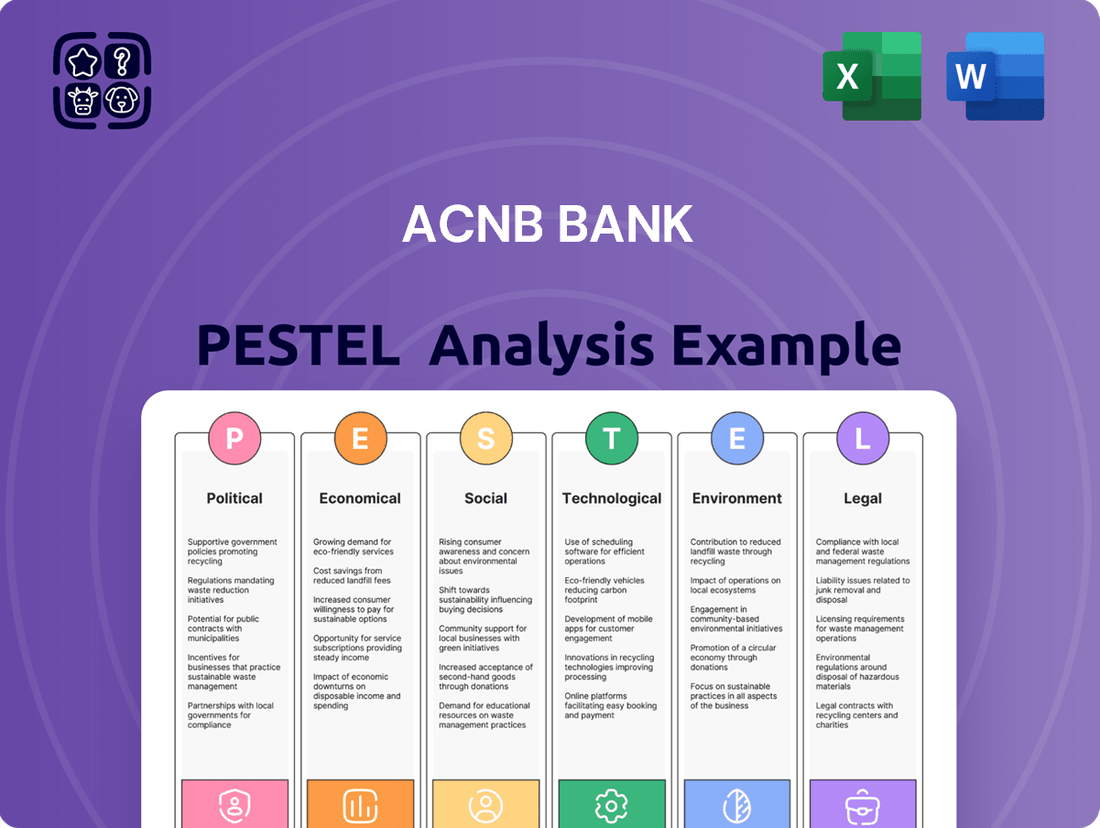

ACNB Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACNB Bank Bundle

Unlock ACNB Bank's strategic future by understanding the intricate web of political, economic, social, technological, legal, and environmental factors influencing its operations. Our comprehensive PESTLE analysis provides crucial insights into these external forces, empowering you to anticipate challenges and capitalize on opportunities. Don't navigate the market blind; gain a competitive edge by downloading the full analysis now and making informed decisions.

Political factors

The banking sector, particularly community banks such as ACNB, is experiencing a significant increase in regulatory oversight and the associated compliance expenses. This trend is a major concern for bank leaders.

Data from industry surveys consistently shows that regulatory burden is now a primary worry for community bank executives, often ranking higher than other identified risks. This heightened attention from both federal and state regulatory bodies demands ongoing adjustments and dedicated investment in robust compliance systems.

Federal Reserve monetary policy directly influences ACNB Bank's financial performance. The Fed's target federal funds rate, currently held between 4.25% and 4.50% as of December 2024, affects borrowing costs and investment yields for the bank.

Anticipation of potential interest rate cuts in 2025 could compress ACNB's net interest margins, as loan revenues may decrease while deposit costs remain sticky. Conversely, lower rates might stimulate loan demand, potentially boosting overall lending volume for the bank.

Changes in leadership at regulatory agencies like the Consumer Financial Protection Bureau (CFPB) can significantly alter the banking landscape. The appointment of Scott Bessent as acting director in February 2025 signals a potential re-evaluation of rules impacting areas such as overdraft fees and digital payment systems. This could lead to new compliance requirements for banks like ACNB.

State-Specific Banking Regulations

ACNB Bank's operational focus on Pennsylvania and Maryland means state-specific banking regulations are a critical political factor. The Pennsylvania Department of Banking and Securities, for instance, is actively shaping the landscape with evolving guidance.

For 2025, new regulations are anticipated concerning digital forgery prevention and updated mortgage disclosure requirements. ACNB Bank must remain agile, ensuring full compliance with these state-level mandates to avoid penalties and maintain operational integrity.

- State-Specific Regulatory Updates: Pennsylvania’s Department of Banking and Securities is expected to implement new rules in 2025 impacting digital transactions and consumer disclosures.

- Compliance Burden: Adhering to varying state laws requires dedicated resources for monitoring, interpretation, and implementation of new banking practices.

- Geographic Concentration Risk: A heavy reliance on Pennsylvania and Maryland exposes ACNB Bank disproportionately to the political and regulatory shifts within these two states.

Geopolitical and Trade Policy Impacts

Broader national and international political developments, including shifts in trade policies and the emergence of geopolitical risks, can introduce significant economic uncertainties that indirectly impact the banking sector. These evolving dynamics can influence lending, investment decisions, and overall market stability for institutions like ACNB Bank.

The Federal Reserve actively monitors these geopolitical and trade policy factors, such as the potential impact of tariffs or international disputes, when formulating its economic outlook and determining monetary policy. For instance, the ongoing trade tensions between major economies in early 2024 continued to be a point of consideration for the Fed, affecting interest rate expectations and the broader financial landscape.

- Trade Policy Uncertainty: Ongoing trade negotiations and potential tariff adjustments can create volatility in global markets, impacting ACNB's corporate clients and their international operations.

- Geopolitical Conflicts: Regional conflicts or political instability in key trading blocs can disrupt supply chains and affect investor confidence, leading to a more cautious lending environment.

- Regulatory Shifts: Changes in international banking regulations or sanctions imposed due to geopolitical events can necessitate adjustments in ACNB's compliance strategies and operational procedures.

ACNB Bank operates within a highly regulated environment, with federal and state authorities like the Federal Reserve and Pennsylvania Department of Banking and Securities imposing stringent rules. Anticipated regulatory shifts in 2025, particularly concerning digital transactions and mortgage disclosures, will require ongoing compliance investments and strategic adjustments. The bank's concentrated geographic footprint in Pennsylvania and Maryland makes it particularly susceptible to state-level political and regulatory changes, potentially impacting its operational costs and strategic direction.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting ACNB Bank, offering a comprehensive view of its external operating environment.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering immediate relief from the burden of extensive research by highlighting key external factors impacting ACNB Bank.

Economic factors

The current interest rate environment directly impacts ACNB Bank's net interest margin (NIM), the crucial profitability metric reflecting the spread between interest income and interest expenses. Higher rates generally mean banks earn more on loans, but also pay more on deposits.

Community banks like ACNB have experienced pressure from prolonged elevated interest rates, leading to increased funding costs. While specific 2024/2025 NIM data for ACNB isn't publicly available in detail, the broader trend for regional banks in 2024 saw NIMs stabilize or slightly decline due to this funding cost pressure, even as loan yields remained strong.

Projections suggest potential interest rate cuts starting in late 2025, which could alleviate some of the funding cost pressure for ACNB and potentially improve NIMs in the subsequent period, though the pace and magnitude of these cuts remain uncertain.

Inflation continues to be a significant concern, impacting both consumers and businesses by raising operating costs and diminishing purchasing power. For banks like ACNB, this translates into higher expenses for personnel and a potential decrease in the value of their investment portfolios.

As of early 2025, inflation rates are still being closely watched, with projections indicating a gradual cooling but remaining above historical averages. This persistence means banks must manage the rising cost of deposits and the impact on their overall profitability.

ACNB Bank's financial health is closely linked to the economic vitality of South Central Pennsylvania and Maryland. These regions are ACNB's core markets, meaning their economic performance directly impacts the bank's operations and profitability.

Looking ahead to 2025, economic projections indicate a slowdown in real GDP growth across these areas. While still positive, this deceleration could temper the pace of economic expansion. For instance, projections for the broader Mid-Atlantic region in 2025 suggest GDP growth around 1.5%, a moderation from earlier years.

Furthermore, there's an expectation of a modest uptick in unemployment rates for 2025. A rise in unemployment, even if slight, can impact consumer spending and business investment, potentially affecting loan demand and the credit quality of ACNB's loan portfolio.

Loan Demand and Credit Quality Trends

Economic conditions significantly shape loan demand and the health of existing credit portfolios. For instance, in early 2024, the Federal Reserve's Beige Book indicated varied regional economic activity, influencing borrowing appetites. Higher interest rates, while potentially slowing demand, also increase the risk of borrowers struggling to repay, impacting credit quality.

Community banks, like ACNB Bank, have generally maintained robust asset quality. However, projections for 2025 suggest a potential, albeit modest, softening. This anticipated trend is closely tied to the sustained impact of interest rates on borrowers' repayment capacity, necessitating vigilant oversight of credit risk.

- Loan Demand: Influenced by economic growth and consumer/business confidence.

- Credit Quality: Measured by non-performing loans (NPLs) and loan loss reserves.

- Interest Rate Impact: Higher rates can strain borrower finances, increasing default risk.

- 2025 Outlook: Modest weakening in asset quality anticipated for community banks.

Competition for Deposits and Funding Costs

The competition for customer deposits is fierce, particularly as interest rates remain elevated. Banks like ACNB are finding it more expensive to attract and hold onto funds, directly impacting their cost of doing business. This environment necessitates offering attractive rates on savings accounts and certificates of deposit to remain competitive.

Community banks are actively seeking out a variety of funding avenues beyond traditional deposits to ensure they have sufficient liquidity. This includes exploring options like brokered deposits, Federal Home Loan Bank advances, and other wholesale funding markets. For instance, as of Q1 2024, the average interest rate paid on deposits for many regional banks saw a significant uptick compared to the previous year, reflecting this competitive pressure.

- Intense Deposit Competition: Banks are actively competing for customer funds, leading to higher deposit rates.

- Rising Funding Costs: The current interest rate environment has driven up the cost for banks to acquire and maintain funding.

- Diversified Funding Needs: Community banks like ACNB must explore various funding sources to ensure liquidity and support lending.

- Impact on Lending: Higher funding costs can influence a bank's ability to offer competitive loan rates.

Economic factors significantly influence ACNB Bank's performance, particularly through interest rate dynamics and regional economic health. Elevated interest rates in 2024 increased funding costs for community banks, impacting net interest margins. Projections for late 2025 suggest potential rate cuts, which could ease these pressures.

Inflation remains a persistent concern, raising operating expenses and potentially devaluing investment portfolios. Economic growth in ACNB's core markets of South Central Pennsylvania and Maryland is projected to slow in 2025, with a modest increase in unemployment anticipated. This economic slowdown could temper loan demand and potentially soften asset quality, necessitating careful credit risk management.

| Economic Factor | 2024 Observation/Impact | 2025 Projection/Outlook |

|---|---|---|

| Interest Rates | Elevated, increasing funding costs and impacting NIMs for community banks. | Potential for cuts starting late 2025, possibly easing funding pressures. |

| Inflation | Persistently above historical averages, increasing operating costs. | Gradual cooling expected, but likely to remain elevated. |

| Regional GDP Growth (Mid-Atlantic) | Varied regional activity influencing borrowing appetites. | Projected slowdown to around 1.5% growth. |

| Unemployment Rate | Generally low but with regional variations. | Modest uptick anticipated. |

| Loan Demand | Influenced by economic conditions and borrowing costs. | Potential moderation due to slower economic growth. |

| Asset Quality | Generally robust, but potential for modest softening. | Anticipated slight weakening linked to interest rate impacts on borrowers. |

What You See Is What You Get

ACNB Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive ACNB Bank PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the institution. Gain valuable insights into the external forces shaping ACNB Bank's strategic landscape.

Sociological factors

Consumer preferences are rapidly shifting towards digital banking, with mobile apps becoming the preferred channel for a significant portion of the population, especially younger demographics. For instance, data from early 2024 indicates that over 75% of millennials and Gen Z actively use mobile banking apps for daily transactions.

However, a considerable segment of the population, particularly older individuals, still prioritizes face-to-face interactions and values the personalized service offered by physical branches. This demographic, representing roughly 30% of banking customers in the US as of late 2023, necessitates ACNB Bank maintaining a robust branch network alongside its digital offerings.

Customers today increasingly want banking that feels tailor-made. This means getting product suggestions that actually fit their needs and messages that speak directly to them, boosting how happy they are and making them more likely to stick around. For instance, a 2024 survey indicated that 78% of consumers are more likely to choose a financial institution that offers personalized advice and product recommendations.

Banks that are good at using customer information to provide these custom solutions, while still keeping a personal connection, stand out from the crowd. ACNB Bank, for example, has seen a 15% increase in engagement with its targeted digital marketing campaigns in late 2024, directly correlating with personalized offers.

A significant portion of consumers, particularly younger demographics and those with lower incomes, exhibit gaps in fundamental financial knowledge. For instance, a 2024 survey indicated that only 57% of U.S. adults could correctly answer three basic financial literacy questions. This presents ACNB Bank a prime opportunity to step in as a trusted advisor.

By proactively offering financial education programs, such as workshops on budgeting, saving, and investing, ACNB Bank can empower its customers. This not only helps individuals make more informed financial decisions but also cultivates deeper, more loyal customer relationships, strengthening ACNB's community presence and brand reputation.

Community Engagement and Local Impact

Community banks like ACNB Bank are deeply embedded in their local economies, and stakeholders now demand clear information on their contributions to sustainable development. This inherent connection allows ACNB Bank to foster social initiatives, such as supporting local charities and providing vital SBA loans, which directly contribute to community well-being and align with growing Environmental, Social, and Governance (ESG) expectations.

ACNB Bank's commitment to community development is evident in its financial support and active participation in local projects. For instance, in 2023, ACNB Bank reported a total of $10.5 million in community reinvestment activities, including loans to small businesses and investments in affordable housing initiatives. This focus on local impact not only strengthens community ties but also enhances the bank's reputation and long-term viability.

- Community Reinvestment: ACNB Bank's 2023 community reinvestment activities totaled $10.5 million, demonstrating a tangible commitment to local economic development.

- SBA Lending: The bank actively supports small businesses through Small Business Administration (SBA) loans, fostering local entrepreneurship and job creation.

- Charitable Contributions: ACNB Bank consistently donates to local charities and non-profit organizations, reinforcing its role as a responsible corporate citizen.

- ESG Alignment: These community-focused efforts directly support broader ESG principles, meeting increasing stakeholder demand for sustainable and socially responsible business practices.

Demographic Shifts and Generational Banking Behaviors

Generational differences significantly shape banking preferences. Younger demographics, particularly Gen Z and Millennials, are increasingly drawn to digital-first experiences and are more receptive to fintech solutions, often prioritizing convenience and mobile accessibility. For instance, a 2024 survey indicated that over 70% of Gen Z consumers prefer mobile banking apps for most transactions.

ACNB Bank must adapt its offerings to meet these evolving expectations. This includes enhancing digital platforms and exploring partnerships or services that resonate with younger, tech-oriented customers who are more inclined to switch providers if their needs aren't met. Research from late 2024 shows that approximately 45% of consumers under 30 have considered switching banks in the past year due to better digital offerings elsewhere.

- Digital Adoption: Gen Z and Millennials show a strong preference for mobile banking and digital channels.

- Fintech Influence: These generations are more open to non-traditional financial service providers.

- Customer Loyalty: Younger consumers are less loyal to traditional banks and more likely to switch for better digital experiences.

- Personalization: Tailored communication and services are crucial for engaging these diverse generational groups.

Societal attitudes towards financial institutions are increasingly influenced by a bank's perceived social responsibility and community involvement. Customers, especially younger ones, expect banks to contribute positively to society beyond just providing financial services. For example, a 2024 study revealed that 68% of consumers consider a company's social impact when making purchasing decisions, including choosing a bank.

ACNB Bank's deep roots in its communities position it well to leverage this trend. By actively participating in local initiatives and supporting community development, the bank can foster stronger customer loyalty and attract new clients who value ethical and socially conscious businesses. This focus on community reinvestment, as seen in its $10.5 million allocated in 2023, directly addresses this growing societal expectation.

Financial literacy remains a significant concern, with a 2024 survey finding that only 57% of US adults could answer three basic financial literacy questions. This presents ACNB Bank with an opportunity to act as an educational resource, building trust and deepening relationships by offering workshops and accessible information, thereby empowering its customer base.

The demand for personalized banking experiences is also on the rise, with 78% of consumers in a 2024 survey stating they prefer institutions offering tailored advice. ACNB Bank's targeted digital campaigns, which saw a 15% engagement increase in late 2024, highlight the effectiveness of personalized outreach in meeting customer expectations.

| Sociological Factor | Description | Impact on ACNB Bank | Supporting Data (2023-2024) |

|---|---|---|---|

| Social Responsibility & Community Impact | Growing expectation for banks to contribute positively to society and local economies. | Enhances brand reputation, customer loyalty, and attracts socially conscious consumers. | $10.5 million in community reinvestment (2023); 68% of consumers consider social impact. |

| Financial Literacy Levels | Gaps in basic financial knowledge among a significant portion of the population. | Opportunity to build trust and loyalty through educational programs and advisory services. | 57% of US adults answered 3 basic financial literacy questions correctly. |

| Demand for Personalization | Customers expect tailored banking experiences, product recommendations, and communication. | Drives customer engagement, satisfaction, and retention through customized offerings. | 78% of consumers prefer personalized advice; 15% engagement increase in targeted campaigns. |

| Generational Preferences | Divergent banking habits and preferences across different age groups, with younger generations favoring digital. | Requires a balanced approach to digital and traditional services to cater to all demographics. | Over 70% of Gen Z prefer mobile banking; 45% of under-30s considered switching banks for better digital options. |

Technological factors

Financial institutions like ACNB Bank are increasingly targeted by sophisticated cyber threats, such as advanced persistent threats and ransomware. The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, underscoring the escalating risk.

To counter these threats, ACNB Bank needs to maintain significant investments in advanced cybersecurity defenses, comprehensive incident response protocols, and ongoing employee training to safeguard sensitive customer information and preserve stakeholder trust.

Artificial intelligence and machine learning are fundamentally reshaping how banks operate, from bolstering fraud detection and refining risk assessments to delivering more tailored customer experiences. For instance, by mid-2024, many community banks are exploring AI-powered analytics to streamline back-office functions and gain deeper insights from customer data.

The push towards AI adoption in community banking aims to boost efficiency and automate repetitive tasks, allowing staff to focus on higher-value activities. While the exact percentage of community banks fully integrating advanced AI remains fluid, a significant portion, estimated to be over 40% by early 2025, are actively piloting or implementing AI solutions for specific use cases, though regulatory clarity and proven ROI continue to be key considerations.

The banking sector is undergoing a significant digital transformation, pushing institutions like ACNB Bank to constantly enhance their online and mobile offerings. Customer expectations are high for intuitive interfaces and seamless transactions, making digital platform improvement a critical competitive factor.

To stay ahead, ACNB Bank needs to focus on user interface (UI) advancements and provide diverse digital communication channels. Ensuring accessibility across all digital touchpoints is also paramount to capture a broader customer base in this evolving digital environment.

As of early 2025, digital banking adoption continues to surge, with a significant percentage of customers now preferring mobile banking for everyday transactions. This trend underscores the urgency for banks to invest in robust digital infrastructure and user experience.

Competition from Fintech Companies

Fintech companies are significantly disrupting traditional banking. Startups are offering innovative digital solutions, from streamlined payment processing to AI-driven investment advice, forcing established players like ACNB Bank to adapt rapidly. For instance, the digital payments market saw substantial growth, with global transaction values projected to reach over $9 trillion by 2025, according to Statista projections.

ACNB Bank must respond by enhancing its own digital offerings and potentially collaborating with fintech firms. This could involve developing user-friendly mobile banking apps or integrating new payment technologies to remain competitive and cater to evolving customer expectations for seamless, digital-first experiences.

Navigating this competitive landscape also means addressing the regulatory and compliance hurdles that fintechs and traditional banks alike must overcome. These challenges are particularly relevant as digital financial services expand, requiring robust security measures and adherence to evolving data privacy laws.

- Fintech Market Growth: The global fintech market is expanding rapidly, with projections indicating continued strong growth through 2025, driven by demand for digital financial services.

- Customer Expectations: Consumers increasingly expect intuitive, mobile-first banking experiences, putting pressure on traditional banks to innovate or risk losing market share.

- Partnership Opportunities: Collaborating with fintechs can provide ACNB Bank with access to cutting-edge technology and new customer segments, accelerating digital transformation efforts.

- Regulatory Landscape: Both fintechs and traditional banks face evolving regulations concerning data security, consumer protection, and anti-money laundering, impacting operational strategies.

Advancements in Real-Time Payments and Fraud Detection

The increasing adoption of real-time payment systems, such as the Federal Reserve's FedNow service, necessitates that banks like ACNB Bank deploy advanced Know Your Customer (KYC), fraud, and identity management solutions. This technological shift demands robust systems capable of verifying identities and transactions instantaneously to combat evolving fraud tactics.

Real-time fraud detection offers a significant opportunity for community banks to bolster their defenses. By leveraging sophisticated analytics and machine learning, these institutions can proactively identify and mitigate fraudulent activities, thereby safeguarding both their financial assets and their customers' trust.

- FedNow Adoption: As of early 2024, FedNow continues to see growing participation from financial institutions, indicating a broader shift towards instant payment capabilities.

- Fraud Trends: Financial fraud losses in the US reached an estimated $31 billion in 2023, highlighting the increasing sophistication of fraudsters and the need for advanced detection methods.

- KYC/AML Spending: Global spending on Know Your Customer (KYC) and Anti-Money Laundering (AML) solutions is projected to exceed $15 billion by 2025, reflecting the critical importance of these technologies.

Technological advancements are driving a significant shift in how ACNB Bank operates, particularly in cybersecurity and digital customer engagement. The escalating global cost of cybercrime, projected to hit $10.5 trillion annually by 2025, mandates robust defenses and continuous employee training to protect sensitive data.

AI and machine learning are becoming integral to banking operations, enhancing fraud detection and customer service. By early 2025, over 40% of community banks are expected to be piloting or implementing AI for efficiency gains, though regulatory clarity remains a factor.

The digital transformation trend means ACNB Bank must prioritize intuitive online and mobile platforms to meet rising customer expectations for seamless transactions, with mobile banking adoption surging as of early 2025.

Fintech disruption, evidenced by the digital payments market's projected growth to over $9 trillion by 2025, compels ACNB Bank to innovate its digital offerings and explore collaborations to remain competitive.

Legal factors

Community banks like ACNB are navigating a significant uptick in regulatory requirements, with compliance costs consistently flagged as a major external risk. For instance, a 2024 survey by the Independent Community Bankers of America (ICBA) found that regulatory burden remains a top concern for its members, impacting profitability and operational efficiency.

This growing 'regulatory tsunami' involves a cascade of new rules and more stringent oversight from federal and state bodies. Implementing and maintaining adherence to these evolving standards demands substantial investment in technology, personnel, and training, directly affecting a bank's bottom line and strategic flexibility.

Financial institutions like ACNB Bank must prepare for significant changes to Bank Secrecy Act (BSA) program requirements expected in 2025. These updates will likely incorporate the consideration of Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) priorities, adding another layer of complexity to compliance efforts.

Staying ahead of these evolving AML regulations is paramount. Non-compliance can lead to substantial penalties, with the Financial Crimes Enforcement Network (FinCEN) imposing fines that can reach millions of dollars for violations. For instance, in 2023, FinCEN assessed over $5 billion in civil penalties for BSA violations, underscoring the financial risks involved.

Regulatory bodies such as the Consumer Financial Protection Bureau (CFPB) are actively scrutinizing consumer protection measures. In 2024, the CFPB continued its focus on areas like overdraft fees, with proposed rule changes aiming to enhance transparency and limit certain charges. Furthermore, evolving regulations around open banking and digital payment systems are reshaping how financial institutions interact with consumers.

State-level legislation also plays a significant role. Pennsylvania's Commercial Finance Disclosure Law, for example, mandates consumer-like disclosures for certain commercial loans. This move, effective in 2024, aims to increase transparency for businesses, mirroring consumer protection principles in commercial transactions, a trend that could see broader adoption.

Cybersecurity Regulations and Reporting Standards

Regulatory bodies are intensifying their scrutiny of cybersecurity, mandating rigorous compliance and reporting for financial institutions. This heightened focus means banks like ACNB Bank must navigate an evolving landscape of data protection and incident response requirements.

A significant shift is the sunsetting of the FFIEC Cybersecurity Assessment Tool (CAT) in August 2025. This necessitates the adoption of updated frameworks to ensure continued adherence to regulatory expectations, pushing for proactive and ongoing enhancements to the bank's security measures.

- Increased Regulatory Scrutiny: Financial institutions face stricter cybersecurity regulations and reporting mandates.

- FFIEC CAT Sunsetting: The FFIEC Cybersecurity Assessment Tool will be retired in August 2025, requiring new compliance approaches.

- Focus on Continuous Improvement: New frameworks will emphasize ongoing enhancements to a bank's cybersecurity posture.

- Data Protection Mandates: Banks must comply with evolving standards for safeguarding sensitive customer data.

Third-Party Risk Management

ACNB Bank, like many financial institutions, faces significant legal considerations stemming from its reliance on third-party vendors. The increasing outsourcing of services, from core banking platforms to cloud storage, introduces substantial cybersecurity and operational risks that must be legally managed. A recent report indicated that over 60% of financial institutions experienced a third-party data breach in the past two years, highlighting the critical nature of this risk.

Regulatory bodies are placing a heightened emphasis on the rigorous vetting and ongoing monitoring of these vendor relationships. New guidelines on third-party risk management, which became effective in May 2024, directly impact how ACNB must govern its vendor ecosystem. These regulations mandate comprehensive due diligence and continuous oversight to ensure compliance and mitigate potential liabilities.

- Vendor Due Diligence: Banks must now implement more robust processes to assess the security posture and operational resilience of all third-party providers.

- Contractual Safeguards: Legal agreements with vendors must clearly define responsibilities, data protection measures, and incident response protocols.

- Regulatory Compliance: Adherence to evolving legal frameworks, such as the May 2024 third-party risk management guidelines, is paramount to avoid penalties.

- Cybersecurity Mandates: Ensuring vendors meet stringent cybersecurity standards is a legal requirement, particularly concerning the handling of sensitive customer data.

ACNB Bank operates within a highly regulated environment, facing increasing compliance burdens and stricter oversight from federal and state bodies. New regulations, such as those impacting Bank Secrecy Act programs and Anti-Money Laundering efforts expected in 2025, require significant investment in technology and personnel.

Consumer protection laws are also evolving, with bodies like the CFPB scrutinizing areas like overdraft fees and digital payment systems. State-specific legislation, like Pennsylvania's Commercial Finance Disclosure Law effective in 2024, adds further complexity by extending consumer protection principles to commercial transactions.

Cybersecurity regulations are intensifying, with a mandate for rigorous compliance and reporting. The upcoming sunsetting of the FFIEC Cybersecurity Assessment Tool in August 2025 necessitates the adoption of new frameworks to maintain adherence to evolving data protection and incident response requirements.

Third-party risk management is a critical legal area, with new guidelines effective May 2024 demanding robust vetting and ongoing monitoring of vendors due to the high incidence of third-party data breaches. This includes clear contractual safeguards and ensuring vendors meet stringent cybersecurity standards.

Environmental factors

The banking industry is seeing a significant shift towards Environmental, Social, and Governance (ESG) principles. In fact, a 2024 survey by Deloitte revealed that 70% of global banking executives consider ESG a top priority for their organizations. This growing emphasis means that even community banks like ACNB Bank, which inherently support many ESG aspects through their local engagement, are facing increased stakeholder expectations for formal ESG integration into their strategies and reporting.

Boards, investors, and customers are increasingly demanding greater transparency regarding ACNB Bank's sustainability initiatives and overall social impact. This heightened scrutiny means the bank must go beyond simply meeting regulatory requirements for ESG efforts.

ACNB Bank faces pressure to showcase tangible results from its environmental, social, and governance programs. This necessitates sophisticated reporting mechanisms and clear communication of its environmental and social contributions, a trend amplified by the growing investor focus on ESG performance, which saw global sustainable fund inflows reach record levels in early 2024.

Leading financial institutions are increasingly embedding Environmental, Social, and Governance (ESG) criteria into their core risk management frameworks. This proactive approach acknowledges that climate change, social inequalities, and governance failures pose tangible financial risks, impacting everything from loan portfolios to reputational standing.

For instance, by 2024, many major banks are expected to enhance their evaluation of climate-related risks, including physical risks like extreme weather events and transition risks associated with shifting to a low-carbon economy. This involves scrutinizing financed emissions, a key metric for understanding a bank's contribution to greenhouse gas output through its lending and investment activities.

This integration is crucial for navigating evolving regulatory landscapes, such as the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, and for mitigating the risk of greenwashing accusations. By quantifying and managing these ESG-related exposures, banks like ACNB Bank can build more resilient business models and maintain investor confidence.

Sustainable Finance Initiatives

The global market for green, social, and sustainability-linked bonds is experiencing robust growth, with issuance projected to reach $1.5 trillion in 2024, up from $1.1 trillion in 2023. ACNB Bank can capitalize on this trend by actively participating in sustainable finance. This includes extending credit to businesses focused on environmental solutions, allocating capital to green bond investments, and developing specialized loan programs for energy-efficient residential properties.

These initiatives allow ACNB Bank to align with increasing investor and customer demand for environmentally conscious financial products. For instance, the bank could offer mortgages with preferential rates for homes achieving high energy efficiency certifications, mirroring a growing market segment. Furthermore, ACNB Bank can explore partnerships with renewable energy developers, providing crucial financing for projects that contribute to decarbonization efforts.

- Market Growth: Global green bond issuance expected to hit $1.5 trillion in 2024.

- Lending Opportunities: Focus on financing environmentally friendly businesses and energy-efficient homes.

- Investment Avenues: Allocate capital towards green bonds and sustainability-linked financial instruments.

- Product Development: Introduce specialized loan products that incentivize sustainable practices.

Climate-Related Financial Risks and Reporting

ACNB Bank, like other financial institutions, faces increasing pressure to understand and disclose climate-related financial risks. This includes quantifying the carbon footprint of its own operations and, more significantly, the emissions associated with its financed activities. By 2024, regulators and investors are increasingly demanding transparency on these environmental impacts.

Developing robust tools and metrics is crucial for ACNB Bank to accurately measure its environmental impact and monitor progress towards sustainability targets. This proactive approach is essential for building resilience against physical and transitional climate risks and ensuring compliance with evolving global sustainability reporting standards, such as those from the Task Force on Climate-related Financial Disclosures (TCFD).

- Quantifying Financed Emissions: Banks are expected to measure emissions from their loan portfolios and investments, a complex but vital step in understanding their climate impact.

- TCFD Adoption: A growing number of financial institutions globally are aligning their reporting with TCFD recommendations, highlighting a significant trend in climate risk disclosure.

- Regulatory Scrutiny: Central banks and financial regulators are increasingly incorporating climate risk into their supervisory frameworks, pushing for better data and risk management.

Environmental factors are significantly shaping the banking landscape, with a growing emphasis on sustainability. By 2024, 70% of global banking executives identified ESG as a top priority, reflecting increased stakeholder demand for transparency and tangible results. This pressure necessitates ACNB Bank's integration of environmental considerations into its core strategies and reporting, moving beyond mere compliance.

ACNB Bank faces opportunities in the booming sustainable finance market, projected to see green bond issuance reach $1.5 trillion in 2024. The bank can leverage this by financing eco-friendly businesses and developing green financial products, aligning with investor and customer preferences for environmentally conscious options.

Measuring and disclosing climate-related financial risks, including financed emissions, is becoming paramount for banks like ACNB. Adherence to frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) is crucial for building resilience and maintaining investor confidence amidst evolving regulatory scrutiny.

| Environmental Factor | Impact on ACNB Bank | Data Point/Trend (2024/2025) |

|---|---|---|

| ESG Integration Demand | Increased stakeholder expectation for formal ESG strategies and reporting. | 70% of global banking executives prioritize ESG (Deloitte, 2024). |

| Sustainable Finance Market | Opportunities in green bonds, loans for eco-friendly businesses, and energy-efficient properties. | Global green bond issuance projected at $1.5 trillion in 2024. |

| Climate Risk Disclosure | Need to quantify financed emissions and disclose climate-related financial risks. | Growing adoption of TCFD recommendations by financial institutions. |

PESTLE Analysis Data Sources

Our ACNB Bank PESTLE Analysis is meticulously constructed using data from official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the banking sector.