NetEase PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NetEase Bundle

Unlock the strategic landscape surrounding NetEase with our comprehensive PESTLE Analysis. Understand how political stability, economic fluctuations, and evolving social trends are shaping its gaming and internet services. Discover the technological advancements and environmental considerations that present both opportunities and challenges for this industry giant. This expert-crafted analysis provides actionable insights to inform your own strategic decisions.

Don't miss out on critical intelligence that could redefine your market approach. Gain a competitive edge by leveraging our in-depth understanding of the external forces impacting NetEase. Purchase the full PESTLE Analysis now and equip yourself with the knowledge to navigate the complexities of this dynamic sector.

Political factors

The Chinese government heavily regulates the gaming industry, significantly impacting NetEase through strict content reviews and a mandatory licensing process for every game release. This intense oversight, managed by agencies like the National Press and Publication Administration (NPPA), often leads to substantial delays in game launches. For instance, game approvals in 2024 have shown a continued cautious approach, requiring NetEase to allocate significant resources to ensure compliance with evolving regulations. The unpredictable regulatory landscape remains a primary political factor influencing the company's operational environment and revenue streams.

China's government has imposed strict regulations on youth gaming, restricting minors to playing only during specific hours on Fridays, weekends, and public holidays, typically between 8 PM and 9 PM. These anti-addiction measures, which mandate real-name registration systems, directly constrain NetEase's potential user engagement and overall player base. While the initial impact of these rules, implemented in late 2021, led to a significant drop in minor gaming time—reportedly over 75% for some platforms by early 2022—the long-term effect continues to shape market strategy. This regulatory stance reflects the government's ongoing focus on addressing what it terms spiritual opium, influencing NetEase's content development and marketing for 2024 and 2025.

Rising geopolitical tensions, particularly between the U.S. and China, pose significant risks to NetEase's international operations and expansion plans. This environment, highlighted by ongoing trade restrictions and potential export controls affecting Chinese tech companies through 2024, can limit access to global technologies and key markets. Such challenges create considerable uncertainty, potentially hindering cross-border collaborations and impacting NetEase's projected revenue growth in international segments for 2025.

State Interest in Cultural Export

The Chinese government actively promotes video games as a key category for global cultural export, aiming to tell China's story well. This initiative presents a significant opportunity for NetEase, especially with titles like "Justice Mobile" gaining international traction in 2024. However, it also implies substantial government interest and potential influence over game content to align with national narratives and values. NetEase must navigate this delicate balance between its commercial goals and adhering to state objectives for cultural dissemination, a critical consideration for new game approvals and global market expansion.

- Government support for cultural exports could streamline NetEase's global market entry for games showcasing Chinese elements.

- NetEase's compliance with state content guidelines is crucial for domestic market stability and licensing for new titles through 2025.

- Potential for increased funding or preferential policies for games that effectively promote Chinese culture abroad.

Evolving Regulatory Landscape

The regulatory environment for China's tech and gaming sector remains highly dynamic, as evidenced by the draft rules curbing in-game spending circulated in late 2023, which were later removed in 2024. This unpredictability necessitates that companies like NetEase maintain exceptional agility and strong government relations to navigate potential policy shifts. The government's continued focus on regulation aims to foster a more stable, albeit controlled, business landscape. NetEase's Q1 2024 gaming revenue growth, despite the ongoing regulatory scrutiny, highlights its adaptability.

- Draft gaming rules withdrawn in early 2024, indicating fluid policy.

- NetEase's operational agility is crucial for navigating regulatory uncertainty.

- Government aims for market stability through increased oversight.

The Chinese government's strict content reviews and licensing, managed by the NPPA, significantly delay NetEase's 2024 game releases, requiring substantial compliance efforts. Youth gaming restrictions, limiting play to specific weekend hours, continue to constrain user engagement, directly impacting NetEase's player base. Geopolitical tensions, particularly US-China trade restrictions, pose risks to 2025 international expansion. However, government support for cultural exports presents opportunities for global market entry, while NetEase maintains agility amid dynamic regulatory shifts.

| Political Factor | Impact on NetEase (2024-2025) | Key Data/Trend |

|---|---|---|

| Content Regulation & Licensing | Delays game launches, increases compliance costs. | Ongoing NPPA approvals, resource allocation for compliance. |

| Youth Gaming Restrictions | Limits user engagement, constrains domestic player base. | Minor gaming time down over 75% by early 2022, continued impact. |

| Geopolitical Tensions | Hinders international expansion, access to tech. | Ongoing trade restrictions, potential export controls. |

| Cultural Export Promotion | Opportunity for global market entry, potential content influence. | Titles like Justice Mobile gaining traction, state narrative alignment. |

What is included in the product

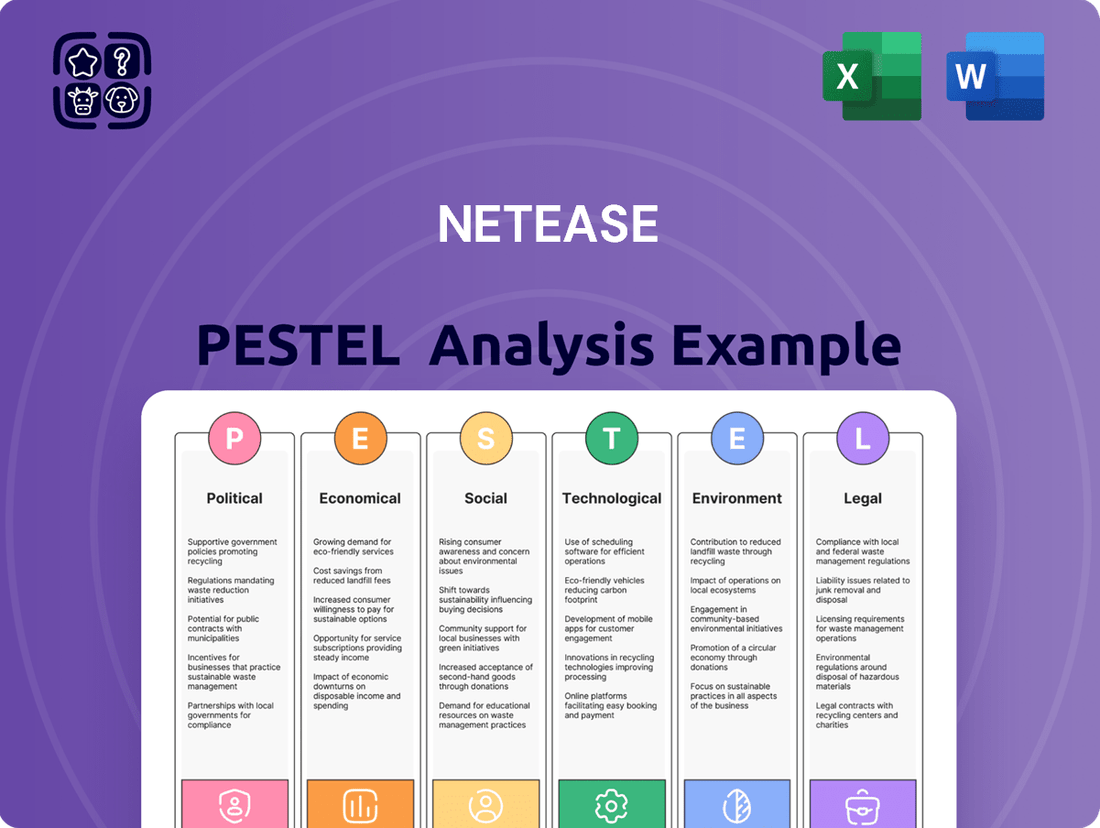

This NetEase PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

A clear, actionable summary of NetEase's PESTLE factors, enabling swift identification of potential market challenges and opportunities for proactive strategy development.

Economic factors

NetEase's revenue directly links to consumer spending on entertainment, heavily influenced by disposable income and broader economic conditions. An economic slowdown could temper spending on games, music, and other services. However, the online gaming sector often proves resilient, with global gaming revenues projected to reach approximately $232 billion in 2024. Despite economic uncertainties, consumers often shift towards more affordable digital entertainment. NetEase’s online game services continue to show strong performance, reflecting consistent consumer engagement into 2024 and early 2025.

The Chinese gaming market remains intensely competitive, primarily dominated by NetEase and Tencent. While these two giants collectively held over 70% of the domestic market share in early 2024, emerging competitors like miHoYo, with its Genshin Impact generating over $5 billion in revenue by 2024, are increasingly challenging their dominance. This fierce competition puts pressure on NetEase's profitability and market dynamics, necessitating continuous innovation. Furthermore, this competitive landscape extends globally, as Chinese gaming companies aggressively expand overseas, vying for a larger share of the projected $200 billion global gaming market in 2025.

NetEase is significantly ramping up its international market expansion, particularly targeting growth in lucrative markets like Japan and North America. This strategic focus is crucial as overseas revenue becomes an increasingly vital component of its financial performance, driven by the need to diversify away from China's highly regulated domestic gaming market. The company is actively investing in this strategy by acquiring foreign game studios and developing titles specifically designed for global appeal. This aggressive international push aims to secure new revenue streams and reduce reliance on its primary market as of 2024/2025.

Fluctuating Financial Performance

NetEase exhibits robust financial performance, with overall revenue growth remaining strong, but specific segments show volatility. For instance, innovative businesses and Cloud Music experienced a 7.2% year-over-year revenue decline in Q4 2023, impacting overall segment contributions. Profitability is also influenced by marketing expenses, which are expected to normalize throughout 2024, potentially boosting margins. Despite these fluctuations, the company maintains a solid financial foundation.

- Q4 2023 innovative businesses and Cloud Music revenue declined 7.2% year-over-year.

- NetEase reported a 2023 net income of 27.8 billion CNY.

- The company held a substantial cash and cash equivalents position of 113.6 billion CNY as of December 31, 2023.

Growth of the Digital Economy

The continued expansion of China's digital economy, especially the robust mobile gaming and esports sectors, underpins NetEase's core business strength. China's digital economy is projected to exceed 60 trillion RMB by 2025, fueled by technological accessibility and a vast, engaged gamer population. The mobile gaming user base is expected to surpass 700 million by 2025, with esports revenue nearing $400 million in 2024. This consistent growth trajectory presents a highly favorable long-term economic outlook for the industry.

- China's digital economy projected to exceed 60 trillion RMB by 2025.

- Mobile gaming user base expected to surpass 700 million by 2025.

- Esports market revenue projected to approach $400 million in 2024.

- Strong foundation for NetEase's core business.

NetEase's revenue is directly influenced by consumer spending on digital entertainment, with the global gaming market projected to reach $232 billion in 2024. China's digital economy, expected to exceed 60 trillion RMB by 2025, provides a robust foundation. Despite economic shifts, the online gaming sector remains resilient, with mobile gaming users projected to surpass 700 million by 2025. This consistent growth trajectory supports NetEase's core business into 2025.

| Economic Indicator | 2024 Projection | 2025 Projection |

|---|---|---|

| Global Gaming Revenue | $232 billion | $200 billion |

| China Digital Economy | N/A | >60 trillion RMB |

| China Mobile Gaming Users | N/A | >700 million |

Preview Before You Purchase

NetEase PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment.

This comprehensive NetEase PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

You'll gain insights into market trends, competitive landscapes, and strategic opportunities relevant to NetEase's operations.

This detailed report is designed to equip you with the knowledge needed for informed business decisions.

Sociological factors

China's gaming demographic is maturing, with the average gamer age reaching around 35 years by early 2025, indicating a financially stable user base. This demographic shift influences game design, prompting a focus on more complex and monetizable content tailored for older audiences. NetEase's diverse portfolio, spanning from immersive MMORPGs to competitive mobile games, strategically appeals to this wide range of age groups. This broad appeal ensures sustained engagement and robust revenue streams from a seasoned player base.

Player tastes in gaming are always changing, with trends shifting between genres and platforms. NetEase must continuously innovate its game development to meet these evolving preferences, balancing its portfolio of successful titles like Fantasy Westward Journey with new offerings. The rise of social and interactive entertainment, including live streaming on platforms such as NetEase's own CC Live, directly reflects these demands. Adapting to these shifts is crucial for sustaining revenue, which saw NetEase's online game services generate approximately 21.5 billion RMB in Q1 2024.

The accelerated adoption of online education, particularly post-pandemic, has solidified its status as a new normal for learners globally. This societal shift creates a substantial market opportunity, with the global online education market projected to reach USD 307.2 billion in 2024. NetEase's Youdao division is strategically positioned to leverage this trend, offering diverse services from K-12 to adult and vocational learning programs. NetEase Youdao reported net revenues of RMB1.38 billion (USD191.0 million) in Q1 2024, highlighting its continued relevance. This broadens NetEase's revenue streams significantly beyond its core gaming sector.

Demand for Interactive and Social Entertainment

There is a robust and escalating demand for entertainment that deeply integrates social and interactive elements, particularly evident in the rapid expansion of esports and live streaming platforms.

This trend provides significant opportunities for NetEase, as the global esports market is projected to reach approximately $1.8 billion in revenue by 2025, with a compound annual growth rate of over 10%.

NetEase's extensive gaming portfolio and platforms are well-positioned to capitalize on this growth, especially with titles fostering competitive play.

Furthermore, features within NetEase's services, such as the active social comment sections on NetEase Cloud Music, directly cater to the consumer need for community and interaction.

- Global esports revenue is forecast to exceed $1.8 billion by 2025.

- NetEase benefits from strong user engagement in social gaming and streaming.

Cultural Influence and Content

As a prominent content provider, NetEase significantly influences cultural trends both domestically and internationally, especially through its diverse portfolio including titles like *Fantasy Westward Journey* and music streaming via NetEase Cloud Music. The company's platforms shape user perspectives and tastes, reaching hundreds of millions of monthly active users. This influence mandates strict adherence to China's content regulations, which prohibit material endangering social order or public morality, a key compliance area in 2024-2025 given ongoing regulatory scrutiny.

- NetEase Cloud Music reported over 200 million monthly active users in early 2024, shaping music consumption trends.

- NetEase games, such as *Justice Mobile*, continue to be scrutinized for cultural alignment with domestic values in 2024.

China's gaming demographic is maturing, with the average gamer age reaching around 35 years by early 2025, driving demand for more complex, monetizable content. The global online education market is projected to reach USD 307.2 billion in 2024, significantly benefiting NetEase's Youdao division, which reported RMB1.38 billion in Q1 2024 net revenues. A robust demand for social and interactive entertainment, with global esports revenue forecast to exceed $1.8 billion by 2025, further strengthens NetEase's market position. NetEase's platforms, like Cloud Music with over 200 million MAU in early 2024, also significantly influence cultural trends.

| Sociological Factor | Key Trend | 2024/2025 Data Point | ||

|---|---|---|---|---|

| Demographic Shift | Maturing Gamer Age | Average age ~35 years by early 2025 | ||

| Education Trends | Online Education Market Growth | Global market USD 307.2 billion (2024) | ||

| Entertainment Preferences | Esports & Social Gaming Demand | Global esports revenue >$1.8 billion (2025) |

Technological factors

NetEase is heavily investing in and integrating Artificial Intelligence across its business segments, reflecting a strategic priority for innovation. In gaming, AI is crucial for enhancing development efficiency and creating sophisticated intelligent NPCs, notably improving titles like *Justice Mobile* which contributed significantly to Q1 2024 revenues. Furthermore, AI powers advanced music creation tools on NetEase Cloud Music, a platform that reached 207 million monthly active users by late 2023. AI also drives its Youdao intelligent learning products, supporting its educational technology offerings. These integrations aim to boost operational efficiency and user engagement across the company's diverse portfolio.

NetEase has significantly invested in cloud gaming, developing platforms focused on high stability and low latency to enhance user experience. The rapid expansion of 5G networks is a critical enabler, projected to push global cloud gaming revenue towards $15.3 billion by 2025, making high-quality gaming accessible without powerful local hardware. However, intense market competition led NetEase to strategically adjust its focus, discontinuing its public cloud service in late 2023 to concentrate resources on its core gaming and enterprise solutions.

Mobile gaming remains the dominant force in China's market, projected to capture over 70% of total gaming revenue in 2024 and 2025, driving significant user engagement. NetEase's strong portfolio of mobile titles, including hits like Eggy Party and Justice Mobile, serves as its primary revenue engine. For instance, NetEase's online game services revenue, largely mobile-driven, reached RMB 21.5 billion in Q1 2024. The company's sustained success hinges on its ability to consistently develop and maintain popular, long-running mobile games that capture evolving player preferences and market trends. This focus ensures NetEase retains its competitive edge in a dynamic digital landscape.

Cybersecurity and Data Protection

As a leading Chinese tech firm, NetEase handles immense volumes of user data, necessitating substantial investments in cutting-edge cybersecurity. China's evolving data protection landscape, including the Personal Information Protection Law (PIPL) enacted in 2021, mandates stringent protocols for data localization, encryption, and user privacy, directly impacting NetEase's operations.

Ensuring compliance with these increasingly strict regulations, with potential fines reaching 5% of annual turnover, represents a significant technological and operational challenge for NetEase heading into 2025. The company's data security budget is projected to increase by over 15% for 2024-2025 to meet these escalating demands.

- PIPL mandates strict data localization for sensitive user information.

- NetEase must comply with encryption standards to protect user privacy.

- Estimated 2024-2025 cybersecurity investment increase of 15%+.

- Non-compliance penalties can reach 5% of annual revenue.

Innovation in Online Education Tech

NetEase's Youdao division significantly leverages technology to create innovative educational products. This includes advanced AI-powered tools and smart hardware, such as their popular dictionary pens, which enhance the learning experience and attract a growing user base. Continuous technological advancement is crucial for Youdao to maintain its competitive edge in the rapidly evolving EdTech market, particularly with a focus on generative AI integration.

- Youdao's smart learning devices shipped over 1.1 million units in Q1 2024.

- AI integration drives personalized learning paths for over 15 million active users.

- Research and Development (R&D) investment in AI for education exceeded 5% of NetEase's revenue in 2023.

NetEase's strategic focus on AI significantly enhances gaming, music, and educational products, contributing to Q1 2024 revenues and user engagement. Mobile gaming remains crucial, capturing over 70% of China's market by 2025, with NetEase's mobile titles driving RMB 21.5 billion in Q1 2024 online game services revenue. Increased cybersecurity investments, projected to rise over 15% for 2024-2025, are critical for compliance with strict data protection laws like PIPL, which carries penalties up to 5% of annual turnover. Youdao's AI-powered educational tools, including 1.1 million smart device shipments in Q1 2024, underscore continuous tech innovation.

| Technological Area | Key Metric | 2024/2025 Data |

|---|---|---|

| AI Integration | NetEase Cloud Music MAU | 207 million (late 2023) |

| Mobile Gaming | China Market Share | >70% of revenue (2024-2025) |

| Cybersecurity Investment Increase | Projected Budget Growth | >15% (2024-2025) |

| Youdao Smart Devices Shipped | Q1 2024 Units | 1.1 million |

Legal factors

Operating legally in China mandates obtaining a license from the National Press and Publication Administration (NPPA) for each game, a significant legal hurdle for NetEase. This involves rigorous content scrutiny, making the approval process unpredictable for both domestic and international titles. While 2023 saw over 1,000 games approved, and monthly batches continued steadily into 2024, the regulatory framework remains stringent. This strict oversight can delay new game launches and impact NetEase's revenue projections, requiring continuous adaptation to evolving compliance requirements.

China maintains a robust legal framework governing data security and privacy, including the Cybersecurity Law, Data Security Law, and Personal Information Protection Law. NetEase must strictly adhere to these regulations concerning data collection, storage, and cross-border transfers to avoid substantial penalties. For instance, fines can reach up to 5% of annual revenue or 50 million RMB for serious PIPL violations. New regulatory clarifications effective in 2025 further enhance these compliance obligations, impacting NetEase's operational costs and data management strategies.

Protecting its intellectual property is paramount for NetEase, especially given its strong portfolio of self-developed game franchises like Westward Journey and Fantasy Westward Journey, which contribute significantly to its estimated 2024 gaming revenue. The robust legal framework for IP protection in China and globally is crucial for safeguarding these assets and NetEase’s competitive edge. The company continuously navigates complex IP issues, particularly when licensing international titles, as seen with past collaborations like the Blizzard Entertainment games which ended their licensing agreement in early 2023. Ensuring strong legal recourse against infringement remains vital for its 2025 strategic growth and content monetization.

Restrictions on Foreign Investment (VIE Structure)

Due to ongoing Chinese government restrictions on foreign investment in telecommunications and internet services, NetEase operates through a Variable Interest Entity (VIE) structure. This complex legal arrangement, based on contractual agreements, carries inherent uncertainties regarding its interpretation and enforcement by PRC authorities, particularly given the evolving regulatory landscape in 2024. Any adverse changes in these regulations could significantly impact NetEase's control and financial consolidation of its primary business entities.

- The Cybersecurity Law and Data Security Law, enforced since 2021, continue to influence regulatory oversight for VIEs handling large data volumes, adding compliance burdens in 2024.

- Potential shifts in the Variable Interest Entity (VIE) contractual enforcement by Beijing remain a key risk for companies like NetEase entering 2025.

- The uncertain legal status of VIEs in China means there is no explicit legislative backing for their enforceability, posing ongoing challenges.

Global Regulatory Compliance

As NetEase expands its global footprint, particularly with popular titles like *Eggy Party* and *Diablo Immortal*, it navigates a complex web of international regulations. The company faces stringent data privacy laws, such as the General Data Protection Regulation (GDPR) in Europe, where compliance failures can lead to significant fines, potentially reaching 4% of global annual turnover. Furthermore, increasing scrutiny from US authorities regarding data handling and content moderation necessitates a robust legal framework. NetEase must adapt to diverse legal standards for content, advertising practices, and user rights across markets like the EU, US, and Japan, requiring a sophisticated and continuously updated global compliance strategy to mitigate legal risks.

- GDPR fines can reach €20 million or 4% of global annual turnover, whichever is higher, impacting international operations.

- US regulatory bodies, including the FTC, are intensifying oversight on data privacy and digital advertising, with new guidelines expected through 2025.

- Content moderation and user protection laws vary significantly, requiring tailored compliance strategies for each major market.

NetEase navigates complex legal landscapes, from China's stringent game licensing by the NPPA, which approved over 1,000 games in 2023, to its robust data privacy laws, where PIPL violations can incur fines up to 5% of annual revenue. The company’s VIE structure faces ongoing regulatory uncertainty into 2025, impacting control and consolidation. Global expansion demands adherence to international regulations like GDPR, with potential fines reaching 4% of global annual turnover, alongside critical IP protection efforts.

| Legal Factor | Key Impact | 2024/2025 Data |

|---|---|---|

| Game Licensing (NPPA) | Launch Delays | 1000+ games approved 2023 |

| Data Privacy (PIPL) | Operational Fines | Up to 5% annual revenue |

| Global Compliance (GDPR) | International Penalties | Up to 4% global turnover |

Environmental factors

NetEase has formalized its ESG strategy, consistently publishing comprehensive Environmental, Social, and Governance reports to enhance stakeholder transparency. The company's 2024 ESG report, anticipated in mid-2025, will likely detail ongoing progress in areas like carbon reduction and resource efficiency. Reporting adheres to international frameworks, including the Sustainability Accounting Standards Board (SASB) and recommendations from the Task Force on Climate-related Financial Disclosures (TCFD). This commitment highlights an increasing integration of sustainability into NetEase's core business strategy and decision-making processes, aligning with global investor expectations.

NetEase is actively integrating green concepts into its operations, demonstrating a commitment to environmental protection. While specific quantitative targets remain part of its internal strategy, the company's public disclosures highlight its awareness of its environmental footprint. This includes ongoing efforts to enhance the energy efficiency and environmental performance of its numerous data centers and office buildings, aligning with broader 2024 sustainability trends in the tech sector.

While NetEase's specific carbon neutrality timeline is not as publicly detailed as some competitors, the broader Chinese tech industry is moving towards setting such goals, with major players aiming for net-zero by 2030 or 2040. As a significant entity, NetEase faces increasing expectations from investors and regulators to address climate change risks and contribute to a lower-carbon economy. The company's ESG reports for 2023-2024 reference climate-related disclosures, suggesting this is an area of increasing focus for operational adjustments and reporting. This trend is amplified by China's national target to achieve carbon neutrality before 2060, influencing corporate environmental strategies.

Sustainable Supply Chain Management

NetEase's environmental, social, and governance (ESG) commitments increasingly extend to its supply chain, particularly for its e-commerce platform Yanxuan and hardware components used across its services. The company is actively working to manage the environmental and social impacts of its suppliers, which is a crucial aspect of its corporate social responsibility strategy for 2024-2025. This focus includes efforts to reduce carbon emissions within the supply chain, aligning with broader sustainability goals.

- NetEase aims to enhance supplier environmental performance, with a focus on waste reduction and energy efficiency.

- By Q1 2025, NetEase is expected to have further integrated ESG clauses into supplier contracts.

- Yanxuan's supply chain initiatives are projected to contribute to a 5% reduction in packaging waste by year-end 2024.

Energy Consumption of Data Centers

NetEase, with its extensive gaming and cloud services, faces significant environmental considerations due to the substantial energy consumption of its data centers. Efficiently managing this energy use and actively exploring renewable sources are crucial environmental opportunities and challenges. The broader tech industry's push towards green computing, including initiatives like the **2024 Energy-Efficient Computing Initiative**, directly influences NetEase's operational and environmental strategy, necessitating investments in sustainable infrastructure.

- NetEase relies on numerous data centers to support its gaming, cloud, and online services.

- Data center energy consumption is a major environmental impact for technology companies.

- Exploring renewable energy sources is a key opportunity for NetEase to reduce its carbon footprint.

- The tech industry's focus on green computing impacts NetEase's operational strategy for 2024-2025.

NetEase increasingly prioritizes ESG, with its anticipated mid-2025 ESG report detailing 2024 carbon reduction and resource efficiency efforts, aligning with SASB and TCFD frameworks. The company faces growing pressure to address data center energy consumption and supply chain emissions, especially as China targets carbon neutrality before 2060. Efforts include enhancing energy efficiency and integrating green clauses into supplier contracts, aiming for reductions like a projected 5% cut in Yanxuan packaging waste by year-end 2024.

| Environmental Focus Area | 2024-2025 Initiative | Projected Impact |

|---|---|---|

| Data Center Efficiency | Energy-Efficient Computing Initiative | Reduced operational carbon footprint |

| Supply Chain Sustainability | ESG clauses in supplier contracts | 5% reduction in Yanxuan packaging waste by 2024 |

| Climate Risk Management | Increased climate-related disclosures | Alignment with China's 2060 carbon neutrality goal |

PESTLE Analysis Data Sources

Our PESTLE analysis for NetEase is grounded in a comprehensive review of official government reports, financial filings, and reputable industry publications. We analyze market research data and economic indicators to provide a robust understanding of the external factors influencing NetEase's operations.