Remeha BV PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Remeha BV Bundle

Gain a strategic advantage with our comprehensive PESTLE Analysis of Remeha BV. Uncover how political shifts, economic fluctuations, and technological advancements are shaping the heating solutions market. Understand the social trends and environmental regulations impacting Remeha's operations and future growth. This analysis is your key to informed decision-making and competitive positioning. Download the full version now to unlock actionable intelligence and navigate the external landscape with confidence.

Political factors

European Union directives, notably the revised Energy Performance of Buildings Directive (EPBD) aiming for zero-emission buildings by 2028 and the Renewable Energy Directive (RED) targeting 42.5% renewable energy by 2030, significantly shape Remeha's operational landscape. National governments, such as Germany, which banned new fossil fuel heating systems from 2024, and the UK's Clean Heat Market Mechanism, pushing for 60,000 heat pump installations in 2024-2025, accelerate the shift away from gas boilers. These policies create substantial opportunities for Remeha's renewable heating solutions, like heat pumps, while simultaneously challenging its traditional fossil fuel boiler market. The UK's Boiler Upgrade Scheme, offering grants up to 7,500 GBP for heat pumps in 2024, further incentivizes this transition.

Government subsidies are pivotal, with programs like Germany's Federal Funding for Efficient Buildings (BEG) offering up to 40% for heat pump installations in 2024. This financial support significantly boosts demand for Remeha's heat pumps and hybrid solutions across European markets. The availability and scale of these incentives directly influence sales and revenue streams. However, market uncertainty looms with the 2025 prohibition of subsidies for fossil fuel-only boilers, shifting focus entirely to sustainable alternatives and impacting consumer choices.

Ongoing global political instability significantly impacts energy prices and supply chain stability, directly affecting manufacturing costs for companies like Remeha and increasing consumer energy bills. This environment, particularly evident with 2024 oil price volatility, accelerates the push towards energy independence and boosts the appeal of locally sourced renewable heating solutions. Governments are increasingly investing in sustainable infrastructure, with EU countries targeting significant renewable energy expansion by 2025. Remeha's strategy must account for these risks by diversifying its supply chain and focusing on highly energy-efficient products, aligning with the growing demand for sustainable alternatives.

Building Regulations and Codes

Stricter building codes across Europe are mandating higher energy efficiency standards for new constructions and renovations. Regulations, like the anticipated EU Energy Performance of Buildings Directive (EPBD) revisions, will increasingly phase out fossil fuel heating systems from 2025 in new buildings, directly benefiting Remeha's advanced heat pump and renewable technology portfolio. For instance, Germany aims for 65% renewable energy in new heating systems from 2024. Remeha must continuously innovate to ensure its products meet or exceed these evolving environmental and efficiency benchmarks, adapting to national variations.

- EPBD revisions push for zero-emission buildings by 2030, impacting heating system choices.

- Netherlands targets 100% emission-free heating for new builds by 2026.

- Heat pump sales surged by 38% in Europe in 2023, reflecting regulatory impact.

- Remeha's product development must align with 2025-2030 regulatory timelines.

Trade Policies and Tariffs

Remeha, operating in over 80 countries, faces direct exposure to shifting international trade policies and tariffs. Geopolitical events, like the ongoing US-China trade tensions impacting global supply chains through late 2024, can significantly alter raw material costs and market access. For instance, increased tariffs on steel or components, which saw fluctuations of over 15% in certain regions during early 2025, directly affect production expenses.

A stable trade environment is vital for Remeha to maintain competitive pricing and a resilient supply chain, especially given the EU's 2024 trade agreements and their influence on import duties for specific manufacturing parts.

- Global trade uncertainty, fueled by geopolitical shifts, continues to impact supply chain stability for multinational companies like Remeha through 2025.

- Potential new tariffs on key components could raise production costs by an estimated 5-10% in certain markets by late 2024.

- Navigating diverse regional trade blocs and their evolving regulations, such as the EU's 2024 green trade initiatives, is crucial for market access.

- Maintaining a diversified supplier base helps mitigate risks from localized trade disruptions, a key strategy for 2025 resilience.

European Union directives and national policies, like Germany's 2024 fossil fuel heating ban and the UK's £7,500 heat pump grants, are accelerating the shift to renewable heating. Government subsidies, such as Germany's 40% heat pump grants in 2024, significantly boost demand, while 2025 subsidy prohibitions for fossil fuel boilers reshape the market. Stricter building codes, including the Netherlands' 2026 target for emission-free new builds, mandate higher energy efficiency. Global trade uncertainties, with potential 5-10% cost rises from tariffs by late 2024, impact supply chains.

| Policy Area | Key Development (2024/2025) | Impact on Remeha |

|---|---|---|

| EU/National Directives | EPBD aims for zero-emission buildings by 2028. Germany banned new fossil fuel heating from 2024. | Drives demand for heat pumps; challenges traditional boiler market. |

| Subsidies | Germany offers up to 40% for heat pumps in 2024. UK Boiler Upgrade Scheme: £7,500 grants in 2024. | Boosts sales of renewable solutions; shifts consumer focus. |

| Trade Policies | Potential 5-10% rise in production costs due to tariffs by late 2024. | Affects raw material costs and supply chain stability. |

What is included in the product

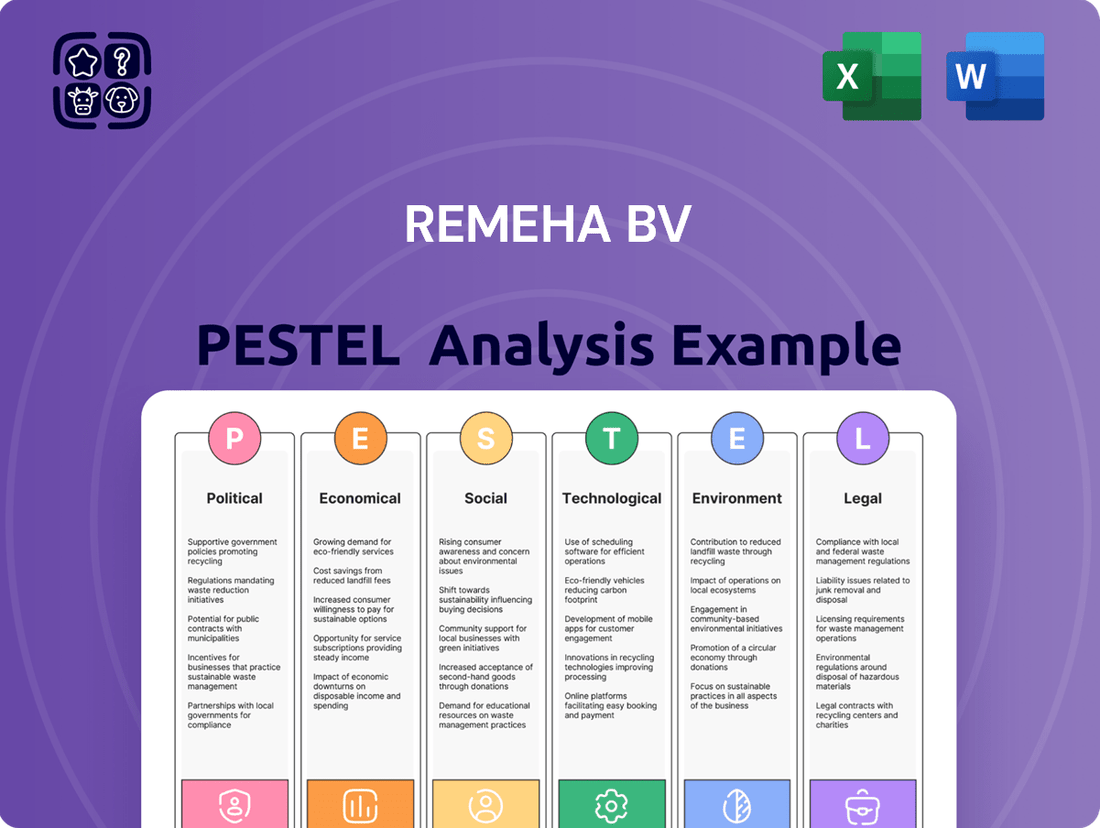

This PESTLE analysis of Remeha BV thoroughly examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company's operations and strategic decisions.

It offers a comprehensive overview of the external landscape, highlighting key trends and their potential impact on Remeha BV's market position and future growth.

A clear, actionable overview of Remeha BV's external environment, enabling proactive strategies to mitigate risks and capitalize on opportunities.

Provides a structured framework to identify and address key external factors impacting Remeha BV, thereby reducing uncertainty and improving strategic decision-making.

Economic factors

Fluctuating energy prices significantly shape consumer choices, driving demand for more energy-efficient heating solutions to reduce utility bills. For instance, European household energy costs, while stabilizing slightly in early 2025, remain elevated compared to pre-2022 levels, reinforcing the long-term shift towards efficiency. This environment enhances the appeal of Remeha's high-efficiency condensing boilers and renewable systems like heat pumps, which are projected to see continued growth in the EU, with installations potentially reaching 3.5 million units in 2024-2025. However, persistent economic uncertainty could also lead some consumers to postpone large capital expenditures, such as upgrading an entire heating system, impacting immediate sales despite the underlying efficiency trend.

The overall economic health of key European markets directly impacts consumer spending and investment in home and commercial building upgrades for Remeha BV. Economic slowdowns, like the projected modest Eurozone GDP growth of around 0.8% for 2024, coupled with persistent inflation, still elevated at approximately 2.5% in early 2025, and higher interest rates, such as the ECB's main refinancing operations rate remaining above pre-2022 levels, can lead consumers to prioritize repairing existing HVAC systems over investing in new units, affecting sales. Conversely, a strong economy and higher consumer confidence, potentially recovering into late 2025, can accelerate the adoption of new, more sustainable heating technologies like heat pumps, which saw significant growth in 2023 despite economic headwinds.

Remeha's sales are directly linked to the vitality of the construction and renovation sectors. New residential and commercial construction, particularly projects emphasizing green building standards, are driving significant demand for their heating solutions, with European green building market growth projected at 10-12% annually through 2025. The retrofit market, focused on upgrading existing buildings to meet stringent 2024-2025 energy efficiency directives, represents a substantial growth area, as approximately 75% of the EU building stock is energy inefficient.

Supply Chain Costs and Disruptions

Global supply chain volatility, a persistent challenge through 2024, continues to inflate raw material and component costs for manufacturers like Remeha, directly impacting their manufacturing expenses and eroding profit margins. Geopolitical tensions and logistical bottlenecks, such as those seen with shipping container availability, can cause significant delays and product shortages, disrupting Remeha's delivery schedules and market availability. Strategic sourcing, emphasizing diversified supplier networks and robust inventory management, is crucial to mitigate these risks and maintain operational stability in the face of ongoing global economic shifts. For instance, the average cost of international freight in early 2025 remains elevated compared to pre-2020 levels, influencing overall production expenditures.

- Global freight costs in Q1 2025 remain up to 40% higher than 2019 averages for key routes, increasing import expenses.

- Lead times for certain electronic components and specialized metals can extend by several months, impacting production timelines.

- Energy price fluctuations, particularly for natural gas, directly influence manufacturing and transportation costs for Remeha's European operations.

- Companies are allocating increased budgets, averaging 15-20% more in 2024-2025, towards supply chain resilience initiatives like dual-sourcing.

Interest Rates and Financing

Current interest rates significantly influence client investment in heating systems. The European Central Bank's deposit facility rate, at 4.00% as of June 2024, impacts the cost of borrowing for both commercial and residential customers. Higher financing costs can slow down purchasing decisions, especially for more expensive renewable energy solutions like heat pumps. The availability of government-backed schemes and competitive loan products becomes crucial for market expansion.

- ECB's deposit facility rate was 4.00% in June 2024, influencing borrowing costs.

- Higher rates impact larger investments like renewable heat pumps, which average €10,000-€20,000.

- Affordable financing is key as 2025 projections suggest gradual rate adjustments.

Economic factors significantly influence Remeha's market, with elevated energy prices and stringent efficiency directives driving demand for advanced heating solutions. However, modest Eurozone GDP growth forecast for 2024 (0.8%) coupled with persistent inflation (2.5% in early 2025) and higher interest rates (ECB 4.00% June 2024) can constrain consumer spending. Global supply chain volatility, with Q1 2025 freight costs up to 40% higher than 2019, continues to inflate raw material and component costs, impacting profit margins.

| Economic Factor | 2024/2025 Data Point | Impact on Remeha BV |

|---|---|---|

| Eurozone GDP Growth | ~0.8% (2024 projection) | Slows consumer investment in new systems. |

| EU Inflation Rate | ~2.5% (early 2025) | Erodes purchasing power, higher input costs. |

| ECB Deposit Facility Rate | 4.00% (June 2024) | Increases borrowing costs for customers. |

| Green Building Market Growth | 10-12% annually (through 2025) | Drives demand for energy-efficient solutions. |

| Global Freight Costs | Up to 40% higher than 2019 (Q1 2025) | Increases supply chain and production expenses. |

Same Document Delivered

Remeha BV PESTLE Analysis

The Remeha BV PESTLE analysis previewed here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Remeha BV. It provides crucial insights for strategic planning and decision-making.

Understand the external forces shaping Remeha BV's market landscape with this detailed report.

The content and structure shown in the preview is the same document you’ll download after payment, offering a complete and actionable overview.

Sociological factors

Increasing environmental awareness significantly boosts demand for sustainable heating. Consumers are actively seeking eco-friendly solutions, with surveys indicating that over 70% of European consumers prioritize sustainability in purchasing decisions by early 2025. This societal shift directly benefits Remeha, as its focus on high-efficiency heat pumps and hybrid systems aligns with reducing carbon footprints. Such alignment enhances Remeha's brand reputation and strengthens its market position, capitalizing on the growing preference for renewable energy technologies.

Post-pandemic, there is a significantly heightened awareness regarding indoor air quality and overall home comfort. This trend fuels robust demand for advanced ventilation and climate control systems, with market projections indicating continued growth through 2025. Consumers are increasingly willing to invest in healthier living environments, recognizing IAQ as a core component of well-being. This creates a clear opportunity for Remeha to integrate sophisticated IAQ features into its heating and cooling solutions, aligning with this evolving consumer priority.

Demographic shifts, notably Europe's aging population, drive demand for user-friendly heating. By 2025, over 20% of the EU population will be 65 or older, prioritizing reliable, low-maintenance systems. Increasing urbanization, with 75% of Europeans living in urban areas, favors compact and efficient solutions. Remeha’s offerings align with these trends, providing quiet and space-saving options for densely populated environments.

Rise of Smart Homes and Connectivity

The increasing adoption of smart home technology significantly influences consumer demand for integrated HVAC solutions. By 2025, the global smart home market is projected to reach approximately $138 billion, driving expectations for connected heating systems that offer remote control and seamless integration with other devices. Consumers prioritize convenience, personalized climate control, and data-driven insights to optimize energy usage, with over 60% of new HVAC installations in developed markets featuring smart thermostat compatibility by late 2024. Remeha's ongoing investment in smart thermostats and IoT-enabled systems directly addresses these evolving consumer preferences, ensuring their offerings align with the future of home connectivity.

- Global smart home market nearing $138 billion by 2025.

- Over 60% of new HVAC installations in developed markets are smart thermostat compatible by late 2024.

- Remeha focuses on IoT-enabled systems for energy optimization.

Workforce Skills Gap

The shift towards advanced renewable heating technologies, particularly heat pumps, creates a significant demand for a highly skilled workforce in installation and maintenance. A shortage of qualified technicians, estimated at over 300,000 across the EU by 2025 for heat pumps alone, could impede the widespread adoption of these solutions. Remeha and the broader HVAC industry must proactively invest in comprehensive training and development programs to bridge this critical skills gap. This strategic investment ensures future growth and supports energy transition goals.

- Heat pump installer shortage: EU faces a deficit of over 300,000 qualified technicians by 2025.

- Training needs: Industry organizations project training approximately 1 million new installers across Europe by 2030.

- Remeha's role: Expanding technical academies and partnerships to upskill existing and new professionals.

Growing environmental consciousness leads over 70% of European consumers by early 2025 to prioritize sustainable heating, boosting demand for Remeha's eco-friendly solutions. Post-pandemic, heightened indoor air quality awareness drives investment in advanced climate systems, while an aging EU population (over 20% by 2025) favors user-friendly options. The smart home market, nearing $138 billion by 2025, also shapes demand for integrated, IoT-enabled HVAC systems, with 60% of new installations smart-compatible by late 2024. Addressing the EU's 300,000+ heat pump installer deficit by 2025 is crucial for market growth.

| Sociological Factor | Key Trend/Metric | 2024/2025 Data |

|---|---|---|

| Environmental Awareness | EU Consumer Sustainability Priority | >70% by early 2025 |

| Demographic Shifts | EU Population Aged 65+ | >20% by 2025 |

| Technology Adoption | Global Smart Home Market | ~$138 Billion by 2025 |

| Workforce Development | EU Heat Pump Installer Shortage | >300,000 by 2025 |

Technological factors

Continuous innovation is making heat pumps significantly more efficient and cost-effective, particularly for colder climates where performance has historically been a challenge. Modern units are achieving higher Coefficients of Performance (COP), with some air-source models demonstrating COPs exceeding 4.0 in optimal conditions by early 2025. The development of systems utilizing low Global Warming Potential (GWP) refrigerants like R290 (propane), with a GWP of 3, is critical given the revised EU F-Gas Regulation aiming for an 80% reduction in HFC emissions by 2030. Remeha must remain at the forefront of these advancements to maintain its competitive edge in a rapidly expanding market, projected to see over 3.5 million units sold in Europe during 2024.

The integration of Artificial Intelligence and the Internet of Things is transforming HVAC systems into smart, predictive solutions for Remeha BV. These technologies enable predictive maintenance, remote diagnostics, and learning algorithms that optimize energy consumption based on user behavior and external factors. This shift from reactive to proactive maintenance is crucial as the global smart HVAC market is projected to reach $30.5 billion by 2025. AI-driven systems can reduce energy consumption by up to 30%, significantly saving consumers money and improving system reliability.

The energy transition is accelerating research into hydrogen as a clean heating fuel, with projections indicating a significant increase in hydrogen-ready boiler installations by 2030. Remeha is proactively developing and testing hydrogen-ready boilers, ensuring its products can operate on up to 100% hydrogen. This strategic focus positions Remeha as a crucial innovator in the emerging hydrogen heating market, aligning with European Union targets for hydrogen infrastructure development by 2025. For instance, pilot projects in the Netherlands and UK are already deploying initial units, showcasing early market readiness.

Rise of HVAC-as-a-Service (HVACaaS)

The emergence of HVAC-as-a-Service (HVACaaS) represents a significant technological shift for Remeha, offering new revenue streams. This model allows customers to subscribe to heating and cooling, eliminating high upfront equipment costs, which is particularly appealing as energy efficiency upgrades become more prevalent. Forecasts indicate the global HVACaaS market could reach $1.9 billion by 2025, driven by demand for predictable costs and integrated maintenance solutions. Remeha can leverage this trend to provide comprehensive service packages, ensuring long-term customer engagement and stable income.

- HVACaaS mitigates upfront capital expenditure for consumers.

- It generates recurring revenue and strengthens customer relationships for providers.

- The global HVACaaS market is projected to expand significantly, reaching an estimated $1.9 billion by 2025.

- Service contracts often include predictive maintenance and system optimization, enhancing efficiency.

Prefabrication and Modular Systems

The growing trend towards prefabrication and modular design in HVAC components significantly impacts Remeha. This approach streamlines installation, potentially reducing on-site labor by up to 30% and improving quality control for projects in 2024-2025. Adopting such manufacturing principles can lead to increased efficiency and substantial cost savings, enhancing Remeha's competitive edge. For instance, modular boiler rooms can cut project timelines by weeks.

- By 2025, the global modular construction market is projected to reach over €100 billion.

- Prefabrication can reduce construction waste by 50% compared to traditional methods.

- Efficiency gains from modular systems can lower installation costs by 15-20%.

- Improved quality control in factory settings minimizes on-site rework.

Technological advancements are rapidly transforming the HVAC sector, impacting Remeha's strategy. Key trends include the rise of highly efficient heat pumps using low GWP refrigerants and the integration of AI/IoT for smart, predictive solutions. The shift towards hydrogen-ready boilers and HVAC-as-a-Service models, alongside increased prefabrication, are reshaping product development and market approaches.

| Technological Trend | Impact on Remeha | 2024/2025 Market Data |

|---|---|---|

| High-Efficiency Heat Pumps | Enhances product competitiveness and sustainability. | European sales projected over 3.5 million units in 2024. |

| AI & IoT Integration | Enables predictive maintenance and energy optimization. | Global smart HVAC market projected to reach $30.5 billion by 2025. |

| Hydrogen-Ready Boilers | Positions Remeha for future clean energy markets. | Pilot projects deploying units in NL/UK by 2025. |

| HVAC-as-a-Service (HVACaaS) | Creates new recurring revenue streams and customer engagement. | Global HVACaaS market projected to reach $1.9 billion by 2025. |

| Prefabrication & Modular Design | Reduces installation time and improves quality control. | Modular construction market projected over €100 billion by 2025. |

Legal factors

Governments across Europe are significantly tightening energy efficiency standards for heating and cooling equipment. The EU's Energy Efficiency Directive (EED), updated for 2024-2025, mandates a 1.5% annual energy consumption reduction, impacting all of Remeha's product lines. Ecodesign regulations further set minimum performance requirements, with new tiers for heat pumps and boilers becoming effective through 2025. Compliance is mandatory, pushing Remeha to continuously innovate and invest in high-efficiency product development, ensuring their portfolio meets or exceeds these rigorous legal benchmarks.

The EU F-Gas Regulation significantly impacts Remeha, mandating a phase-down of high Global Warming Potential HFCs. Starting in 2025, new heat pump and air conditioning equipment must use lower-GWP refrigerants, directly affecting Remeha's product lines. This necessitates a strategic transition to compliant alternatives like R-32 or R-454B. The regulation aims to reduce EU F-gas emissions by two-thirds by 2030 compared to 2014 levels, compelling manufacturers like Remeha to innovate for sustainability.

The EU Data Act, effective September 2025, significantly impacts Remeha BV by governing data access and sharing for its smart, connected HVAC systems. This legislation will dictate how Remeha and third-party service providers utilize data generated by these devices, potentially affecting service models and data monetization. Concurrently, ensuring robust cybersecurity for these connected products is a paramount legal and reputational requirement. Companies face increasing scrutiny; for instance, the average cost of a data breach globally is projected to reach over $4.5 million by 2025, underscoring the financial and brand risks of non-compliance.

Clean Heat Market Mechanism (CHMM)

The UK's Clean Heat Market Mechanism (CHMM), effective from 2025, creates significant legal obligations for boiler manufacturers like Remeha. This national legislation mandates that manufacturers sell a specific proportion of heat pumps relative to their fossil fuel boiler sales. This directly incentivizes Remeha to increase its focus on the heat pump market in the UK, adapting its product strategy. Manufacturers face fines, potentially £3,000 for each unfulfilled quota, emphasizing compliance.

- UK CHMM starts in 2025, requiring 4% of sales as heat pumps initially, rising to 6% in 2026.

- Remeha must align UK sales strategies to meet these quotas, impacting product development.

Consumer Protection Laws

Remeha must strictly adhere to comprehensive consumer protection laws across all markets, including the EU Consumer Rights Directive 2011/83/EU, which remains a core framework for 2024-2025, ensuring product safety and fair warranty terms. This also encompasses regulations on transparent pricing and ethical marketing practices, vital for maintaining customer trust and avoiding penalties. Non-compliance could lead to significant fines, potentially impacting profitability, especially with increased regulatory scrutiny on sustainable product claims.

- EU regulators are intensifying efforts against greenwashing, with new directives expected to be fully implemented by late 2024, requiring verifiable environmental claims.

- Product safety standards, like the EU's Ecodesign Directive for heating products, are continuously updated, with 2025 targets pushing for higher energy efficiency.

- Consumer complaints regarding faulty products or misleading information can lead to substantial reputational damage and legal costs.

Remeha navigates a complex legal landscape, with EU energy efficiency and F-Gas regulations tightening through 2025, demanding product innovation and refrigerant transitions. The EU Data Act, effective September 2025, governs smart HVAC data sharing, alongside increasing cybersecurity scrutiny. Concurrently, the UK's Clean Heat Market Mechanism (2025) mandates heat pump sales quotas for boiler manufacturers. Strict consumer protection laws and intensified greenwashing scrutiny further necessitate transparent and compliant operations.

| Legal Area | Key Regulation (2024-2025) | Impact on Remeha |

|---|---|---|

| Energy Efficiency | EU EED / Ecodesign Directive | Mandates 1.5% annual energy reduction, new tiers for heat pumps by 2025. |

| Refrigerants | EU F-Gas Regulation | 2025 phase-down of high-GWP HFCs, requiring R-32/R-454B transition. |

| Data & UK Market | EU Data Act (Sept 2025) / UK CHMM (2025) | Governs smart HVAC data; UK requires 4% heat pump sales initially. |

Environmental factors

Ambitious climate change targets, like the EU's goal for net-zero emissions by 2050, are a primary environmental driver for Remeha. This creates a massive market opportunity for sustainable heating solutions, with the EU aiming for 60 million heat pumps installed by 2030 under the REPowerEU plan. Remeha's heat pumps and hydrogen-ready boilers are crucial for decarbonizing the building sector, which accounts for approximately 36% of EU CO2 emissions. The urgency of the climate crisis accelerates the phase-out of fossil fuel-based heating systems, pushing demand for eco-friendly alternatives.

The shift towards a circular economy is increasingly vital, moving beyond the traditional take-make-dispose model. For Remeha, this involves a commitment to designing heating products for enhanced longevity, easier reparability, and full recyclability. By 2025, Remeha aims for over 85% of its new product designs to incorporate circular principles, focusing on material recovery. This strategy also includes implementing robust take-back programs for end-of-life products and increasing the use of certified recycled materials in manufacturing processes, aligning with EU Green Deal objectives for resource efficiency.

Beyond carbon emissions, environmental regulations increasingly limit other pollutants like nitrogen oxides (NOx) from heating systems. The EU Ecodesign Directive, for instance, sets strict NOx emission limits, often capping new gas boilers at 56 mg/kWh, pushing manufacturers like Remeha to innovate. This drives the development of ultra-low NOx condensing boilers and hydrogen-ready solutions, which Remeha is actively pursuing with models available in 2024. Furthermore, a growing focus on improved indoor air quality presents an opportunity for advanced ventilation and filtration systems to complement heating solutions.

Phasing Out of Harmful Refrigerants

Environmental regulations are increasingly mandating the phase-out of refrigerants with high Global Warming Potential (GWP), significantly impacting Remeha’s product strategy. The revised EU F-Gas Regulation, effective from early 2024, accelerates the reduction of HFCs, pushing for alternatives with GWP below 150 for many applications. This necessitates Remeha to continually adapt its air conditioning and heat pump portfolio to utilize lower GWP refrigerants like R-290 (propane) or R-32. This shift is a primary driver for product design and extensive research and development investments.

- EU F-Gas Regulation targets a 98% reduction in HFC quotas by 2050 compared to 2015 levels.

- R-410A, a common refrigerant, has a GWP of 2088, while alternatives like R-290 (propane) have a GWP of 3.

- Remeha’s 2025 product roadmap emphasizes systems using natural refrigerants to comply with upcoming bans on high GWP fluids.

- Market demand for heat pumps using low GWP refrigerants is projected to grow over 25% annually through 2025 in Europe.

Waste Management and Resource Efficiency

Remeha, as a key manufacturer within the BDR Thermea Group, faces significant pressure to minimize operational waste and reduce water consumption in its production processes. Improving overall resource efficiency is crucial, aligning with the 2025 HVAC trends emphasizing sustainable manufacturing. Adopting such practices not only lessens environmental impact but also drives cost savings, enhancing the company’s corporate social responsibility profile. The BDR Thermea Group's 2024 reflections highlight a transformative period, underscoring ongoing efforts in this area.

- Resource efficiency is critical for manufacturers like Remeha to meet evolving 2025 sustainability standards.

- Minimizing operational waste directly contributes to cost savings and improved environmental performance.

- Water consumption reduction in manufacturing processes is a key focus for responsible industrial operations.

- Sustainable practices enhance corporate social responsibility, appealing to environmentally conscious markets.

Environmental factors critically shape Remeha's strategy, driven by ambitious EU climate targets pushing sustainable heating solutions like heat pumps and hydrogen-ready boilers. Stricter F-Gas regulations, effective early 2024, necessitate a rapid shift to low GWP refrigerants in products. The company also focuses on circular economy principles, aiming for over 85% circular new product designs by 2025, alongside reducing operational waste and NOx emissions.

| Factor | 2024/2025 Impact | Remeha Goal |

|---|---|---|

| EU Heat Pumps | 60M by 2030 | Market growth |

| F-Gas Reg | HFC phase-out | Low GWP shift |

| Circular Design | >85% new products | By 2025 |

PESTLE Analysis Data Sources

Our Remeha BV PESTLE Analysis is built upon a robust foundation of data sourced from official government publications, reputable industry associations, and leading market research firms. We integrate insights from energy policy directives, economic forecasts, and technological innovation reports to ensure comprehensive and accurate assessments.