LifeMD Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

LifeMD Bundle

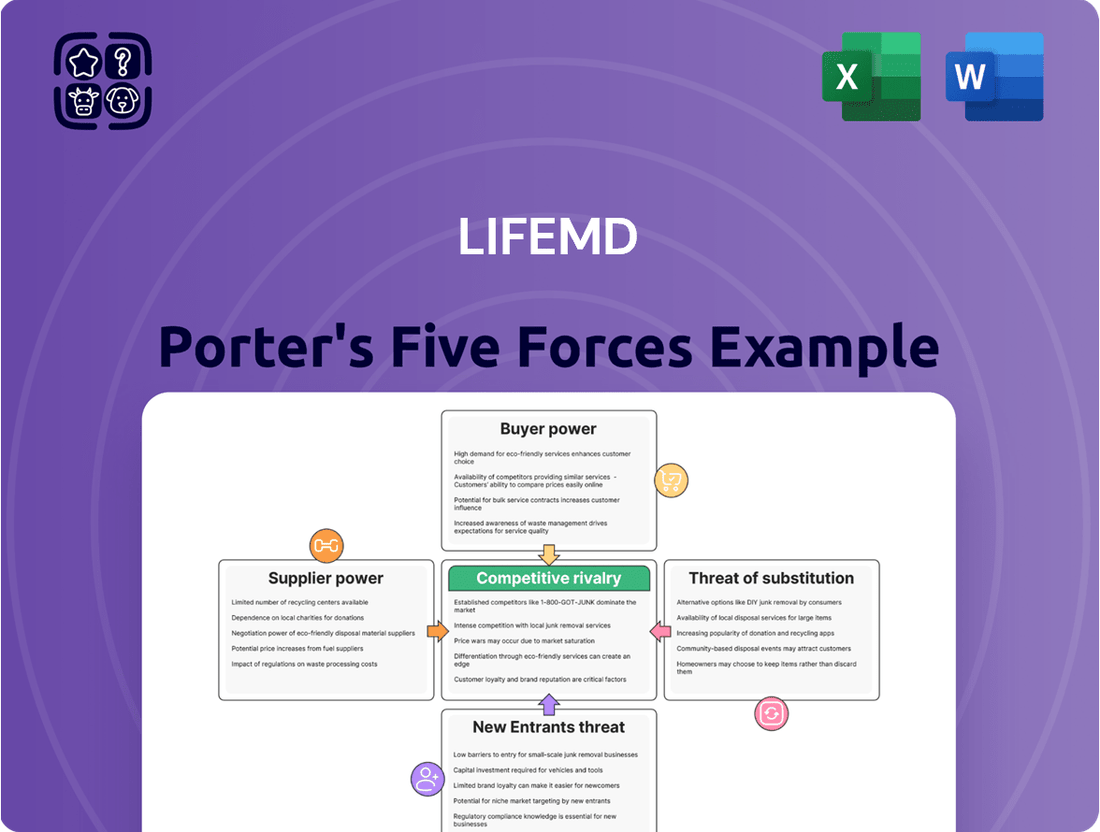

LifeMD's competitive landscape is shaped by several key forces, including the bargaining power of buyers and the intensity of rivalry within the telehealth sector. Understanding these dynamics is crucial for grasping LifeMD's strategic positioning and future growth potential.

The threat of new entrants and the availability of substitutes also play significant roles, influencing pricing power and market share. Supplier power, while potentially less dominant in this digital-first industry, still warrants careful consideration.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore LifeMD’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of healthcare providers, particularly licensed professionals and specialists, is a key factor for telehealth companies like LifeMD. When demand for specific medical expertise is high and supply is limited, providers can negotiate for better compensation and terms. For instance, as of early 2024, shortages persist in certain specialties like psychiatry and dermatology, allowing providers in these fields to exert more influence.

Telehealth platforms can attract providers by offering reduced administrative burdens and greater flexibility compared to traditional brick-and-mortar practices. This can be a counter-balance to provider power, as many seek convenient work arrangements. However, if a platform relies heavily on a niche set of specialists, those specialists can leverage their unique skills to demand higher rates or more favorable contract conditions.

LifeMD's reliance on specialized technology and software platforms, including secure data storage and robust operational software, makes technology and software vendors a significant force. Vendors offering unique or proprietary solutions, particularly those with high switching costs for LifeMD, can wield considerable bargaining power. The critical nature of these systems for service delivery means LifeMD has limited alternatives for essential functions.

The telehealth industry's stringent requirements for HIPAA compliance and data security further empower these suppliers. Companies that can guarantee and maintain these high standards are invaluable, and their expertise can translate into greater leverage in negotiations. For instance, the global cybersecurity market was projected to reach $300 billion in 2024, highlighting the significant investment and specialized nature of these services.

LifeMD's direct-to-consumer prescription model relies heavily on its partnerships with pharmaceutical manufacturers and pharmacy networks for prescription fulfillment. Major pharmaceutical distributors and large pharmacy chains possess considerable leverage due to their established distribution networks, logistical prowess, and influence over drug pricing. For instance, in 2024, the top five pharmaceutical distributors in the United States accounted for over 90% of drug distribution, underscoring their consolidated power.

This dependence means that these suppliers can exert significant bargaining power, potentially impacting LifeMD's cost of goods and the availability of medications. Their ability to control access to drugs and dictate terms can influence LifeMD's profitability and operational efficiency, especially given the highly regulated nature of the pharmaceutical supply chain.

Marketing and Advertising Platform Power

LifeMD's reliance on digital marketing platforms like Google and Meta for patient acquisition means these platforms wield significant supplier power. In 2023, digital advertising spending globally reached approximately $600 billion, highlighting the substantial influence of these gatekeepers. These platforms can control ad pricing, targeting capabilities, and even content policies, directly impacting LifeMD's cost of acquiring new patients and its ability to reach its desired demographic.

The bargaining power of these marketing and advertising platforms stems from their essential role in a direct-to-consumer model like LifeMD's. Without effective reach on these channels, patient acquisition would be severely hampered. For instance, Meta's advertising revenue alone was over $130 billion in 2023, demonstrating its market dominance and leverage. LifeMD must navigate these relationships carefully, as increased ad costs or restricted access can directly impact profitability and growth.

- Dominant Platforms: Google and Meta control a vast majority of the digital advertising market, making them indispensable for direct-to-consumer businesses.

- Pricing Power: These platforms can adjust ad auction dynamics and pricing, increasing customer acquisition costs for companies like LifeMD.

- Targeting and Access: The ability to precisely target specific patient demographics is a critical service, and platforms can limit or change these capabilities.

- Policy Control: Advertising policies on these platforms can impact what LifeMD can promote, potentially hindering its marketing efforts.

Payment Processing and Cybersecurity Service Power

The bargaining power of suppliers in payment processing and cybersecurity for a company like LifeMD is significant. Secure and efficient transaction handling, alongside robust data protection, are absolutely essential for any healthcare organization managing sensitive patient and financial information. Providers offering these specialized, mission-critical services, especially those with demonstrated expertise in the healthcare industry, can leverage their position to command higher fees.

This is due to the extreme sensitivity of the data involved and the potentially catastrophic financial and reputational damage that a data breach could inflict. In 2023, the average cost of a data breach in the healthcare sector reached $10.10 million, underscoring the immense value placed on effective cybersecurity solutions. Companies that can reliably safeguard this data are in a strong negotiating position.

- High Stakes: Healthcare data breaches are exceptionally costly, driving demand for top-tier security and payment processing.

- Specialized Expertise: Suppliers with proven healthcare sector experience possess unique knowledge and capabilities.

- Critical Infrastructure: Payment and cybersecurity services are fundamental to daily operations and regulatory compliance.

- Limited Substitutes: Finding equally reliable and compliant alternatives can be challenging and time-consuming.

The bargaining power of suppliers in the telehealth sector, particularly for specialized medical professionals and technology providers, significantly impacts companies like LifeMD. Shortages in specific medical fields, like psychiatry, as observed in early 2024, enable these professionals to negotiate more favorable terms. Similarly, vendors of critical software and cybersecurity solutions, essential for HIPAA compliance and data security, hold considerable leverage due to high switching costs and the specialized nature of their offerings.

Pharmaceutical distributors and pharmacy networks also represent a powerful supplier group, controlling drug access and pricing. The consolidation within this sector, with the top five distributors handling over 90% of drug distribution in the US in 2024, grants them substantial influence over LifeMD's costs and medication availability. Digital advertising platforms like Google and Meta, which are crucial for patient acquisition, similarly exert significant power through their pricing, targeting capabilities, and policy control, impacting LifeMD's marketing expenses and reach.

| Supplier Type | Key Leverage Factors | Impact on LifeMD | Relevant Data (2023/2024) |

|---|---|---|---|

| Specialized Medical Professionals | High demand, limited supply (e.g., psychiatry) | Negotiation for higher compensation, favorable terms | Specialty shortages persist in early 2024 |

| Technology & Software Vendors | Proprietary solutions, high switching costs, critical infrastructure | Increased costs for essential systems, potential service disruption | Global cybersecurity market projected at $300 billion in 2024 |

| Pharmaceutical Distributors/Pharmacies | Consolidated market share, control over drug pricing and access | Impact on cost of goods, medication availability, profitability | Top 5 US distributors held >90% of drug distribution in 2024 |

| Digital Advertising Platforms | Market dominance, control over pricing and targeting | Increased patient acquisition costs, potential marketing limitations | Meta's advertising revenue over $130 billion in 2023; Global digital ad spend ~ $600 billion in 2023 |

What is included in the product

This analysis meticulously examines the five competitive forces impacting LifeMD, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the influence of substitutes to understand LifeMD's market position and strategic options.

Simplify strategic decision-making by instantly visualizing LifeMD's competitive landscape and identifying key pain points within the healthcare market.

Customers Bargaining Power

Patients generally experience low switching costs when moving between telehealth platforms or deciding to use traditional healthcare. This ease of changing providers means customers can readily select the most convenient, cost-effective, or preferred option. For LifeMD, this translates into pressure to consistently offer competitive pricing and high-quality services to retain its patient base.

The telehealth market is indeed brimming with options, giving consumers a strong hand. As of early 2024, the number of telehealth providers has surged, with many offering comparable services. This abundance means patients can readily shop around, comparing prices and features from numerous platforms, which naturally amplifies their bargaining power.

Think about it: if one virtual clinic doesn't meet your needs or price point, another is likely just a click away. This ease of switching and the sheer volume of competitors means that providers must work harder to attract and retain customers, often through competitive pricing or enhanced service offerings. For instance, reports in late 2023 indicated that customer acquisition costs in the telehealth sector were rising, partly due to this intense competition for consumer attention.

Customers at LifeMD, while attracted to the convenience of telehealth, are also quite sensitive to pricing, particularly when insurance coverage falls short or out-of-pocket expenses become significant. This price sensitivity is amplified because LifeMD operates on a direct-to-consumer model, meaning patients directly feel the impact of costs, making cost-effectiveness a major consideration in their decision-making.

In 2024, the average out-of-pocket cost for a telehealth visit in the US can range widely, but for services not fully covered by insurance, patients are actively seeking value. This places a direct onus on LifeMD to demonstrate competitive pricing and justify its service costs clearly to retain its customer base.

Access to Information and Reviews

Patients today are incredibly well-informed, thanks to the internet. They can easily find online reviews, compare different telehealth providers, and research the quality and cost of services. This access to information significantly boosts their bargaining power with companies like LifeMD.

The ability for patients to readily access and digest information about healthcare providers means they can make much more informed choices. They aren't just picking a service; they're evaluating it based on peer experiences and objective data. This transparency forces providers to be more competitive in both service quality and pricing.

- Increased Transparency: Patients can easily compare LifeMD's services, pricing, and patient feedback against competitors, leveraging online review platforms and health information sites.

- Informed Decision-Making: Access to detailed information empowers patients to scrutinize provider reputations, treatment outcomes, and overall value, influencing their choice of telehealth service.

- Demand for Value: With readily available comparative data, patients are better positioned to demand superior service, better outcomes, and more competitive pricing from LifeMD.

- Shifting Power Dynamics: The ease of information access shifts the balance of power, making it harder for companies to dictate terms without considering patient expectations and market alternatives.

Perceived Lack of Differentiation

If LifeMD's core virtual consultation services are seen as too similar to what other telehealth providers offer, customers might start treating telehealth like a basic, interchangeable service. This lack of perceived uniqueness puts pressure on pricing, potentially driving down what customers are willing to pay. For instance, in 2024, the telehealth market continued to mature, with numerous players offering similar appointment booking and virtual visit functionalities.

This commodity perception forces companies like LifeMD to either compete aggressively on price or find ways to stand out. Customers might then demand more for their money, looking for extra benefits or a noticeably better experience to choose and stay with a particular platform. In Q1 2024, LifeMD reported a slight increase in patient acquisition costs, suggesting a competitive landscape where differentiation is key to efficient growth.

- Commoditization Risk: If LifeMD's virtual consultations are viewed as undifferentiated, telehealth can become a commodity.

- Price Sensitivity: This perception can lead to increased customer sensitivity to pricing, demanding lower costs.

- Demand for Value-Add: Customers may then seek additional services or a superior user experience to justify their choice.

- Competitive Pressure: In 2024, the telehealth market saw intense competition, making differentiation crucial for LifeMD.

The bargaining power of customers in the telehealth sector, including for LifeMD, is significantly influenced by low switching costs and a high degree of market transparency. As of early 2024, the telehealth landscape is densely populated, offering patients numerous alternatives for virtual care. This abundance allows consumers to easily compare services, pricing, and patient reviews across different platforms, placing considerable pressure on providers like LifeMD to maintain competitive offerings and justify their value proposition.

| Factor | Impact on LifeMD | 2024 Data Point |

|---|---|---|

| Switching Costs | Low, enabling patients to easily move to competitors. | Telehealth adoption continued to grow, increasing patient familiarity with multiple platforms. |

| Information Availability | High, empowering patients to compare LifeMD with rivals. | Online health platforms and review sites saw increased traffic for telehealth service comparisons. |

| Price Sensitivity | Significant, especially for out-of-pocket expenses. | Average out-of-pocket costs for non-insured telehealth visits remained a key consideration for patients. |

| Service Commoditization | Risk of virtual consultations being perceived as similar across providers. | Market maturity in 2024 meant many telehealth services offered comparable core functionalities. |

What You See Is What You Get

LifeMD Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You are viewing the complete Porter's Five Forces Analysis for LifeMD, detailing the competitive landscape and strategic implications for the company. This comprehensive analysis covers the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the telehealth industry, providing actionable insights for stakeholders. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy.

Rivalry Among Competitors

The telehealth sector is a crowded space, with established giants like Teladoc Health and Amwell competing against nimble direct-to-consumer startups and even traditional hospitals venturing into virtual services. This proliferation of providers intensifies competition, driving down prices and making it harder for any single company to capture significant market share.

In 2024, the telehealth market continues to grapple with this intense rivalry. For instance, while Teladoc saw its revenue grow, it also faced increased competition, impacting its profitability metrics. This saturation means companies must constantly innovate and differentiate to stand out.

The sheer volume of telehealth platforms available to consumers and employers creates a dynamic where providers are frequently vying for the same patient base. This competitive pressure necessitates aggressive marketing and a strong focus on user experience to retain and attract customers.

Competitors in the direct-to-consumer telehealth market are heavily invested in marketing to draw in and keep patients. This translates to aggressive pricing, special deals, and a high cost to acquire each new customer, which really heats up the competition for LifeMD.

For example, in 2023, many telehealth providers significantly increased their advertising spend, with some dedicating upwards of 20% of their revenue to marketing and sales. This intense promotional activity drives up customer acquisition costs across the board, creating a challenging environment for companies like LifeMD to gain market share efficiently.

Competitive rivalry within the telehealth sector, including for companies like LifeMD, is intensified by rapid technological innovation and a constant expansion of services. This includes advancements in AI for diagnostics, the integration of wearable device data, and the introduction of new therapeutic areas. For instance, telehealth platforms are increasingly incorporating AI-powered symptom checkers and diagnostic tools, aiming to improve accuracy and efficiency. In 2023, the telehealth market saw significant growth, with companies investing heavily in R&D to stay ahead of competitors.

Low Patient Loyalty and High Churn Potential

The direct-to-consumer telehealth model, like that of LifeMD, inherently faces challenges in fostering strong patient loyalty. With numerous platforms offering similar services, patients can easily switch providers based on convenience, cost, or perceived quality. This ease of switching significantly amplifies the potential for high customer churn, meaning telehealth companies must continually work to retain their existing patient base. For instance, a 2023 report indicated that the average patient acquisition cost for telehealth services can be substantial, making churn a costly issue.

This constant need to re-engage patients fuels intense rivalry among telehealth providers. Companies are pushed to differentiate themselves through superior service quality, innovative features, and exceptional patient experiences. The pressure to continuously attract and retain patients means that price wars and aggressive marketing campaigns are common. In 2024, the telehealth market saw increased competition, with many platforms offering introductory discounts and loyalty programs to combat churn.

The low patient loyalty dynamic directly impacts competitive rivalry in the following ways:

- Increased Marketing Spend: Companies must invest heavily in marketing and customer retention programs to combat churn.

- Service Innovation Focus: Differentiation through enhanced user experience and specialized services becomes crucial.

- Price Sensitivity: Patients are often drawn to the most cost-effective option, leading to price competition.

- Reputation Management: Positive reviews and word-of-mouth referrals are critical for attracting and retaining patients in a competitive landscape.

Regulatory and Reimbursement Landscape Evolution

The competitive rivalry within the telehealth sector, including for LifeMD, is significantly shaped by the evolving regulatory and reimbursement landscape. Changes in how telehealth services are licensed, how patient data is protected, and what insurance plans cover can dramatically alter the competitive playing field.

Companies that can swiftly navigate these shifts, like adapting to new state-specific telehealth licensing requirements or understanding updated Medicare reimbursement rates, can carve out a stronger market position. For instance, as of early 2024, the Centers for Medicare & Medicaid Services (CMS) continued to refine reimbursement policies for virtual services, with some pandemic-era flexibilities being made permanent while others remained under review, creating uncertainty and requiring proactive adaptation from providers like LifeMD.

- Regulatory Agility: LifeMD's ability to quickly adapt to changing state and federal regulations, such as varying telehealth licensing requirements, directly impacts its operational reach and competitive standing.

- Reimbursement Dynamics: Fluctuations in insurance coverage and reimbursement rates for virtual care services, as seen with ongoing CMS policy adjustments in 2024, create competitive pressure and reward providers with strong payer relationships and efficient billing processes.

- Data Privacy Compliance: Adhering to evolving data privacy laws, like HIPAA, is crucial; failure to comply can lead to significant penalties and reputational damage, giving compliant companies a competitive advantage.

- Service Model Innovation: Companies that can innovate their service models to align with new reimbursement structures or regulatory allowances, such as incorporating new types of virtual consultations, are better positioned to thrive.

The telehealth market is intensely competitive, with numerous players vying for patients. This includes large, established companies, emerging startups, and even traditional healthcare systems expanding their virtual offerings. Companies like Teladoc Health and Amwell are significant competitors, but many smaller, specialized providers also contribute to the crowded landscape, driving down prices and increasing customer acquisition costs.

In 2024, the intense rivalry continues to force providers to innovate and focus on user experience. For instance, many telehealth platforms are investing heavily in marketing, with some spending over 20% of their revenue on customer acquisition. This makes it challenging for companies like LifeMD to gain market share efficiently due to high marketing expenses and the constant need to differentiate through service quality and features.

Low patient loyalty exacerbates competitive rivalry. Patients can easily switch between telehealth providers based on cost or convenience, leading to high churn rates. This necessitates continuous efforts in patient re-engagement through loyalty programs and superior service, as demonstrated by the increased competition observed in 2024, with many platforms offering introductory discounts.

The regulatory and reimbursement environment also fuels competition. Companies must be agile in adapting to changing telehealth licensing requirements and evolving reimbursement policies from entities like CMS. For example, ongoing adjustments to Medicare reimbursement rates in early 2024 require providers like LifeMD to proactively adapt their service models to maintain a competitive edge.

| Key Competitors | 2023 Revenue (Approx.) | Key Differentiators |

|---|---|---|

| Teladoc Health | $2.4 billion | Broad service offering, established network |

| Amwell | $1.2 billion | Platform integration, focus on health systems |

| Doctor On Demand | $300 million | Convenience, integrated pharmacy services |

| MDLive | $250 million | Partnerships with health plans, broad specialty care |

SSubstitutes Threaten

The most significant substitute for LifeMD's telehealth services remains traditional in-person healthcare. This includes visits to primary care physician offices, urgent care clinics, and hospital emergency rooms. These physical settings are often preferred or necessary for patients dealing with complex medical conditions, those requiring hands-on physical examinations, or when immediate, in-person intervention is crucial.

For many, especially older adults or individuals with chronic illnesses, the familiarity and perceived thoroughness of in-person care are strong deterrents to adopting telehealth exclusively. Data from 2024 indicates that while telehealth utilization saw a surge, a substantial portion of healthcare spending still directs patients to brick-and-mortar facilities. For instance, emergency room visits, a direct substitute for many urgent care needs that telehealth aims to address, accounted for billions in healthcare expenditures annually.

Retail clinics, often found within pharmacies and large retail chains, present a significant threat of substitution for services like those offered by LifeMD. These clinics provide convenient, walk-in access for common ailments, vaccinations, and basic health checks, directly competing for a segment of the market that values immediate and accessible care. For instance, in 2024, the number of retail clinics in the U.S. continued to grow, with major players like CVS Health (MinuteClinic) and Walgreens (Healthcare Clinic) expanding their footprints, making these alternatives increasingly prevalent.

For many everyday health concerns that LifeMD addresses, individuals can turn to over-the-counter (OTC) medications, home-based remedies, or simple lifestyle changes. This provides a straightforward and often less expensive alternative to scheduling a virtual doctor's appointment. For instance, common colds, minor aches, and digestive issues frequently have accessible OTC solutions available at any pharmacy or grocery store.

The accessibility and affordability of OTC options present a significant competitive force. In 2024, the global OTC pharmaceutical market was valued at over $150 billion, demonstrating a massive consumer reliance on these self-treatment methods. This broad availability means patients may bypass professional medical consultations for ailments they feel comfortable managing themselves, thus limiting the demand for LifeMD's services for these particular conditions.

Specialty-Specific Physical Medical Practices

Patients often seek out specialty-specific physical medical practices for chronic conditions or highly specialized care, valuing the direct, long-term relationships established with in-person specialists. While telehealth, like that offered by LifeMD, can certainly supplement ongoing care and provide convenient access, it may not fully replicate the comprehensive, hands-on approach that some patients, particularly those with complex medical needs, perceive as essential. This preference can limit the substitutability of telehealth services for these specific patient segments.

For instance, during 2024, while telehealth adoption continued to grow, patient retention in specialized fields often remained higher for practices offering a robust in-person component. Data from healthcare analytics firms indicated that patient satisfaction scores for chronic care management were, on average, 8-12% higher when a physical touchpoint with a specialist was regularly incorporated. This suggests that for certain critical healthcare needs, the perceived value of in-person interaction creates a barrier to complete substitution.

- Specialty Care Preference: Patients with chronic or complex conditions often prioritize direct, in-person relationships with specialists.

- Telehealth Limitations: While telehealth is a valuable tool, it may not fully substitute the perceived comprehensive care of a dedicated physical specialist.

- Patient Retention: Practices offering a blend of telehealth and in-person visits tend to see higher patient retention in specialized care areas.

- Satisfaction Data: In 2024, patient satisfaction for chronic care management was notably higher in models that included regular physical specialist interaction.

Digital Health Apps and Information Websites

Digital health apps and information websites present a notable threat of substitutes for LifeMD's telehealth services. The increasing availability of online symptom checkers and wellness tracking applications allows individuals to self-diagnose and manage common health concerns without needing a professional consultation. For instance, by mid-2024, it's estimated that over 70% of consumers use digital tools for health information, potentially reducing the perceived necessity of a virtual doctor's visit for minor ailments.

These digital resources can influence patient behavior by offering readily accessible information and self-management tools. While they don't replace the diagnostic capabilities of a healthcare professional, they can satisfy a portion of the demand for health advice, particularly for less complex issues. This can lead to a decrease in the volume of patients seeking telehealth appointments for these specific needs.

- Prevalence of Digital Health Tools: Millions of users actively engage with health apps and websites daily for tracking, information, and initial symptom assessment.

- Cost-Effectiveness of Substitutes: Many online resources are free or low-cost, making them an attractive alternative to paid telehealth consultations for some consumers.

- Accessibility and Convenience: Information is available 24/7, offering immediate gratification for users seeking quick answers or health management tips.

- Impact on Demand: The ease of access and low cost of these digital substitutes can fragment the market and reduce the overall demand for traditional or telehealth medical consultations for non-urgent matters.

The threat of substitutes for LifeMD's telehealth services is significant, encompassing traditional in-person healthcare, retail clinics, over-the-counter (OTC) medications, and digital health apps. Patients often opt for in-person visits for complex conditions or when a physical examination is deemed necessary, a segment where telehealth may not fully substitute. In 2024, despite telehealth growth, a substantial portion of healthcare expenditure still flowed to brick-and-mortar facilities, highlighting the persistent appeal of traditional care.

Retail clinics, easily accessible within pharmacies, offer a convenient alternative for common ailments, directly competing with LifeMD for a segment of the market valuing immediate care. The expansion of these clinics in 2024, by major players like CVS and Walgreens, further intensified this competitive pressure. Similarly, the vast and affordable market for OTC medications and home remedies presents a readily available substitute for less severe health concerns, bypassing the need for a virtual consultation entirely.

The global OTC pharmaceutical market, valued at over $150 billion in 2024, underscores the widespread reliance on self-treatment. Furthermore, digital health apps and symptom checkers provide free or low-cost alternatives for health information and initial symptom assessment, potentially reducing the perceived necessity of professional telehealth consultations for minor issues. By mid-2024, with an estimated 70% of consumers using digital health tools, this trend is poised to fragment the market for non-urgent medical advice.

| Substitute Type | Key Characteristics | 2024 Market Data/Trend | Impact on LifeMD |

| In-Person Healthcare | Hands-on examination, complex conditions, patient familiarity | Billions in annual healthcare spending, higher patient retention in specialized care with physical touchpoints | Limits telehealth adoption for chronic/complex cases |

| Retail Clinics | Convenience, walk-in access, common ailments | Growing number of clinics by major pharmacy chains | Direct competition for routine care needs |

| OTC Medications & Home Remedies | Accessibility, affordability, self-management | Global OTC market over $150 billion | Reduces demand for minor ailment consultations |

| Digital Health Apps/Websites | Information access, symptom checkers, low/no cost | Estimated 70%+ consumers use digital health tools | Potential reduction in demand for non-urgent telehealth |

Entrants Threaten

The healthcare sector, particularly telehealth, faces formidable barriers to entry due to stringent regulatory and licensing requirements. New companies must contend with a complex web of state-specific medical licensing, evolving telehealth regulations, and robust data privacy laws such as HIPAA, which mandates strict protection of patient health information. These intricate compliance demands significantly elevate the cost and complexity of establishing a new operation.

The significant capital required to build and maintain advanced telehealth technology presents a formidable barrier to entry. Developing a secure, scalable platform with robust cybersecurity and seamless EHR integration demands substantial upfront investment. For instance, in 2024, the global telehealth market saw continued investment, with companies allocating tens of millions to platform upgrades and cybersecurity alone.

In the highly regulated and trust-dependent healthcare industry, building a strong brand reputation and patient loyalty is a significant barrier for new entrants. LifeMD, having invested heavily in marketing and patient acquisition, has cultivated a recognized name and a substantial patient base. This established presence makes it challenging for newcomers to gain traction. For instance, LifeMD's commitment to patient care and accessible telehealth services has been a cornerstone of its brand building.

Acquiring and Retaining Qualified Provider Networks

The threat of new entrants in the telehealth space, particularly concerning the ability to acquire and retain qualified provider networks, presents a significant hurdle. Building a robust network of licensed and credentialed healthcare professionals across diverse specialties is a complex and resource-intensive undertaking. New players must contend with established entities that already have strong relationships with providers, making recruitment a costly and protracted process.

For instance, in 2024, the demand for telehealth services continued to surge, exacerbating the existing shortage of qualified healthcare professionals. This increased demand intensifies competition for talent, driving up compensation and benefits packages. New entrants face the challenge of offering competitive terms to attract and keep providers, which can strain their financial resources.

- Provider Shortages: Many regions continue to experience shortages of specific medical specialists, making it difficult for any new telehealth platform to quickly build a comprehensive network.

- Credentialing Complexity: The process of credentialing and onboarding new providers is often lengthy and involves rigorous verification of licenses, certifications, and background checks, acting as a natural barrier.

- Competition for Talent: Established telehealth providers often have established brand recognition and existing provider relationships, making it harder for newcomers to attract top talent.

- Cost of Recruitment: Aggressively recruiting and retaining providers can involve significant marketing, HR, and compensation expenses, impacting profitability for new entrants.

Economies of Scale in Operations and Marketing

Established telehealth providers, like LifeMD, possess significant advantages due to economies of scale in their operations and marketing efforts. These larger players can spread the substantial costs of technology development, such as sophisticated patient portals and secure data infrastructure, across a wider customer base. This reduces the per-unit cost of innovation and maintenance.

Furthermore, established companies benefit from more efficient marketing spend. They can negotiate better rates for advertising and have the resources for broader reach campaigns, which new entrants may find prohibitively expensive. For example, in 2024, major telehealth platforms continued to invest heavily in digital marketing, reaching millions of potential patients.

This disparity creates a significant barrier for new companies. Without comparable scale, startups struggle to match the cost efficiencies of established players. This can make it difficult to compete on price, a critical factor for many consumers in the healthcare market, or to allocate sufficient capital for aggressive growth and market penetration.

- Economies of Scale in Technology: Established telehealth platforms can amortize R&D costs for proprietary software and AI-driven diagnostic tools over a larger user base, lowering the per-user expense.

- Marketing Efficiency: Larger companies often command lower customer acquisition costs (CAC) due to bulk advertising buys and established brand recognition, a feat difficult for new entrants to replicate in 2024.

- Operational Leverage: Existing providers benefit from streamlined back-office functions, including billing, customer support, and compliance, which become more cost-effective with higher patient volumes.

- Competitive Pricing: The cost advantages derived from scale allow incumbent firms to offer more competitive pricing, putting pressure on new entrants to either accept lower margins or charge higher prices.

The threat of new entrants in the telehealth sector is generally moderate to low due to substantial barriers. Significant capital investment is required for robust technology platforms and cybersecurity, with companies in 2024 continuing to invest heavily in these areas. Stringent regulatory compliance, including state-specific licensing and HIPAA, adds considerable cost and complexity for newcomers.

Porter's Five Forces Analysis Data Sources

Our LifeMD Porter's Five Forces analysis is built upon a foundation of credible data, including LifeMD's SEC filings, investor presentations, and publicly available financial reports. We supplement this with insights from reputable industry research firms and market intelligence platforms to provide a comprehensive view of the competitive landscape.