TripAdvisor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TripAdvisor Bundle

TripAdvisor operates in a dynamic travel industry, facing significant competitive pressures. Understanding these forces is crucial for any stakeholder. The threat of new entrants, for instance, is moderate, as establishing a similar platform requires substantial capital and brand recognition. Buyer power is high, with travelers easily comparing options and switching between platforms.

The intensity of rivalry among existing players like Booking.com and Expedia is fierce, driving constant innovation and price competition. Supplier power, primarily from hotels and airlines, is also considerable, as they control the inventory and can negotiate terms. Furthermore, the threat of substitutes, such as direct booking or alternative travel planning methods, constantly challenges TripAdvisor's core business model.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore TripAdvisor’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

TripAdvisor's suppliers are predominantly its vast network of hotels, restaurants, attractions, and individual users who contribute content. This supplier base is incredibly fragmented, meaning no single entity holds significant sway over TripAdvisor.

The sheer volume of user-generated content, which surpassed one billion reviews and ratings by 2024, further dilutes any individual supplier's bargaining power. This abundance of information makes it challenging for any one contributor or establishment to dictate terms.

Consequently, TripAdvisor benefits from a low bargaining power of suppliers. This fragmentation ensures that TripAdvisor can maintain its platform's diversity and quality without being overly reliant on or dictated to by any specific group of suppliers.

TripAdvisor's reliance on booking partners like Booking.com and Expedia for transaction completion positions these partners as a potential source of supplier power. These large Online Travel Agencies (OTAs) are critical for facilitating bookings generated through TripAdvisor's platform, giving them leverage.

The bargaining power of these booking partners stems from their significant market share and their ability to influence commission structures or terms of data sharing. For instance, major OTAs often negotiate favorable terms due to the volume of business they represent.

However, TripAdvisor's substantial user base and its role as a major traffic driver to these booking partners somewhat counterbalances this supplier power. In 2024, TripAdvisor continued to be a primary source of qualified leads for many travel providers, reducing the partners' ability to dictate terms unilaterally.

The bargaining power of suppliers, particularly content contributors like individual reviewers, is generally low for TripAdvisor due to low switching costs. Reviewers can easily share their opinions on numerous other platforms such as Google Reviews, Yelp, or social media, diminishing their dependence on any single site. This ease of cross-posting means TripAdvisor doesn't hold exclusive leverage over individual user-generated content.

Despite this, TripAdvisor's substantial network effect, boasting millions of active users and a vast repository of reviews, still makes it a highly desirable platform for contributors seeking to reach a wide audience. In 2023, TripAdvisor reported over 200 million reviews and opinions, a testament to its reach. The company's focus on content integrity, through moderation and user flagging systems, further reinforces its appeal by fostering trust among both contributors and consumers.

Data and Technology Providers

TripAdvisor relies on a range of data and technology providers for its operational backbone, from cloud infrastructure to sophisticated data analytics and AI tools. The bargaining power of these suppliers is generally moderate. This is largely because many of the essential services, like cloud hosting and standard software solutions, are widely available from multiple vendors, making switching less costly and complex.

However, the power can increase if a provider offers a highly unique or proprietary technology that is critical to TripAdvisor's platform functionality or competitive edge, and for which alternatives are scarce or prohibitively expensive to implement. For instance, if a specific AI algorithm provider significantly enhances user experience or search accuracy, their leverage would be higher.

- Supplier Dependence: TripAdvisor's reliance on technology providers for platform stability and innovation influences supplier power.

- Switching Costs: The ease or difficulty of migrating services impacts how much leverage suppliers hold. For general cloud services, these costs are typically manageable.

- Technology Uniqueness: Highly specialized or proprietary technologies from suppliers can significantly increase their bargaining power.

- Market Availability: The presence of numerous alternative providers for essential services moderates supplier power.

Advertising Partners

Advertising partners, essentially suppliers of revenue to TripAdvisor, hold considerable bargaining power. This power stems from their ability to choose where to allocate their advertising budgets, comparing TripAdvisor's effectiveness against numerous other digital platforms. TripAdvisor must consistently prove its return on investment (ROI) to retain these crucial revenue streams.

The effectiveness of advertising on TripAdvisor is a key determinant of supplier bargaining power. If advertisers perceive better results or more cost-efficient campaigns on competing platforms, they can easily shift their spending. For instance, in 2023, the digital advertising market saw significant shifts, with platforms emphasizing user engagement and conversion rates gaining favor, directly impacting TripAdvisor's ability to command premium ad rates.

- Advertising partners can easily switch to alternative platforms if they don't see sufficient ROI.

- TripAdvisor's reliance on ad revenue makes it vulnerable to advertiser demands.

- The company must continuously demonstrate the value proposition of its advertising solutions.

- Declining core brand revenue in recent periods (e.g., 2023 reporting) intensifies the need to retain advertisers.

The bargaining power of TripAdvisor's suppliers is largely low, primarily due to the highly fragmented nature of its content contributors, such as individual reviewers and smaller travel providers. This fragmentation means no single supplier can exert significant influence. The sheer volume of user-generated content, exceeding one billion reviews by 2024, further dilutes any individual's leverage.

While major Online Travel Agencies (OTAs) like Booking.com and Expedia, acting as booking partners, possess moderate bargaining power due to their market share, TripAdvisor's role as a significant traffic driver offers a counterbalance. This dynamic means neither party can unilaterally dictate terms.

Technology and data providers generally have moderate bargaining power, as many services are commoditized. However, this power increases if a provider offers unique, mission-critical technology with few viable alternatives, potentially impacting platform functionality.

Advertising partners wield considerable bargaining power because they can easily shift their budgets to competing platforms if TripAdvisor fails to demonstrate a strong return on investment. The company must consistently prove its advertising value to retain this crucial revenue, especially given market shifts favoring platforms with high user engagement.

What is included in the product

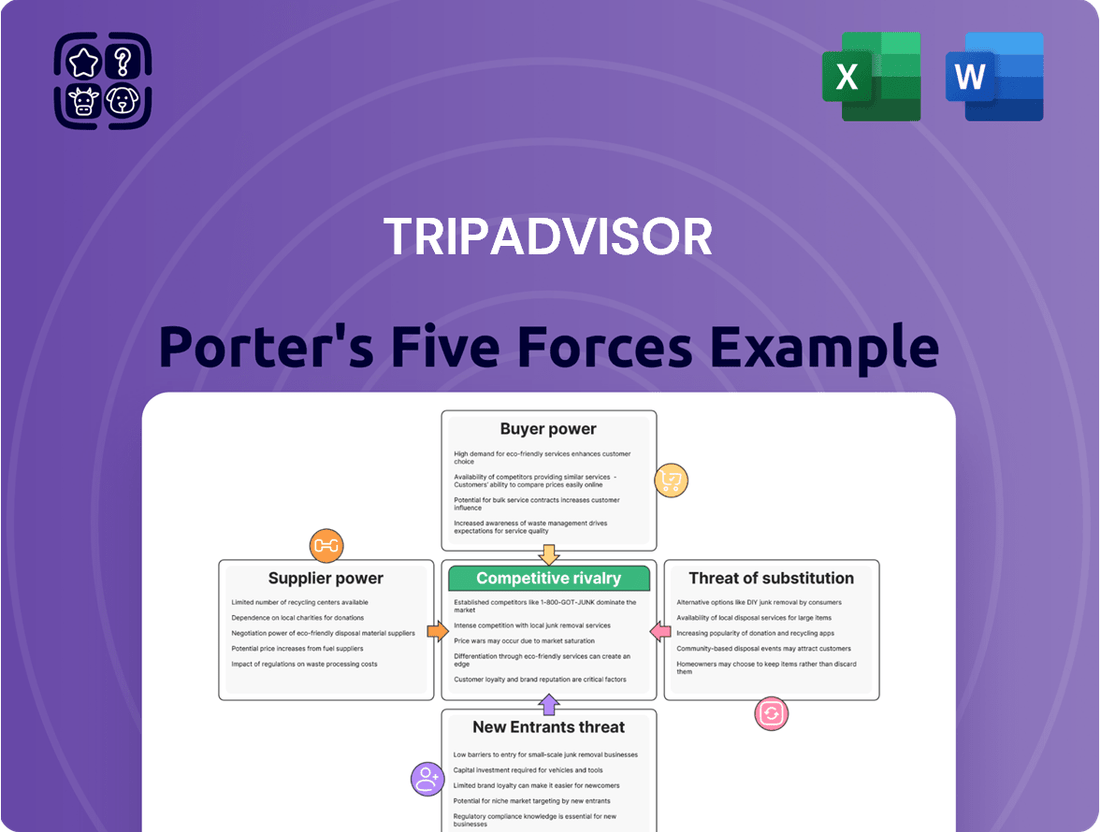

Analyzes the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants and substitutes impacting TripAdvisor's market position.

Quickly identify and neutralize competitive threats by visualizing the intensity of each of Porter's Five Forces.

Gain immediate clarity on industry dynamics, allowing for swift adjustments to strategy and proactive problem-solving.

Customers Bargaining Power

Individual travelers experience remarkably low costs when moving between different travel planning and booking platforms. They can effortlessly compare prices and read reviews on sites such as Google Travel, Booking.com, and Expedia, often within moments. This lack of friction in switching significantly amplifies their bargaining power, pushing platforms to maintain competitive pricing and user-friendly features to retain them.

Customers today wield significant power due to the sheer volume of travel information readily available. Beyond TripAdvisor, platforms like Google Travel, Booking.com, and even Instagram provide extensive details, reviews, and price comparisons. This accessibility allows travelers to thoroughly research options, compare pricing across numerous providers, and understand the true value of services. For instance, a 2024 report indicated that over 85% of travelers consult online reviews before booking accommodation, a clear sign of informed decision-making.

Many travelers are highly price-sensitive, actively hunting for the best value on flights, hotels, and activities. This means platforms like TripAdvisor must constantly feature competitive pricing, often facilitated by their meta-search capabilities. In 2024, for instance, online travel agencies (OTAs) reported intense competition on price, with average hotel booking commission rates hovering around 15-20%, directly impacting profitability.

User-Generated Content as a Customer Contribution

Customers on TripAdvisor are not just consumers; they are also the creators of the platform's core value through user-generated content. Their active participation in writing reviews and providing ratings directly fuels TripAdvisor's appeal to other travelers. This reliance on customer contributions grants them a unique form of bargaining power, compelling TripAdvisor to prioritize maintaining a positive and trustworthy user experience to ensure continued engagement and content flow.

The willingness of these 'customer-producers' to share their experiences is paramount. In 2024, platforms that foster strong community engagement often see higher user retention and content generation. TripAdvisor's success hinges on its ability to keep these contributors motivated and satisfied, as a decline in quality or quantity of reviews could significantly diminish its value proposition. This informal power means TripAdvisor must constantly innovate and respond to user feedback to sustain its competitive edge.

- Customer as Producer: TripAdvisor's business model relies heavily on travelers sharing reviews and ratings.

- Value Proposition Dependency: The platform's attractiveness to new users is directly tied to the volume and quality of existing user content.

- Informal Bargaining Power: Customers can indirectly influence TripAdvisor's policies and platform development by their willingness to contribute.

- Engagement is Key: TripAdvisor must foster a sense of community and trust to ensure continued contributions from its user base.

Growth of Direct Bookings

The growing tendency for travelers to book directly with hotels and airlines, often driven by exclusive loyalty program benefits, diminishes their dependence on platforms like TripAdvisor for actual reservations. This shift directly impacts TripAdvisor's commission-based revenue, especially within its primary Brand TripAdvisor business, as fewer bookings are routed through its site.

For instance, in 2024, many major hotel chains continued to heavily promote their direct booking channels, offering enhanced perks like free Wi-Fi, room upgrades, or flexible cancellation policies. This strategy aims to capture a larger share of customer relationships and revenue, bypassing third-party intermediaries.

- Direct booking incentives: Hotels and airlines increasingly offer exclusive discounts, loyalty points, and personalized services for direct bookings.

- Reduced reliance on OTAs: Travelers, particularly frequent ones, are becoming more adept at navigating direct booking channels for better value.

- Impact on commission revenue: This trend directly pressures TripAdvisor's core revenue model, which relies on commissions from bookings made via its platform.

Customers hold considerable sway in the travel industry due to readily accessible information, allowing for easy price comparisons and review analysis across numerous platforms. This transparency empowers travelers, forcing companies like TripAdvisor to maintain competitive pricing and user-friendly interfaces to retain their business. For example, data from 2024 shows that over 85% of travelers consult online reviews before booking, highlighting their informed decision-making process.

Travelers also act as content creators, directly contributing to TripAdvisor's value through reviews and ratings. This reliance on user-generated content gives customers indirect bargaining power, pushing TripAdvisor to prioritize a positive and trustworthy user experience to ensure continued engagement and content flow. In 2024, platforms fostering strong community engagement saw higher user retention, underscoring the importance of keeping contributors motivated.

The increasing trend of travelers booking directly with hotels and airlines, often lured by loyalty programs, reduces their reliance on platforms like TripAdvisor for actual reservations. This shift directly impacts TripAdvisor's commission-based revenue, as fewer bookings are routed through its site. Major hotel chains in 2024 continued to heavily promote their direct booking channels, offering perks like free Wi-Fi and flexible cancellations to capture customer relationships.

| Factor | Impact on TripAdvisor | Supporting Data (2024) |

|---|---|---|

| Information Accessibility | High customer bargaining power due to easy price and review comparisons. | Over 85% of travelers consult online reviews before booking. |

| Customer as Content Creator | Customers influence platform value and policies through reviews. | Platforms with strong community engagement see higher user retention. |

| Direct Booking Trend | Reduced reliance on OTAs, impacting commission revenue. | Major hotel chains heavily promote direct booking channels with exclusive perks. |

Preview the Actual Deliverable

TripAdvisor Porter's Five Forces Analysis

This preview showcases the complete TripAdvisor Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape affecting the travel giant. The document you see here is precisely what you'll receive instantly after purchase, ensuring full transparency and immediate access to this professionally crafted report. You're looking at the actual, fully formatted analysis, ready for your immediate use without any placeholders or modifications. This is the exact, ready-to-use document that will be delivered to you upon completing your purchase, providing a comprehensive understanding of TripAdvisor's strategic positioning.

Rivalry Among Competitors

TripAdvisor operates in a highly competitive landscape, facing substantial rivalry from established Online Travel Agencies (OTAs) such as Booking.com and Expedia Group. These platforms offer a full spectrum of booking services, from flights to accommodations and activities, directly competing for traveler attention and transactions.

The influence of major search engines, particularly Google, further intensifies this competitive pressure. Google's integrated travel services, including Google Flights and Google Hotels, increasingly capture user intent early in the travel planning process, often directing users within their own ecosystem rather than to third-party sites like TripAdvisor.

In 2024, the dominance of these OTAs and search engines is evident in market share figures. For instance, Booking Holdings and Expedia Group collectively command a significant portion of the global online travel market. Google's own travel-related advertising revenue continues to grow, underscoring its powerful position in influencing consumer choices.

TripAdvisor faces intense competition from rivals with more diversified revenue streams and robust direct booking capabilities, such as Online Travel Agencies (OTAs). These competitors can leverage their financial strength to significantly invest in marketing and technology advancements.

This competitive advantage directly pressures TripAdvisor's various business segments. For instance, the Brand TripAdvisor segment experienced a noticeable revenue decline of 8% in 2024, highlighting the impact of these well-funded competitors.

Google also presents a formidable challenge, particularly through its dominance in search advertising, which can divert potential customers away from TripAdvisor's platform.

The online travel sector is intensely competitive, demanding significant outlays for marketing and user acquisition. Companies like TripAdvisor must continuously invest to capture and retain customer attention in a crowded digital space.

TripAdvisor's marketing expenditure reached $729 million in 2024, a clear indicator of the substantial financial resources needed to stay competitive. This investment is crucial for maintaining brand visibility and driving traffic to its platform.

High user acquisition costs are a persistent challenge, as businesses vie for the same audience through online advertising, search engine optimization, and content creation.

This intense rivalry in marketing and user acquisition directly impacts profitability and necessitates efficient strategies to ensure a positive return on investment.

Differentiation Through User-Generated Content and Experiences

TripAdvisor's competitive edge is significantly bolstered by its immense collection of user-generated reviews, a core differentiator. This platform’s strength lies in the sheer volume and diversity of traveler feedback, which builds trust and aids decision-making.

However, the landscape is evolving. Competitors are actively enhancing their own review functionalities and expanding into the experiences market, mirroring TripAdvisor's successful Viator segment. This escalating competition means the fight for unique content and compelling travel experiences is becoming more intense.

- User-Generated Content Dominance: TripAdvisor's vast library of traveler reviews and ratings remains a primary competitive advantage, fostering a strong sense of community and trust.

- Experiences Segment Growth: The integration and growth of TripAdvisor Experiences, particularly through its acquisition of Viator, provides a direct revenue stream and a competitive offering against booking platforms.

- Intensifying Rivalry: Competitors like Booking.com and Google Travel are increasingly investing in their own user review systems and curated experience offerings, directly challenging TripAdvisor's market position.

- Content Quality and Volume Battle: The ongoing competition centers on attracting and retaining users who contribute high-quality, voluminous content, as this directly impacts platform utility and user engagement.

Impact of AI Integration and Personalization

The competitive rivalry within the online travel sector is intensifying as companies like TripAdvisor integrate artificial intelligence to offer highly personalized recommendations and streamline trip planning. This AI-driven personalization is becoming a key differentiator, allowing businesses to better cater to individual traveler preferences and needs.

Companies that excel in leveraging AI to enhance user experience and robustly combat fraudulent content are poised to gain a significant competitive advantage. For instance, by using AI to analyze user behavior and booking patterns, platforms can proactively suggest relevant activities or accommodations, thereby increasing engagement and conversion rates.

In 2024, the focus on AI in travel is evident. A significant portion of travel companies are investing heavily in AI technologies. For example, market research indicates that AI adoption in the travel and hospitality industry saw a substantial increase, with projections suggesting continued growth in AI-powered personalization features throughout 2024 and beyond.

- AI-driven personalization is becoming a critical factor in traveler acquisition and retention.

- Companies are investing in AI to improve user experience and combat fraudulent content.

- Effective AI integration can lead to a significant competitive edge in the online travel market.

- The online travel market saw substantial AI investment in 2024, with ongoing growth expected.

TripAdvisor faces fierce competition from major online travel agencies (OTAs) like Booking.com and Expedia Group, which offer comprehensive booking services and possess significant financial resources for marketing and technological advancements. Google's expanding travel offerings, including Google Flights and Hotels, also pose a substantial threat by capturing user intent early in the travel planning journey, diverting traffic away from third-party platforms.

The online travel market demands continuous, substantial investment in marketing and user acquisition to maintain visibility and engagement. In 2024, TripAdvisor's marketing expenditure reached $729 million, illustrating the high costs associated with competing for customer attention in this crowded digital space. This intense rivalry directly impacts profitability, necessitating efficient strategies for a positive return on investment.

TripAdvisor's core strength lies in its extensive user-generated content, a key differentiator that builds trust. However, competitors are actively enhancing their review systems and expanding into the experiences market, mirroring TripAdvisor's Viator segment and intensifying the competition for unique content and travel experiences.

Artificial intelligence is increasingly central to competitive strategy, with companies investing heavily in AI-driven personalization to improve user experience and combat fraudulent content. This focus on AI in 2024 indicates a trend toward enhanced personalization as a critical factor for traveler acquisition and retention, promising a significant competitive edge for those who leverage it effectively.

| Competitor | Key Offerings | 2024 Market Impact |

| Booking.com / Expedia Group | Flights, Hotels, Activities (Full-service OTAs) | Dominant market share, significant marketing/tech investment |

| Google Travel | Flights, Hotels, Search Integration | Captures early user intent, growing advertising revenue |

| Other OTAs | Niche or broad travel bookings | Fragmented market, localized competition |

SSubstitutes Threaten

Travelers increasingly bypass online travel agencies (OTAs) and review sites like TripAdvisor by booking directly with service providers. Many airlines and hotel chains, for instance, offer incentives such as lower prices or enhanced loyalty points for direct bookings, making them a compelling alternative. This trend is amplified by providers' investments in user-friendly websites and mobile apps, aiming to capture the entire customer relationship.

In 2024, a significant portion of travel bookings are expected to occur directly with providers. For example, many major hotel groups report that over 40% of their bookings originate from their own channels, a figure that has been steadily growing. This direct engagement allows providers to control the customer experience and avoid commission fees that are typically paid to platforms, thereby strengthening the threat of substitutes.

Social media platforms like Instagram and TikTok, along with niche travel blogs and vlogs, represent a potent threat of substitutes for TripAdvisor. These channels offer visually-driven, often authentic-feeling content that can directly inspire travel decisions, bypassing the need for aggregated reviews.

Users are increasingly seeking out these peer-generated narratives for travel ideas, shifting their attention away from traditional platforms. For instance, a 2024 report indicated that over 60% of Gen Z travelers discover new destinations primarily through social media content, a trend that directly challenges the utility of sites like TripAdvisor for initial inspiration.

The ability of these substitutes to provide immediate, often user-generated visual proof of experiences can be more persuasive than text-based reviews, diminishing the perceived value of TripAdvisor's core offering. This makes it easier for consumers to find and book travel without consulting established review aggregators.

The emergence of advanced AI-powered travel planning tools presents a significant threat of substitution for TripAdvisor. These AI assistants, including generative AI platforms like ChatGPT and specialized travel bots, can now curate entire travel experiences, from suggesting destinations to building detailed itineraries, bypassing the need for user-generated reviews.

For instance, by mid-2024, many travelers are increasingly leveraging AI to compare prices, identify hidden gems, and even book accommodations directly, diminishing reliance on platforms primarily built on aggregated user feedback. This shift means that a traveler might get comprehensive trip planning directly from an AI without ever visiting TripAdvisor.

The capability of these AI tools to synthesize vast amounts of data and provide personalized recommendations directly challenges TripAdvisor's core value proposition as a go-to source for travel information and planning. This direct service offering from AI can fulfill traveler needs more efficiently, thereby substituting the traditional role of review sites.

Offline Travel Agencies and Word-of-Mouth

While TripAdvisor dominates online travel planning, traditional brick-and-mortar travel agencies persist as a substitute, particularly for complex or luxury itineraries requiring bespoke service. Though their market share has shrunk, these agencies offer a personal touch that online platforms can’t fully replicate. For instance, in 2024, while online bookings continued to surge, a segment of the luxury travel market still sought out agents for their expertise in crafting unique, high-end experiences.

Word-of-mouth recommendations from trusted friends and family also serve as a powerful substitute, often outweighing online reviews for many travelers. This organic endorsement provides a level of credibility that even the most detailed online feedback might struggle to match. Personal referrals continue to be a significant driver of travel choices, influencing booking decisions in ways that online algorithms cannot fully capture.

- Traditional travel agencies continue to cater to a niche market seeking personalized service for complex or luxury trips.

- Word-of-mouth referrals remain a potent substitute, offering a level of trust often exceeding online reviews.

- The perceived value of personal recommendations is a persistent threat, influencing traveler decisions even in the digital age.

General Search Engines for Information Gathering

General search engines, notably Google, present a significant threat of substitution for TripAdvisor. Users frequently bypass TripAdvisor's meta-search to directly access booking sites or official vendor pages for destinations, attractions, and accommodations. This is often facilitated by Google's expanding suite of travel-related features, which aggregate information and booking options.

The ease with which users can find and book travel directly through search engines diminishes TripAdvisor's role as an intermediary. For instance, Google Flights and Google Hotels allow travelers to compare prices and book directly, a core function previously dominated by platforms like TripAdvisor. This direct access bypasses TripAdvisor's content and reviews, directly impacting its traffic and revenue streams.

- Google's dominance in online search translates directly into its ability to capture travel intent.

- Direct booking capabilities on Google Travel offer a seamless alternative to TripAdvisor's meta-search.

- **In 2024, Google continued to invest heavily in its travel products**, further strengthening its position as a direct competitor.

The threat of substitutes for TripAdvisor is significant, encompassing direct bookings, social media inspiration, AI travel planners, traditional agencies, word-of-mouth, and general search engines. These alternatives often offer more personalized, visually engaging, or convenient experiences, diverting users from TripAdvisor's aggregated review model.

In 2024, the landscape is marked by increasing user reliance on integrated digital solutions. For instance, Google's travel features allow direct price comparisons and bookings, bypassing TripAdvisor entirely. Furthermore, over 60% of Gen Z travelers discover destinations via social media, highlighting a clear shift in inspiration sources.

| Substitute Category | Key Characteristics | Impact on TripAdvisor | 2024 Relevance |

|---|---|---|---|

| Direct Bookings | Incentives, loyalty programs, user-friendly interfaces | Reduces reliance on aggregators, bypasses commission | Over 40% of bookings for major hotel groups via own channels |

| Social Media & Blogs | Visual inspiration, authentic narratives, peer recommendations | Shifts discovery phase away from reviews | 60%+ of Gen Z discover destinations via social media |

| AI Travel Planners | Personalized itineraries, data synthesis, direct booking | Fulfills planning needs more efficiently | Increasing traveler leverage of AI for planning and booking |

| Traditional Agencies | Bespoke service, expertise for complex/luxury travel | Caters to a niche seeking personalized touch | Continued demand in luxury segment for tailored experiences |

| Word-of-Mouth | Trusted personal recommendations, credibility | Offers a high level of trust | Significant driver of travel choices, outperforming online reviews for some |

| Search Engines (Google) | Aggregated information, direct booking capabilities | Captures travel intent, bypasses meta-search | Google Travel features facilitate direct comparison and booking |

Entrants Threaten

TripAdvisor's user-generated content, exceeding one billion reviews and ratings as of early 2024, creates a formidable barrier to entry. This vast repository fosters a powerful network effect, where more users attract more users, leading to a richer and more comprehensive experience that new platforms struggle to match.

Establishing the trust and cultivating a vibrant community of engaged contributors, the bedrock of TripAdvisor's success, requires substantial time and financial resources. This organic growth, built over years, is a significant hurdle for any potential competitor seeking to disrupt the market.

New entrants face a formidable barrier in the form of substantial capital requirements for effective marketing and technology development. Building a recognizable brand and attracting a significant user base in the online travel agency (OTA) sector demands considerable investment in advertising, promotions, and customer acquisition strategies. For instance, the global OTA market was projected to reach over $1.5 trillion by 2024, highlighting the immense scale of investment needed to compete.

Furthermore, the technological infrastructure underpinning a successful OTA is complex and costly. Developing and maintaining user-friendly booking platforms, integrating with numerous suppliers, and ensuring data security require ongoing and significant R&D expenditure. This intense competition for market share translates directly into high marketing spend, making it difficult for smaller players to gain traction against established giants with deep pockets.

Established players like TripAdvisor boast deep-rooted relationships with millions of hotels, restaurants, and attractions globally for their listings and advertising. For instance, in 2024, TripAdvisor continued to leverage its vast network, facilitating bookings and advertising opportunities for a significant portion of the travel industry.

Newcomers would struggle to replicate this extensive web of partnerships, which is crucial for offering a comprehensive and appealing platform to users. Building trust and securing favorable terms with these providers takes considerable time and resources.

Regulatory and Data Privacy Compliance Burdens

The online travel industry, including platforms like TripAdvisor, faces substantial hurdles for new entrants due to stringent regulatory and data privacy compliance. Operating globally means grappling with diverse legal frameworks, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States. These regulations mandate robust data protection measures, increasing operational complexity and cost for any new player. In 2024, the ongoing evolution of data privacy laws globally means any new entrant must invest heavily in legal counsel and compliance infrastructure from day one, creating a significant barrier to entry.

These compliance burdens translate into substantial financial outlays. New companies must allocate resources towards legal expertise, secure data storage solutions, and ongoing audits to ensure adherence to varying international standards. The risk of significant fines for non-compliance, as seen with large tech companies facing penalties under GDPR, acts as a powerful deterrent. For instance, GDPR fines can reach up to 4% of annual global revenue or €20 million, whichever is higher. This financial and legal exposure makes it exceptionally challenging for smaller, less capitalized companies to compete effectively against established players who have already absorbed these costs.

- High Compliance Costs: Significant investment needed for legal, technical, and operational adherence to global data privacy regulations.

- Legal and Financial Risks: Exposure to substantial fines and litigation for non-compliance, particularly concerning user data handling.

- Navigating Diverse Regulations: Complexity arises from managing differing data protection laws across multiple jurisdictions, requiring specialized expertise.

- Established Player Advantage: Incumbents like TripAdvisor have existing infrastructure and experience in managing these regulatory landscapes, offering a competitive edge.

Competitive Response from Incumbents

Established players such as TripAdvisor are poised to react robustly to emerging competitors. This response often manifests through aggressive pricing, the introduction of superior features, or strategic acquisitions designed to neutralize nascent threats. For instance, TripAdvisor's ongoing efforts to diversify its revenue streams via platforms like Viator, which focuses on tours and activities, and TheFork, a restaurant booking service, are clear indicators of its strategy to fortify its market standing against potential new entrants.

TripAdvisor's proactive diversification demonstrates a commitment to enhancing its competitive moat. By expanding into adjacent markets, the company aims to capture a broader share of the travel and leisure ecosystem, making it a more formidable competitor for any new player attempting to enter. This strategic move not only strengthens its existing business but also builds resilience against disruptions.

- Aggressive Pricing: Incumbents may lower prices to make it less attractive for new entrants to gain market share.

- Feature Enhancement: Existing platforms can rapidly improve their offerings, adding value and loyalty incentives for customers.

- Acquisitions: Successful new entrants might be acquired by larger players, absorbing their innovation and customer base.

- Loyalty Programs: Strengthening customer loyalty through rewards and personalized experiences can deter new entrants.

The threat of new entrants for TripAdvisor remains moderate, primarily due to significant barriers like brand loyalty, user-generated content, and substantial capital requirements. While the online travel sector is attractive, replicating TripAdvisor's established network and trust is a major challenge for newcomers.

Porter's Five Forces Analysis Data Sources

Our TripAdvisor Porter's Five Forces analysis is built on a foundation of data from company annual reports, investor presentations, and financial filings. We also incorporate insights from industry research reports and travel sector publications to capture competitive dynamics.