Minova Insurance Holdings Ltd PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Minova Insurance Holdings Ltd Bundle

Uncover the intricate web of external factors influencing Minova Insurance Holdings Ltd's trajectory. Our PESTLE analysis delves into the political stability, economic fluctuations, evolving social attitudes, disruptive technological advancements, stringent environmental regulations, and evolving legal frameworks that shape its operational landscape. Gain a critical understanding of these forces to anticipate challenges and capitalize on emerging opportunities.

Equip yourself with actionable intelligence to navigate the complex environment Minova Insurance Holdings Ltd operates within. This comprehensive PESTLE analysis provides the strategic foresight needed to make informed decisions, mitigate risks, and unlock new avenues for growth. Don't just react to change; proactively shape your strategy.

Ready to gain a competitive edge? Our expertly crafted PESTLE analysis for Minova Insurance Holdings Ltd offers a deep dive into the macro-environmental forces impacting its present and future. Download the full version now for immediate access to insights that will empower your strategic planning and investment decisions.

Political factors

Government policies and regulatory frameworks are critical for specialty insurers like Minova. For example, in the United States, the National Association of Insurance Commissioners (NAIC) continues to refine solvency requirements, with updates to the Risk-Based Capital (RBC) framework expected in 2024-2025 to address emerging risks like cyber and climate. These changes directly affect Minova's capital allocation and operational strategies in its key markets.

Shifts in insurance supervision, licensing, or capital adequacy rules in major operating regions, such as the European Union's Solvency II directive, can demand substantial business model and compliance adjustments. The ongoing review of Solvency II, with potential revisions to risk factors and reporting requirements anticipated by late 2025, poses a direct challenge and opportunity for Minova to adapt its risk management practices.

Political stability in regions where Minova operates or plans to expand is paramount for consistent business operations and investment security. For instance, political uncertainty in certain emerging markets could deter expansion plans or increase the cost of doing business due to potential policy reversals or increased operational risks, impacting Minova's growth trajectory.

Governments worldwide are stepping up their role in managing systemic risks, which directly impacts the insurance industry. For instance, in response to increasing climate-related events, the UK government, through its Flood Re scheme, has been actively involved in managing flood risk for homeowners since 2016, demonstrating a model of public-private partnership that could influence specialist insurance markets.

This growing government intervention, whether through direct provision of coverage, subsidies, or regulatory mandates, shapes the landscape for companies like Minova. The emergence of public-private partnerships, such as those being explored for cyber risk mitigation in several G7 nations, presents both potential opportunities for collaboration and competitive challenges, particularly in sectors deemed critical or prone to widespread disruption.

For example, the European Union's proposed Cyber Risk Insurance Net (CRIN) initiative aims to create a public-private reinsurance pool for large-scale cyberattacks, a move that could significantly alter market dynamics for cyber insurance providers. Minova's strategic planning must account for the evolving scope and nature of these governmental interventions to effectively develop relevant products and maintain a strong market position.

Minova Insurance Holdings Ltd's global operations are significantly influenced by international trade agreements and the prevailing sentiment towards protectionism. The company's extensive network of brokers worldwide relies on smooth cross-border transactions, which can be hampered by new tariffs or non-tariff barriers. For instance, the World Trade Organization (WTO) reported a rise in trade-restrictive measures globally in 2023, a trend that could increase compliance burdens for Minova.

Shifts towards protectionist policies can directly impact Minova's ability to offer its services in certain markets, potentially leading to increased operational costs or even restricted market access. This is particularly relevant for the insurance sector, where regulatory frameworks often vary significantly by country. The International Monetary Fund (IMF) has noted that such policies can fragment global markets, making it harder for companies like Minova to achieve economies of scale.

Conversely, the potential for new trade agreements that liberalize services, including financial services, presents significant opportunities for Minova. Such agreements could pave the way for expansion into new territories and the acquisition of a broader client base. For example, ongoing discussions around digital trade agreements could streamline cross-border data flows essential for modern insurance operations.

Sanctions and Geopolitical Risks

International sanctions, such as those targeting Russia or Iran, directly restrict Minova Insurance Holdings Ltd's ability to underwrite policies for entities or operations within those sanctioned jurisdictions, limiting its market reach and potential revenue streams. For instance, the extensive sanctions imposed on Russia following its 2022 invasion of Ukraine have significantly curtailed insurance opportunities for global firms operating there.

Heightened geopolitical tensions, like ongoing conflicts in Eastern Europe or the Middle East, amplify the risk profile for specialty insurance lines. This includes political risk, trade credit, and terrorism coverage, areas where Minova might see increased demand but also greater underwriting complexity and potential claims. The rise in global conflict, as evidenced by the ongoing war in Ukraine, directly impacts the pricing and availability of war risk insurance, a key segment for specialty insurers.

- Sanctions Impact: Restrictions on insuring entities in sanctioned nations like Russia limit Minova's operational and revenue potential.

- Geopolitical Risk Escalation: Conflicts in regions like Eastern Europe increase demand and complexity for political risk and war insurance.

- Underwriting Adaptation: Minova must continually adjust its underwriting strategies and risk appetite to navigate evolving geopolitical landscapes and associated insurance risks.

- Market Volatility: Geopolitical instability contributes to market volatility, affecting investment returns on Minova's portfolio and potentially increasing claims frequency.

Industry Lobbying and Advocacy

The insurance sector, encompassing specialty lines like those offered by Minova Insurance Holdings Ltd, actively participates in lobbying efforts to influence legislative and regulatory landscapes. This advocacy is crucial for shaping policies that impact solvency requirements, data privacy standards, and the management of emerging risks. For instance, industry groups often advocate for regulatory frameworks that balance consumer protection with the need for insurers to innovate and remain competitive. As of early 2024, discussions around cybersecurity insurance and its regulatory oversight remain a key focus for industry lobbyists, aiming to create clear guidelines that foster growth in this vital specialty area.

Minova, by engaging with industry associations or through direct advocacy, can play a significant role in shaping these policies. This influence helps ensure a more favorable operating environment and promotes fair competition within the specialty insurance market. For example, lobbying can influence the interpretation and implementation of new regulations, potentially reducing compliance burdens or creating opportunities for specialized products. The American Property Casualty Insurance Association (APCIA), a prominent voice, regularly engages with lawmakers on issues affecting property and casualty insurers, including those in specialty lines.

Key areas of focus for industry lobbying often include:

- Solvency Regulations: Advocating for capital requirements that are robust yet not overly burdensome, allowing for sustainable growth and underwriting capacity.

- Data Privacy and Security: Shaping regulations to protect sensitive customer data while enabling insurers to leverage data analytics for risk assessment and product development.

- Emerging Risks: Influencing policy responses to new and evolving risks, such as cyber threats, climate change impacts, and supply chain disruptions, to ensure adequate insurance solutions can be developed and offered.

- Fair Competition: Promoting a level playing field that prevents undue advantages for state-run or non-traditional market participants.

Government policies and regulatory frameworks are critical for specialty insurers like Minova. For example, in the United States, the National Association of Insurance Commissioners (NAIC) continues to refine solvency requirements, with updates to the Risk-Based Capital (RBC) framework expected in 2024-2025 to address emerging risks like cyber and climate. These changes directly affect Minova's capital allocation and operational strategies in its key markets.

Shifts in insurance supervision, licensing, or capital adequacy rules in major operating regions, such as the European Union's Solvency II directive, can demand substantial business model and compliance adjustments. The ongoing review of Solvency II, with potential revisions to risk factors and reporting requirements anticipated by late 2025, poses a direct challenge and opportunity for Minova to adapt its risk management practices.

Political stability in regions where Minova operates or plans to expand is paramount for consistent business operations and investment security. For instance, political uncertainty in certain emerging markets could deter expansion plans or increase the cost of doing business due to potential policy reversals or increased operational risks, impacting Minova's growth trajectory.

What is included in the product

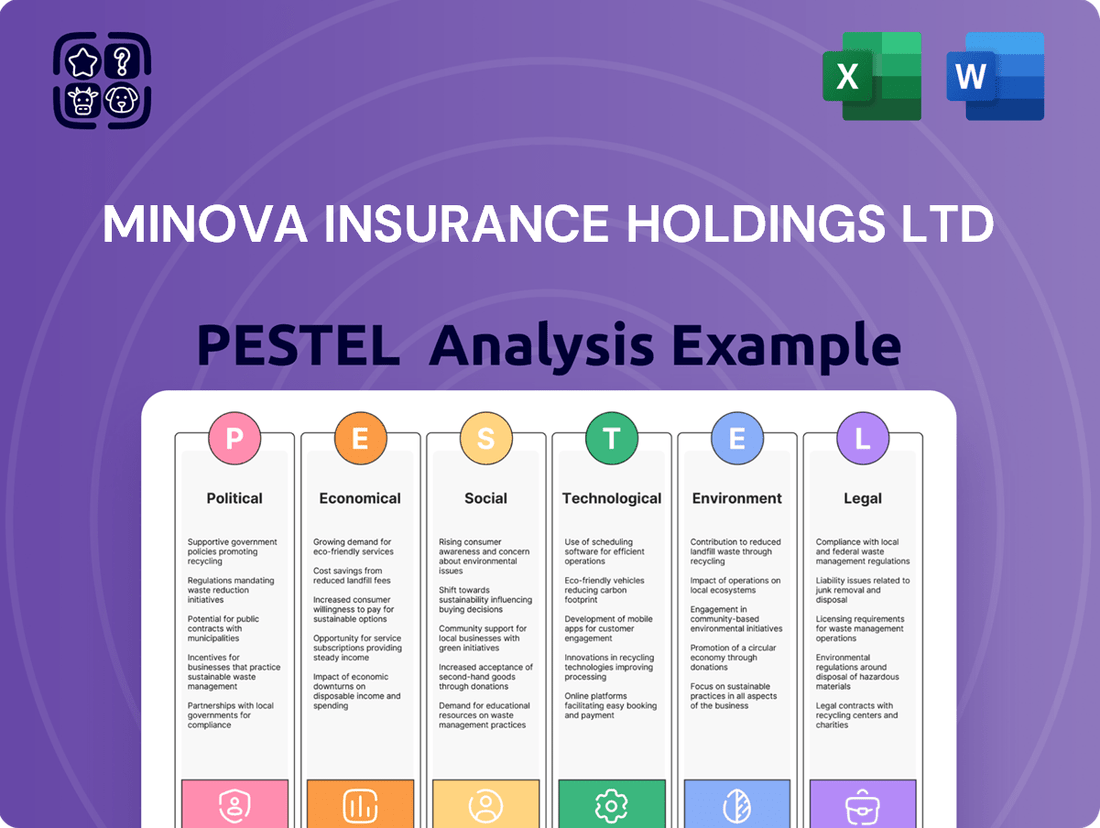

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Minova Insurance Holdings Ltd, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

It offers forward-looking insights into how these dynamic forces present both challenges and strategic opportunities for Minova Insurance Holdings Ltd's growth and sustainability.

Provides a concise PESTLE analysis of Minova Insurance Holdings Ltd, streamlining strategic discussions and identifying key external factors influencing the business.

Economic factors

The global economic landscape in late 2024 and early 2025 presents a mixed picture, with varying growth rates across regions. While some emerging markets are showing robust expansion, developed economies are navigating a more subdued growth environment. For instance, the IMF projected global growth to be around 3.2% for 2024, a slight uptick from previous years, but still subject to geopolitical and inflationary pressures.

This economic backdrop directly impacts Minova Insurance Holdings Ltd. Strong global growth generally translates into increased demand for insurance, particularly for specialized commercial lines as businesses invest and expand. In 2024, sectors like technology and renewable energy, which are experiencing growth, are likely to drive demand for tailored liability and property insurance.

Conversely, periods of heightened economic volatility, characterized by interest rate fluctuations and supply chain disruptions, can dampen corporate spending. For example, if inflation remains persistent, businesses might scale back on discretionary spending, including enhanced insurance coverage, which could affect Minova's premium growth in certain segments.

Minova's performance will therefore be closely tied to the stability and growth trajectory of key global markets. The company's ability to adapt its product offerings to the prevailing economic conditions, whether robust growth or increased uncertainty, will be crucial for maintaining its market position and profitability throughout 2024 and into 2025.

The interest rate environment is crucial for Minova Insurance Holdings Ltd, as a significant portion of its profitability stems from investment income generated by its premium reserves. As of late 2024, central banks globally, including the US Federal Reserve and the European Central Bank, have been navigating a complex landscape. While inflation has shown signs of moderating from its 2023 peaks, policy rates remain elevated compared to the preceding decade, with the US Federal Funds rate hovering around 5.25%-5.50% and the ECB's main refinancing operations rate at 4.50%.

Higher prevailing interest rates, like those experienced in 2024, generally translate into greater investment income for insurers like Minova. This is because the yield on fixed-income securities, which form a substantial part of insurer portfolios, increases. For instance, yields on benchmark 10-year US Treasury bonds have been trading in the 4.25%-4.75% range, offering a more attractive return than in prior years. This directly boosts Minova's ability to generate returns on its held capital.

Conversely, a sustained period of lower interest rates, as seen for much of the 2010s, would compress Minova's investment income and potentially squeeze profitability margins. Furthermore, interest rate fluctuations impact the cost of capital for borrowing and the relative attractiveness of different asset classes. For example, when rates rise, the present value of future cash flows from long-duration assets can decrease, while the appeal of shorter-term, higher-yielding instruments increases.

The ongoing divergence in monetary policy between major economies, with some central banks potentially cutting rates sooner than others in 2025, introduces further complexity. This creates opportunities and challenges for Minova's investment strategy, requiring careful asset allocation to capitalize on varying yield environments across different geographies and maturities, while managing the associated risks.

Inflation poses a significant threat to Minova Insurance Holdings Ltd by increasing the cost of settling claims, as the replacement or repair value of insured assets escalates. For example, persistent inflation in the automotive sector, which saw a 5.4% increase in repair costs in the US during 2023 according to industry reports, directly translates to higher payouts for vehicle insurance.

Beyond claims, operational expenditures for Minova are also on the rise. This includes higher wages needed to retain talent amidst cost of living increases, as well as escalating costs for technology and administrative services. The UK's Consumer Price Index (CPI) remained elevated, averaging 6.8% for 2023, impacting these general business costs.

To counteract these erosive effects on profitability, Minova must strategically adjust its pricing models and bolster its claims reserves. This proactive approach is crucial to maintain healthy profit margins in an environment where the cost of doing business is continually pushed upwards by inflationary pressures.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations pose a significant risk for Minova Insurance Holdings Ltd, particularly given its potential for international operations. When Minova converts revenues earned in foreign currencies back to its reporting currency, adverse exchange rate movements can reduce the reported value of those earnings. For instance, if the US dollar strengthens considerably against currencies where Minova operates, its international profits would translate into fewer dollars.

Volatility in exchange rates also impacts Minova's expenses. If the company incurs costs in foreign currencies, a strengthening reporting currency would make those expenses cheaper. Conversely, a weakening reporting currency would increase the cost of foreign-denominated expenses, thereby squeezing profit margins. The International Monetary Fund (IMF) projects global economic growth to moderate in 2024, which can lead to increased currency volatility as markets react to differing economic performance and monetary policies across regions.

- Impact on Revenue: A stronger reporting currency (e.g., USD) reduces the reported value of foreign currency earnings.

- Impact on Expenses: A weaker reporting currency increases the cost of foreign-denominated operational expenses.

- Risk Management: Minova may need to employ hedging strategies, such as forward contracts, to mitigate the impact of adverse currency movements.

- Profitability Squeeze: Significant, unpredictable swings in exchange rates can introduce financial risk, making financial planning and profitability forecasts more challenging.

Access to Capital and Reinsurance Market Conditions

Minova Insurance Holdings Ltd's capacity to take on substantial or intricate risks is directly tied to its access to adequate capital and the prevailing reinsurance market environment. As of early 2025, global reinsurer capital levels remain a key consideration, with some analysts noting a stabilization after previous volatility. However, ongoing geopolitical instability and the increasing frequency of natural catastrophes continue to exert upward pressure on reinsurance pricing in certain lines, potentially impacting Minova's cost of operations and ability to compete effectively.

For instance, the property catastrophe reinsurance market, a critical area for insurers like Minova, has seen significant price increases in recent renewal periods. Data from industry reports in late 2024 indicated that global reinsurers reported a notable increase in net premiums written, but also faced challenges with elevated claims. This dynamic suggests that while reinsurance capacity may be available, it comes at a higher cost, directly affecting Minova's underwriting profitability and strategic flexibility.

- Capital Availability: The overall health of global financial markets in 2024-2025 impacts the cost and availability of capital for insurers.

- Reinsurance Pricing: Hardening market conditions in key reinsurance segments, driven by loss experience, can increase Minova's operating expenses.

- Underwriting Capacity: Limited reinsurance capacity, particularly for complex risks, could constrain Minova's ability to write new business or expand its portfolio.

- Competitive Landscape: Higher reinsurance costs could disadvantage Minova compared to competitors with more robust capital or captive reinsurance arrangements.

Global economic growth in 2024 and early 2025 is projected to be around 3.2%, with emerging markets showing stronger expansion than developed economies. This growth fuels demand for insurance, especially specialized commercial lines, as businesses invest. However, economic volatility, including persistent inflation and supply chain issues, can temper corporate spending on enhanced insurance coverage, impacting Minova's premium growth.

Preview the Actual Deliverable

Minova Insurance Holdings Ltd PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Minova Insurance Holdings Ltd PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understanding these forces is crucial for strategic decision-making and identifying potential opportunities and threats in the insurance market.

Sociological factors

Societal awareness of risks is definitely shifting. Think about climate change events, like the record-breaking heatwaves in Europe during summer 2024, or the increasing frequency of cyberattacks. These aren't abstract anymore; they're real threats impacting businesses and individuals daily. This heightened awareness directly translates into what clients expect from their insurance providers.

Minova needs to be nimble, adjusting its insurance products to cover these emerging threats. Clients are increasingly looking for protection against reputational damage stemming from social media crises, disruptions to their supply chains – a concern highlighted by global trade tensions in 2024 – and new types of professional liability arising from digital operations. For instance, a 2024 survey indicated that over 60% of businesses now consider cyber risk a top-tier concern, demanding more comprehensive coverage than a few years ago.

Demographic shifts, such as the aging population in many developed countries, directly influence insurance demand. As the workforce ages, there's a greater need for health, retirement, and long-term care insurance products. For instance, in the US, the number of individuals aged 65 and over is projected to reach over 80 million by 2040, highlighting a significant market opportunity for Minova in these specialized coverage areas.

The increasing prevalence of the gig economy and flexible work arrangements also presents a unique sociological challenge and opportunity. These non-traditional employment structures necessitate new insurance solutions, like portable benefits or specialized professional liability for independent contractors. In 2024, the freelance economy is estimated to comprise over 60 million US workers, a segment Minova can target with tailored offerings.

Attracting and retaining a skilled workforce is a critical sociological factor for any company, including Minova Insurance Holdings Ltd. In a competitive talent market, offering robust employee benefits, including comprehensive health insurance and retirement plans, becomes paramount. In 2025, the insurance industry faces a tight labor market, with a projected shortage of actuaries and data scientists, making employee well-being and retention strategies crucial for operational success.

Modern clients, whether they are individuals or businesses, are increasingly demanding greater transparency, faster response times, and more personalized service from their insurance partners. This shift in expectations is a significant sociological factor impacting companies like Minova Insurance Holdings Ltd.

To meet these evolving demands, Minova needs to invest in and optimize its digital platforms, ensuring they are user-friendly and efficient for policy management and claims processing. Clear, proactive communication and the ability to offer customized insurance solutions that align with individual client needs are also paramount. For example, a recent survey indicated that over 60% of consumers expect insurers to offer digital self-service options, a trend that is likely to grow by 2025.

Failure to adapt to these heightened service expectations could result in significant client dissatisfaction, directly impacting Minova's market share. In 2024, customer churn rates in the insurance industry due to poor service were reported to be as high as 15% for some providers, highlighting the critical need for a responsive and client-centric approach.

Public Trust and Ethical Considerations

Public trust is the bedrock of the insurance sector, and for Minova Insurance Holdings Ltd, societal expectations regarding ethical conduct are paramount. Recent surveys in 2024 indicate that over 70% of consumers consider a company's ethical practices when choosing an insurer. This heightened scrutiny extends to claims processing transparency and corporate social responsibility initiatives, directly influencing Minova's brand image and market standing.

Minova's commitment to robust ethical frameworks and demonstrable corporate citizenship is therefore not just a matter of good practice but a strategic imperative. In 2025, emerging trends show a growing segment of the market actively seeking insurers aligned with their values, with a reported 60% of millennials considering sustainability and ethical sourcing when making financial decisions. This necessitates a proactive approach to maintaining impeccable ethical standards to attract and retain these socially conscious clients and build enduring partnerships.

- Reputation Management: Public perception of Minova's ethical behavior, particularly in claims handling, directly influences customer loyalty and new business acquisition.

- Regulatory Scrutiny: Societal emphasis on fairness and transparency often translates into stricter regulatory oversight for the insurance industry.

- Talent Acquisition: A strong ethical reputation makes Minova more attractive to top talent who increasingly prioritize working for socially responsible organizations.

- Investor Relations: Socially responsible investing (SRI) is a growing trend, with funds increasingly evaluating companies based on their environmental, social, and governance (ESG) performance.

Impact of Social Media and Information Dissemination

The swift circulation of information via social media platforms significantly shapes how the public views insurers like Minova. A negative customer experience, or even public questioning of underwriting practices, can rapidly morph into a major reputational challenge. For instance, a viral video of a denied claim, even if justified by policy terms, could lead to widespread backlash, impacting new business acquisition and customer retention.

Minova must therefore be exceptionally vigilant in managing its digital footprint. This involves not only monitoring online conversations but also having robust strategies in place for prompt and transparent communication. In 2024, customer sentiment analysis tools are increasingly crucial for insurers to gauge public perception in near real-time. Failing to address negative discourse effectively can amplify reputational damage, as seen in instances where other financial institutions have faced significant public relations crises due to slow or inadequate responses to social media criticism.

Key considerations for Minova include:

- Proactive Social Listening: Implementing advanced tools to track brand mentions and sentiment across major social media channels.

- Rapid Response Protocols: Developing clear guidelines and teams for addressing customer complaints and public inquiries online.

- Transparent Communication: Clearly explaining policy decisions and company practices to preempt misunderstandings and build trust.

- Influencer Engagement: Strategically partnering with credible voices to positively shape public perception and disseminate accurate information.

Societal expectations around insurance are increasingly shaped by heightened awareness of emerging risks such as climate change and cyber threats. Minova must adapt its offerings to cover these evolving concerns, as demonstrated by the growing demand for more comprehensive cyber risk protection, with over 60% of businesses identifying it as a top-tier concern in 2024.

Demographic shifts, particularly the aging population in developed nations, create opportunities for Minova in health, retirement, and long-term care insurance, reflecting projections of over 80 million Americans aged 65+ by 2040.

Technological factors

Advancements in data analytics and AI are fundamentally reshaping the insurance landscape. Minova can harness these technologies to refine risk assessment, offering more precise pricing models and bolstering fraud detection capabilities. For instance, AI-powered analytics are projected to contribute billions to the global insurance sector's efficiency gains by 2025.

By integrating AI, Minova can automate claims processing, leading to faster settlements and improved customer satisfaction. This technological leap also enables a deeper understanding of intricate specialty risks, a crucial advantage in complex insurance markets. The global AI in insurance market was valued at approximately $2.5 billion in 2023 and is expected to grow significantly, reaching over $10 billion by 2028, highlighting the immense potential for companies like Minova to gain a competitive edge.

Minova, as a company deeply integrated with digital systems, faces escalating cybersecurity threats. These risks range from sophisticated data breaches to disruptive cyberattacks, impacting everything from client data protection to core operational continuity. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the significant financial and reputational stakes involved.

Implementing advanced cybersecurity measures is not merely a technical necessity but a strategic imperative for Minova. These defenses are crucial for safeguarding sensitive client information, ensuring regulatory compliance, and maintaining the trust that underpins its business relationships. Proactive investment in threat detection and response systems is paramount.

The increasing prevalence of cyber threats also fuels a growing demand for specialized cyber insurance products. This trend presents Minova with a dual challenge: the need to protect its own digital assets while simultaneously identifying opportunities to offer tailored cyber insurance solutions to its clients, thereby expanding its service portfolio in a high-growth market.

The insurance industry is experiencing a significant shift due to Insurtech innovation, with new business models and digital platforms rapidly emerging. These advancements are reshaping how insurance is distributed and consumed, forcing traditional players like Minova to adapt. For instance, the global Insurtech market was projected to reach $11.02 billion in 2024, highlighting the scale of this disruption.

Minova needs to actively integrate cutting-edge technologies or partner with Insurtech firms to remain competitive. Collaborating through digital broker platforms, for example, could open up new avenues to reach previously untapped client segments. This strategic approach is crucial for enhancing current offerings and expanding market reach in the evolving digital landscape.

Automation and Operational Efficiency

Automation, particularly through robotic process automation (RPA), is a key technological factor for Minova Insurance Holdings Ltd. It can significantly streamline back-office tasks like policy administration, compliance verifications, and report generation. This streamlining directly translates to substantial cost reductions and a marked decrease in human error.

The implementation of automation is projected to enhance Minova's operational efficiency, enabling faster service delivery to clients. This improved speed and accuracy will bolster Minova's competitive edge in the insurance market. For instance, by 2024, the global RPA market was estimated to reach over $13 billion, indicating widespread adoption and the tangible benefits organizations are realizing.

Key impacts of automation on Minova's operations include:

- Reduced operational costs: Automating repetitive tasks can cut labor expenses.

- Improved accuracy: RPA minimizes human-induced errors in data processing.

- Enhanced customer service: Faster processing times lead to quicker policy issuance and claims handling.

- Increased scalability: Automated systems can handle higher volumes without proportional increases in staffing.

Blockchain and Distributed Ledger Technology

Blockchain and distributed ledger technology (DLT) are poised to revolutionize insurance by streamlining operations. For Minova, this means potential improvements in areas like automated claims processing via smart contracts and more secure, efficient data sharing among partners. The global blockchain in insurance market was valued at approximately USD 500 million in 2023 and is projected to grow significantly, indicating a strong industry trend towards adoption.

Exploring these advancements could offer Minova a competitive edge. Think about how smart contracts could automatically trigger claim payouts once predefined conditions are met, reducing administrative overhead and speeding up settlements. This technology could also enhance transparency in complex specialty insurance transactions, building greater trust with clients and reinsurers. The potential for DLT to create immutable records for policy data and transactions is a key benefit for security and auditability.

- Enhanced Transparency: DLT can provide a shared, immutable record of transactions, improving visibility for all parties involved in specialty insurance.

- Smart Contracts: Automation of policy conditions and claims processing can lead to faster settlements and reduced operational costs.

- Improved Security: Cryptographic principles inherent in blockchain offer robust data protection and fraud prevention capabilities.

- Efficient Data Sharing: DLT facilitates secure and controlled sharing of information between Minova and its partners, simplifying complex reinsurance arrangements.

The technological landscape is rapidly evolving, with AI and automation at the forefront. Minova can leverage these tools for enhanced risk assessment, fraud detection, and claims processing, as AI in insurance is projected to exceed $10 billion by 2028. Furthermore, the rise of Insurtech, with the market valued at $11.02 billion in 2024, necessitates strategic integration or partnerships to maintain competitiveness.

| Technology | Key Benefit for Minova | Relevant Market Data (2023-2025 Projections) |

| AI & Data Analytics | Precise risk assessment, fraud detection, automated claims | AI in Insurance Market: ~$2.5 billion (2023), projected to exceed $10 billion by 2028 |

| Insurtech | New distribution channels, digital platforms, enhanced customer experience | Global Insurtech Market: Projected $11.02 billion (2024) |

| Automation (RPA) | Streamlined back-office tasks, reduced costs, improved accuracy | Global RPA Market: Estimated over $13 billion (2024) |

| Blockchain/DLT | Enhanced transparency, smart contracts for claims, improved security | Global Blockchain in Insurance Market: ~$500 million (2023), significant growth expected |

Legal factors

Minova Insurance Holdings Ltd navigates a complex web of insurance regulatory frameworks across its operating regions. Adherence to stringent solvency requirements, such as those mandated by Solvency II in Europe, is critical for maintaining financial stability and operational licenses. For instance, Solvency II requires insurers to hold sufficient capital against all their risks, with specific Pillar 1 ratios that Minova must consistently meet.

Compliance extends to conduct rules and consumer protection laws, which vary significantly by jurisdiction. In the US, for example, Minova must comply with state-specific regulations governing market conduct, claims handling, and policyholder disclosures. Failure to meet these diverse national and international standards can result in substantial penalties and reputational damage, impacting its ability to operate and grow.

The dynamic nature of these regulations necessitates continuous monitoring and adaptation. For 2024 and into 2025, insurers like Minova are closely watching developments in areas like cyber risk regulation, data privacy laws (building on GDPR principles), and evolving capital requirements driven by macroeconomic factors. Proactive engagement with regulatory bodies and investment in compliance technology are therefore essential for Minova's long-term success.

Global data protection regulations like GDPR and CCPA significantly influence Minova's handling of client information. These laws mandate strict protocols for data collection, storage, and processing, impacting how Minova operates. Failure to comply can lead to substantial penalties; for instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher, a risk Minova must actively mitigate.

Maintaining strong data security and privacy is paramount for Minova, not just to meet legal requirements but also to foster client trust. In 2024, data breaches continued to be a major concern for financial institutions, with average costs escalating. Minova's commitment to robust privacy practices directly supports its reputation and client retention efforts in a landscape where data security is a key differentiator.

Minova Insurance Holdings Ltd, operating as a financial institution, faces significant legal obligations concerning Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF). These regulations mandate the implementation of rigorous Know Your Customer (KYC) protocols, including identity verification and risk assessment, to identify and mitigate potential illicit financial activities. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, with ongoing scrutiny in 2024 and into 2025 on beneficial ownership transparency, a key component of AML compliance.

Furthermore, Minova must maintain comprehensive sanctions screening processes to ensure its operations do not inadvertently facilitate transactions with individuals or entities on government watchlists. Failure to adhere to these stringent legal frameworks can result in substantial financial penalties, regulatory sanctions, and severe damage to the company's reputation. In 2023, global AML fines reached record highs, and this trend is expected to continue as regulatory bodies enhance their enforcement capabilities.

Contract Law and Policy Wording

Contract law forms the bedrock of Minova Insurance Holdings Ltd's operations, dictating the enforceability and interpretation of all its insurance policies. Ensuring that bespoke policy wordings are not only clear and unambiguous but also legally sound is paramount to preventing costly disputes and litigation. For instance, the Insurance Contracts Act in various jurisdictions sets strict standards for disclosure and misrepresentation, directly impacting policy validity.

The dynamic nature of emerging risks, such as cyber threats or climate-related events, frequently requires meticulous legal scrutiny of new product terms and conditions. In 2024, the global insurance industry saw a significant increase in litigation related to coverage for business interruption due to unforeseen events, highlighting the critical need for precise legal drafting.

- Clarity in Policy Wording: Ambiguous clauses can lead to disputes, impacting claim payouts and customer satisfaction.

- Legal Compliance: Adherence to evolving contract law and regulatory frameworks is essential for operational integrity.

- Risk Mitigation: Proactive legal review of new products minimizes the likelihood of litigation and financial penalties.

- Adaptability to New Risks: Policy wording must evolve to accurately reflect and cover contemporary and emerging risks.

Competition Law and Market Conduct

Minova Insurance Holdings Ltd must navigate a complex landscape of competition laws, which are crucial for maintaining a fair marketplace within the specialty insurance sector. These regulations are in place to prevent anti-competitive behaviors such as price fixing, market allocation, and the formation of cartels. For instance, in 2024, regulatory bodies like the European Commission continued to scrutinize insurance mergers and acquisitions for potential impacts on competition, reflecting an ongoing commitment to market fairness.

The company's operations, particularly concerning pricing strategies and its relationships with brokers, are subject to scrutiny under these laws. Adherence to rules governing market conduct ensures that Minova does not engage in practices that could stifle innovation or disadvantage consumers. For example, a 2025 report by the UK's Competition and Markets Authority highlighted concerns regarding transparency in certain financial services, underscoring the importance of clear and fair dealings.

- Pricing Regulations: Minova must ensure its pricing models are compliant and do not constitute predatory pricing or price collusion.

- Broker Agreements: Contracts and relationships with insurance brokers are reviewed to prevent exclusivity clauses that could limit consumer choice.

- Market Share Monitoring: Significant market share gains or mergers may trigger antitrust reviews to assess potential monopolistic effects.

- Consumer Protection: Competition laws ultimately aim to protect policyholders by ensuring a competitive environment that drives better value and service.

Minova Insurance Holdings Ltd faces stringent regulatory oversight, including capital adequacy requirements akin to Solvency II in Europe, demanding robust financial management. Compliance with consumer protection laws and evolving data privacy regulations like GDPR and CCPA is paramount, with significant penalties for breaches. Furthermore, adherence to Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws, including Know Your Customer (KYC) protocols, is critical for operational integrity.

Environmental factors

Climate change is a significant environmental factor for Minova Insurance Holdings Ltd. The increasing frequency and intensity of extreme weather events, such as hurricanes, floods, and wildfires, directly affect the company's underwriting and claims processes. For instance, in 2024, the economic losses from natural catastrophes were estimated to be in the hundreds of billions of dollars globally, with insured losses also reaching substantial figures, impacting property and casualty insurers like Minova.

These escalating weather-related risks necessitate continuous reassessment of Minova's exposure. The company must adapt its risk models to accurately price policies and manage its capital effectively. Failure to do so could lead to underpricing of risks and increased claims payouts, potentially straining profitability and solvency.

Minova's pricing strategies need to evolve to reflect the heightened probability of severe weather. This involves incorporating advanced climate data and predictive analytics into their actuarial calculations. The goal is to ensure premiums adequately cover the anticipated claims costs arising from a changing climate, maintaining the company's financial stability.

The increasing global emphasis on Environmental, Social, and Governance (ESG) factors significantly shapes Minova Insurance Holdings Ltd's operational and investment strategies. This includes evolving mandates for comprehensive sustainability reporting and the integration of climate-related risks into financial disclosures, a trend mirrored by growing investor demand for ESG-aligned portfolios. For instance, by the end of 2024, major financial markets saw a substantial increase in ESG-labeled funds, with assets under management reaching trillions globally.

Adherence to these burgeoning ESG standards directly influences investor and client perceptions, potentially impacting Minova's market competitiveness and access to capital. Companies demonstrating robust ESG performance often attract a broader investor base and may benefit from lower borrowing costs, as evidenced by the widening gap in valuation between high-ESG and low-ESG companies observed throughout 2024.

Resource scarcity and ecological degradation pose significant threats to Minova Insurance Holdings Ltd by potentially disrupting the supply chains of its insured businesses. This can translate into an increase in business interruption claims, impacting profitability. For instance, the ongoing global semiconductor shortage, exacerbated by factors like plant shutdowns and shipping delays, has affected numerous industries, highlighting the vulnerability of intricate supply networks.

Minova must develop a robust understanding of the environmental vulnerabilities affecting its clients' supply chains. This includes assessing risks associated with water scarcity impacting manufacturing, extreme weather events disrupting logistics, and the availability of raw materials. The increasing frequency of climate-related disasters, such as the severe droughts affecting agricultural output in parts of Europe in 2023, directly impacts businesses reliant on those resources.

Pollution and Environmental Liability Risks

Growing public and governmental focus on environmental protection is intensifying pollution and environmental liability risks for companies across various sectors. This heightened awareness translates into more stringent regulations and a greater likelihood of litigation stemming from environmental damage.

As a specialty insurer, Minova Insurance Holdings Ltd. is well-positioned to benefit from increased demand for environmental impairment liability (EIL) coverage. For instance, in 2024, the global environmental insurance market was valued at approximately $15 billion and is projected to grow significantly in the coming years, driven by these evolving risks. Minova's success hinges on its ability to accurately underwrite and price these intricate environmental exposures, which often involve complex scientific and legal considerations.

- Stricter Regulations: Anticipate more rigorous environmental standards, leading to increased compliance costs and potential fines for non-adherence.

- Growing EIL Demand: Expect a surge in the need for specialized EIL policies as businesses seek to mitigate risks associated with pollution incidents.

- Underwriting Complexity: Minova must develop sophisticated methods for assessing and pricing environmental liabilities, which can be highly variable and site-specific.

- Litigation Trends: Be aware of the increasing propensity for lawsuits related to environmental contamination and remediation efforts.

Transition to a Green Economy and New Insurable Risks

The global shift towards a green economy presents both burgeoning opportunities and evolving risks for insurers like Minova. This transition necessitates the development of specialized insurance products tailored for the rapidly expanding renewable energy sector, including solar, wind, and geothermal projects, as well as emerging carbon capture technologies and other sustainable business ventures. For instance, the global renewable energy market was valued at approximately USD 1,068.4 billion in 2023 and is projected to reach USD 2,019.6 billion by 2030, according to some market analyses.

Conversely, Minova must proactively manage the inherent risks associated with 'stranded assets'—traditional, carbon-intensive industries that may face declining value or obsolescence due to environmental regulations and market shifts. This includes insuring assets in fossil fuel extraction and processing, which are increasingly vulnerable to policy changes and reduced demand. A 2024 report from the International Energy Agency highlighted that investments in fossil fuels need to peak and decline sharply this decade to meet climate goals, underscoring the growing 'stranded asset' risk for insurers heavily exposed to these sectors.

- New Product Development: Opportunities exist in insuring offshore wind farms, battery storage facilities, and green hydrogen production.

- Risk Mitigation: Strategies are needed to underwrite and re-insure portfolios with significant exposure to coal-fired power plants or oil sands operations.

- Market Growth: The global market for climate tech, which includes many green economy initiatives, saw significant venture capital investment, indicating substantial growth potential for related insurance products.

Climate change, with its increasing frequency of extreme weather events like hurricanes and wildfires, directly impacts Minova's underwriting and claims. Global insured losses from natural catastrophes in 2024 alone were in the hundreds of billions, necessitating updated risk models and pricing strategies for solvency.

The growing focus on ESG factors influences Minova's operations and investments, with trillions invested globally in ESG funds by the end of 2024, impacting investor perception and capital access.

Resource scarcity and ecological degradation, as seen with supply chain disruptions impacting various industries in 2024, can lead to increased business interruption claims for Minova.

Heightened environmental protection awareness is increasing pollution liability risks, driving demand for Environmental Impairment Liability (EIL) coverage, a market valued around $15 billion in 2024.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Minova Insurance Holdings Ltd is built on a robust foundation of data from leading financial institutions, regulatory bodies, and market research firms. We incorporate insights from economic forecasts, environmental reports, technological advancements, and legislative updates to provide a comprehensive overview.