77 Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

77 Bank Bundle

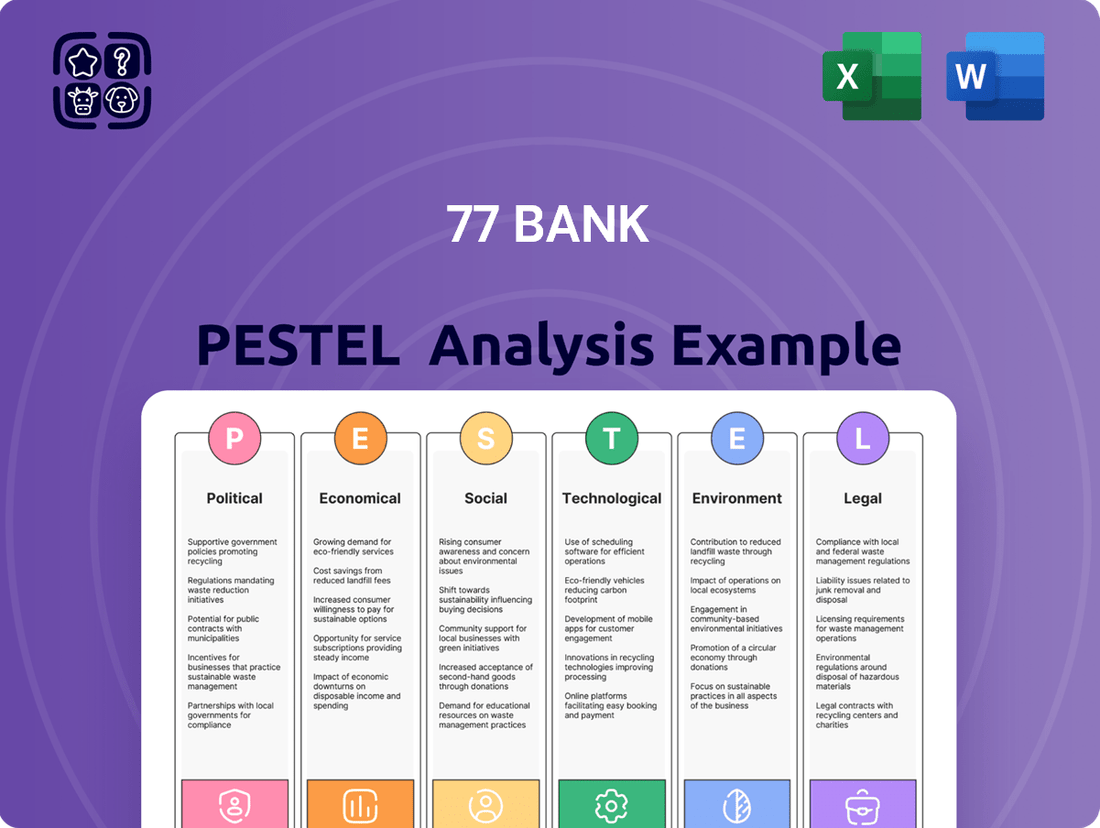

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping 77 Bank's trajectory. Our PESTLE analysis provides a comprehensive overview of the external forces influencing its operations and strategic decisions. Gain a competitive advantage by understanding these dynamics. Download the full PESTLE analysis now for actionable insights.

Political factors

The Bank of Japan's recent move away from negative interest rates, signaling a shift towards a positive interest rate environment, will directly influence 77 Bank's operational costs and revenue streams. This policy pivot, with expectations of further increases potentially reaching 0.5% by mid-2025, aims to curb persistent deflation and encourage economic growth.

While these monetary policy adjustments are designed to foster a healthier economy, they present a dual-edged sword for regional institutions like 77 Bank. On one hand, higher rates can boost net interest margins, but on the other, they introduce increased credit risk as some businesses may find it harder to service debt at elevated borrowing costs.

The Financial Services Agency (FSA) and the Bank of Japan (BOJ) are actively shaping the banking landscape through continuous updates to regulations. These changes, which came into sharp focus in 2024 and are expected to continue through 2025, cover critical areas like capital adequacy ratios, permissible business activities, and robust customer protection measures. For instance, recent directives have emphasized strengthening cybersecurity defenses, with a notable increase in regulatory scrutiny on data protection and resilience against cyber threats.

77 Bank, like all financial institutions in Japan, must be agile in its response to these evolving frameworks. The regulatory drive towards enhancing financial stability, fostering digital transformation, and mitigating emerging risks such as sophisticated money laundering schemes and escalating cybersecurity threats means constant adaptation is key. By adhering to these updated guidelines, 77 Bank aims to maintain its operational integrity and build trust in an increasingly complex financial ecosystem.

The Japanese government's commitment to regional revitalization presents a significant opportunity for 77 Bank. For instance, the government allocated approximately ¥1 trillion (roughly $6.7 billion USD as of mid-2024) towards its "Regional Revitalization Grant Program" in the fiscal year 2024, aiming to boost local economies and create jobs.

These government-backed initiatives often translate into direct support for local businesses and infrastructure development, areas where 77 Bank has a strong presence and commitment. This alignment allows the bank to leverage these programs to foster economic growth and stability within Miyagi Prefecture and the broader Tohoku region, potentially leading to increased lending and investment opportunities.

International Trade Policies and Geopolitical Risks

Shifting global trade policies, especially those emanating from major economies like the United States, create significant headwinds for Japan. For instance, the U.S. Trade Representative's office continued to monitor trade practices in 2024, with potential implications for Japanese exports. These policies can directly affect the competitiveness of Japanese businesses, a key client base for 77 Bank.

Broader geopolitical risks, such as ongoing regional tensions and the potential for supply chain disruptions, add another layer of uncertainty. In 2024, the global economic outlook remained susceptible to geopolitical events, impacting investor sentiment and capital flows into Japan. This volatility can strain the financial resilience of 77 Bank's corporate clients and create a more challenging operating environment.

These external factors have tangible consequences:

- Trade Tariffs: Increased tariffs on Japanese goods could reduce export volumes, impacting corporate revenues.

- Currency Fluctuations: Geopolitical instability often leads to currency volatility, affecting the value of international transactions and investments for clients.

- Supply Chain Disruptions: Events in 2024 highlighted the fragility of global supply chains, potentially hindering production and increasing costs for Japanese manufacturers.

- Investment Climate: Heightened geopolitical risks can deter foreign direct investment into Japan, slowing economic growth and client expansion.

Cybersecurity and Data Protection Legislation

Japan's commitment to enhancing cybersecurity and data protection is evident in its ongoing legislative efforts. The Personal Information Protection Act (PIPA) underwent significant revisions effective April 1, 2022, introducing stricter rules for data handling and cross-border transfers, impacting how financial institutions like 77 Bank manage sensitive customer information. The increasing sophistication of cyber threats, targeting financial services globally, necessitates robust compliance frameworks. In 2023, Japan reported a notable rise in ransomware attacks targeting businesses, underscoring the urgency for banks to invest in advanced security measures and adhere to evolving regulatory demands to prevent data breaches and maintain customer trust.

77 Bank must navigate this evolving legal landscape to ensure compliance and protect its digital infrastructure. Key areas of focus include:

- Adapting to PIPA Revisions: Implementing updated data processing protocols and consent mechanisms.

- Strengthening Cyber Defenses: Investing in advanced threat detection and response systems to counter sophisticated attacks.

- Ensuring Regulatory Adherence: Staying abreast of new cybersecurity mandates and data privacy guidelines issued by the Financial Services Agency (FSA).

- Maintaining Operational Resilience: Developing robust business continuity plans to mitigate the impact of potential cyber incidents.

The Japanese government's strategic focus on regional revitalization, with initiatives like the ¥1 trillion Regional Revitalization Grant Program in 2024, directly benefits 77 Bank's operational environment by stimulating local economies. These policies create a more favorable climate for lending and investment in regions where 77 Bank has a strong presence, such as Miyagi Prefecture.

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing 77 Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions with specific regional and industry relevance.

It provides actionable insights, supported by current trends and data, to equip stakeholders with the understanding needed to identify opportunities and mitigate threats for strategic decision-making.

A clear, actionable summary of the 77 Bank PESTLE analysis, designed to quickly identify and address external threats and opportunities, thereby reducing strategic uncertainty.

Economic factors

The Bank of Japan's shift away from negative interest rates, with expectations of further increases, is a significant tailwind for 77 Bank's net interest margins. This normalization is projected to boost profitability by allowing the bank to earn more on its lending activities.

However, this positive outlook is tempered by the inherent challenge of managing increased credit risks. As interest rates climb, some borrowers may find it harder to service their debts, potentially leading to a rise in non-performing loans for regional banks like 77 Bank.

The 77 Bank's fortunes are intrinsically linked to the economic health of Miyagi Prefecture and the broader Tohoku region. Japan's economic outlook for 2024 and into 2025 suggests a moderate recovery, with consumer spending and private investment anticipated to be key drivers of this growth. This trend bodes well for 77 Bank, potentially boosting its lending activities to both individuals and businesses within its operational areas.

Japan's demographic shifts present a significant hurdle for regional banks like 77 Bank. The nation's aging and shrinking population, especially outside major metropolitan areas, directly impacts the customer base and loan demand. By 2023, Japan's population had fallen to its lowest point since 1950, with projections indicating a continued decline.

This shrinking pool of potential borrowers and depositors means 77 Bank must innovate to sustain its business. A smaller, older population often translates to lower demand for new loans, particularly for mortgages and business expansion. The bank needs to explore new revenue streams and customer segments to counter this persistent trend.

Inflationary Pressures and Consumer Spending

While corporate inflation in Japan has seen some moderation, consumer inflation, particularly for essential goods, continues to be a notable economic factor. This persistent consumer price pressure impacts household budgets and influences spending habits.

The Bank of Japan is keenly observing wage growth trends and the overall trajectory of consumer spending. These metrics are crucial in shaping the central bank's decisions regarding future monetary policy adjustments.

Sustained real wage growth for Japanese consumers would likely translate into a positive impact for 77 Bank's retail client segment. Increased disposable income from higher real wages could boost demand for banking services and products.

- Consumer inflation: Japan's Consumer Price Index (CPI) excluding fresh food was 2.5% year-on-year in April 2024, indicating ongoing price pressures.

- Wage growth focus: The Bank of Japan's Tankan survey for Q1 2024 showed a slight increase in planned wage hikes by companies, but the impact on real wages for consumers is still being assessed.

- Retail banking impact: If real wages rise consistently, it could lead to higher deposit growth and increased lending opportunities for 77 Bank's retail customers.

Impact of Global Economic Slowdown

A global economic slowdown presents significant challenges for Japan, potentially impacting 77 Bank's performance. Projections for global GDP growth in 2024 and 2025 indicate a moderation, with organizations like the IMF forecasting around 3% growth, down from higher rates in prior years. This deceleration can translate into reduced demand for Japanese exports, a key driver for the nation's economy.

While Japan's domestic demand shows resilience, supported by factors like government stimulus and a recovering tourism sector, it may not fully offset the drag from external economic weakness. Uncertainties surrounding international trade, including potential protectionist measures and geopolitical tensions, further complicate the outlook. These external headwinds could dampen the pace of Japan's overall economic recovery, directly affecting the business environment for financial institutions like 77 Bank.

The impact on 77 Bank could manifest in several ways:

- Reduced loan demand: Businesses facing slower global sales may scale back investment and borrowing.

- Increased credit risk: Companies exposed to international markets might experience financial strain, leading to higher non-performing loans.

- Lower profitability: A weaker economic environment generally leads to narrower interest margins and reduced fee income for banks.

Japan's economic trajectory in 2024-2025 points towards moderate growth, driven by consumer spending and private investment, which is beneficial for 77 Bank's lending activities.

However, the nation's persistent demographic challenge of an aging and shrinking population, with population decline continuing from its 1950s low, directly impacts 77 Bank's customer base and loan demand.

Consumer inflation remains a factor, with CPI (excluding fresh food) at 2.5% year-on-year in April 2024, influencing household budgets and potentially wage growth, a key focus for the Bank of Japan.

A global economic slowdown, with IMF forecasting around 3% GDP growth for 2024-2025, poses external headwinds that could reduce export demand and impact 77 Bank through lower loan demand and increased credit risk.

| Economic Factor | 2024-2025 Outlook | Impact on 77 Bank |

|---|---|---|

| Domestic Growth Drivers | Moderate, led by consumption and investment | Increased lending opportunities |

| Demographics | Aging and shrinking population | Reduced customer base and loan demand |

| Inflation | Consumer inflation at 2.5% (Apr 2024) | Influences spending and wage growth |

| Global Economic Slowdown | IMF forecasts ~3% GDP growth | Reduced export demand, potential credit risk |

Preview the Actual Deliverable

77 Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive 77 Bank PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank. Gain actionable insights to inform your strategic decisions.

Sociological factors

Japan's demographic landscape, marked by an aging and shrinking populace, significantly impacts 77 Bank. Regions such as Miyagi and Tohoku are experiencing this trend acutely, directly affecting the bank's potential customer pool and the types of financial products and services in demand. For instance, as of early 2024, Japan's elderly population (65 and over) constitutes over 30% of its total population, a figure expected to rise.

This demographic reality compels 77 Bank to adapt its offerings. Services catering to retirement planning, wealth management for seniors, and healthcare-related financial solutions are becoming increasingly crucial. Simultaneously, the bank must develop strategies to engage and attract younger demographics, who are essential for long-term growth and innovation, especially in less populated areas.

Japanese consumers are rapidly shifting towards digital financial services, with a significant increase in the adoption of cashless payment methods. For instance, the total value of cashless payments in Japan reached approximately ¥111 trillion in 2023, a notable rise from previous years, indicating a strong trend.

The 77 Bank must actively respond to this evolving landscape by bolstering its digital platforms and improving the overall user experience. This adaptation is crucial for staying competitive and appealing to a growing segment of tech-savvy customers who expect seamless and convenient digital interactions.

A rising tide of financial literacy among diverse decision-makers, from novice investors to seasoned professionals, fuels a growing demand for complex financial products and expert investment guidance. This trend presents a significant opportunity for 77 Bank to expand its offerings in investment products and personalized advisory services to meet this sophisticated market need.

For instance, in 2024, surveys indicated that over 60% of individuals aged 25-55 actively sought financial education resources, a figure projected to climb by 8% annually through 2025. This heightened awareness directly translates into a greater appetite for diverse investment vehicles, including alternative assets and structured products, areas where 77 Bank can strategically position itself.

Community Engagement and Local Economic Development

77 Bank's deep roots in the Tohoku region mean its engagement with local communities directly impacts its standing and success. By actively supporting small and medium-sized enterprises (SMEs) and individual financial well-being, the bank fosters a sense of shared prosperity. For instance, in fiscal year 2023, 77 Bank provided approximately ¥1.2 trillion in loans to regional businesses, a crucial factor in local job creation and economic resilience.

This commitment translates into tangible benefits for the bank, enhancing its brand reputation and solidifying customer loyalty. Initiatives like sponsoring local festivals or providing financial literacy programs for residents contribute to a positive societal image. In 2024, the bank launched a new initiative to support startups in the Tohoku region, aiming to inject ¥50 billion into new ventures over the next five years, further embedding itself in the local economic fabric.

- Community Support: 77 Bank's lending to regional SMEs in FY2023 reached approximately ¥1.2 trillion.

- Brand Loyalty: Active participation in local events and financial education programs strengthens customer relationships.

- Economic Impact: The bank's new startup support initiative targets ¥50 billion in funding for Tohoku businesses by 2029.

- Regional Development: Fostering local economic growth is central to 77 Bank's sociological strategy.

Workforce Dynamics and Talent Acquisition

The Japanese financial sector, including regional players like 77 Bank, is grappling with a significant shortage of skilled cybersecurity and IT professionals. This talent gap is projected to worsen as digital transformation accelerates, making it harder for banks to protect themselves from evolving cyber threats and implement new technologies. For instance, a 2024 report indicated that over 60% of Japanese companies surveyed experienced a lack of cybersecurity expertise within their IT departments.

To counter this, 77 Bank must prioritize robust talent acquisition and retention strategies. This includes investing heavily in internal training programs to upskill existing staff and developing attractive career paths for IT and cybersecurity specialists. Partnerships with universities and specialized training institutions could also be crucial in bridging the immediate skills deficit.

- Talent Shortage: Japan faces a critical deficit in cybersecurity and IT talent, impacting the financial sector's ability to innovate and secure operations.

- Digital Transformation Needs: The increasing reliance on digital services necessitates a strong IT workforce to manage and protect infrastructure.

- Investment in Training: 77 Bank needs to allocate resources for employee development and specialized IT/cybersecurity training to build internal capabilities.

- Strategic Partnerships: Collaborating with educational institutions and tech firms can provide access to a pipeline of skilled professionals.

Societal expectations are increasingly influencing banking operations, with a growing emphasis on corporate social responsibility and ethical practices. Consumers and stakeholders alike are scrutinizing banks for their environmental impact and community engagement. For instance, in 2024, surveys revealed that over 70% of Japanese consumers consider a company's social and environmental record when making financial decisions.

This societal shift necessitates that 77 Bank proactively demonstrates its commitment to sustainability and community well-being. Initiatives focused on financial inclusion and supporting underserved populations are becoming paramount for maintaining public trust and brand reputation. The bank's efforts in the Tohoku region, such as its startup funding initiative aiming for ¥50 billion by 2029, directly address these evolving societal demands.

The increasing demand for digital financial services, driven by convenience and technological adoption, is reshaping customer interactions. As of early 2024, over 80% of transactions at many Japanese banks were conducted digitally, highlighting a significant behavioral change. 77 Bank must continue to invest in user-friendly digital platforms to meet these evolving customer preferences.

Furthermore, the aging demographic in Japan, with over 30% of the population aged 65 or older in early 2024, creates a specific demand for financial products tailored to retirement and healthcare needs. 77 Bank's strategic focus on these areas, alongside efforts to engage younger demographics, is crucial for long-term market relevance and growth.

Technological factors

77 Bank is actively pursuing digital transformation, mirroring trends across Japan's financial sector. In 2023, Japanese banks collectively invested over ¥1.5 trillion in IT modernization and digital services, aiming to boost efficiency and customer experience. This includes a strategic push towards fintech integration, with 77 Bank exploring collaborations to enhance its digital banking offerings and meet the growing demand for seamless online financial solutions.

Japan's financial sector's swift digital transformation, including 77 Bank's operations, significantly elevates its exposure to cyber threats. Robust cybersecurity infrastructure is no longer optional but a fundamental necessity to safeguard sensitive data and maintain operational continuity.

The evolving threat landscape demands constant vigilance, with sophisticated attacks like ransomware and distributed denial-of-service (DDoS) becoming increasingly prevalent. According to various industry reports from late 2024 and early 2025, financial institutions are experiencing a marked increase in the frequency and complexity of these cyber incidents.

Addressing the critical shortage of skilled cybersecurity professionals is paramount for 77 Bank. The gap between demand and supply for cybersecurity talent in Japan remained a significant challenge throughout 2024, impacting the ability of many organizations, including banks, to adequately staff their defense teams.

AI and machine learning are transforming banking, with adoption accelerating. By 2024, global spending on AI in banking was projected to reach $12.6 billion, a significant jump from previous years, indicating a strong trend towards automation and enhanced analytics. 77 Bank can harness these advancements to automate routine tasks, leading to greater efficiency and cost savings.

Furthermore, these technologies enable deeper insights from vast datasets, allowing for more accurate risk assessment and fraud detection. For instance, AI-powered credit scoring models can improve loan portfolio quality. This data-driven approach also facilitates hyper-personalization of customer offerings, a key differentiator in the competitive financial landscape.

Mobile Banking and Digital Payment Solutions

The surge in mobile banking and digital payment adoption in Japan, a trend accelerating through 2024 and into 2025, directly impacts how customers interact with financial institutions. 77 Bank must prioritize enhancing its mobile platform's usability and seamlessly integrate with widely used digital payment services to align with evolving consumer behaviors.

This technological shift offers significant opportunities for increased customer engagement and transaction efficiency. For instance, by the end of 2024, it's projected that over 70% of Japanese consumers will utilize some form of digital payment for daily transactions, a figure expected to climb further in 2025. To capitalize on this, 77 Bank is focusing on:

- Upgrading mobile app interfaces to ensure intuitive navigation and a superior user experience.

- Expanding partnerships with leading digital wallet providers to offer broader payment options.

- Implementing advanced security features within mobile banking to build customer trust in digital transactions.

- Leveraging data analytics from mobile interactions to personalize financial product offerings.

Cloud Computing and Data Management

The increasing adoption of cloud computing presents 77 Bank with significant opportunities for enhanced scalability and operational efficiency. By migrating services to the cloud, banks can more easily adjust their IT infrastructure to meet fluctuating demands, potentially reducing costs associated with on-premise hardware. For instance, global spending on public cloud services reached an estimated $600 billion in 2024, highlighting its widespread integration across industries.

However, this transition necessitates a strong focus on data management and robust security protocols. 77 Bank must ensure the integrity and confidentiality of customer data stored in the cloud, adhering to stringent regulatory requirements. The bank’s strategy should prioritize secure cloud architecture and comprehensive data governance frameworks to mitigate risks.

Key considerations for 77 Bank include:

- Scalability: Leveraging cloud infrastructure to dynamically adjust resources based on business needs.

- Efficiency: Streamlining banking operations through cloud-based platforms and services.

- Data Security: Implementing advanced cybersecurity measures to protect sensitive financial data in the cloud.

- Regulatory Compliance: Ensuring all cloud operations meet current and future data protection and financial regulations.

Technological advancements are reshaping 77 Bank's operational landscape, driving a significant push towards digital transformation. In 2024, Japanese financial institutions collectively allocated over ¥1.6 trillion towards IT modernization and digital service enhancement, a trend 77 Bank is actively participating in. This includes integrating fintech solutions to meet escalating customer demand for seamless online banking experiences.

Legal factors

77 Bank's operations are strictly governed by Japan's Banking Act and the Financial Services Agency (FSA) regulations. These frameworks dictate everything from licensing and organizational structure to the bank's business scope, capital requirements, and how it protects its customers. For instance, as of early 2024, the FSA continues to emphasize robust capital adequacy ratios, with major Japanese banks generally maintaining Common Equity Tier 1 ratios well above the Basel III minimums, often exceeding 10%.

The FSA actively updates these regulations to keep pace with evolving market dynamics and to foster technological advancements within the financial sector. This includes directives on digital transformation, cybersecurity, and consumer data protection, reflecting a proactive approach to modern banking challenges and opportunities. Recent FSA initiatives have focused on promoting open banking and enhancing financial inclusion through digital channels.

Japanese authorities are intensifying their focus on Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) regulations. This means financial institutions, including the 77 Bank, must bolster their compliance frameworks. These efforts are driven by a global push to combat illicit financial activities, and Japan is aligning with international standards.

The Financial Action Task Force (FATF) continues to emphasize robust AML/CFT measures. In 2024, Japan's commitment to these standards is reflected in increased supervisory scrutiny and the implementation of stricter reporting requirements for financial transactions. This necessitates significant investment in technology and personnel for the 77 Bank to ensure ongoing adherence.

In Japan, 77 Bank must navigate a complex web of data privacy and protection laws, such as the Act on the Protection of Personal Information (APPI). With digital transactions soaring, particularly following the pandemic, adherence to these regulations is paramount for maintaining customer trust and operational integrity. Failure to comply can result in significant fines, with recent amendments to the APPI in 2022 strengthening enforcement and increasing potential penalties for data breaches, impacting the bank's reputation and financial standing.

Financial Instruments and Exchange Act (FIEA) Updates

Recent updates to Japan's Financial Instruments and Exchange Act (FIEA) are designed to boost investor confidence and foster new avenues for asset management businesses. These revisions, effective from early 2024, aim to simplify disclosures and encourage greater participation in financial markets. For institutions like 77 Bank, understanding and implementing these changes is crucial for maintaining regulatory compliance and capitalizing on emerging business models within the financial sector.

The FIEA's evolution directly impacts how banks offer investment products. By focusing on enhanced transparency and investor engagement, the act provides a framework for more accessible and innovative financial solutions. 77 Bank needs to align its product offerings and operational procedures with these new standards to ensure they meet regulatory requirements and effectively serve their client base in the evolving Japanese financial landscape.

Key aspects of the FIEA updates include:

- Streamlined Disclosure Requirements: Simplifying reporting for certain investment products to improve clarity for retail investors.

- Support for Fintech in Asset Management: Creating a more conducive environment for technology-driven innovation in the asset management industry.

- Enhanced Investor Protection Measures: Strengthening safeguards to ensure fair treatment and adequate information for all investors.

- Promoting New Business Models: Facilitating the development of innovative asset management strategies and products.

Corporate Governance Reforms

Japan's ongoing corporate governance reforms are significantly reshaping the landscape for banks like 77 Bank. These initiatives aim to boost capital efficiency and enhance shareholder value, directly influencing strategic planning and operational adjustments within the financial sector. For instance, the Tokyo Stock Exchange's continued push for improved governance standards, with many companies actively working to meet the new prime market requirements, sets a precedent that 77 Bank must consider.

These reforms often translate into tangible actions, such as increased pressure on banks to optimize their balance sheets and deliver more consistent shareholder returns. This can lead to revised dividend policies, share buyback programs, or a more aggressive approach to non-performing loan resolution. In 2024, many Japanese financial institutions reported progress in aligning with these governance principles, with a notable focus on board independence and disclosure practices.

Key aspects of these reforms impacting 77 Bank include:

- Enhanced Board Oversight: Greater emphasis on independent directors and audit committees to ensure robust decision-making.

- Shareholder Engagement: Increased expectations for dialogue and responsiveness to shareholder concerns regarding capital allocation.

- Performance Metrics: A shift towards metrics that better reflect profitability and return on equity, encouraging more efficient operations.

- Disclosure Standards: More transparent reporting on executive compensation, related-party transactions, and risk management practices.

77 Bank operates under stringent legal frameworks, including Japan's Banking Act and the Financial Services Agency (FSA) regulations, which dictate capital adequacy, business scope, and customer protection. As of early 2024, the FSA continues to mandate robust capital ratios, with major Japanese banks maintaining Common Equity Tier 1 ratios above 10%. The FSA also actively updates regulations concerning digital transformation, cybersecurity, and data protection, promoting open banking and financial inclusion.

Increased scrutiny on Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) regulations requires 77 Bank to strengthen compliance, aligning with global standards and FATF recommendations. In 2024, Japan's adherence to these standards involves stricter reporting and supervisory oversight. Furthermore, the Act on the Protection of Personal Information (APPI) mandates strict adherence to data privacy, with amendments in 2022 increasing penalties for breaches.

The Financial Instruments and Exchange Act (FIEA) revisions, effective early 2024, aim to simplify disclosures and foster new asset management models, enhancing investor confidence. These changes impact how 77 Bank offers investment products, requiring alignment with new standards for transparency and investor engagement. Corporate governance reforms, driven by the Tokyo Stock Exchange's prime market requirements, also push for improved capital efficiency and shareholder returns, influencing strategic planning and operational adjustments for banks like 77 Bank.

Environmental factors

The Japanese banking sector, including institutions like 77 Bank, is actively embracing environmental, social, and governance (ESG) principles. This commitment is driven by a national push towards carbon neutrality, with banks increasingly financing green projects. For instance, by the end of fiscal year 2023, Japanese banks had significantly increased their lending to renewable energy sectors, demonstrating a tangible shift in investment priorities.

77 Bank's strategy will likely involve bolstering its sustainability reporting and aligning its financing activities with Japan's ambitious climate targets. This includes providing capital for renewable energy infrastructure and supporting businesses that demonstrate strong environmental stewardship. Such initiatives are crucial for meeting the nation's goal of achieving carbon neutrality by 2050.

As a regional bank headquartered in Miyagi Prefecture and deeply embedded in the Tohoku region, 77 Bank faces significant exposure to natural disaster risks, particularly earthquakes and tsunamis. The devastating 2011 Tohoku earthquake and tsunami serve as a stark reminder of this vulnerability, impacting infrastructure and economic activity across the region.

To mitigate these risks, 77 Bank must maintain and continuously enhance its business continuity plans and invest in resilience measures. This ensures the uninterrupted provision of essential financial services to its customers, even in the face of severe environmental disruptions. For instance, the bank's disaster preparedness likely includes redundant data centers and diversified operational sites.

Japan's commitment to sustainable finance is accelerating, evident in the increasing issuance of Green Transformation (GX) bonds. In 2023, the total value of green and sustainability-linked bonds issued in Japan reached approximately ¥5.5 trillion, signaling robust investor interest and a clear market direction.

This trend offers significant opportunities for 77 Bank to finance environmentally conscious projects, aligning with both national sustainability goals and the growing global demand for green investments. By engaging in this sector, the bank can tap into a burgeoning market and enhance its reputation as a responsible financial institution.

Resource Scarcity and Energy Costs

Global trends in resource scarcity, particularly concerning critical minerals and water, are projected to intensify. For instance, the International Energy Agency (IEA) reported in early 2024 that demand for minerals essential for clean energy technologies, like lithium and cobalt, could increase by over 40 times by 2040 compared to 2020 levels. This scarcity directly impacts manufacturing costs for businesses, potentially affecting loan demand and the creditworthiness of clients in sectors reliant on these resources.

Energy costs remain a significant variable. Crude oil prices, a benchmark for global energy expenses, have seen volatility, with forecasts for 2024-2025 suggesting a range influenced by geopolitical events and supply-demand dynamics. For 77 Bank, this translates to potential fluctuations in operational expenses and the financial health of its corporate and retail customers. The bank must consider strategies to mitigate these impacts, such as promoting energy efficiency within its own operations and offering financial products that support clients in adopting renewable energy sources or improving energy management.

The increasing focus on environmental, social, and governance (ESG) factors means that resource efficiency and energy transition are becoming critical for business sustainability and access to capital. Businesses that proactively manage their resource consumption and energy use are likely to be more resilient and attractive to investors and lenders. 77 Bank can leverage this by providing advisory services and financial solutions that facilitate a client's transition to greener practices.

- Resource Scarcity Impact: Rising costs of critical minerals for technology and manufacturing sectors could increase loan default risk for businesses in those industries.

- Energy Price Volatility: Fluctuations in oil and gas prices directly affect transportation, manufacturing, and consumer spending, impacting the borrowing capacity of many of 77 Bank's clients.

- Transition Finance: Demand for financing green technologies and sustainable infrastructure is expected to grow significantly, presenting an opportunity for 77 Bank to support clients in their energy transition efforts.

- Operational Efficiency: Implementing energy-saving measures within 77 Bank's own branches and data centers can lead to direct cost reductions and reinforce its commitment to sustainability.

Environmental Reporting and Disclosure Requirements

Environmental reporting and disclosure requirements are becoming increasingly stringent. Stakeholders, including investors and regulators, are demanding greater transparency from financial institutions like 77 Bank regarding their environmental footprint and sustainability initiatives. This pressure is driving the adoption of frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD).

In 2024, the global focus on climate risk reporting intensified, with many jurisdictions implementing or strengthening mandatory disclosure rules. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD) significantly expanded reporting obligations for companies, including financial institutions, requiring detailed information on environmental impacts and risks. 77 Bank, like its peers, faces the imperative to align its reporting practices with these evolving global standards to maintain investor confidence and regulatory compliance.

Key areas of focus for 77 Bank's environmental disclosures in 2024-2025 will likely include:

- Scope 1, 2, and 3 greenhouse gas emissions: Quantifying direct and indirect emissions across operations and financed activities.

- Climate-related risks and opportunities: Assessing physical and transition risks, and identifying opportunities in the green economy, aligning with TCFD recommendations.

- Sustainable finance products: Disclosing the volume and impact of green bonds, sustainability-linked loans, and other environmentally focused financial instruments.

- Biodiversity impact: Increasingly, disclosures will need to address the bank's impact on biodiversity and natural capital.

Japan's commitment to carbon neutrality by 2050 is a significant environmental driver, pushing financial institutions like 77 Bank towards green financing. This national agenda is supported by increasing issuance of Green Transformation (GX) bonds, with the market value reaching approximately ¥5.5 trillion in 2023, indicating strong investor appetite for sustainable projects.

77 Bank must navigate the increasing stringency of environmental reporting, aligning with global standards like the Task Force on Climate-related Financial Disclosures (TCFD). This includes transparently disclosing greenhouse gas emissions and climate-related risks, a trend amplified by directives such as the EU's CSRD, impacting financial institutions worldwide.

The bank's regional focus in Miyagi Prefecture exposes it to natural disaster risks, necessitating robust business continuity plans. Mitigating these physical risks is paramount for ensuring uninterrupted service delivery, especially given the region's vulnerability to events like earthquakes and tsunamis.

Global resource scarcity, particularly for minerals vital to clean energy technologies, is projected to escalate, potentially impacting manufacturing costs and client creditworthiness. For instance, demand for lithium and cobalt could surge over 40 times by 2040, a trend 77 Bank needs to monitor closely when assessing loan portfolios.

PESTLE Analysis Data Sources

Our PESTLE Analysis for 77 Bank is meticulously crafted using data from reputable financial institutions like the IMF and World Bank, alongside official government publications and leading economic research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the banking sector.