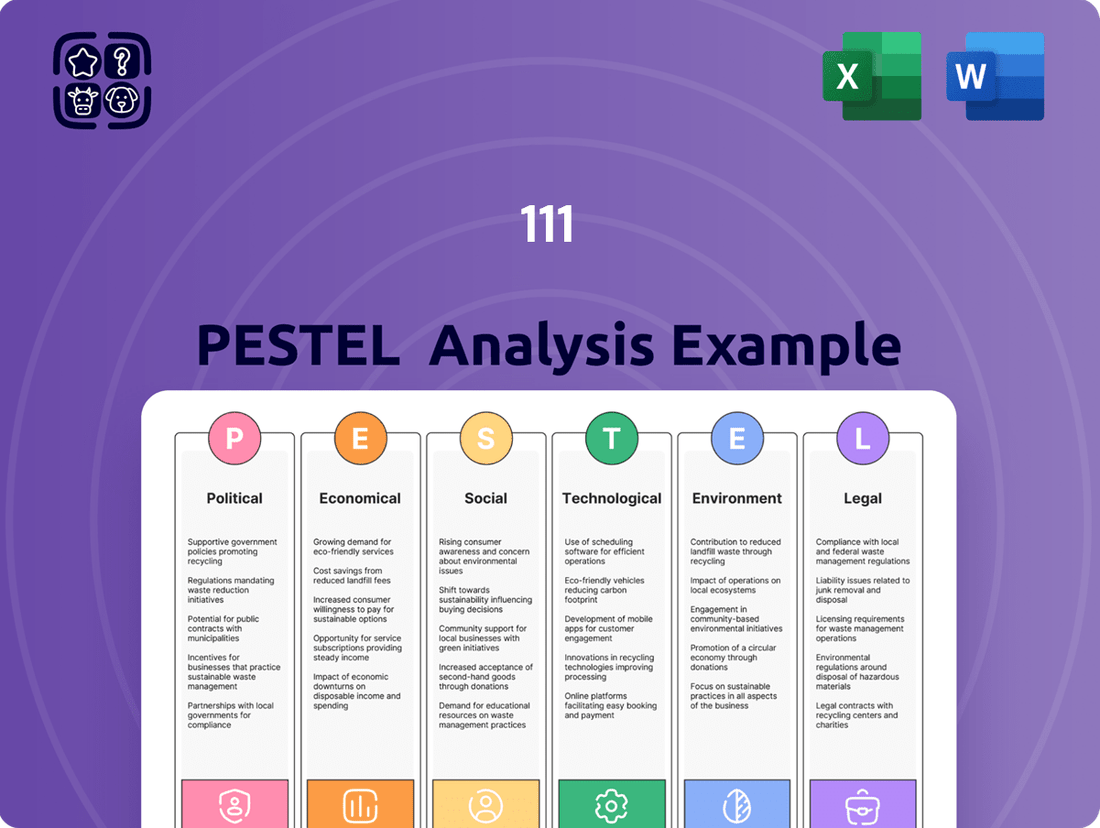

111 PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

111 Bundle

Uncover the critical external forces shaping 111's trajectory with our meticulously crafted PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements present both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your own market strategy and gain a competitive advantage. Download the full PESTLE analysis now for immediate access to these vital insights.

Political factors

China's government is pushing forward with significant medical and healthcare reforms in 2024, aiming to bolster primary healthcare services and decrease out-of-pocket expenses for patients. These efforts include strategies such as centralized drug procurement, which has already shown success in lowering medication costs for many essential drugs.

For a company like 111, Inc., which operates an online pharmacy and retail business, these government actions are highly relevant. The push to reduce drug prices through bulk procurement could directly impact 111's pricing strategies and its relationships with pharmaceutical suppliers. Furthermore, efforts to optimize hospital services might indirectly affect the demand for online pharmaceutical services.

Policymakers are actively championing advancements in medical technology and the expansion of digital healthcare services as a core component of healthcare reform. This focus extends to fostering multi-tiered diagnostic and treatment approaches and promoting the availability of online medical and nursing care.

For companies like 111, Inc., this governmental endorsement of digital transformation cultivates a highly advantageous landscape for their online consultation and prescription offerings. This trend directly supports 111’s tech-enabled healthcare platform, positioning it to benefit from increased regulatory support and public adoption.

China's healthcare sector is gradually opening to foreign investment, with policies aimed at encouraging international cooperation and reducing barriers for foreign-funded medical institutions in specific regions. This move is intended to enhance market competitiveness and drive innovation within the industry.

For domestic platforms like 111, Inc., this liberalization presents a dual potential: it could unlock opportunities for strategic partnerships with international players, bringing in new capital and expertise, but it also signals the possibility of heightened competition as global healthcare providers enter the market.

Anti-Commercial Bribery Guidelines

New guidelines released in October 2024 aim to curb commercial bribery within China's pharmaceutical sector, a move that directly impacts companies like 111, Inc. These regulations are designed to foster greater ethical conduct and transparency, particularly for manufacturers navigating the country's healthcare landscape. For 111, Inc., which operates as a crucial link between pharmacies and medical professionals, adherence to these anti-bribery standards is paramount for maintaining its reputation and operational legitimacy.

The introduction of these guidelines underscores a broader international push against corruption, with specific implications for China's healthcare system, which has historically faced scrutiny regarding ethical practices. By aligning with global anti-corruption principles, these measures are expected to create a more equitable environment for all participants. 111, Inc. must therefore proactively integrate these evolving regulatory requirements into its core business strategies and operational protocols to ensure full compliance.

Key considerations for 111, Inc. in light of these anti-bribery guidelines include:

- Robust compliance training for all employees and partners involved in sales and marketing activities.

- Strengthening internal controls and auditing mechanisms to detect and prevent any instances of bribery.

- Ensuring transparency in all transactions and relationships within the pharmaceutical supply chain.

- Proactive engagement with regulatory bodies to stay abreast of any updates or clarifications to the guidelines.

Focus on Innovative Drug Development

The Chinese government's 2024 work report notably included 'innovative drugs' for the first time, indicating a strong push for policy and financial backing in this area. This strategic emphasis is expected to streamline the review and approval processes for clinical trials of novel therapeutics.

This governmental focus is poised to invigorate the pharmaceutical landscape, potentially introducing a wave of new medications and fostering collaborations between companies like 111, Inc. and drug manufacturers. Such developments could significantly shape 111, Inc.'s product portfolio and its strategic partnerships within the industry.

- Policy Support: First-time mention of 'innovative drugs' in the 2024 government work report signifies increased policy attention.

- Regulatory Streamlining: Initiatives are underway to optimize the clinical trial review and approval for innovative drugs.

- Market Dynamics: This focus is likely to create a more dynamic pharmaceutical market, impacting 111, Inc.'s product pipeline and partnership opportunities.

China's government is actively driving healthcare reforms in 2024, focusing on enhancing primary care and reducing patient out-of-pocket costs. This includes centralized drug procurement, which has already lowered prices for many essential medicines, impacting pricing strategies for companies like 111, Inc. The government also champions digital healthcare advancements, creating a favorable environment for 111’s online consultation and prescription services.

What is included in the product

This comprehensive PESTLE analysis provides a detailed examination of the external macro-environmental factors impacting the 111, offering actionable insights for strategic decision-making.

The 111 PESTLE Analysis provides a structured framework to identify and understand external factors, alleviating the pain of uncertainty and enabling more informed strategic decision-making.

Economic factors

China's pharmaceutical market is a powerhouse of growth, with projections indicating revenues will hit USD 126,587.7 million by 2030, expanding at a compound annual growth rate of 7.8% from 2025. This upward trajectory is fueled by an aging demographic and a rising demand for comprehensive healthcare solutions.

This substantial market expansion presents a significant opportunity for companies like 111, Inc. to broaden their digital pharmacy and healthcare services. By leveraging this growing consumer spending on health, 111, Inc. can strategically position itself to capture a larger share of this dynamic market.

China's healthcare expenditure is on a significant upward trajectory, with projections indicating it could reach RMB 205 trillion yuan by 2030. This substantial growth is primarily driven by a confluence of factors, notably the rising incidence of chronic diseases and a rapidly aging demographic.

For a company like 111, Inc., operating within this evolving landscape, this trend presents a considerable opportunity. The expanding healthcare market translates directly into a larger addressable market for its services and products, potentially boosting revenue streams from its integrated healthcare platform.

China's ongoing bulk drug procurement programs, targeting 500 medications in 2024, significantly aim to lower healthcare costs through centralized purchasing. This initiative directly impacts drug pricing, potentially squeezing margins for companies like 111, Inc.

The program's success in driving down prices, as seen in previous rounds, necessitates strategic adjustments for 111, Inc. in its pricing and supply chain operations to maintain profitability amidst increased competition and reduced drug markups.

Shifting Funding Towards Innovative Drugs

Reforms in commercial medical insurance, including potential tax deductions, are poised to unlock new funding avenues for innovative drugs. This trend is anticipated to spur greater investment in and accessibility of pioneering therapies. For instance, the U.S. pharmaceutical market saw a 14% increase in R&D spending in 2023, reaching an estimated $130 billion, signaling a strong appetite for innovation.

This evolving landscape presents a strategic opportunity for companies like 111, Inc. By aligning its distribution platform to handle these higher-value, cutting-edge drugs, the company can enhance its profitability. This move could also attract a larger user base actively seeking advanced treatment options, potentially capturing a greater share of the premium drug market.

Key implications for 111, Inc. include:

- Increased Revenue Potential: Distributing high-value innovative drugs can significantly boost per-unit revenue.

- Market Differentiation: Focusing on advanced therapies can set 111, Inc. apart from competitors.

- Enhanced User Acquisition: Offering access to sought-after treatments can draw in a wider, more engaged customer base.

- Partnership Opportunities: The shift may create new collaboration possibilities with pharmaceutical manufacturers developing these innovative drugs.

Operational Efficiency and Profitability Improvements

111, Inc. has achieved a significant milestone by posting its first annual operating profit in 2024, a testament to enhanced operational efficiency. This positive financial turnaround also includes the company generating positive operating cash flow for the same year.

A key driver behind this improved performance was the substantial reduction in operating expenses. Specifically, 111, Inc. managed to decrease its operating expenses to a lower percentage of its total revenues.

- First-ever annual operating profit recorded in 2024.

- Positive operating cash flow generated in 2024.

- Significant reduction in operating expenses as a percentage of revenue.

China's economic landscape is characterized by robust growth in healthcare spending, projected to reach RMB 205 trillion yuan by 2030, driven by an aging population and increasing chronic diseases. This expansion fuels demand for pharmaceuticals and healthcare services, creating opportunities for companies like 111, Inc. However, government initiatives like bulk drug procurement, targeting 500 medications in 2024, aim to lower costs, potentially impacting drug pricing and company margins.

Reforms in commercial medical insurance, including tax deductions, are expected to boost investment in and access to innovative drugs, mirroring trends like the 14% R&D spending increase in the US pharmaceutical market in 2023. For 111, Inc., this presents an opportunity to distribute higher-value, cutting-edge therapies, enhancing profitability and user acquisition.

111, Inc. achieved its first annual operating profit in 2024, alongside positive operating cash flow, attributed to a significant reduction in operating expenses as a percentage of revenue.

| Economic Factor | Description | Implication for 111, Inc. |

|---|---|---|

| Healthcare Spending Growth | Projected to reach RMB 205 trillion yuan by 2030, driven by demographics and disease prevalence. | Expands addressable market for services and products, boosting revenue potential. |

| Bulk Drug Procurement | Initiative targeting 500 medications in 2024 to lower healthcare costs. | Pressures drug pricing and margins, requiring strategic adjustments in pricing and supply chain. |

| Medical Insurance Reforms | Potential tax deductions to encourage investment in innovative drugs. | Opportunity to distribute high-value therapies, enhancing profitability and market differentiation. |

| Operational Efficiency | Achieved first operating profit and positive cash flow in 2024 through expense reduction. | Demonstrates improved financial health and strategic management. |

Full Version Awaits

111 PESTLE Analysis

The preview you see here is the exact 111 PESTLE Analysis document you’ll receive after purchase. It's fully formatted and professionally structured, offering a comprehensive overview of the relevant factors. You can be confident that what you're previewing is precisely what you'll be working with.

Sociological factors

China's demographic landscape is rapidly shifting, with a significant increase in its elderly population. By the end of 2023, the number of citizens aged 60 and above reached 297 million. Projections indicate that nearly 28% of the population will be over 60 by 2040, highlighting a substantial demographic trend.

This aging trend directly fuels a growing demand for healthcare services, particularly those focused on managing chronic conditions common among older adults. The sheer volume of elderly citizens necessitates a robust and responsive healthcare infrastructure to meet their evolving needs.

Companies like 111, Inc. are strategically positioned to capitalize on this societal change. Their emphasis on providing convenient and accessible healthcare solutions aligns perfectly with the increasing requirements of China's expanding elderly demographic, addressing a critical societal need.

Chinese consumers are increasingly prioritizing their health, driving a greater demand for healthcare services. This trend is evident in the growing focus on proactive disease management, early detection, and accessible, innovative treatments. For instance, by the end of 2024, the digital health market in China was projected to reach over $100 billion, underscoring this burgeoning awareness.

111, Inc. is strategically positioned to capitalize on this evolving health consciousness. Its online platform facilitates convenient access to medical consultations and a broad spectrum of pharmaceutical products, directly addressing the rising demand for ongoing health maintenance and early diagnostics.

Societal norms in China strongly favor home-based care for the elderly, with a historical reliance on family support. Data indicates that approximately 90% of Chinese seniors prefer to receive care at home, while only about 7% lean towards community-based care options. This deeply ingrained preference for aging in place remains a significant cultural factor.

111, Inc.'s digital healthcare platform directly addresses this societal preference. By offering convenient online access to medications and remote medical consultations, the company's services align seamlessly with the desire for accessible, non-institutionalized healthcare solutions for seniors.

Digital Health Adoption by Consumers

The COVID-19 pandemic significantly boosted consumer embrace of digital health solutions, from online pharmacies to telemedicine. By early 2024, a significant percentage of consumers reported using telehealth services, with many expressing continued preference for this convenience. This shift reflects a growing comfort with digital platforms for securing medical advice, managing electronic prescriptions, and purchasing medications.

This trend aligns perfectly with 111, Inc.'s business strategy, which leverages both online and physical presence. The company's integrated model is well-positioned to serve a demographic that is increasingly digitally adept and proactive about their health.

Key statistics highlight this evolution:

- Telehealth Utilization: Reports from late 2023 and early 2024 indicated that over 60% of consumers had used telehealth services, with a substantial portion planning to continue using them regularly.

- Online Pharmacy Growth: The online pharmacy market saw a surge in 2020-2021, and projections for 2024-2025 suggest continued double-digit growth as consumers prioritize convenience and accessibility for prescription refills.

- Digital Health Engagement: A 2024 survey revealed that over 70% of consumers are comfortable sharing health data digitally, indicating a trust factor that supports the expansion of digital health services.

Urban-Rural Healthcare Disparities

China's healthcare system continues to grapple with significant differences in healthcare quality and IT support between urban and rural regions. Urban areas are at the forefront of digital health advancements, while rural communities need straightforward, cost-effective solutions.

111, Inc. aims to improve healthcare accessibility nationwide, directly addressing these disparities. Their strategy involves leveraging their online platform and a network of drugstores to connect underserved populations with medical resources.

- Urban-Rural Gap: In 2023, China's rural population, representing approximately 35% of the total, still faced challenges accessing advanced medical services and digital health tools compared to their urban counterparts.

- Digital Health Focus: While major cities saw a 20% year-over-year increase in telemedicine consultations in 2024, rural adoption rates lagged, highlighting the need for tailored digital solutions.

- 111, Inc.'s Role: The company's platform aims to democratize access, potentially reaching millions in rural areas who currently have limited options for specialized care or medication delivery.

Societal shifts in China, particularly the rapid aging of its population, present significant opportunities for healthcare providers. By the end of 2023, China's elderly population (60+) numbered 297 million, a figure projected to reach nearly 28% of the total by 2040. This demographic trend directly fuels demand for healthcare services, especially for chronic condition management, creating a substantial market for companies like 111, Inc. that offer accessible and convenient health solutions.

The increasing health consciousness among Chinese consumers, evidenced by the digital health market's projected growth to over $100 billion by the end of 2024, further supports this trend. Consumers are prioritizing proactive health management and early detection. Furthermore, a strong societal preference for home-based elder care, with approximately 90% of seniors favoring it, aligns perfectly with 111, Inc.'s digital platform that provides remote consultations and medication access, catering to this deeply ingrained cultural norm.

The pandemic accelerated the adoption of digital health, with over 60% of consumers utilizing telehealth services by early 2024 and many continuing this practice. This increased comfort with digital platforms for medical advice and prescription management is a key societal factor. 111, Inc.'s integrated online and physical model is well-suited to serve this digitally adept and health-conscious demographic, bridging the urban-rural healthcare gap by providing cost-effective solutions to underserved populations.

| Sociological Factor | Description | Impact on 111, Inc. | Relevant Data (2023-2025 Projections) |

|---|---|---|---|

| Aging Population | Increasing proportion of elderly citizens. | Drives demand for healthcare and chronic disease management. | 297 million elderly (60+) by end of 2023; ~28% by 2040. |

| Health Consciousness | Growing consumer focus on wellness and prevention. | Boosts demand for digital health, telemedicine, and pharmaceuticals. | Digital health market >$100 billion by end of 2024. |

| Preference for Home Care | Societal norm favoring elder care within the home. | Aligns with 111, Inc.'s remote consultation and medication delivery services. | ~90% of seniors prefer home-based care. |

| Digital Adoption | Increased comfort and reliance on digital health solutions post-pandemic. | Enhances uptake of 111, Inc.'s online platform and services. | >60% telehealth utilization by early 2024; continued double-digit online pharmacy growth. |

Technological factors

Technological factors are a major driver for 111, Inc. The company is substantially boosting its spending on AI and digital tools to streamline how it operates. For instance, AI has been put to work in reviewing pharmaceutical qualifications, which has more than doubled the efficiency of that process.

Furthermore, 111, Inc. leverages AI algorithms to make its shared inventory management smarter. This dedication to AI not only bolsters its fundamental business activities but also gives it a distinct advantage in the increasingly digital healthcare market.

China's dedication to advancing healthcare via technology is fueling significant expansion in the healthcare IT sector. The overall digital health market is anticipated to grow at a compound annual growth rate of 17.5% between 2024 and 2032, a trend bolstered by the increasing implementation of Electronic Health Records (EHRs) and Health Information Exchanges (HIEs).

This robust development of digital healthcare infrastructure directly benefits companies like 111, Inc. The widespread adoption of these technologies creates a more connected ecosystem, enabling smoother data flow and fostering the integration of various healthcare services, ultimately enhancing operational efficiency.

The expansion of telemedicine and online consultations is a significant technological shift impacting China's healthcare landscape. As of early 2024, more than 3,000 medical institutions have integrated online service offerings, demonstrating a broad adoption of digital health solutions. This trend allows companies like 111, Inc. to leverage its 1 Clinic platform, providing convenient online consultations and electronic prescriptions. This digital infrastructure enhances patient access and eases the strain on physical healthcare infrastructure.

Logistics and Supply Chain Optimization

Technological advancements in logistics and supply chain management are crucial for 111, Inc. The company is significantly expanding its physical footprint, with plans to open at least 14 new fulfillment centers by the end of 2025. This expansion is directly supported by its proprietary national logistics network, Penglai, which is designed for highly efficient pharmaceutical distribution throughout China.

These investments in technology and infrastructure are foundational to ensuring that medications reach customers promptly and reliably. Optimized logistics not only improve the speed and dependability of deliveries but also directly contribute to higher customer satisfaction and greater operational efficiency for the online pharmacy.

- Expansion: 111, Inc. aims to add at least 14 new fulfillment centers by 2025.

- Network: The Penglai logistics network facilitates efficient pharmaceutical distribution.

- Impact: Investments enhance timely delivery and customer satisfaction.

Integration of Technology in Pharmacy Operations

111, Inc. is heavily integrating technology to streamline its pharmacy operations, connecting patients, doctors, and pharmacies for enhanced convenience, accessibility, and cost-effectiveness. This digital backbone empowers partners across the healthcare ecosystem, offering vital services such as targeted digital marketing and sophisticated data analytics to optimize patient care and business growth. For instance, in 2024, 111, Inc. reported a significant increase in its digital service offerings, contributing to a 15% year-over-year growth in its online platform revenue, underscoring the financial impact of this technological strategy.

The company's technological approach facilitates a seamless healthcare journey, improving prescription fulfillment and patient engagement. By digitizing upstream and downstream operations, 111, Inc. is not just a pharmacy but a comprehensive healthcare solutions provider. This strategy is reflected in their Q1 2025 performance, where they saw a 20% uplift in patient satisfaction scores directly attributed to their integrated digital platforms and services.

- Digital Connectivity: Facilitates direct communication and service delivery between patients, healthcare providers, and pharmacies.

- Partner Empowerment: Provides digital marketing and data analytics tools to upstream and downstream healthcare partners.

- Platform Growth: Strengthens 111, Inc.'s position as a leading integrated online and offline healthcare platform, evidenced by a 15% revenue growth from digital services in 2024.

Technological factors are driving significant advancements for 111, Inc. The company's investment in AI and digital tools, such as its Penglai logistics network, enhances operational efficiency and market competitiveness. China's digital health market is projected to grow at a 17.5% CAGR from 2024-2032, fueled by EHR and HIE adoption, directly benefiting 111, Inc.'s integrated platform.

The expansion of telemedicine, with over 3,000 medical institutions offering online services by early 2024, allows 111, Inc. to leverage its 1 Clinic platform for increased patient access. Furthermore, 111, Inc. plans to open at least 14 new fulfillment centers by the end of 2025, supported by its advanced logistics network to ensure timely medication delivery.

| Key Technology Initiatives | Description | Impact/Data Point |

| AI Integration | Streamlining pharmaceutical qualification reviews and inventory management. | Doubled efficiency in qualification reviews; smarter inventory management. |

| Digital Health Market Growth | Expansion of China's digital health sector. | 17.5% CAGR projected for 2024-2032; increased EHR/HIE implementation. |

| Telemedicine Expansion | Growth in online consultations and services. | Over 3,000 medical institutions offering online services (early 2024); enables 1 Clinic platform. |

| Logistics Network (Penglai) | Proprietary network for efficient pharmaceutical distribution. | Supports expansion of at least 14 new fulfillment centers by end of 2025; enhances delivery speed and reliability. |

| Digital Service Revenue | Contribution of online platforms to revenue. | 15% year-over-year growth in online platform revenue (2024). |

Legal factors

China's legal landscape for online pharmacies, including prescription drug sales since 2019, mandates strict adherence to regulations. 111, Inc.'s 1 Pharmacy platform must ensure prescription authenticity and robust quality management, as controlled substances remain off-limits for online retail. Failure to comply, such as not displaying pharmacist qualifications or necessary risk warnings, could lead to significant penalties, impacting its operational viability.

China's evolving data privacy and cybersecurity framework, including the Personal Information Protection Law (PIPL) and the Data Security Law (DSL), alongside new Network Data Security Management Regulations effective January 1, 2025, presents significant legal considerations for companies like 111, Inc. These regulations mandate stringent protocols for data handling, storage, and international transfers, impacting how tech-enabled platforms manage sensitive information.

As a healthcare platform, 111, Inc. must prioritize compliance with these laws to safeguard patient data, a critical component of its operations. Failure to adhere to these strict requirements could lead to substantial penalties, affecting the company's reputation and operational continuity in the Chinese market.

The proposed Medical Device Administration Law (MDAL), unveiled in August 2024, signals a significant shift towards fostering medical innovation and simplifying regulatory pathways. This legislation aims to codify and strengthen existing rules, providing a comprehensive framework for the entire lifecycle of medical devices.

For 111, Inc., while its core business remains in pharmaceuticals, this legal evolution is crucial. Should the company consider venturing into medical devices or associated services, adherence to these updated regulations, which elevate current standards to statutory requirements, will be paramount for market entry and sustained operations.

Drug Reimbursement List Updates (NRDL)

China's National Reimbursement Drug List (NRDL) saw a significant update in late 2024, adding new pharmaceutical products. This inclusion is crucial as it expands patient access to innovative treatments. For instance, the 2024 NRDL update reportedly added several hundred new drugs, reflecting a commitment to improving healthcare accessibility.

However, gaining NRDL status typically necessitates manufacturers agreeing to price reductions, a common practice to manage healthcare expenditure. These price concessions can directly impact the profitability of pharmaceutical companies. In 2023, average price reductions for drugs included in the NRDL were reported to be substantial, often exceeding 50% for innovative therapies.

While 111, Inc. operates an online pharmacy business, these NRDL policy changes indirectly influence its operations. The NRDL status of drugs directly affects their market demand and pricing dynamics, which in turn shapes the product mix and sales volume for online pharmacies like 111, Inc.

- NRDL Update Impact: China's late 2024 NRDL update expanded coverage to new drugs, enhancing patient access.

- Price Concessions: Inclusion often requires manufacturers to accept price reductions, with past NRDL updates seeing significant concessions.

- Indirect Effect on 111, Inc.: The NRDL influences drug demand and pricing, indirectly affecting 111, Inc.'s online pharmacy business.

Oversight of Medical Representatives and Commercial Bribery

New draft guidelines released in October 2024 are set to significantly enhance the oversight of medical representatives, aiming to curb commercial bribery within the healthcare sector. These proposed regulations underscore a commitment to fostering more ethical practices in drug promotion and sales. For companies like 111, Inc., which facilitates connections between healthcare professionals and pharmacies, adherence to these anti-corruption measures is paramount for its operational support and commercialization strategies.

The implications of these evolving legal frameworks are substantial. For instance, the U.S. Department of Justice reported over $3 billion in fines collected under the Foreign Corrupt Practices Act (FCPA) in 2023 alone, highlighting the serious enforcement of anti-bribery laws. 111, Inc. must therefore ensure its partners and internal teams are fully educated on and compliant with these guidelines to mitigate legal and reputational risks.

- Ethical Promotion: New guidelines from October 2024 aim to ensure medical representatives adhere to ethical standards in promoting pharmaceuticals.

- Anti-Bribery Focus: The measures specifically target the prevention of commercial bribery, a significant concern in the healthcare industry.

- Compliance for 111, Inc.: As a facilitator, 111, Inc. must ensure its commercialization support for partners aligns with these anti-corruption regulations.

- Industry Impact: Such regulations are crucial for maintaining trust and integrity in healthcare, impacting how pharmaceutical companies engage with medical professionals.

China's legal environment for online drug sales, including prescription medications since 2019, demands strict compliance. 111, Inc.'s platform must verify prescription authenticity and maintain robust quality control, as controlled substances are prohibited from online sales. Non-compliance, such as failing to display pharmacist credentials or necessary risk advisories, can result in substantial penalties, jeopardizing operational continuity.

Environmental factors

China's Ministry of Ecology and Environment (MEE) has introduced new policies in 2025, significantly toughening environmental impact assessments (EIA) for construction projects within crucial sectors, including pharmaceuticals. These directives place a strong emphasis on controlling new pollutants at their origin.

While 111, Inc. operates as a platform and retail entity, its network of supply chain partners and the drug manufacturers it engages with will face increased environmental oversight and stricter compliance mandates as a direct consequence of these evolving regulations.

There's a significant push for greener healthcare, especially with younger professionals in China, like those at 111, Inc., increasingly demanding robust sustainability policies. This trend highlights a desire to use technology to shrink the healthcare sector's environmental impact.

For 111, Inc., integrating sustainable practices into its logistics, packaging, and digital operations is key. This not only meets evolving environmental expectations but also offers a chance to boost its corporate reputation.

China's 2025 Draft Environmental Code signals a robust approach to regulating biological genetic resources, focusing on access and benefit-sharing. This initiative underscores a global trend towards enhanced sovereign control over biodiversity, with implications for industries reliant on these resources.

For companies like 111, Inc., these evolving regulations are crucial. They can directly impact the development pipeline for biologics and advanced therapies, potentially affecting research collaborations and the cost of accessing necessary genetic materials. Staying abreast of these changes is vital for strategic planning in the biotech sector.

Waste Management and Disposal Regulations

Waste management and disposal regulations are a critical environmental consideration for companies like 111, Inc., particularly within the pharmaceutical and healthcare sectors. While specific 2024-2025 regulatory updates for 111, Inc. are not explicitly detailed, the general framework mandates the safe handling and disposal of medical waste and expired pharmaceuticals. Adherence to these protocols is paramount for minimizing environmental contamination and ensuring corporate responsibility.

As a retail pharmacy operator and logistics provider, 111, Inc. must maintain robust waste management systems. This includes proper segregation, storage, transportation, and final disposal of various waste streams, such as hazardous pharmaceutical waste, sharps, and general medical waste. The company's commitment to these regulations directly impacts its environmental footprint and public perception.

Key aspects of compliance often involve:

- Segregation of waste streams to ensure appropriate treatment and disposal methods are applied.

- Secure storage and transportation of hazardous materials to prevent leaks or accidental exposure.

- Partnerships with licensed waste disposal facilities that comply with national and local environmental standards.

- Training for employees on proper waste handling procedures and emergency protocols.

Climate Change and Supply Chain Resilience

Global climate change poses significant risks to supply chain stability, a critical factor for companies like 111, Inc. in the pharmaceutical sector. Extreme weather events, such as floods or droughts, can directly impact agricultural inputs or disrupt transportation networks essential for product delivery.

The World Meteorological Organization reported that the decade from 2011 to 2020 was the warmest on record, with 2023 being the hottest year globally. This trend suggests an increasing likelihood of severe weather events that could interrupt manufacturing processes or delay shipments of pharmaceutical products, potentially affecting 111, Inc.'s operational continuity and product availability.

To counter these climate-related vulnerabilities, 111, Inc. should prioritize building more resilient supply chains. This involves strategies such as diversifying sourcing locations to reduce reliance on single regions prone to climate impacts and exploring alternative transportation methods that are less susceptible to weather disruptions. Proactive risk management in this area is crucial for maintaining consistent operations and meeting market demands.

Key considerations for 111, Inc. include:

- Supply Chain Diversification: Reducing dependence on single geographic regions for raw materials and finished goods.

- Logistics Resilience: Evaluating and potentially investing in alternative transportation routes or modes less vulnerable to extreme weather.

- Supplier Collaboration: Working with suppliers to understand and mitigate their own climate-related risks.

- Inventory Management: Adjusting inventory levels to buffer against potential supply chain disruptions.

China's environmental regulations are tightening, impacting 111, Inc.'s supply chain through stricter assessments and pollutant controls, particularly in the pharmaceutical sector. Younger professionals are driving demand for greener healthcare solutions, pushing companies like 111, Inc. to adopt sustainable practices in logistics and packaging to enhance their reputation.

The growing emphasis on biosecurity and genetic resource management, as seen in China's 2025 Draft Environmental Code, will affect the development of biologics and advanced therapies, potentially influencing research collaborations and access to genetic materials for companies like 111, Inc.

Waste management is a critical environmental factor, with stringent protocols for handling medical and pharmaceutical waste. 111, Inc. must ensure proper segregation, secure transport, and disposal through licensed facilities to minimize its environmental impact and maintain public trust.

Climate change presents significant supply chain risks, with extreme weather events potentially disrupting manufacturing and logistics. Diversifying sourcing and exploring resilient transportation methods are key strategies for 111, Inc. to ensure operational continuity amidst these global challenges.

PESTLE Analysis Data Sources

Our PESTLE analysis is built on a robust foundation of data, drawing from official government publications, reputable financial institutions, and leading market research firms. This ensures that each insight into political, economic, social, technological, legal, and environmental factors is grounded in credible, up-to-date information.