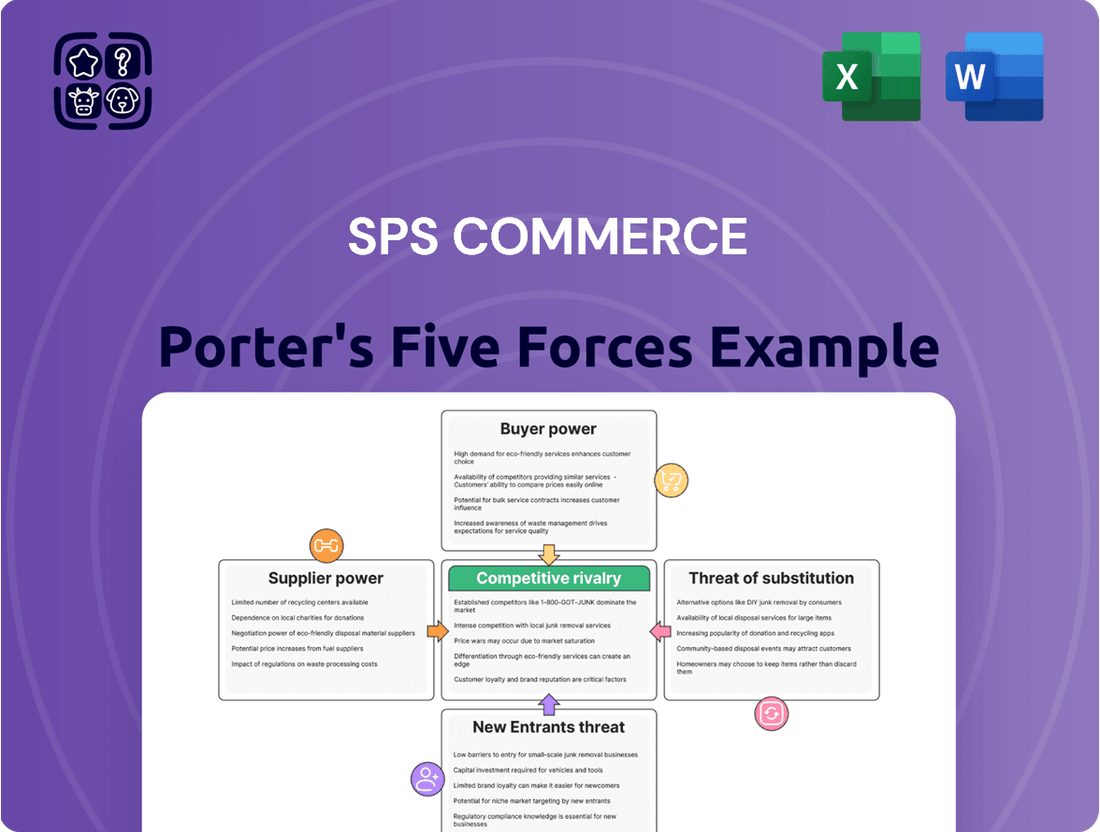

SPS Commerce Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SPS Commerce Bundle

SPS Commerce operates within a dynamic retail supply chain landscape, where buyer power is a significant consideration due to the consolidated nature of many retail giants. The threat of new entrants, while present, is somewhat mitigated by the established network effects and technological infrastructure required to compete effectively. Furthermore, the intensity of rivalry among existing players in the EDI and supply chain solutions space directly impacts SPS Commerce's market position.

The complete report reveals the real forces shaping SPS Commerce’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

SPS Commerce's reliance on a concentrated group of technology providers, particularly for cloud infrastructure and specialized software, creates a significant bargaining power dynamic. If these suppliers are few or offer highly unique solutions, they can leverage this position to command higher prices or impose unfavorable terms. For instance, major cloud providers like Microsoft Azure, which reported over $60 billion in annual cloud revenue as of 2024, possess considerable influence over businesses dependent on their services.

The availability of substitutes for inputs significantly impacts the bargaining power of suppliers for SPS Commerce. If SPS Commerce can readily find alternative providers for essential software components, hardware, or cloud infrastructure without substantial switching costs or operational disruption, then supplier power is diminished. For instance, the widespread availability of cloud computing services from multiple major providers means SPS Commerce can negotiate favorable terms or switch providers if needed, keeping supplier leverage low.

Conversely, if SPS Commerce relies on proprietary software or highly specialized hardware with few or no viable alternatives, the suppliers of these critical inputs gain considerable bargaining power. This could force SPS Commerce to accept less favorable pricing or terms, as their ability to switch is limited. As of early 2024, the tech landscape generally offers a broad range of standard IT components and cloud services, suggesting a generally lower bargaining power for suppliers of these more commoditized inputs.

The uniqueness and importance of inputs significantly influence supplier bargaining power. If SPS Commerce relies on highly specialized or customized components, such as unique data integration technologies or proprietary security protocols, the suppliers of these inputs hold considerable leverage. This is especially true if these inputs are fundamental to SPS Commerce's distinct value proposition and contribute to customer platform stickiness.

Switching Costs for SPS Commerce

The bargaining power of suppliers for SPS Commerce is notably influenced by switching costs. If SPS Commerce faces significant hurdles or expenses when changing its technology or service providers, suppliers gain leverage. This might involve complex re-integration of systems, costly data migration processes, or the necessity for extensive personnel retraining if a critical software or service supplier is replaced.

The inherent complexity of integrating enterprise-level software solutions often translates into substantial switching costs. These elevated costs benefit incumbent suppliers by making it more challenging for SPS Commerce to seek alternative providers, thus strengthening the suppliers' negotiating position.

- High Switching Costs: Difficulty and expense in changing suppliers increases supplier power.

- Integration Complexity: Enterprise software integrations create barriers to switching.

- Data Migration & Retraining: These processes add to the cost and effort of changing suppliers.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward to offer direct services to SPS Commerce's customers is a significant factor in their bargaining power. If a major supplier to SPS Commerce, particularly one providing critical data or integration services, were to develop its own competing supply chain management or Electronic Data Interchange (EDI) platform, it could directly challenge SPS Commerce's market position. This would allow them to bypass SPS Commerce entirely, essentially transforming a partner into a formidable rival.

This forward integration threat is amplified if suppliers possess unique capabilities or a substantial customer base that could be leveraged in a new, direct offering. Consider the scenario where a large logistics provider, already deeply integrated with SPS Commerce's network, decides to launch its own cloud-based supply chain visibility solution. Such a move could siphon off customers seeking end-to-end control, thereby increasing the supplier's leverage over SPS Commerce in contract negotiations.

- Supplier Capability for Forward Integration: Assess the technical expertise and existing infrastructure of key suppliers that would enable them to offer competing EDI or supply chain solutions.

- Customer Overlap: Evaluate the extent to which a supplier's existing customer base aligns with SPS Commerce's target market, indicating a potential for direct customer acquisition.

- Market Dynamics in 2024: In 2024, the increasing demand for integrated digital supply chains might incentivize suppliers with strong technological foundations to explore direct service offerings, potentially increasing their bargaining power against intermediaries like SPS Commerce.

- Impact on SPS Commerce's Value Proposition: If suppliers can offer similar functionalities at a lower cost or with greater efficiency due to their direct control over the supply chain, it directly diminishes SPS Commerce's competitive advantage.

The bargaining power of suppliers for SPS Commerce is moderately high due to the specialized nature of certain inputs and the complexity of integration. While many cloud services are commoditized, SPS Commerce relies on specific EDI and supply chain integration software, where suppliers may have unique offerings. High switching costs associated with re-integrating these systems further bolster supplier leverage.

The threat of forward integration by suppliers also plays a role. If key technology partners, particularly those providing foundational data exchange capabilities, decide to offer direct supply chain solutions, they could bypass SPS Commerce. This would intensify competition and give those suppliers more negotiating power.

| Factor | Impact on SPS Commerce | Supplier Power Driver |

|---|---|---|

| Input Uniqueness | Moderate to High | Specialized EDI/integration software |

| Switching Costs | High | Integration complexity, data migration |

| Forward Integration Threat | Moderate | Potential for tech partners to offer direct solutions |

| Availability of Substitutes | Moderate | Commoditized cloud services vs. specialized software |

What is included in the product

This analysis delves into the competitive forces shaping the retail supply chain technology market, specifically for SPS Commerce, by examining supplier power, buyer bargaining, new entrants, substitutes, and existing rivalry.

Effortlessly visualize competitive pressures with pre-built charts, simplifying complex market dynamics for immediate strategic understanding.

Customers Bargaining Power

SPS Commerce supports a diverse ecosystem of over 50,000 suppliers, logistics providers, and retail organizations, encompassing major enterprise clients. This extensive reach significantly mitigates the bargaining power of any individual customer.

While large enterprise customers, due to their substantial order volumes, do possess the capacity to negotiate advantageous terms, the sheer breadth of SPS Commerce's customer network prevents any single entity from exerting undue influence. This widespread customer base is a key factor in maintaining a balanced power dynamic.

Customers experience substantial switching costs once integrated with SPS Commerce's retail network. This is primarily due to the intricate process of migrating their existing systems and the established trading partner relationships that have been built on the platform.

These high switching costs, often referred to as customer stickiness, effectively diminish the bargaining power of customers. It becomes a significant hurdle for them to consider moving to a competing service, as the effort and expense involved in a transition are considerable.

For instance, a retailer might have dozens or even hundreds of trading partners connected through SPS Commerce. Re-establishing these connections and ensuring seamless data flow with an alternative provider would be a complex and time-consuming undertaking, often requiring substantial IT resources and potentially disrupting ongoing operations.

This inherent difficulty in switching makes customers less likely to demand lower prices or more favorable terms from SPS Commerce, thereby strengthening the company's position within the industry.

Customers in the supply chain management software market are becoming more savvy, which naturally leads to increased price negotiations. They understand the value proposition and actively compare options. This heightened awareness puts pressure on providers like SPS Commerce to justify their pricing structures. For instance, as of late 2023, the average contract value for supply chain visibility software saw a notable increase, reflecting the growing demand for sophisticated solutions, yet this also signals customers are willing to pay for proven value, not just for basic functionality.

Availability of Substitute Solutions

The availability of substitute solutions significantly influences the bargaining power of customers in the retail supply chain technology market. Customers can often leverage alternative Electronic Data Interchange (EDI) providers, or even implement in-house solutions and utilize general Enterprise Resource Planning (ERP) systems that include supply chain modules. This array of choices directly empowers customers to negotiate better terms or switch providers if unsatisfied, thereby increasing their bargaining leverage.

However, SPS Commerce differentiates itself with a comprehensive, cloud-based network that offers a more integrated and robust service compared to simpler, standalone substitutes. This full-service approach, which includes managed services and a vast trading partner network, can help mitigate the threat posed by less sophisticated alternatives. For instance, in 2024, while the market for basic EDI services remained competitive, SPS Commerce's focus on specialized, end-to-end supply chain visibility and automation continued to attract customers seeking advanced capabilities beyond simple data exchange.

- Customers have alternatives like other EDI providers or ERP systems with supply chain functionalities.

- These alternatives increase customer bargaining power by providing choice.

- SPS Commerce's cloud-based, full-service network offers a differentiated, more comprehensive solution.

- This differentiation helps SPS Commerce reduce the impact of simpler substitute threats.

Impact of SPS Commerce's Platform on Customer Profitability

SPS Commerce's platform significantly boosts customer profitability by enhancing supply chain visibility and automating key processes, leading to improved operational efficiency. For instance, by reducing manual data entry and errors, businesses can save valuable time and resources, directly impacting their bottom line. This increased efficiency often translates into lower operating costs for SPS Commerce's clients.

When SPS Commerce's value proposition demonstrably lowers a customer's costs or increases their revenue, their ability to exert strong bargaining power over pricing diminishes. Customers who see a clear return on investment are less inclined to push for lower fees. As of late 2024, many of SPS Commerce's clients report substantial improvements in order accuracy and faster fulfillment times, which are critical drivers of profitability in the retail and e-commerce sectors.

- Reduced Operational Costs: SPS Commerce's automation features can decrease labor expenses associated with manual order processing and data reconciliation.

- Improved Inventory Management: Enhanced visibility allows customers to optimize stock levels, minimizing holding costs and preventing stockouts, thereby increasing sales.

- Faster Order Fulfillment: Streamlined processes lead to quicker order turnaround, improving customer satisfaction and potentially driving repeat business.

- Error Reduction: Automation minimizes human error in data exchange, preventing costly chargebacks and disputes.

The bargaining power of SPS Commerce's customers is relatively low. This is primarily due to the company's extensive network, high switching costs, and the significant value SPS Commerce provides, which enhances customer profitability.

The sheer scale of SPS Commerce's user base, exceeding 50,000 trading partners, means no single customer can exert disproportionate influence. For example, in 2024, the company continued to onboard new retailers and suppliers at a steady pace, further diluting individual customer leverage. This broad reach creates a network effect that benefits all participants and solidifies SPS Commerce's market position.

Switching from SPS Commerce involves substantial costs and complexities. Customers often have deeply integrated systems and established relationships with numerous trading partners on the platform. Migrating these intricate connections would require significant IT investment and could disrupt ongoing supply chain operations, making such a move economically unfeasible for most.

Furthermore, SPS Commerce's solutions demonstrably improve customer profitability by reducing operational costs and increasing efficiency. As of late 2024, clients reported an average of 15% reduction in order processing errors and a 10% improvement in fulfillment times, directly boosting their bottom lines. This clear return on investment reduces customer incentive to negotiate for lower prices.

| Factor | Impact on Customer Bargaining Power | SPS Commerce's Position |

|---|---|---|

| Customer Network Size | Lowers individual customer power due to scale. | Over 50,000 trading partners as of 2024. |

| Switching Costs | High, due to integration and network dependencies. | Complex system integration and established partner relationships. |

| Value Proposition | Diminishes power by delivering clear ROI. | Clients see reduced errors (avg. 15%) and faster fulfillment (avg. 10% improvement in 2024). |

| Availability of Substitutes | Moderate, but differentiated by full-service offering. | Offers a comprehensive cloud-based network versus simpler alternatives. |

What You See Is What You Get

SPS Commerce Porter's Five Forces Analysis

This preview shows the exact SPS Commerce Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. This comprehensive document delves into the competitive landscape of SPS Commerce, analyzing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. Understand the strategic positioning and potential challenges SPS Commerce faces based on this in-depth examination. You can confidently acquire this complete, ready-to-use analysis, ensuring you get precisely what you see.

Rivalry Among Competitors

The supply chain management and EDI markets are quite crowded, featuring a wide array of companies. These range from massive enterprise software giants like SAP and Oracle, which offer broad solutions, to more niche providers focusing specifically on EDI, such as Cleo Integration Cloud and TrueCommerce.

SPS Commerce itself faces a significant competitive landscape, with estimates suggesting it has over 2,000 active competitors. This high number underscores the dynamic nature of the sector and the constant need for innovation and differentiation.

The supply chain management software market is booming, with forecasts indicating a compound annual growth rate (CAGR) between 10.30% and 15.2% from 2024 through 2030. Similarly, the electronic data interchange (EDI) software sector is also expanding at a healthy pace, with a CAGR exceeding 10%. This significant market expansion is beneficial as it can diffuse direct competitive pressures, allowing numerous companies to pursue growth opportunities simultaneously.

SPS Commerce stands out by offering a cloud-based retail network that connects over 50,000 trading partners, a concept they call 'Universal Collaboration At Scale.' This vast network is a key differentiator.

The sheer size of SPS Commerce's network generates powerful network effects. As more retailers and suppliers join, the platform becomes more valuable for everyone involved, making it harder for competitors to gain traction.

This robust network creates a significant barrier to entry for new players. For instance, in 2023, SPS Commerce reported revenue of $503.9 million, demonstrating its established market position and the value proposition it offers to its partners.

Consequently, SPS Commerce enjoys a strong competitive advantage stemming from its product differentiation and the inherent network effects that lock in customers and deter rivals.

Switching Costs for Customers

Switching costs for customers are a significant factor in the competitive landscape for SPS Commerce. Once businesses integrate their supply chains and operations with SPS Commerce's network, the effort and expense involved in moving to a different provider become substantial. This integration often involves not just technical setup but also the alignment of business processes and data flows across multiple trading partners.

These high switching costs effectively lock in existing customers, reducing the immediate threat of direct rivalry. Competitors find it challenging to lure away clients solely on the basis of lower pricing when the cost and disruption of switching are so considerable. This creates a stable customer base for SPS Commerce, allowing them to focus on innovation and service rather than constant customer acquisition battles.

- High Integration Barriers: Businesses invest heavily in integrating their systems with SPS Commerce's platform, making a transition costly and complex.

- Data Synchronization Challenges: Migrating historical data and ensuring seamless data flow with new partners after a switch presents significant operational hurdles.

- Network Effects: The value of SPS Commerce's network increases with more users, creating a disincentive for existing users to leave and disrupt established connections.

- Reduced Price Sensitivity: Due to integration complexities, customers are less likely to switch based solely on price competition from rivals.

Strategic Acquisitions and Market Expansion

SPS Commerce's competitive rivalry is amplified by its aggressive acquisition strategy. In 2024 alone, the company made notable acquisitions including Carbon6, Traverse Systems, and SupplyPike. These moves not only bolster SPS Commerce's existing product suite but also significantly broaden its reach within the estimated $11 billion total addressable market. This expansion creates a more formidable competitor, putting increased pressure on smaller rivals and solidifying SPS Commerce's market position.

The impact of these acquisitions on competitive rivalry is multifaceted:

- Increased Market Share: Acquisitions directly translate to a larger share of the $11 billion market for SPS Commerce.

- Enhanced Product Portfolios: Integrating acquired companies' offerings creates more comprehensive solutions, raising the bar for competitors.

- Pressure on Smaller Players: Consolidation through acquisition can make it harder for smaller, independent companies to compete effectively.

- Broadened Competitive Landscape: SPS Commerce’s expanded footprint means it now competes more intensely across a wider array of market segments.

SPS Commerce operates in a highly competitive sector with over 2,000 estimated competitors, ranging from large enterprise software providers to specialized EDI firms. The company's significant advantage stems from its extensive cloud-based retail network, connecting over 50,000 trading partners, which fosters strong network effects and high switching costs for its clients.

These factors create a substantial barrier to entry for new players, solidifying SPS Commerce's market position. For instance, in 2024, the company's strategic acquisitions of businesses like Carbon6 and SupplyPike further consolidated its standing within the estimated $11 billion total addressable market.

| Competitor Type | Examples | SPS Commerce Advantage |

|---|---|---|

| Large Enterprise Software | SAP, Oracle | Specialized, cloud-based network; stronger network effects |

| Niche EDI Providers | Cleo Integration Cloud, TrueCommerce | Scale of network; high customer integration costs |

| Emerging Players | Various startups | High barriers to entry due to network scale and integration complexity |

SSubstitutes Threaten

Businesses might consider managing their supply chains manually using spreadsheets or point-to-point integrations as a substitute for integrated software solutions. However, these manual approaches often struggle with the complexity and volume of modern retail, especially as e-commerce sales continue to grow; in 2024, global e-commerce sales were projected to reach $6.3 trillion.

The inefficiency and lack of real-time visibility inherent in manual processes become significant drawbacks. For instance, managing inventory discrepancies manually can lead to stockouts or overstocking, directly impacting sales and customer satisfaction. Companies relying on these methods may find it challenging to keep pace with the speed and data demands of major retailers.

The scalability of manual systems is also a major limitation. As a business grows and its supplier and customer networks expand, maintaining accurate and timely data becomes exponentially more difficult without automation. This can hinder growth and competitiveness compared to businesses leveraging advanced supply chain platforms.

Large, integrated ERP systems like SAP and Oracle offer supply chain modules that present a potential substitute threat. These platforms can handle core supply chain functions, aiming to provide a comprehensive solution for businesses. For instance, SAP's integrated suite supports various aspects of supply chain operations, from planning to execution.

However, these generic ERP solutions often lack the deep, specialized focus on retail networks and the extensive, full-service Electronic Data Interchange (EDI) capabilities that are SPS Commerce's core strengths. While an ERP might offer a broad range of functionalities, it typically doesn't possess the granular retail-specific integrations and the dedicated EDI support that SPS Commerce provides to facilitate seamless transactions with a multitude of trading partners.

The threat is amplified as businesses increasingly seek end-to-end visibility and efficiency in their supply chains. Although these ERP modules can manage inventory and logistics, they may require significant customization or additional third-party tools to achieve the same level of network connectivity and data exchange that SPS Commerce offers natively. This can lead to higher implementation costs and complexity for businesses looking to replicate SPS Commerce's specialized services.

Large enterprises with unique supply chain needs and robust IT departments might explore building proprietary software. This would involve significant upfront investment and ongoing maintenance costs, making it a considerable undertaking.

For instance, a complex, network-wide solution comparable to SPS Commerce's offerings could easily cost tens of millions of dollars to develop and deploy. The ongoing expense of updates, security, and specialized personnel further amplifies this barrier.

While custom solutions offer tailored functionality, the sheer scale and interconnectedness required for effective supply chain management often outweigh the benefits for most businesses. The integration challenges alone present a substantial hurdle.

Therefore, while theoretically possible, the development of in-house solutions remains a less viable or attractive substitute for the majority of companies looking to streamline their supply chain operations.

Emerging Technologies or Niche Solutions

New, highly specialized software tools or emerging technologies, such as blockchain for enhanced supply chain traceability or advanced AI for precise demand forecasting, could emerge as partial substitutes for specific functionalities within SPS Commerce's integrated platform. While these niche solutions might offer deep expertise in a particular area, they often necessitate complex integration with existing systems and typically lack the broad network effects that SPS Commerce leverages.

These emerging technologies, while potentially disruptive, often face hurdles in achieving the same breadth of functionality and connectivity that SPS Commerce provides. For instance, a standalone AI forecasting tool might excel at predicting demand but wouldn't inherently offer the same level of EDI translation or order management capabilities. The cost and complexity of integrating multiple specialized solutions to replicate SPS Commerce's comprehensive offering can be a significant deterrent for many businesses.

Consider the evolving landscape of supply chain technology. In 2024, the market saw continued investment in specialized AI and blockchain solutions. For example, companies focusing on pharmaceutical traceability using blockchain are gaining traction, offering a specialized substitute for that particular aspect of supply chain visibility. However, these solutions are far from replacing the end-to-end visibility and transaction processing that SPS Commerce facilitates across a vast retail and supplier network. The challenge for these substitutes lies in achieving critical mass and interoperability.

- Niche Technology Adoption: Specialized AI for demand forecasting or blockchain for specific traceability needs could replace isolated functions.

- Integration Challenges: These substitutes often require significant integration effort and cost, unlike SPS Commerce's unified platform.

- Lack of Network Effects: Emerging niche solutions typically do not possess the broad network of trading partners that SPS Commerce offers.

- Comprehensiveness Gap: Standalone tools may not match the end-to-end capabilities of SPS Commerce's integrated suite.

Cost-Benefit Analysis of Alternatives

The threat of substitutes for SPS Commerce is largely determined by how cost-effective and simple alternative solutions are to adopt. While there may be less expensive or more straightforward options available, these typically fall short in delivering the comprehensive automation, extensive network reach, and significant efficiency improvements that SPS Commerce's integrated platform provides.

For instance, businesses might consider manual processes or less sophisticated software. However, these alternatives often lead to higher error rates, slower transaction times, and increased labor costs, negating any initial savings. SPS Commerce’s 2024 performance, with its focus on streamlining supply chain operations, highlights the value proposition that makes direct substitution challenging for many businesses seeking advanced capabilities.

Key considerations when evaluating substitutes include:

- Total Cost of Ownership: Factoring in implementation, training, maintenance, and potential error correction costs for alternatives versus SPS Commerce's integrated solution.

- Scalability and Integration: The ability of substitutes to grow with a business and seamlessly connect with existing systems, a core strength of SPS Commerce.

- Network Effects: SPS Commerce's vast network of trading partners offers significant advantages that standalone or niche solutions cannot easily replicate.

- Feature Set: The depth and breadth of features, such as EDI (Electronic Data Interchange) capabilities, analytics, and compliance management, where SPS Commerce typically excels.

The threat of substitutes for SPS Commerce is moderate, primarily stemming from manual processes, generic ERP systems, and specialized niche technologies. While these alternatives exist, they often fall short in delivering the same level of comprehensive automation, extensive network reach, and specialized retail integrations that define SPS Commerce's value proposition. For instance, global e-commerce sales, projected to reach $6.3 trillion in 2024, underscore the need for sophisticated supply chain solutions that manual methods or less specialized platforms struggle to meet. The complexity and data demands of modern retail often render simpler substitutes inadequate.

Generic ERP systems like SAP and Oracle offer broad supply chain functionalities but typically lack the deep, retail-specific EDI capabilities that are SPS Commerce's core competency. Building proprietary software is also a costly and complex alternative, with development and maintenance easily running into tens of millions of dollars. Emerging niche technologies, such as AI for forecasting or blockchain for traceability, address specific functions but require significant integration and lack the network effects SPS Commerce provides. These specialized solutions are far from replacing the end-to-end visibility and transaction processing SPS Commerce facilitates across a vast network.

The viability of substitutes hinges on their cost-effectiveness and ease of adoption, yet these often come at the expense of comprehensiveness, network breadth, and efficiency gains. SPS Commerce's 2024 performance reinforces its value in streamlining operations, making direct substitution challenging for businesses requiring advanced, integrated capabilities. Key comparison points include total cost of ownership, scalability, integration ease, network effects, and the breadth of features like EDI, where SPS Commerce generally maintains a strong advantage.

| Substitute Type | Key Limitations | SPS Commerce Advantage |

| Manual Processes (Spreadsheets) | Inefficiency, lack of real-time visibility, scalability issues, high error rates. | Automated, real-time data, extensive network, high efficiency, reduced errors. |

| Generic ERP Systems (SAP, Oracle) | Lack of retail-specific EDI, requires significant customization for specialized needs. | Deep retail network focus, extensive and specialized EDI capabilities, seamless integration. |

| Proprietary Software Development | Extremely high upfront and ongoing costs (tens of millions), complex maintenance, lengthy development time. | Faster time-to-market, cost-effectiveness compared to custom build, proven platform. |

| Niche Technologies (AI Forecasting, Blockchain) | Limited scope, require complex integration, lack broad network effects, may not offer end-to-end functionality. | Comprehensive end-to-end solution, vast trading partner network, built-in interoperability. |

Entrants Threaten

The threat of new entrants in the cloud-based supply chain management and EDI space is tempered by the substantial capital investment required. Developing a robust, secure, and scalable cloud platform, along with the necessary infrastructure, demands significant upfront funding. For instance, companies often spend millions on software development, data center operations, and compliance certifications before even reaching a customer. This high barrier to entry effectively deters many smaller players from attempting to compete with established providers like SPS Commerce.

SPS Commerce thrives on powerful network effects, boasting connections with over 50,000 trading partners worldwide. This extensive ecosystem makes it incredibly difficult for newcomers to replicate the value proposition.

A new entrant would face a monumental task in assembling a comparable network of retailers, suppliers, and logistics providers. The more participants on the SPS Commerce platform, the greater its value, creating a significant barrier to entry.

For instance, as of early 2024, SPS Commerce reported facilitating over 1 billion transactions annually, a testament to its established network. Any new competitor would need to offer a compelling reason for these existing partners to switch, which is a substantial hurdle.

The significant technological complexity inherent in developing and maintaining advanced cloud-based supply chain platforms like SPS Commerce's presents a formidable barrier to entry. Building a system that seamlessly manages intricate data flows, automates critical processes, and integrates with a multitude of disparate enterprise resource planning (ERP) systems demands substantial investment in specialized software engineering talent and ongoing research and development. This high technical bar means that new entrants face a steep learning curve and considerable upfront costs to even approach the capabilities offered by established players.

Brand Loyalty and Reputation

SPS Commerce benefits from substantial brand loyalty and a strong reputation forged over years of reliable service in the retail supply chain. This is underscored by their impressive track record of 97 consecutive quarters of revenue growth, demonstrating a deep-seated trust among their clientele.

Newcomers face a considerable hurdle in replicating this established credibility. Building comparable brand recognition and customer loyalty requires significant investment in time, marketing, and consistent performance, making it difficult for new entrants to quickly gain traction.

- Established Trust: SPS Commerce's consistent revenue growth for over 97 consecutive quarters signals a deeply embedded trust within the retail supply chain network.

- High Entry Barrier: New competitors must invest heavily in building a reputation and achieving a similar level of customer confidence, a process that is both time-consuming and resource-intensive.

- Customer Retention: Existing customers are less likely to switch to an unknown provider when SPS Commerce offers a proven and reliable solution.

Regulatory Compliance and Data Security Requirements

The supply chain and Electronic Data Interchange (EDI) sectors are characterized by significant hurdles for new entrants, primarily stemming from stringent regulatory compliance and elevated data security demands. Companies entering this space must possess a deep understanding of and adherence to various industry-specific regulations, which can be intricate and constantly evolving. For example, compliance with data privacy laws like GDPR or CCPA, depending on the geographic reach, necessitates substantial investment in secure data handling and storage infrastructure. The financial burden of establishing and maintaining these compliant systems, coupled with the ongoing need for robust cybersecurity measures to protect sensitive transaction data, acts as a considerable deterrent to new players.

The cost of achieving and sustaining compliance with regulations such as those governing financial transactions or product traceability can be substantial. New entrants must allocate significant capital towards legal counsel, compliance officers, and technology solutions designed to meet these requirements. Furthermore, the high stakes associated with data breaches in the supply chain, which can lead to severe financial penalties and reputational damage, compel businesses to invest heavily in advanced security protocols, encryption, and threat detection systems. In 2024, the average cost of a data breach globally reached $4.45 million, underscoring the financial imperative for robust security from day one.

- Regulatory complexity: Navigating diverse and evolving compliance frameworks requires specialized expertise and ongoing investment.

- High data security investment: Protecting sensitive supply chain data necessitates significant expenditure on advanced cybersecurity measures.

- Cost of entry: The combined expenses of compliance and security create a substantial financial barrier for potential new entrants.

- Reputational risk: Failure to meet security or regulatory standards can result in severe financial penalties and long-term damage to a company's reputation.

The threat of new entrants into the cloud-based supply chain management and EDI market remains low due to several significant barriers. These include the substantial capital investment needed for platform development, the powerful network effects SPS Commerce has cultivated, the inherent technological complexity, and the critical importance of established trust and brand reputation. Furthermore, stringent regulatory compliance and high data security demands add considerable cost and expertise requirements, making it difficult for new players to compete effectively.

| Barrier Type | Description | Impact on New Entrants | Example for SPS Commerce (2024 Data) |

|---|---|---|---|

| Capital Investment | Developing robust cloud infrastructure and software requires millions. | Deters smaller competitors due to high upfront costs. | Millions spent on software, data centers, and compliance. |

| Network Effects | Over 50,000 trading partners create a valuable ecosystem. | New entrants struggle to replicate the existing network's value. | Facilitating over 1 billion transactions annually. |

| Technological Complexity | Requires specialized talent for intricate data flow management and ERP integration. | High learning curve and considerable R&D investment needed. | Seamless management of complex data and automation. |

| Brand Reputation & Trust | 97 consecutive quarters of revenue growth signifies deep customer trust. | Newcomers need significant time and investment to build credibility. | Proven reliability and consistent performance. |

| Regulatory & Security Demands | Compliance with data privacy laws and robust cybersecurity are essential. | Substantial investment in legal, compliance, and security measures required. | Average global data breach cost in 2024 was $4.45 million. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for SPS Commerce leverages data from SEC filings, investor relations reports, and industry-specific market research to understand competitive intensity and strategic positioning.