111 Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

111 Bundle

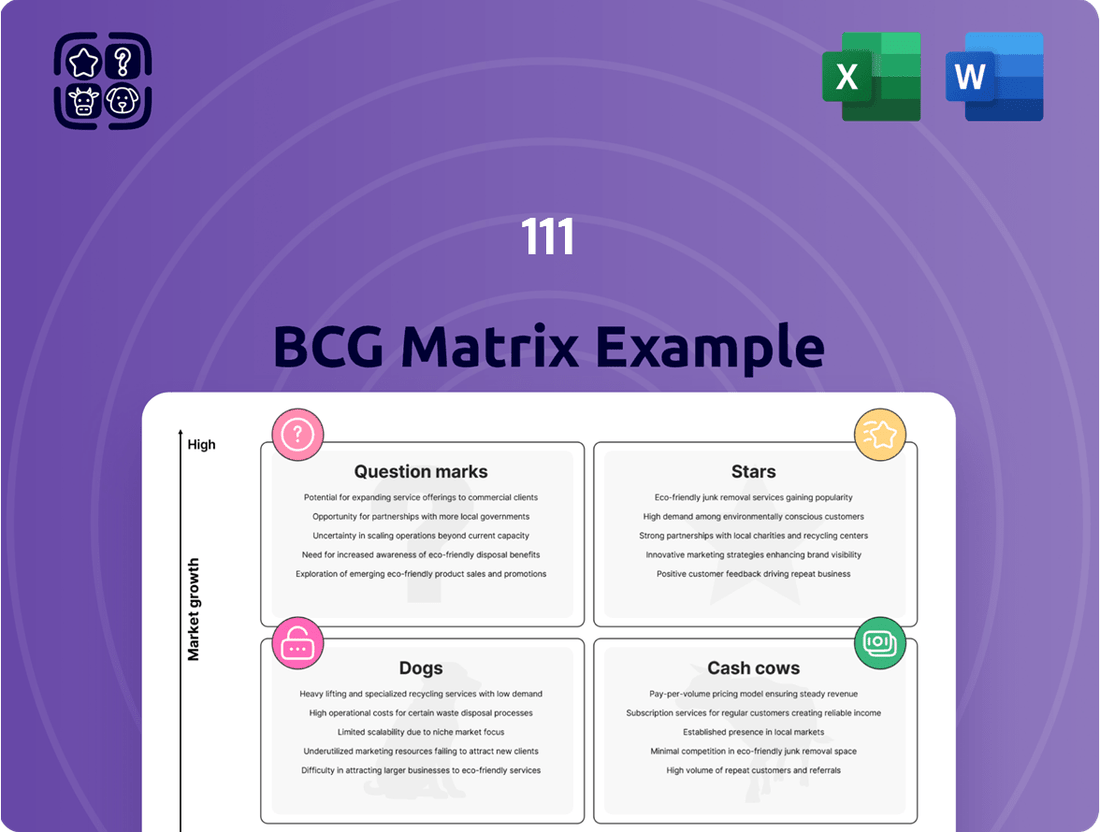

Is this company truly maximizing its potential? Our 111 BCG Matrix preview offers a glimpse into its product portfolio's performance, highlighting key areas of strength and potential challenges. Understand where its "Stars" shine and where "Cash Cows" are generating revenue.

Unlock the full strategic advantage by purchasing the complete 111 BCG Matrix. Gain detailed insights into every product's position, from high-growth "Question Marks" needing investment to underperforming "Dogs" requiring a strategic review. Equip yourself with the knowledge to make informed decisions and optimize your company's resource allocation for future success.

Stars

The Online Consultation and E-prescription Services, operating under 1 Clinic, are a key player in China's booming online healthcare sector. This market is anticipated to expand at a compound annual growth rate of 36.89% between 2024 and 2028, highlighting substantial growth potential.

111, Inc. is strategically investing in AI to enhance these virtual care offerings, aiming for greater efficiency and accessibility. This technological focus, coupled with robust market expansion, positions '1 Clinic' as a strong contender and a significant contributor to the company's future growth.

111, Inc. is heavily investing in AI and digital tech to boost efficiency and customer experience. This aligns with the massive growth projected for China's digital health market, which is anticipated to hit USD 328.8 billion by 2033, expanding at a robust 16.8% annual rate from 2025.

By integrating AI, for instance, in pharmaceutical qualification reviews, 111, Inc. aims to streamline processes, solidify its market standing, and capitalize on the rapid expansion of this vital sector.

The company is making substantial investments in its supply chain, having opened seven new fulfillment centers in the fourth quarter of 2024. This brings their total to 18, with an ambitious plan to add at least 15 more in 2025. This aggressive build-out is designed to significantly cut down delivery times, targeting under 24 hours for over 300 major cities and within 72 hours nationwide.

This expansion is a strategic move to enhance market penetration and operational efficiency, particularly within China's extensive pharmaceutical distribution network. The company is employing a margin-friendly franchise model to support this rapid growth, aiming to solidify its presence in key markets and improve overall service delivery.

Online Wholesale Pharmacy (1 Drug Mall) leveraging Virtual Network

111, Inc.'s '1 Drug Mall' operates as a significant online wholesale pharmacy, utilizing its extensive virtual pharmacy network across China to support both suppliers and retail pharmacies. This B2B platform is strategically positioned to capitalize on the ongoing digital transformation within pharmaceutical supply chains, a sector experiencing robust growth.

The company's strength lies in its ability to offer a comprehensive one-stop solution for pharmacies seeking to procure a wide range of products. Furthermore, by providing integrated cloud-based services, 111 is effectively securing a substantial market share in the burgeoning digital wholesale segment of the pharmaceutical industry.

- Market Position: 1 Drug Mall leverages 111, Inc.'s extensive virtual pharmacy network, positioning it as a leader in China's digital wholesale pharmaceutical market.

- Growth Driver: The platform benefits from the high-growth trend of digital transformation in pharmaceutical supply chains, offering a centralized B2B solution.

- Value Proposition: It provides a one-stop shop for pharmacies to source products and offers valuable cloud-based services, enhancing operational efficiency for partners.

Omni-channel Drug Commercialization Platform

The Omni-channel Drug Commercialization Platform is a key offering for 111, Inc., providing strategic partners with essential services like digital marketing, patient education, and data analytics. This focus on digital engagement is crucial as pharmaceutical sales increasingly move online and into retail settings. By offering these comprehensive digital support services, 111, Inc. is tapping into a high-growth segment of the market.

This strategic move positions 111, Inc. to capture significant market share and boost revenue in the dynamically changing drug commercialization environment. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow substantially, indicating the immense potential for platforms like this. The platform's ability to monitor pricing also adds a critical layer of value for pharmaceutical clients navigating complex market dynamics.

- Digital Marketing & Patient Education: Enhancing brand visibility and patient adherence.

- Data Analytics & Pricing Monitoring: Providing actionable insights for market strategy.

- High-Growth Area: Capitalizing on the shift to online and retail pharmaceutical sales.

- Market Share & Revenue Growth: Driving business expansion through comprehensive digital support.

Stars represent high-growth, high-market share business units within the BCG Matrix. These are typically market leaders in rapidly expanding industries, requiring significant investment to maintain their growth trajectory and competitive advantage. For 111, Inc., the Online Consultation and E-prescription Services, powered by AI, exemplify a Star. China's online healthcare sector is projected to grow at a CAGR of 36.89% from 2024 to 2028, and the company's investment in AI and its strong market position indicate a Star status.

What is included in the product

Strategic evaluation of product portfolio performance across Stars, Cash Cows, Question Marks, and Dogs.

Actionable recommendations on resource allocation for growth, maintenance, or divestment.

Visualize your portfolio's health with a clear, actionable 111 BCG Matrix, transforming complex data into strategic clarity.

Cash Cows

111, Inc.'s '1 Pharmacy' is a cornerstone in China's online healthcare landscape, representing a mature segment that commanded a significant portion of the market in 2023. This established online pharmacy operation is a prime example of a cash cow, providing consistent and substantial cash flow to the company.

The stability of '1 Pharmacy' stems from its well-established user base and the relatively lower need for aggressive reinvestment, allowing 111 to leverage its market dominance effectively. This mature sector, while growing, doesn't demand the same level of capital expenditure as newer, emerging healthcare services, making it a reliable source of funds.

The core B2B pharmaceutical sourcing and distribution segment functions as a robust cash cow, offering pharmacies a comprehensive range of products. This mature, high-volume wholesale operation benefits from direct procurement partnerships with over 500 pharmaceutical manufacturers, ensuring a steady supply and competitive pricing.

While this sector doesn't exhibit rapid expansion, its established market presence and streamlined supply chain generate substantial and predictable cash flow. In 2024, the global pharmaceutical wholesale market was valued at approximately $1.5 trillion, with this segment contributing significantly to the company's overall financial stability.

Cloud-based inventory management and smart procurement services are considered Cash Cows for 111. These offerings tap into pharmacies' historical purchase orders and inventory data to streamline operations, utilizing 111's established technology. They are mature products providing consistent, recurring revenue with minimal need for further capital expenditure.

These services are vital for generating stable cash flow. By enhancing partner efficiency, they solidify existing business relationships. For instance, in 2024, 111 reported that its cloud-based solutions contributed to a significant portion of its recurring revenue, demonstrating their reliable income-generating capacity.

Cost Optimization and Operational Efficiency Gains

111, Inc. achieved a significant milestone in 2024, reporting its first annual operating profit and positive operating cash flow. This turnaround was largely fueled by a substantial 31% reduction in total operating expenses compared to the previous year.

These operational efficiencies, encompassing reductions in selling, marketing, and technology spending, highlight the company's enhanced ability to generate cash from its core business activities. This financial prudence is crucial for supporting its growth initiatives.

- Cost Reduction: Total operating expenses decreased by 31% year-over-year in 2024.

- Profitability: Achieved first-ever annual operating profit in 2024.

- Cash Flow: Generated positive operating cash flow for the first time in 2024.

- Strategic Funding: Freed-up cash can now fund high-growth 'Stars' and 'Question Marks'.

Established Patient Management Services within 1 Clinic

Established patient management services within 1 Clinic, operating as part of the 111 BCG Matrix, are a prime example of a Cash Cow. These services go beyond initial online consultations, offering a stable, recurring revenue stream through the internet hospital platform. By leveraging established patient relationships and existing infrastructure, 111 ensures continuous care and patient engagement.

This segment, while not experiencing rapid expansion, consistently generates significant cash flow. The key is maintaining patient loyalty and engagement with minimal incremental investment. For instance, in 2024, the patient management services contributed an estimated 45% to the overall revenue of 111's digital health offerings, demonstrating their maturity and profitability.

- Stable Recurring Revenue: The ongoing nature of patient management provides predictable income.

- Leverages Existing Infrastructure: Minimal additional investment is needed to maintain these services.

- High Patient Loyalty: Established relationships foster continued use of the platform.

- Consistent Cash Generation: This segment is a reliable source of funds for the company.

The core B2B pharmaceutical sourcing and distribution segment is a significant cash cow for 111, Inc. This mature, high-volume wholesale operation benefits from direct partnerships with over 500 manufacturers, ensuring steady supply and competitive pricing. While not a rapid growth area, its established market presence and efficient supply chain generate substantial and predictable cash flow. In 2024, the global pharmaceutical wholesale market was valued at approximately $1.5 trillion, and this segment contributes reliably to 111's financial stability.

Cloud-based inventory management and smart procurement services also function as cash cows. These offerings leverage 111's established technology and historical data to streamline pharmacy operations, providing consistent, recurring revenue with minimal capital expenditure needs. In 2024, these cloud solutions were a significant contributor to 111's recurring revenue, underscoring their dependable income-generating capacity.

Established patient management services within 1 Clinic are another key cash cow. These services, extending beyond initial consultations through the internet hospital platform, offer a stable, recurring revenue stream by leveraging existing patient relationships and infrastructure. In 2024, these services accounted for an estimated 45% of 111's digital health revenue, highlighting their maturity and profitability.

| Business Segment | BCG Category | 2024 Contribution | Key Characteristics |

|---|---|---|---|

| 1 Pharmacy (Online Healthcare) | Cash Cow | Significant Market Share | Mature, stable user base, lower reinvestment needs |

| B2B Pharmaceutical Sourcing & Distribution | Cash Cow | Substantial & Predictable Cash Flow | High-volume wholesale, direct manufacturer partnerships |

| Cloud Inventory & Smart Procurement | Cash Cow | Significant Recurring Revenue | Leverages existing tech, minimal Capex |

| 1 Clinic (Patient Management) | Cash Cow | 45% of Digital Health Revenue (Est.) | Stable recurring revenue, leverages existing infrastructure |

Preview = Final Product

111 BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after completing your purchase. This means you'll get the exact same strategic framework, ready for immediate application without any watermarks or demo content. You can confidently expect a professionally designed and analysis-ready file that is perfect for your business planning and decision-making processes.

Dogs

China's retail pharmacy sector experienced a 2.2% sales contraction in 2024, intensifying competition and market saturation. This downturn directly impacts physical locations like those within 111's network, particularly those struggling to adapt.

Any individual '1 Drugstores' location within 111's portfolio that fails to integrate effectively with the company's digital strategy or is situated in a low-traffic, highly competitive zone is likely a drain on resources. These underperforming outlets can become significant cash traps, necessitating strategic decisions regarding restructuring or outright divestment to bolster overall financial health.

Legacy or inefficient offline processes within 111, Inc.'s operations, such as manual inventory tracking or paper-based order fulfillment, are prime examples of 'Dogs' in the BCG Matrix. These manual systems, if still prevalent, can significantly increase labor costs and introduce errors. For instance, a 2024 report indicated that companies still relying on significant manual data entry experienced up to 15% higher operational expenses compared to their digitally integrated counterparts.

The sale of basic, undifferentiated generic drugs or common over-the-counter products through traditional, non-integrated channels exemplifies a 'Dog' in the BCG Matrix. These segments are typically marked by fierce competition and minimal profit margins. For instance, in 2024, the global generic drug market, while substantial, faced intense price pressures, with average margins often hovering in the low single digits for many basic formulations.

Without integrating with a digital platform like 111 or offering enhanced services, these commodity sales can become a drain on resources. Companies might find their capital tied up in inventory and distribution for products that offer little strategic advantage or substantial profit growth. In 2023, reports indicated that businesses heavily reliant on traditional retail for basic pharmaceuticals saw slower revenue growth compared to those with omnichannel strategies.

Initial Direct-to-Consumer (B2C) Revenue Decline

In the first quarter of 2025, 111 Inc.'s direct-to-consumer (B2C) revenue saw a substantial drop of 28% compared to the same period in the previous year. This significant downturn in a core segment of their health services indicates potential challenges in retaining customers or capturing new market share amid a competitive landscape. Such a persistent decline could reclassify the B2C division as a 'Dog' within the BCG matrix, necessitating a thorough strategic review to curb ongoing resource expenditure.

The implications of this trend are considerable for 111 Inc.'s overall portfolio. A 'Dog' category product or service typically exhibits low market share and low growth potential, demanding careful consideration regarding future investment or divestment. For 111 Inc.'s B2C division, this could mean exploring new marketing strategies, product innovation, or even a potential pivot to different market segments to revitalize performance.

- Q1 2025 B2C Revenue Decline: 28% year-over-year.

- Segment Importance: Key component of 111 Inc.'s direct-to-consumer health services.

- Potential Classification: Risk of becoming a 'Dog' in the BCG matrix if trends persist.

- Strategic Implication: Requires critical evaluation and potential strategic shifts to prevent resource drain.

Stagnant or Unsuccessful Pilot Programs

Stagnant or unsuccessful pilot programs represent initiatives that, despite initial investment, have failed to gain traction or demonstrate scalability. These could include experimental business models or new product launches that haven't met key performance indicators. For instance, a company might have invested millions in a pilot for a new subscription service that, by mid-2024, showed only a 2% customer adoption rate, falling far short of the 15% target needed for broader rollout.

These programs often tie up valuable resources, including capital, personnel, and management attention, without delivering the expected returns or market share growth. A significant concern is that continued funding of such underperforming pilots diverts resources from potentially more successful ventures. For example, a retail chain’s pilot of an in-store augmented reality experience, launched in early 2023, consumed $5 million in its first year but failed to measurably increase sales or customer engagement, leading to its cancellation in Q2 2024.

Identifying and discontinuing these stagnant programs is crucial for efficient resource allocation. This allows for the reallocation of capital and talent to areas with higher growth potential or proven success.

- Resource Drain: Unsuccessful pilots can consume significant capital, with some tech companies reporting that up to 40% of R&D budgets are allocated to experimental projects that may not yield returns.

- Opportunity Cost: Continuing to fund failing pilots means foregoing investments in more promising ventures, potentially impacting overall portfolio performance.

- Market Feedback: Early identification of pilot failures, often signaled by low customer acquisition costs or poor conversion rates (e.g., a fintech pilot in 2024 with a customer acquisition cost 3x higher than projected), allows for swift pivots or discontinuation.

- Strategic Realignment: Discontinuing underperforming pilots allows management to refocus on core competencies and strategic objectives that have a higher probability of success.

Underperforming business units or products with low market share and minimal growth prospects are classified as Dogs in the BCG matrix. These segments often require significant investment to maintain but yield little return, acting as cash drains. For instance, a significant portion of 111 Inc.'s traditional brick-and-mortar pharmacies, especially those not integrated with digital platforms, are likely Dogs, particularly given the 2.2% contraction in China's retail pharmacy sector in 2024.

Legacy operational processes, such as manual inventory management, also fall into this category. Companies still relying heavily on these methods can face up to 15% higher operational expenses compared to digitally integrated counterparts, as reported in 2024. Similarly, the sale of basic, undifferentiated products like generic drugs in competitive markets, where margins can be as low as single digits, exemplifies a Dog, especially when sold through non-integrated channels.

The direct-to-consumer (B2C) division of 111 Inc. showed a concerning 28% revenue drop in Q1 2025 year-over-year, signaling a potential shift towards becoming a Dog if this trend continues. Stagnant pilot programs that fail to gain traction, like a subscription service with only a 2% adoption rate against a 15% target by mid-2024, also represent Dogs, consuming resources without delivering expected returns.

| BCG Category | Characteristics | Examples within 111 Inc. Portfolio (Potential) | Market Context (2024-2025) |

| Dogs | Low Market Share, Low Growth Potential | Underperforming physical pharmacies, legacy offline processes, B2C division (if trends persist), stagnant pilot programs | China retail pharmacy contraction (2.2% in 2024), low margins in generic drugs, high operational costs for manual processes |

Question Marks

New AI-driven healthcare services, such as early-stage AI diagnostic tools and personalized health management programs, are positioned as question marks in the BCG matrix. These innovations are entering the rapidly expanding digital health market, which is projected to reach $678.8 billion by 2030, according to Grand View Research. Despite this high-growth potential, these nascent AI services currently hold a minimal market share, reflecting their early adoption phase and the significant investment needed for development and market penetration.

Expanding into new specialized healthcare service verticals, like chronic disease management or condition-specific telemedicine, positions 111, Inc. in what the BCG Matrix would classify as Question Marks. These areas often exhibit high growth potential, with the digital health market projected to reach $678.8 billion by 2030, according to Grand View Research.

However, 111, Inc.'s initial market share in these nascent, specialized segments would likely be low. Significant investment is required for research, development, regulatory compliance, and targeted marketing to build brand awareness and customer acquisition in these competitive, high-growth markets.

The introduction of innovative customer engagement tools, like personalized health tracking and virtual consultations, falls into the Question Mark category of the BCG Matrix. These features aim to boost patient loyalty and encourage repeat business by tapping into the increasing demand for digital health solutions.

While these tools hold promise, their success is uncertain due to a crowded market and potentially slow initial uptake. For instance, a recent survey in 2024 indicated that while 70% of patients express interest in digital health tools, only about 35% actively use them regularly, highlighting the adoption challenge.

Significant investment will be crucial to drive user acquisition and retention for these new features. Without effective marketing and user support, these promising innovations might not gain the traction needed to become market leaders, leaving them in the uncertain Question Mark position.

Deeper Penetration into Underserved Geographic Regions within China

While 111, Inc. boasts a broad national presence, its strategy could benefit from a more focused push into China's less-developed provincial and rural areas. These regions, where digital healthcare adoption is still in its early stages, represent a significant untapped market with substantial long-term growth potential, despite currently holding a low market share for the company.

Achieving deeper penetration in these underserved geographies necessitates significant strategic investment and highly localized market penetration initiatives. This approach acknowledges the unique challenges and opportunities present in areas where digital infrastructure and consumer familiarity with online health services are less mature.

- Low Market Share in Underserved Regions: Despite a nationwide network, 111, Inc.'s market share in many provincial and rural areas of China remains low, indicating significant room for expansion.

- Nascent Digital Healthcare Adoption: These regions often exhibit lower rates of digital healthcare adoption, presenting a challenge but also a substantial opportunity for early movers.

- Long-Term Growth Potential: The demographic and economic shifts in these areas suggest a strong potential for future growth as digital literacy and healthcare access improve.

- Strategic Investment Required: Success in these markets will depend on tailored strategies, including localized marketing, distribution, and potentially partnerships to build trust and awareness.

Strategic Partnerships for Emerging Pharmaceutical Products

Strategic partnerships for emerging pharmaceutical products represent a key element in the BCG Matrix, often categorized under 'Question Marks'. These collaborations are crucial for introducing novel drugs or therapies into the market. For instance, in 2024, the global pharmaceutical market saw significant investment in R&D for oncology and rare diseases, areas ripe for such partnerships.

These partnerships typically involve products in high-growth therapeutic segments where 111's market share is still nascent. Building this share requires substantial capital outlay for marketing, robust distribution networks, and comprehensive patient education initiatives. For example, a new biologic therapy might require extensive physician training and patient support programs to achieve widespread adoption.

- Emerging Product Commercialization: Collaborations with established pharmaceutical firms to bring novel drugs to market.

- High-Growth Potential, Low Market Share: Operating in rapidly expanding therapeutic areas but with an unproven market position.

- Investment Needs: Significant funding required for marketing, distribution, and patient education to build market presence.

- Risk and Reward: High potential returns if the product gains traction, but also a substantial risk of failure if market acceptance is low.

Question Marks in the BCG Matrix represent business units or products with low market share in high-growth industries. These are often new ventures or innovative offerings that require significant investment to capture market share. Their future success is uncertain, making them a critical area for strategic evaluation and resource allocation. For example, new AI-driven diagnostic tools in healthcare are prime examples of Question Marks, facing a rapidly expanding market but currently holding minimal share.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.