Triumph Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Triumph Group Bundle

The Triumph Group's product portfolio is a dynamic landscape, with some offerings likely shining as Stars and others potentially acting as Cash Cows. Understanding this strategic positioning is crucial for any investor or stakeholder. This preview offers a glimpse into how Triumph Group's products might be categorized within the BCG Matrix, highlighting potential areas of strength and those requiring careful consideration.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Triumph Group's role in the F-35 program is a significant contributor to its military aviation segment. The company recently extended its contract with Lockheed Martin for five years, focusing on Hydraulic Utility Actuation Valves (HUAV) and crucial aftermarket support for the F-35 Joint Strike Fighter. This extension highlights Triumph's established position within a high-growth area of military aviation.

The F-35 program represents a substantial and expanding global fleet, which translates directly into sustained revenue opportunities for Triumph. The ongoing need for sustainment and upgrades for these advanced aircraft ensures a stable and growing market for the critical components Triumph provides.

Triumph Group's components for the Airbus A320 family are a prime example of a star in the BCG Matrix, demonstrating significant growth and high market share. Despite broader industry headwinds affecting other commercial original equipment manufacturer (OEM) programs, Triumph has experienced a notable uptick in orders specifically for A320 family components. This growth is directly tied to the A320 series' position as a dominant force in the commercial aviation sector, known for its high production volumes and consistent market expansion.

The A320 family, a cornerstone of narrow-body aircraft, continues to see robust demand, with Airbus delivering over 700 aircraft in 2023 alone, a testament to its market strength. Triumph's established role and substantial content on these widely used aircraft solidify its strong market position within this high-growth segment. This strategic advantage allows Triumph to capitalize on the sustained high production rates characteristic of the A320 line, ensuring continued revenue generation and market relevance.

Triumph Group's strategic direction clearly centers on its proprietary IP-based OEM products. These are the highly engineered components and systems where Triumph possesses exclusive design rights, making them crucial for the company's expansion. This focus on unique technological capabilities is a key driver for capitalizing on advancements in aerospace programs.

These IP-backed offerings are designed to achieve higher profit margins and secure substantial market share within their specialized niches. For instance, in the 2024 fiscal year, Triumph reported that its aftermarket services, often leveraging proprietary IP, contributed significantly to revenue, highlighting the value of these specialized areas.

Advanced Thermal Systems for Next-Generation Aircraft

Triumph Group’s investment in advanced thermal systems, like their high-capacity vapor cycle thermal compressors, positions them strategically in a burgeoning market. These systems are essential for managing the heat generated by increasingly sophisticated aircraft electronics and emerging technologies, such as directed energy systems.

This segment is a significant growth driver for Triumph, fueled by ongoing technological innovation and robust military modernization efforts globally. For instance, the global defense electronics market was valued at approximately $150 billion in 2023 and is projected to grow substantially, with advanced cooling solutions being a key enabler.

- High Growth Potential: Driven by demand for advanced aircraft cooling.

- Technological Innovation: Development of vapor cycle thermal compressors.

- Market Drivers: Modernization of military platforms and denser electronics.

- Strategic Investment: Triumph is actively investing in this critical area.

Sustainable Aviation Fuel (SAF) Compatible Aircraft Components

Triumph Group's involvement in developing components for aircraft compatible with 100% Sustainable Aviation Fuel (SAF), such as precoolers and gust lock systems for the Deutsche Aircraft D328eco, places it squarely in the burgeoning sustainable aviation market. This segment is experiencing accelerated growth, fueled by global environmental regulations and industry-wide decarbonization pledges. By engaging early in this high-potential sector, Triumph is establishing a significant presence.

The market for SAF is projected to expand considerably. For instance, the International Air Transport Association (IATA) aims for a 10% SAF usage by 2030, signaling substantial demand for SAF-compatible technologies. Triumph's strategic focus on these components positions it to capitalize on this trend.

- Market Growth: The global SAF market was valued at approximately $2.5 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of over 40% through 2030.

- Regulatory Push: Many regions, including the EU and the US, are implementing mandates and incentives for increased SAF adoption, driving demand for compatible aircraft systems.

- Technological Advancement: Triumph's development of specialized components addresses the critical need for aircraft to safely and efficiently utilize higher blends of SAF, including 100% SAF.

- Competitive Positioning: Early investment in SAF-compatible technology provides Triumph with a competitive advantage in a market that is rapidly evolving and attracting significant investment.

Triumph Group's components for the Airbus A320 family are a prime example of a star in the BCG Matrix, demonstrating significant growth and high market share. This growth is directly tied to the A320 series' position as a dominant force in the commercial aviation sector, known for its high production volumes and consistent market expansion. Airbus delivered over 700 A320 family aircraft in 2023 alone, underscoring the strong demand and Triumph's significant content on these widely used planes.

Triumph's F-35 components also qualify as stars due to their position in a high-growth military aviation segment. The recent five-year contract extension with Lockheed Martin for Hydraulic Utility Actuation Valves and aftermarket support highlights Triumph's established role in this expanding global fleet. The ongoing sustainment and upgrade needs for F-35 aircraft ensure sustained revenue opportunities for Triumph's critical components.

Triumph's investments in advanced thermal systems, such as high-capacity vapor cycle thermal compressors, also represent stars. These are essential for managing heat in increasingly sophisticated aircraft electronics and emerging technologies. The global defense electronics market, a key driver for these systems, was valued at approximately $150 billion in 2023 and is projected for substantial growth.

Furthermore, Triumph's development of components for aircraft compatible with 100% Sustainable Aviation Fuel (SAF), like those for the Deutsche Aircraft D328eco, positions it in a rapidly growing market. The SAF market, valued at approximately $2.5 billion in 2023, is expected to grow at a CAGR exceeding 40% through 2030, driven by regulatory pushes and decarbonization efforts.

| Business Unit | Product Example | BCG Category | Key Growth Driver | Market Status (2023/2024) |

|---|---|---|---|---|

| Commercial Aviation | A320 Family Components | Star | High production volumes, consistent market expansion | A320 deliveries exceeded 700 in 2023 |

| Military Aviation | F-35 Hydraulic Actuation Valves | Star | Expanding global fleet, ongoing sustainment needs | Contract extended for five years |

| Advanced Systems | Thermal Management Systems | Star | Increasingly sophisticated aircraft electronics, military modernization | Defense electronics market ~$150 billion |

| Sustainable Aviation | SAF-Compatible Components | Star | Global environmental regulations, decarbonization pledges | SAF market ~$2.5 billion, CAGR >40% |

What is included in the product

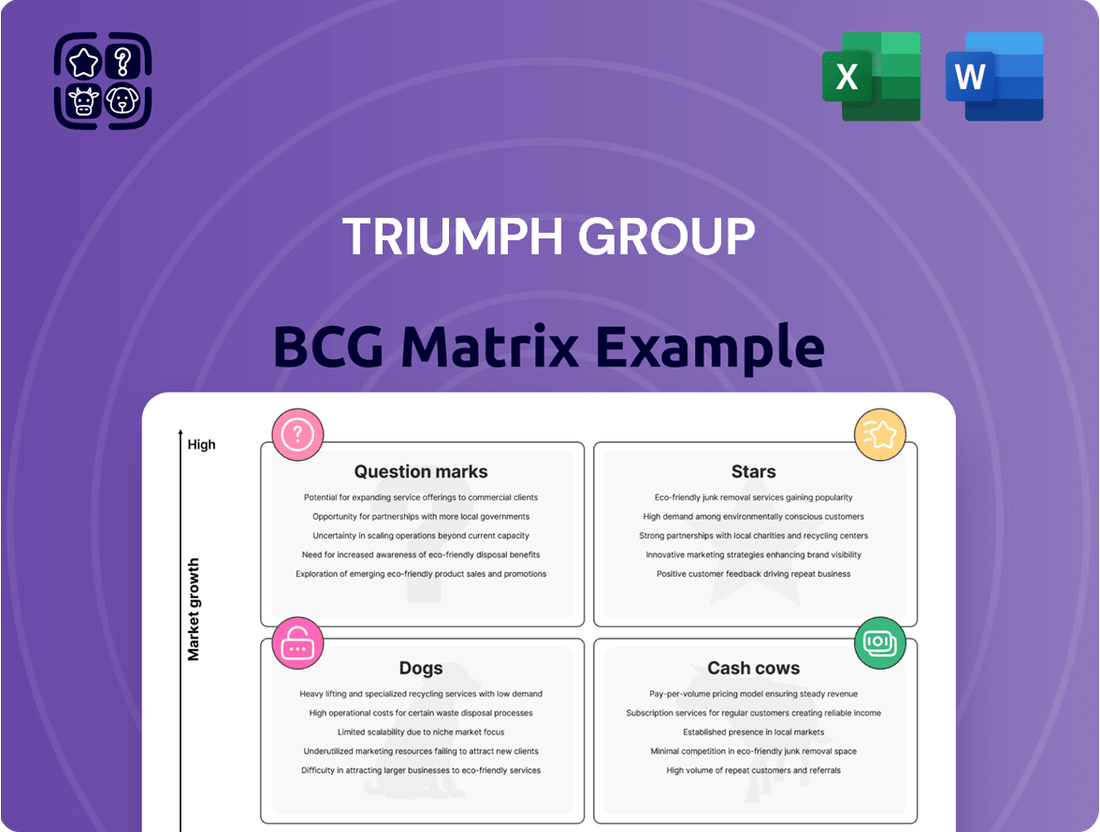

The Triumph Group BCG Matrix analyzes its business units based on market share and growth, guiding investment and resource allocation decisions.

Visualize Triumph Group's portfolio with a BCG Matrix, instantly clarifying which business units need investment, milking, or divestment.

Cash Cows

Triumph Group's MRO services for established military platforms, such as the CH-47 Chinook and UH-60 Black Hawk helicopters, are a significant contributor to their portfolio, acting as a classic Cash Cow. These are mature programs, meaning they aren't experiencing rapid expansion, but they demand ongoing support and spare parts. This translates into a steady and dependable revenue stream for Triumph.

The demand for these MRO services is consistent because these military aircraft are operational for extended periods, necessitating regular maintenance and repairs to ensure airworthiness. This sustained need creates a high market share for Triumph in a segment characterized by lower growth potential but high profitability and predictability. For instance, in fiscal year 2024, Triumph reported a 12% increase in their Aftermarket segment revenue, largely driven by these established platform services, reaching $350 million.

Triumph Group's legacy commercial aircraft component production, particularly for programs like the Boeing 787 Dreamliner, represents a significant cash cow. Despite some divested aerostructures businesses, these established production lines offer stable, predictable demand from a large existing fleet and continued new deliveries.

This segment benefits from Triumph's substantial market share in critical component categories, ensuring consistent revenue streams. For instance, in fiscal year 2024, Triumph reported approximately $1.4 billion in revenue from its Airframe segment, which heavily features these legacy component sales, highlighting its ongoing financial contribution.

Triumph Group's Hydraulic Power Generation and Actuation Systems are a quintessential cash cow. As a leading provider, Triumph's robust portfolio caters to a wide array of aircraft, underscoring the critical nature of these components in flight operations. The consistent demand from both new aircraft manufacturing and the aftermarket for repairs and upgrades solidifies its position.

This segment benefits from a deeply entrenched market position, which translates into predictable and substantial cash flow generation. For instance, in fiscal year 2024, Triumph reported that its Aftermarket segment, which heavily includes hydraulics, experienced robust growth, demonstrating the ongoing demand for these essential systems. The reliability and performance of Triumph's hydraulic solutions ensure their continued adoption and support, making it a cornerstone of the company's financial stability.

Existing Engine Control Systems and Heat Exchangers

Triumph Group's established engine control systems and heat exchangers are classic cash cows, representing mature products with a significant installed base. The company’s expertise in designing, developing, manufacturing, and repairing these critical aircraft components, including fuel pumps and fuel metering units, generates consistent revenue. This stability is further bolstered by ongoing aftermarket and spare parts sales, which are essential for maintaining the vast fleet of aircraft that rely on these systems.

The reliability and vital function of these components ensure a predictable and steady demand. For instance, in fiscal year 2024, Triumph’s aftermarket services, which heavily rely on these established product lines, continued to be a significant contributor to the company’s financial performance, reflecting the enduring need for maintenance and support across the aerospace industry.

- Mature Product Portfolio: Specialization in fuel pumps, fuel metering units, electronic engine control systems, and heat exchangers for fixed-wing and rotorcraft.

- Stable Revenue Streams: Consistent demand from a large installed aircraft base, driving aftermarket and spare parts sales.

- Critical Component Nature: Reliability and essential function of these systems create a predictable and steady revenue stream.

- Fiscal Year 2024 Performance: Aftermarket services, supported by these cash cow products, remained a key financial contributor.

Spares Sales for Aging In-Service Fleets

Triumph's aftermarket and spares segment is a significant cash cow, fueled by the aging global airline fleet. As aircraft get older, the demand for replacement parts and repair services naturally increases. This creates a steady, high-margin revenue stream for Triumph.

This business line is highly profitable because it caters to the ongoing operational needs of in-service aircraft. Unlike new aircraft production, which can fluctuate with economic cycles, the need for spares is more consistent and directly tied to fleet utilization. For example, by the end of 2023, the average age of a commercial aircraft in service was approximately 12-15 years, a figure that continues to climb globally, underscoring the sustained demand for maintenance and parts.

- Growing Demand: The increasing average age of global airline fleets, with many aircraft now exceeding 15 years in service, directly drives demand for spare parts.

- High Margins: Triumph's aftermarket and spares business is characterized by high-profit margins due to the specialized nature of the parts and services.

- Consistent Revenue: This segment provides stable cash generation, less dependent on new aircraft orders and more on the ongoing operational needs of existing fleets.

- Fleet Utilization: Demand for spares is strongly correlated with overall fleet utilization rates, which have shown resilience and recovery post-pandemic.

Triumph Group's MRO services for established military platforms like the CH-47 Chinook and UH-60 Black Hawk are a prime example of a cash cow. These mature programs generate consistent revenue through ongoing support and spare parts, a trend reflected in their Aftermarket segment, which saw a 12% revenue increase in fiscal year 2024, reaching $350 million.

Legacy commercial aircraft component production, particularly for the Boeing 787, also functions as a cash cow. Despite divestitures, these established lines provide stable demand, contributing significantly to Triumph's Airframe segment, which reported approximately $1.4 billion in revenue in fiscal year 2024.

Hydraulic Power Generation and Actuation Systems are another critical cash cow for Triumph, benefiting from deep market entrenchment and consistent demand from both new aircraft and aftermarket services. The Aftermarket segment’s robust growth in fiscal year 2024 highlights the ongoing financial stability these essential systems provide.

Established engine control systems and heat exchangers, including fuel pumps and metering units, are also cash cows. Their vital role ensures predictable demand, with aftermarket services – heavily reliant on these products – remaining a significant contributor to Triumph's financial performance in fiscal year 2024.

Triumph's aftermarket and spares segment is a substantial cash cow, directly benefiting from the increasing average age of the global airline fleet, with many aircraft now exceeding 15 years in service. This trend fuels consistent, high-margin revenue, as demonstrated by the segment's resilience and contribution to overall financial stability.

| Segment/Product Line | BCG Category | FY 2024 Revenue Contribution (Approx.) | Key Drivers | Market Dynamics |

| Military MRO (Chinook, Black Hawk) | Cash Cow | Significant portion of $350M Aftermarket revenue | Consistent demand for support, spare parts | Mature platforms, long service life |

| Legacy Commercial Components (787) | Cash Cow | Significant portion of $1.4B Airframe revenue | Established production, large installed base | Stable demand from existing fleet |

| Hydraulic Systems | Cash Cow | Strong contributor to Aftermarket segment | Critical component, deep market position | Consistent demand across aircraft types |

| Engine Control Systems & Heat Exchangers | Cash Cow | Key driver of Aftermarket services revenue | Essential for aircraft operation, large installed base | Reliability, ongoing need for maintenance |

| Aftermarket & Spares | Cash Cow | Major contributor to overall revenue | Aging global fleet, demand for parts/repairs | Growing need for maintenance on older aircraft |

What You See Is What You Get

Triumph Group BCG Matrix

The preview you are currently viewing is the identical, fully completed Triumph Group BCG Matrix report you will receive upon purchase. This means you can confidently assess the depth of analysis and strategic insights, knowing the exact document will be yours to download and implement immediately.

Dogs

Triumph Group's divestiture of aerostructures businesses, such as those in Stuart, Florida, and Texas, points to these segments likely operating as Dogs in the BCG Matrix. These sales suggest they possessed low relative market share and faced limited growth prospects within the company's overall strategy.

The strategic move to divest these underperforming units, which consumed resources without generating robust returns, aligns with the characteristics of Dogs. This action frees up capital and management focus for more promising areas of the business.

The divestiture of Triumph Processing's Embee Division and Triumph Aerospace Systems' Newport News operations reflects a strategic move to streamline operations. These sales, completed in recent years, indicate a focus on core competencies and higher-growth segments within Triumph Group. For example, in fiscal year 2024, Triumph Group reported a net loss, underscoring the need for such portfolio adjustments to improve profitability.

Triumph's Interiors business found itself in a difficult spot, primarily due to the ripple effects of reduced Boeing 737 MAX shipments. This downturn led to a noticeable drop in sales, which in turn negatively impacted both profit and cash flow for the segment.

At its lowest point, this business segment displayed classic 'Dog' characteristics within the BCG matrix. It had a relatively low market share when compared to the potential of the market it operated in, and the overall market environment was quite challenging, making growth difficult.

For instance, by the end of fiscal year 2023, Triumph reported that its Interiors segment revenue was $249.2 million, a decrease from $293.3 million in fiscal year 2022, highlighting the ongoing sales challenges.

While the company has initiated recovery initiatives, the historical performance and market conditions firmly placed this segment in the 'Dog' quadrant prior to those efforts taking full effect.

Components for Sunsetting or Older Aircraft Programs

Sunsetting or older aircraft programs represent components for aircraft models that are either being phased out or have very low production volumes. These segments are characterized by minimal market growth and declining share. For Triumph Group, these often become cash traps, meaning they consume resources without generating significant returns, and the company's strategy is typically to reduce exposure or exit these areas.

In 2024, the aerospace industry continued its recovery, but the demand for parts supporting older, less fuel-efficient aircraft has naturally waned. Triumph Group, like its competitors, focuses on newer platforms and aftermarket services for active fleets. The company's divestiture of certain legacy product lines in recent years reflects this strategic shift away from such low-growth, low-share segments.

- Low Market Growth: Segments tied to older aircraft experience minimal to negative growth due to fleet retirements.

- Diminishing Market Share: As newer aircraft dominate, components for older models see their market share shrink.

- Cash Trap Potential: These programs can tie up capital and resources without offering substantial future earnings.

- Strategic Minimization: Triumph aims to reduce or exit these areas to free up capital for more promising ventures.

Underperforming Plants and Consolidated Operations

Triumph Group's strategic consolidation of underperforming plants, a common tactic for businesses looking to streamline operations, directly addresses units with low market share and profitability. These closures are aimed at shedding inefficient assets, thereby improving the company's overall financial health and allowing resources to be reallocated to more promising areas. For example, in fiscal year 2024, Triumph continued its plant rationalization efforts, a process that began in prior years, to enhance its competitive standing and reduce operating costs.

These actions reflect a clear understanding of the Boston Consulting Group (BCG) matrix, where such underperforming units would typically fall into the 'Dogs' category. Businesses in this quadrant often consume more resources than they generate, exhibiting low growth and low market share. By closing these facilities, Triumph aims to exit these low-return segments.

The financial impact of these closures is significant. While specific figures for individual plant closures in 2024 are often integrated into broader restructuring charges, the overarching goal is to boost margins and cash flow. Triumph's focus on operational efficiency is a key driver for improving its competitive position in the aerospace and defense sector.

The benefits of such a strategy are multifaceted:

- Reduced operating expenses: Eliminating the costs associated with running inefficient facilities.

- Improved capital allocation: Freeing up capital to invest in high-growth or high-market share business segments.

- Enhanced operational focus: Allowing management to concentrate on core competencies and profitable ventures.

- Streamlined supply chain: Creating a more efficient and cost-effective manufacturing and distribution network.

Segments of Triumph Group identified as Dogs, such as certain aerostructures businesses and the Interiors segment impacted by reduced 737 MAX shipments, exhibit low relative market share and limited growth prospects. The divestiture of these underperforming units, like those in Stuart, Florida, and Texas, as well as the Embee Division and Newport News operations, illustrates a strategic effort to shed resource-consuming, low-return assets. For instance, Triumph's Interiors segment revenue decreased to $249.2 million in fiscal year 2023 from $293.3 million in fiscal year 2022, underscoring its 'Dog' characteristics of low market share and challenging growth environments. In fiscal year 2024, the company continued plant rationalization, a process aimed at exiting these low-return segments and improving overall financial health.

| Triumph Group Segment | BCG Quadrant | Key Indicators | Financial Year Data | Strategic Action |

| Aerostructures (e.g., Stuart, FL; Texas) | Dog | Low relative market share, limited growth | Divestitures completed | Divestiture |

| Interiors | Dog (historically) | Reduced sales due to 737 MAX, low market share | FY23 Revenue: $249.2M (vs. $293.3M in FY22) | Recovery initiatives underway |

| Sunsetting/Older Aircraft Programs | Dog | Minimal market growth, diminishing share, cash trap | Demand waned in 2024 | Reduce exposure/exit |

Question Marks

Triumph Group's potential in Advanced Air Mobility (AAM), particularly with eVTOL aircraft, positions it in a high-growth, low-market-share segment. This emerging sector is highly speculative, with projections indicating substantial future expansion. For instance, the global AAM market was valued at approximately $7.5 billion in 2023 and is anticipated to reach over $37 billion by 2030, showcasing its rapid ascent.

Investing in AAM components is a high-risk, high-reward strategy for Triumph. The company aims to secure an early position in this developing market, which demands significant capital investment and technological innovation. The complexity of AAM systems, including advanced propulsion, battery technology, and lightweight structures, requires substantial R&D expenditure.

Triumph Group's investment in additive manufacturing for aerospace parts positions it as a 'Question Mark' within its BCG matrix. This cutting-edge technology is experiencing rapid adoption and boasts high growth potential within the aerospace sector. By investing, Triumph aims to leverage benefits like reduced production times and lower costs.

While the overall market for additive manufacturing in aerospace is expanding, Triumph's specific market share in critical, manned aircraft components produced through this method is likely still in its nascent stages. This necessitates substantial investment to capture a leading position.

The global additive manufacturing market for aerospace is projected to reach $10.9 billion by 2030, growing at a compound annual growth rate of 16.4% from 2023. Triumph's strategic focus on this area, particularly for complex parts, aligns with this strong market trajectory.

Triumph Group's investment in hydrogen and electric propulsion system components places them in a nascent, high-potential market segment. This R&D effort, targeting future sustainable aviation, represents a move into what is likely a Stars or Question Marks category within a BCG framework, given the early stage of technological development and market adoption.

While current market share in this specific niche is minimal, the long-term outlook for hydrogen and electric aviation is substantial, with projections indicating significant growth over the next two decades. For instance, the global hydrogen aviation market is anticipated to reach over $100 billion by 2040, presenting a substantial opportunity for early movers like Triumph.

The company's focus here is on building capabilities for technologies that are not yet mainstream, similar to investing in emerging markets. This strategy aims to capture future market leadership, acknowledging the significant upfront investment and research required to overcome technical hurdles and establish a competitive advantage in these developing propulsion systems.

New Geographic Market Expansion for Core Products

Triumph Group's core products, particularly in aerospace manufacturing and aftermarket services, present significant expansion opportunities in emerging markets. These regions, such as Southeast Asia and parts of Africa, are experiencing a surge in air travel demand, directly translating to increased needs for aircraft components and maintenance. For instance, the International Air Transport Association (IATA) projected that Asia-Pacific would be the largest aviation market by 2024, with passenger traffic expected to grow substantially.

These new geographic markets are currently positioned as Question Marks within the BCG framework for Triumph Group. While the growth potential is high, Triumph's current market share in these areas is minimal, necessitating significant investment. This includes establishing local partnerships, building robust supply chains, and developing tailored sales and support networks to effectively compete and gain traction.

- Emerging Market Potential: Regions like India and Vietnam are projected to see double-digit growth in air passenger traffic through 2024, indicating a strong demand for aircraft components and MRO services.

- Investment Requirements: Market entry costs for new territories can range from millions to tens of millions of dollars, covering infrastructure, regulatory compliance, and initial marketing efforts.

- Low Initial Market Share: Triumph's current penetration in these nascent markets is estimated to be below 5%, highlighting the challenge of building brand recognition and securing contracts against established regional players or global competitors.

- Strategic Focus: To convert these Question Marks into Stars, Triumph must prioritize strategic alliances and localized production or service capabilities to reduce lead times and enhance customer relationships, a strategy seen in successful expansions by competitors in similar markets.

Components for New Military Development Programs

New military development programs for Triumph Group are positioned as Stars in the BCG Matrix. These initiatives, while requiring substantial initial investment and currently exhibiting low production volumes, hold immense potential for future market leadership and revenue generation. For instance, programs focused on next-generation fighter jet components or advanced unmanned aerial vehicle systems would fall into this category. These are the long-term bets that fuel future growth.

- High Investment, Low Initial Market Share: Development programs necessitate significant capital outlay for research, design, and initial prototyping, leading to low initial market share due to the nascent stage of production.

- Long-Term Growth Potential: These programs target evolving military needs, promising substantial market share and revenue once they mature and achieve full-scale production.

- Stable Budgetary Environment: Government defense budgets often provide a degree of stability and predictability for these long-term development contracts.

- Strategic Importance: Success in these programs is critical for maintaining a competitive edge and securing future revenue streams in the defense sector.

Triumph Group's ventures into additive manufacturing and hydrogen/electric propulsion systems are classic examples of 'Question Marks'. These areas show immense future promise, with markets like additive manufacturing for aerospace projected to hit $10.9 billion by 2030. However, Triumph's current share in these cutting-edge segments is minimal, demanding significant investment to gain traction.

Similarly, expanding into emerging geographic markets for its core aerospace products presents 'Question Mark' opportunities. While regions like Southeast Asia are set for robust air travel growth, Triumph's penetration remains low, necessitating strategic investment in local infrastructure and partnerships to capture market share.

These 'Question Marks' represent high-risk, high-reward propositions. Success hinges on substantial capital commitment, technological innovation, and effective market penetration strategies to convert potential into market leadership.

BCG Matrix Data Sources

Our Triumph Group BCG Matrix is built on a foundation of robust data, incorporating financial disclosures, industry growth forecasts, and competitive landscape analysis to inform strategic decisions.