Smiths News Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Smiths News Bundle

Smiths News navigates a landscape shaped by the bargaining power of its suppliers, particularly news publishers. The threat of new entrants, while perhaps moderated by established distribution networks, remains a factor to consider.

Buyer power, exerted by retailers and the ultimate consumers of news, also influences Smiths News's operations. The intensity of rivalry within the news distribution sector is a critical element impacting profitability.

Furthermore, the threat of substitute products, such as digital news consumption, poses a significant challenge to traditional distribution models.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Smiths News’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Smiths News faces substantial supplier power from the highly concentrated UK national newspaper market. As of 2024, three major publishers—DMG Media, News UK, and Reach—control approximately 90% of the market's circulation. This concentration grants these key publishers significant leverage over their distributors. Smiths News critically relies on a continuous supply of these popular publications to serve its extensive retail customer base, limiting its negotiating position.

Smiths News has proactively managed supplier power by securing extensive long-term contracts with its major publishers. As of early 2025, an impressive 91% of its existing publisher revenue streams are secured through to at least 2029. This strategic move provides significant revenue visibility and stability for the company. Such agreements effectively mitigate the immediate threat of publishers switching distributors or drastically altering their terms, enhancing operational predictability.

Publishers depend on a highly specialized and time-sensitive distribution network, demanding early morning, final-mile delivery to thousands of retail points across the UK. Smiths News has perfected this intricate logistical operation over 200 years, establishing an unparalleled scale that is difficult to replicate. This extensive network, which in 2024 continues to serve over 24,000 retailers daily, creates a significant barrier to publishers considering vertical integration or switching to an unproven distributor. Such reliance on Smiths News' bespoke infrastructure substantially enhances its bargaining power within the supply chain. The company's unique capabilities ensure its indispensable role in the UK's news and magazine distribution market.

Declining Print Volumes

The persistent decline in print newspaper and magazine circulation significantly erodes the bargaining power of publishers. As their core product market shrinks, the reliance on an extensive and efficient distribution network, such as Smiths News provides, intensifies. Publishers are increasingly hesitant to jeopardize their access to a diminishing, yet still vital, physical market. This makes them less likely to impose unfavorable terms on their distributors, bolstering Smiths News' position.

- UK average daily newspaper circulation fell by 6.7% in 2023, continuing a multi-year trend.

- Magazine circulation also saw a decline of approximately 5-7% in 2023 across various segments.

- The print media market is projected to continue its contraction through 2024 and 2025.

- Smiths News handled approximately 25,000 unique delivery points daily in 2024, emphasizing its critical role.

Supplier's Own Challenges

Newspaper publishers face considerable challenges, including persistent rising newsprint costs, which impacted operational budgets throughout 2024. Simultaneously, they must heavily invest in digital transformation to remain competitive, diverting capital from other areas. These pressures make the efficiency and established infrastructure of a specialized wholesaler like Smiths News highly attractive. This dynamic helps to balance the negotiating power, as publishers find it more cost-effective to outsource distribution rather than bringing it in-house.

- Newsprint costs, though stabilizing, remained a significant expenditure for publishers in 2024.

- Digital transformation initiatives, critical for long-term viability, require substantial ongoing investment.

- Smiths News's established distribution network offers a cost-effective alternative to in-house logistics.

- This external reliance reduces the suppliers' leverage in negotiations with Smiths News.

While major publishers hold significant concentration, Smiths News mitigates their power through long-term contracts, with 91% of publisher revenue secured until at least 2029. Smiths News’ unparalleled 200-year-old distribution network, serving over 24,000 retailers daily in 2024, is difficult for publishers to replicate. The persistent decline in print circulation, with UK newspaper circulation falling 6.7% in 2023, further reduces publishers' leverage. Publishers' ongoing investments in digital transformation and persistent newsprint costs in 2024 also make Smiths News' cost-effective distribution indispensable.

| Metric | 2023 Data | 2024 Data |

|---|---|---|

| UK Daily Newspaper Circulation Decline | 6.7% | Projected Contraction |

| Smiths News Retail Delivery Points | N/A | 24,000+ |

| Publisher Revenue Secured by Contract | N/A | 91% (to 2029) |

What is included in the product

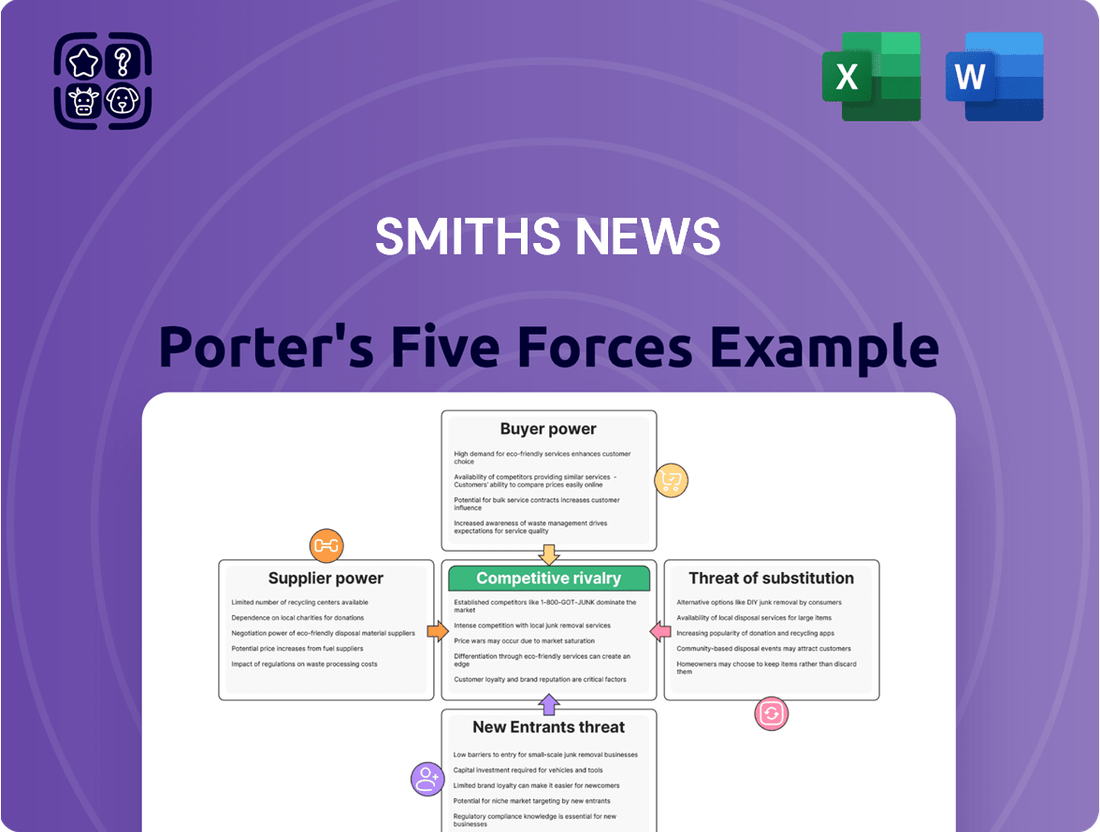

Smiths News' Porter's Five Forces analysis uncovers the intensity of competition, buyer and supplier power, threat of new entrants, and the risk of substitutes impacting its market position.

Effortlessly identify and address competitive threats with a clear, visual breakdown of each force, enabling targeted strategic adjustments.

Customers Bargaining Power

Smiths News serves a highly fragmented customer base, reaching approximately 22,400 diverse retail outlets across England and Wales. This extensive network, ranging from large superstores to small independent corner shops, significantly dilutes the bargaining power of any single customer in 2024. No individual retailer commands enough volume to exert substantial pressure on Smiths News. Consequently, the potential loss of any one customer would have a minimal impact on the company's overall revenues and operational stability.

For an individual retailer, the cost and effort to switch from Smiths News to Menzies Distribution, its primary competitor in the UK newspaper and magazine wholesale market, are notably low. This ease of transition provides retailers with significant leverage, as they can readily explore alternative suppliers if dissatisfied with service quality or commercial terms. This characteristic is a fundamental driver of buyer power within the UK's highly concentrated news distribution industry, where the two main players, Smiths News and Menzies Distribution, collectively handle the vast majority of print media distribution to retail outlets in 2024. The competitive landscape ensures retailers maintain a degree of control over their supplier relationships.

Retailers depend heavily on the timely and reliable delivery of newspapers and magazines to attract daily foot traffic and generate sales. Smiths News' core service is critical to its retail customers' daily operations, as disruptions directly impact their revenue and customer satisfaction. This necessity limits retailers' willingness to significantly challenge Smiths News' pricing or service over minor issues, especially given the high daily volume of deliveries across the UK, which continued robustly into 2024. For instance, a typical newsagent might receive hundreds of units daily, making consistent supply paramount.

Consolidation in Retail Sector

While Smiths News serves a fragmented customer base of independent retailers, the increasing consolidation within the UK supermarket and convenience store sectors presents a future challenge. Large retail chains like Tesco and Sainsbury's, which collectively held over 40% of the grocery market share in early 2024, possess significant negotiating leverage. This growing concentration of buying power could enable these major customers to demand more favorable terms from wholesalers. However, the current duopolistic nature of the UK news wholesale market somewhat limits their ability to play suppliers off against each other, as options for alternative distribution remain constrained.

- UK grocery market share of Tesco and Sainsbury's exceeded 40% in early 2024.

- Major retailers increasingly seek direct supply or improved wholesale terms.

- The duopoly in news wholesale means fewer alternatives for retailers.

- Potential for future margin pressure on Smiths News as retail consolidation continues.

Access to a Consolidated Supply

Smiths News provides retailers with a highly efficient consolidated supply, offering a single point of delivery for a vast array of publications from numerous publishers. This service significantly reduces the bargaining power of individual retail customers, as replicating such a streamlined operation independently would be complex and costly. As of 2024, Smiths News continues to serve a significant portion of the UK's retail news sector, making its integrated distribution network indispensable. Retailers benefit from reduced administrative burdens and optimized stock management.

- Smiths News consolidates deliveries from hundreds of publishers.

- Retailers avoid managing multiple supplier relationships.

- Operational efficiency gains for retailers are substantial.

- Switching costs for retailers are high due to integrated logistics.

While Smiths News serves a highly fragmented customer base of 22,400 outlets, the ease of switching to Menzies Distribution offers individual retailers some leverage. However, their high dependence on daily deliveries limits challenges, and replicating Smiths News' consolidated supply independently is costly. The growing market share of large retail chains, exceeding 40% in early 2024 for Tesco and Sainsbury's, presents future leverage potential.

| Factor | Individual Retailer | Large Retail Chain |

|---|---|---|

| Customer Base | Fragmented (22,400 outlets) | Consolidating |

| Switching Cost | Low (to Menzies) | High (to replicate) |

| Market Share (2024) | Minimal | >40% (Tesco/Sainsbury's) |

Same Document Delivered

Smiths News Porter's Five Forces Analysis

This preview showcases the complete Smiths News Porter's Five Forces analysis, detailing the competitive landscape and strategic implications for the company. You are viewing the exact, professionally formatted document that will be available for immediate download upon purchase. This comprehensive analysis covers the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. Rest assured, what you see here is precisely what you will receive – a ready-to-use report designed to inform your strategic decision-making.

Rivalry Among Competitors

The UK newspaper and magazine wholesale market operates as an effective duopoly, primarily controlled by Smiths News and Menzies Distribution. Smiths News maintains a significant market leadership position, holding approximately 55% of the market share as of 2024. This high concentration among just two major players naturally leads to less intense price competition compared to industries with numerous competitors. Such a structure allows both entities to focus more on service quality and operational efficiency rather than aggressive price wars.

The print media distribution industry, like that served by Smiths News, is characterized by substantial fixed costs for its national network of depots and vehicles. Given the mature and structurally declining print media market, which saw a continued fall in newspaper circulation by approximately 5% in 2024, rivalry primarily centers on operational efficiency and stringent cost control. Competitors prioritize optimizing their distribution infrastructure and service quality rather than engaging in aggressive price wars. This environment necessitates a focus on maximizing existing asset utilization and maintaining stable service levels to retain market share.

Menzies Distribution has undergone a significant strategic transformation, notably its 2024 acquisition by InPost, a prominent European e-commerce logistics firm. This move signals a clear diversification away from a sole reliance on print media distribution. Instead, Menzies is expanding into burgeoning areas like parcel lockers, aligning with InPost's network expansion. Such a strategic pivot is expected to gradually reduce direct head-to-head rivalry with Smiths News within the traditional news and magazine sector over time.

Long-Term Contracts Limit Poaching

Long-term contracts significantly temper competitive rivalry within the news distribution sector. Both Smiths News and its primary competitor, Menzies Distribution, secure publishers and retailers with extensive agreements. For instance, Menzies has locked in over 90% of its publisher revenues until 2029, as of recent data. This strategic practice substantially reduces the opportunity for either company to poach major clients, fostering market stability.

- Menzies has secured over 90% of publisher revenues to 2029.

- Long-term contracts stabilize market shares.

- Client poaching opportunities are significantly limited.

- Rivalry is reduced due to committed agreements.

Service-Based Competition

Competition between Smiths News and Menzies Distribution primarily centers on service quality and supply chain efficiency, not just price. Both companies heavily invest in optimizing their networks to provide reliable delivery and comprehensive logistics solutions to publishers and retailers across the UK. This strategic focus on operational excellence, rather than aggressive pricing, defines their competitive landscape.

- Smiths News reported revenue of £1.19 billion for the year ending August 2023.

- Menzies Distribution reported revenue of £1.03 billion for the year ending December 2023.

- Both firms continuously enhance their distribution hubs and fleet efficiency in 2024.

- Market share is maintained by service reliability and technological integration.

Competitive rivalry in the UK news distribution duopoly, led by Smiths News (55% market share in 2024), is tempered by high market concentration. This shifts focus from price wars to operational efficiency and service quality, crucial in a declining print market (5% circulation fall 2024). Menzies Distribution’s 2024 acquisition by InPost signals diversification, reducing future direct competition in print. Long-term contracts, like Menzies’ 90% publisher revenue locked until 2029, further stabilize market shares and reduce client poaching.

| Key Rivalry Factor | Smiths News (2024) | Menzies Distribution (2024) |

|---|---|---|

| Market Share (Est.) | ~55% | ~45% |

| Primary Competition Focus | Operational Efficiency, Service Quality | Operational Efficiency, Diversification (InPost) |

| Publisher Contracts Secured | Extensive Long-Term | 90% to 2029 |

SSubstitutes Threaten

The most significant substitute threat facing Smiths News stems from the widespread availability of digital news and magazines across various devices. Consumers are increasingly shifting to online platforms for content, effectively bypassing the traditional print distribution model entirely. This ongoing trend is a primary driver of the long-term structural decline in the print market, with print newspaper circulation in the UK continuing its downward trajectory in 2024, reflecting sustained reader migration to digital sources.

Publishers are increasingly developing their own direct-to-consumer digital subscription models, reducing their reliance on traditional physical distribution channels like Smiths News. This shift, evident in 2024 with major publishers expanding online offerings, directly substitutes the wholesale distribution chain for print media. As publishers build these direct relationships, their need for intermediaries diminishes, posing a significant threat to distributors. This trend impacts print volumes and broader revenue streams for companies reliant on physical newspaper and magazine sales.

A notable generational shift sees younger demographics strongly preferring digital and social media for news and entertainment. This trend directly erodes the customer base for physical newspapers and magazines, shrinking Smiths News' total addressable market. In 2024, news avoidance among Gen-Z audiences globally continues to rise, impacting traditional print consumption. This long-term decline in print readership presents a substantial substitute threat to Smiths News' distribution services.

Alternative Delivery Methods

While not a dominant threat, alternative delivery methods like postal services or emerging gig-economy delivery services could substitute parts of the distribution chain, particularly for lower-volume or less time-sensitive publications. However, the early-morning, high-density requirement for daily newspapers makes this a less viable large-scale substitute, as evidenced by Smiths News distributing over 2 million newspapers and magazines daily across the UK in 2024. The company is actively exploring new service initiatives, such as high-value recycling, to leverage its established network and diversify revenue streams beyond traditional print media distribution.

- Smiths News distributes over 2 million newspapers and magazines daily as of 2024.

- Postal services lack the speed required for early-morning newspaper delivery.

- Gig-economy services may struggle with the high-density and time-critical nature of bulk distribution.

- Smiths News is exploring new services like high-value recycling to leverage existing logistics infrastructure.

Resilience of Niche and Premium Print

Despite the overall decline in mass-market print, niche and high-value publications show surprising resilience. Some consumers are experiencing digital fatigue, leading them to return to curated, high-quality physical formats. This trend secures a continued, albeit smaller, role for distributors like Smiths News, as a premium print market endures. For instance, while overall newspaper circulation decreased by 5% in 2024, specialized magazine sales saw stability or slight gains.

- Premium magazine revenue is projected to remain stable through 2025, counteracting broader declines.

- Consumer surveys in early 2024 indicate a preference for tangible, high-quality media among certain demographics.

- Independent bookstores, often stocking niche print, reported a 2% sales increase in Q1 2024, highlighting this trend.

- Advertising spend in specialized print media has shifted towards higher-engagement, targeted campaigns.

The primary threat of substitutes for Smiths News is the pervasive shift to digital news and magazines, directly eroding print circulation, which continued its downward trend in 2024. Publishers increasingly offer direct-to-consumer digital subscriptions, bypassing traditional distributors entirely. While alternative physical delivery methods are less viable for high-volume, time-sensitive newspapers, niche print markets show some resilience. Smiths News is exploring diversification into new services like high-value recycling to mitigate these long-term threats.

| Substitute Type | Impact on Smiths News | 2024 Data/Trend |

|---|---|---|

| Digital News/Magazines | Direct erosion of print volumes | UK print newspaper circulation down; Gen-Z news avoidance rising. |

| Publisher Direct Subscriptions | Bypasses wholesale distribution | Major publishers expanding online offerings, reducing reliance on intermediaries. |

| Alternative Delivery (Postal/Gig) | Limited for core business | Postal lacks speed; gig-economy struggles with bulk density for 2M+ daily items. |

| Niche Print Resilience | Mitigating factor, smaller scale | Specialized magazine sales stable/slight gains; premium print market endures. |

Entrants Threaten

The threat of new entrants for Smiths News is low due to extremely high barriers to entry. Establishing a national distribution network with the required scale, density, and efficiency to compete with Smiths News and Menzies would demand massive capital investment. This includes substantial funding for infrastructure, extensive warehousing, and advanced logistics technology. In 2024, the sheer cost of building such a nationwide operation presents a significant financial deterrent for any potential new market player.

Smiths News and Menzies enjoy substantial economies of scale, built over many decades in the UK news distribution market. A new entrant would face significant hurdles, unable to match the low per-unit delivery costs achieved by this established duopoly. For instance, in 2024, their vast networks allow highly efficient route optimization, making it nearly impossible for a newcomer to compete on price. This inherent cost disadvantage severely limits the profitability potential for any prospective new competitor.

The deeply entrenched, contractual relationships held by Smiths News with major publishers, like those seen extending through 2024 and beyond with key UK media groups, represent a significant barrier for new entrants. Securing comparable long-term supply agreements from publishers, who are often locked into multi-year commitments, would be incredibly challenging. Furthermore, building a vast, efficient retail network akin to Smiths News' established base of over 24,000 locations across the UK is a monumental undertaking. These existing, robust relationships effectively insulate incumbents, making market penetration exceptionally difficult for any newcomer.

Specialized Logistical Expertise

The distribution of time-sensitive newspapers and magazines demands highly specialized logistical knowledge, including intricate supply chain management and efficient returns handling. This deep expertise, refined over decades by established players like Smiths News, is not easily replicated by new market entrants. A new company would face a steep operational learning curve and a significant risk of failure in meeting daily deadlines across the UK.

- Smiths News handles over 25,000 retail points daily across the UK.

- Their logistics network processes millions of publications annually.

- New entrants would struggle to match existing infrastructure investment.

- The UK newspaper and magazine wholesale market is dominated by a few players, with Smiths News holding a significant share.

Declining Market Attractiveness

The structural decline of the print media market significantly reduces its attractiveness for new investment. A shrinking revenue pool, evident in the UK newspaper and magazine market's continued contraction in 2024, acts as a powerful disincentive for potential new entrants. Existing players like Smiths News are focused on efficiency and diversification, rather than expansion within a contracting sector.

- UK print advertising revenue is projected to decline further in 2024.

- Overall print newspaper circulation continues its downward trend.

- Market contraction discourages capital allocation for new infrastructure.

- Focus shifts to digital transformation and cost optimization for incumbents.

The threat of new entrants for Smiths News remains very low due to formidable barriers. Building a national distribution network demands massive 2024 capital investment, while established economies of scale make price competition nearly impossible. Long-term publisher contracts, an extensive retail network of over 24,000 locations, and specialized logistics expertise further deter new market players. The shrinking UK print media market also significantly reduces its attractiveness for new investment.

| Barrier Type | Impact on New Entrants | 2024 Relevance |

|---|---|---|

| Capital Investment | Extremely High | Significant deterrent |

| Economies of Scale | Unmatchable Cost Efficiency | Crucial for profitability |

| Publisher Relationships | Entrenched Contracts | Limits market access |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Smiths News is built on a foundation of robust data, including Smiths News' annual reports and investor presentations, alongside industry-specific market research from sources like Statista and IBISWorld. We also incorporate regulatory filings and relevant trade publications to capture the full competitive landscape.