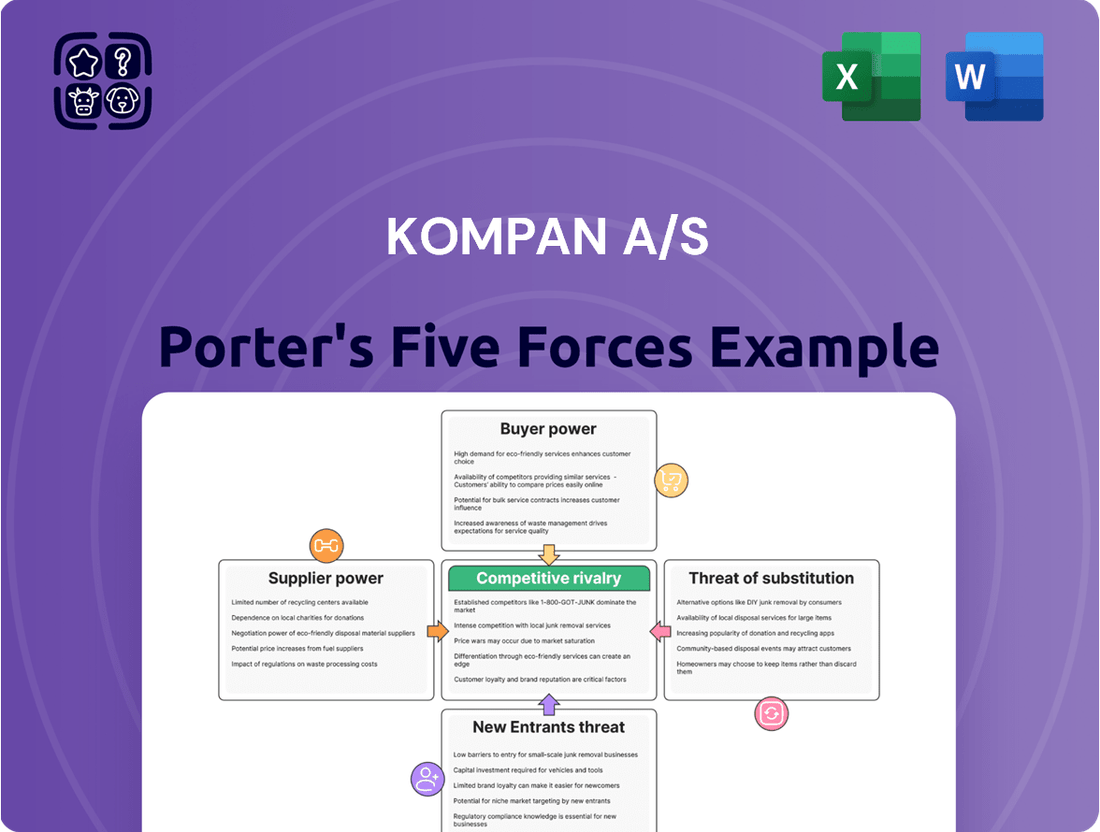

Kompan A/S Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kompan A/S Bundle

Kompan A/S operates in a dynamic playground equipment market, facing moderate competitive rivalry and significant buyer power from municipalities and large institutions. The threat of new entrants is somewhat limited by capital requirements and established brand loyalty, but innovation is key to staying ahead. Substitutes, like DIY or alternative leisure activities, present a constant challenge to discretionary spending.

The complete report reveals the real forces shaping Kompan A/S’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The playground and outdoor fitness equipment industry, which Kompan operates within, depends on key raw materials such as steel, plastics, wood, and rubber. If a small number of suppliers control the production of these specialized materials or essential components, their ability to influence prices rises significantly. This concentration can translate into higher costs for Kompan.

In 2023, global steel prices, a critical input for playground structures, saw fluctuations. For instance, the average price of hot-rolled coil steel in the US hovered around $750-$850 per ton, a slight decrease from 2022 peaks but still a considerable cost factor. Similarly, specialized recycled plastics, increasingly sought after for sustainability, might be sourced from a more limited set of processors, potentially enhancing their bargaining leverage.

However, the growing emphasis on sustainable materials in the sector could broaden the supplier landscape for eco-friendly options. As more manufacturers adopt greener practices, the availability of recycled plastics and sustainably sourced wood may increase, potentially diluting the bargaining power of any single supplier. This trend could offer Kompan more flexibility in sourcing and cost management.

Kompan's commitment to innovative and sustainable playground designs often necessitates specialized materials and components. For instance, their use of FSC-certified wood or proprietary recycled plastics means suppliers of these unique inputs hold significant leverage. This reliance on specialized sourcing can make it harder for Kompan to switch suppliers, thereby increasing supplier bargaining power. In 2024, the global market for sustainable building materials, a key area for Kompan, saw continued growth, further solidifying the position of suppliers in this niche.

Switching suppliers for core materials or specialized components presents Kompan with substantial hurdles. The cost and time involved in re-tooling manufacturing lines, redesigning playground equipment to meet new material specifications, and the rigorous process of re-certifying products for safety standards like BS EN 1176 or CPSC can be prohibitive. These expenses directly increase supplier bargaining power.

Supplier's Ability to Forward Integrate

If Kompan's key suppliers possess the capability or incentive to move downstream and manufacture playground equipment themselves, they could directly compete. This potential threat incentivizes Kompan to cultivate strong supplier relationships and potentially offer more favorable terms to deter such forward integration, thus bolstering supplier power. For instance, a supplier of specialized, high-performance playground surfacing materials might explore manufacturing complete play structures if the market signals strong demand and profitability.

However, the highly specialized nature of designing, manufacturing, and globally distributing complex finished products like Kompan's playground equipment makes this forward integration less probable for most suppliers. The significant capital investment and established brand recognition required to compete effectively in the finished playground market present substantial barriers.

Consider these factors regarding supplier forward integration for Kompan:

- Threat of Competition: Suppliers entering Kompan's market directly increases competition and can pressure Kompan's pricing and market share.

- Supplier Leverage: The credible threat of forward integration allows suppliers to negotiate better terms, potentially impacting Kompan's cost structure.

- Industry Specifics: The high technical expertise and capital needed for playground manufacturing limit the number of suppliers capable of effective forward integration. For example, while a raw material supplier might have scale, the engineering and design capabilities for finished playground equipment are distinct.

Importance of Kompan to Supplier

For large, diversified raw material suppliers, Kompan's business might only represent a small fraction of their total sales, which naturally lessens Kompan's ability to negotiate favorable terms. However, for suppliers of highly specialized components crucial to playground manufacturing, Kompan could be a key client, thereby enhancing Kompan's bargaining position. Kompan's standing as a global leader in the playground industry means it is likely a substantial customer for many of its suppliers, a factor that can influence supplier willingness to offer competitive pricing and terms.

Kompan's significant purchasing volume, driven by its global presence and market leadership, provides it with considerable leverage when negotiating with suppliers. This scale allows Kompan to potentially secure better pricing and more favorable contract conditions than smaller competitors. For instance, in 2023, the global playground equipment market was valued at approximately $10.8 billion, with Kompan holding a significant share, indicating its substantial purchasing power.

- Diversified Suppliers: Kompan's contribution to the revenue of large, diversified suppliers may be minimal, limiting Kompan's negotiating leverage.

- Specialized Suppliers: For niche component providers, Kompan can be a dominant customer, granting Kompan increased bargaining power.

- Market Leadership: As a global leader, Kompan's substantial order volumes make it an important client for many suppliers, enhancing its ability to negotiate favorable terms.

Suppliers of specialized materials and components, like FSC-certified wood or proprietary recycled plastics, hold significant bargaining power over Kompan due to the high switching costs and the need for product re-certification. In 2024, the market for sustainable building materials continued its upward trajectory, reinforcing the leverage of suppliers in this niche. However, Kompan's status as a global leader, with substantial purchasing volumes, grants it considerable negotiation power with many suppliers, potentially securing better pricing and terms.

| Factor | Impact on Kompan | Example/Data (2023-2024) |

|---|---|---|

| Supplier Concentration | Increased costs if few suppliers control key inputs. | Steel prices around $750-$850/ton in the US (2023) remained a significant cost. |

| Switching Costs | High costs for re-tooling, redesign, and re-certification limit supplier flexibility. | Safety standards like BS EN 1176 require rigorous re-certification processes. |

| Forward Integration Threat | Credible threat allows suppliers to negotiate better terms. | Suppliers of specialized surfacing materials might consider finished product manufacturing. |

| Kompan's Purchasing Power | Leverage from significant order volumes for global leadership. | Global playground equipment market valued at ~$10.8 billion (2023). |

What is included in the product

This Porter's Five Forces analysis for Kompan A/S reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes within the playground equipment industry.

Effortlessly identify and quantify competitive pressures, allowing Kompan A/S to strategically mitigate threats and capitalize on opportunities.

Customers Bargaining Power

Kompan's customer base is quite varied, spanning municipal governments, educational institutions, childcare facilities, housing cooperatives, and private construction firms across the globe. This broad reach means no single customer segment dominates, diluting the power of any one group.

However, the presence of large public sector contracts or significant projects from major developers can concentrate purchasing power. These substantial deals, while not the norm for every transaction, can give these specific customers a stronger hand in negotiations, potentially influencing pricing or contract terms.

For instance, a large city's bid for a comprehensive playground upgrade involving multiple locations would represent a substantial revenue stream for Kompan. Such a client could leverage the sheer volume of the order to negotiate better terms, impacting Kompan's profitability on that specific deal.

While Kompan aims for broad market penetration, the potential for a few large clients to exert influence means managing these relationships and understanding their purchasing dynamics is crucial for maintaining pricing power and overall profitability.

Customers for Kompan A/S face a broad spectrum of alternatives for play and fitness. These range from free public parks and playgrounds to commercial indoor play centers and even digital entertainment options that compete for children's leisure time. This wide array of choices significantly empowers customers.

The presence of readily available substitutes, particularly those that are more budget-friendly or offer advantages like weather independence, directly impacts Kompan's pricing power. For instance, the growing popularity and accessibility of indoor play facilities, which are less susceptible to seasonal or weather-related limitations, present a strong alternative for parents seeking consistent entertainment for their children.

In 2024, the global market for children's entertainment and active play saw continued growth, with indoor play centers experiencing a notable surge in demand due to their year-round usability. This trend means that customers have viable, often less expensive, alternatives to Kompan's specialized outdoor play equipment, thereby increasing their bargaining leverage.

Public sector clients, including municipalities and schools, frequently face stringent budget limitations. This financial pressure often translates into a heightened price sensitivity, making them actively seek competitive bidding processes and prioritize value for their investment. For instance, in 2024, many local government budgets saw increases in spending on public infrastructure, but this often came with a mandate for greater cost-efficiency.

This intense focus on price empowers these customers, directly influencing manufacturers like Kompan. They are compelled to meticulously manage their operational costs and ensure that product quality and safety standards remain uncompromised, even when faced with demands for lower pricing. The pressure to deliver high-quality, safe play equipment within tight budgetary frameworks is a constant balancing act.

Customer's Ability to Backward Integrate

Kompan's customers, primarily municipalities and educational institutions, possess very limited ability to backward integrate. The substantial capital expenditure needed for specialized manufacturing equipment, coupled with the intricate design and engineering skills required for playground and fitness equipment, presents a significant barrier to entry. For instance, establishing a facility capable of producing high-quality, durable playground structures would likely require investments in the tens of millions of dollars, far exceeding the core competencies and budgets of these public entities.

The complexity of ensuring compliance with rigorous safety standards, such as EN 1176 and ASTM F1487, further deters backward integration. These certifications necessitate ongoing investment in testing, quality control, and expert knowledge that are core to Kompan's operations but impractical for their clientele to replicate. This inherent difficulty in developing in-house manufacturing capabilities effectively curbs the bargaining power of Kompan's customers.

- High Capital Costs: Setting up manufacturing facilities for playground equipment can cost upwards of $50 million, a prohibitive sum for typical municipal or school budgets.

- Specialized Expertise: Producing safe and durable equipment requires advanced engineering, materials science, and design skills that are not readily available within customer organizations.

- Regulatory Compliance: Meeting stringent safety certifications (e.g., EN 1176) demands dedicated resources for testing and quality assurance, a significant undertaking for non-manufacturers.

- Limited Incentive: The core mission of municipalities and schools is education and community service, not manufacturing, making backward integration an unlikely strategic pursuit.

Product Differentiation of Kompan

Kompan's product differentiation significantly curtails the bargaining power of its customers. The company's robust brand reputation, built over decades, instills confidence and loyalty, making customers less inclined to seek out cheaper alternatives. For instance, Kompan's commitment to safety and quality is a key differentiator that resonates with municipalities and schools, which are often primary buyers and prioritize long-term value over initial cost.

Continuous innovation is another cornerstone of Kompan's differentiation strategy. By consistently introducing new play concepts and integrating technology, such as their smart playgrounds that offer interactive digital experiences, Kompan creates unique value propositions. This focus on cutting-edge design and engagement reduces the commoditization of their offerings, making it harder for customers to compare them solely on price and thus weakening their leverage.

Kompan's pronounced focus on sustainability further distinguishes its products. As environmental consciousness grows, customers, particularly public bodies, increasingly favor suppliers with strong eco-friendly credentials. Kompan's use of sustainable materials and manufacturing processes appeals to this segment, reducing the perceived substitutability of their products and thereby diminishing customer bargaining power.

The company boasts a diverse product portfolio, ranging from traditional play structures to advanced digital play solutions. This breadth allows Kompan to cater to a wide array of customer needs and preferences. This comprehensive offering means customers are less likely to find a single competitor that can match Kompan's entire range, which strengthens Kompan's position and lessens the bargaining power of individual customers who might otherwise threaten to switch if a single product is perceived as too expensive.

- Brand Reputation: Kompan's established global brand recognition minimizes the perceived risk for buyers.

- Innovation: Investment in smart playgrounds and digital play enhances product uniqueness.

- Sustainability Focus: Use of eco-friendly materials appeals to a growing market segment.

- Diverse Portfolio: Offering a wide range of play solutions reduces customer reliance on single competitors.

Kompan's customers generally have moderate bargaining power. While individual customers may not have significant leverage due to Kompan's broad customer base, large-scale public sector contracts or major developer projects can concentrate purchasing power. This means that while most customers have limited influence, a few substantial deals can shift the balance, allowing those specific clients to negotiate better terms. For example, a major city's initiative to upgrade multiple playgrounds in 2024 could represent a significant portion of Kompan's revenue for that region, giving that client more weight in negotiations.

The availability of numerous substitutes, from public parks to indoor play centers, significantly empowers Kompan's customers. The increasing popularity of year-round indoor play facilities, especially noted in 2024, offers a strong, often more budget-friendly, alternative. This direct competition for children's leisure time forces Kompan to remain competitive on pricing and value.

Customers, particularly public entities like municipalities and schools, are highly price-sensitive due to budget constraints, a factor amplified in 2024 by mandates for cost-efficiency in public spending. This price focus compels Kompan to manage costs diligently while maintaining its high standards for safety and quality. Customers' inability to backward integrate, due to high capital costs and specialized expertise required for manufacturing, limits their ability to exert downward pressure on prices.

Kompan's strong brand reputation, continuous innovation in areas like smart playgrounds, and commitment to sustainability reduce the perceived substitutability of its offerings. This product differentiation, coupled with a diverse portfolio that caters to a wide range of needs, weakens customers' bargaining power by making it harder for them to switch to or consolidate suppliers based solely on price.

Same Document Delivered

Kompan A/S Porter's Five Forces Analysis

This preview shows the exact Kompan A/S Porter's Five Forces analysis you'll receive immediately after purchase, offering a comprehensive overview of the competitive landscape. You'll gain insights into the industry's bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. This document is fully formatted and ready for your strategic planning needs, providing actionable intelligence without any surprises or placeholders.

Rivalry Among Competitors

The global playground equipment market is characterized by a moderate to high level of competitive rivalry. Kompan operates within a landscape populated by several significant players, including PlayCore, Landscape Structures, and Playpower. These companies, along with others like ELI, possess substantial market share and established brand recognition, especially within their respective geographic strongholds.

Kompan, while a prominent global leader, particularly in the European market, faces robust competition from these large, well-established entities. The presence of multiple sizeable competitors means that market share gains are often hard-won, requiring continuous innovation and strategic pricing. For instance, in 2023, the North American playground equipment market alone was valued at over $1.5 billion, with these key players vying for significant portions of that revenue.

The global playground equipment market is expected to see robust expansion, with a projected compound annual growth rate (CAGR) of 6.7% between 2025 and 2031. This healthy growth trajectory, coupled with strong performance in the outdoor fitness equipment sector, offers companies like Kompan A/S opportunities for expansion. Such market growth can temper the intensity of competitive rivalry, as firms can increase their revenue by capturing new demand rather than solely by market share acquisition.

Kompan actively pursues product differentiation through ongoing innovation, evident in their development of smart playgrounds, immersive digital play experiences, and environmentally conscious designs utilizing recycled materials. This focus on unique features and sustainability sets them apart in the market.

The competitive landscape for playground equipment is characterized by rivals also prioritizing innovation, paramount safety standards, and inclusive design principles. This shared emphasis means that product differentiation is a primary arena for competition, rather than just competing on price alone.

For instance, in 2024, the global playground equipment market was valued at approximately $5.2 billion, with growth anticipated due to increasing demand for innovative and safety-certified play solutions.

This intense focus on developing novel features and superior quality intensifies rivalry, as companies strive to capture market share by offering distinct value propositions beyond basic functionality.

Switching Costs for Customers

While Kompan strives to build loyalty, the switching costs for customers in the playground equipment sector aren't excessively high. Many competitors offer comparable product lines and installation, making it relatively easy for buyers to move between providers. This situation can unfortunately fuel more intense competition.

The relatively low switching costs mean that customers can more readily explore alternatives. This dynamic is particularly relevant when considering the broader market for recreational and educational play spaces. For instance, in 2023, the global playground equipment market was valued at approximately $5.6 billion, with significant growth projected. This indicates a large and accessible market where customer retention is crucial.

- Low Switching Costs: Customers can often switch between playground equipment suppliers without incurring substantial financial penalties or significant disruption.

- Similar Offerings: Major players frequently offer overlapping product categories and standardized installation processes, reducing the perceived risk of switching.

- Increased Competition: This ease of transition directly contributes to heightened rivalry among manufacturers as they vie for market share.

- Market Accessibility: With a global market value in the billions, the accessibility for new entrants or established competitors to attract dissatisfied customers is notable.

Exit Barriers

High capital investment in manufacturing facilities, such as specialized machinery and large-scale production lines, presents a significant hurdle for companies looking to exit the playground equipment manufacturing sector. For instance, a typical advanced manufacturing facility for Kompan A/S might require tens of millions of Euros in initial investment, making it difficult to recoup these costs upon sale.

Specialized intellectual property, including patents for unique play features and proprietary design software, further solidifies exit barriers. These assets are often difficult to transfer or sell to unrelated parties, reducing their residual value and discouraging divestment.

Established distribution networks and long-term supplier relationships are also critical factors. Kompan A/S, for example, has built a global network over decades, and breaking these ties or finding buyers for them can be a complex and costly process, effectively trapping capital within the business.

These substantial exit barriers mean that companies are more inclined to persevere and compete even during periods of economic slowdown or reduced demand. This persistence intensifies competitive rivalry, as firms are less likely to exit the market, leading to prolonged battles for market share and continued pressure on pricing and innovation.

- High Capital Investment: Playground equipment manufacturing requires substantial upfront investment in specialized machinery, tooling, and facilities, often running into millions of Euros.

- Specialized Intellectual Property: Patents for unique play features and proprietary design technologies are difficult to monetize upon exit.

- Established Distribution Networks: Global and regional distribution channels are built over time and are hard to replicate or sell independently.

- Sustained Rivalry: The difficulty in exiting encourages companies to remain operational, leading to continued, intense competition even in challenging market conditions.

Competitive rivalry in the playground equipment market is robust, driven by several large, established players like PlayCore and Landscape Structures. While Kompan A/S is a global leader, particularly in Europe, these competitors possess significant market share and brand recognition. This intense competition is further fueled by relatively low switching costs for customers, encouraging easier transitions between suppliers. The global playground equipment market was valued at approximately $5.2 billion in 2024, with continued growth expected.

SSubstitutes Threaten

Indoor play centers present a significant substitute threat to traditional outdoor playground providers like Kompan. These indoor facilities offer a climate-controlled environment, ensuring year-round usability regardless of weather conditions, a key advantage in many markets. They provide children with physical activity and social engagement, directly competing for leisure time and spending. In 2023, the global indoor playground market was valued at approximately $10.5 billion, demonstrating substantial consumer demand for such alternatives.

Digital play, encompassing video games and online interactive experiences, also acts as a growing substitute. While not offering the same physical benefits, digital entertainment competes for children's attention and parents' disposable income. Recognizing this, Kompan has been actively incorporating digital elements into its playground designs, aiming to blend physical and digital play to remain competitive. The global video game market, for instance, generated over $184 billion in 2023, highlighting the immense draw of digital entertainment.

Unspecialized public parks and green spaces represent a significant threat of substitutes for Kompan A/S. These areas offer free access to outdoor recreation and physical activity, directly competing with Kompan's structured play and fitness equipment. For instance, in 2024, many municipalities continued to invest in enhancing their public parks, with some local government budgets allocating substantial funds towards general green space improvements and basic amenities rather than specialized play structures. This trend means families and communities can opt for these cost-free alternatives for outdoor enjoyment.

For residential customers, home-based play equipment like swing sets, trampolines, and simple outdoor playsets present a readily available and private alternative to commercial playgrounds. These options, while often less elaborate, satisfy fundamental play requirements without the need for public access or scheduled visits.

The market for home-based play equipment is substantial, with the global outdoor playground equipment market, which includes many home-use items, projected to reach approximately $12.5 billion by 2027. This indicates a significant existing demand for private play solutions.

The convenience and control over usage offered by home equipment can be a strong draw, especially for families with young children. This personal ownership model directly competes with the service-based model of public or commercial play facilities.

While Kompan A/S offers professional-grade, often larger-scale installations, the accessibility and lower initial cost of many home-based alternatives can be a significant threat, particularly for price-sensitive consumers or those with limited space.

Organized Sports and Fitness Programs

Structured sports leagues, fitness classes, and other organized activities represent a significant threat of substitutes for Kompan A/S. These programs offer comparable fitness and social development benefits, directly competing with the outcomes achieved through Kompan's playground and fitness equipment. For instance, the global fitness industry, valued at over $96 billion in 2023, demonstrates a strong consumer preference for structured, guided activities.

The availability of diverse fitness classes, from yoga and Pilates to high-intensity interval training (HIIT), provides consumers with readily accessible alternatives for maintaining physical health. Furthermore, organized sports leagues, such as youth soccer or adult basketball, foster social interaction and physical exertion, mirroring the community-building aspects often facilitated by public play spaces. Data from 2024 indicates continued growth in participation in these organized recreational activities, especially among families seeking structured outlets for their children.

- Direct Competition: Organized sports and fitness programs directly fulfill the need for physical activity and social engagement.

- Market Value: The global fitness industry's valuation exceeding $96 billion in 2023 highlights the significant market for alternative fitness solutions.

- Participation Trends: Growing participation in structured sports and fitness classes in 2024 suggests a strong preference for these organized offerings.

- Accessibility: The widespread availability and often lower perceived cost of community sports leagues and fitness classes make them attractive substitutes.

Natural Play Environments

The rise of natural play environments presents a significant threat of substitutes for traditional, highly manufactured playground structures. These adventure playgrounds, which prioritize natural elements like wood and recycled materials, foster free play and creativity, appealing to a growing demand for organic and less structured children's experiences.

This shift is driven by a broader societal trend toward sustainability and a desire for children to engage with the environment. For instance, in 2024, the global nature-based play market is projected to see continued growth, with an increasing number of municipalities and educational institutions investing in natural play spaces.

- Growing Demand: Parents and educators are increasingly seeking play experiences that connect children with nature, potentially reducing the appeal of purely manufactured equipment.

- Cost-Effectiveness: Natural play environments can sometimes be more cost-effective to implement and maintain compared to complex, manufactured structures.

- Educational Value: These spaces offer unique developmental benefits, promoting problem-solving, risk assessment, and sensory exploration, which can be seen as a superior alternative by some.

- Sustainability Focus: The use of recycled and natural materials aligns with environmental consciousness, making them an attractive option for eco-aware consumers and communities.

The threat of substitutes for Kompan A/S is multi-faceted, encompassing everything from free public spaces to digital entertainment. Indoor play centers, valued at around $10.5 billion globally in 2023, offer weather-proof alternatives, while digital gaming, a colossal $184 billion market in 2023, competes for children's attention. Even unspecialized public parks, often enhanced by municipal budgets in 2024, provide cost-free outdoor recreation, directly challenging Kompan's specialized offerings.

Home-based play equipment, part of a global market projected to reach $12.5 billion by 2027, offers convenience and privacy, particularly appealing to families. Additionally, structured sports and fitness programs, within a $96 billion global industry in 2023, provide comparable physical and social development benefits, with participation showing strong growth in 2024. Finally, natural play environments are gaining traction, aligning with sustainability trends and offering unique developmental advantages.

| Substitute Category | Key Characteristics | Market Context (2023/2024 Data) | Kompan's Challenge |

|---|---|---|---|

| Indoor Play Centers | Climate-controlled, year-round usability | Global market valued at ~$10.5 billion (2023) | Offers an alternative to outdoor play, regardless of weather |

| Digital Play | Interactive, screen-based entertainment | Global video game market generated over $184 billion (2023) | Competes for attention and disposable income, driving Kompan's digital integration |

| Public Parks/Green Spaces | Free access, unstructured outdoor activity | Municipal investments in parks continued in 2024 | Provides a cost-free alternative for outdoor recreation |

| Home-Based Play Equipment | Private, convenient, lower initial cost | Global outdoor playground equipment market projected ~$12.5 billion by 2027 | Appeals to price-sensitive consumers and those seeking personal play solutions |

| Structured Sports & Fitness | Organized physical activity, social development | Global fitness industry valued at over $96 billion (2023); strong participation growth in 2024 | Fulfills similar developmental needs through guided activities |

| Natural Play Environments | Focus on natural materials, free play, sustainability | Growing market for nature-based play (2024 projections) | Appeals to demand for organic, eco-friendly, and less structured play experiences |

Entrants Threaten

Kompan A/S, a leader in the playground and outdoor fitness equipment sector, faces a significant barrier to entry due to high capital requirements. Establishing state-of-the-art design studios, advanced manufacturing plants, and robust global distribution channels demands substantial upfront investment. For instance, setting up a modern manufacturing facility with specialized machinery can easily run into tens of millions of dollars, deterring many potential new players.

The playground equipment manufacturing industry, including companies like Kompan A/S, faces a significant threat from new entrants due to stringent regulatory and safety standards. Compliance with benchmarks such as BS EN 1176 in Europe and Consumer Product Safety Commission (CPSC) guidelines in the United States is non-negotiable. These regulations cover everything from the materials used and product design to installation procedures and ongoing maintenance requirements.

Meeting these complex and continuously updated safety requirements demands considerable technical expertise and substantial financial investment in research, development, and testing. This creates a formidable barrier to entry for potential new competitors who may lack the established infrastructure and specialized knowledge necessary to navigate and satisfy these demanding compliance protocols. For instance, failing to meet these standards can result in product recalls and significant legal liabilities, deterring new players.

Established players like Kompan have cultivated robust brand reputations over many years, emphasizing quality, safety, and innovation. This deep-seated trust makes it challenging for newcomers to compete effectively. For instance, Kompan's commitment to safety standards is often a non-negotiable for institutional clients, a reputation built over decades of consistent performance and adherence to rigorous testing protocols.

New entrants would face significant hurdles in replicating the brand loyalty Kompan enjoys, particularly among institutional buyers such as municipalities and schools. These organizations typically prioritize proven reliability and a track record of excellence, which new companies would struggle to demonstrate initially. In 2024, municipalities continue to allocate substantial budgets to public play spaces, often favoring suppliers with established safety certifications and long-term warranties, which Kompan readily provides.

Access to Distribution Channels

Kompan's formidable global presence, with operations in over 90 countries, presents a significant barrier for new entrants. Establishing a comparable distribution network requires substantial investment and time, making it difficult for newcomers to compete effectively.

New players would struggle to replicate Kompan's established relationships with retailers, distributors, and direct sales teams, which are vital for market penetration.

- Extensive Global Network: Kompan operates in more than 90 countries, creating a widespread reach that is difficult and costly for new entrants to match.

- Channel Control: Kompan's established relationships with sales partners and direct sales infrastructure provide significant control over how its products reach the market.

- Brand Recognition and Trust: Years of operation have built trust and brand recognition within these channels, which new entrants lack.

Economies of Scale and Experience Curve

Kompan, as a leading player in the playground equipment industry, leverages significant economies of scale. This translates into lower per-unit costs for production, raw material sourcing, and research and development. For instance, in 2024, major manufacturers often benefit from bulk purchasing discounts that smaller newcomers cannot access.

These cost efficiencies create a substantial barrier for new entrants. A new company entering the market would likely operate at a much smaller scale, resulting in higher production costs. This cost disadvantage would make it challenging to compete on price with established firms like Kompan, who can absorb development costs over larger volumes.

Furthermore, Kompan's established experience curve allows for continuous process optimization and innovation, further reducing costs and improving product quality. New entrants lack this accumulated knowledge and would face a steeper learning curve, both in terms of manufacturing efficiency and product design, delaying their ability to reach competitive cost structures.

- Economies of scale in production and procurement provide cost advantages to established firms like Kompan.

- New entrants face higher per-unit costs due to their smaller operational scale, hindering price competitiveness.

- The experience curve allows Kompan to refine processes and reduce costs over time, a benefit new firms do not initially possess.

- Significant upfront investment in R&D and manufacturing infrastructure is required, posing a financial hurdle for potential new competitors.

The threat of new entrants for Kompan A/S is moderate to low. Significant capital investment is required for design, manufacturing, and distribution, with new facilities costing tens of millions of dollars. Stringent safety regulations, like BS EN 1176 and CPSC guidelines, demand expertise and financial resources for compliance, a hurdle for newcomers.

Kompan's established brand reputation, built on decades of quality and safety, fosters strong customer loyalty, particularly with institutional buyers who prioritize proven reliability. New entrants struggle to match this trust and track record. For instance, in 2024, municipalities continue to favor suppliers with established safety certifications and long-term warranties, which Kompan readily offers.

Kompan's extensive global distribution network, spanning over 90 countries, and its established relationships with sales channels are difficult and costly for new players to replicate. Economies of scale also provide Kompan with lower per-unit production costs, making it challenging for smaller, new entrants to compete on price. In 2024, bulk purchasing discounts available to large manufacturers further widen this cost gap.

| Factor | Impact on New Entrants | Kompan's Advantage |

| Capital Requirements | High | Established infrastructure |

| Regulatory Compliance | Demanding & Costly | Expertise & resources |

| Brand Reputation & Loyalty | Difficult to build | Decades of trust |

| Distribution Network | Costly & time-consuming | Global presence |

| Economies of Scale | Disadvantageous | Cost efficiencies |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Kompan A/S leverages data from industry-specific market research reports, Kompan's own annual financial statements and investor presentations, and publicly available information on competitor strategies and market share to provide a comprehensive view of the playground equipment industry.