77 Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

77 Bank Bundle

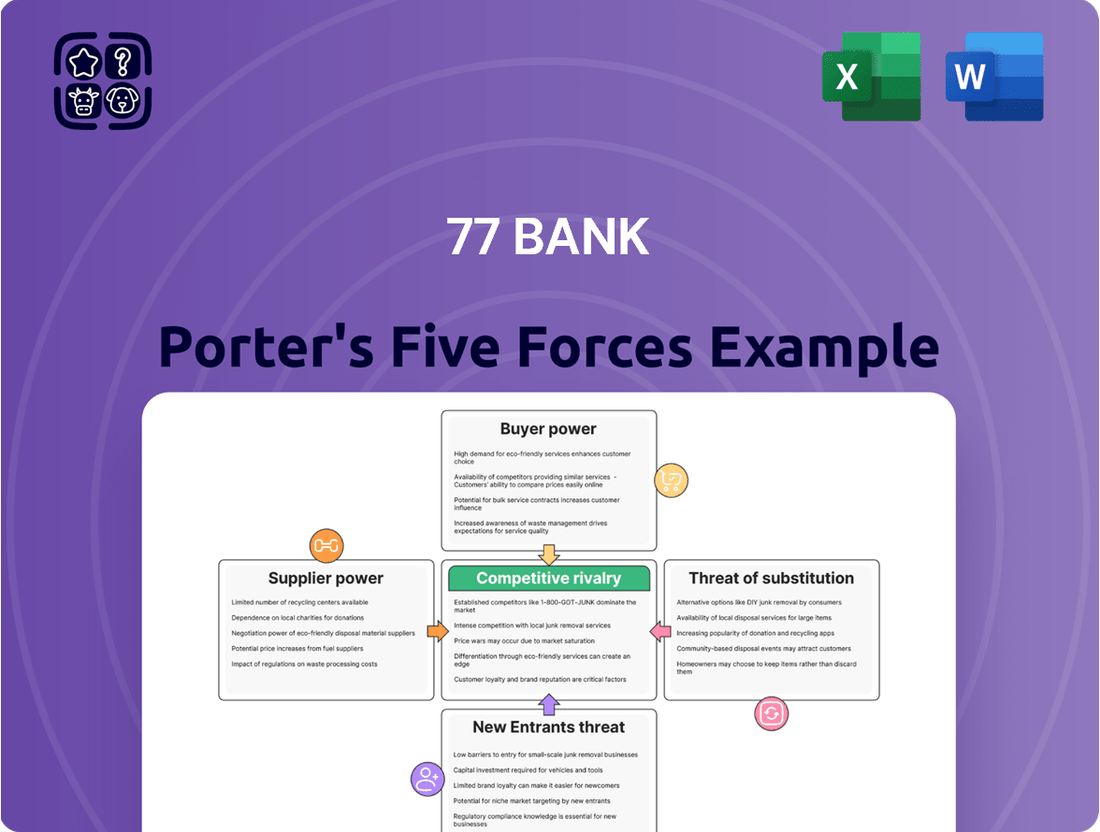

Understanding the competitive landscape for 77 Bank is crucial for any strategic decision. Our analysis delves into the five forces that shape its market, revealing the intensity of rivalry, the power of buyers and suppliers, and the threats from new entrants and substitutes.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore 77 Bank’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Technology providers hold significant sway over 77 Bank, supplying essential digital infrastructure, core banking systems, and cybersecurity. This power can range from moderate to high, particularly when specialized or proprietary technologies are critical for the bank's operations. For instance, advancements in AI and cloud computing are reshaping banking, and providers of these cutting-edge solutions often command greater leverage.

Financial market data providers wield considerable influence over 77 Bank, as access to real-time data, analytics, and intelligence is fundamental for its investment products and foreign exchange operations. Major players like Bloomberg and Refinitiv possess significant bargaining power due to the indispensable and often proprietary nature of their offerings, impacting the bank's ability to deliver competitive services.

The bargaining power of human capital, especially skilled labor, is a significant consideration for 77 Bank. The increasing demand for expertise in specialized fields such as fintech, cybersecurity, and advanced data analytics means that professionals with these skills can command higher wages and better benefits, thereby increasing their leverage.

In Japan, the demographic shift and a shrinking workforce further amplify this power. For instance, reports in early 2024 indicated a persistent shortage of IT professionals across various sectors, including finance. This scarcity allows skilled individuals to negotiate terms more favorably, impacting the bank's recruitment and retention costs.

77 Bank's strategic focus on innovation and digital transformation, as evidenced by its investments in new technologies throughout 2023 and early 2024, directly correlates with its need for specialized talent. Attracting and retaining these individuals is paramount to its operational success and competitive edge, granting skilled labor considerable bargaining power.

Payment Network Providers

Payment network providers, such as Visa and Mastercard, wield considerable bargaining power over banks like 77 Bank. As digital transactions become the norm, the bank's capacity to serve its customers effectively hinges on its access to these established payment infrastructures. In 2024, Japan's continued push towards a cashless society, with a target of increasing cashless payments to 40% by 2025, further amplifies the leverage of these network operators. This reliance means 77 Bank must often accept the terms and fees dictated by these dominant players to ensure seamless payment processing for its retail and corporate clients.

The bargaining power of payment network providers is a critical factor for 77 Bank.

- Dependence on Infrastructure: 77 Bank relies on networks like Visa and Mastercard for its digital payment services, limiting its negotiation options.

- Market Dominance: These providers often operate with duopolistic or monopolistic market structures, giving them significant pricing power.

- Growing Cashless Trend: Japan's increasing adoption of cashless payments, projected to reach 40% by 2025, strengthens the position of network providers.

Regulatory and Compliance Service Providers

Specialized regulatory and compliance service providers, such as law firms and consulting groups, wield significant bargaining power over Japanese banks. This is largely due to the intricate and constantly changing regulatory landscape in Japan, necessitating deep expertise to ensure adherence to frameworks like Basel III and the Banking Act.

The critical need for banks to maintain compliance, with penalties for non-compliance potentially reaching substantial figures, further amplifies the suppliers' leverage. For instance, in 2023, fines for regulatory breaches in the financial sector globally saw a notable increase, underscoring the cost of non-adherence.

- High Demand for Specialized Expertise: Banks require niche knowledge that only a limited number of firms possess.

- Cost of Non-Compliance: Penalties for failing to meet regulatory standards are severe, making compliance services indispensable.

- Limited Substitutes: The complexity of banking regulations leaves few viable alternatives to expert legal and compliance advice.

- Supplier Concentration: The market for highly specialized regulatory services often features a concentrated group of providers.

The bargaining power of suppliers for 77 Bank is a multifaceted issue, influenced by technology, data, human capital, payment networks, and regulatory services. Key suppliers in technology and data often hold significant sway due to the proprietary and essential nature of their offerings, impacting 77 Bank's operational efficiency and competitive edge.

Skilled human capital, particularly in areas like fintech and cybersecurity, possesses considerable leverage, amplified by Japan's ongoing demographic shifts and IT professional shortages observed in early 2024. Furthermore, dominant payment network providers like Visa and Mastercard exert substantial influence, a trend reinforced by Japan's drive towards a cashless society, aiming for 40% cashless payments by 2025.

Specialized regulatory and compliance service providers also command strong bargaining power, driven by the complexity of financial regulations and the severe financial repercussions of non-compliance, as evidenced by global increases in financial sector fines in 2023.

| Supplier Category | Key Influence Factors | Impact on 77 Bank | 2024 Data/Trend |

|---|---|---|---|

| Technology Providers | Proprietary solutions, innovation | Operational dependence, cost of upgrades | Increased investment in AI and cloud by banks |

| Data Providers | Real-time, indispensable data | Service competitiveness, operational costs | High reliance on major providers like Bloomberg |

| Skilled Labor | Specialized expertise (fintech, cyber) | Recruitment/retention costs, talent acquisition | IT professional shortages in Japan |

| Payment Networks | Market dominance, infrastructure access | Transaction fees, service availability | Japan's cashless payment push (40% by 2025) |

| Regulatory Services | Complex compliance needs | Cost of advisory, risk of penalties | Increased global fines for regulatory breaches (2023) |

What is included in the product

This analysis of 77 Bank's competitive environment dissects the intensity of rivalry, buyer and supplier power, threat of new entrants, and the influence of substitutes.

Instantly identify and address competitive threats with a dynamic, visual representation of each force, streamlining your strategic planning.

Customers Bargaining Power

Individual depositors, particularly in a localized market such as Miyagi, typically wield low to moderate bargaining power. While the option to switch financial institutions exists, factors like the accessibility of 77 Bank's local branches, existing customer relationships, and the breadth of services provided contribute to customer retention.

However, the increasing prevalence of digital-only banks, offering attractive interest rates and streamlined user experiences, presents a growing challenge that could amplify depositor leverage. For instance, as of early 2024, some neobanks were offering savings account rates significantly above traditional bank averages, creating a clear incentive for customers to consider moving their funds.

Small and Medium-sized Enterprises (SMEs) represent a significant client base for 77 Bank, wielding moderate bargaining power. Their reliance on regional banks for specialized lending and localized assistance can restrict their choices. In 2024, SMEs accounted for approximately 45% of 77 Bank's loan portfolio, highlighting their importance.

However, the competitive landscape among regional banks, coupled with the emergence of alternative financing channels and government-backed loan programs, grants SMEs a degree of leverage. For instance, the availability of fintech lending platforms in 2024 offered SMEs quicker access to capital, potentially reducing their dependence on traditional banking relationships and increasing their negotiation power.

Large corporations wield significant bargaining power over banks like 77 Bank. Their sheer size means they conduct massive transaction volumes and have complex, diverse financial needs, allowing them to negotiate for better terms on everything from loans to treasury services. For instance, in 2024, major corporations often secured prime lending rates, sometimes significantly below standard published rates, by leveraging their strong credit profiles and the competitive banking landscape.

These entities can easily switch banking partners if they don't receive preferential treatment. Their ability to access national and international banking networks means 77 Bank must continuously offer competitive, tailored solutions, including specialized financing and efficient cash management, to maintain these valuable relationships and prevent client attrition.

Investment Product Customers

Customers seeking investment products, whether individual or institutional, wield considerable bargaining power. This stems from their increasing sophistication, keen price sensitivity, and the sheer abundance of investment choices available across numerous financial institutions like securities firms and online brokerages. For instance, in 2024, assets under management in global ETFs reached an estimated $13 trillion, highlighting the vast array of alternatives available to investors.

To capture and retain this discerning clientele, 77 Bank must consistently present compelling returns and a broad spectrum of investment products. The competitive landscape is fierce, with many providers vying for investor capital. Data from the first half of 2024 indicates that net inflows into global equity funds alone surpassed $300 billion, underscoring investor appetite for well-performing and diverse offerings.

- Investor Sophistication: Customers are increasingly knowledgeable about financial markets and product performance.

- Price Sensitivity: Fees, expense ratios, and overall cost of investment are critical decision factors.

- Availability of Alternatives: A wide range of competitors offer similar or superior investment products.

- Switching Costs: For many investors, the cost and effort to switch providers are relatively low.

Foreign Exchange Service Users

Users of foreign exchange services, especially businesses engaged in international trade, possess moderate bargaining power. They actively shop around, comparing rates and fees from various providers, including major banks and dedicated forex platforms. In 2024, the global foreign exchange market saw significant activity, with daily trading volumes averaging over $6.5 trillion, highlighting the competitive landscape for service providers.

The ability of these customers to switch providers based on favorable terms is a key factor. For 77 Bank, offering competitive pricing and efficient transaction processing is crucial for customer retention in this segment. For instance, a slight difference in spread or a faster settlement time can sway a business’s decision.

- Moderate Bargaining Power: Businesses involved in international trade can easily switch FX providers.

- Rate and Fee Comparison: Customers routinely compare offerings from multiple financial institutions.

- Competitive Landscape: The FX market is vast, with numerous players vying for business.

- Retention Strategy: 77 Bank must focus on competitive pricing and service efficiency to keep these clients.

The bargaining power of customers is a critical factor influencing 77 Bank's profitability. Individual depositors, while numerous, generally have low to moderate power due to convenience and existing relationships, though digital alternatives are increasing this leverage. SMEs, representing a significant portion of 77 Bank's loan portfolio, possess moderate power, influenced by competitive regional banking and fintech options.

Large corporations hold substantial bargaining power, dictating terms due to their transaction volume and ability to switch banks, forcing 77 Bank to offer premium services. Investors also wield significant power, driven by market sophistication and the wide array of investment choices, compelling 77 Bank to provide competitive returns and products.

| Customer Segment | Estimated Bargaining Power (2024) | Key Influencing Factors |

|---|---|---|

| Individual Depositors | Low to Moderate | Branch accessibility, digital competition, interest rates |

| Small and Medium-sized Enterprises (SMEs) | Moderate | Regional bank competition, fintech lending, government programs |

| Large Corporations | High | Transaction volume, credit profile, ability to switch banks |

| Investment Product Seekers | High | Market sophistication, price sensitivity, availability of alternatives |

Full Version Awaits

77 Bank Porter's Five Forces Analysis

This comprehensive preview showcases the exact 77 Bank Porter's Five Forces Analysis you will receive immediately after purchase. You're looking at the actual, professionally written document, ensuring no surprises or placeholders, just the complete analysis ready for your strategic planning. Once your purchase is complete, you’ll gain instant access to this fully formatted and ready-to-use file.

Rivalry Among Competitors

The 77 Bank faces significant competitive rivalry from other regional banks operating within Japan's Tohoku region. These competitors, such as the Hokuriku Bank and the Shonai Bank, actively vie for local market share by emphasizing their community ties and offering comparable financial products and services. This intense rivalry often translates into aggressive marketing campaigns and efforts to differentiate through customer service and localized initiatives.

Japanese megabanks like MUFG, SMBC, and Mizuho present a substantial competitive challenge, especially for 77 Bank's larger corporate clients and in the realm of digital banking. These giants possess vast financial muscle and expansive networks, both domestically and globally. For instance, as of the fiscal year ending March 2024, MUFG reported total assets of ¥334.7 trillion, SMBC ¥231.8 trillion, and Mizuho ¥230.6 trillion, dwarfing the asset base of regional players.

These megabanks are channeling significant investment into digital transformation initiatives, aiming to enhance customer experience and operational efficiency. This aggressive push into digital services forces regional banks like 77 Bank to accelerate their own innovation efforts. Failure to keep pace could lead to a loss of market share, particularly among tech-savvy corporate customers who increasingly demand seamless digital solutions.

The competitive rivalry from digital banks and fintechs is a significant force. Companies like Rakuten Bank and SBI Sumishin Net Bank in Japan, and numerous fintech players globally, are directly challenging traditional banks. These digital disruptors often attract customers with better rates and slicker mobile experiences, forcing established institutions to adapt rapidly.

Credit Unions and Cooperative Banks

Credit unions and cooperative banks present a distinct competitive challenge to 77 Bank, particularly within its local operating areas. These institutions, often smaller than traditional banks, leverage deep community roots and a member-centric approach to attract and retain customers. For instance, as of late 2023, credit unions in the United States collectively held over $2.3 trillion in assets, demonstrating their significant market presence and ability to offer competitive financial products and services.

These entities frequently cater to specific demographic or geographic segments, fostering strong customer loyalty. Their cooperative structure can translate into more favorable loan rates and lower fees for members, directly impacting 77 Bank's pricing strategies. The National Credit Union Administration (NCUA) reported that in 2023, credit unions served over 137 million members nationwide, highlighting their widespread reach and influence.

- Localized Competition: Credit unions and cooperative banks often excel in specific geographic regions, creating concentrated competitive pressure for 77 Bank.

- Member-Centric Offerings: Their focus on member benefits can lead to more attractive rates and lower fees compared to traditional banks.

- Community Ties: Strong local relationships and a focus on community needs can foster significant customer loyalty, making it harder for 77 Bank to gain market share.

- Asset Growth: The credit union sector's substantial asset base, exceeding $2.3 trillion in late 2023, underscores their capacity to compete effectively on scale and service.

Non-Bank Financial Institutions

Non-bank financial institutions (NBFIs) like securities firms, insurance companies, and specialized lenders present a significant competitive force, particularly in niche markets. For instance, in 2024, the global asset management industry, dominated by NBFIs, managed over $130 trillion in assets, directly challenging banks' investment product offerings. These NBFIs often excel in specific areas, offering tailored solutions that can draw customers away from traditional banking services.

The competition from NBFIs is particularly acute in areas such as investment funds, where specialized asset managers can offer diverse portfolios and potentially higher returns. Similarly, the insurance sector, with companies providing a range of life, health, and property insurance products, competes for customer capital that might otherwise be deposited in banks. Consumer lending also sees robust competition from fintech lenders and credit unions, which can offer more agile and personalized loan products.

- Securities Firms: Compete directly with banks for investment banking, wealth management, and trading services. In 2023, global investment banking fees reached approximately $110 billion, a significant portion of which was generated by non-bank entities.

- Insurance Companies: Offer savings and investment products that rival bank deposits and investment accounts. The global insurance market's gross written premiums exceeded $6.7 trillion in 2023, indicating substantial capital flow outside traditional banking.

- Specialized Lenders: Including fintech companies and private credit funds, increasingly compete in consumer and corporate lending, often with faster approval processes and specialized risk assessment. The private credit market alone saw significant growth, with assets under management reaching over $1.7 trillion by the end of 2023.

The competitive rivalry in the banking sector is multifaceted, encompassing both traditional players and newer entrants. 77 Bank faces pressure from Japanese megabanks like MUFG, SMBC, and Mizuho, which possess significantly larger asset bases and are investing heavily in digital transformation. Regional banks and credit unions also pose a threat due to their strong community ties and localized offerings. Furthermore, non-bank financial institutions, including securities firms and specialized lenders, compete for customer capital and lending opportunities, particularly in niche markets.

| Competitor Type | Key Characteristics | 2023/2024 Data Point |

|---|---|---|

| Megabanks (e.g., MUFG, SMBC, Mizuho) | Vast financial resources, extensive networks, digital investment | MUFG total assets: ¥334.7 trillion (FY ending March 2024) |

| Regional Banks | Community focus, localized services | Actively compete for local market share |

| Credit Unions | Member-centric, community roots, competitive rates | US credit unions held over $2.3 trillion in assets (late 2023) |

| Digital Banks/Fintechs | Slicker mobile experiences, potentially better rates | Challenging traditional banks with innovative digital solutions |

| Non-Bank Financial Institutions (NBFIs) | Specialized services, niche market focus | Global asset management industry managed over $130 trillion (2024) |

SSubstitutes Threaten

Digital payment platforms like PayPay, LINE Pay, and Rakuten Pay are increasingly replacing traditional bank payment methods. In 2023, Japan's PayPay alone reported over 50 million registered users, highlighting its significant market penetration. This shift reduces reliance on banks for everyday transactions, posing a direct threat of substitution.

Direct lending and peer-to-peer (P2P) platforms offer viable alternatives to traditional bank financing, posing a threat of substitution for banks. For instance, in 2024, the global P2P lending market was projected to reach over $150 billion, demonstrating a growing appetite for non-bank credit solutions, particularly among small and medium-sized enterprises (SMEs) seeking faster or more flexible funding compared to conventional bank loans.

These alternative channels can bypass traditional banking intermediaries, especially for businesses that may find it challenging to meet stringent bank lending criteria. As of early 2025, several direct lending funds in developed markets have reported significant capital deployment, indicating a robust demand for these substitute financing options.

The rise of cryptocurrencies and stablecoins, particularly with evolving regulatory landscapes like Japan's, poses a potential long-term threat by offering alternatives to traditional currency and banking services. These digital assets, though still developing for widespread use, could provide new avenues for payments and remittances, impacting how financial transactions are conducted.

Investment Management Apps and Robo-Advisors

Online investment management apps and robo-advisors present a significant threat of substitutes for traditional bank investment services. These digital platforms provide automated, often lower-cost alternatives, attracting a growing segment of tech-savvy investors. For instance, by the end of 2023, the robo-advisory market globally was estimated to manage over $1.5 trillion in assets, a figure projected to climb substantially in the coming years.

These services appeal to investors looking for convenience and diversified portfolios without the higher fees or perceived complexity of human financial advisors. The ease of use and accessibility offered by these apps democratize investment, making them a compelling substitute for many.

- Low Fees: Robo-advisors typically charge management fees ranging from 0.25% to 0.50%, considerably lower than the 1% or more often charged by traditional advisors.

- Accessibility: Many platforms allow investors to start with very small amounts, often as low as $100, lowering the barrier to entry.

- Automation: Features like automatic rebalancing and tax-loss harvesting offer a hands-off approach that appeals to busy individuals.

Non-Financial Companies Offering Financial Services

Large technology firms and other non-financial corporations are increasingly encroaching on traditional banking territory. These players are introducing embedded finance solutions and specialized financial products, effectively acting as substitutes for some core banking services.

These new entrants can tap into vast existing customer bases and leverage advanced technological infrastructure. For instance, by mid-2024, companies like Apple and Google continued to expand their financial service offerings, including payment solutions and credit products, directly competing with banks for customer transactions and loyalty.

This trend presents a significant threat as these companies can often offer more seamless user experiences and potentially lower costs due to their scale and existing digital ecosystems. Consider that in 2023, the global embedded finance market was valued at over $67 billion and is projected to grow substantially, indicating a clear shift in how consumers access financial services.

- Increased Competition: Non-financial companies offer alternative payment, lending, and investment platforms.

- Customer Data Leverage: Tech giants utilize extensive customer data to personalize and offer financial products.

- Technological Agility: These firms often possess superior technological capabilities for faster innovation and deployment of new services.

- Market Share Erosion: Banks risk losing market share in key areas like payments and consumer lending to these digital-first competitors.

The threat of substitutes for traditional banking services is substantial, driven by digital payment platforms, alternative lending, and investment services. These substitutes often offer greater convenience, lower fees, and wider accessibility, directly challenging banks' core offerings.

For example, digital payment apps like PayPay in Japan have amassed millions of users, diverting everyday transactions away from traditional bank channels. Similarly, global peer-to-peer lending markets are projected to exceed $150 billion in 2024, providing businesses with an alternative to bank loans. Robo-advisors, managing over $1.5 trillion in assets by the end of 2023, also present a strong substitute for traditional investment management.

Furthermore, large technology firms are increasingly embedding financial services into their ecosystems, capturing market share in payments and lending. The global embedded finance market, valued at over $67 billion in 2023, underscores this trend. These substitutes leverage technology and customer data to offer seamless, often cheaper, alternatives, forcing banks to innovate or risk losing customers.

| Substitute Category | Examples | Key Advantages | Market Data/Trend (2023-2024) |

|---|---|---|---|

| Digital Payments | PayPay, LINE Pay, Rakuten Pay | Convenience, speed, user experience | PayPay: Over 50 million registered users (2023) |

| Alternative Lending | P2P lending platforms, Direct lending funds | Faster access to capital, flexible terms | Global P2P lending market projected >$150 billion (2024) |

| Investment Services | Robo-advisors, Online investment apps | Lower fees, automation, accessibility | Robo-advisory market managed >$1.5 trillion (end of 2023) |

| Embedded Finance | Tech firms' payment/credit solutions | Seamless integration, existing customer base | Global embedded finance market valued >$67 billion (2023) |

Entrants Threaten

Fintech startups in Japan are a growing concern for traditional banks. These agile companies are introducing innovative solutions in areas like payments, lending, and wealth management, often with a focus on user experience and lower costs. For instance, by the end of 2023, Japan saw a significant increase in fintech adoption, with reports indicating that over 60% of consumers had used at least one fintech service, highlighting the potential for these new entrants to capture market share.

The rise of digital-only banks, often called neobanks, poses a considerable threat to traditional institutions. These agile players bypass the overhead of physical branches, allowing them to offer more attractive rates and lower fees. For instance, in 2024, neobanks continued to gain traction, with some reporting substantial customer growth, attracting millions of users seeking seamless digital banking experiences and competitive savings yields.

Foreign banks might find opportunities in Japan's regional markets, despite local complexities and regulations. For instance, if they can offer specialized digital services or tap into niche customer bases, The 77 Bank could face increased competition. This expansion could be driven by identifying unmet needs within these regions, potentially impacting market share.

Large Non-Financial Corporations

Major non-financial corporations, especially those with substantial customer reach and advanced tech, like telcos or e-commerce leaders, pose a significant threat by potentially entering the banking space. These entities can capitalize on their established brand loyalty and vast customer data to introduce financial products, presenting a formidable competitive challenge to traditional banks.

For instance, in 2024, companies like Amazon and Apple continue to expand their financial service offerings, from payment processing to credit products, blurring the lines between technology and finance.

- Leveraging Existing Infrastructure: Non-financial firms can utilize their current technological platforms and customer interaction channels to roll out banking services with lower initial investment.

- Brand Recognition and Trust: Strong existing brands can translate into customer trust, making it easier to attract users to new financial products.

- Data Analytics Capabilities: Access to extensive customer data allows these entrants to personalize offerings and identify market gaps more effectively.

- Potential for Disruption: Their agility and focus on customer experience can lead to innovative models that traditional banks may struggle to replicate quickly.

Relaxation of Banking Regulations

A significant relaxation of banking regulations, particularly by bodies like the Financial Services Agency (FSA), could dramatically lower the hurdles for new companies to enter the banking sector. This would make it simpler for innovative fintech firms or even established non-financial companies to launch banking services.

This potential influx of new competitors, especially those unburdened by legacy systems or older regulatory frameworks, could intensify competition for The 77 Bank. For instance, if regulations were eased to allow non-bank entities to offer certain deposit or lending products, it could directly challenge traditional banks.

The threat is amplified when considering the global trend of regulatory divergence. In 2024, some jurisdictions have explored sandbox environments for fintech innovation, which, if mirrored by broader regulatory easing, could create new competitive pressures. For example, a 2023 report indicated a 15% increase in the number of new digital-only banks launched globally in the preceding two years, a trend that could accelerate with regulatory reform.

- Lowered Capital Requirements: Easing capital adequacy ratios could reduce the financial barrier for new entrants.

- Streamlined Licensing: Simplified approval processes for banking licenses would expedite market entry.

- Fintech Integration: Allowing easier integration of new technologies could empower non-traditional players.

- Increased Competition: A surge in new competitors could lead to price wars and reduced profit margins for The 77 Bank.

The threat of new entrants for The 77 Bank is multifaceted, stemming from agile fintech startups, digital-only neobanks, and even large non-financial corporations. These players often leverage technology and customer-centric approaches to gain market share, potentially eroding the customer base and profitability of traditional institutions. For instance, by the close of 2023, fintech adoption in Japan reached over 60% of consumers, underscoring the significant potential for these new entrants.

The competitive landscape is further shaped by potential regulatory shifts. Easing capital requirements or streamlining licensing processes could dramatically lower entry barriers, inviting more competition. In 2024, global trends show a continued rise in digital banking solutions, with some jurisdictions experimenting with regulatory sandboxes to foster innovation. This suggests that if regulations were to become more permissive, the influx of new competitors could intensify, leading to increased price competition and reduced margins for established banks like The 77 Bank.

The 77 Bank faces a growing threat from new entrants, particularly fintech startups and neobanks, which are rapidly capturing market share through innovative digital offerings and competitive pricing. By the end of 2023, over 60% of Japanese consumers had used fintech services, indicating a strong market appetite for these alternatives. Furthermore, major non-financial corporations are increasingly venturing into financial services, leveraging their vast customer data and brand recognition to offer banking-like products, as seen with companies like Amazon and Apple expanding their financial service portfolios in 2024.

Porter's Five Forces Analysis Data Sources

Our 77 Bank Porter's Five Forces analysis is built upon a robust foundation of data, drawing from publicly available financial statements, industry-specific market research reports, and economic indicators. We also incorporate insights from regulatory filings and reputable financial news outlets to ensure a comprehensive understanding of the competitive landscape.