Meneba Meel BV PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Meneba Meel BV Bundle

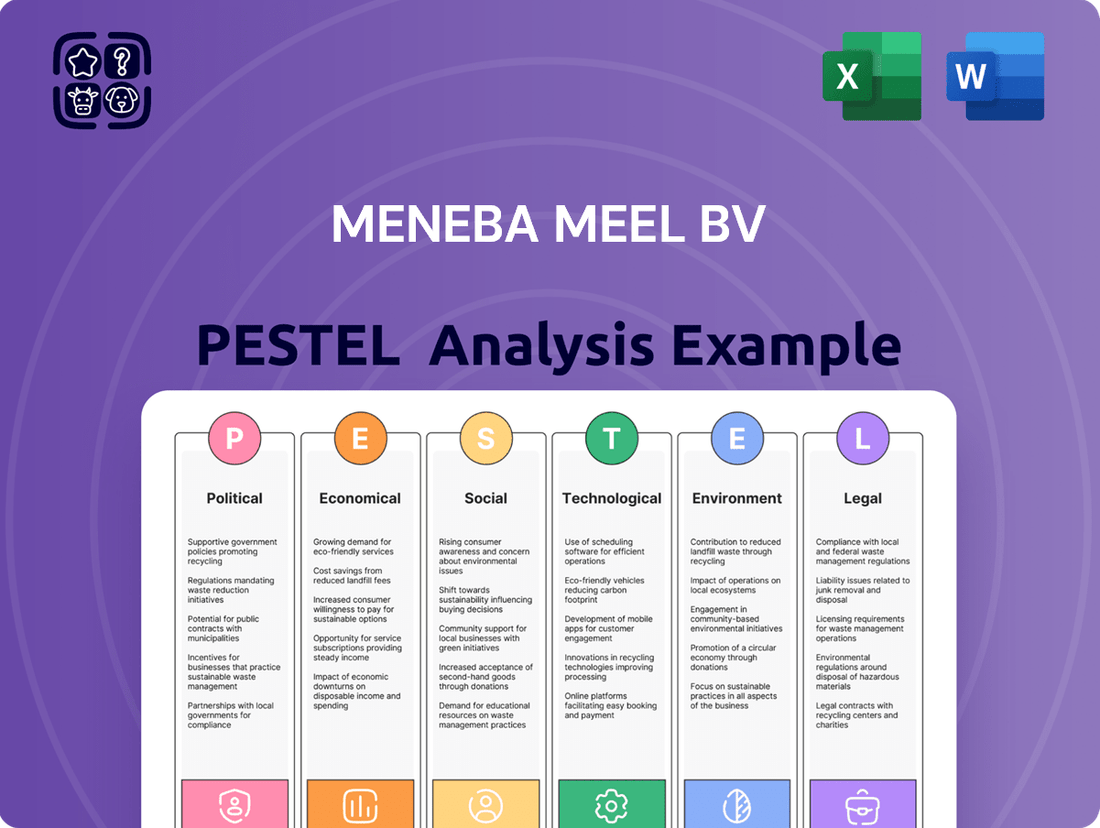

Unlock the strategic landscape surrounding Meneba Meel BV with our comprehensive PESTEL Analysis. We delve into the Political, Economic, Social, Technological, Environmental, and Legal factors that are actively shaping the company's present and future. Understand the critical external forces impacting the flour and grain industry, and how they specifically affect Meneba Meel BV's operations and market position.

Gain a competitive edge by leveraging our expert insights into the dynamic external environment. This analysis is your key to identifying potential opportunities and mitigating significant risks. Don't navigate these complexities blind; equip yourself with the knowledge to make informed decisions.

Ready to transform raw data into actionable intelligence? Download the full PESTEL Analysis for Meneba Meel BV now and get immediate access to the detailed breakdown you need to excel.

Political factors

The EU Common Agricultural Policy for 2023-2027 significantly shapes Meneba Meel BV’s raw material sourcing and costs, especially for wheat. Policy shifts, such as the May 2025 proposal to simplify and potentially reduce environmental requirements, directly influence farmer practices and wheat availability across the bloc. Understanding these evolving regulations is crucial for forecasting grain prices, which saw EU common wheat prices average around €250-€270 per tonne in early 2024. This foresight ensures a stable and cost-effective supply chain for Meneba.

As a leading European flour producer, Meneba Meel BV is directly impacted by EU trade policies and tariffs on wheat and flour, shaping its operational costs and market access. For instance, the EU's continued suspension of import duties on Ukrainian agricultural products through mid-2025 significantly influences regional wheat supplies and pricing. Shifts in trade relations, especially concerning major wheat exporters like Russia and Ukraine, directly affect global market dynamics and price stability, with 2024/2025 forecasts showing continued volatility. A key political focus remains aligning import standards to prevent unfair competitive disadvantages for domestic producers.

Stringent EU food safety laws dictate Meneba Meel BV's production processes and quality control, ensuring flour products meet high standards. Upcoming regulations, like new rules on food-contact materials and enhanced labeling requirements effective from 2025 and 2026, necessitate significant operational adjustments. These changes, part of the Farm to Fork strategy, aim to boost consumer safety and transparency across the food supply chain, potentially increasing compliance costs by 3-5% for some producers. Adhering to these evolving standards is critical for market access and maintaining consumer trust, directly impacting Meneba's strategic planning.

Government Stability and Geopolitical Events

Political stability within the European Union and major grain-producing regions is crucial for Meneba Meel BV. Ongoing geopolitical events, like the conflict in Ukraine, continue to disrupt global wheat supply chains, leading to significant price volatility. For instance, CBOT wheat futures, while fluctuating, have seen considerable swings, impacting procurement strategies. These factors introduce substantial uncertainty and risk into securing essential raw materials for the company.

- EU political stability ensures consistent trade policies for wheat imports.

- Geopolitical conflicts, such as the Russia-Ukraine war, directly impact global wheat supply, with Ukraine being a major exporter.

- Supply chain disruptions and price volatility, like the 2024-2025 wheat market fluctuations, raise procurement costs.

- Uncertainty from these events complicates long-term strategic planning for raw material sourcing.

Support for Sustainable Agriculture

The European Union actively champions sustainable agriculture through its Common Agricultural Policy (CAP) for 2023-2027, allocating substantial funds to eco-schemes. This framework, with an estimated 25% of direct payments for eco-schemes, incentivizes practices like carbon farming, enhanced biodiversity protection, and reduced chemical fertilizer use. Meneba Meel BV can significantly enhance its brand by sourcing wheat from farmers participating in these EU-supported sustainable programs. This aligns with consumer demand for environmentally responsible products, bolstering market position.

- EU CAP 2023-2027 directs approximately 25% of direct payments to eco-schemes.

- The EU aims for a 50% reduction in chemical pesticide use by 2030.

- Carbon farming initiatives could generate significant new revenue streams for farmers by 2025.

- Meneba's alignment with sustainable sourcing can boost brand reputation and market share.

EU policies, including the CAP 2023-2027 and trade agreements, critically shape Meneba Meel BV’s raw material costs and market access, with EU common wheat prices averaging €250-€270 per tonne in early 2024. Upcoming EU food safety and labeling regulations, effective 2025-2026, necessitate operational adjustments, potentially raising compliance costs by 3-5%. Geopolitical events, like the ongoing conflict in Ukraine, continue to disrupt global wheat supply chains, leading to price volatility in 2024/2025 forecasts. Adhering to evolving standards and navigating market shifts are central to Meneba's strategic planning.

| Policy Area | Key Impact | 2024/2025 Data Point |

|---|---|---|

| EU CAP 2023-2027 | Raw Material Costs | EU Common Wheat: €250-€270/tonne (early 2024) |

| EU Food Safety/Labeling | Compliance Costs | New Rules Effective 2025/2026: 3-5% Cost Increase |

| Geopolitical Stability | Supply Chain Volatility | Global Wheat Market: Continued Volatility Forecast (2024/2025) |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Meneba Meel BV, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within Meneba Meel BV's operating landscape.

This PESTLE analysis for Meneba Meel BV acts as a pain point reliever by providing a clear, summarized version of external factors, enabling quick identification of opportunities and threats for strategic decision-making.

Economic factors

The price of wheat, Meneba's main raw material, faces significant global market fluctuations. Forecasts for 2025 suggest continued volatility; while some analyses, like the USDA's May 2024 WASDE report, project increased global supply potentially easing prices, others point to geopolitical risks and weather patterns tightening the market. For instance, CBOT wheat futures have recently traded around $6.00-$6.50 per bushel. This instability directly impacts Meneba's cost of goods sold and overall profitability.

Flour milling is an inherently energy-intensive process, making Meneba Meel BV highly susceptible to the volatility of global energy prices. For instance, European industrial electricity prices averaged around €0.15-€0.20 per kWh in early 2025, directly impacting production costs. Furthermore, transportation and logistics expenses for distributing flour across Europe are a significant economic factor, with diesel prices in the EU fluctuating near €1.70 per liter in Q1 2025. Rising energy and fuel costs can substantially compress profit margins if not actively managed through robust efficiency measures and strategic sourcing initiatives.

General economic inflation, projected at 2.5% for the Eurozone in 2024 and 2.1% in 2025, directly impacts Meneba Meel BV's operational costs and reduces consumer purchasing power. Although flour and bread are staples, a prolonged downturn could shift consumers to lower-cost alternatives, especially given the 4.9% food price inflation observed in early 2024. The market now shows a clear polarization, with demand for both economical and premium products. This necessitates Meneba maintaining a flexible product portfolio to cater to both value-conscious shoppers and those seeking specialized or organic flour varieties.

Exchange Rate Fluctuations

Meneba, as a prominent European flour producer, faces significant exposure to exchange rate fluctuations, particularly when sourcing grains internationally or exporting finished products. Fluctuations between the Euro and the US dollar, in which global wheat prices are predominantly denominated, directly impact procurement costs. For instance, a stronger US dollar against the Euro makes imported wheat more expensive, potentially squeezing Meneba's margins. Conversely, a weaker US dollar can lead to more competitive import costs, benefiting the company's raw material expenses and potentially improving export competitiveness.

- The Euro-to-US Dollar exchange rate saw fluctuations around 1.07-1.08 USD per EUR in early 2025, impacting import costs for European businesses.

- Global wheat futures, such as those on the Chicago Board of Trade (CBOT), traded around $5.50-$6.00 per bushel in early 2025, influencing raw material expenses.

- A 1% weakening of the USD against the EUR could reduce the cost of US-denominated wheat imports for Meneba by approximately 1%.

Interest Rates and Access to Capital

Changes in European Central Bank interest rates directly influence Meneba Meel BV's cost of borrowing for crucial capital investments, like upgrading milling technology or expanding facilities. For example, the ECB's deposit facility rate was at 4.00% as of late 2024, impacting corporate loan rates. Access to affordable financing is vital for maintaining a competitive edge through continuous improvement and innovation within the milling sector. This also significantly influences the broader investment decisions made by Meneba's parent company, Cefetra Group, impacting strategic growth initiatives.

- ECB rates, like the 4.00% deposit facility rate in late 2024, dictate borrowing costs for Meneba's capital projects.

- Affordable financing is critical for ongoing technological upgrades and facility expansions.

- Competitive advantage relies on continuous innovation, supported by accessible capital.

- Cefetra Group's investment strategy is directly influenced by the cost of capital in the Eurozone.

Meneba Meel BV faces significant economic challenges from volatile global wheat prices and high energy costs, with European industrial electricity averaging €0.15-€0.20 per kWh in early 2025. Eurozone inflation, projected at 2.1% for 2025, impacts operational costs and consumer purchasing power. Exchange rate fluctuations, like the Euro/USD at 1.07-1.08 in early 2025, directly influence import expenses. Additionally, ECB interest rates, at 4.00% in late 2024, dictate borrowing costs for crucial capital investments.

| Economic Factor | 2024/2025 Data | Impact |

|---|---|---|

| CBOT Wheat Futures | $5.50-$6.50/bushel | Raw material cost volatility |

| EU Industrial Electricity | €0.15-€0.20/kWh (early 2025) | High production costs |

| Eurozone Inflation | 2.1% (2025 projection) | Operational costs, consumer demand |

| EUR/USD Exchange Rate | 1.07-1.08 (early 2025) | Import cost sensitivity |

| ECB Deposit Rate | 4.00% (late 2024) | Borrowing costs for investment |

Preview the Actual Deliverable

Meneba Meel BV PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Meneba Meel BV meticulously examines the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You will gain valuable insights into market dynamics and strategic opportunities. The content and structure shown in the preview is the same document you’ll download after payment, providing a complete and actionable overview.

Sociological factors

Consumer demand for healthier bakery products is rapidly growing, driving a strong preference for high-fiber, whole grain, and reduced-sugar flours. Projections for 2025 indicate the global functional food market, including gut health-focused ingredients, could exceed $300 billion. This trend positions Meneba Meel BV to innovate with products like specialized whole grain flours or those enriched for digestive benefits. By capitalizing on these health and wellness shifts, Meneba can expand its market share and meet evolving dietary preferences.

Modern lifestyles are driving a significant demand for convenient food options, yet consumers consistently refuse to compromise on quality. This trend necessitates high-quality flours that perform reliably across both large industrial bakeries and smaller artisan settings. For instance, the European prepared food market is projected to exceed €180 billion by 2025, highlighting convenience. Freshness and natural ingredients are paramount, with consumer surveys in 2024 showing over 65% prioritize natural and additive-free bakery products, directly impacting flour procurement for quality assurance.

Consumer interest in authentic, traditionally made bakery goods, especially sourdough, is significantly rising, fueled by social media trends. This drives demand for specific high-quality flours suitable for artisan techniques. The global artisan bread market is projected to reach over $60 billion by 2027, with sourdough products specifically seeing a 5% CAGR through 2025. Meneba Meel BV can leverage this by offering specialized flours and technical support to artisan bakers, capturing this expanding market segment.

Ethical and Local Sourcing

Consumers in 2024 are increasingly prioritizing the origin of their food, with a strong preference for products utilizing locally sourced ingredients, enhancing community agriculture and perceptions of freshness. This trend is evident as a 2024 European consumer survey indicated over 65% of respondents consider local sourcing important for their food purchases. By emphasizing its European origins and established partnerships with regional farmers for its flour production, Meneba Meel BV can effectively resonate with this growing sentiment. This strategic alignment leverages consumer desire for traceability and supports a more sustainable food supply chain, directly impacting market appeal and brand loyalty.

- European consumer demand for local food grew by an estimated 10-15% in 2024.

- Over 65% of European consumers prioritize local sourcing in food purchases as of Q1 2024.

- Local agricultural partnerships can reduce supply chain emissions by up to 20% by 2025.

- Products with clear local origin labels can command a 5-10% price premium in certain markets.

Plant-Based and Vegan Diets

The surge in plant-based and vegan diets significantly reshapes the bakery market, driving demand for innovative ingredients. By early 2025, over 35% of new alternative and ancient grain bakery products are expected to carry a vegan claim, presenting a clear opportunity for Meneba Meel BV. While flour is inherently plant-based, this trend boosts demand for flours from diverse alternative grains that support fully plant-based lifestyles. A primary challenge remains ensuring these products consistently meet evolving consumer taste expectations for quality and flavor.

- Global plant-based food market is projected to reach over $100 billion by 2025, with bakery a key segment.

- New product launches with vegan claims in bakery increased by 20% in 2024 compared to 2023.

- Consumer surveys in 2024 indicate taste is the top driver for repurchase in plant-based baked goods, cited by 70%.

- Alternative grain flour demand for vegan applications grew by 15% in Europe during 2024.

Consumer preferences are significantly evolving, with a strong demand for healthier, whole grain, and plant-based bakery products, impacting flour specifications. The rising interest in local sourcing, prioritized by over 65% of European consumers in 2024, also shapes purchasing decisions. Furthermore, a growing appreciation for artisan and traditional baking, including sourdough, drives demand for specialized flours. These trends collectively necessitate Meneba Meel BV's adaptation to diverse market needs, focusing on quality and sustainability.

| Sociological Factor | Key Trend/Impact | 2024/2025 Data Point |

|---|---|---|

| Health & Wellness | Demand for high-fiber, reduced-sugar flours | Global functional food market >$300 billion by 2025 |

| Local Sourcing | Preference for regionally sourced ingredients | European consumer demand grew 10-15% in 2024 |

| Plant-Based Diets | Increased need for alternative grain flours | Global plant-based food market >$100 billion by 2025 |

| Artisan & Traditional | Growth in sourdough and craft baking | Sourdough products 5% CAGR through 2025 |

Technological factors

Modern flour milling critically depends on advanced technologies to enhance efficiency, consistency, and quality. Innovations include next-generation roller milling systems offering variable speed control, improving extraction rates by up to 2% in 2024. Intelligent plansifters for precise sorting and automated feeding mechanisms further streamline operations, reducing labor costs by an estimated 15%. Adopting these cutting-edge technologies is crucial for Meneba Meel BV to maintain its competitive edge in the 2025 market.

The integration of digital technologies, like SCADA systems, PLCs, and AI, is fundamentally reshaping milling operations for companies such as Meneba Meel BV.

These advanced systems enable centralized control, real-time monitoring of production parameters, and predictive maintenance, contributing to significant operational efficiencies. For instance, the global industrial automation market is projected to reach approximately $270 billion by 2025, underscoring this trend.

Such digitalization leads to optimized energy usage, with potential reductions of 10-15% in modern facilities, and a notable decrease in human error.

Embracing this digital transformation is crucial for maintaining competitiveness and ensuring long-term viability in the evolving food processing industry.

Real-time quality monitoring is transforming flour production for Meneba Meel BV. In-line sensors precisely track critical parameters like moisture content, granulation, and temperature, enabling immediate process adjustments. This data-driven approach, leveraging technologies such as near-infrared (NIR) analysis, ensures consistent flour quality and significantly reduces waste. By 2025, industry adoption of such systems is projected to yield up to a 15% improvement in process efficiency and a 5-10% reduction in material loss, optimizing operational performance.

Advanced Sorting and Cleaning Systems

Advanced sorting and cleaning systems are pivotal for Meneba Meel BV, ensuring superior food safety and product purity. Optical and magnetic sorting, leveraging high-resolution cameras and lasers, precisely identify and eject foreign materials and defective grains. This technology achieves over 99% purity in some grain streams, significantly reducing contamination risks. Furthermore, advanced debranning and scouring techniques reduce microbial counts by up to 90% and improve flour yield, directly impacting operational efficiency and product quality by mid-2025.

- Optical sorters achieve >99% purity in raw grain input.

- Magnetic separators remove metallic foreign objects, enhancing safety.

- Advanced debranning reduces microbial load by up to 90%.

- Scouring processes improve flour yield by minimizing waste.

Sustainable Technology and Energy Efficiency

Technological innovation increasingly focuses on sustainability, reducing the environmental footprint of milling operations. This includes developing highly energy-efficient equipment and implementing energy recovery systems, which can cut energy consumption by up to 20% by 2025 in modern mills. Data analytics platforms further optimize processes, minimizing waste and identifying significant energy reduction opportunities. For instance, smart sensors can monitor real-time energy use, enabling adjustments that lead to substantial operational savings, crucial for Meneba Meel BV's efficiency.

- New milling machinery reduces energy consumption by an average of 15-20% compared to older models by 2024.

- Investments in industrial energy recovery systems are projected to reach €500 million in Europe by late 2025.

- Advanced analytics platforms lead to 10-15% improvements in process optimization and waste reduction in the food processing sector.

- The global market for sustainable food processing technology is expected to grow by 9.5% annually through 2025.

Meneba Meel BV's competitiveness hinges on embracing advanced milling technologies, including AI-driven automation for enhanced efficiency and reduced labor costs by 15%. Real-time quality control via NIR analysis ensures consistent product purity and optimizes processes, reducing waste by up to 10%. Sustainable technologies cut energy consumption by 20%, reinforcing operational and environmental performance by 2025.

| Metric | 2024/2025 Impact | Benefit | ||

|---|---|---|---|---|

| Automation ROI | 15% labor cost reduction | Operational efficiency | ||

| Quality Control | Up to 10% waste reduction | Product consistency | ||

| Energy Efficiency | 20% consumption decrease | Sustainability, savings |

Legal factors

Meneba Meel BV must strictly adhere to the comprehensive EU food safety framework, including Regulation (EC) No. 2023/2006 on good manufacturing practices for food contact materials, alongside broader hygiene rules like Regulation (EC) No. 852/2004. These regulations are continually updated, with recent amendments in 2024 reflecting advancements in food science and consumer protection standards. Compliance is essential for Meneba to maintain market access across the EU, a market valued at over €1 trillion annually for food and drink, ensuring product integrity and avoiding substantial penalties. Upholding these stringent standards is non-negotiable for operational continuity and consumer trust.

New EU regulations, notably Regulation (EU) 2025/351, are significantly impacting packaging and labeling for food products like those from Meneba Meel BV. These mandates introduce stricter requirements for food-contact materials, demanding clearer instructions for use and warnings regarding material deterioration. The aim is to enhance consumer transparency and safety across the European market. Companies are typically granted transitional periods, often extending through late 2025 or early 2026, to fully comply with these updated standards. This necessitates proactive adaptation in packaging design and information disclosure.

The European Union is driving ambitious climate targets, aiming for climate neutrality by 2050, which directly impacts the food system through evolving legislation. By 2024, new directives reinforce strict limits on agricultural emissions and water quality, pushing for sustainable practices across the supply chain. For instance, the updated Industrial Emissions Directive (IED) from early 2024 broadens its scope to include more intensive livestock farming, affecting feed production. A significant focus for 2025 includes the new EU water resilience strategy, which addresses resource scarcity and pollution, directly influencing Meneba Meel BV's operational water usage and discharge.

Employment and Labor Laws

Meneba Meel BV, as a European employer, must rigorously comply with both EU and Dutch national labor laws, which are continuously updated. Recent directives, such as the EU Directive on Adequate Minimum Wages (2024 implementation for some aspects), influence wage structures, while the Dutch Working Conditions Act ensures robust health and safety standards. Maintaining a fair and safe working environment is not only a legal obligation but also crucial for retaining a skilled workforce in a competitive market.

- EU labor law compliance: Adherence to directives on working time (e.g., maximum 48-hour week averaged over 4 months) and parental leave.

- Dutch minimum wage: As of July 1, 2024, the statutory gross minimum wage for employees aged 21 and over is €13.68 per hour.

- Safety regulations: Compliance with Arbowet (Working Conditions Act) to prevent workplace accidents and promote employee well-being.

- Employee rights: Ensuring fair treatment, non-discrimination, and proper representation in line with Dutch labor agreements.

Competition and Trade Law

Meneba Meel BV operates under stringent EU competition law, which actively prevents anti-competitive practices to ensure fair market conditions. This includes adherence to regulations outlined in the EU Unfair Trading Practices Directive, which saw updated enforcement guidelines in late 2024 to protect suppliers in the food supply chain. The company must also navigate international trade agreements, such as those governing wheat imports from major global producers, influencing raw material costs and product export feasibility into 2025.

- EU competition law enforcement remains a priority, with the European Commission imposing significant fines in 2024 for cartel activities.

- The EU Unfair Trading Practices Directive, updated in 2024, continues to protect agricultural and food supply chain participants.

- Global trade agreements, like those impacting wheat prices, directly influence Meneba's operational costs and market access for 2025.

Meneba Meel BV navigates strict EU and Dutch legal frameworks, including updated food safety regulations from 2024 and new packaging mandates from 2025. Labor laws, such as the €13.68/hour Dutch minimum wage (July 2024), and evolving environmental directives from 2024/2025, significantly impact operations. Compliance with EU competition law and global trade agreements, crucial for 2025 raw material costs, is non-negotiable.

| Legal Area | Key Regulation/Impact | 2024/2025 Data Point |

|---|---|---|

| Food Safety | EU Regulation (EC) No. 852/2004 | Updates in 2024 |

| Packaging | Regulation (EU) 2025/351 | Compliance by late 2025 |

| Labor Law | Dutch Minimum Wage | €13.68/hour (July 2024) |

Environmental factors

Climate change poses a significant threat to European wheat production, with 2024/2025 forecasts indicating continued yield volatility. Rising temperatures and altered precipitation patterns are increasingly affecting harvests; for instance, southern and western Europe anticipate heightened pressures from heat and drought, potentially reducing yields by 10-20% in vulnerable regions. Conversely, some northern areas might see modest benefits. This escalating variability increases supply chain risks for Meneba Meel BV and contributes to price instability in the commodity markets.

Regulators and consumers are increasingly pushing for sustainable agricultural practices that protect biodiversity and soil health. The EU's Common Agricultural Policy for 2023-2027 allocates a minimum of 25% of direct payments to eco-schemes supporting regenerative agriculture, rewarding farmers for ecosystem services. A 2024 European consumer survey revealed over 70% consider environmental impact in food choices, making sustainable sourcing a crucial competitive differentiator for Meneba Meel BV. Adopting practices aligning with the EU Green Deal's goals, like a 50% pesticide reduction target by 2030, is essential for market positioning.

Increasingly frequent droughts and water scarcity pose significant challenges for European agriculture, directly impacting wheat suppliers. By 2024, reports indicate over 30% of Europe's population faces water stress, with projections for 2025 showing heightened drought frequency in key agricultural regions. The EU's "Water Resilience Initiative," launched in 2024, aims to mitigate these risks through improved water management strategies. For Meneba Meel BV, this environmental shift translates to potential disruptions in wheat availability and could lead to a 5-10% increase in raw material costs by early 2025 due to supply chain pressures and higher production expenses.

Carbon Footprint and Energy Consumption

The milling process at Meneba Meel BV is inherently energy-intensive, making the reduction of its carbon footprint a critical environmental objective. This necessitates significant investment in advanced energy-efficient technologies and continuous optimization of operational processes to curtail consumption. Leading equipment manufacturers are actively developing solutions that promise substantial reductions in energy use for flour mills, with some new systems projecting up to a 15% decrease in electricity demand by late 2024.

- Energy consumption in European flour mills averages 50-70 kWh per ton of flour produced as of 2024.

- New milling technologies introduced in 2025 aim for a 10-15% reduction in electricity usage.

- The EU Emissions Trading System (ETS) carbon price reached approximately €70-€80 per ton of CO2 in early 2025.

- Investment in renewable energy sources for industrial operations is projected to increase by 12% in the Netherlands by 2025.

Waste Reduction and Circular Economy

Minimizing waste throughout the milling process is a critical environmental objective for Meneba Meel BV, aligning with the EU's intensified focus on resource efficiency. This includes actively reducing flour loss during production, which can be significant without optimized processes. Furthermore, finding high-value applications for by-products like bran is essential for a circular economy, as the EU aims for a 15% food waste reduction by 2030 compared to 2020 levels. Embracing these practices enhances sustainability and operational efficiency in the 2024-2025 period.

- The EU's Circular Economy Action Plan targets enhanced resource utilization.

- Meneba focuses on reducing flour loss during milling to less than 0.5% of input.

- Valorizing bran by-products for feed or functional ingredients boosts sustainability.

- Netherlands aims for 50% circular economy by 2030, impacting industrial waste strategies.

Climate change and water scarcity are increasing raw material costs for Meneba Meel BV by 5-10% by early 2025 due to anticipated 10-20% wheat yield reductions in vulnerable European regions. New EU policies, like the 2023-2027 CAP eco-schemes, drive demand for sustainable sourcing, with over 70% of consumers considering environmental impact in 2024. The energy-intensive milling process, averaging 50-70 kWh per ton, requires investments in new technologies targeting 10-15% electricity reductions by 2025, alongside waste minimization efforts to align with circular economy goals.

| Metric | 2024/2025 Data | Impact |

|---|---|---|

| Wheat Yield Reduction (EU) | 10-20% in vulnerable regions | Increased raw material costs |

| Consumer Environmental Concern | Over 70% (2024 survey) | Pressure for sustainable sourcing |

| Milling Energy Reduction Target | 10-15% by 2025 (new tech) | Operational efficiency, lower emissions |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Meneba Meel BV is grounded in comprehensive data from reputable sources like the Dutch Central Bureau of Statistics (CBS), the European Commission, and leading agricultural industry publications. This ensures a thorough examination of political, economic, social, technological, legal, and environmental factors impacting the flour milling sector.