RAND Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RAND Bundle

RAND's industry landscape is shaped by powerful forces: the bargaining power of buyers, the threat of new entrants, the availability of substitutes, the intensity of rivalry, and the power of suppliers. Understanding these dynamics is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore RAND’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

RAND's core suppliers are its highly specialized research staff, possessing deep expertise in national security, health, and education. This unique intellectual capital is a critical input, granting these knowledge suppliers significant bargaining power. The scarcity of individuals with advanced degrees and analytical skills means RAND competes intensely for talent. In 2024, the market for top-tier policy researchers demands highly competitive compensation packages. RAND must offer attractive benefits and a compelling work environment to attract and retain these essential professionals.

While RAND leverages extensive publicly available data, its specialized research often requires procuring proprietary datasets and unique information from external providers. The high cost and distinctiveness of this data grant significant bargaining power to certain suppliers, particularly if they are the sole source for critical insights in emerging fields like AI ethics or climate modeling. This reliance can directly influence project timelines and overall research expenditures, with the global big data market valued at over $200 billion in 2024, highlighting the scale of potential supplier leverage. Consequently, maintaining access to a diverse portfolio of reliable data sources is a strategic imperative for RAND to ensure research agility and cost-effectiveness.

RAND's reliance on advanced analytical software, data modeling tools, and secure IT infrastructure grants significant bargaining power to technology and software vendors. Specialized providers, particularly in areas like AI and cybersecurity, maintain leverage due to the critical nature of their offerings. For instance, the global cybersecurity market is projected to reach over $200 billion in 2024, highlighting the demand and vendor strength. High switching costs, including staff retraining and data migration, further entrench RAND in these vendor relationships, limiting its alternatives.

Subcontractors and Research Partners

RAND often collaborates extensively with external research organizations, universities, and specialized consultants for large-scale projects. These partners bring unique expertise, critical data access, or specific population insights that RAND might not possess internally. The bargaining power of these subcontractors becomes notably high when their specialized contribution is unique and indispensable for a project's success. This significantly influences the project's overall cost and the terms of collaboration, reflecting market dynamics for niche research capabilities.

- In 2024, specialized AI and cybersecurity research partners command high leverage due to scarce expertise.

- Access to specific demographic data or rare clinical trial participants elevates a partner's bargaining position.

- Unique methodological approaches or proprietary analytical tools provided by subcontractors increase their influence.

- Partners with established reputations in niche fields can dictate more favorable contractual terms.

Government as a Supplier of Information

In its analytical work, RAND relies on governments as powerful suppliers of critical information. Federal, state, and local entities often provide sensitive or classified data essential for RAND's research. The terms for this information, including stringent security clearances and usage restrictions, are non-negotiable. This grants the government substantial leverage as an information supplier, despite also being a primary customer.

- In 2024, RAND continues to manage over 1,000 active projects, many requiring government-supplied classified inputs.

- Security clearances for RAND personnel are a critical, non-negotiable prerequisite, impacting project staffing.

- Government data usage agreements often include strict clauses on dissemination and storage, limiting RAND's flexibility.

- The Department of Defense remains a key source of sensitive data for RAND, influencing research scope.

RAND faces significant supplier power from its specialized research staff due to their scarce expertise and competitive compensation demands in 2024. Proprietary data and critical software vendors also wield leverage, driven by high costs and switching barriers. Furthermore, unique external research partners and government entities providing essential, sensitive information dictate non-negotiable terms for their vital inputs.

| Supplier Type | Source of Power | 2024 Market Data |

|---|---|---|

| Research Staff | Scarce, niche expertise | Top-tier policy researcher salaries often exceed $150K. |

| Data Providers | Proprietary, unique access | Global big data market valued over $200B. |

| Tech Vendors | Specialized software, high switching costs | Global cybersecurity market projected over $200B. |

What is included in the product

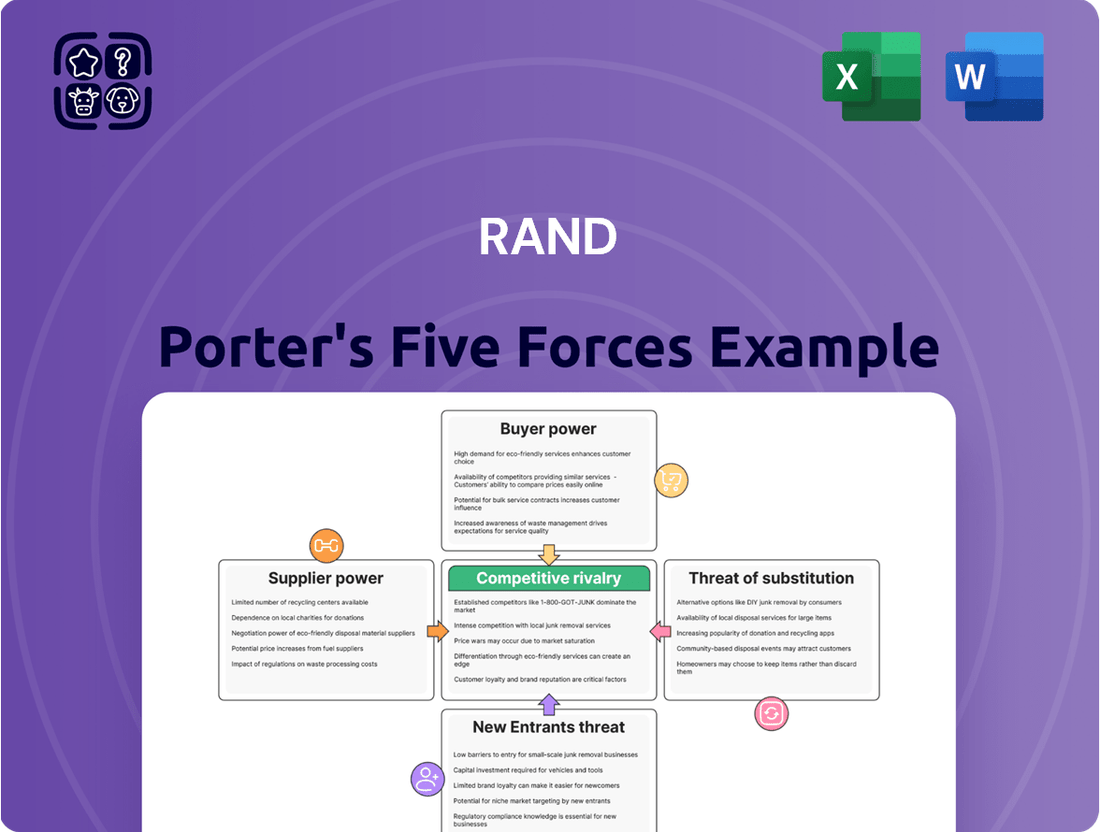

Analyzes the competitive intensity and attractiveness of RAND's operating environment by examining industry rivalry, buyer and supplier power, threat of new entrants, and the presence of substitutes.

Quickly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

A significant portion of RAND's revenue comes from a concentrated base of U.S. government agencies, notably the Department of Defense and other national security bodies. This concentration grants these clients substantial bargaining power over RAND. For instance, in fiscal year 2023, a large percentage of RAND's sponsored research was indeed for the U.S. federal government. The potential loss of a major government contract could significantly impact RAND's financial stability and operational scope. These powerful agencies can effectively dictate the precise scope, detailed terms, and pricing structures for research projects, underscoring their leverage.

Grantmakers and foundations represent a key customer segment for RAND, essentially purchasing social impact and policy insights through their funding. These philanthropic organizations often possess substantial bargaining power, directing research priorities to align with their specific agendas and desired outcomes. For instance, the Council on Foundations reported that U.S. foundation giving was projected to reach over $100 billion in 2024, highlighting the scale of their influence. The high competition among research institutions for these substantial grants further empowers funders to be highly selective and impose stringent reporting and performance requirements.

RAND operates within a highly competitive landscape, vying with numerous other think tanks and consulting firms for projects. Clients, including major government agencies like the Department of Defense with its 2024 budget of over $800 billion, are keenly budget-conscious and routinely solicit multiple proposals. This significant price sensitivity empowers customers to negotiate favorable terms, compelling RAND to consistently demonstrate exceptional value and cost-effectiveness in its research and analysis services. The intense competition ensures that customer leverage remains a critical factor in securing contracts.

Demand for Measurable Impact

Customers are increasingly demanding clear, measurable outcomes and demonstrable policy impact from their research investments, empowering buyers to shift funding based on perceived effectiveness. This heightened scrutiny means organizations like RAND must consistently demonstrate the real-world application of their analysis. In 2024, funding decisions for policy research increasingly hinge on evidence of societal benefit and return on investment. While RAND's reputation for objective, high-quality analysis provides a strong counter, the demand for tangible results remains a powerful force in customer bargaining power.

- Clients prioritize research that directly informs policy changes or yields quantifiable improvements.

- The ability to showcase successful past project impacts strengthens a research organization's position.

- Funding bodies, including government agencies, often link disbursements to performance metrics.

- Organizations failing to demonstrate clear value face reduced demand for their services.

Low Switching Costs for Some Services

For certain types of analysis, clients perceive low switching costs between RAND and other providers like universities or for-profit consulting firms. This holds true for research in social and economic policy areas, where numerous organizations compete. The availability of credible alternatives gives customers leverage to seek the best value proposition, pressuring RAND to differentiate itself through quality and unique expertise.

- The global management consulting market, a segment RAND operates in, was valued at over $300 billion in 2024.

- Many universities, such as Stanford and Harvard, actively conduct research in policy areas, directly competing with RAND.

- Government agencies, a key RAND client base, often utilize competitive bidding processes for research contracts.

- The U.S. federal contract spending for research and development was significant in 2024, attracting many bidders.

RAND's customers, primarily U.S. government agencies and large foundations, possess substantial bargaining power due to concentrated funding and intense competition among research providers. These clients can dictate project terms, demand measurable policy impacts, and easily switch to alternative organizations like universities or consulting firms. The U.S. Department of Defense's 2024 budget exceeding $800 billion and over $100 billion in projected 2024 foundation giving highlight this significant financial leverage. This dynamic compels RAND to consistently demonstrate exceptional value and cost-effectiveness.

| Customer Segment | Key Influence Factor | 2024 Data Point |

|---|---|---|

| U.S. Government Agencies | Concentrated Funding, Budget Size | DoD Budget: Over $800 Billion |

| Foundations/Grantmakers | Projected Giving, Agenda Setting | U.S. Foundation Giving: Over $100 Billion |

| All Clients | Competitive Alternatives | Global Consulting Market: Over $300 Billion |

Preview the Actual Deliverable

RAND Porter's Five Forces Analysis

The preview you see is the exact, professionally written RAND Porter's Five Forces Analysis you will receive immediately after purchase. This comprehensive document delves into the competitive landscape by examining the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. You are viewing the complete, ready-to-use analysis, ensuring there are no surprises or placeholders. This detailed report is formatted and ready for your strategic decision-making the moment your transaction is complete.

Rivalry Among Competitors

RAND faces direct competition from other prominent non-profit think tanks like the Brookings Institution and the Center for Strategic and International Studies (CSIS). These organizations fiercely compete for government contracts, grants, and philanthropic funding, which are critical revenue streams. For instance, in 2024, the landscape for defense and national security research funding remained highly competitive, with multiple entities vying for significant Department of Defense and other agency awards. This rivalry is particularly intense in high-profile areas such as national security, international affairs, and public policy research.

Large, for-profit consulting firms with robust public sector practices pose a significant competitive threat. Companies like Booz Allen Hamilton and Deloitte actively compete for government contracts, offering extensive research and analysis services. For instance, Booz Allen Hamilton reported over $11 billion in revenue for fiscal year 2024, largely from government work, highlighting their strong market presence. These firms leverage vast resources and can sometimes bid aggressively, intensifying rivalry for lucrative government-funded projects.

Major universities, particularly those with strong public policy, international relations, and STEM programs, represent significant competitive forces in the research landscape. Institutions like Harvard, Stanford, and Johns Hopkins operate research centers that produce high-quality analysis, vying for crucial research grants and government funding. These centers benefit from access to top-tier academic talent, attracting over $80 billion in federal research and development funding in 2024 across U.S. universities. They can also effectively leverage their core educational missions to support and expand their extensive research activities.

Specialized and Boutique Research Organizations

The policy research landscape sees intense competition from numerous smaller, specialized organizations and boutique firms. These entities, like the Center for Budget and Policy Priorities or the American Enterprise Institute, may not rival RAND across all domains but are fierce competitors within their niche areas. This creates a highly fragmented and competitive environment for specific research topics, demanding unique value propositions.

- In 2024, specialized think tanks like the Peterson Institute for International Economics continue to dominate specific policy discussions.

- Advocacy groups, such as the Environmental Defense Fund, often conduct highly focused research to support their specific policy goals.

- The proliferation of data analytics firms also adds to competitive pressure in targeted data-driven policy analysis.

- Smaller organizations often offer greater agility and specialized expertise, attracting targeted project funding.

Internal Government Research Capabilities

Government agencies maintain robust internal research and analysis capabilities, acting as a significant competitive force against external contractors like RAND. While they frequently engage organizations such as RAND for specialized studies, the option to conduct research in-house always exists. This inherent do-it-yourself capacity places a tangible ceiling on the prices RAND can charge, compelling it to consistently demonstrate superior value beyond what federal departments can produce internally. For instance, the US federal government's projected R&D budget for 2024 was approximately 171.7 billion USD, underscoring vast internal research potential.

- Internal teams provide a cost-effective alternative.

- Government agencies can leverage existing staff expertise.

- This rivalry caps pricing for external research organizations.

- RAND must offer specialized insights or efficiency gains.

RAND navigates intense competitive rivalry from diverse sources. Other non-profit think tanks and large for-profit consulting firms, like Booz Allen Hamilton with over $11 billion in 2024 revenue, fiercely compete for government contracts. Major universities, receiving over $80 billion in federal R&D funding in 2024, and specialized organizations also vie for research grants. Even government agencies, with a 2024 R&D budget of approximately $171.7 billion, pose a competitive threat through their internal research capabilities, capping RAND's pricing.

SSubstitutes Threaten

The most significant substitute for RAND's specialized services is the decision by its primary clients, particularly government agencies, to conduct research and analysis internally. Many large organizations, including various U.S. federal departments, maintain robust in-house analytical teams capable of performing studies, directly substituting contracted external expertise. For example, the U.S. government's 2024 budget continues to allocate substantial resources to internal policy and research divisions, reflecting a capacity for self-sufficiency. The viability of this internal substitute depends heavily on the client's specific internal expertise, available resources, and the perceived need for an independent, external perspective on complex issues.

Academic institutions and researchers generate extensive knowledge on public policy, serving as a significant substitute for RAND's applied research. While often theoretical, this academic output, including over 4 million scholarly articles published globally in 2024, offers alternative insights. Decision-makers frequently access academic journals, books, and conferences, potentially reducing the demand for specialized, commissioned studies. The increasing availability of open-access research further empowers entities to leverage university-driven analyses, sometimes bypassing the need for external policy research organizations.

High-quality investigative journalism can act as a substitute for formal policy analysis, offering alternative insights into complex issues. News organizations, like ProPublica or The New York Times, often deploy specialized teams to uncover detailed accounts of societal problems. While these reports may lack the rigorous, structured frameworks typical of a RAND study, their ability to influence public understanding and policy debates remains significant. For instance, in 2024, such reporting continues to shape public discourse on critical topics, sometimes preceding or paralleling formal research efforts.

Advocacy and Special Interest Group Reports

Advocacy and special interest groups pose a significant threat of substitution by producing reports that can influence policy, often reflecting a specific agenda. These publications, while not always objective, serve as alternatives to the comprehensive analysis offered by organizations like RAND, particularly for stakeholders seeking to validate a pre-existing viewpoint. The sheer volume of these reports, with thousands published annually in 2024 by various think tanks and non-profits, creates a challenging and often noisy information landscape.

- Over 1,800 active advocacy groups were identified in the US in 2024, many issuing policy-focused reports.

- These reports often prioritize persuasive arguments over strictly neutral analysis, impacting decision-maker perception.

- The accessible nature and targeted distribution of these reports make them direct substitutes for deeper, objective studies.

- The proliferation of online platforms amplifies the reach and immediate availability of advocacy content.

Artificial Intelligence and Data Analytics Platforms

The rise of sophisticated AI and data analytics platforms presents a significant threat of substitution for some of RAND's traditional services. These technologies can automate extensive data collection, complex analysis, and even generate policy insights, potentially reducing the reliance on human-led research teams for certain projects. The global AI market is projected to reach approximately $300 billion in 2024, indicating rapid adoption and capability expansion. As these tools become more powerful and accessible, they could substantially disrupt the traditional policy analysis model, offering quicker, data-driven alternatives.

- The global AI market is estimated to grow by over 20% in 2024, emphasizing its rapid expansion.

- Automated data processing tools can now handle vast datasets, a core component of policy research.

- AI-driven insights generation could offer faster, cost-effective alternatives to human analysis for specific queries.

- Consulting firms are increasingly integrating AI, with 2024 seeing a surge in AI-powered analytical service offerings.

RAND faces significant substitution threats from clients' internal research capabilities, particularly government agencies with robust in-house teams. Academic institutions and specialized journalism also offer alternative insights, with millions of scholarly articles and impactful reports shaping public understanding in 2024. Furthermore, advocacy groups flood the policy landscape with thousands of agenda-driven reports annually, while advanced AI and data analytics platforms increasingly automate complex analysis, posing a growing disruption.

| Substitute Source | 2024 Data Point | Impact on RAND |

|---|---|---|

| Internal Client Teams | US Gov't internal policy division budget remains substantial. | Reduces need for external contracts. |

| Academic Research | Over 4 million scholarly articles published globally. | Provides accessible alternative insights. |

| Advocacy Groups | Over 1,800 active US groups, thousands of reports annually. | Offers agenda-driven, accessible policy views. |

| AI/Data Analytics | Global AI market projected at $300B; over 20% growth. | Automates analysis, offering faster, cheaper alternatives. |

Entrants Threaten

A major barrier for new entrants in policy research is the formidable brand and reputation of established organizations like RAND. Clients, especially government agencies dealing with sensitive issues, rely heavily on the proven track record and perceived objectivity of these institutions. Building this level of trust and credibility takes decades; for instance, RAND's consistent federal funding, exceeding 70% of its 2023 revenue, showcases this deep reliance. This makes it incredibly difficult for new entrants to compete for high-stakes, large-scale projects in the market. Consequently, new firms struggle to gain traction against such entrenched players.

The non-profit research sector, exemplified by institutions like RAND, critically relies on attracting and retaining elite intellectual capital. New entrants face a significant hurdle in recruiting highly qualified researchers with specialized expertise and advanced degrees, especially given the intense competition for top analytical talent. For instance, the average salary for a principal researcher in 2024 can exceed $150,000, reflecting the high demand. Established organizations possess a substantial advantage in attracting these top-tier analysts, often due to reputation, funding, and established research infrastructure.

New entrants face a significant hurdle in securing the large-scale, long-term government contracts central to RAND's revenue. These client relationships are cultivated over decades, often institutionalized through mechanisms like Federally Funded Research and Development Centers (FFRDCs). For example, RAND operates three FFRDCs, including Project AIR FORCE and Arroyo Center for the U.S. Air Force, and the National Security Research Division for the Office of the Secretary of Defense, which collectively represented a substantial portion of its $364.5 million in operating revenue in fiscal year 2023. Breaking into these established networks of funding and trust remains a formidable challenge for any potential competitor.

Economies of Scale and Scope

RAND benefits significantly from economies of scale and scope, boasting a broad research portfolio across numerous critical domains. This allows the organization to leverage its extensive expertise and vast data resources efficiently across diverse projects. Maintaining a large, diverse staff of over 1,100 researchers, as reported in their recent publications, further solidifies this advantage. A new entrant would likely be more specialized, struggling to match RAND's comprehensive capabilities across such a wide range of policy issues.

- RAND's 2024 research budget is substantial, reflecting its extensive operational scale.

- The organization published hundreds of research reports in 2023, showcasing its broad scope.

- Its global presence, with offices in multiple continents, reinforces its economies of scope.

- New entrants face high barriers to building comparable data infrastructure and expert networks.

Political and Regulatory Hurdles

New organizations face substantial political and regulatory hurdles when attempting to enter sensitive areas like defense and intelligence research. Securing the necessary personnel clearances, which can take 90-120 days for a Top Secret clearance in 2024, acts as a significant barrier. Navigating this intricate environment demands extensive experience and established procedural compliance. These stringent requirements, including compliance with numerous federal acquisition regulations, deter potential new entrants from competing in the national security analysis market.

- Top Secret security clearance processing averages 90-120 days in 2024.

- Compliance with Federal Acquisition Regulations (FAR) is mandatory for defense contractors.

- The Department of Defense issued over 2.5 million security clearances in 2023.

- New entrants require significant upfront investment in compliance infrastructure.

New entrants face formidable barriers due to RAND's deep-rooted reputation, extensive government contracts, and significant economies of scale. Recruiting top-tier talent, with principal researcher salaries exceeding $150,000 in 2024, is a major hurdle. Navigating complex regulatory landscapes, including 90-120 day security clearance processes, further deters new competition. Established client relationships, like RAND's 2023 federal funding exceeding 70% of revenue, make market penetration difficult.

| Barrier | Metric | 2024 Data |

|---|---|---|

| Intellectual Capital | Principal Researcher Salary | >$150,000 |

| Regulatory Compliance | Top Secret Clearance Time | 90-120 Days |

| Client Relationships | 2023 Federal Funding | >70% of Revenue |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive mix of data, including company financial statements, industry association reports, and market research databases, to thoroughly assess competitive intensity and strategic positioning.