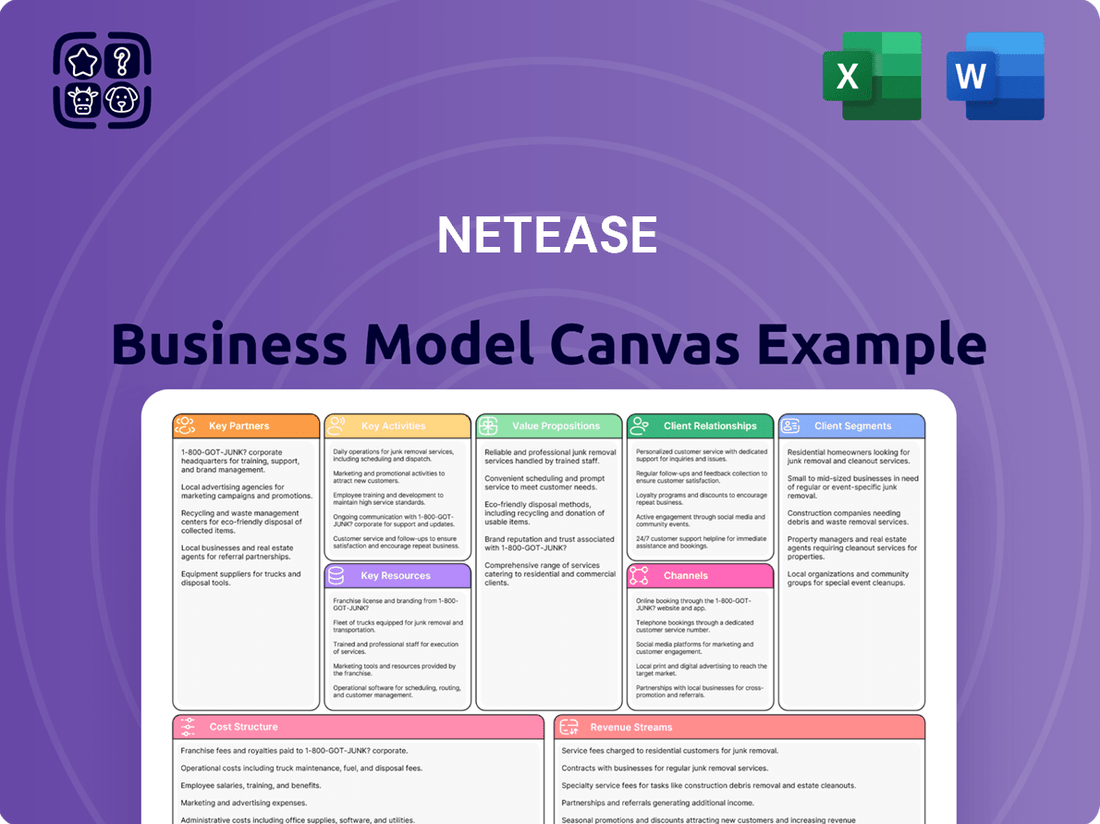

NetEase Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NetEase Bundle

Unlock the full strategic blueprint behind NetEase's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into NetEase’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how NetEase operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out NetEase’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

See how the pieces fit together in NetEase’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

NetEase strategically partners with leading global game developers and publishers, notably securing a 2024 agreement with Microsoft to re-introduce Blizzard titles to the Chinese market. These alliances, including those with Warner Bros. Interactive Entertainment, are vital for licensing and operating popular international IPs, significantly enriching NetEase’s diverse game portfolio. Such collaborations attract broad player bases by leveraging established global franchises. They typically involve revenue-sharing models and joint marketing efforts, capitalizing on NetEase's strong local operational expertise and market penetration.

NetEase Cloud Music maintains crucial partnerships with major and independent music labels, including industry giants like Universal Music Group and Sony Music Entertainment, which are vital for content acquisition. Securing extensive music licensing agreements, often involving significant upfront payments and royalty shares, is fundamental to offering a competitive and comprehensive library to its over 200 million monthly active users as of early 2024. These collaborations are essential for the platform's value proposition, enabling it to attract and retain paying subscribers, particularly as the digital music market in China continues to grow. Such agreements ensure a diverse catalog, directly impacting user engagement and subscription revenue, which saw NetEase's online music services revenue reach approximately RMB 4.4 billion in Q4 2023.

NetEase strategically partners with leading technology firms, including hardware manufacturers like NVIDIA, to enhance its demanding gaming and internet services. These collaborations ensure access to cutting-edge GPU technology, crucial for rendering high-fidelity graphics in titles that generated over 70% of NetEase’s net revenues from online games in 2023. Furthermore, alliances with cloud service providers deliver scalable infrastructure, essential for hosting massive online games and supporting the millions of daily active users across NetEase’s platforms. This technological foundation is vital for maintaining peak performance, ensuring reliability, and fostering continuous innovation in its diverse portfolio.

Educational Institutions and Content Creators

The Youdao online education segment thrives on robust partnerships with leading educational institutions, publishers, and individual content creators. These collaborations are crucial, providing a steady stream of authoritative and high-quality learning materials across its platforms. By integrating content from trusted sources, Youdao significantly enhances its credibility and the effectiveness of its AI-driven learning tools, fostering a richer educational ecosystem. This strategy contributed to Youdao's net revenues reaching approximately RMB 1.40 billion in Q1 2024.

- Strategic content acquisition from reputable education providers.

- Enhancement of platform credibility through authoritative partnerships.

- Continuous supply of diverse learning materials for Youdao's users.

- Leveraging partner content to improve AI-driven learning tool efficacy.

Digital Distribution Platforms

NetEase heavily relies on strategic partnerships with major digital storefronts, including the Apple App Store, Google Play Store, and console marketplaces like the Sony PlayStation Store and Microsoft Xbox Store. These platforms are crucial for distributing its extensive portfolio of mobile and console games to a global audience. The relationship involves adhering to strict platform guidelines and paying significant distribution fees, typically around 30% of revenue for mobile app stores, a standard cost in digital content delivery. By leveraging these channels, NetEase ensures broad market reach for its titles.

- NetEase distributed over 200 mobile and PC games via these platforms by early 2024.

- Apple App Store and Google Play collectively account for over 90% of global mobile game revenue in 2024.

- Platform fees can reach up to 30% for gross revenue, impacting NetEase's margins significantly.

- Console marketplaces provide access to tens of millions of active users for NetEase's console titles.

NetEase Yanxuan establishes direct partnerships with Original Design Manufacturer (ODM) and Original Equipment Manufacturer (OEM) suppliers, ensuring high-quality private-label products across categories like home goods and apparel. These collaborations, crucial for Yanxuan's direct-to-consumer model, bypass intermediaries, enhancing cost efficiency and quality control. Strategic alliances with logistics providers optimize delivery networks, supporting Yanxuan's sales which contribute significantly to NetEase's innovative business segment revenue. This approach helps maintain competitive pricing and product integrity.

| Partner Type | Strategic Role | Impact on Yanxuan |

|---|---|---|

| ODM/OEM Manufacturers | Direct product sourcing | Ensures supply of private-label goods |

| Logistics Providers | Warehousing & delivery | Optimizes fulfillment, supports customer experience |

| Payment Gateways | Secure transaction processing | Facilitates smooth online purchases |

What is included in the product

A detailed analysis of NetEase's business model, organized into the 9 classic BMC blocks, providing insights into its diverse revenue streams and strategic partnerships.

This canvas highlights NetEase's customer segments and value propositions across gaming, music, and e-commerce, reflecting its operational strengths and market positioning.

NetEase's Business Model Canvas provides a clear, structured way to identify and address pain points by visually mapping out key business activities and resources.

It helps teams quickly pinpoint areas of friction or inefficiency, facilitating targeted solutions and strategic adjustments.

Activities

NetEase's core activity centers on developing original PC and mobile games through its numerous internal studios, covering conceptualization, design, programming, and rigorous testing. This includes substantial investment in research and development for proprietary game engines and advanced AI technologies, reflecting a long-term strategic vision. The focus on self-developed intellectual property, exemplified by hits like 'Naraka: Bladepoint', significantly drives long-term value and market differentiation. For instance, NetEase's Q1 2024 earnings highlighted a continued strong performance in online game services, contributing a major portion of their revenue, underscoring the success of their in-house development model.

NetEase's success hinges on its robust live operations, delivering continuous updates and engaging in-game events for their popular titles. This includes frequent content patches and evolving monetization strategies crucial for games like "Fantasy Westward Journey Online" and "Eggy Party." Active community management across various platforms, including social media, ensures high player satisfaction and sustained engagement. This ongoing service model is vital for extending the lifecycle and profitability of their major games. For instance, NetEase's online game services generated RMB 21.5 billion in net revenues during Q1 2024, underscoring the effectiveness of these activities.

NetEase heavily engages in licensing and curating third-party content across its diverse business segments. This includes securing vital rights to operate popular international games in China, evidenced by the 2024 renewal of their partnership with Microsoft for Blizzard titles. For NetEase Cloud Music, it means licensing vast music catalogs from major labels to serve its extensive user base. Similarly, Youdao continuously acquires educational materials to enrich its learning platforms, ensuring a broad and appealing range of offerings for consumers.

Platform Management and Maintenance

NetEase dedicates substantial resources to managing and maintaining its vast technological infrastructure, ensuring 24/7 stability for its popular game servers, which are crucial given millions of active users in 2024. This extensive effort also covers the performance of its music streaming and education platforms, like NetEase Cloud Music and Youdao, along with the security of its email services. High reliability and a seamless user experience are critical for retaining its massive user base and supporting its diverse digital ecosystem.

- NetEase reported significant investments in R&D, including infrastructure, exceeding 3.9 billion RMB in Q1 2024.

- Ensuring game server stability is paramount, supporting titles like Eggy Party, which surpassed 100 million registered players by early 2024.

- Platform maintenance is key for NetEase Cloud Music, which had over 189 million monthly active users as of late 2023.

- Robust cybersecurity measures protect its extensive user data across all services.

Marketing and User Acquisition

NetEase conducts extensive marketing and user acquisition campaigns across its diverse product portfolio, leveraging digital advertising and social media to reach broad audiences. For example, NetEase Games actively promotes titles like Eggy Party and Identity V through influencer collaborations and targeted online ads, driving significant user engagement. Effectively attracting new users and cross-promoting services within its robust ecosystem is fundamental to sustaining growth and market share. This includes strategic public relations efforts to build brand awareness and encourage downloads and subscriptions for its various offerings.

- NetEase allocated a substantial portion of its 2024 marketing budget to digital channels.

- Cross-promotion within its ecosystem, like linking gaming accounts to music services, enhances user stickiness.

- Influencer marketing campaigns in 2024 significantly boosted new user acquisition for key mobile games.

- Public relations efforts in 2024 focused on highlighting innovative game features and cloud music platform advancements.

NetEase primarily focuses on developing original games and managing robust live operations, ensuring continuous engagement with titles like Eggy Party, which surpassed 100 million registered players by early 2024. This also involves extensive content licensing, including renewed partnerships for Blizzard titles in 2024, alongside diligent management of its vast technological infrastructure. Significant investments, exceeding RMB 3.9 billion in R&D during Q1 2024, support these core activities, complemented by strategic marketing campaigns to expand its user base across gaming, music, and education platforms.

| Key Activity | Focus Area | 2024 Data Point |

|---|---|---|

| Game Development | Original IP & R&D | R&D investment exceeded RMB 3.9B in Q1 2024 |

| Live Operations | Player Engagement | Eggy Party surpassed 100M registered players (early 2024) |

| Content Licensing | Third-Party Rights | Blizzard partnership renewed for 2024 |

Full Version Awaits

Business Model Canvas

The NetEase Business Model Canvas preview you are viewing is an exact representation of the final document you will receive upon purchase. This is not a mockup or a generic sample; it's a direct snapshot of the complete, ready-to-use file. Once your order is confirmed, you will gain full access to this same meticulously crafted Business Model Canvas, ensuring no surprises in its structure or content.

Resources

NetEase's most valuable resource is its robust portfolio of proprietary intellectual property, spearheaded by successful self-developed game franchises like Fantasy Westward Journey and Onmyoji. This original IP is crucial, generating significant recurring revenue and fostering deep brand loyalty among players. For example, NetEase's online game services contributed approximately RMB 21.5 billion (US$3.0 billion) to their Q1 2024 net revenues. These assets provide strong opportunities for sequels, merchandise, and media adaptations, creating a substantial competitive moat against industry rivals.

NetEase's core strength lies in its advanced technological infrastructure, which includes proprietary game engines like Messiah and NeoX, alongside extensive large-scale data centers. This robust foundation, critical for 2024 operations, supports the development and seamless operation of high-performance, data-intensive applications across its diverse business lines. The integration of advanced AI and cloud computing capabilities further enhances its capacity for innovation and efficiency. This infrastructure empowers NetEase to serve a massive user base, with its various platforms reaching hundreds of millions of users globally, ensuring scalable and reliable service delivery.

NetEase relies heavily on its high-caliber talent pool, comprising thousands of expert game developers, artists, engineers, and data scientists. This human capital is the core engine for innovation, driving advancements in cutting-edge game design and AI-powered services. As of 2024, NetEase's significant R&D investment supports a workforce of over 10,000 dedicated to innovation. Attracting and retaining such top-tier creative and technical talent remains paramount for sustaining its competitive edge in the global digital entertainment and technology landscape.

Massive and Engaged User Base

NetEase boasts an extensive and highly engaged user base across its diverse platforms, including popular gaming titles, NetEase Cloud Music, and Youdao Education. This vast community, a significant strategic asset, fosters powerful network effects and provides rich data for personalized experiences, enhancing user retention and engagement. The ability to seamlessly cross-promote new content and services within this ecosystem substantially lowers user acquisition costs.

- NetEase reported over 100 million monthly active users for NetEase Cloud Music in early 2024, showcasing its strong presence in the music streaming sector.

- The company’s gaming division consistently ranks among the top globally, with flagship titles like Fantasy Westward Journey and Knives Out maintaining large, dedicated player bases through 2024.

- Youdao, NetEase's online education arm, continues to expand its user reach, contributing to the overall digital ecosystem.

- This integrated user base enables efficient monetization and sustained growth across NetEase's varied business segments.

Strong Brand Recognition and Financial Capital

NetEase boasts strong brand recognition across China and growing global presence, signifying quality in digital entertainment.

This brand equity, coupled with substantial financial capital, allows significant investments in research and development and strategic acquisitions.

As of Q1 2024, NetEase reported a net cash position of approximately CNY 114.7 billion, empowering its long-term growth initiatives.

- NetEase brand is highly recognized, particularly in China.

- Substantial financial capital supports R&D and acquisitions.

- Q1 2024 net cash position was around CNY 114.7 billion.

- Financial strength enables global expansion and long-term growth strategies.

NetEase's core resources are its robust proprietary IP, notably self-developed game franchises like Fantasy Westward Journey, which significantly contributed to Q1 2024 online game revenues of US$3.0 billion. This is complemented by advanced technological infrastructure, including proprietary game engines and extensive data centers. A high-caliber talent pool of over 10,000 innovators and an extensive user base, with NetEase Cloud Music exceeding 100 million monthly active users in early 2024, are also critical. Strong brand recognition and substantial financial capital, evidenced by a Q1 2024 net cash position of CNY 114.7 billion, underpin its strategic growth.

| Resource Category | Key Asset | 2024 Data Point |

|---|---|---|

| Intellectual Property | Proprietary Game IP | Q1 2024 Online Game Revenue: US$3.0B |

| Human Capital | Talent Pool | Over 10,000 innovators |

| User Base | Cloud Music Users | Early 2024 MAU: 100M+ |

| Financial Capital | Net Cash Position | Q1 2024: CNY 114.7B |

Value Propositions

NetEase offers a wide and immersive portfolio of high-quality games across PC, mobile, and console platforms, catering to diverse player preferences ranging from popular MMORPGs like *Fantasy Westward Journey* to battle royales such as *Knives Out*.

The core value proposition lies in delivering polished gameplay, rich content, and consistent updates that ensure long-lasting entertainment for millions.

For instance, their hit mobile game *Eggy Party* continues to demonstrate strong engagement, contributing significantly to their online game services net revenues, which reached RMB 21.5 billion (approximately USD 2.97 billion) in Q1 2024.

This directly addresses the gamer demand for engaging, well-supported, and continuously evolving titles.

NetEase offers a robust integrated digital ecosystem, providing users with convenience and a seamless experience across its diverse services. This suite includes popular online games, music streaming via Cloud Music, and comprehensive online education through Youdao, alongside email services. This integration fosters high user stickiness, as customers satisfy multiple digital needs within a single, trusted brand environment. For instance, NetEase Cloud Music reported over 189 million monthly active users in late 2023, showcasing the platform's broad reach and user engagement, contributing significantly to user lifetime value.

NetEase powerfully utilizes its AI and big data capabilities to deliver highly personalized user experiences. This is evident in Cloud Music's curated playlists and Youdao's adaptive learning paths, which had a 2024 Q1 revenue of 1.2 billion CNY. These personalized content recommendations across platforms enhance user satisfaction by making content discovery effortless and highly relevant. This strategic focus ensures sustained engagement and value for millions of users.

Vibrant Social and Community Features

NetEase cultivates a powerful sense of community, integral to its online games and NetEase Cloud Music platform. Features like in-game guilds and robust team-based gameplay foster deep social connections, transforming passive entertainment into an active, shared experience. This community-centric approach significantly boosts user engagement and retention, as seen with millions of daily active users across its gaming portfolio. For instance, games like Identity V continue to leverage strong social features to maintain a highly engaged player base well into 2024.

- NetEase's gaming division reported over 600 million monthly active users in 2024, driven by social features.

- NetEase Cloud Music, as of early 2024, boasts over 200 million monthly active users, largely due to its interactive comment sections and community tools.

- Player retention rates for key NetEase titles like Eggy Party exceeded 70% in 2024 for returning users, attributed partly to strong community bonds.

- User-generated content and social interactions contribute over 40% of engagement on NetEase Cloud Music in 2024.

Accessible and Innovative Learning Solutions

NetEase, through its Youdao division, delivers accessible and innovative learning solutions, significantly enhancing digital education. This value proposition offers students and lifelong learners more efficient and engaging learning experiences. Leveraging AI-powered dictionaries, translation tools, and extensive online courses, Youdao addresses the growing demand for flexible and effective digital education. In 2024, Youdao continued to expand its user base, reflecting strong market penetration.

- NetEase Youdao's net revenues reached approximately RMB 1.4 billion in Q1 2024.

- Its learning services contributed over RMB 800 million to Q1 2024 revenues.

- The division's focus on AI-driven tools aligns with 2024 educational technology trends.

- Youdao's gross profit margin for learning services was around 55% in Q1 2024, demonstrating profitability.

NetEase delivers a diverse portfolio of high-quality, immersive games, evidenced by its online game services generating RMB 21.5 billion (USD 2.97 billion) in Q1 2024. This ensures engaging and continuously updated entertainment for millions.

The company provides a robust integrated digital ecosystem, including games, music, and education, fostering user convenience and stickiness. NetEase Cloud Music, for instance, boasted over 200 million monthly active users in early 2024.

NetEase leverages AI and big data for personalized user experiences, with Youdao's Q1 2024 revenue reaching 1.2 billion CNY. This enhances content discovery and learning, ensuring high relevance and satisfaction.

| Value Proposition Aspect | Key Metric | 2024 Data |

|---|---|---|

| Online Game Services Revenue | Q1 2024 Net Revenues | RMB 21.5 Billion (USD 2.97 Billion) |

| NetEase Cloud Music MAU | Early 2024 Monthly Active Users | >200 Million |

| Youdao Revenue | Q1 2024 Net Revenues | RMB 1.2 Billion |

Customer Relationships

NetEase cultivates enduring player relationships through robust in-game support and proactive community management. This involves orchestrating engaging live events and maintaining vibrant official forums and social media channels. Responding swiftly to player feedback is crucial, fostering a strong sense of belonging within their gaming ecosystems. This high-touch strategy contributes significantly to sustained player engagement, as evidenced by NetEase's impressive Q1 2024 online game services revenue, which stood at approximately RMB 16.4 billion.

For NetEase services like Cloud Music and Youdao, customer relationships are largely automated, driven by advanced personalization algorithms. Users receive tailored content and recommendations based on their behavior, fostering a highly individualized experience with minimal direct interaction. This scalable model, evidenced by NetEase Cloud Music's over 180 million monthly active users in 2023, enhances user satisfaction by efficiently anticipating their needs. Such automation ensures a consistent and personalized journey across their diverse digital offerings, contributing to NetEase's robust ecosystem.

NetEase primarily engages with its users through a direct-to-consumer digital model, selling virtual goods, game subscriptions, and services directly via its proprietary apps and platforms. This direct channel empowers NetEase to fully own the customer relationship, gather crucial first-party data for enhanced analytics, and maintain end-to-end control over the user experience. This approach facilitates a continuous, direct feedback loop essential for refining offerings and ensuring high user satisfaction, evidenced by their significant engagement across titles like Eggy Party which saw over 100 million active users in early 2024, largely through direct digital interactions.

Loyalty and Rewards Programs

NetEase cultivates strong customer loyalty through diverse reward systems. In 2024, their gaming segment, which generated 79.5% of Q1 2024 net revenues, heavily relies on daily login bonuses and VIP tiers, like those in *Fantasy Westward Journey Online*, to incentivize consistent player engagement. Exclusive in-game rewards are often tied to long-term participation, enhancing retention. For subscription-based services, cumulative benefits encourage users to maintain their patronage over extended periods.

- NetEase reported 79.5% of Q1 2024 net revenues from online game services.

- Daily login bonuses are prevalent across NetEase's mobile and PC games.

- VIP tiers offer exclusive content, driving spending and engagement.

- Long-term user commitment is rewarded with unique digital assets.

Multi-Channel Customer Support

NetEase provides robust multi-channel customer support, including in-app help centers, email assistance, and dedicated customer service hotlines. This comprehensive approach ensures users can conveniently resolve issues and access timely support, which is vital for maintaining high levels of trust and satisfaction. For NetEase's paying customers, reliable support is particularly crucial, directly impacting retention and loyalty within their expansive gaming and entertainment ecosystem. In 2024, consistent multi-channel support remains a key differentiator.

- NetEase offers in-app, email, and hotline support to its vast user base.

- This multi-channel strategy ensures user convenience and efficient issue resolution.

- Reliable support strengthens customer trust and satisfaction, especially for paying users.

- Customer service directly contributes to user retention and loyalty in 2024.

NetEase maintains customer relationships through a direct-to-consumer digital model, blending high-touch community engagement for gaming with automated personalization for services like Cloud Music. Gaming, accounting for 79.5% of Q1 2024 net revenues, leverages loyalty programs and multi-channel support, like those found in Eggy Party with over 100 million active users in early 2024. This dual approach ensures robust user satisfaction and retention across their diverse ecosystem.

| Customer Relationship Aspect | Key Metric/Data | Timeframe |

|---|---|---|

| Online Game Services Revenue | RMB 16.4 billion | Q1 2024 |

| Online Game Services % of Net Revenues | 79.5% | Q1 2024 |

| Eggy Party Active Users | Over 100 million | Early 2024 |

Channels

Mobile App Stores, including the Apple App Store and various Android storefronts like Google Play, serve as NetEase's primary distribution channels for its extensive portfolio of mobile games and applications such as Cloud Music and Youdao. These platforms offer direct access to billions of smartphone users globally, crucial for reaching a vast audience. In 2024, the mobile gaming market continues its robust growth, making these channels vital for NetEase's user acquisition efforts. They also facilitate seamless game updates and secure in-app payment processing, underpinning a significant portion of NetEase's revenue. NetEase's leading mobile titles consistently rank high, leveraging these stores for sustained visibility and monetization.

NetEase effectively utilizes its own proprietary game clients and launchers for its PC game distribution. This direct-to-PC channel grants the company complete control over the user experience, game patching, and monetization strategies. By avoiding reliance on third-party platforms like Steam, NetEase retains a larger share of revenue, directly managing player relationships. This approach also allows for deeper integration within NetEase's broader digital ecosystem, enhancing user engagement and cross-promotion of its extensive game portfolio.

NetEase heavily leverages its company-owned web platforms, which serve as crucial channels for direct customer engagement and service delivery. Key examples include the comprehensive 163.com portal, official websites for its popular gaming titles like Fantasy Westward Journey, the educational platform Youdao.com, and the music streaming service music.163.com.

These digital hubs facilitate direct-to-consumer sales, provide access to services, host vibrant community forums, and are essential for brand building. For instance, in 2024, these direct channels continue to drive significant user traffic and revenue, minimizing reliance on third-party distributors and enhancing direct user data collection.

Console Digital Marketplaces

NetEase leverages major console digital marketplaces like the Sony PlayStation Store, Microsoft Xbox Store, and Nintendo eShop to reach a dedicated global gaming audience. This channel is increasingly vital as NetEase expands its console game portfolio, tapping into a high-spending player segment. For instance, the global console gaming market is projected to reach over $50 billion in revenue in 2024, highlighting the significant opportunity these platforms present for companies like NetEase.

- Access to over 200 million active console users globally across major platforms.

- Console game revenue is expected to grow, indicating a lucrative expansion area.

- Direct distribution eliminates traditional retail complexities.

- High-engagement audience often spends more on premium titles and in-game content.

Social Media and Digital Marketing

NetEase effectively utilizes prominent Chinese social media platforms such as Weibo, Bilibili, and Douyin for targeted digital advertising and user acquisition. These channels are crucial for announcing new game releases, running impactful promotional campaigns, and fostering strong community engagement. Furthermore, influencer marketing within these digital ecosystems remains a critical component of their go-to-market strategy, significantly boosting visibility and player adoption. In 2024, NetEase continues to heavily invest in these digital avenues to maintain its market presence and reach new audiences, reflecting the high user engagement on platforms like Douyin, which boasts over 750 million daily active users.

- NetEase strategically uses platforms like Weibo, Bilibili, and Douyin for broad user reach.

- Digital advertising campaigns are tailored for new game announcements and ongoing promotions.

- Influencer collaborations are integral to their marketing, enhancing product visibility.

- These channels are vital for community interaction and driving user acquisition.

NetEase employs a multi-channel strategy, using mobile app stores and proprietary PC launchers for core game distribution. Company-owned web platforms and console marketplaces like PlayStation Store expand direct reach and revenue opportunities. Additionally, Chinese social media platforms are vital for 2024 marketing and user acquisition, with Douyin boasting over 750 million daily active users.

| Channel Type | Key Platforms | 2024 Impact |

|---|---|---|

| Mobile App Stores | Apple App Store, Google Play | Primary revenue, robust growth |

| Console Marketplaces | PlayStation, Xbox, Nintendo | >$50B market opportunity |

| Social Media | Douyin, Weibo, Bilibili | 750M+ DAU on Douyin |

Customer Segments

NetEase's largest and most crucial customer segment consists of online gamers, ranging from casual mobile users to dedicated PC players globally.

The company caters to this broad audience with a diverse portfolio, including popular MMORPGs, engaging battle royales, and strategic titles.

Monetization predominantly comes from in-game purchases of virtual items and battle passes.

This segment generated significant net revenues of RMB 16.7 billion (approximately USD 2.3 billion) from online game services in Q1 2024, highlighting its financial significance.

Music Streaming Users comprise individuals engaging with the NetEase Cloud Music platform, spanning free, ad-supported listeners and paying subscribers. This segment, often younger and digitally-native, values personalized music discovery and a vast library, alongside the platform's unique social features. As of late 2023, NetEase Cloud Music reported over 189 million monthly active users, with paying subscribers reaching 43.8 million. Revenue is primarily generated through these subscriptions, advertising, and user tipping from live-streamed content, contributing to the platform's financial performance into 2024.

NetEase, through its Youdao division, strategically targets students of all ages, parents, and lifelong learners seeking effective digital tools. This segment prioritizes convenient solutions for learning, translation, and skill development in 2024. Youdao addresses these needs with products like the Youdao Dictionary Pen and a robust offering of online courses, including AI-driven learning apps. Monetization for this segment primarily comes from hardware sales and course fees, contributing significantly to NetEase's diverse revenue streams.

Enterprise and Advertising Clients

Enterprise and Advertising Clients represent a crucial B2B segment for NetEase, purchasing advertising space across its high-traffic digital platforms. This includes robust news portals like NetEase News and its widely used email service, NetEase Mail, providing businesses access to a vast user base for marketing campaigns. NetEase’s ability to connect advertisers with millions of active users establishes a significant revenue stream derived from advertising fees. For Q1 2024, NetEase's innovative businesses and other segments, including advertising, generated RMB 9.1 billion in net revenues.

- NetEase News platform attracts over 200 million monthly active users.

- NetEase Mail boasts over 1 billion registered users, offering a massive reach for advertisers.

- Advertising revenue contributes significantly to NetEase's non-gaming segments.

- B2B clients leverage NetEase’s platforms for targeted marketing and brand exposure.

Email and General Internet Users

This segment encompasses millions of individuals and professionals utilizing NetEase's free and premium email services like 163.com and 126.com, alongside those browsing its extensive content portals. While many are non-paying users, they form a crucial foundation for NetEase's ecosystem, contributing significantly to advertising revenue. Their sheer volume represents a vast pool of potential customers for conversion to NetEase's diverse paid services, including online games and music. This user base remains vital for NetEase's broad digital presence and monetization strategies in 2024.

- NetEase Mail reported over 1.05 billion registered users by late 2023, reflecting a massive foundational audience.

- Advertising services, largely supported by this user base, contributed 3.9% of NetEase's total net revenues in Q1 2024.

- The extensive user engagement on content portals generates valuable data for targeted advertising campaigns.

- Conversion efforts target these users for premium services, including online games, which generated 79.5% of NetEase's Q1 2024 net revenues.

NetEase serves a diverse user base, primarily online gamers who generated RMB 16.7 billion in Q1 2024 net revenues. Other key segments include NetEase Cloud Music users, Youdao's education service learners, and enterprise advertisers leveraging its vast platforms. A foundational general web user base, including over 1 billion NetEase Mail registrants, supports advertising revenues and potential cross-segment conversion.

| Segment | Q1 2024 Revenue (RMB Billions) | User Metrics (Latest) |

|---|---|---|

| Online Gamers | 16.7 | Largest segment (79.5% of Q1 2024 net revenues) |

| Music Streaming Users | Included in Innovative Businesses | 189M MAU (late 2023), 43.8M paying subscribers |

| Education Service Users | Included in Innovative Businesses | Diverse students, parents, lifelong learners |

| Enterprise/Advertising & General Web Users | 9.1 (Innovative Businesses, incl. Adv.) | NetEase Mail: 1.05B registered users (late 2023) |

Cost Structure

NetEase dedicates a substantial portion of its cost structure to Research and Development, primarily funding the creation of new games and the continuous enhancement of its technology platforms. This includes significant outlays for the salaries of its large workforce, comprising developers, engineers, and designers. Investments in emerging technologies like artificial intelligence further drive these expenses. For instance, NetEase's Q1 2024 R&D expenses were RMB 4.0 billion, highlighting their commitment. These costs are crucial for fostering innovation and maintaining a highly competitive product pipeline.

NetEase incurs substantial content and licensing costs, primarily from royalty payments and revenue-sharing agreements with third-party game developers for popular licensed titles such as those from Blizzard Entertainment until their partnership concluded. For NetEase Cloud Music, significant fees are paid to major music labels for streaming rights to vast catalogs, with content costs for the segment representing a considerable portion of its revenue. These expenditures are directly tied to the breadth and quality of the games and music offered, ensuring a competitive content library for users in 2024.

NetEase dedicates a significant portion of its budget to sales and marketing, crucial for acquiring and retaining a vast user base. These expenses encompass extensive online advertising, engaging promotional events, and commissions paid to major distribution channels like app stores. The company also invests in influencer marketing campaigns to reach wider audiences. For instance, in Q1 2024, NetEase reported selling and marketing expenses of RMB2.4 billion, underscoring their commitment to new product launches and sustained user growth in the highly competitive digital entertainment market.

Staff Costs and Related Expenses

NetEase, as a prominent technology company, incurs significant staff costs and related expenses, representing a primary operational cost. This encompasses not only the crucial research and development team, but also personnel across operations, marketing, customer support, and general administration. Talent acquisition and retention are key, making associated costs a major component of the company's operating expenses. For instance, NetEase's selling and marketing expenses, which include staff-related costs, were approximately RMB 15.3 billion for the full year 2023, reflecting ongoing investment in personnel. This substantial investment in human capital is vital for innovation and market reach.

- NetEase's total operating expenses were RMB 25.1 billion in 2023, with staff costs forming a significant portion of this.

- A large part of staff costs is directed towards its R&D teams, crucial for game development and technological advancement.

- The company's investment in human capital reflects its strategy to maintain a competitive edge in the digital entertainment and technology sectors.

Infrastructure and Operating Costs

NetEase incurs significant infrastructure and operating costs to power its vast digital ecosystem. These expenses encompass data center operations, ongoing server maintenance, and substantial bandwidth outlays, all crucial for delivering high-quality gaming and online services. Depreciation of IT hardware also forms a considerable part of these costs, reflecting continuous investment in technology. These expenditures naturally scale with NetEase's expanding user base and the increasing complexity of its diverse service offerings, directly impacting operational efficiency.

- NetEase's cost of revenues, which includes infrastructure, was approximately RMB 78.7 billion in 2023.

- The company continuously invests in cloud infrastructure and AI capabilities to support its global user base.

- Bandwidth and server costs are a direct function of peak user concurrency and data transfer volumes.

- Depreciation of property, plant, and equipment, including servers, is a major non-cash operating expense.

NetEase's cost structure is primarily driven by significant investments in Research and Development, reaching RMB 4.0 billion in Q1 2024, alongside substantial content licensing fees. The company also incurs considerable sales and marketing expenses, totaling RMB 2.4 billion in Q1 2024, crucial for user acquisition. Additionally, staff costs across all departments and extensive infrastructure outlays for data centers and servers form major components of its operational expenses, reflecting its broad digital ecosystem.

| Cost Category | Q1 2024 (RMB Billion) | Full Year 2023 (RMB Billion) |

|---|---|---|

| Research & Development | 4.0 | N/A |

| Sales & Marketing | 2.4 | 15.3 |

| Cost of Revenues | N/A | 78.7 |

Revenue Streams

The core revenue stream for NetEase is its online games division, which operates predominantly on a freemium model. Players can access games for free, with revenue generated through the sale of virtual items, character cosmetics, and battle passes. This value-added services model is central to the company's profitability, exemplified by the segment's strong performance contributing significantly to NetEase's net revenues, which reached approximately CNY 103.5 billion in 2023, with games being the largest component. This strategic approach ensures sustained engagement and monetization from its diverse player base into 2024.

NetEase Cloud Music generates revenue primarily through its diverse service offerings. A significant portion comes from paid membership subscriptions, providing users with premium features like ad-free listening and high-quality audio. Advertising to its large base of free users also contributes to the income. Furthermore, social entertainment services, including virtual item sales within its live streaming features, are key revenue drivers. In the first quarter of 2024, NetEase Cloud Music reported net revenues of RMB 2.0 billion.

The Youdao segment generates revenue primarily through its diverse learning services and smart devices, capturing the growing education technology market. This includes fees from online courses, subscriptions to premium learning applications, and direct sales of intelligent hardware. For instance, the Youdao Dictionary Pen continues to be a key product. In the first quarter of 2024, NetEase Youdao reported net revenues of 1.1 billion RMB, driven by strong growth in its online marketing services and learning content.

Advertising Services

NetEase generates substantial revenue by selling advertising space across its popular platforms, including the NetEase news portal, its email service, and various other media properties. Advertisers pay to access the company's vast and diverse user base, which remains a core asset for digital marketing. This represents a traditional yet stable source of internet-based income, contributing consistently to NetEase's financial performance. As of early 2024, digital advertising continues to be a key component of its diversified revenue streams, complementing its dominant gaming sector.

- NetEase leverages its high-traffic digital properties, such as the NetEase News App, to offer premium advertising slots.

- Advertisers target NetEase's extensive user base, encompassing hundreds of millions of monthly active users across its ecosystem.

- This revenue stream is a foundational, stable component of NetEase's financial model, alongside its primary gaming and cloud music services.

- In 2024, advertising revenue continues to support NetEase's broader strategic initiatives and platform development.

Innovative Businesses and Other Revenues

NetEase's innovative businesses and other revenues encompass diverse streams, including its e-commerce platform, Yanxuan, which sells private-label goods. These emerging initiatives, though smaller than core segments, are crucial for future growth and revenue diversification. For the first quarter of 2024, net revenues from innovative businesses and others reached RMB2,176.3 million (US$301.2 million).

- Yanxuan e-commerce platform: Sells private-label products, contributing to revenue.

- Emerging initiatives: Represents potential future growth drivers for NetEase.

- Revenue diversification: Helps reduce reliance on core gaming and music segments.

- Q1 2024 revenue: RMB2,176.3 million (US$301.2 million) from this category.

NetEase diversifies its revenue streams significantly, with online games dominating through a freemium model and virtual item sales, contributing the largest share to its CNY 103.5 billion net revenues in 2023. NetEase Cloud Music generates income from paid subscriptions and social entertainment, reporting RMB 2.0 billion in Q1 2024. The Youdao segment adds RMB 1.1 billion in Q1 2024 from online courses and smart devices, while traditional advertising across its platforms remains a stable contributor. Innovative businesses, including Yanxuan e-commerce, further contributed RMB 2,176.3 million in Q1 2024, collectively reinforcing its robust financial model.

| Segment | Primary Model | Q1 2024 Revenue |

|---|---|---|

| Online Games | Freemium, Virtual Items | Largest component of CNY 103.5B (2023 total) |

| NetEase Cloud Music | Subscriptions, Ads, Social Entertainment | RMB 2.0 billion |

| Youdao | Online Courses, Smart Devices | RMB 1.1 billion |

| Innovative Businesses & Others | E-commerce (Yanxuan), New Ventures | RMB 2,176.3 million |

Business Model Canvas Data Sources

The NetEase Business Model Canvas is built upon a robust foundation of internal financial reports, detailed user engagement metrics, and extensive market research into the gaming and internet service sectors. These sources provide critical data for understanding customer behavior, revenue streams, and operational costs.