Ventas Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ventas Bundle

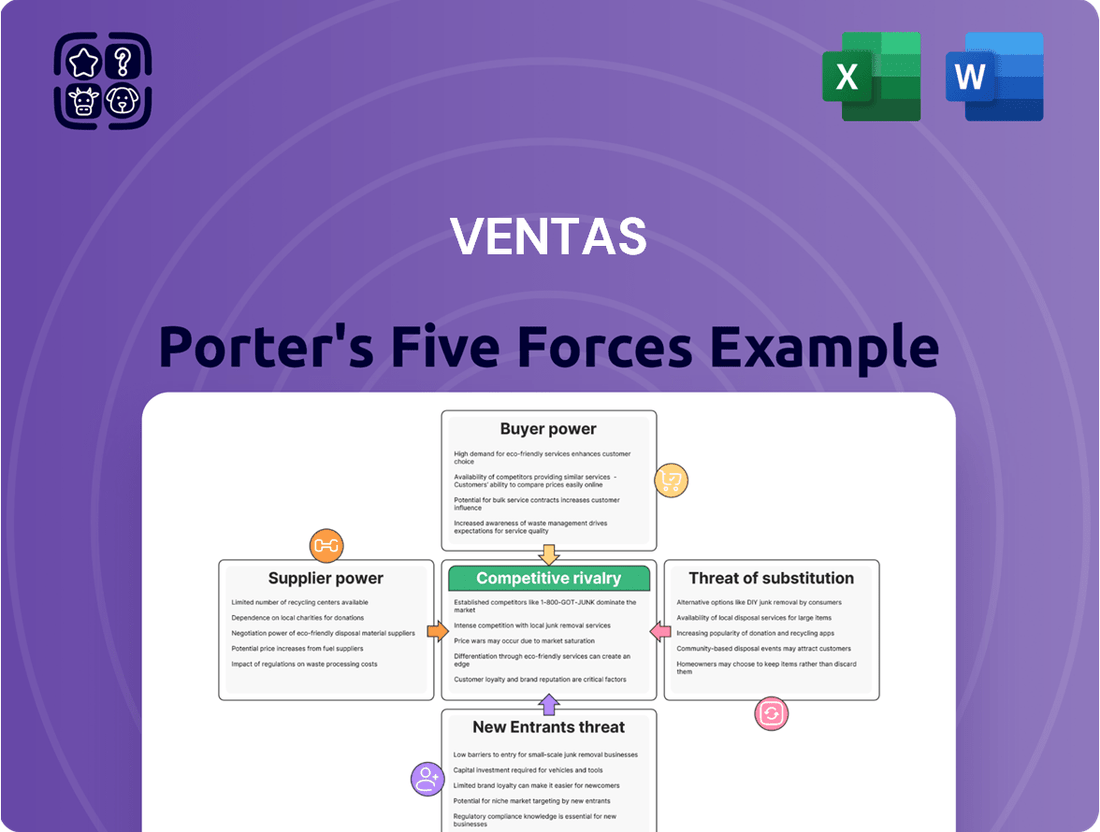

Porter's Five Forces provides a powerful lens to understand Ventas's competitive landscape. It dissects the industry into key forces: the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for Ventas's strategic positioning. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Ventas’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

In the healthcare real estate sector, the bargaining power of suppliers is significantly influenced by specialization. Ventas, for instance, might face higher costs from highly specialized contractors needed for constructing advanced life science facilities or state-of-the-art hospitals, as these skills are less common. For example, the demand for specialized medical construction expertise can drive up project costs, impacting Ventas's capital expenditures for new builds.

Conversely, for more standardized property types within Ventas's portfolio, such as typical senior living communities or basic medical office buildings, the supplier market tends to be more fragmented. This wider availability of contractors and service providers generally dilutes the individual bargaining power of any single supplier, leading to more competitive pricing for Ventas.

The availability of alternative financing significantly impacts the bargaining power of suppliers for Ventas, a Real Estate Investment Trust (REIT). As Ventas relies heavily on capital markets for acquisitions and development, financial institutions like lenders and equity investors act as crucial suppliers of capital. Their bargaining power can shift based on prevailing interest rates and the overall liquidity of the financial markets. For instance, in early 2024, while interest rates remained elevated, the market demonstrated resilience, with Ventas securing a significant $1.25 billion unsecured revolving credit facility, showcasing continued access to capital.

The cost and availability of skilled labor are crucial for Ventas's operations, impacting everything from property maintenance to development. A shortage of qualified personnel, especially in specialized trades like HVAC or healthcare facility management, can significantly increase operational expenses. For instance, in 2024, the U.S. Bureau of Labor Statistics reported persistent shortages in skilled trades, contributing to wage growth in these sectors.

When the labor market tightens, suppliers of labor or specialized service companies gain leverage. This can lead to higher wages and service fees, directly affecting Ventas's bottom line. This trend is not unique to Ventas but is a broader challenge across the real estate and healthcare sectors, where maintaining and operating facilities requires a consistent supply of skilled workers.

Technology and Software Providers

As healthcare real estate, like Ventas's portfolio, increasingly adopts advanced technology for efficiency and patient engagement, the bargaining power of specialized technology and software providers can grow. This is particularly true for solutions that are proprietary or critical to operations, creating significant switching costs for Ventas. For example, the adoption of integrated smart building management systems or advanced AI-driven patient monitoring software could give these suppliers leverage.

The ability of these tech providers to dictate terms is amplified if their platforms are deeply embedded within a healthcare facility's workflow, impacting everything from energy management to patient care delivery. Consider the trend towards digital health platforms; companies offering unique, integrated solutions that enhance telehealth capabilities or streamline administrative tasks could see their influence increase. For Ventas, this means carefully evaluating the long-term strategic value and potential lock-in associated with such technologies when making investment decisions.

- Increased Dependence: Ventas's reliance on technology for operational efficiency, such as its Ventas OI™ platform, can empower software and technology suppliers if their offerings are indispensable and difficult to replace.

- Proprietary Solutions & Switching Costs: Providers of unique, integrated technology solutions in areas like AI-driven analytics or advanced building automation systems may command higher prices due to significant costs and complexities associated with switching to alternative vendors.

- Market Concentration: A concentrated market for specialized healthcare technology, with few dominant players, can further strengthen supplier bargaining power, allowing them to negotiate more favorable terms.

- Innovation Pace: The rapid evolution of health tech means providers with cutting-edge, essential innovations can exert greater influence over pricing and contract terms, impacting Ventas's technology investment strategies.

Land and Regulatory Approval Process

The availability of suitable land, particularly in sought-after areas for healthcare and life sciences, significantly impacts Ventas. For instance, in 2024, the demand for prime real estate in established medical hubs continued to drive up acquisition costs. Obtaining regulatory approvals for new healthcare facilities or life science labs is often a lengthy and intricate process. This can extend development timelines, adding to overall project expenses.

These factors grant considerable leverage to landowners and governmental bodies involved in zoning and permitting. Ventas, like other real estate investment trusts (REITs) in the healthcare sector, must navigate these complexities. The longer lead times and increased upfront costs associated with land acquisition and regulatory hurdles directly strengthen the bargaining power of early-stage property development suppliers and landholders.

- Land Scarcity in Key Markets: Prime locations for healthcare facilities, especially near established research institutions or major hospitals, faced intense competition in 2024, inflating land prices.

- Regulatory Hurdles: Navigating zoning laws, environmental reviews, and building permits for healthcare-specific developments can add 12-24 months to project timelines.

- Increased Development Costs: The combined effect of higher land prices and extended approval processes can increase initial capital outlay by 15-25% for new projects.

- Supplier Leverage: Landowners and entities controlling the approval process can dictate terms, leading to higher acquisition costs and potentially impacting project feasibility for Ventas.

The bargaining power of suppliers for Ventas is shaped by the availability of specialized services and materials. For highly specific needs, such as advanced medical equipment installation or unique construction elements for life science facilities, Ventas faces suppliers with greater leverage due to limited alternatives. This was evident in 2024 with ongoing demand for specialized healthcare construction expertise, which continued to drive up project costs for new developments.

Conversely, for more common services like routine property maintenance or standard construction, Ventas benefits from a more competitive supplier landscape. This fragmentation of suppliers in less specialized areas generally leads to better pricing and terms for Ventas, mitigating supplier power. The key lies in Ventas's ability to leverage its scale across its diverse portfolio to secure favorable agreements.

The financial markets themselves act as a critical supplier of capital for Ventas. In early 2024, Ventas secured a substantial $1.25 billion unsecured revolving credit facility, demonstrating continued access to funding despite elevated interest rates. This access indicates that while lenders have influence, the market's depth allows Ventas to negotiate terms effectively.

What is included in the product

Analyzes the five competitive forces impacting Ventas: threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and rivalry among existing competitors.

Quickly identify and quantify competitive pressures with a visual map of the five forces, streamlining strategic planning and mitigating uncertainty.

Customers Bargaining Power

Ventas's customer base is varied, encompassing healthcare providers, senior living operators, and research facilities. The bargaining power of these customers largely depends on their size and market concentration.

Large, consolidated healthcare systems or national senior living operators possess considerable leverage due to their substantial operational scale and the potential to engage in multiple lease agreements with Ventas. For instance, a major hospital network acquiring or merging with another could significantly increase its negotiating power.

Conversely, smaller, independent healthcare providers or single-location senior living communities typically have less individual bargaining power. Their ability to negotiate favorable lease terms is generally more limited compared to their larger counterparts.

Ventas actively manages this dynamic by fostering relationships with a wide array of operators, thereby diversifying its tenant mix and mitigating the concentrated risk associated with a few dominant customers. This strategic approach ensures a more stable revenue stream even with varying customer bargaining strengths.

Switching costs for tenants in the healthcare and senior living sectors are a significant factor limiting their bargaining power. Relocating a healthcare facility or senior living community is not a simple move; it involves considerable disruption to patient care and resident well-being. For example, moving a hospital requires not only transferring expensive medical equipment but also navigating complex regulatory approvals and ensuring continuity of care, which can take months.

These substantial barriers make tenants hesitant to switch landlords. The expense and logistical challenges associated with patient or resident relocation, coupled with the need to re-establish licenses and certifications in a new location, create a strong incentive to remain with their current provider, even if lease terms are not ideal. This is particularly true for specialized assets like life science centers or advanced medical facilities where the infrastructure is highly specific and costly to replicate.

In 2024, the average cost for a business to relocate its physical operations can range from tens of thousands to millions of dollars, depending on the industry and scale. For healthcare providers, these costs are often on the higher end due to the specialized nature of their operations and the critical need for uninterrupted service. This high cost of switching directly translates to reduced bargaining power for these tenants, as the financial and operational risks of moving outweigh the potential benefits of negotiating a better lease.

The availability of comparable healthcare and senior living properties significantly impacts customer bargaining power. In markets where demand outstrips supply, like the current senior housing sector where demand is outstripping new construction, Ventas's customers possess less negotiation leverage.

For instance, as of early 2024, many senior housing markets are experiencing occupancy rates in the high 80s and low 90s, indicating a tight supply-demand balance that favors property owners like Ventas.

Conversely, an oversupply in specific segments, such as some life science markets, can empower tenants by increasing their options and thus their negotiating strength.

Importance of Real Estate to Customer Business

For healthcare providers and senior living operators, the physical real estate is a mission-critical asset, directly impacting their ability to deliver services. This high reliance on specialized facilities means that while customers seek favorable terms, they are ultimately dependent on access to quality properties, which can limit their power to push for extreme concessions.

In 2024, the healthcare real estate sector continued to demonstrate resilience, with occupancy rates for senior living facilities averaging around 85% by Q3 2024, according to industry reports. This indicates a consistent demand for well-located and well-maintained properties.

The specialized nature of healthcare and senior living properties means that switching costs for operators are high. Finding and building out alternative locations can be time-consuming and capital-intensive, further anchoring customers to their existing, suitable real estate.

- Mission-Critical Asset: Healthcare real estate directly influences service delivery and patient/resident care quality.

- High Reliance: Operators depend on specific facility types and locations to function.

- Limited Concessions: Dependence on quality properties restricts customers' ability to demand extreme price reductions.

- Switching Costs: High costs associated with relocating or redeveloping facilities anchor tenants.

Demographic Tailwinds and Demand Growth

The aging demographic is a powerful force for Ventas, creating a strong demand for its senior living and healthcare facilities. This trend means customers, particularly those in the 80 and over age group, have a fundamental and growing need for these specialized properties. This sustained demand inherently strengthens Ventas's bargaining power because the essential nature of the services provided makes customers less likely to switch providers based solely on price.

In 2024, the senior housing market continues to benefit from this demographic shift. For instance, the number of individuals aged 65 and older in the United States is projected to reach nearly 80 million by 2040, a significant increase from approximately 56 million in 2020. This expanding customer base for senior living and healthcare services directly translates into a more favorable position for Ventas, as the need for their real estate assets is not a discretionary purchase but a necessity.

- Aging Population Growth: The U.S. population aged 65+ is expected to grow to 80 million by 2040.

- Demand for Senior Housing: This demographic trend fuels consistent demand for senior living and healthcare properties.

- Customer Necessity: The fundamental need for healthcare and senior housing reduces customer price sensitivity.

- Ventas's Position: This strengthens Ventas's bargaining power by highlighting the essential nature of its real estate offerings.

Ventas's customers, ranging from large healthcare systems to independent operators, exhibit varying degrees of bargaining power. This power is significantly influenced by customer concentration and the costs associated with switching properties. High switching costs, driven by the mission-critical nature of healthcare facilities and the operational complexities of senior living communities, tend to limit customer leverage.

For instance, the difficulty and expense of relocating medical equipment and ensuring continuity of care for patients make healthcare providers hesitant to switch landlords, even if lease terms are not ideal. In 2024, business relocation costs could easily reach hundreds of thousands to millions of dollars, a substantial deterrent for tenants.

The bargaining power of Ventas's customers is also shaped by the availability of comparable properties. In markets with tight supply, such as senior housing where occupancy rates were in the high 80s to low 90s by early 2024, Ventas holds a stronger negotiating position.

Conversely, an oversupply in certain segments, like some life science markets, can empower tenants. However, the fundamental reliance on specialized, mission-critical real estate inherently limits how much negotiation power customers can wield, as access to suitable facilities is paramount for their operations.

| Factor | Impact on Customer Bargaining Power | 2024 Data/Context |

|---|---|---|

| Customer Size & Concentration | Larger, consolidated customers have greater power. | Mergers in healthcare can increase tenant leverage. |

| Switching Costs | High costs limit power. | Relocation costs for businesses can be millions; healthcare relocation is complex. |

| Property Availability | Oversupply empowers customers; undersupply limits them. | Senior housing occupancy high (~85% by Q3 2024), favoring Ventas. |

| Reliance on Property Type | High reliance on specialized facilities limits concessions. | Healthcare real estate is mission-critical for service delivery. |

Full Version Awaits

Ventas Porter's Five Forces Analysis

This preview showcases the complete Ventas Porter's Five Forces Analysis you will receive. What you see here is the exact, professionally formatted document, ready for immediate download and use upon purchase, ensuring no surprises or placeholder content. The analysis meticulously details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry, all presented in a ready-to-use format. This document provides a comprehensive overview of the strategic factors influencing Ventas' market position. You are looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file.

Rivalry Among Competitors

Ventas operates in a healthcare REIT sector populated by significant, well-established entities. Key rivals such as Welltower and Healthpeak Properties are substantial players, directly vying for similar assets and tenants. This landscape also includes a variety of smaller, niche REITs and increasingly, private equity firms actively seeking to acquire and manage healthcare real estate portfolios.

The healthcare real estate sector is enjoying a period of strong expansion, fueled by demographic shifts and rising healthcare spending. In 2024, this growth is projected to continue, offering a larger pie for all participants and potentially softening intense competition. This expanding market can absorb new entrants and accommodate existing players more readily than a saturated or shrinking one.

However, not all segments within healthcare real estate are growing at the same pace. Senior housing, for instance, is exhibiting significantly higher growth rates compared to other sub-sectors. This disparity means that while the overall industry growth is a positive factor, competition can still be fierce within the most dynamic niches, such as those catering to the elderly.

Ventas's broad approach to real estate, spanning senior living, medical offices, hospitals, and life science facilities, sets it apart from competitors focused on just one niche. This diversification helps to mitigate risk and offers a wider array of investment opportunities. For instance, in 2024, Ventas continued to leverage its diverse portfolio to attract a range of tenants, from healthcare providers to life science innovators.

However, within each of these specialized sectors, Ventas still faces significant competition. Companies actively compete to acquire and manage prime properties and partner with leading operators. This rivalry intensifies when it comes to securing the most desirable locations and tenants, driving up acquisition costs and potentially impacting rental yields.

The capacity to provide highly specialized facilities and tailored services acts as a crucial differentiator. For example, Ventas's investments in state-of-the-art life science labs or advanced senior living communities can command premium rents and attract higher-quality tenants compared to more generic offerings. This focus on specialized capabilities is key to maintaining a competitive edge in a crowded market.

Barriers to Exit

High capital intensity and the long-term, illiquid nature of real estate investments create significant exit barriers for healthcare REITs. This commitment to their market positions, even during economic slowdowns, can exacerbate competitive rivalry. For instance, Ventas, a major healthcare REIT, reported total assets of $32.5 billion as of the first quarter of 2024, illustrating the substantial capital tied up in its portfolio, making quick divestitures challenging and costly.

These high exit barriers mean that healthcare REITs are often "locked in" to their existing markets, even if those markets become less profitable. Instead of easily exiting, companies may feel compelled to continue operating, potentially leading to increased competition for tenants and services. This can manifest as price wars or aggressive marketing efforts to retain market share.

- High Capital Investment: Healthcare real estate requires substantial upfront investment in properties, equipment, and ongoing maintenance, making it difficult to recoup costs quickly.

- Illiquid Assets: Real estate is inherently illiquid; selling properties can take considerable time and may require accepting a lower price than desired, especially in a down market.

- Long-Term Leases: Many healthcare facilities operate under long-term lease agreements, committing REITs to specific locations and tenants for extended periods.

- Specialized Nature: Healthcare properties often have specialized build-outs and regulatory requirements, limiting their appeal to non-healthcare buyers and further complicating divestment.

Operational Expertise and Data Analytics

Ventas distinguishes itself through its advanced operational expertise and data analytics, primarily powered by its Ventas OI™ platform. This sophisticated system allows for the meticulous optimization of property performance, a critical factor in the healthcare real estate sector. By leveraging proprietary data, Ventas can more effectively manage its relationships with operators and identify high-potential investment opportunities.

This data-driven approach provides a tangible competitive advantage, especially when compared to rivals who may lack similar sophisticated analytical capabilities. For instance, in 2024, Ventas continued to refine its data analytics, aiming to improve NOI growth across its portfolio. The ability to forecast trends and proactively address operational inefficiencies positions Ventas favorably.

- Ventas OI™ Platform: Enhances property performance optimization.

- Data-Driven Decisions: Informs investment strategies and operator management.

- Competitive Edge: Rivals without similar analytics may lag in efficiency and returns.

- 2024 Focus: Continued refinement of data analytics to drive NOI growth.

Competitive rivalry within the healthcare REIT sector is intense due to the presence of large, established players like Welltower and Healthpeak Properties, alongside numerous smaller REITs and private equity firms. While overall market growth in 2024 offers space for all, competition sharpens within high-growth niches like senior housing. Ventas’s diversified portfolio across senior living, medical offices, hospitals, and life science facilities allows it to compete broadly, but specialized capabilities and prime locations remain key battlegrounds, driving up acquisition costs.

The significant capital investment and illiquid nature of healthcare real estate create high exit barriers, essentially locking companies like Ventas into their market positions. This can intensify rivalry as firms must compete for tenants and operational efficiency rather than easily exiting underperforming segments. Ventas’s total assets, reported at $32.5 billion in Q1 2024, underscore the substantial, illiquid capital commitment common in this industry.

Ventas leverages its Ventas OI™ platform, utilizing advanced data analytics, to optimize property performance and inform strategic decisions. This data-driven approach offers a distinct advantage over competitors, enabling more efficient operator management and identification of investment opportunities. The focus on refining these analytics in 2024 aims to drive Net Operating Income (NOI) growth across its extensive portfolio, a critical metric in demonstrating competitive strength.

SSubstitutes Threaten

The growing adoption of telehealth and remote patient monitoring presents a significant threat of substitutes for traditional healthcare real estate. As more care shifts to virtual platforms, the demand for physical medical office space could see a slowdown.

For instance, a 2024 report indicated that over 80% of patient visits that can be done remotely will be done virtually. This trend directly impacts the need for brick-and-mortar facilities for routine check-ups and consultations.

While not a perfect replacement for all medical services, especially those requiring hands-on procedures, telehealth can diminish the necessity for certain types of medical office buildings and even some hospital services. This shift could temper demand growth for these specific real estate segments over the long term.

The increasing availability and sophistication of in-home care services pose a significant threat of substitution for traditional senior living communities, directly impacting Ventas. As seniors increasingly express a desire to age in place, advancements in technology and care delivery models are making it more feasible to manage complex health needs at home, potentially diverting demand away from Ventas's senior housing portfolio.

This trend could lead to lower occupancy rates and reduced revenue for Ventas's senior living assets. For instance, the home healthcare market in the U.S. was valued at approximately $140 billion in 2023 and is projected to grow, indicating a substantial and expanding alternative for senior care.

Government-funded and non-profit healthcare facilities present a significant threat of substitutes for Ventas' portfolio. These institutions, often prioritizing community access and public health missions, may not be driven by the same profit motives as Ventas' tenants. For instance, in 2024, the U.S. saw continued growth in community health centers, many of which are non-profit, offering primary care services that could compete with those provided in Ventas-leased facilities.

Alternative Investment Vehicles for Real Estate Exposure

Investors looking to gain exposure to the healthcare real estate sector have options beyond publicly traded Real Estate Investment Trusts (REITs) like Ventas. These alternatives act as substitutes for Ventas as an investment vehicle, though not for the underlying physical properties it owns. For instance, private equity real estate funds focusing on healthcare or direct investment in healthcare properties offer different avenues for capital allocation.

The availability of these substitutes can influence the demand for Ventas's shares and its overall valuation. In 2024, the private real estate market continued to see significant activity, with global private equity real estate fundraising reaching approximately $200 billion by mid-year, according to Preqin data. This indicates a substantial pool of capital available for direct property investments and fund structures that bypass public markets.

- Private Equity Funds: These funds often provide access to specialized healthcare real estate niches and can offer more illiquid, long-term investment opportunities.

- Direct Property Ownership: High-net-worth individuals or institutional investors may directly acquire healthcare facilities, bypassing the need to invest in a REIT.

- Venture Capital in HealthTech Real Estate: Investments in companies developing innovative healthcare facility models or proptech solutions for healthcare real estate also represent an indirect substitute.

- Diversification Benefits: Investors may choose these alternatives to diversify their portfolios away from publicly traded securities, seeking different risk-return profiles.

Repurposing of Commercial Real Estate

The repurposing of commercial real estate, particularly office buildings, presents a significant threat of substitutes for Ventas. As traditional office vacancy rates remain elevated in many markets, owners are increasingly exploring conversions into medical office spaces or other healthcare-related facilities. This trend could directly increase the supply of alternative healthcare real estate, offering potential tenants options beyond Ventas's purpose-built properties.

While such conversions are often capital-intensive, the economic pressures from underutilized assets are driving this shift. For instance, in late 2023, reports indicated that a substantial portion of vacant office space across major U.S. cities was being considered for adaptive reuse. This influx of new supply, even if not perfectly tailored, can dilute demand for existing, specialized healthcare properties and create competitive pricing pressure.

- Increased Supply: Conversions of office buildings to medical space directly add to the available healthcare real estate inventory.

- Cost-Effectiveness: In some cases, converted spaces might offer more competitive rental rates than new, purpose-built facilities.

- Location Advantages: Repurposed buildings may be situated in desirable urban or suburban locations that appeal to healthcare providers.

The increasing viability of telehealth and remote patient monitoring serves as a significant substitute for traditional healthcare real estate. As virtual care gains traction, the demand for physical medical office space could face a slowdown.

A 2024 report found that over 80% of eligible patient visits are now conducted virtually, directly impacting the need for brick-and-mortar facilities for routine care.

While not a complete replacement for all services, especially those requiring in-person procedures, telehealth can reduce the necessity for certain types of medical office buildings, potentially tempering demand for these segments.

| Substitute Type | Impact on Ventas | Supporting Data (2023-2024) |

|---|---|---|

| Telehealth & Remote Monitoring | Reduced demand for medical office space | Over 80% of eligible visits conducted virtually (2024) |

| In-Home Senior Care | Lower occupancy in senior living facilities | U.S. home healthcare market valued at ~$140 billion (2023), projected growth |

| Community Health Centers | Competition for primary care services | Continued growth in non-profit community health centers (2024) |

| Alternative Investment Vehicles | Potential impact on Ventas' share demand/valuation | Global private equity real estate fundraising ~$200 billion (mid-2024) |

| Repurposed Commercial Real Estate | Increased supply of competing healthcare spaces | Significant vacant office space considered for adaptive reuse (late 2023) |

Entrants Threaten

Entering the healthcare real estate sector, particularly for companies aiming for diversified portfolios comparable to Ventas, demands immense capital. The sheer cost of acquiring and developing specialized medical facilities, from state-of-the-art hospitals to senior living communities, presents a formidable financial hurdle for newcomers.

For instance, the average cost to build a hospital can range from hundreds of millions to over a billion dollars, a figure that immediately deters smaller players. Similarly, establishing a sizable senior housing portfolio requires substantial upfront investment in land, construction, and initial operational setup, creating a significant barrier to entry.

The healthcare real estate sector presents a formidable barrier to new entrants due to intense regulatory complexities. Navigating the labyrinth of healthcare laws, compliance mandates, and specific facility requirements demands specialized knowledge that newcomers often lack. For instance, understanding HIPAA regulations, state licensing for medical facilities, and evolving reimbursement models is crucial and takes significant time and resources to master, effectively deterring less experienced players.

This need for deep specialization acts as a significant deterrent for potential new firms. Building the necessary expertise in healthcare operations, compliance, and the unique demands of medical facilities requires substantial investment in both human capital and ongoing education. Without this prior industry experience, a new entrant would struggle to even identify viable opportunities, let alone successfully acquire and manage healthcare properties.

Ventas benefits from deeply entrenched relationships with healthcare providers and senior living operators, cultivated over many years. These established connections are vital for securing long-term leases and ensuring effective property management, providing a significant barrier to entry. For instance, Ventas's extensive network means new competitors would face the arduous task of replicating these trust-based partnerships, a process that typically takes considerable time and resources in this relationship-centric sector.

Scalability and Portfolio Diversification

The significant scale and diversification of Ventas, encompassing senior living, medical office buildings, hospitals, and life science facilities, create substantial barriers to entry. This broad operational footprint allows Ventas to achieve economies of scale and spread risk across different healthcare and real estate sectors, a feat difficult for new, smaller players to replicate.

New entrants typically begin with limited capital and a narrower focus, making it challenging to compete with Ventas on critical factors like access to financing or the ability to absorb market downturns in a single segment. For instance, Ventas's robust portfolio, valued in the tens of billions of dollars, provides considerable financial leverage that startups simply cannot match.

- Diversification as a Shield: Ventas's presence in multiple healthcare real estate niches, from senior living to life science campuses, reduces its reliance on any single market. This contrasts sharply with new entrants who often face concentrated risks.

- Capital Access Disparity: Ventas's established credit rating and market presence facilitate easier and cheaper access to capital for acquisitions and development, a crucial advantage over less-established competitors.

- Operational Efficiencies: The sheer scale of Ventas's operations allows for greater bargaining power with suppliers and more efficient management of its diverse property portfolio, translating into cost advantages.

- Risk Mitigation Through Scale: By operating a vast and varied portfolio, Ventas can better absorb the impact of localized economic downturns or sector-specific challenges, a resilience that nascent competitors lack.

Market Saturation in Specific Niches

While overall demand for healthcare real estate remains robust, certain niches and geographic areas are experiencing increased supply, which can temper the attractiveness for new entrants. For instance, some life science markets observed a rise in vacancy rates towards the end of 2024, signaling a temporary oversupply in those specific segments. This saturation can make it more challenging for new developments to gain traction and achieve optimal occupancy quickly.

Conversely, the senior housing sector continues to demonstrate a strong demand-supply imbalance, remaining a more inviting prospect for new players. However, even in these high-demand areas, the significant capital investment required for development and operational setup acts as a natural barrier, influencing the threat of new entrants.

- Niche Saturation: Life science markets, for example, saw increased vacancy in late 2024, indicating potential oversupply in specific sub-sectors.

- Demand Outpacing Supply: The senior housing sector, however, continues to experience demand that exceeds available supply, making it more attractive.

- Capital Intensity: The substantial financial commitment needed for healthcare real estate development and operation serves as a significant barrier to entry.

The threat of new entrants for Ventas is generally low, primarily due to the substantial capital requirements and the specialized knowledge needed to operate within the healthcare real estate sector. The high cost of acquiring or developing medical facilities, coupled with complex regulatory landscapes, deters many potential competitors. Furthermore, Ventas's established relationships and diversified portfolio create significant competitive advantages that are difficult for newcomers to overcome.

For instance, acquiring a single large hospital can cost upwards of $300 million to $1 billion, a massive hurdle for smaller entities. Additionally, navigating regulations like HIPAA and specific state licensing for medical properties requires significant legal and operational expertise, which new entrants may lack. Ventas’s established relationships with major healthcare providers, built over decades, also present a significant advantage, making it hard for new players to secure long-term leases and operational stability.

| Barrier Type | Description | Ventas Advantage |

| Capital Requirements | High cost of acquiring/developing specialized healthcare properties. | Ventas has significant financial resources and access to capital markets. |

| Regulatory Complexity | Navigating healthcare laws, licensing, and compliance mandates. | Ventas possesses deep expertise in healthcare compliance and operations. |

| Established Relationships | Securing long-term leases with healthcare providers. | Ventas has cultivated strong, long-standing partnerships across the industry. |

| Economies of Scale | Achieving cost efficiencies through large-scale operations. | Ventas’s diversified and extensive portfolio enables significant operational efficiencies. |

Porter's Five Forces Analysis Data Sources

Our Ventas Porter's Five Forces analysis is built upon a robust foundation of data, drawing from public company filings, investor presentations, and industry-specific market research reports to capture supplier and buyer power accurately.

We leverage detailed financial statements, analyst reports, and competitive intelligence databases to assess industry rivalry and the threat of new entrants and substitutes for Ventas.