Schindler Holding Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Schindler Holding Bundle

Unlock the full strategic blueprint behind Schindler Holding's business model. This in-depth Business Model Canvas reveals how the company drives value through its innovative elevator and escalator solutions, captures market share by focusing on urban mobility, and stays ahead in a competitive landscape with strong customer relationships. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a global leader.

Partnerships

Schindler actively partners with a diverse range of construction companies and real estate developers, both globally and at the local level. These collaborations are fundamental to Schindler's strategy, acting as a gateway for securing new installation projects across various building types, including residential, commercial, and public infrastructure. For example, in 2023, Schindler reported a significant portion of its new installation revenue stemmed from these crucial construction sector partnerships.

Schindler strategically partners with technology and digital solution providers to drive innovation in its elevator and escalator business. These collaborations are crucial for developing advanced features and improving operational efficiency.

For instance, Schindler has formed alliances with companies like Huawei for Internet of Things (IoT) components, enabling greater connectivity in its products. Additionally, partnerships with digital engineering firms, such as L&T Technology Services, are instrumental in advancing the development of smart elevators and sophisticated digital solutions.

These technological alliances directly support Schindler's focus on creating smart elevators and implementing predictive maintenance systems, which are key to enhancing service reliability. The integration of digital twin technologies, facilitated by these partnerships, allows for better monitoring and management of assets.

In 2023, Schindler continued to invest in its digital transformation, recognizing that these technology partnerships are fundamental to improving customer experience and maintaining a competitive edge in the evolving market for intelligent building solutions.

Schindler's business model relies heavily on a network of component and raw material suppliers to ensure the consistent production of its elevators and escalators. These partnerships are crucial for maintaining high-quality standards and operational efficiency. For instance, in 2023, Schindler continued to strengthen its supplier relationships, focusing on reliability and innovation to support its global manufacturing footprint.

Efficiently managing these supply chain relationships is paramount. It directly impacts Schindler's ability to meet production schedules, manage costs effectively, and uphold the quality and safety of its final products. This includes fostering collaborative relationships that allow for early integration of new technologies and materials.

Furthermore, Schindler places significant emphasis on sustainable sourcing. Partnerships with suppliers committed to environmental responsibility and ethical practices are increasingly important. This aligns with the company's broader sustainability goals and ensures that the raw materials and components used meet stringent environmental and social criteria, contributing to a more resilient and responsible supply chain.

Service and Modernization Partners

Schindler leverages partnerships with specialized service providers to enhance its existing maintenance and modernization capabilities. These collaborations are crucial for extending its service network into specific geographical areas or for undertaking complex modernization projects that require niche expertise. For instance, in 2024, Schindler continued to integrate local service partners to ensure prompt response times and efficient upkeep of its elevators and escalators portfolio, a key component of its recurring revenue stream.

These strategic alliances are vital for maintaining and upgrading the vast installed base of Schindler equipment, contributing significantly to the company's aftermarket business. By teaming up with entities possessing local market knowledge and specialized technical skills, Schindler can offer a more comprehensive and responsive service offering. This approach not only boosts operational efficiency but also strengthens customer relationships by ensuring the longevity and optimal performance of their vertical transportation systems.

The impact of these partnerships is directly reflected in Schindler's financial performance, particularly within its service segment. In 2024, the company reported continued growth in its service business, with modernization projects playing a substantial role. These partnerships allow Schindler to:

- Expand geographic service coverage

- Access specialized technical expertise for complex upgrades

- Improve response times for maintenance requests

- Enhance the overall customer experience for existing installations

Public Transport Authorities and Infrastructure Developers

Schindler actively collaborates with public transport authorities and infrastructure developers to integrate its mobility solutions into major urban development projects. These partnerships are crucial for securing large-scale contracts for escalators and moving walkways in high-traffic environments like airports, train stations, and metro systems.

A prime example of this strategic alignment is Schindler's involvement in the Surrey Langley SkyTrain project in Canada, where they are supplying elevators and escalators. This contract underscores the vital role these relationships play in advancing modern urban mobility and enhancing passenger flow.

- Strategic Alliances: Schindler leverages partnerships with public transport authorities and infrastructure developers for significant urban mobility projects.

- Key Project: The Surrey Langley SkyTrain project in Canada highlights Schindler's role in delivering elevators and escalators for essential public transit infrastructure.

- Market Access: These collaborations provide Schindler with access to large-scale infrastructure tenders, solidifying its position in the urban mobility sector.

- Growth Driver: Partnerships with entities managing airports, train stations, and metro systems are a key driver for Schindler's business development and revenue generation.

Schindler’s key partnerships extend to technology providers, enabling innovation in smart building solutions. These collaborations are vital for integrating advanced features and improving product efficiency. For instance, partnerships with companies like Huawei for IoT components and L&T Technology Services for digital engineering are crucial for developing smart elevators and predictive maintenance systems.

Schindler also relies on a robust network of component and raw material suppliers, ensuring quality and operational efficiency. These relationships are critical for maintaining production schedules and upholding product standards. Furthermore, partnerships with specialized service providers are essential for expanding its service network and undertaking complex modernization projects, thereby bolstering its aftermarket business.

The company actively engages with public transport authorities and infrastructure developers, securing large-scale contracts for urban mobility projects. The Surrey Langley SkyTrain project in Canada, for example, showcases Schindler's role in supplying critical vertical transportation systems for public transit.

| Partner Type | Focus Area | Example | 2023/2024 Impact |

|---|---|---|---|

| Construction Companies & Real Estate Developers | New Installations | Global & Local Developers | Significant portion of new installation revenue |

| Technology Providers | Innovation & Digitalization | Huawei (IoT), L&T Technology Services (Digital Engineering) | Enhancing smart elevator features and predictive maintenance |

| Component & Raw Material Suppliers | Production & Quality | Various global suppliers | Ensuring consistent production and high-quality standards |

| Specialized Service Providers | Maintenance & Modernization | Local service partners | Expanding service coverage and improving response times |

| Public Transport Authorities & Infrastructure Developers | Urban Mobility Projects | Surrey Langley SkyTrain (Canada) | Securing large-scale contracts for public transit infrastructure |

What is included in the product

Schindler Holding's Business Model Canvas focuses on delivering innovative mobility solutions to a diverse customer base, leveraging a strong global network of sales, service, and manufacturing facilities. Its value proposition centers on reliable, efficient, and technologically advanced elevators and escalators, supported by a comprehensive service and maintenance offering.

The Schindler Holding Business Model Canvas offers a structured approach to identify and address key business challenges, acting as a pain point reliever by providing a visual framework for strategic problem-solving.

It simplifies complex business strategies into a single, actionable document, effectively relieving the pain of lengthy, unorganized strategic planning sessions.

Activities

Schindler's key activities center on the sophisticated design and engineering of its core products: elevators, escalators, and moving walkways. This foundational work drives innovation and ensures the company remains at the forefront of vertical and horizontal transportation solutions.

The company dedicates significant resources to research and development, constantly pushing the boundaries of what's possible. This commitment to R&D is evident in their development of advanced products like the Schindler X8, a high-performance elevator system, and their focus on modular platforms, which enhance adaptability and efficiency in installation.

Safety, efficiency, and the ability to adapt to diverse architectural requirements are paramount in Schindler's design and engineering processes. These principles guide every stage of product development, from conceptualization to final implementation, ensuring reliable performance across a wide range of building types and urban environments.

By prioritizing these advanced design and engineering capabilities, Schindler not only creates cutting-edge products but also builds a strong foundation for future growth and market leadership in the mobility solutions sector.

Schindler's manufacturing and production activities are central to its business, involving the operation of numerous production facilities across the globe. These sites are dedicated to producing elevators and escalators, ensuring high-quality standards are met for these complex mobility solutions. In 2024, Schindler continued to invest in modernizing its production capabilities to enhance efficiency and product innovation.

The company places a strong emphasis on optimizing its supply chain and logistics networks. This is crucial for delivering products to customers worldwide in a timely and cost-effective manner, managing the flow of components and finished goods efficiently. Their global footprint allows for localized production where beneficial, reducing lead times and transportation costs.

Schindler's key activity includes the meticulous installation of its elevators and escalators. This demands highly skilled project management to orchestrate complex operations on construction sites, ensuring deadlines are met and safety standards are paramount. For instance, in 2024, Schindler successfully managed the installation of over 50,000 new elevators and escalators globally, a testament to their project management prowess.

Effective coordination with general contractors and adherence to evolving building regulations are critical. Schindler's teams are adept at navigating these requirements, often working with local authorities to ensure compliance. Their project managers utilize advanced digital tools to track progress and manage resources, minimizing disruptions and optimizing efficiency on site.

Maintenance and Service Operations

Schindler's key activities heavily feature the maintenance and servicing of its vast global installed base. This is a critical revenue generator, with over 1.5 million elevators and escalators under their care worldwide. This ongoing service ensures equipment longevity and operational safety.

These maintenance operations provide a stable, recurring revenue stream, crucial for Schindler's financial health. The company's commitment to service excellence underpins customer loyalty and brand reputation.

- Global Service Network: Schindler operates a widespread network of technicians and service centers to efficiently manage its installed base.

- Preventive Maintenance: A significant focus is placed on preventive maintenance to minimize downtime and ensure optimal performance of elevators and escalators.

- Modernization Services: Beyond routine maintenance, Schindler also offers modernization services to upgrade older equipment, extending its lifespan and incorporating new technologies.

- Digitalization of Services: The company is increasingly leveraging digital tools and data analytics to optimize service delivery and predictive maintenance.

Modernization and Upgrade Services

Schindler's modernization and upgrade services are crucial for extending the lifespan and enhancing the performance of existing elevator and escalator installations. These services focus on improving safety features, boosting energy efficiency, and ensuring compliance with the latest building codes and accessibility standards. For instance, in 2023, Schindler reported a significant portion of its revenue derived from modernization projects, reflecting the strong demand for upgrading older infrastructure.

This strategic activity allows Schindler to tap into a substantial installed base, offering tailored solutions that go beyond simple repairs. By incorporating new technologies, such as advanced control systems and digital connectivity, Schindler can upsell enhanced functionalities and predictive maintenance capabilities. This not only benefits building owners by reducing operational costs and improving user experience but also strengthens Schindler's recurring revenue streams.

- Modernization efforts focus on safety upgrades, energy efficiency improvements, and compliance with current regulations.

- These services extend the operational life of existing Schindler equipment.

- Opportunities exist to integrate new technologies and digital solutions during upgrades.

- Schindler's 2023 financial reports indicate a robust contribution from modernization projects to overall revenue.

Schindler's key activities encompass the comprehensive lifecycle management of its mobility solutions. This includes the initial design and engineering of elevators and escalators, a process driven by innovation to meet diverse architectural needs and safety standards.

Manufacturing and global supply chain optimization are vital, ensuring efficient production and timely delivery of high-quality products. Schindler's commitment to research and development, including advancements like modular platforms, underpins its competitive edge.

Installation and project management form another core activity, requiring skilled execution on construction sites to ensure safety and adherence to regulations. Furthermore, the extensive maintenance and modernization of its installed base, comprising over 1.5 million units, represent a significant ongoing revenue stream.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Design & Engineering | Developing innovative and safe elevator/escalator solutions. | Continued focus on modular platforms and high-performance systems. |

| Manufacturing & Supply Chain | Producing and delivering mobility solutions globally. | Investment in modernizing production facilities for enhanced efficiency. |

| Installation & Project Management | Managing complex on-site installations. | Successfully managed installation of over 50,000 new units globally. |

| Maintenance & Modernization | Servicing and upgrading existing installed base. | Over 1.5 million elevators and escalators under maintenance contracts. |

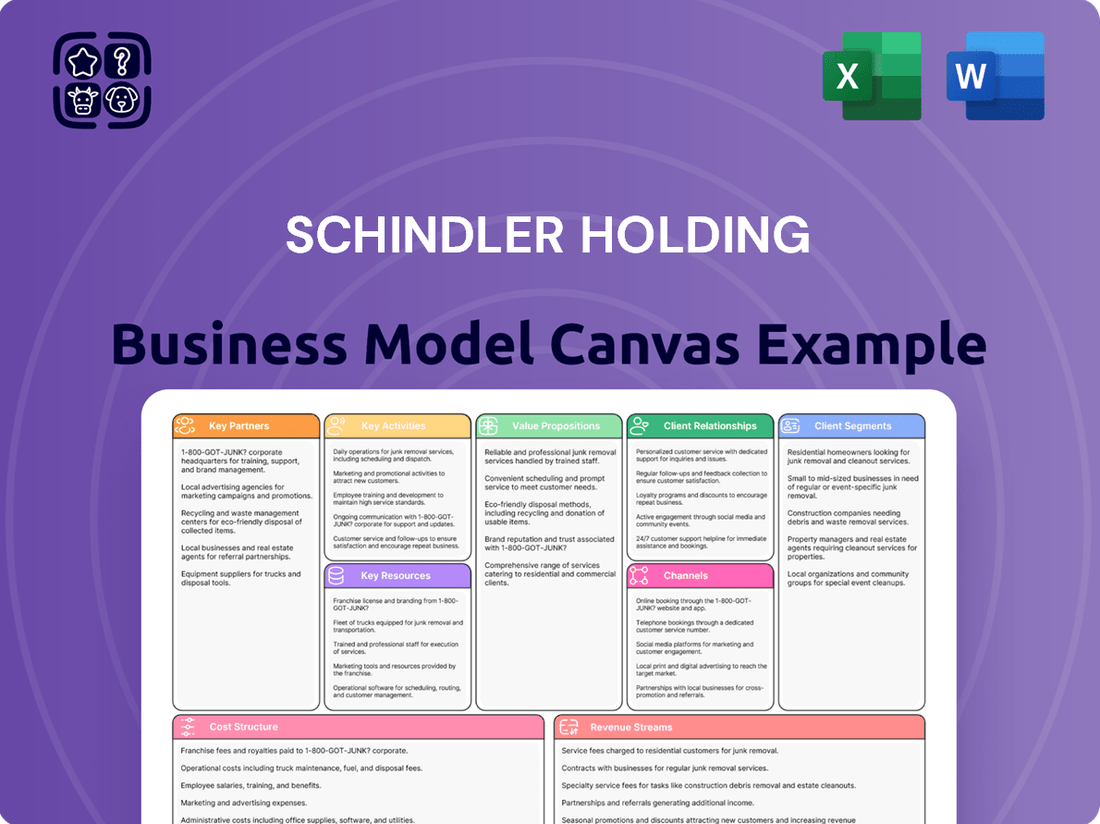

What You See Is What You Get

Business Model Canvas

This preview showcases the actual Schindler Holding Business Model Canvas you'll receive upon purchase. It's a direct representation of the comprehensive document, providing a clear view of its structure and content. Once your order is complete, you'll gain full access to this exact file, ready for immediate use.

Resources

Schindler's extensive global workforce, numbering over 70,000 employees in more than 100 countries, is a cornerstone of its business model. This vast talent pool offers crucial technical, engineering, sales, and service expertise, vital for handling intricate projects and supporting a far-reaching service network.

This diverse, international team is instrumental in Schindler's ability to operate effectively across varied markets, bringing localized knowledge and global best practices to its operations. The sheer scale and geographical spread of its workforce directly enable the company to deliver and maintain its sophisticated elevator and escalator solutions worldwide.

Schindler Holding's proprietary technology and intellectual property are cornerstones of its business model, encompassing a vast portfolio of patents in elevator and escalator design, advanced control systems, and innovative digital solutions. This deep well of IP fuels their ability to create differentiated products and services.

The company's commitment to research and development is substantial, evidenced by its consistent investment in R&D, which allows it to maintain a significant competitive advantage. This ongoing investment is crucial for developing next-generation technologies that address evolving market demands.

Schindler's proprietary technology directly enables the creation of unique offerings such as Schindler PORT, a personalized access control system, and Schindler Ahead, a digital ecosystem for smart buildings. These innovations enhance customer experience and operational efficiency.

In 2024, Schindler continued to focus on digitalizing its portfolio, with advancements in IoT and connectivity for its elevators and escalators. This strategic focus on intellectual property positions them for continued leadership in the smart mobility sector.

Schindler's global manufacturing footprint, comprising 13 production facilities, is a cornerstone of its operational strategy. This network allows for localized production and efficient distribution, crucial for serving a diverse international customer base.

The company's established supply chain network is intricately designed to manage material flow and production volumes across these facilities. This robust infrastructure ensures timely delivery of elevators and escalators to markets worldwide.

In 2023, Schindler reported net sales of CHF 11.6 billion, underscoring the scale and efficiency of its manufacturing and supply chain operations in meeting global demand.

These physical assets are not just production sites but also hubs for innovation and quality control, enabling Schindler to maintain its competitive edge in the elevator and escalator industry.

Installed Base and Maintenance Contracts

Schindler’s extensive global network of installed elevators and escalators is a cornerstone of its business. As of 2024, this vast installed base, numbering in the millions of units, provides a predictable foundation for revenue. These units are often supported by long-term maintenance contracts, which are crucial for recurring income.

These maintenance agreements, typically spanning several years, offer a consistent revenue stream regardless of new installation cycles. This stability is a significant advantage, allowing Schindler to forecast earnings with a higher degree of certainty. For instance, maintenance and modernization services accounted for a substantial portion of Schindler's revenue in recent years, underscoring the value of this segment.

- Installed Base: Millions of elevators and escalators globally, representing a vast and enduring asset.

- Recurring Revenue: Long-term maintenance contracts ensure a steady income stream.

- Foundation for Growth: The installed base is key for future modernization and upgrade opportunities.

- Financial Stability: Maintenance services contribute significantly to overall revenue and profitability.

Strong Brand Reputation and Customer Trust

Schindler's brand reputation, cultivated since its founding in 1874, is a cornerstone of its business model. This deep-seated trust in quality, safety, and reliability is not just a legacy; it's a powerful driver of new contracts and client retention in the highly competitive elevator and escalator market. In 2023, Schindler reported a robust order intake, underscoring the continued market confidence in its offerings.

This strong brand equity translates directly into customer loyalty. Clients often prioritize established players like Schindler for critical infrastructure projects where performance and longevity are paramount. This loyalty reduces customer acquisition costs and provides a stable revenue base. The company's commitment to innovation and service further solidifies this trust, ensuring repeat business and positive word-of-mouth referrals.

Key aspects of Schindler's strong brand reputation include:

- Longevity and Heritage: Over 140 years of experience instills confidence.

- Perceived Quality and Safety: A consistent track record in delivering safe, durable products.

- Customer Trust: High levels of satisfaction leading to repeat business and referrals.

- Reliability: The expectation of dependable performance and excellent after-sales service.

Schindler's key resources are its vast global workforce, proprietary technology and intellectual property, extensive manufacturing and supply chain network, a massive installed base of elevators and escalators, and its strong, long-standing brand reputation.

The company's 70,000+ employees across over 100 countries provide essential technical and service expertise, enabling global operations. Its intellectual property, protected by numerous patents, drives product differentiation and innovation, with significant R&D investments fueling advancements like Schindler PORT and Schindler Ahead.

The 13 global production facilities and sophisticated supply chain ensure efficient, localized manufacturing and timely delivery, supporting net sales of CHF 11.6 billion reported in 2023. Millions of installed units, managed through long-term maintenance contracts, provide a stable, recurring revenue stream, a crucial element for financial predictability.

This installed base is a significant asset, offering ongoing service opportunities and future modernization potential. Schindler's brand, built over 140 years, signifies quality and reliability, fostering customer trust and loyalty, which is vital in securing new contracts and ensuring repeat business.

| Key Resource | Description | Impact/Benefit | 2024/Recent Data Point |

| Global Workforce | Over 70,000 employees worldwide | Technical expertise, localized market knowledge, service delivery | Operations in over 100 countries |

| Proprietary Technology & IP | Patents in design, control systems, digital solutions | Product differentiation, competitive advantage, innovation (e.g., Schindler PORT) | Continued focus on IoT and connectivity in 2024 |

| Manufacturing & Supply Chain | 13 production facilities, global network | Localized production, efficient distribution, cost management | Supported net sales of CHF 11.6 billion in 2023 |

| Installed Base | Millions of elevators and escalators | Recurring revenue from maintenance, future modernization opportunities | Provides a stable foundation for revenue |

| Brand Reputation | Over 140 years of heritage | Customer trust, loyalty, market confidence, competitive advantage | Robust order intake in 2023 reflecting market confidence |

Value Propositions

Schindler's core value proposition revolves around providing exceptionally reliable and safe mobility solutions. This is absolutely critical, especially for environments like high-rise buildings and essential infrastructure where dependability is non-negotiable. Think about the millions of people who rely on elevators and escalators every single day to get where they need to go.

Their dedication to stringent safety standards and solid engineering is the backbone of this reliability. This focus ensures that Schindler's systems consistently perform, minimizing disruptions and prioritizing passenger well-being. For instance, in 2024, Schindler continued its investment in advanced diagnostics and predictive maintenance technologies, aiming to further reduce downtime across its vast installed base.

Schindler enhances building efficiency through advanced transit management systems like Schindler PORT, which intelligently directs passenger flow. This technological integration significantly reduces wait times and optimizes elevator usage, leading to a smoother, more responsive building experience for occupants.

Digital solutions such as Schindler Ahead further boost operational efficiency by providing real-time data and predictive maintenance capabilities. This allows building owners to proactively manage their assets, minimizing downtime and improving overall building performance.

By reducing energy consumption through smarter traffic management and optimized equipment operation, Schindler's solutions contribute to lower operating costs for building owners. For instance, smart destination control systems can reduce energy usage by up to 30% compared to traditional systems.

The improved traffic flow and reduced energy consumption directly translate into a better experience for building occupants and greater value for property owners. In 2024, the focus on smart building technology continues to drive demand for these efficiency-enhancing solutions.

Schindler excels at providing elevator and escalator solutions that seamlessly blend with a building's unique architectural style. Their customizability means clients can select finishes, lighting, and even control interfaces to match specific design briefs, whether for a high-end retail space or a modern corporate headquarters.

In 2024, Schindler reported a significant portion of its new installations focused on technologically advanced and aesthetically integrated systems, reflecting the growing demand for solutions that enhance the passenger experience and building image. This focus on aesthetic integration is a key differentiator, allowing them to capture premium projects where design is paramount.

Long-term Partnership and Comprehensive Service

Schindler's commitment to long-term partnership is evident in its comprehensive service offering, covering the entire lifecycle of its products. This means customers receive support from the initial design and installation phases right through to ongoing maintenance and eventual modernization. This end-to-end approach fosters strong, lasting relationships and ensures equipment operates at peak performance while maximizing its useful life.

For instance, Schindler's extensive service network is a cornerstone of this value proposition. In 2024, Schindler reported a significant portion of its revenue coming from services, highlighting the ongoing engagement with its customer base. This focus on comprehensive, lifecycle support not only benefits the customer by ensuring reliability and efficiency but also provides Schindler with recurring revenue streams, reinforcing the partnership.

- Full Lifecycle Support: Schindler provides services from design and installation to maintenance and modernization.

- Long-Term Relationships: This comprehensive approach builds enduring partnerships with customers.

- Optimized Equipment Performance: Customers benefit from extended lifespan and peak operational efficiency.

- Recurring Revenue: Service contracts contribute significantly to Schindler's revenue, demonstrating customer loyalty and ongoing value.

Innovation and Digital Advancement

Schindler is committed to innovation, embedding digital advancements such as IoT connectivity, predictive maintenance, and digital twin technology across its product lines and services. This commitment ensures customers receive intelligent, future-ready mobility solutions.

These digital integrations translate into tangible benefits for clients, offering superior monitoring capabilities and deeper operational insights. For instance, Schindler's digital solutions aim to reduce downtime and optimize elevator and escalator performance, contributing to greater efficiency.

- Smart Solutions: Integration of IoT for real-time data and remote monitoring.

- Predictive Maintenance: Utilizing data analytics to anticipate and prevent potential equipment failures, minimizing service disruptions.

- Digital Twins: Creating virtual replicas of physical assets for enhanced simulation, analysis, and performance optimization.

- Enhanced Customer Experience: Providing greater transparency and control over building mobility systems.

Schindler offers reliable and safe mobility solutions, crucial for high-traffic environments. Their focus on stringent safety standards and robust engineering ensures consistent performance, minimizing downtime. In 2024, Schindler continued investing in predictive maintenance to enhance dependability.

Schindler provides advanced transit management systems, like Schindler PORT, to improve building efficiency by optimizing passenger flow and reducing wait times. Digital solutions such as Schindler Ahead offer real-time data for proactive asset management, further boosting operational efficiency.

Schindler's solutions contribute to lower operating costs through energy efficiency, with smart destination control systems potentially reducing energy use by up to 30%. This enhances the occupant experience and property owner value, with smart building technology driving demand in 2024.

Customer Relationships

Schindler excels in customer relationships through dedicated sales and account management, fostering strong ties with major clients like property developers and construction firms. This personalized strategy, evident in their focus on understanding specific client requirements, drives tailored solutions and repeat business.

In 2024, Schindler reported a significant portion of its revenue stemming from long-term service contracts, underscoring the success of these dedicated relationship management efforts. These contracts, often secured through close collaboration with key accounts, provide a stable revenue stream and reinforce customer loyalty.

Schindler’s extensive global service network is a cornerstone of its customer relationships, facilitating direct and consistent interaction. This network, comprised of over 20,000 service technicians worldwide, allows for prompt maintenance and support.

These technicians are the face of Schindler to its customers, directly engaging with them for installations, repairs, and routine upkeep. This ongoing, personal contact is vital for fostering trust and ensuring high levels of customer satisfaction, as evidenced by Schindler's consistent customer retention rates. For example, in 2023, Schindler reported that over 90% of its revenue came from existing customers, underscoring the strength of these relationships built through its service presence.

Schindler enhances customer relationships through digital platforms like Schindler Ahead ActionBoard and RemoteMonitoring. These tools provide clients with real-time data and actionable insights into their elevator and escalator equipment's performance, fostering a proactive management approach.

This digital engagement offers unprecedented transparency, allowing customers to track maintenance schedules, equipment health, and service responses directly. For example, Schindler reported a significant increase in the adoption of its digital services in 2024, with over 70% of its new installations being connected, enabling remote monitoring and predictive maintenance.

By empowering customers with this information, Schindler builds stronger partnerships based on trust and efficiency. This shift towards digital interaction supports predictive maintenance, minimizing downtime and ensuring optimal equipment operation, which is crucial for high-traffic buildings.

Technical Support and Consultation

Schindler offers dedicated technical support and consultation, guiding clients from the initial design and planning stages right through to installation and beyond. This expert advisory service empowers customers to make well-informed choices, ensuring their mobility solutions are seamlessly integrated and perform optimally. For instance, in 2024, Schindler reported a significant increase in client engagement with their technical consultation services, particularly for complex urban development projects, highlighting the value placed on this expert guidance.

- Expert Guidance: Schindler's technical teams provide specialized knowledge throughout a project's duration.

- Informed Decision-Making: Consultation helps clients select the most suitable mobility solutions for their specific needs.

- Seamless Integration: Support ensures that Schindler's products work harmoniously within existing infrastructure.

- Post-Installation Support: Ongoing assistance guarantees continued optimal performance and client satisfaction.

Customer Training and Education

Schindler Holding actively invests in customer training and education, focusing on building managers and operators. This initiative ensures they can safely and efficiently run Schindler's elevators and escalators. By empowering users with knowledge, Schindler enhances product utility and fosters lasting customer satisfaction.

This commitment to education directly impacts product lifespan and operational efficiency, translating into fewer service calls and a better overall customer experience. For instance, Schindler's digital platforms often include modules on preventative maintenance, helping clients identify potential issues before they become major problems.

- Enhanced Product Utility: Training ensures users maximize the capabilities of Schindler's advanced elevator and escalator systems.

- Improved Safety: Educated operators contribute to safer building environments by understanding correct operating procedures.

- Long-Term Satisfaction: Empowering customers with knowledge leads to greater confidence and loyalty.

- Reduced Operational Costs: Proper training can lead to more efficient operation and potentially lower energy consumption for building owners.

Schindler cultivates robust customer relationships through a multi-faceted approach, prioritizing personalized service and technical expertise. Their dedicated sales and account management teams foster strong ties with key clients like property developers and construction firms, ensuring tailored solutions and driving repeat business. This commitment is further solidified by a vast global service network, with over 20,000 technicians providing essential on-site support for installations and maintenance.

Digital engagement plays a crucial role, with platforms like Schindler Ahead ActionBoard offering clients real-time data and insights into equipment performance, promoting transparency and proactive management. In 2024, Schindler observed a significant uptick in the adoption of its connected services, with over 70% of new installations enabling remote monitoring, which is vital for predictive maintenance and minimizing downtime.

Customer training and education are also key, empowering building managers and operators with the knowledge to safely and efficiently manage Schindler's systems, thereby enhancing product utility and fostering long-term satisfaction. This focus on customer support and continuous engagement underpins Schindler's strong customer retention, with over 90% of its 2023 revenue generated from existing clientele.

| Customer Relationship Aspect | Description | 2024 Data/Impact |

|---|---|---|

| Dedicated Account Management | Personalized service for key clients | Drives tailored solutions and repeat business |

| Global Service Network | Over 20,000 technicians for on-site support | Ensures prompt maintenance and direct customer interaction |

| Digital Engagement | Schindler Ahead ActionBoard, RemoteMonitoring | Over 70% of new installations connected; enhanced transparency |

| Customer Training & Education | Empowering building managers and operators | Increases product utility, safety, and long-term satisfaction |

| Customer Retention | Focus on existing clientele | Over 90% of 2023 revenue from existing customers |

Channels

Schindler's direct sales force is a cornerstone, primarily targeting large commercial clients, real estate developers, and governmental entities. This approach is crucial for navigating the intricate negotiations and customized solutions often required for major projects.

In 2024, Schindler continued to leverage this direct channel to build robust, long-term relationships. Their sales teams are equipped to present tailored elevator and escalator solutions, directly addressing the specific needs of significant infrastructure and building developments.

The effectiveness of this direct engagement is evident in Schindler's consistent market presence in key sectors. For instance, their involvement in major urban development projects globally underscores the value of having a dedicated, knowledgeable sales force capable of complex deal structuring.

This direct sales model allows for a deep understanding of client requirements and project scope, enabling Schindler to offer integrated solutions from initial design through to long-term maintenance, thereby fostering client loyalty and securing substantial contracts.

Schindler's global branch and service network is a cornerstone of its business model, facilitating direct customer interaction for installation, maintenance, and modernization. This extensive network ensures close proximity to clients, enabling swift and efficient service delivery, a key differentiator in the elevator and escalator industry.

In 2023, Schindler operated approximately 1,000 branches and service centers across more than 140 countries. This vast reach allows for localized support and rapid deployment of technicians, crucial for minimizing downtime and ensuring customer satisfaction.

The network's strength lies in its ability to provide a comprehensive service offering, from initial installation to ongoing maintenance and upgrades. This integrated approach fosters long-term customer relationships and recurring revenue streams.

Schindler's commitment to its service network is evident in its continued investment in digital tools and training for its field personnel, aiming to enhance service quality and response times further. For instance, the company is increasingly leveraging digital platforms to manage service calls and provide remote diagnostics, improving efficiency.

Schindler leverages its corporate website and dedicated investor relations portals as key channels for disseminating information, highlighting its innovative product portfolio, and streamlining customer engagement. These digital platforms serve as the primary interface for stakeholders to access company news, financial reports, and product specifications.

Furthermore, Schindler actively utilizes digital tools and cloud-based services to enhance its customer offerings. For instance, platforms like BuildingMinds provide a robust channel for delivering advanced building management solutions and data analytics, directly engaging customers with value-added services.

Industry Trade Shows and Conferences

Schindler actively participates in key industry trade shows and conferences, like Interlift in Augsburg, Germany, a major event for the elevator and escalator sector. These events are crucial for demonstrating new technologies and solutions, such as their advanced Schindler 3300 AP and 5500 models. This direct engagement helps them connect with building owners, architects, and developers, fostering new business relationships and reinforcing their position as an industry leader.

These gatherings serve as vital channels for market visibility and lead generation. For instance, in 2024, the global elevator and escalator market was projected to reach substantial figures, highlighting the importance of these platforms for capturing market share. Schindler leverages these opportunities to gain insights into emerging trends and competitor activities, ensuring their product development remains aligned with market demands.

- Showcasing Innovation: Demonstrating new products and digital solutions like the Schindler Ahead IoT platform.

- Networking: Connecting with potential clients, partners, and industry influencers to build relationships.

- Brand Visibility: Strengthening brand recognition and reputation within the global construction and real estate markets.

- Market Intelligence: Gathering insights on industry trends, customer needs, and competitive landscape.

Partnership and Distributor Network

While Schindler prioritizes direct customer engagement, its partnership and distributor network plays a crucial role in expanding market reach. This network is particularly important in regions where a direct presence might be less efficient or for specialized product segments. For instance, Schindler's presence in emerging markets often relies on strategic alliances with local entities that possess established distribution channels and market knowledge.

These collaborations allow Schindler to access new customer bases and provide localized support, enhancing its overall market penetration. The company carefully selects partners who align with its quality standards and long-term vision. In 2024, Schindler continued to refine its partner selection process, focusing on those demonstrating strong service capabilities and a commitment to customer satisfaction.

- Geographic Expansion: Partnerships enable Schindler to enter and serve markets where establishing a direct subsidiary is not immediately feasible or cost-effective.

- Niche Market Access: Distributors can specialize in specific product lines or customer segments, effectively reaching niche markets that might be overlooked by direct sales efforts.

- Enhanced Local Support: Local partners often provide crucial on-the-ground technical support, installation, and maintenance services, improving the customer experience.

- Risk Mitigation: Working with established local distributors can help mitigate risks associated with entering new or politically sensitive regions.

Schindler's channels are multifaceted, blending direct sales for major projects with an extensive global service network for ongoing client relationships. Digital platforms and industry events are also key for showcasing innovation and gathering market intelligence.

Partnerships and distributors further extend market reach, particularly in emerging markets or for specialized segments, ensuring localized support and efficient market penetration.

| Channel | Description | 2024 Focus/Example |

| Direct Sales Force | Targets large commercial clients, developers, and government entities for complex projects. | Building long-term relationships through tailored solutions for infrastructure developments. |

| Global Branch & Service Network | Provides installation, maintenance, and modernization services worldwide. | Leveraging digital tools for improved service quality and response times, with approximately 1,000 service centers globally. |

| Digital Platforms (Website, Investor Relations, BuildingMinds) | Information dissemination, customer engagement, and advanced building management solutions. | Enhancing customer offerings with data analytics and cloud-based services. |

| Industry Trade Shows & Conferences (e.g., Interlift) | Showcasing new technologies, networking, and market intelligence gathering. | Demonstrating advanced models and IoT platforms to industry professionals. |

| Partnership & Distributor Network | Expanding market reach and providing localized support, especially in new or niche markets. | Strategic alliances with local entities for enhanced market penetration and service capabilities. |

Customer Segments

Commercial building owners and developers, including those managing office towers, retail centers, hotels, and healthcare facilities, represent a key customer segment. These clients are looking for mobility solutions that are not only high-capacity and energy-efficient but also complement the architectural design of their properties.

A significant driver for this segment is the demand for advanced digital integration, such as smart elevators that can manage traffic flow, optimize energy consumption, and offer personalized user experiences. By 2024, new commercial construction projects globally are expected to reach trillions of dollars, with a substantial portion of this investment focused on creating modern, connected, and sustainable spaces.

Schindler’s ability to provide reliable, aesthetically appealing, and technologically advanced elevators and escalators directly addresses the needs of these discerning customers. For instance, the company's focus on digital services can improve building operational efficiency, a critical factor for owners seeking to maximize rental income and property value.

Schindler is a key partner for residential building developers and management companies, offering them elevator and escalator solutions for a wide range of projects from single-family homes to large condominium complexes. These clients prioritize equipment that ensures the smooth, safe, and efficient daily movement of residents and their belongings.

For these customers, the focus is on long-term reliability and operational cost-effectiveness. Schindler's offerings are designed to minimize downtime and maintenance expenses, which are critical for maintaining resident satisfaction and the overall profitability of residential properties.

In 2024, the residential construction sector continued to see robust activity in many regions, driving demand for new elevator and escalator installations. Schindler’s commitment to innovation, such as advancements in energy efficiency and smart building integration, directly addresses the evolving needs of developers looking to enhance property value and resident experience.

Public transportation authorities, including entities managing airports, train stations, and metro systems, represent a key customer segment for Schindler. These government bodies and agencies prioritize solutions that can withstand extremely high passenger volumes and offer exceptional reliability. For instance, in 2024, major metropolitan transit systems worldwide continue to invest heavily in upgrading aging infrastructure, with a significant portion allocated to passenger movement technologies like escalators and moving walkways to improve passenger flow and experience. Schindler's durable, high-capacity offerings directly address these critical needs for continuous operation and passenger safety in demanding environments.

Existing Building Owners (Modernization Market)

Existing building owners represent a crucial customer segment for modernization services. These owners are typically looking to enhance the safety, energy efficiency, and overall lifespan of their current elevator and escalator systems. For instance, in 2024, the global building modernization market was estimated to be worth billions, driven by a strong demand for retrofitting older structures to meet current standards and performance expectations. This segment often prioritizes solutions that offer a clear return on investment through reduced operational costs and improved tenant satisfaction.

This group is particularly interested in upgrades that can:

- Improve Safety Features: Implementing advanced safety protocols and equipment to meet evolving regulatory requirements and passenger expectations.

- Boost Energy Efficiency: Adopting new technologies that significantly lower power consumption, such as regenerative drives and LED lighting, contributing to lower utility bills and environmental sustainability goals.

- Extend Equipment Lifespan: Investing in comprehensive modernization packages to prevent costly breakdowns and prolong the operational life of existing installations, thereby deferring major capital expenditures.

Institutional and Specialized Facilities

Schindler serves institutional and specialized facilities, a segment characterized by complex and often unique vertical mobility needs. This includes large-scale venues like universities, sports stadiums, and convention centers, where high passenger traffic and specific operational demands are paramount. For example, a major stadium might require rapid evacuation capabilities, while a sprawling university campus needs efficient transport across multiple buildings and levels.

The marine sector also falls under this umbrella, presenting distinct challenges such as extreme environmental conditions and stringent safety regulations. Schindler's approach here involves developing robust, customized solutions that can withstand harsh maritime environments and ensure reliable operation.

These clients typically require a high degree of customization, moving beyond standard elevator and escalator models to integrated mobility systems designed for their specific footprints and usage patterns. Schindler's ability to provide specialized solutions, as evidenced by their work in diverse sectors, highlights their commitment to addressing these niche requirements.

- Universities require efficient movement across large, multi-building campuses.

- Sports Stadiums prioritize rapid passenger flow, especially during peak events and emergencies.

- Convention Centers need flexible mobility solutions to accommodate varying event sizes and layouts.

- Marine Vessels demand highly durable and safe equipment resilient to harsh environmental conditions.

Schindler's customer base is broad, encompassing commercial property owners and developers who prioritize modern, efficient, and aesthetically pleasing mobility solutions for office buildings, retail spaces, and hotels. These clients are increasingly focused on digital integration and sustainability, with global new commercial construction projected to be in the trillions of dollars in 2024.

Residential developers and management companies also form a significant segment, seeking reliable and cost-effective elevators and escalators to ensure resident satisfaction and property value. The residential construction sector in 2024 continued to show strong demand for these essential building components.

Public transportation authorities, managing airports and transit systems, require highly durable, high-capacity equipment for heavy passenger use, with substantial infrastructure investments continuing in 2024 for upgrades. Existing building owners are a key market for modernization services, aiming to improve safety and energy efficiency, with the global building modernization market valued in the billions in 2024.

Schindler also serves institutional and specialized facilities, including universities and stadiums, which have unique, high-volume mobility needs, as well as the marine sector requiring robust, environmentally resilient solutions.

| Customer Segment | Key Needs | 2024 Market Context |

|---|---|---|

| Commercial Building Owners/Developers | High-capacity, energy-efficient, digitally integrated, aesthetically pleasing solutions. | Trillions in global new construction, focus on connected and sustainable spaces. |

| Residential Developers/Management | Long-term reliability, operational cost-effectiveness, smooth and safe resident movement. | Robust activity in residential construction driving demand for installations. |

| Public Transportation Authorities | Exceptional reliability, high passenger volume capacity, durability. | Heavy investment in transit infrastructure upgrades worldwide. |

| Existing Building Owners | Modernization for safety, energy efficiency, extended lifespan, ROI. | Billions in the global building modernization market, retrofitting older structures. |

| Institutional/Specialized Facilities & Marine | Customized, high-volume, robust, and environmentally resilient solutions. | Specific needs for large venues and challenging maritime environments. |

Cost Structure

Schindler Holding dedicates substantial resources to Research and Development, a cornerstone of its business model. In 2024, the company continued its significant investments in R&D, focusing on groundbreaking product innovation, the expansion of digital solutions, and the advancement of sustainable technologies for the future of urban mobility.

These R&D expenditures are not merely operational costs; they are strategic investments essential for Schindler to maintain its competitive edge in a rapidly evolving market. By developing next-generation mobility solutions, the company aims to anticipate and meet future customer needs, driving long-term growth and market leadership.

Schindler Holding's manufacturing and production costs are a significant part of its business model. These expenses encompass everything from the steel and electronics needed for elevators and escalators to the wages of its factory workers worldwide. In 2024, controlling these costs is paramount, as Schindler operates numerous production facilities across the globe, each with its own set of operational expenses.

Efficient supply chain management plays a crucial role in mitigating these costs. By optimizing how raw materials and components are sourced and transported, Schindler can reduce waste and secure better pricing. Furthermore, leveraging economies of scale, meaning producing larger quantities to lower per-unit costs, is a key strategy. For instance, Schindler's extensive global reach allows it to negotiate bulk discounts on essential materials, thereby improving its cost efficiency.

Schindler's installation and project execution costs are primarily variable, directly linked to the number of new elevator and escalator units installed. These expenses encompass the wages for skilled technicians who perform the physical installation, the cost of specialized tools and equipment required for each project, and the overhead associated with project management, including planning, supervision, and quality control. For instance, in 2024, the significant global demand for new building construction and modernization directly influenced these costs, as more projects meant higher labor and equipment expenditures.

Sales, Marketing, and Administrative Costs

Schindler Holding's cost structure heavily relies on substantial investment in sales, marketing, and administrative functions. This includes the expenses associated with maintaining a global sales force, crucial for reaching diverse markets and managing customer relationships worldwide. For instance, in 2023, Schindler reported Selling, General, and Administrative (SG&A) expenses of CHF 3.99 billion, reflecting the significant operational overhead required to support its international presence and market penetration strategies.

These costs are vital for brand building and executing comprehensive marketing campaigns designed to enhance market penetration and customer loyalty. The company's commitment to these areas underscores the importance of a strong brand presence and effective customer engagement in the competitive elevator and escalator industry. Schindler's SG&A expenses as a percentage of net sales in 2023 stood at 26.5%, indicating a substantial portion of revenue is dedicated to these functions.

- Global Sales Force: Maintaining a presence in over 100 countries requires a significant investment in sales personnel and infrastructure.

- Marketing and Brand Building: Expenses for advertising, promotions, and brand development to ensure market recognition and customer preference.

- Administrative Overhead: Costs related to managing operations, human resources, legal, and finance across its international subsidiaries.

- 2023 SG&A: CHF 3.99 billion, representing 26.5% of net sales, highlighting the scale of these operational expenditures.

Service and Maintenance Network Costs

Schindler's global service and maintenance network is a major cost driver, essential for ensuring the reliability and longevity of their elevators and escalators. These expenses are largely recurring, reflecting the ongoing nature of upkeep and customer support across a vast geographical footprint.

The core components of these costs include the salaries and training of a skilled technician workforce, the procurement and management of a comprehensive spare parts inventory, and the complex logistics required to deliver parts and services efficiently worldwide. Investment in digital infrastructure for remote monitoring and predictive maintenance also contributes significantly, enabling proactive issue resolution and reducing downtime.

- Personnel Costs: Technicians represent a substantial investment, encompassing wages, benefits, and continuous training to keep pace with technological advancements.

- Spare Parts Inventory: Maintaining a robust inventory of genuine parts across numerous global locations is critical, requiring significant capital outlay and inventory management expertise.

- Logistics and Transportation: The movement of parts and personnel to diverse sites incurs considerable expenses related to shipping, warehousing, and fleet management.

- Digital Infrastructure: Investments in IoT platforms, data analytics, and remote diagnostic tools are increasingly important for operational efficiency and cost optimization.

For Schindler, these service and maintenance operations are not just a cost center but a crucial element of their value proposition, directly impacting customer satisfaction and retention. In 2023, Schindler reported that its services segment, which includes maintenance, generated approximately CHF 5.7 billion in revenue, highlighting the scale of this operational cost structure.

Schindler's cost structure is dominated by manufacturing and production, encompassing raw materials, components, and labor for its elevators and escalators. These operational expenses are managed through efficient supply chains and economies of scale, crucial for maintaining competitiveness in its global production network.

Significant investment in Research and Development is another key cost area, driving innovation in mobility solutions and digital technologies. Furthermore, costs associated with a global sales force, marketing, and administrative functions are substantial, as evidenced by Schindler's 2023 SG&A expenses of CHF 3.99 billion, representing 26.5% of net sales.

The extensive service and maintenance network also forms a major part of the cost structure, involving personnel, spare parts inventory, logistics, and digital infrastructure for ongoing support and customer retention. The services segment alone generated approximately CHF 5.7 billion in revenue in 2023, underscoring the scale of these operational costs.

| Cost Category | Description | 2023 Impact |

| Manufacturing & Production | Raw materials, components, factory labor | Core operational cost, managed via supply chain efficiency |

| Research & Development | Product innovation, digital solutions, sustainable tech | Strategic investment for competitive edge |

| Sales, Marketing & Admin (SG&A) | Global sales force, marketing campaigns, overhead | CHF 3.99 billion (26.5% of net sales) |

| Service & Maintenance | Technician labor, spare parts, logistics, digital tools | CHF 5.7 billion revenue generated from services |

Revenue Streams

Schindler's new installation sales represent a core revenue driver, stemming from the sale and installation of elevators, escalators, and moving walkways for new building projects. This segment is highly sensitive to global construction trends and overall market demand for new infrastructure.

In 2024, the global construction market experienced varied performance, with some regions showing resilience while others faced headwinds. Schindler’s focus on urban development and infrastructure projects in growing economies continues to fuel this revenue stream.

The company's extensive product portfolio, catering to diverse building types from residential complexes to commercial high-rises, allows it to capture market share across different construction segments. This adaptability is crucial in navigating fluctuating demand.

Schindler's commitment to innovation, including smart and sustainable mobility solutions, further enhances the appeal of its new installations, positioning it favorably against competitors in a dynamic market.

Schindler's maintenance and repair services represent a robust and reliable revenue engine, driven by its extensive installed base of elevators and escalators. These long-term service contracts are the bedrock of the company's recurring income, providing significant stability and predictability to its financial performance.

In 2023, Schindler's service segment, which encompasses maintenance and modernization, continued to be a vital contributor, reflecting the ongoing need for upkeep and upgrades of vertical mobility solutions. This segment's consistent growth underscores the value proposition of its comprehensive service offerings to building owners and operators.

The company's strategy heavily relies on maximizing the lifespan and operational efficiency of its installed units through proactive maintenance and timely repairs. This not only ensures customer satisfaction but also generates a predictable and substantial portion of Schindler's overall revenue, bolstering its cash flow throughout the business cycle.

Schindler generates revenue by offering modernization services for its existing elevator and escalator installations. This involves upgrading older equipment to meet current safety standards, improve energy efficiency, and enhance passenger experience through aesthetic improvements.

These modernization projects represent a significant growth avenue, especially in developed markets where a large installed base of Schindler products exists. For instance, in 2024, the demand for building retrofits and upgrades continued to be strong, driven by regulatory changes and sustainability initiatives.

This stream taps into the lifecycle of their products, ensuring long-term customer relationships and recurring revenue. Schindler's focus on modernizing its installed base allows them to capitalize on the natural aging of equipment and the desire for improved performance and appearance.

Spare Parts Sales

Schindler Holding generates revenue through the sale of spare parts and components, which are crucial for the ongoing repair and maintenance of its installed elevators and escalators. These sales are frequently bundled with service contracts, creating a recurring revenue stream and reinforcing customer loyalty.

This segment of the business is vital for ensuring the continued functionality and extending the lifespan of Schindler's products. For instance, in 2024, the demand for replacement parts remained robust as building owners prioritized maintaining their existing vertical transportation systems rather than investing in entirely new installations amidst fluctuating economic conditions.

- Spare parts sales are integral to Schindler's aftermarket services.

- Revenue from spare parts is often tied to service and maintenance agreements.

- This stream supports the longevity and operational efficiency of installed units.

- In 2024, the market saw consistent demand for essential replacement components.

Digital Services and Solutions

Schindler's digital services represent a burgeoning revenue stream, moving beyond traditional elevator and escalator sales. These advanced solutions, like Schindler Ahead, offer predictive maintenance and operational insights, often structured as recurring subscription services. This shift leverages the installed base to generate ongoing income through value-added digital offerings.

The Schindler PORT platform enhances user experience and building management, while BuildingMinds provides comprehensive building performance monitoring. These digital tools are increasingly bundled or offered as standalone services, contributing to a more diversified and predictable revenue model for the company. For example, as of late 2023, Schindler reported significant growth in its digital services segment, reflecting the market demand for smart building technologies.

- Schindler Ahead: Predictive maintenance and transit management solutions.

- Schindler PORT: Advanced building access and transit management systems.

- BuildingMinds: Platform for building performance monitoring and optimization.

- Revenue Model: Primarily subscription-based and value-added service fees.

Schindler's revenue streams are multifaceted, encompassing new installations, maintenance and repair services, modernization projects, spare parts sales, and increasingly, digital services. This diversified approach ensures resilience and caters to various customer needs throughout the lifecycle of their products.

In 2024, Schindler continued to leverage its global presence, with new installations remaining a key revenue generator, especially in infrastructure-heavy markets. The company's extensive service network underpins its recurring revenue from maintenance and repairs, a segment that demonstrates consistent growth due to the large installed base.

Modernization services are also a significant contributor, driven by the need to upgrade aging equipment and comply with evolving regulations, a trend observed strongly in 2024. The sale of spare parts complements these services, ensuring operational continuity for clients.

Schindler's strategic push into digital services, such as predictive maintenance and smart building solutions, is creating new recurring revenue opportunities and enhancing customer value. This digital transformation is a key focus for future growth.

| Revenue Stream | Description | 2024 Focus/Trend |

|---|---|---|

| New Installations | Sale and installation of elevators and escalators for new constructions. | Driven by global construction activity, particularly in urban development. |

| Maintenance & Repair | Long-term service contracts for upkeep of installed units. | Provides stable, recurring revenue from a large installed base. |

| Modernization | Upgrading older elevators and escalators. | Strong demand in developed markets due to aging infrastructure and regulations. |

| Spare Parts | Sales of components for repairs and maintenance. | Supports aftermarket services and ensures product longevity. |

| Digital Services | Subscription-based solutions like predictive maintenance and smart building tech. | Growing segment, enhancing efficiency and creating new recurring revenue streams. |

Business Model Canvas Data Sources

The Schindler Holding Business Model Canvas is informed by a blend of financial disclosures, internal operational data, and extensive market research. These sources provide a comprehensive view of Schindler's current performance and future opportunities.