental, Social, and Governance (ESG) performance is a significant driver for PT Adaro Energy Indonesia's strategic decisions. Adaro's aim to increase non-coal revenues to 50% by 2025 is a direct response to these pressures, signaling a commitment to diversification and reduced environmental impact, which is increasingly critical for attracting responsible investment.

| Sociological Factor | Description | Relevance to Adaro Energy Indonesia | Data Point/Target |

|---|---|---|---|

| Energy Transition & Employment | Societal acceptance and impact of shifting from fossil fuels to renewables on employment. | Potential job displacement in coal regions, need for retraining workforce for new energy sectors. | Adaro aims for 50% non-coal revenue by 2025. |

| Community Development & Social License | Maintaining positive relationships with local communities and ensuring equitable benefit sharing. | Crucial for operational stability, especially in areas with concentrated mining. | Adaro's community programs focus on education and health in South Kalimantan. |

| Labor Market Evolution | Adapting workforce skills to technological advancements and the energy transition. | Need for upskilling in areas like data analytics and renewable energy project management. | Projected rise in demand for specialized skills by 2025. |

| ESG Expectations | Increasing investor and public demand for strong environmental, social, and governance performance. | Drives diversification strategies and emissions reduction commitments. | Global sustainable investment assets projected to reach $50 trillion by 2025. |

Technological factors

Indonesia's mining sector is rapidly embracing digitalization and Mining 4.0 principles, integrating advanced technologies such as artificial intelligence, the Internet of Things (IoT), and big data analytics. This shift is aimed at significantly boosting operational efficiency, lowering costs, and elevating safety standards across the industry.

PT Adaro Energy Indonesia Tbk can strategically capitalize on these technological advancements. By implementing predictive maintenance powered by AI, optimizing logistics through intelligent route planning, and utilizing real-time monitoring systems, Adaro can achieve substantial improvements in its operational performance and cost management.

For instance, in 2024, many mining operations globally reported a 15-20% increase in productivity and a 10-15% reduction in operational expenses after adopting key Mining 4.0 technologies. Adaro's investment in these areas is expected to yield similar, if not greater, benefits in the Indonesian context, enhancing its competitive edge.

Indonesia is rapidly advancing its renewable energy sector, boasting substantial potential in solar, wind, and hydropower. The government's commitment is evident in policies aimed at increasing renewable energy's share in the national mix. For instance, by the end of 2023, Indonesia's installed renewable energy capacity reached approximately 12.5 gigawatts, with solar and hydro contributing significantly.

PT Adaro Energy Indonesia is strategically positioning itself within this technological shift. The company is actively investing in renewable energy projects, notably a large-scale hydropower project and solar power plants designed to support its own operational needs. This move not only diversifies Adaro's energy portfolio but also enhances its energy generation capabilities, demonstrating a proactive response to evolving technological landscapes and sustainability demands.

Indonesia's energy strategy, though not specifically detailing Adaro, acknowledges the role of Carbon Capture, Utilization, and Storage (CCUS) for abated fossil fuels, particularly in coal-fired power plants. This technological advancement positions CCUS as a crucial factor for Adaro to consider in mitigating emissions from its existing coal infrastructure as the nation pursues decarbonization goals.

The increasing global focus on climate action and the potential for carbon pricing mechanisms in the future make CCUS a significant technological consideration for Adaro's long-term operational viability. For instance, by 2025, many countries are expected to have stricter emissions standards, making the adoption of such technologies financially imperative for continued operation of coal assets.

Advanced Processing and Downstreaming Technologies

Indonesia's government is strongly encouraging downstream processing within its mining sector, aiming to boost the value derived from raw materials. This strategic push is evident in initiatives like Adaro Energy Indonesia's significant investment in advanced processing technologies.

Adaro is constructing a major aluminum smelter, a clear demonstration of its commitment to moving up the industrial value chain. This project is designed to process raw bauxite into higher-value aluminum, which is crucial for supporting the burgeoning domestic electric vehicle (EV) battery industry. The smelter is expected to be a key component in Indonesia’s plan to become a regional hub for EV battery production, leveraging its mineral resources.

- Investment in Aluminum Smelter: Adaro's aluminum smelter project, with an estimated investment of around USD 4 billion, is a cornerstone of its downstreaming strategy.

- Capacity and Output: The smelter is projected to have an annual production capacity of 500,000 tons of aluminum once fully operational, significantly contributing to domestic supply.

- EV Battery Link: Aluminum is a critical component in EV battery casings and other lightweight structures, aligning Adaro's downstream efforts directly with the government's EV ecosystem development goals.

- Value Addition: By processing bauxite into aluminum, Adaro aims to capture more value domestically, moving beyond simple resource extraction and enhancing Indonesia's industrial competitiveness.

Energy Efficiency Technologies

Improving energy efficiency is central to Indonesia's energy transition and climate pledges. For PT Adaro Energy Indonesia, embracing these technologies in its mining and processing can unlock significant cost savings. This focus aligns with global sustainability trends and supports Adaro's environmental, social, and governance (ESG) objectives.

Adaro's commitment to efficiency is evident in its ongoing efforts. For instance, in 2023, the company reported a reduction in its energy intensity per tonne of coal produced, a testament to its operational improvements. The adoption of advanced machinery and optimized operational processes are key drivers of this progress.

- Adaro's 2023 energy intensity reduction contributed to lower operational expenditures.

- Investment in modern mining equipment enhances fuel efficiency and reduces emissions.

- Process optimization in coal handling and preparation minimizes energy waste.

PT Adaro Energy Indonesia is strategically integrating digital technologies like AI and IoT to enhance operational efficiency and safety, mirroring global Mining 4.0 trends. This adoption is crucial for staying competitive in a sector increasingly driven by data and automation.

The company's significant investment in an aluminum smelter, costing approximately USD 4 billion and targeting 500,000 tons annual production, exemplifies its move towards downstream processing and value addition. This aligns with Indonesia's push to bolster its industrial base, particularly for the burgeoning electric vehicle (EV) battery sector.

Adaro is also diversifying into renewable energy, investing in hydropower and solar projects to support its operations and contribute to Indonesia's energy transition goals. By the close of 2023, Indonesia's renewable capacity reached about 12.5 GW, showcasing the nation's commitment to cleaner energy sources.

Furthermore, exploring Carbon Capture, Utilization, and Storage (CCUS) technologies is becoming vital for mitigating emissions from existing fossil fuel assets, a consideration as global emissions standards tighten, with many countries expected to implement stricter regulations by 2025.

| Technological Factor | Description | Adaro's Action/Implication | Relevant Data/Context |

| Digitalization & Mining 4.0 | Integration of AI, IoT, Big Data for efficiency and safety. | Adaro can leverage these for predictive maintenance and logistics optimization. | Global mining operations saw 15-20% productivity increase post-adoption in 2024. |

| Downstream Processing | Processing raw materials into higher-value products. | Adaro's USD 4 billion aluminum smelter project (500,000 tons/year capacity). | Supports Indonesia's EV battery ecosystem development. |

| Renewable Energy Integration | Shift towards cleaner energy sources. | Adaro's investments in hydropower and solar power plants. | Indonesia's renewable capacity reached ~12.5 GW by end of 2023. |

| Carbon Capture Technologies | Mitigating emissions from fossil fuels. | Consideration for existing coal infrastructure amid decarbonization efforts. | Anticipated stricter emissions standards globally by 2025. |

Legal factors

Law No. 2 of 2025, the fourth amendment to the Mineral and Coal Mining Law (UU Minerba), significantly reshapes the Indonesian mining landscape. This crucial legislation impacts licensing, land utilization, and the extension of existing mining contracts. The amendments are designed to bolster legal certainty for mining operations and encourage the growth of the domestic industry.

Furthermore, the revised UU Minerba emphasizes the adoption of sustainable mining practices. This focus is intended to ensure that companies operating within Indonesia adhere to stricter environmental and social responsibility standards. For PT Adaro Energy Indonesia, these changes mean adapting operational strategies to align with the new legal framework, potentially affecting long-term resource management and expansion plans.

New environmental regulations, like Presidential Regulation No. 77 of 2024, are pushing coal mining companies to speed up land restoration efforts. This means permit holders must accelerate the development of their nursery facilities, crucial for replanting, and submit self-assessment reports by February 2025.

Failure to comply with these new directives carries the risk of administrative sanctions, impacting operational continuity and potentially financial performance. For PT Adaro Energy Indonesia, this necessitates a proactive approach to environmental management and reporting.

The new Indonesian Mining Law (Law No. 3 of 2020) mandates that holders of mining business licenses, including IUP and IUPK, must fulfill domestic market needs before engaging in exports. This legislation explicitly prioritizes the utilization of minerals and coal within Indonesia, potentially affecting PT Adaro Energy Indonesia's sales strategy and the volume of coal available for international markets.

This legal framework requires Adaro Energy to allocate a portion of its production to meet domestic demand, with a particular emphasis on state-owned enterprises. For instance, in 2023, Adaro reported that its domestic sales volume reached 19.9 million tons, demonstrating its commitment to fulfilling these obligations amidst evolving regulations.

The enforcement of the Domestic Market Obligation (DMO) could lead to adjustments in Adaro's export volumes, potentially impacting revenue streams if export prices are significantly higher than domestic prices. The company's ability to navigate these requirements while maintaining profitability will be crucial, especially as global energy demand and prices fluctuate.

Carbon Pricing Mechanisms and Regulations

Indonesia has actively implemented carbon pricing mechanisms, notably launching the Indonesia Carbon Exchange (IDXCarbon) in September 2022. The nation also expanded its Emissions Trading System (ETS) to encompass coal-fired power plants, a critical sector for PT Adaro Energy Indonesia. Furthermore, a carbon tax is on the horizon, signaling a comprehensive regulatory approach to emissions reduction.

These evolving regulations directly impact Adaro by introducing new compliance obligations and potential financial liabilities tied to its carbon footprint. For instance, the ETS for coal plants, which began with pilot projects in 2021 and expanded, necessitates monitoring, reporting, and potentially purchasing emission allowances if emissions exceed set caps. The anticipated carbon tax, with rates potentially around IDR 30,000 per ton of CO2 equivalent in its initial phase, could add significant operational costs.

- IDXCarbon Launch: Indonesia's carbon exchange, IDXCarbon, commenced trading in September 2022, facilitating the buying and selling of carbon credits.

- ETS Expansion: The Emissions Trading System has been extended to cover coal power plants, creating a framework for regulated emissions.

- Carbon Tax Implementation: A carbon tax is being introduced, with initial proposals suggesting rates of approximately IDR 30,000 per ton of CO2 equivalent.

- Compliance Costs: Adaro faces potential increases in operating expenses due to the need to comply with these carbon pricing mechanisms and regulations.

Foreign Ownership and Investment Rules

While the 2020 amendment to Indonesia's mining laws relaxed the mandatory 10-year divestment timeline for foreign mining companies, foreign ownership remains a key legal factor for PT Adaro Energy Indonesia. This change allows for greater flexibility in structuring international partnerships, but foreign investors still need to navigate existing regulations regarding equity stakes and operational control within the Indonesian mining sector.

The Indonesian government continues to encourage foreign investment, but specific sectors, including mining, may have varying requirements for local participation or ownership percentages. These rules are subject to periodic review and potential adjustments by the Ministry of Energy and Mineral Resources.

- Divestment Flexibility: The removal of the strict 10-year divestment deadline in 2020 provides foreign investors with more strategic options for their holdings in Indonesian mining operations.

- Regulatory Oversight: Foreign ownership in the mining sector is still governed by laws administered by the Ministry of Energy and Mineral Resources, requiring adherence to specific guidelines.

- Investment Climate: Understanding these evolving foreign ownership rules is crucial for attracting and managing international capital for mining projects in Indonesia.

- Local Partnership Emphasis: While direct ownership flexibility has increased, the underlying principle of fostering local economic benefit often translates into continued emphasis on local partnerships or joint ventures.

Indonesia's legal framework for mining, particularly Law No. 2 of 2025, mandates adherence to domestic market obligations (DMO) and promotes sustainable practices, directly influencing PT Adaro Energy Indonesia's sales strategy and operational planning. For instance, Adaro fulfilled a domestic sales volume of 19.9 million tons in 2023, showcasing its compliance with these regulations. The nation's push towards carbon pricing, including the Indonesia Carbon Exchange (IDXCarbon) and an expanded Emissions Trading System for coal power plants, introduces compliance costs and potential financial liabilities for Adaro, with a carbon tax anticipated around IDR 30,000 per ton of CO2 equivalent. Furthermore, while 2020 amendments offer more flexibility in foreign ownership timelines, adherence to Ministry of Energy and Mineral Resources guidelines remains critical for international investment in the sector.

| Legal Factor | Impact on Adaro Energy | Relevant Data/Regulation |

|---|---|---|

| Domestic Market Obligation (DMO) | Prioritizes domestic sales, potentially impacting export volumes and revenue. | Adaro's domestic sales in 2023: 19.9 million tons. |

| Carbon Pricing & Taxation | Introduces compliance costs and financial liabilities related to emissions. | IDXCarbon launched Sep 2022; Carbon tax proposed ~IDR 30,000/ton CO2e. |

| Foreign Ownership Rules | Offers flexibility but requires adherence to Ministry regulations. | 2020 amendment relaxed 10-year divestment, but oversight by Ministry of Energy & Mineral Resources continues. |

Environmental factors

Indonesia has committed to ambitious climate goals, aiming for net-zero emissions by 2060, or potentially sooner, aligning with its Paris Agreement pledges and the Just Energy Transition Partnership (JETP). These targets signal a clear direction for the nation's environmental policy.

Despite these commitments, coal continues to be a cornerstone of Indonesia's energy landscape, contributing significantly to the country's power generation. This reliance presents a complex challenge in balancing development needs with emission reduction efforts.

Concerns persist regarding the increasing emissions from off-grid coal power plants, which may not be fully captured by national reporting frameworks. This highlights a critical area for policy scrutiny and enforcement to ensure comprehensive emission control.

New environmental regulations, particularly Presidential Regulation No. 77 of 2024, are significantly impacting mining operations in Indonesia. These regulations require mining permit holders, including PT Adaro Energy Indonesia, to accelerate their land reclamation efforts and develop nursery facilities by December 2025.

Adaro Energy must adapt to these stricter environmental mandates to address land degradation and promote biodiversity. Failure to comply could result in penalties and reputational damage, underscoring the critical need for proactive environmental stewardship.

The company's commitment to these obligations is crucial for its long-term sustainability and social license to operate. For instance, Adaro's 2023 Sustainability Report highlighted ongoing reforestation programs, though the new regulations will demand a more intensified and measurable approach to nursery development and seedling deployment.

Mining operations, especially coal extraction like that undertaken by PT Adaro Indonesia, inherently involve significant water usage and the potential for water pollution. Effective water management is therefore paramount to minimize environmental impact and comply with stringent regulations. While specific 2024/2025 data for Adaro's water management initiatives isn't readily available in the provided context, the broader mining industry is increasingly focusing on closed-loop water systems and advanced treatment technologies to reduce discharge and reuse water. For instance, global mining companies are investing heavily in desalination and advanced filtration to meet water quality standards, a trend likely to influence Adaro's operational strategies.

Diversification into Renewable Energy and Green Initiatives

PT Adaro Energy Indonesia is actively diversifying its portfolio into renewable energy sources, reflecting a strategic shift towards sustainability. The company's investment in a groundbreaking aluminum smelter powered by hydropower in North Kalimantan signifies a commitment to reducing its carbon footprint and embracing greener industrial processes. This ambitious project, with an estimated investment of around US$2 billion, is designed to leverage the region's significant hydropower potential.

This diversification is not just about new energy sources; it's a direct response to global decarbonization trends and increasing pressure for environmentally responsible operations. By integrating renewable energy into its core business, Adaro aims to align with broader national and international climate goals, potentially enhancing its long-term value proposition.

- Hydropower Investment: Adaro is developing significant hydropower capacity to support its industrial ventures, including the aluminum smelter.

- Solar Power Exploration: The company is also exploring opportunities in solar power generation as part of its renewable energy strategy.

- Carbon Footprint Reduction: These initiatives are directly aimed at lowering the company's overall greenhouse gas emissions.

- Alignment with Global Trends: Diversification into renewables positions Adaro to benefit from the growing demand for green energy and sustainable business practices.

Impact of Coal Consumption and Production

Despite increasing global pressure for a transition away from fossil fuels, global coal demand, particularly in Indonesia, remains robust. This sustained demand is primarily fueled by industrial activities and the critical need for electricity generation. In 2023, Indonesia's coal production reached approximately 688 million tonnes, underscoring its continued importance in the energy mix.

As a major coal producer, PT Adaro Energy Indonesia navigates the complex landscape of meeting this ongoing demand while confronting heightened environmental scrutiny. The company faces the significant challenge of balancing its operational output with the growing imperative to adopt sustainable practices and mitigate its environmental footprint.

- Sustained Demand: Global coal consumption, including in Indonesia, remains significant due to industrial and power generation needs.

- Production Volume: Indonesia produced around 688 million tonnes of coal in 2023, highlighting the sector's scale.

- Environmental Scrutiny: Adaro, as a leading producer, must address increasing environmental concerns and regulations.

- Sustainability Imperative: Balancing production with sustainable practices is a key challenge for Adaro.

Indonesia's commitment to net-zero emissions by 2060, or sooner, underpins its environmental policy, yet coal remains a significant energy source, creating a balancing act. New regulations, like Presidential Regulation No. 77 of 2024, mandate accelerated land reclamation and nursery development by December 2025 for mining permit holders, including Adaro Energy.

Adaro Energy is actively diversifying into renewables, notably investing around US$2 billion in a hydropower-powered aluminum smelter in North Kalimantan, signaling a strategic move to reduce its carbon footprint and align with green industrial trends.

The company must adapt to stricter environmental mandates, focusing on water management and reclamation, while navigating sustained global coal demand, which saw Indonesian production reach approximately 688 million tonnes in 2023.

PT Adaro Energy Indonesia's environmental performance is increasingly scrutinized, requiring proactive adaptation to regulations and a demonstrated commitment to sustainability, including intensified nursery development and seedling deployment as highlighted in its 2023 Sustainability Report.

PESTLE Analysis Data Sources

Our PESTLE Analysis for PT Adaro Energy Indonesia is built on a foundation of official government publications, financial reports from reputable institutions like the World Bank and IMF, and up-to-the-minute industry analyses. We meticulously gather data on political stability, economic indicators, technological advancements, and environmental regulations to ensure a comprehensive and accurate overview.