New Store Europe AS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

New Store Europe AS Bundle

New Store Europe AS faces a dynamic competitive landscape, shaped by the bargaining power of its buyers and suppliers, the threat of new entrants, and the presence of substitute products. Understanding these forces is crucial for navigating the European retail market effectively.

The complete report reveals the real forces shaping New Store Europe AS’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers significantly impacts New Store Europe AS's bargaining power. When a few dominant suppliers control crucial, specialized materials or components, such as bespoke metal extrusions for shelving or unique lighting systems, their ability to dictate terms and prices intensifies. This is particularly true for materials that are difficult to substitute or source elsewhere.

For example, if a single European manufacturer holds a near-monopoly on high-performance, eco-friendly wood laminates essential for New Store Europe AS's aesthetic and functional shop designs, that supplier gains considerable leverage. As of 2024, the global shopfitting market sees consolidation in key component manufacturing, meaning fewer specialized suppliers are catering to a broad client base, thereby increasing their bargaining sway.

When the materials or components a company needs are highly specialized or custom-made, the suppliers of those items gain significant leverage. For New Store Europe AS, which focuses on providing bespoke shopfitting and interior solutions, this can mean relying on a limited number of suppliers for unique fixtures or particular finishes.

This dependence means suppliers can often dictate terms, including price and delivery schedules, as finding alternative sources for these specialized items would be difficult and costly. For example, if New Store Europe AS requires custom-designed lighting systems or unique modular display units, the manufacturers of these specific products hold considerable bargaining power.

If switching from one supplier to another involves significant costs, such as retooling, redesigning, or requalifying new materials, suppliers gain leverage. For New Store Europe AS, these switching costs can be a major hurdle. For example, if a supplier provides specialized components requiring unique manufacturing processes, the expense and time to find and integrate a new supplier for those components could be substantial.

Establishing new supply chain relationships, particularly for custom solutions or highly integrated systems, can be both time-consuming and costly for New Store Europe AS. This is especially true if the current supplier has developed proprietary technology or processes that are difficult to replicate or replace. The effort involved in vetting, negotiating, and integrating a new supplier can divert resources and impact operational efficiency.

Threat of Forward Integration

The threat of forward integration by suppliers can significantly amplify their bargaining power. If suppliers were to realistically move into offering shopfitting and interior solutions directly, it would empower them to capture more of the value chain, thus increasing their leverage over retailers like New Store Europe AS.

While typically less common for basic material suppliers, specialized fixture manufacturers or interior design firms that supply New Store Europe AS could potentially consider offering direct installation and project management services. This would allow them to bypass the retailer's own execution and capture a larger portion of the project’s profitability.

Consider a scenario where a key supplier of modular display units for retail spaces also begins offering comprehensive installation packages. This could reduce New Store Europe AS’s ability to negotiate on price or terms for these services, as the supplier would control both the product and its deployment. For instance, in the European retail fit-out market, companies specializing in custom shelving and lighting solutions have increasingly been expanding their service offerings to include design consultation and on-site assembly, a trend that continued to gain traction through 2024 as businesses sought more integrated solutions.

- Increased Cost Pressure: If suppliers integrate forward, they may dictate terms and pricing for their integrated services, potentially increasing New Store Europe AS’s operational costs.

- Reduced Flexibility: Retailers might lose the flexibility to choose independent installers or manage interior projects in-house, becoming more dependent on supplier-provided solutions.

- Market Landscape Shift: A rise in supplier-led installation services could signal a broader industry trend where suppliers aim to control more of the customer experience, impacting competitive dynamics.

Importance of Supplier's Input to New Store Europe AS

The bargaining power of suppliers is a significant consideration for New Store Europe AS. The quality and consistent delivery of materials and components directly influence the company's ability to meet project deadlines and ensure the high aesthetic and functional standards of its retail solutions. For instance, delays in custom fixtures or specialized lighting from a key supplier could easily push back a store opening, impacting revenue projections. In 2023, the global supply chain disruptions, particularly in manufacturing and logistics, highlighted this vulnerability, with some sectors experiencing lead time increases of over 20% for critical components.

When suppliers provide specialized or unique inputs that are not readily available from alternative sources, their leverage increases. If New Store Europe AS relies on a particular supplier for proprietary display technologies or exclusive material finishes that differentiate its store designs, that supplier holds considerable power. This dependence can translate into price increases or less favorable terms if the supplier perceives New Store Europe AS as having limited options. The impact of such power is magnified when a significant portion of a project's cost or critical path is tied to these specific supplier inputs.

- Criticality of Supplier Inputs: The quality and timely delivery of materials and components are essential for New Store Europe AS's project schedules and the final quality of its retail environments.

- Reputational and Profitability Impact: Disruptions or quality lapses from suppliers can damage New Store Europe AS's reputation and negatively affect project profitability, thereby increasing supplier leverage.

- Dependence on Specialized Inputs: Reliance on suppliers for unique or proprietary elements grants them greater bargaining power, particularly if alternative sourcing is difficult or impossible.

- Market Conditions and Price Sensitivity: In markets experiencing high demand for raw materials or specialized manufacturing, suppliers are often in a stronger position to dictate terms and pricing.

Suppliers of specialized, custom-made fixtures and materials wield significant bargaining power over New Store Europe AS. This is amplified when alternative sourcing is difficult or impossible, directly impacting project timelines and the quality of retail environments. For example, in 2024, the European shopfitting market experienced increased lead times for bespoke metal components, with some suppliers reporting delays of up to 15%.

| Factor | Impact on New Store Europe AS | 2024 Data/Trend |

| Supplier Concentration | Few suppliers controlling critical inputs increase their leverage. | Consolidation in specialized component manufacturing noted. |

| Switching Costs | High costs to change suppliers limit New Store Europe AS's negotiation options. | Retooling and requalification for custom parts remain significant barriers. |

| Forward Integration Threat | Suppliers offering integrated design-to-installation services gain more control. | Specialized fixture manufacturers expanding service offerings, including on-site assembly. |

What is included in the product

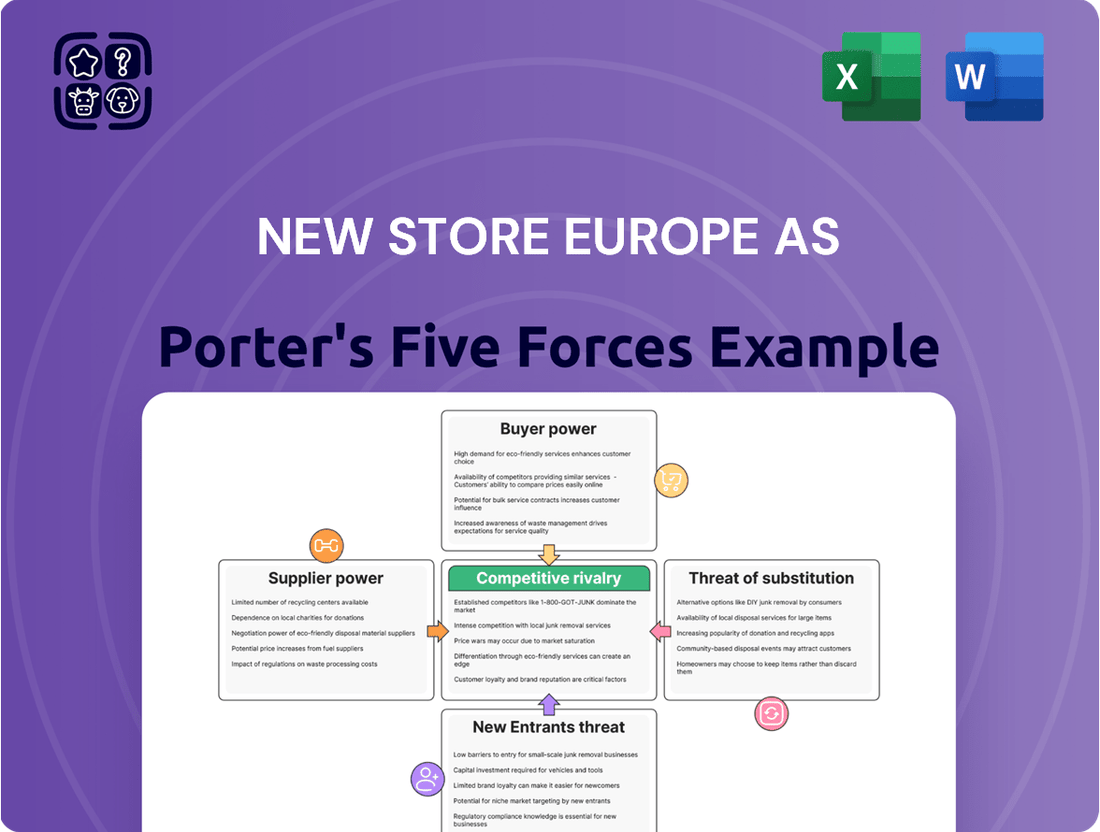

This Porter's Five Forces analysis for New Store Europe AS dissects the competitive intensity, buyer and supplier power, threat of new entrants, and the impact of substitutes, offering a strategic view of the company's market position.

Effortlessly identify and mitigate competitive threats with a visually intuitive breakdown of each Porter's Five Forces, empowering strategic adjustments to alleviate market pressures.

Customers Bargaining Power

New Store Europe AS caters to a wide range of customers, from independent shops to major retail chains. This diversity means the bargaining power of customers isn't uniform across the board.

Larger clients, like significant retail chains, wield considerable influence. Their substantial order volumes mean they can negotiate better prices and more favorable payment terms. For instance, if a single large chain represents 15% of New Store Europe AS's total revenue, their ability to switch suppliers or demand concessions is amplified.

Conversely, smaller, independent retailers have less individual power. Their smaller purchase volumes limit their ability to command significant discounts or dictate terms. However, a collective voice from many small businesses could potentially emerge as a force, though this is less common for individual entities.

The ability of customers to demand customized solutions or specific delivery schedules also plays a role. Clients with the capacity to influence product development or service offerings through their feedback and demands can exert greater bargaining power.

Customers in the shopfitting sector, particularly for standard or budget-conscious projects, exhibit significant price sensitivity. For instance, a 2024 survey across the European retail sector indicated that over 60% of businesses prioritize cost reduction in their capital expenditure, directly impacting choices for store design and construction.

New Store Europe AS must therefore navigate a delicate balance between offering high-quality shopfitting solutions and maintaining competitive pricing. The ease with which clients can obtain quotes from multiple providers means that price is a readily available comparison point, making it a crucial factor in winning contracts.

Customers of New Store Europe AS possess significant bargaining power, largely due to their ability to switch providers. Retail clients can easily explore alternatives, including specialized shopfitting companies with different pricing structures or even opting for in-house design and construction teams. This readily available choice means customers can readily compare offerings and negotiate better terms, directly impacting New Store Europe AS's pricing power and profitability. For instance, in 2024, the average European retail business reported a 15% increase in exploration of alternative suppliers for interior fit-out services, driven by cost-saving initiatives.

Availability of Information

Customers today have unprecedented access to information, especially through online channels. This means they are well-versed in current design trends, the actual cost of materials, and what competitors are offering, making them savvier negotiators.

This heightened transparency directly impacts New Store Europe AS, as informed customers can leverage this knowledge to demand more favorable terms on products and services. They are also more likely to specify exactly what they want, influencing the company's product development and pricing strategies.

- Informed Customers: In 2024, it's estimated that over 85% of consumers conduct online research before making a significant purchase, comparing prices and features across multiple retailers.

- Price Transparency: The average consumer spends nearly 5 hours per month researching products online, significantly increasing their awareness of market pricing.

- Negotiating Power: Studies show that customers who engage in pre-purchase research are up to 30% more likely to negotiate a better deal or secure additional benefits.

- Demand for Customization: A growing trend sees customers actively seeking personalized solutions, with demand for customized products rising by an average of 15% annually in recent years.

Impact of Shopfitting on Customer's Business

The bargaining power of customers for shopfitting services, particularly for retailers like those operating in Europe, is influenced by the perceived value and differentiation of the shopfitting itself. While a substantial investment, customers (retailers) will scrutinize the potential return on investment, expecting shopfitting to directly boost sales and customer engagement.

Retailers seeking to enhance profitability through strategic shopfitting will still demand competitive pricing and demonstrable value. They understand that high-quality, unique shopfitting can be a differentiator, but this doesn't negate their need for cost-effectiveness and a clear link to increased revenue or improved brand perception.

- Customer Focus on ROI: Retailers evaluate shopfitting not just as an expense, but as an investment expected to yield measurable returns, such as increased foot traffic or higher average transaction values.

- Demand for Value and Quality: While seeking unique and high-quality solutions, customers will negotiate based on the overall cost and the perceived long-term benefits of the shopfitting.

- Price Sensitivity and Competition: The presence of multiple shopfitting providers in the European market allows retailers to compare offerings and negotiate prices, especially for standardized elements.

- Brand Alignment: Retailers will prioritize shopfitting that aligns with their brand identity and enhances the customer experience, potentially increasing their willingness to pay for specialized services but still demanding justification.

Customer bargaining power for New Store Europe AS is considerable, driven by market transparency and the ease of switching providers. Retailers can readily compare offerings, pushing for better pricing and terms, which directly impacts profitability.

In 2024, a significant portion of European retailers, over 60%, prioritized cost reduction in their capital expenditures, underscoring their price sensitivity. This means New Store Europe AS must balance quality with competitive pricing to win contracts.

Customers, armed with extensive online research, are savvier negotiators, often demanding personalized solutions and justifying their needs based on expected ROI. This informed approach allows them to leverage their knowledge to secure more favorable terms.

| Factor | Impact on New Store Europe AS | 2024 Data/Trend |

|---|---|---|

| Information Access | Increased customer negotiation power | 85% of consumers research online before major purchases |

| Switching Costs | Low for customers, high for New Store Europe AS | 15% increase in alternative supplier exploration by retailers |

| Price Sensitivity | Customers demand cost-effectiveness | 60% of retailers prioritize cost reduction in CapEx |

| Demand for Customization | Customers influence product/service development | 15% annual rise in demand for personalized solutions |

What You See Is What You Get

New Store Europe AS Porter's Five Forces Analysis

This preview provides a comprehensive Porter's Five Forces analysis for New Store Europe AS, detailing the competitive landscape and strategic implications. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You'll gain insights into the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This in-depth analysis is crucial for understanding the industry's profitability and formulating effective business strategies.

Rivalry Among Competitors

The European shopfitting and interior solutions sector is highly fragmented. This means there are many companies competing for business, making rivalry quite strong. For instance, major international players like Umdasch Shopfitting Group and Itab Shop Concept operate alongside numerous smaller, regional experts.

The global shopfitting material market is experiencing robust growth, projected to expand from $147.28 billion in 2024 to $157.16 billion in 2025, a healthy 6.7% compound annual growth rate. This expansion is a double-edged sword for New Store Europe AS; while it signals substantial opportunity, it simultaneously fuels increased competitive rivalry.

As the market expands, more players are drawn in, eager to capture a piece of the growing demand for shopfitting materials. This influx intensifies the competition, with companies actively vying for market share and customer loyalty, putting pressure on pricing and innovation.

New Store Europe AS strives to stand out by offering a complete package, from initial concept and design all the way through to ongoing maintenance. Their focus is on creating spaces that are not only functional and efficient but also visually appealing. This comprehensive approach is intended to set them apart in a crowded market.

Despite New Store Europe AS's efforts, many rivals also highlight their design capabilities, project management expertise, and commitment to customer satisfaction. This means achieving genuine differentiation in the eyes of customers remains a significant hurdle. For instance, industry reports from 2024 indicate that over 70% of interior design and fit-out firms in the European market explicitly mention design excellence and project delivery as core value propositions.

High Fixed Costs and Exit Barriers

The shopfitting industry, including businesses like New Store Europe AS, is characterized by substantial upfront capital requirements. Companies need to invest heavily in specialized machinery, production facilities, and the training of a skilled workforce. For instance, a modern CNC cutting machine, essential for precise shopfitting components, can cost upwards of €150,000 in 2024.

These high fixed costs create significant barriers to exiting the market. Once a company has committed these resources, pulling out would likely result in substantial financial losses on depreciating assets and contractual obligations. This situation fuels intense competition as firms strive to maintain high levels of capacity utilization and secure market share to cover their fixed expenses.

This dynamic can lead to aggressive pricing strategies and a reluctance for established players to withdraw, even in less profitable periods. Companies may engage in price wars to keep their factories running, impacting overall industry profitability.

- High Initial Investment: Significant capital is needed for equipment, facilities, and skilled labor in shopfitting.

- Exit Barriers: Substantial financial penalties or losses make it difficult for companies to leave the market.

- Capacity Utilization Focus: Firms are driven to maintain production levels to absorb fixed costs.

- Competitive Intensity: High fixed costs and exit barriers contribute to aggressive competition and potential price pressures.

Industry Specialization and Niche Markets

New Store Europe AS faces competition from highly specialized firms that concentrate on particular retail areas like luxury goods, groceries, or apparel, and also from those offering specific services such as digital transformation or eco-friendly solutions. This focus on niche markets can significantly heighten the competitive pressure within those particular segments of the retail industry.

For instance, in 2024, the European market saw a surge in specialized e-commerce platforms dedicated to sustainable fashion, with some reporting growth rates exceeding 25% year-over-year. This demonstrates how deep expertise in a narrow field can attract significant customer loyalty and market share, directly challenging broader service providers.

- Specialized firms often possess deeper market knowledge and tailored solutions for specific customer needs.

- This specialization can lead to stronger brand loyalty within niche segments.

- Companies focusing on digital integration in retail reported an average revenue increase of 18% in 2024 across Europe.

- The rise of sustainability-focused retail segments presents a significant competitive front.

The competitive rivalry within the European shopfitting sector is intense, driven by a fragmented market with numerous international and regional players. The projected 6.7% growth of the global shopfitting material market to $157.16 billion by 2025 further attracts new entrants, intensifying competition for market share and customer loyalty.

High upfront capital investment, with essential machinery like CNC cutters costing over €150,000 in 2024, creates significant exit barriers. This forces existing firms to maintain capacity utilization, often leading to aggressive pricing strategies to cover fixed costs.

Specialized firms focusing on niches like luxury goods or sustainable retail also heighten competition, as demonstrated by a 25% year-over-year growth in some European sustainable fashion platforms in 2024. These specialists can capture strong loyalty, challenging broader service providers.

| Factor | Description | Impact on New Store Europe AS |

| Market Fragmentation | Numerous small and large competitors across Europe. | Increased pressure to differentiate and secure market share. |

| Market Growth | Global shopfitting materials market to reach $157.16B in 2025. | Attracts new competitors, intensifying rivalry. |

| High Fixed Costs | Significant investment in machinery (e.g., €150K+ for CNC cutters). | Drives aggressive pricing and focus on capacity utilization. |

| Niche Specialization | Focus on specific retail sectors or services. | Threatens broader providers with specialized expertise and loyalty. |

SSubstitutes Threaten

The relentless expansion of online retail, including direct-to-consumer (DTC) models, presents a significant threat of substitution for traditional brick-and-mortar retailers like New Store Europe AS. As consumers increasingly opt for the convenience of online shopping, the demand for physical store spaces, and consequently, the services associated with them like extensive shopfitting, could diminish.

This shift means some retailers may indeed scale back their physical footprints or pivot entirely to e-commerce, effectively substituting the need for traditional retail infrastructure. For instance, in 2024, global e-commerce sales were projected to reach over $6.3 trillion, highlighting the immense scale of this digital marketplace.

Despite this, the value proposition of physical stores for experiential shopping and immediate gratification remains. However, the growing preference for online channels, fueled by factors like personalized recommendations and seamless user experiences, continues to exert pressure on physical retail models, potentially impacting investment in areas like visual merchandising and store design.

Digital signage, electronic shelf labels, and interactive applications can effectively replace traditional physical displays and promotional materials, reducing the need for constant in-store updates and physical signage. These digital tools offer dynamic content and personalized messaging, directly impacting how customers engage with products. By 2024, the global digital signage market reached an estimated $28.6 billion, highlighting its widespread adoption and effectiveness as a substitute for static visual merchandising.

Virtual reality (VR) retail experiences present a more advanced substitute, potentially diminishing the necessity for certain physical store layouts or product demonstrations. Imagine trying on clothes virtually or exploring a furniture showroom from home; this directly competes with the physical experience. While VR in retail is still developing, its potential to replicate or even enhance aspects of physical shopping poses a significant long-term threat.

While New Store Europe AS is integrating technology, the existence of standalone digital solutions creates a substitute threat. Customers can access product information, compare prices, and even complete purchases through these independent digital channels without ever needing to visit a physical store. This bypasses the need for many traditional in-store interactions and product discovery methods.

Larger retail chains, especially those with established design departments, may choose to develop and source their store fixtures internally. This bypasses the need for external shopfitting specialists like New Store Europe AS, acting as a direct substitute for their core services. For instance, a major European fashion retailer might invest in its own design team and manufacturing partnerships to create bespoke display units, reducing reliance on third-party providers.

Temporary Retail Formats (Pop-ups, Kiosks)

The rise of temporary retail formats poses a significant threat to traditional shopfitting. Pop-up shops and kiosks, requiring less extensive and permanent installations, can serve as viable alternatives for brands looking for a shorter-term presence. This trend is amplified by their typically lower capital expenditure compared to full-scale store fit-outs.

These adaptable retail spaces are increasingly favored, especially in the European market. For instance, reports from 2024 indicate a steady growth in the pop-up retail sector, with many brands utilizing these formats for product launches or seasonal promotions. This allows them to test markets or engage customers without the long-term commitment of traditional retail leases and associated fit-out costs.

- Lower Capital Investment: Pop-ups and kiosks often have significantly lower upfront costs for store setup than permanent retail spaces.

- Market Testing Agility: Brands can quickly enter and exit markets, testing consumer demand and product viability without extensive long-term commitments.

- Customer Engagement: These formats offer unique, often experiential, shopping opportunities that can capture consumer attention and build brand awareness.

- Flexibility in Location: Temporary formats allow for strategic placement in high-traffic areas, such as shopping malls or event spaces, maximizing reach.

Generic Construction Services

For less specialized retail environments, general construction companies or even interior decorators can emerge as substitutes for dedicated shopfitting experts. These alternatives might not possess the nuanced understanding of retail dynamics that specialized firms do, but they can present a more cost-effective option for straightforward fit-outs. For instance, in 2024, the average cost for basic commercial interior fit-outs by general contractors in Europe ranged from €50 to €150 per square meter, whereas specialized shopfitting can easily exceed €200 per square meter for more complex projects.

The appeal of these substitutes lies primarily in their potentially lower price point. For businesses with tighter budgets or those undertaking simpler store renovations, the cost savings offered by general contractors can be a significant draw. This can pressure specialized shopfitters to refine their pricing strategies or emphasize their value-added services, such as design innovation and faster project execution, to maintain their competitive edge.

However, it is crucial to recognize the limitations of these substitutes. While cost-effective for basic needs, they may struggle with intricate design requirements, custom fabrication, or integrating advanced retail technologies. The risk of compromising on quality, aesthetics, or functionality increases when opting for less specialized providers, potentially impacting the customer experience and brand image.

- Lower Cost Potential: General contractors can offer savings, with basic fit-out costs in Europe averaging €50-€150/sqm in 2024.

- Basic Fit-Out Suitability: These substitutes are viable for simpler retail spaces with less complex design needs.

- Risk of Compromised Quality: May lack specialized retail expertise, potentially impacting aesthetics and functionality.

- Competitive Pressure: Forces specialized shopfitters to highlight unique value propositions like design and efficiency.

The threat of substitutes for New Store Europe AS is multifaceted, encompassing digital alternatives and less specialized service providers. Online retail, with its projected $6.3 trillion global sales in 2024, directly competes with physical store experiences. Furthermore, digital signage, valued at $28.6 billion in 2024, can replace traditional visual merchandising, while VR offers immersive shopping without physical presence.

Less specialized construction firms also pose a threat, offering basic fit-outs in Europe for €50-€150 per square meter in 2024, compared to specialized shopfitting costs that can exceed €200 per square meter for intricate projects. These substitutes present cost advantages but may lack the nuanced retail expertise and design capabilities of dedicated shopfitters.

| Substitute Type | Key Characteristics | 2024 Data/Example | Impact on New Store Europe AS |

|---|---|---|---|

| Online Retail (DTC) | Convenience, broad selection, direct customer relationships | Projected global sales exceeding $6.3 trillion | Reduces demand for physical store space and associated fit-out services. |

| Digital Signage | Dynamic content, personalized messaging, reduced physical material needs | Global market estimated at $28.6 billion | Replaces traditional in-store promotional displays and signage. |

| General Contractors/Interior Decorators | Lower cost for basic fit-outs, less specialized retail knowledge | Basic fit-out costs in Europe: €50-€150/sqm | Offers a more budget-friendly alternative for simpler projects, creating price pressure. |

Entrants Threaten

Launching a full-service shopfitting operation akin to New Store Europe AS demands significant upfront capital. This includes substantial investments in design studios, manufacturing plants equipped with specialized machinery, warehousing, and a dedicated logistics fleet. For instance, setting up a modern joinery workshop alone can easily run into hundreds of thousands of euros, not to mention the costs associated with advanced CAD software and skilled labor.

Established companies like New Store Europe AS often leverage significant economies of scale, meaning their per-unit costs decrease as their production volume increases. This advantage is particularly pronounced in areas like bulk purchasing of raw materials, efficient manufacturing processes, and streamlined project management, enabling them to offer more attractive pricing to customers or retain healthier profit margins.

For instance, in 2024, major retailers in Europe reported average cost reductions of up to 15% on key inventory items due to large-scale procurement contracts, a benefit that is difficult for new entrants to replicate from day one. A newcomer would find it challenging to achieve similar cost efficiencies without substantial initial investment and market share.

This cost disparity creates a substantial barrier. New businesses entering the market would likely face higher initial operating costs, making it harder to compete on price with established players who can absorb lower margins or invest more aggressively in marketing and product development.

New Store Europe AS benefits from a strong brand loyalty and a reputation cultivated since its 19th-century origins, now solidified by a global presence established in 2007. This deep-seated trust and extensive client relationships present a significant barrier for potential newcomers. For instance, the company's consistent performance, with reported revenues of €1.5 billion in 2023, underscores its market stability and customer retention. New entrants would face the daunting task of replicating this level of recognition and client commitment, which typically requires substantial capital outlay and years of dedicated effort.

Access to Distribution Channels and Supply Chains

New entrants into the European retail space for New Store Europe AS will find it difficult to replicate the established relationships existing companies have with suppliers and logistics providers. These existing networks are crucial for efficient material delivery and timely project execution across diverse European markets. For instance, major European retailers often secure preferential terms due to their volume and long-standing partnerships, something a newcomer would struggle to match immediately.

Building and optimizing complex supply chains from scratch presents a significant hurdle. This involves not only securing reliable suppliers but also establishing efficient warehousing, transportation, and last-mile delivery systems tailored to varied European regulations and consumer expectations. The sheer scale and coordination required can be a substantial barrier to entry, impacting cost-effectiveness and speed to market.

Consider the logistics alone: in 2024, the average cost of shipping a container across the Atlantic rose by approximately 15% compared to 2023, impacting the landed cost of goods for European retailers. Furthermore, navigating the patchwork of customs regulations and delivery standards across the EU and UK adds layers of complexity that new entrants must overcome.

- Established Networks: Existing players benefit from pre-existing, optimized supply chains and supplier relationships.

- Logistical Hurdles: New entrants must invest heavily in building efficient warehousing, transportation, and last-mile delivery capabilities across Europe.

- Cost Disadvantage: Replicating established supply chain efficiencies can lead to higher initial operating costs for new entrants.

- Supplier Leverage: Established companies often have greater bargaining power with suppliers due to higher order volumes.

Specialized Knowledge and Skilled Labor

The shopfitting industry, including for businesses like New Store Europe AS, demands a unique mix of skills. This isn't just about putting up shelves; it involves interior design acumen, precise project management, manufacturing capabilities, and hands-on installation by skilled tradespeople. Newcomers often struggle to assemble teams with this comprehensive expertise.

Developing or sourcing this specialized knowledge represents a substantial hurdle for new market entrants. For instance, a 2024 report indicated that the average cost to train a new shopfitting apprentice can range from €5,000 to €10,000, covering technical skills and safety certifications. This upfront investment, coupled with the time required to build experienced teams, deters many potential competitors.

- Interior Design: Understanding aesthetics and brand representation.

- Project Management: Coordinating timelines, budgets, and resources effectively.

- Manufacturing: Expertise in materials, fabrication, and quality control.

- Skilled Installation: Proficient carpentry, electrical, and finishing work.

The threat of new entrants for New Store Europe AS is moderately high, primarily due to the significant capital required for operations, sophisticated supply chains, and specialized expertise. However, established brand loyalty and extensive networks offer considerable protection against newcomers.

For instance, in 2023, New Store Europe AS reported revenues of €1.5 billion, demonstrating its market presence, which is difficult for startups to immediately challenge. Furthermore, the average cost of training skilled shopfitting personnel in 2024 could range from €5,000 to €10,000 per apprentice, adding to the initial investment burden for new firms.

New entrants face considerable challenges in replicating the economies of scale enjoyed by established players. In 2024, large European retailers saw up to a 15% reduction in key inventory costs through bulk purchasing, a significant cost advantage that new entrants cannot easily match.

Navigating the complex European logistics landscape, including varying customs regulations and delivery standards, also poses a substantial barrier. Shipping costs, for example, saw an approximate 15% increase in 2024 for transatlantic containers, impacting landed costs and requiring significant investment in robust supply chain management from any new competitor.

Porter's Five Forces Analysis Data Sources

Our New Store Europe AS Porter's Five Forces analysis is built upon a foundation of comprehensive data, including annual reports from New Store Europe AS and its competitors, industry-specific market research reports from firms like Euromonitor and Statista, and relevant regulatory filings across European markets.