PT Adaro Energy Indonesia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PT Adaro Energy Indonesia Bundle

PT Adaro Energy Indonesia navigates a competitive landscape shaped by powerful forces. Bargaining power of buyers is significant, as large industrial consumers can negotiate favorable terms. The threat of substitutes, particularly from renewable energy sources, is growing, impacting coal's long-term dominance.

The industry faces intense rivalry among existing players, driving down prices and demanding operational efficiency. While the threat of new entrants in the capital-intensive coal sector is moderate, existing players must remain vigilant. Supplier power, though present, is often balanced by the sheer volume of Adaro's operations.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore PT Adaro Energy Indonesia’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Adaro Energy Indonesia, like many in the mining sector, depends on a select group of global manufacturers for its heavy mining equipment and sophisticated technology. These specialized providers often hold considerable sway because there aren't many alternatives for cutting-edge machinery.

The limited number of high-tech suppliers means they can command significant bargaining power, particularly when Adaro needs critical equipment or specific replacement parts. This dependency is amplified by the fact that these machines often require unique maintenance protocols and specialized operator training.

For Adaro, the costs associated with switching suppliers for such specialized equipment are substantial. This includes the expense of integrating new machinery into existing operations and retraining personnel, further solidifying the bargaining power of current, specialized equipment providers.

While PT Adaro Energy Indonesia possesses significant internal infrastructure, including port facilities and railways, its reliance on external logistics providers for certain transportation needs, especially international shipping of bulk commodities, grants these providers a degree of bargaining power. The availability and pricing of these specialized services can influence Adaro's operational efficiency and profitability. For instance, in 2024, global shipping rates for coal experienced fluctuations due to geopolitical events and supply chain pressures, directly impacting Adaro's landed costs for overseas markets.

The coal mining and energy industry, including PT Adaro Energy Indonesia, relies heavily on a specialized and skilled workforce. This includes critical roles like mining engineers, geologists, and experienced heavy equipment operators, all of whom possess expertise that is not easily replicated.

A scarcity of these highly qualified professionals in the market can significantly amplify the bargaining power of labor. When demand for such talent outstrips supply, skilled workers can command higher wages and better benefits, directly impacting Adaro's operational costs and recruitment expenses. In 2023, the global shortage of skilled labor in mining was a recurring theme, with some reports indicating as much as a 15% increase in average wages for specialized roles compared to pre-pandemic levels.

To counter this, Adaro Energy must proactively invest in robust training and development programs. These initiatives are crucial for nurturing in-house talent, upskilling existing employees, and ensuring a consistent pipeline of qualified personnel. Furthermore, effective retention strategies are vital to keep experienced workers engaged and reduce the costly churn associated with frequent recruitment and onboarding.

Land Owners and Regulatory Bodies

The bargaining power of land owners and regulatory bodies significantly influences PT Adaro Energy Indonesia's operations. Access to new mining concessions and the continuation of existing ones depend heavily on securing agreements with landowners and complying with Indonesian government regulations. This is particularly relevant given the recent amendments to Indonesia's Mining Law in 2025, which impose more stringent requirements on land utilization and mining permits, potentially affecting operational continuity and expansion plans for companies like Adaro.

Adaro must cultivate robust stakeholder relationships and maintain rigorous compliance efforts to navigate these dependencies effectively. The ability of regulatory bodies to grant or revoke licenses, coupled with the potential for land disputes or demands from local communities, represents a substantial leverage point. For instance, the cost and time associated with obtaining environmental permits or land acquisition can be substantial, directly impacting project timelines and profitability. As of early 2024, the Indonesian government continued its focus on sustainable mining practices, which could translate into increased compliance costs and scrutiny for existing and future concessions.

- Landowner Agreements: Securing and maintaining favorable terms with local communities and landholders is crucial for uninterrupted mining activities.

- Regulatory Compliance: Adherence to evolving mining laws, environmental standards, and licensing requirements set by the Indonesian government is non-negotiable and can incur significant costs.

- Impact of 2025 Mining Law Amendments: Stricter rules on land use and mining licenses introduced in 2025 necessitate proactive engagement and adaptation by Adaro to mitigate potential operational disruptions.

- Government Influence: The Ministry of Energy and Mineral Resources holds significant power in granting, extending, or revoking mining permits, directly impacting Adaro's long-term operational viability.

Energy Transition Technology Suppliers

As PT Adaro Energy Indonesia diversifies into renewable energy, its reliance on specialized suppliers for technologies like solar panels, wind turbines, and battery storage solutions increases. These suppliers often possess proprietary technologies and operate in markets with limited competition for cutting-edge solutions. This situation grants them significant bargaining power, especially considering the critical nature of their components for Adaro's new hydropower, wind, and solar energy projects.

- Specialized Technologies: Suppliers of advanced solar PV modules, high-efficiency wind turbines, and large-scale battery energy storage systems (BESS) often hold patents and unique manufacturing processes.

- Limited Competition: For certain critical components or the latest generation of renewable energy technology, the number of qualified global suppliers can be relatively small.

- Critical Input Nature: Adaro’s investment in new energy ventures means the performance and reliability of these supplier-provided technologies directly impact the success and operational efficiency of its renewable energy portfolio.

- Global Market Dynamics: The prices and availability of these technologies are subject to global supply and demand, geopolitical factors, and raw material costs, further influencing supplier leverage.

PT Adaro Energy Indonesia faces significant bargaining power from suppliers of specialized mining equipment and technology, as the market for these items is often concentrated among a few global manufacturers. This reliance is compounded by the high costs associated with switching, including integration and training expenses, which can elevate operational expenditures.

The company's dependence on skilled labor, particularly in specialized mining roles, also grants employees considerable leverage. A 2023 industry report highlighted a potential 15% wage increase for skilled mining professionals due to global shortages, directly impacting Adaro’s labor costs and recruitment strategies.

Furthermore, Adaro's renewable energy diversification means it must contend with suppliers of advanced solar, wind, and battery technologies, where proprietary processes and limited competition amplify supplier influence. The success of these new ventures hinges on the reliability and cost-effectiveness of these critical components.

| Supplier Type | Key Dependencies | Impact on Adaro | 2024/2025 Data Point | Mitigation Strategy |

| Heavy Mining Equipment Manufacturers | Specialized machinery, proprietary parts | High acquisition and maintenance costs, operational downtime risk | Limited public data on specific supplier pricing, but industry reports indicate sustained high demand for new equipment in 2024. | Long-term service agreements, strategic partnerships, exploring alternative but compatible equipment options where feasible. |

| Skilled Labor (Engineers, Operators) | Expertise in mining operations and technology | Wage inflation, recruitment challenges, retention costs | Global mining labor shortage continued through 2024, with wage pressures persisting. | Investment in in-house training programs, competitive compensation and benefits, robust employee retention initiatives. |

| Renewable Energy Technology Suppliers | Advanced solar panels, wind turbines, battery storage | Component costs, technology obsolescence, project execution risk | Prices for solar PV modules saw moderate declines in early 2024, but supply chain disruptions for rare earth minerals used in turbines remained a concern. | Diversifying supplier base, long-term procurement contracts, investing in R&D for alternative materials. |

What is included in the product

Tailored exclusively for PT Adaro Energy Indonesia, this analysis delves into the competitive forces shaping its operational environment, from buyer and supplier power to the threat of new entrants and substitutes.

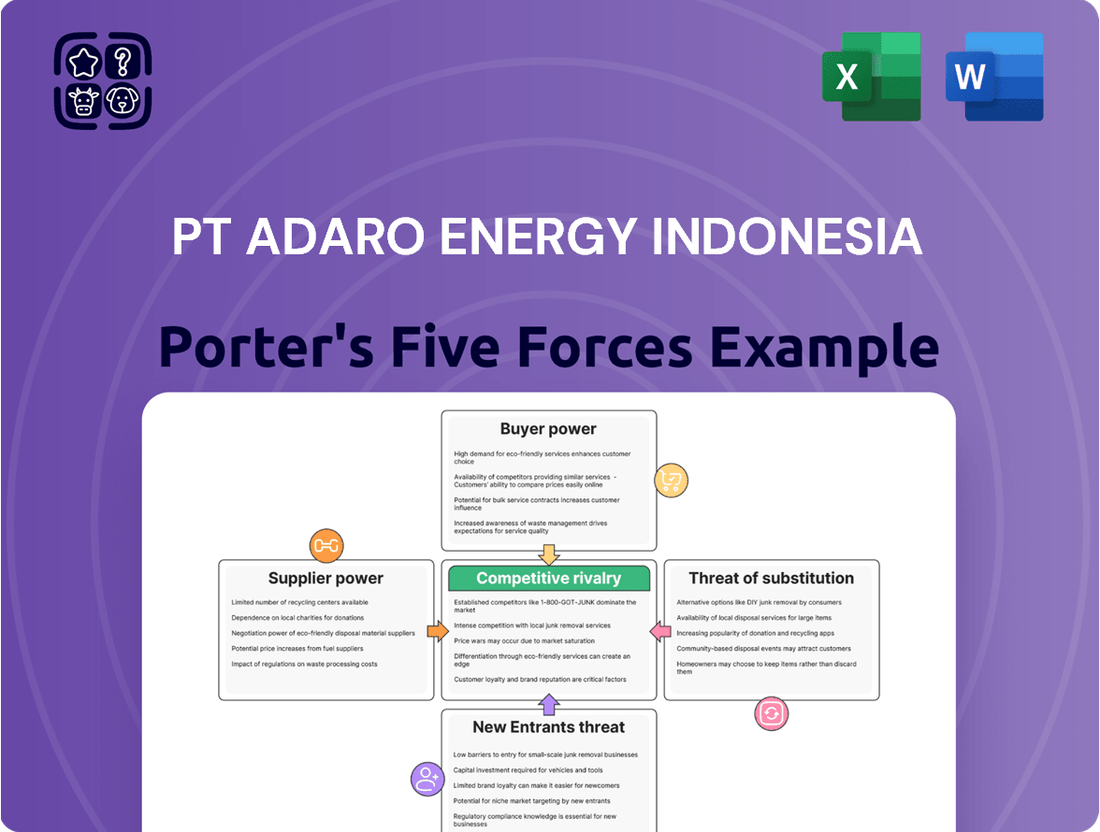

Demystify competitive pressures with a visual breakdown of Adaro Energy's Porter's Five Forces, simplifying complex market dynamics for actionable insights.

Gain clarity on supplier and buyer power, reducing negotiation uncertainty and improving cost management for PT Adaro Energy Indonesia.

Customers Bargaining Power

Adaro's principal customers are major utility firms and industrial entities, both domestically and internationally, who procure coal in substantial quantities. Their significant purchasing influence arises from the sheer volume of their orders and their capacity to negotiate pricing based on prevailing global commodity benchmarks.

These large buyers typically possess numerous supply alternatives, granting them the leverage to exert downward pressure on Adaro's pricing strategies. For instance, a significant portion of Adaro's revenue comes from long-term contracts with utility providers who can switch suppliers if prices become uncompetitive, demonstrating their bargaining clout.

PT Adaro Energy Indonesia operates in a market where coal is largely treated as a commodity. This means that, for many buyers, there's minimal difference between the coal supplied by Adaro and that offered by its competitors. Consequently, price becomes the primary driver in purchasing decisions.

Customers in this sector exhibit high price sensitivity. They are quick to switch to a different supplier if a competitor offers a more attractive price point. This dynamic significantly limits Adaro’s capacity to implement premium pricing strategies, particularly when market conditions are unpredictable.

In 2024, global thermal coal prices experienced fluctuations. For instance, the Newcastle benchmark, a key indicator, saw periods where it traded below $100 per tonne, reflecting this intense price competition. This environment directly impacts Adaro's revenue potential.

Customers can easily source coal from other large producers within Indonesia, or they can look to international markets such as Australia and Russia for supply. This wide array of choices significantly impacts Adaro Energy's bargaining power.

The global coal supply, despite potential regional logistical challenges, offers buyers a multitude of alternative suppliers. This broad availability inherently limits Adaro's ability to dictate terms.

In 2023, Indonesia remained a significant global coal exporter, contributing to the competitive landscape. For instance, Australian thermal coal exports, a key competitor, saw continued demand, reinforcing customer options.

This extensive availability of alternative coal sources directly weakens Adaro's leverage in price negotiations and the ability to set favorable contractual terms, as buyers can readily switch suppliers if conditions are not met.

Long-term Contracts and Market Fluctuations

While long-term contracts offer a degree of predictability for PT Adaro Energy Indonesia, they frequently incorporate price review clauses tied to market benchmarks. This means customers can capitalize on periods of declining coal prices, directly impacting Adaro's revenue stability. For instance, if global coal prices, as tracked by benchmarks like the Newcastle benchmark, experience a significant downturn, customers can push for lower prices on their existing contracts.

In situations characterized by oversupply or diminished demand, customers gain considerable leverage. They can exploit this market imbalance to renegotiate contract terms or even reduce their purchase volumes, thereby limiting Adaro's ability to maintain consistent pricing power over extended periods. This bargaining power is a critical factor affecting Adaro's long-term profitability.

- Price Review Mechanisms: Contracts often include clauses allowing customers to benefit from falling market prices, reducing Adaro's pricing control.

- Leverage in Oversupply: Customers can renegotiate terms or reduce purchases during periods of excess supply, weakening Adaro's position.

- Market Fluctuations Impact: Adaro's pricing power is constrained by its customers' ability to capitalize on market volatility.

- Customer Bargaining Power: The presence of such clauses significantly enhances the bargaining power of Adaro's customers.

Demand for Cleaner Energy and Decarbonization

The increasing global demand for cleaner energy and the urgent push for decarbonization significantly enhance the bargaining power of customers in the energy sector. As environmental concerns grow, buyers are actively seeking alternatives to fossil fuels, putting pressure on coal producers like PT Adaro Energy Indonesia. This shift means customers have more leverage to demand lower prices or to switch to suppliers offering greener alternatives.

Major energy consumers, particularly in key markets like China and India, are implementing policies to reduce their reliance on coal imports. For instance, China's coal consumption growth slowed considerably in 2023, and it continues to prioritize domestic coal production and renewable energy sources. India, while still a significant coal importer, is also increasingly focusing on expanding its renewable energy capacity. These trends directly impact the demand for Adaro's thermal coal exports.

Adaro Energy recognizes this evolving landscape and is strategically positioning itself to mitigate these risks. The company has set an ambitious target to derive 50% of its revenue from non-thermal coal businesses by 2030. This diversification aims to reduce its dependence on thermal coal and tap into the growing demand for cleaner energy solutions. For example, Adaro is investing in projects like renewable energy, aluminum smelting, and green industrial estates, signaling a proactive approach to the energy transition.

- Customer Demand Shift: Growing global pressure for decarbonization empowers customers seeking to reduce their carbon footprint.

- Market Changes: Major buyers like China and India are reducing coal imports in favor of domestic production and cleaner energy.

- Adaro's Response: PT Adaro Energy Indonesia aims for 50% of its revenue from non-thermal coal by 2030 to adapt to market demands.

The bargaining power of customers for PT Adaro Energy Indonesia remains significant due to the commoditized nature of coal and the availability of numerous supply alternatives. Large utility firms and industrial entities, who are Adaro's primary buyers, wield considerable influence because of their substantial order volumes and their ability to negotiate prices based on global benchmarks. This power is amplified when market conditions favor buyers, such as during periods of oversupply or when cleaner energy alternatives gain traction.

In 2024, global thermal coal markets continued to be characterized by price volatility, with benchmarks like the Newcastle index experiencing downward pressure at times, falling below $100 per tonne. This price sensitivity among buyers means they can readily switch suppliers if Adaro's pricing is not competitive. Furthermore, major importing nations like China and India are actively pursuing policies to reduce coal reliance, favoring domestic production and renewables, which further strengthens customer leverage.

Adaro's strategic response includes diversifying its revenue streams, aiming for 50% from non-thermal coal businesses by 2030, acknowledging the shifting energy landscape. This pivot is crucial as customers increasingly prioritize environmental considerations and seek to manage their carbon footprints, enhancing their negotiating position in traditional coal markets.

Same Document Delivered

PT Adaro Energy Indonesia Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces analysis for PT Adaro Energy Indonesia, offering a comprehensive examination of competitive forces within the Indonesian coal mining sector. You'll receive this exact, professionally formatted document immediately after purchase, providing actionable insights into industry rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This detailed analysis is ready for your immediate use, enabling informed strategic decision-making.

Rivalry Among Competitors

The Indonesian coal mining landscape is intensely competitive, with several major integrated energy groups actively vying for dominance. Companies like PT Bukit Asam Tbk. and PT Kideco Jaya Agung are significant players, directly challenging Adaro Energy for market share and valuable contracts. This fierce domestic rivalry is a defining characteristic of the sector, driving down prices and prompting strategic plays for reserves and logistical advantages.

Adaro Energy operates in a highly competitive global coal market. Price volatility, influenced by supply-demand shifts, geopolitical factors, and economic cycles, is a constant. This inherent commodity nature means producers are locked in fierce competition for international markets, directly affecting Adaro's profitability and market standing.

Competitive rivalry within Indonesia's coal sector is significantly shaped by capacity utilization and production levels. Indonesia's coal production reached an impressive 836 million tons in 2024, surpassing initial expectations. However, the government has set a more conservative target of 735 million tons for 2025.

When major players operate at or near full capacity, or ramp up their output, it can flood the market. This increased supply often leads to downward pressure on coal prices, intensifying the competitive battle among producers like PT Adaro Energy Indonesia.

Diversification Strategies of Competitors

Many of Adaro's competitors are also actively diversifying their portfolios, particularly into renewable energy and other non-coal sectors. This mirrors Adaro's own strategic pivot, intensifying the competitive landscape. For instance, by the end of 2023, several major Indonesian coal producers had announced significant investments in solar and hydropower projects, aiming to capture a share of the growing green energy market.

This diversification creates a multi-faceted rivalry. Companies are no longer solely competing on coal production volume and pricing, but also on their ability to secure renewable energy assets, attract green financing, and develop new business models in evolving energy markets. The race for market share in these nascent sectors means that strategic alliances and technological innovation will become increasingly crucial differentiators.

- Renewable Energy Investments: Competitors are channeling capital into solar, wind, and hydro power, seeking to build substantial renewable energy portfolios.

- Shifting Business Models: The focus is moving beyond traditional resource extraction to encompass integrated energy solutions and services.

- Competition for Capital: Companies are vying for investment, both from traditional financial institutions and those focused on ESG (Environmental, Social, and Governance) criteria.

- Talent Acquisition: The demand for expertise in renewable technologies and project development is creating a competitive talent market.

Regulatory Environment and Export Quotas

The Indonesian government's regulatory landscape, particularly concerning coal production and export quotas, is a major force shaping competition for PT Adaro Energy Indonesia. Policies like the Domestic Market Obligation (DMO), which mandates a portion of coal be sold domestically at capped prices, directly impact how much coal can be exported and at what price.

New mining quota rules introduced for the 2024-2025 period are placing a stronger emphasis on compliance and Environmental, Social, and Governance (ESG) commitments. This means companies that can better align their operations with these evolving standards may find themselves in a more advantageous position, potentially securing larger quotas or favorable terms.

These regulatory shifts can create significant competitive advantages or disadvantages. For instance, a player that is already well-positioned to meet stricter ESG requirements might be able to ramp up exports more readily than a competitor facing compliance hurdles, thereby altering market share dynamics.

- Domestic Market Obligation (DMO): In 2024, the Indonesian government maintained the DMO policy, requiring coal producers to supply at least 25% of their production to domestic power plants at a price ceiling of US$70 per tonne.

- New Mining Quota Rules (2024-2025): These rules prioritize companies with strong ESG credentials and a history of regulatory compliance, potentially impacting the allocation of future mining quotas and export permits.

- Export Quota Fluctuations: While specific export quota figures can vary based on global demand and domestic supply needs, policy changes directly influence the volume and value of coal companies can sell internationally.

The competitive rivalry for PT Adaro Energy Indonesia is intense, fueled by both domestic and global market dynamics. Major Indonesian players like PT Bukit Asam and PT Kideco Jaya Agung directly challenge Adaro for market share. Indonesia's coal production hit 836 million tons in 2024, highlighting the scale of competition, though the 2025 target is 735 million tons.

| Metric | 2024 (Est.) | 2025 (Target) |

| Indonesian Coal Production | 836 million tons | 735 million tons |

| Domestic Market Obligation (DMO) | 25% of production | 25% of production |

| DMO Price Ceiling | US$70 per tonne | US$70 per tonne |

SSubstitutes Threaten

The most significant threat to PT Adaro Energy Indonesia comes from the escalating cost-effectiveness and widespread adoption of renewable energy sources like solar, wind, and hydro. Globally, this energy transition is accelerating, directly impacting coal's traditional dominance.

Southeast Asia has ambitious targets, aiming for 23% of its energy mix to come from renewables by 2025, with solar and wind leading this charge. This shift creates a potent substitute for Adaro's core business, particularly its coal-fired power generation segment.

Natural gas, especially in its liquefied form (LNG), presents a significant threat of substitution for coal in the energy sector. As a cleaner-burning fossil fuel, LNG offers lower emissions compared to coal, making it an appealing alternative for electricity generation. This trend is particularly evident in Asia, where LNG is increasingly viewed as a crucial bridging fuel to help nations transition away from coal while still meeting energy demands.

The global LNG market is experiencing robust growth, driven by this shift. For instance, in 2023, global LNG demand reached approximately 404 million tonnes, with projections indicating further increases. This growing availability and environmental advantage of natural gas directly challenge coal's market share, impacting companies like PT Adaro Energy Indonesia, a major coal producer.

Improvements in energy efficiency and demand-side management pose a significant threat to traditional energy sources like coal, impacting companies such as PT Adaro Energy Indonesia. For instance, advancements in building insulation and smart thermostats can drastically cut electricity usage in homes and businesses. Globally, energy efficiency measures are projected to save billions of dollars annually, directly impacting the demand for primary energy. This growing consciousness around energy conservation means less reliance on fossil fuels.

Battery Storage and Grid Modernization

The increasing sophistication of battery storage and grid modernization is a significant threat to traditional energy sources like coal. As these technologies advance, renewable energy, often perceived as intermittent, becomes more dependable and capable of handling larger loads. This shift directly challenges the necessity of baseload power generation, a segment where companies like Adaro Energy Indonesia have historically thrived.

Indonesia is actively investing in its energy infrastructure, including exploring battery components to enhance its storage capacity. This national focus on renewables and storage means a reduced demand for coal as a primary energy source. By 2024, global investment in clean energy technologies continues to surge, making the transition away from fossil fuels more economically viable and strategically attractive.

- Technological Advancements: Battery storage costs have fallen significantly, with lithium-ion battery prices declining by over 85% in the last decade, making grid-scale storage more affordable.

- Grid Modernization: Smart grid technologies improve the integration and management of variable renewable energy sources, increasing their reliability and displacing the need for traditional baseload power.

- Renewable Energy Integration: Enhanced grid capabilities allow for a greater percentage of solar and wind power to be seamlessly incorporated into the energy mix, directly impacting demand for coal.

- National Initiatives: Indonesia's pursuit of battery technology signifies a commitment to diversifying its energy portfolio and reducing reliance on coal, aligning with global decarbonization trends.

Emerging Technologies (e.g., Nuclear, Hydrogen)

Emerging energy technologies like advanced nuclear power and green hydrogen are developing as potential long-term substitutes for coal. While not yet dominant, ongoing innovation could make them cost-competitive and significantly impact coal's market position in the future. Indonesia's 2024-2033 Draft Electricity Supply Business Plan signals an interest in nuclear power, indicating a recognition of these evolving energy landscapes.

The threat from these substitutes is currently moderate but carries significant future potential. Breakthroughs in efficiency and cost reduction for green hydrogen production and small modular reactors (SMRs) could accelerate their adoption. For instance, global investment in green hydrogen is projected to reach hundreds of billions of dollars by 2030, driven by decarbonization efforts.

- Potential for Lower Emissions: Nuclear and green hydrogen offer significantly lower greenhouse gas emissions compared to coal, aligning with global climate goals.

- Technological Advancements: Continuous R&D in areas like hydrogen electrolysis and advanced reactor designs aim to improve efficiency and reduce costs.

- Government Support and Policy: Many governments are actively supporting the development of these technologies through subsidies, tax credits, and regulatory frameworks.

- Growing Market Demand: Increasing corporate and consumer demand for cleaner energy sources creates a favorable environment for these substitutes.

The threat of substitutes for PT Adaro Energy Indonesia primarily stems from the increasing viability and adoption of renewable energy sources and cleaner fossil fuels. As the world moves towards decarbonization, alternatives to coal are becoming more competitive and attractive to consumers and governments alike.

Natural gas, particularly LNG, represents a significant substitute due to its lower emissions profile compared to coal. By 2023, global LNG demand was around 404 million tonnes, underscoring its growing role in the energy mix, especially in Asia, as a bridging fuel. This directly impacts coal's demand in power generation.

Advancements in energy efficiency and battery storage further bolster the threat of substitutes. Improved insulation and smart grid technologies reduce overall energy consumption, while more affordable battery storage makes intermittent renewables more reliable. Indonesia's own investments in battery components signal a move away from fossil fuels, with global clean energy investments surging in 2024.

| Substitute | Key Advantage | Market Trend/Data (as of 2023/2024) | Impact on Coal Demand |

|---|---|---|---|

| Renewable Energy (Solar, Wind) | Zero emissions, falling costs | Southeast Asia targets 23% renewables by 2025. Global clean energy investment rising. | Directly displaces coal in power generation. |

| Natural Gas (LNG) | Lower emissions than coal | Global LNG demand ~404 million tonnes in 2023. Growing use as a bridging fuel. | Competes with coal for baseload and peak power. |

| Energy Efficiency | Reduced energy consumption | Projected to save billions annually globally. | Decreases overall demand for primary energy sources, including coal. |

| Battery Storage | Enhances renewable reliability | Lithium-ion battery costs down >85% in a decade. | Supports renewable integration, reducing need for coal baseload. |

Entrants Threaten

The coal mining and integrated energy sector demands enormous capital outlays. New entrants face the daunting task of funding extensive mining equipment, developing critical infrastructure like ports and railways, and establishing processing facilities. This significant financial hurdle effectively deters many potential competitors.

For instance, the capital expenditure for a new large-scale coal mine, including necessary infrastructure, can easily run into billions of dollars. In 2024, major players like PT Adaro Energy Indonesia continue to invest heavily in maintaining and expanding their operational capacity, further solidifying the high barrier to entry and making it exceptionally challenging for newcomers to achieve comparable economies of scale and cost efficiencies.

The Indonesian mining and energy sectors are indeed a tough nut to crack for new players. Think complex, drawn-out permitting processes, stringent environmental impact assessments, and the sheer headache of acquiring land rights. These aren't minor inconveniences; they are significant barriers to entry.

Adding to this challenge are the recent amendments to the Mining Law, effective in 2025. These updates have tightened the screws even further on land utilization and licensing requirements, making it exceptionally difficult for any newcomer to navigate the system. For instance, obtaining a new mining permit can now take upwards of three to five years, a timeline that deters many potential entrants.

Established companies like PT Adaro Energy Indonesia already possess the necessary licenses and have cultivated long-standing relationships with regulatory bodies and local communities. This existing infrastructure and political capital give them a substantial advantage, making it incredibly hard for new competitors to gain a foothold.

Access to economically viable and high-quality coal reserves is a significant hurdle for potential new entrants in the coal mining industry. Major players, including PT Adaro Energy Indonesia, already control many of the prime locations, limiting opportunities for newcomers. For instance, Adaro's Kalimantan operations boast substantial, long-life reserves, making it difficult for new companies to acquire comparable assets.

Securing new coal concessions is a capital-intensive and complex undertaking. It demands substantial upfront investment for exploration, feasibility studies, and development. Furthermore, these processes often involve navigating competitive government auctions or costly acquisitions of existing tenements, further deterring new entrants. The Indonesian government's approach to granting new mining permits, which often prioritizes established companies with proven track records, adds another layer of difficulty.

Economies of Scale and Cost Advantages of Incumbents

PT Adaro Energy Indonesia Tbk, a major player in the Indonesian coal industry, benefits significantly from established economies of scale. Their extensive operations in mining, processing, and logistics translate into lower per-unit costs, creating a substantial barrier for any new entrants aiming to compete on price. For instance, in 2024, Adaro's robust infrastructure allows for efficient handling of large volumes, a feat difficult and costly for newcomers to replicate.

New entrants would face considerable challenges in matching Adaro's cost advantages. Achieving comparable operational efficiencies requires massive upfront investment in mining equipment, transportation networks, and supply chain management. Without the benefit of Adaro's existing scale, these investments would lead to higher initial production costs, making it exceedingly difficult to undercut established players.

- Economies of Scale: Adaro's large-scale mining and logistical operations significantly reduce per-unit production costs.

- Cost Advantages: Incumbents like Adaro possess inherent cost efficiencies that new entrants struggle to match due to lower initial volumes.

- Procurement Power: Established players can negotiate better prices for raw materials and services due to their purchasing volume.

- Logistical Efficiency: Adaro's developed transportation and distribution networks provide a cost advantage over new, less established supply chains.

Brand Recognition and Established Customer Relationships

While coal is fundamentally a commodity, established energy companies like PT Adaro Energy Indonesia have cultivated significant brand recognition and a proven operational history. This is crucial because new entrants would struggle to replicate Adaro's established trust and long-standing relationships with both domestic and international clientele. Securing crucial long-term contracts becomes a substantial hurdle when competing against a firm with a demonstrated track record.

These deep-seated customer relationships act as a subtle but effective barrier to entry for potential new competitors. For instance, Adaro's consistent supply and quality have fostered loyalty, making it difficult for newcomers to displace them. In 2024, Adaro continued to leverage these relationships, securing significant supply agreements that underscore the difficulty new players face in breaking into the market.

- Brand Loyalty: Adaro's reputation for reliability provides a competitive edge.

- Customer Relationships: Long-term contracts are difficult for new entrants to secure.

- Operational Track Record: Established players have a history of consistent performance.

- Market Trust: Building the same level of trust as Adaro takes considerable time and effort.

The threat of new entrants for PT Adaro Energy Indonesia is significantly low due to substantial capital requirements for mining operations, including equipment and infrastructure, which can amount to billions of dollars. For example, establishing a new large-scale coal mine in 2024 necessitates vast investment, a barrier that PT Adaro Energy Indonesia mitigates through its existing scale and operational efficiencies.

Navigating Indonesia's complex regulatory landscape, including lengthy permitting processes and stringent environmental assessments, poses another significant challenge. Amendments to mining laws, effective from 2025, further tighten licensing, with new permits potentially taking three to five years to secure, deterring potential newcomers.

Established companies like Adaro benefit from secured prime coal reserves and strong relationships with regulators and local communities, creating a formidable barrier for new players attempting to gain a foothold in the market.

PT Adaro Energy Indonesia's established economies of scale translate into lower per-unit costs, making it difficult for new entrants to compete on price, as demonstrated by their efficient handling of large volumes in 2024.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for PT Adaro Energy Indonesia is built upon comprehensive data from the company's annual reports, investor presentations, and official press releases. This is supplemented by insights from reputable industry publications, market research reports, and government energy statistics to provide a robust understanding of the competitive landscape.