NetEase Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NetEase Bundle

NetEase, a titan in the gaming and internet services sector, faces a dynamic competitive landscape. Understanding the forces shaping its market is crucial for any stakeholder. This brief overview touches on the intensity of rivalry and the bargaining power of buyers, but only scratches the surface of NetEase's strategic environment.

The full Porter's Five Forces Analysis delves into the critical factors like the threat of new entrants and the power of suppliers, revealing the true competitive pressures NetEase navigates. It provides a data-driven framework to uncover hidden opportunities and potential risks within its industry.

Ready to move beyond the basics? Get a full strategic breakdown of NetEase’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The online gaming and digital services industry, including NetEase, heavily relies on a few dominant technology and infrastructure providers. Companies like Amazon Web Services, Microsoft Azure, and Google Cloud control a significant share of the global cloud market, with AWS alone holding approximately 31% in Q1 2024. This concentration gives these suppliers substantial leverage over NetEase, as switching costs for core services like game engines or payment gateways are prohibitively high, potentially disrupting operations and incurring significant financial outlay. Any price increases or changes in terms by these essential providers directly impact NetEase’s operational expenses and overall profitability.

High-skilled game developers and engineers are a critical, limited resource in the competitive gaming industry, granting them significant bargaining power. The specialized knowledge required for creating popular, technologically advanced games means NetEase must fiercely compete for top talent. This competition with global giants like Tencent, which saw its R&D expenses reach approximately CNY 65.7 billion in 2023, drives up labor costs. NetEase must offer attractive compensation and environments to retain key personnel, influencing its cost structure and innovation capacity in 2024.

NetEase heavily relies on owners of popular intellectual properties for its licensed games and content across services like Cloud Music. For instance, its gaming division depends on major entertainment franchises, while its streaming service requires content from prominent music labels. These IP holders, such as Universal Music Group and Sony Music Entertainment, command substantial licensing fees and royalties. Their bargaining power remains high, driven by the unique appeal and established fan bases of their content, impacting NetEase's operational costs significantly in 2024.

Hardware and Platform Dependencies

NetEase's extensive game portfolio relies heavily on distribution across various platforms, including mobile (iOS, Android), PC, and consoles (Sony, Microsoft, Nintendo). The owners of these platforms, especially Apple and Google for mobile, act as powerful gatekeepers controlling access to the vast user base. These platform holders impose significant commission fees, often around 30% on in-game purchases, directly impacting NetEase's revenue models and profitability. This substantial control over distribution channels grants platform owners considerable bargaining power over game publishers like NetEase.

- Mobile platforms like Apple's App Store and Google Play collectively commanded over 90% of the global mobile app market share in early 2024.

- Standard commission rates on these platforms remain around 30% for in-app purchases, although some tiers exist for smaller developers or subscriptions.

- NetEase's net revenues from online game services reached approximately RMB 79.1 billion in 2023, with a significant portion subject to these platform fees.

- Console manufacturers also take a share of game sales and in-game transactions, although typically lower than mobile.

Regulatory Bodies as a Form of Supplier Power

The Chinese government acts as a crucial supplier of operating licenses, known as banhao, which are essential for NetEase to launch new games. The National Press and Publication Administration (NPPA) holds immense power due to the unpredictable nature and pace of these approvals. Delays or denials directly impact NetEase's revenue streams and strategic planning, as seen with periods of halted approvals. For instance, in 2024, the NPPA continues to modulate game approvals, affecting the release pipeline and NetEase's market strategy.

- NPPA's authority over game licenses (banhao) is critical for NetEase's operations.

- The unpredictable approval process directly impacts new game launches and revenue generation.

- NetEase's ability to monetize new titles hinges on timely regulatory clearance.

- As of 2024, the regulatory environment remains a significant factor influencing NetEase's growth trajectory.

NetEase experiences substantial supplier power from several key entities. Dominant cloud service providers and crucial intellectual property owners command high fees, impacting operational costs. Mobile platform owners like Apple and Google leverage their market control, imposing significant 30% commissions on game revenues. Additionally, the Chinese government's unpredictable game licensing process acts as a powerful, essential supplier, directly influencing NetEase's product pipeline and profitability in 2024.

| Supplier Category | Key Impact | 2024 Data/Context |

|---|---|---|

| Cloud Services | High switching costs, potential price increases | AWS market share ~31% Q1 2024 |

| Platform Owners | High commission fees on revenue | Mobile platforms ~90%+ market share, ~30% commission |

| Chinese Government | Regulatory approval for game launches | NPPA continues to modulate banhao approvals |

| Skilled Talent | Increased labor costs | Tencent R&D expenses ~CNY 65.7 billion (2023) |

What is included in the product

Tailored exclusively for NetEase, analyzing its position within its competitive landscape and the impact of industry forces on its strategic direction.

Visualize competitive intensity across all five forces with a dynamic, interactive dashboard, eliminating the guesswork in strategic planning.

Customers Bargaining Power

Players in the digital gaming market face minimal costs or barriers when switching from one title to another, especially within the free-to-play segment where NetEase is a major player. The abundance of gaming options across mobile and PC platforms means customer loyalty is often fleeting. Gamers can easily download and try new games from competitors like Tencent, whose Honor of Kings continues to dominate mobile revenue, or miHoYo, developer of Genshin Impact, if dissatisfied with content or monetization models. This ease of movement empowers customers, as evidenced by the intense competition for player engagement in 2024.

The global gaming market is intensely saturated, with a vast number of titles competing for player engagement and spending. This extensive choice empowers customers, as they can readily select from a wide array of games and entertainment services, including those from competitors like Tencent and miHoYo. NetEase must constantly innovate and provide compelling content updates to retain its user base, especially given that the global gaming market is projected to reach approximately $282 billion in 2024, highlighting the immense competition. Customers' high switching power means NetEase's ongoing success hinges on delivering unique and high-quality gaming experiences.

Modern gamers are highly informed and interconnected, leveraging social media, streaming platforms, and online forums to share insights. They easily access reviews and compare games, with collective opinions significantly influencing purchasing decisions and a game's reputation. For NetEase, a negative community reaction to a game update or monetization strategy can spread rapidly, as seen with some community backlashes in 2024, potentially leading to substantial player churn. This collective customer influence grants them considerable bargaining power, impacting NetEase's revenue streams and long-term player engagement.

Free-to-Play (F2P) Model Dominance

The prevalence of the free-to-play model significantly empowers customers, as the initial barrier to entry is zero for NetEase's games. Revenue relies entirely on discretionary in-game purchases, giving players leverage. The engagement of the non-paying majority remains crucial for community health and game longevity. However, paying users, often termed whales, possess substantial power due to their significant financial contributions, driving a large portion of NetEase's mobile game revenue.

- In 2024, the global free-to-play market continued its dominance, with mobile F2P games accounting for over 50% of total mobile gaming revenue.

- NetEase's Q1 2024 net revenues from online game services reached approximately $2.6 billion, heavily reliant on F2P titles and in-game spending.

- Player retention and community engagement are paramount, as only a small percentage of F2P players typically make purchases.

- The top 10% of paying players often contribute over 70% of a F2P game's revenue.

Sensitivity to Monetization Practices

Gamers are increasingly sensitive to and critical of aggressive monetization strategies, especially pay-to-win models. Proposed regulations in China, like the December 2023 draft rules targeting certain in-game reward mechanisms, highlighted official and public concern over these practices. This forces NetEase to carefully balance its revenue generation with fair player experiences to avoid user backlash and potential regulatory scrutiny, impacting titles like Eggy Party which heavily rely on in-app purchases. NetEase must adapt its monetization, with player spending in mobile games globally reaching an estimated $107.3 billion in 2024, emphasizing the need for sustainable models.

- Player backlash to aggressive monetization can significantly impact game longevity and revenue.

- Regulatory proposals in China reflect a growing governmental focus on consumer protection in gaming.

- NetEase must innovate monetization to maintain player trust while securing substantial revenue streams.

- Balancing player experience with financial targets is crucial for NetEase's continued market leadership in 2024.

Customers wield significant bargaining power over NetEase due to minimal switching costs in the highly saturated global gaming market, projected at $282 billion in 2024. The dominance of free-to-play models empowers users, where non-paying players are crucial for community health and the top 10% of paying users often generate over 70% of F2P revenue. Informed gamers leverage online platforms, making collective opinions critical and forcing NetEase to balance monetization with player satisfaction, especially given regulatory scrutiny in China.

| Factor | Impact on Bargaining Power | 2024 Data Point |

|---|---|---|

| Switching Costs | Low | Global gaming market projected $282 billion |

| Market Saturation | High | Mobile F2P over 50% of mobile gaming revenue |

| Monetization Model | High (F2P) | Top 10% of F2P payers contribute over 70% revenue |

What You See Is What You Get

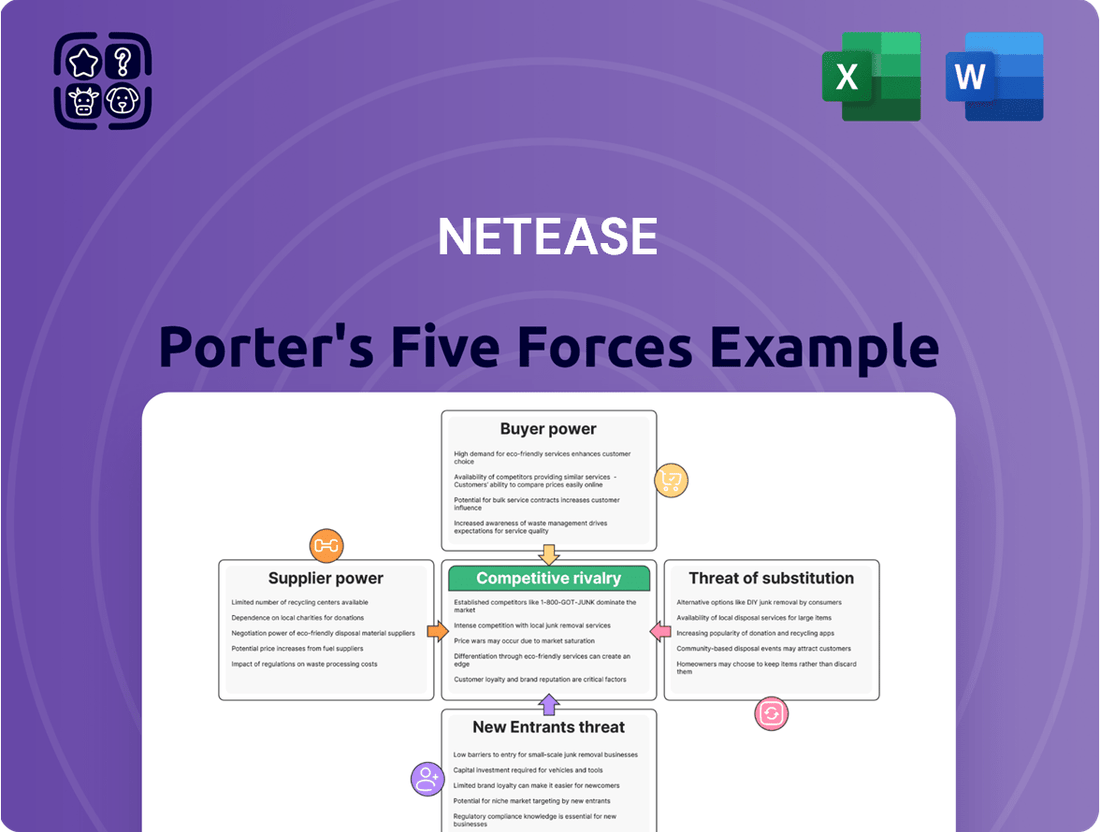

NetEase Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase, offering a comprehensive Porter's Five Forces Analysis of NetEase. You'll gain detailed insights into the competitive landscape, including the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry within the industry. This professionally formatted analysis is ready for your immediate use, providing a thorough understanding of NetEase's strategic positioning.

Rivalry Among Competitors

The Chinese gaming market is defined by an intense duopoly between NetEase and its primary rival, Tencent, fostering fierce competition. Both companies relentlessly vie for market share, top talent, and exclusive intellectual property licenses. This rivalry significantly escalates marketing costs and research and development expenditures. In 2024, these firms continue to invest heavily, striving to launch blockbuster titles and enhance platform services, driving innovation in the sector.

While Tencent and NetEase remain dominant in the gaming sector, the market has seen a significant rise in innovative niche and independent studios. Companies like miHoYo, developer of the globally successful Genshin Impact, which surpassed $5 billion in mobile revenue by early 2024, demonstrate this shift. Game Science's highly anticipated Black Myth: Wukong, set for a 2024 release, further highlights how a single high-quality title can challenge established giants. This trend compels NetEase to not only contend with its primary rival but also to continually innovate to stay ahead of these agile and creative newcomers.

Beyond its core gaming operations, NetEase encounters fierce competition across its diversified segments. NetEase Cloud Music directly rivals Tencent Music Entertainment, which continued to hold the largest market share in China's online music streaming sector in early 2024. Furthermore, NetEase's Youdao education platform and other innovative ventures operate within intensely competitive digital markets. Maintaining and growing their positions necessitates continuous investment and a sharp strategic focus. This widespread rivalry across its portfolio demands substantial resource allocation for market penetration and retention.

Global Expansion and Overseas Competition

As NetEase expands globally, it faces intense rivalry from established international gaming giants like Microsoft, Sony, and other major publishers. This necessitates significant investment in adapting games for Western markets, where user cultural preferences and gaming habits often differ. The push for overseas growth, exemplified by NetEase's 2024 strategic focus, represents a highly contested battleground for market share and user engagement.

- NetEase reported its online game services revenue for Q1 2024 at 21.5 billion RMB, highlighting its core business strength amid global competition.

- Microsoft's gaming revenue, including Xbox content and services, saw a significant increase in Q3 FY2024, partly driven by the acquisition of Activision Blizzard King, intensifying the competitive landscape.

- NetEase's titles such as *Eggy Party* have seen strong international reception, demonstrating their capability to compete outside of their domestic market.

- The global gaming market is projected to reach approximately $282 billion in 2024, signifying the vast opportunity and fierce competition for market share.

High Investment in Game Development and Marketing

The gaming industry demands immense capital for new title development and marketing, reflecting high competitive rivalry. A blockbuster game requires a substantial budget for production quality and user acquisition, with top-tier titles often exceeding $100 million in development costs alone. This continuous cycle of significant investment is crucial for NetEase to maintain a competitive pipeline of new games in a sector where user engagement and market share heavily depend on fresh, high-quality content.

- Major game development budgets can reach hundreds of millions of dollars, like NetEase's investment in Project Mugen.

- Marketing campaigns for new titles frequently exceed tens of millions of dollars annually to reach global audiences.

- In 2024, the global gaming market is projected to generate over $189 billion, intensifying the need for investment.

- NetEase reported significant R&D expenditures, indicating ongoing high investment in new game initiatives.

NetEase faces intense competitive rivalry, primarily from Tencent in China's gaming and digital services, driving significant marketing and R&D costs. The rise of agile independent studios like miHoYo, whose Genshin Impact surpassed $5 billion in mobile revenue by early 2024, also intensifies the market. Globally, NetEase competes with giants like Microsoft, whose gaming revenue increased in Q3 FY2024, necessitating substantial investment for international expansion. This environment demands continuous innovation and high capital expenditure, with NetEase's Q1 2024 online game services revenue at 21.5 billion RMB, reflecting the fierce market.

| Rivalry Aspect | Key Competitor | 2024 Data Point |

|---|---|---|

| Domestic Gaming | Tencent | NetEase Q1 2024 Online Game Services: 21.5 billion RMB |

| Niche Gaming | miHoYo | Genshin Impact (miHoYo) >$5B mobile revenue by early 2024 |

| Global Gaming | Microsoft | Microsoft Gaming Revenue increased Q3 FY2024 |

SSubstitutes Threaten

NetEase faces significant competition not just from other gaming companies but from all forms of digital entertainment vying for user leisure time and disposable income. This includes dominant video streaming services like Netflix and YouTube, which boasted billions of hours watched globally in 2024, alongside popular social media platforms such as TikTok and Weibo. The rise of short-form video content further fragments user attention. The ease of switching between these diverse entertainment options on smartphones and PCs makes the threat of substitution particularly high for NetEase's gaming revenues.

Beyond the digital realm, traditional leisure activities pose a significant substitute threat to NetEase's offerings. Consumers often choose outdoor activities, sports, or attending live events like concerts and movies over digital entertainment. For instance, global box office revenue was projected to reach $32 billion in 2024, indicating strong competition for discretionary spending. The decision to engage with NetEase's gaming or music services is weighed against these diverse recreational pursuits, impacting potential user engagement and revenue streams.

User-generated content platforms like Roblox and YouTube present a significant substitute, offering nearly endless, often free, entertainment. These services directly compete for the same user base as professionally developed games and media. Roblox alone reported over 77.7 million daily active users in Q1 2024, demonstrating massive engagement. The appeal of creating and sharing content, rather than just consuming, is a powerful alternative, drawing significant attention away from traditional gaming. This shift compels NetEase to innovate to retain its audience.

Music and Audio Streaming Alternatives

The threat of substitutes for NetEase Cloud Music is substantial, encompassing a wide array of global and domestic audio entertainment options. Global giants like Spotify, which reported 618 million monthly active users globally in Q1 2024, and Apple Music, with an estimated 100 million subscribers, offer strong alternatives. Domestically, Tencent Music Entertainment dominates, holding a significant market share in China's online music sector in 2024. Beyond music, podcasts, audiobooks, and live audio chat rooms increasingly compete for users' listening time, creating a highly fragmented and competitive environment due to their low cost and wide availability.

- Spotify's global MAUs reached 618 million in Q1 2024.

- Apple Music has an estimated 100 million subscribers worldwide.

- Tencent Music Entertainment (TME) reported 670 million mobile MAUs in Q4 2023.

- NetEase Cloud Music had approximately 206.6 million MAUs in Q3 2023.

Educational and Productivity Tools

NetEase's Youdao faces significant substitute threats in online education. Learners can opt for a wide array of alternative online learning platforms, free educational content on sites like YouTube, or increasingly accessible online courses from traditional universities. For productivity tools such as email, numerous high-quality, often free, alternatives are readily available, making it challenging for NetEase to establish strong user loyalty or differentiate its offerings. This intense competition from substitutes pressures pricing and market share.

- By 2024, the global online education market continued its rapid expansion, intensifying competition.

- Many users prefer free, ad-supported content for basic learning needs.

- Traditional institutions globally expanded online course catalogs, directly competing.

- Alternative email and productivity suites, like Google Workspace and Microsoft 365, dominate with extensive features and often free tiers.

NetEase's offerings face substantial substitution from a wide array of digital entertainment like streaming and social media, alongside traditional leisure activities and user-generated content platforms. For instance, Roblox reported 77.7 million daily active users in Q1 2024, diverting significant attention. NetEase Cloud Music competes with giants like Spotify, with 618 million global MAUs in Q1 2024, and Tencent Music Entertainment, which had 670 million mobile MAUs in Q4 2023. This broad competition across gaming, music, and education segments pressures NetEase's market share and pricing.

| Substitute Category | Key Competitor | 2024 Metric |

|---|---|---|

| User-Generated Content | Roblox | 77.7M Daily Active Users (Q1 2024) |

| Music Streaming | Spotify | 618M Monthly Active Users (Q1 2024) |

| Music Streaming (China) | Tencent Music Entertainment | 670M Mobile MAUs (Q4 2023) |

| Traditional Entertainment | Global Box Office | $32B Projected Revenue (2024) |

| Productivity/Education | Google Workspace/Microsoft 365 | Dominant Market Share (2024) |

Entrants Threaten

Developing and launching top-tier games that can truly compete with NetEase's extensive portfolio demands enormous capital investment and advanced research and development capabilities. The cost to produce a high-quality, AAA-equivalent mobile or PC game often exceeds $100 million. For instance, major titles in 2024 can easily incur development budgets reaching $200 million or even more. This substantial financial barrier to entry is a significant deterrent, limiting the number of potential new competitors in the gaming market.

The Chinese government's strict and unpredictable licensing process for new games presents a significant barrier for new entrants. Obtaining a banhao, or publication license, is a mandatory, lengthy, and often uncertain procedure that heavily favors established companies like NetEase. This regulatory wall effectively limits the number of new games and companies that can enter the world's largest gaming market. For example, in the first five months of 2024, the National Press and Publication Administration approved an average of around 80-90 domestic games monthly, a controlled pace that underscores the difficulty for newcomers.

NetEase benefits from significant economies of scale across its marketing, distribution, and operational activities, creating a formidable barrier for new entrants. Its established brand and extensive portfolio of successful, long-running games like Fantasy Westward Journey have cultivated a highly loyal user base and robust brand recognition. New competitors would struggle to match NetEase's substantial marketing spend, which supported its 2024 revenue projections, or replicate the brand trust built over decades. For instance, NetEase's consistent market presence and user engagement, evident in its strong Q1 2024 financial performance, underscore its entrenched position.

Access to Distribution Channels

Accessing major distribution channels like Apple's App Store and various Android marketplaces is critical for new entrants, yet these are tightly controlled by powerful gatekeepers. While technically open, securing prominent featuring and visibility demands significant marketing investment and established industry relationships. NetEase, as a top global gaming company, leverages its substantial scale and long-standing partnerships to effectively navigate these crucial channels, reaching a vast audience of over 1 billion mobile gamers globally in 2024.

- New entrants face high user acquisition costs, often exceeding 2024 industry averages of $2-$4 per install for casual games.

- Platform fees, typically 15-30% of revenue, significantly impact profitability for smaller developers.

- NetEase's top titles consistently rank within the top 50 grossing games on major app stores, showcasing established channel power.

- Strategic partnerships, like NetEase's collaboration with Blizzard in the past, exemplify established channel access.

Intellectual Property Portfolio and Talent Acquisition

NetEase boasts a substantial intellectual property portfolio, including numerous self-developed and licensed game titles, creating a significant barrier to entry. Its robust ability to attract and retain top development talent, critical in the competitive 2024 gaming market, further complicates new entrants building rival teams. This established ecosystem of IP and talent at incumbent firms like NetEase, which reported R&D expenses of RMB 16.3 billion in 2023, represents a major hurdle for newcomers.

- NetEase holds a vast IP library, including popular games like Fantasy Westward Journey.

- The company's R&D expenditure reached RMB 4.0 billion in Q1 2024.

- Attracting and retaining top-tier game developers is a key competitive advantage.

- New entrants face high costs and long development cycles to replicate NetEase's scale.

New entrants face formidable barriers due to the immense capital required for competitive game development, often exceeding $200 million for AAA titles in 2024. Strict Chinese regulatory licensing, approving around 80-90 domestic games monthly in early 2024, severely restricts market access. NetEase's established brand, vast IP portfolio, and strong distribution channel presence, coupled with high user acquisition costs ($2-$4 per install), create an extremely challenging environment for newcomers.

| Barrier Type | NetEase's Advantage/Impact | 2024 Data/Fact |

|---|---|---|

| Capital Investment | High development costs deter rivals | AAA game budgets often exceed $200 million |

| Regulatory Hurdles | Favors established players like NetEase | ~80-90 domestic game approvals monthly (early 2024) |

| Distribution & User Acquisition | Entrenched channel power, lower relative costs | User acquisition costs $2-$4 per install for casual games |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for NetEase leverages comprehensive data from the company's annual reports, investor presentations, and earnings call transcripts. We also incorporate insights from industry-specific market research reports and reputable gaming news outlets to understand competitive dynamics and market trends.