Inspired Entertainment Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inspired Entertainment Bundle

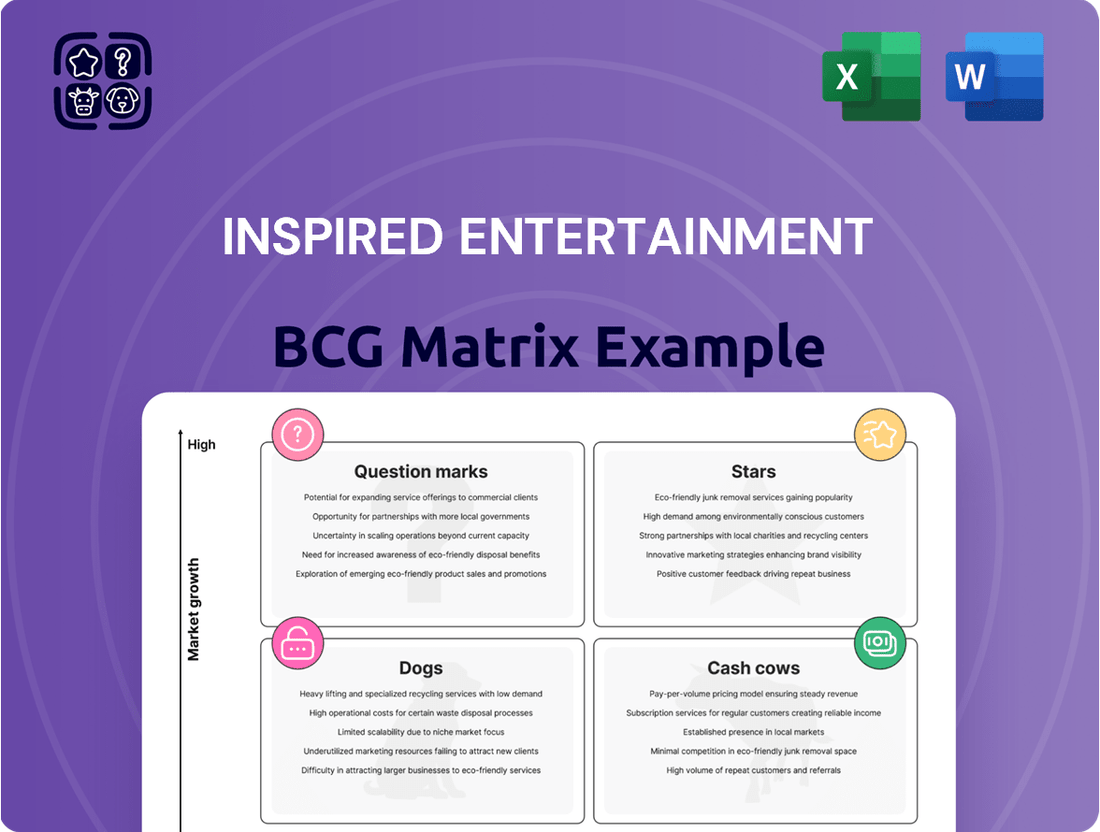

Curious about Inspired Entertainment's product portfolio? Our BCG Matrix preview offers a glimpse into their market positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full strategic picture; purchase the complete BCG Matrix report to unlock detailed analysis and actionable insights for smarter investment decisions.

Stars

Inspired Entertainment's Interactive segment is a shining Star in its BCG Matrix. This segment experienced a remarkable 49% year-over-year revenue increase in Q1 2025, hitting a new high of $12.1 million. This significant growth is a key contributor to the company's overall Adjusted EBITDA improvement.

The Interactive segment's impressive performance is further underscored by its 75% year-over-year growth in Adjusted EBITDA during Q1 2025. Margins within this segment expanded substantially, reaching 64%, demonstrating its strong profitability and market leadership in the dynamic online gaming space.

Inspired Entertainment's Hybrid Dealer product line is a shining Star in its portfolio, demonstrating robust growth and strategic expansion. The successful rollout of new games and key partnerships, such as the MGM Bonus City launch with BetMGM in Michigan, underscores its potential for sustained future success.

Further solidifying its Star status, Hybrid Dealer Roulette made its debut with Loto-Québec in Canada, expanding the product's reach into new markets. Notably, bet365 became the first UK customer to adopt Hybrid Dealer games, signaling strong international interest and adoption.

This innovative offering merges the engaging experience of live dealers with the convenience of digital gaming, directly addressing a high-demand segment of the market. The company’s strategic focus on this hybrid model positions it to capitalize on evolving player preferences and capture significant market share in the coming years.

Inspired Entertainment's North American Interactive segment is a clear star in its BCG Matrix. This segment is experiencing rapid growth, fueled by the expanding regulated iGaming market across the United States. The company has strategically entered key states like Michigan, Pennsylvania, and Connecticut, demonstrating its commitment to this high-potential area.

The success in North America is directly linked to strong partnerships with major operators such as BetMGM, Fanatics, and FanDuel. These collaborations allow Inspired to effectively distribute its iGaming content and capture increasing market share. For instance, in 2024, Inspired reported significant revenue growth from its Interactive division, underscoring the segment's stellar performance and its contribution to the company's overall expansion.

UK Interactive Market Strength

The UK interactive market is a cornerstone for Inspired Entertainment, consistently driving impressive results. This region contributed significantly to the company's record-breaking performance in 2024, showcasing sustained and robust growth.

A key driver of this success is strategic collaboration, exemplified by the January 2025 launch of Hybrid Dealer Roulette with bet365. This partnership underscores Inspired's ability to innovate and deliver engaging content within a competitive landscape.

- UK Interactive Segment Performance: Inspired Entertainment's interactive division has demonstrated exceptional performance, with the UK market being a primary contributor to its record-breaking achievements.

- Strategic Partnerships: The company actively pursues and benefits from strategic alliances, such as the collaboration with bet365 for the launch of Hybrid Dealer Roulette in early 2025, which enhances its market presence.

- Market Position: Inspired Entertainment maintains a strong market share in the UK's interactive sector, a testament to its established presence and ongoing expansion efforts in a mature yet growing market.

Strategic Digital Focus

Inspired Entertainment is strategically shifting its focus and investments towards its higher-margin digital offerings, especially within its Interactive segment. This pivot is designed to expand its digital footprint and simultaneously optimize its land-based operations, ultimately aiming for sustained growth and enhanced shareholder value. The Interactive segment's consistent strong performance serves as a clear validation of this strategic direction.

The company's commitment to digital expansion is evident in its financial performance. For the first quarter of 2024, Inspired Entertainment reported a 34% increase in revenue for its Interactive segment, reaching $36.4 million. This segment's adjusted EBITDA also saw a significant jump, growing by 45% to $15.1 million, highlighting the profitability of this strategic focus.

- Digital Growth Engine: The Interactive segment is the primary driver of Inspired Entertainment's growth, fueled by strategic investments in digital platforms and content.

- Margin Improvement: This digital focus is inherently geared towards higher-margin revenue streams compared to traditional land-based operations.

- Market Validation: Consistent outperformance in the Interactive segment, as seen in Q1 2024 revenue growth, confirms the market's positive reception to this strategy.

- Shareholder Value: The overarching goal is to leverage digital expansion to create sustainable value for shareholders through increased profitability and market share.

Inspired Entertainment's Interactive segment is a clear Star, exhibiting substantial growth and profitability. This segment saw a 34% revenue increase in Q1 2024, reaching $36.4 million, with adjusted EBITDA growing by 45% to $15.1 million. The North American Interactive segment, in particular, is a key driver, benefiting from the expanding regulated iGaming market and strong operator partnerships.

| Segment | Q1 2024 Revenue | Q1 2024 Adj. EBITDA | Growth (YoY) |

|---|---|---|---|

| Interactive | $36.4 million | $15.1 million | 34% Revenue / 45% Adj. EBITDA |

| North America Interactive | N/A | N/A | Significant Growth |

| UK Interactive | N/A | N/A | Record Performance Contributor |

What is included in the product

The Inspired Entertainment BCG Matrix offers a strategic overview of its product portfolio, categorizing offerings into Stars, Cash Cows, Question Marks, and Dogs.

This analysis highlights which segments require investment, maintenance, or divestment to optimize Inspired's market position and profitability.

The Inspired Entertainment BCG Matrix offers a clear, one-page overview, alleviating the pain of complex strategic analysis.

Cash Cows

Inspired Entertainment's Gaming segment, primarily land-based operations, remains its largest revenue source, bringing in $21.7 million in Q1 2025. While this represents a slight 6% year-over-year dip, its consistent cash flow and extensive global footprint, with around 50,000 machines, firmly place it in the Cash Cow category within the BCG Matrix.

The segment's robust Adjusted EBITDA growth in the first quarter of 2025 underscores its strong profitability and its role as a stable, cash-generating business for Inspired Entertainment.

Inspired Entertainment's Gaming segment, particularly its William Hill terminal deployments, clearly operates as a Cash Cow within the BCG matrix. The recent installation of 5,000 new Vantage gaming cabinets with William Hill, completed by Q1 2025, solidifies this position.

This ongoing, long-term partnership with William Hill in the mature UK betting shop market guarantees consistent, recurring revenue streams. It allows Inspired to maintain a significant market share, a hallmark of a Cash Cow.

These deployed terminals are consistently contributing to double-digit growth for the Gaming segment. This reliable performance provides a stable and predictable financial foundation for Inspired Entertainment's overall business operations.

Inspired Entertainment's Virtual Sports segment is a clear Cash Cow, boasting over 80% market share in the U.S. and strong, consistent revenue from its extensive retail presence. This dominance, built over years of operation, provides a stable income stream.

While facing headwinds in Brazil, the core U.S. virtual sports business remains a powerhouse, generating reliable cash flow due to its established customer base and long-standing appeal across various regions. This segment is the bedrock of Inspired's financial stability.

High Virtual Sports Margins

Inspired Entertainment's Virtual Sports segment is a true cash cow, consistently delivering robust Adjusted EBITDA margins exceeding 70%. This high profitability is a key driver of the company's financial strength, even when revenues experience some ups and downs. It's a reliable source of cash for the business.

Management is optimistic about the future of Virtual Sports, with a clear strategy to capitalize on these strong margins. Their focus is on enhancing the content offering and expanding into new markets, aiming to further solidify its position as a significant cash generator.

- High Profitability: Virtual Sports consistently achieves Adjusted EBITDA margins over 70%.

- Cash Generation: This segment is a substantial cash generator for Inspired Entertainment.

- Strategic Focus: Management is investing in content and new markets to leverage these margins.

Operational Efficiency in Gaming

Inspired Entertainment's Gaming segment is a prime example of a Cash Cow within its BCG Matrix.

This segment has demonstrated remarkable operational efficiency, resulting in a significant 43% surge in Adjusted EBITDA during Q1 2025. This growth occurred even as overall revenue saw a dip, highlighting the effectiveness of cost management and a favorable revenue mix.

The company's strategic focus on optimizing its land-based operations and enhancing profitability solidifies the Gaming segment's position as a reliable source of consistent cash flow.

Inspired Entertainment remains dedicated to sustaining and improving productivity within this established market.

- Gaming Segment Adjusted EBITDA Growth: 43% increase in Q1 2025.

- Key Driver: Improvements in operational efficiency and a favorable revenue mix.

- Strategic Focus: Optimizing land-based operations and enhancing profitability.

- Market Position: Mature segment, consistently generating cash flow.

Inspired Entertainment's Gaming segment, particularly its extensive land-based operations and William Hill terminal deployments, clearly functions as a Cash Cow. The segment achieved a substantial 43% surge in Adjusted EBITDA in Q1 2025, demonstrating strong profitability and operational efficiency despite a slight revenue dip.

This segment's robust performance, driven by factors like optimized operations and a favorable revenue mix, provides a stable and predictable financial foundation for the company. The ongoing partnership with William Hill, including the recent installation of 5,000 new Vantage gaming cabinets, ensures consistent, recurring revenue streams and maintains a significant market share.

The Virtual Sports segment also solidifies its Cash Cow status, boasting over 80% market share in the U.S. and consistently delivering Adjusted EBITDA margins exceeding 70%. This high profitability, coupled with a strategy to enhance content and expand into new markets, makes it a reliable and substantial cash generator for Inspired Entertainment.

| Segment | BCG Category | Key Financial Indicator (Q1 2025) | Notes |

| Gaming | Cash Cow | 43% Adjusted EBITDA Growth | Strong operational efficiency, William Hill partnership |

| Virtual Sports | Cash Cow | >70% Adjusted EBITDA Margin | Dominant U.S. market share, high profitability |

Preview = Final Product

Inspired Entertainment BCG Matrix

The Inspired Entertainment BCG Matrix preview you are currently viewing is the exact, unwatermarked, and fully formatted document you will receive immediately after purchase. This comprehensive analysis is ready for immediate integration into your strategic planning, offering clear insights into Inspired Entertainment's product portfolio without any hidden surprises or demo content.

Dogs

The Leisure segment saw a 4% year-over-year revenue drop in Q1 2025, a reversal from its 7% growth in Q4 2024. This dip highlights ongoing volatility and suggests the segment isn't a significant contributor to the company's overall growth trajectory.

Inspired's Leisure segment operates within the mature UK market, specifically targeting pubs, family entertainment centers, motorway services, and bingo halls. These sectors are characterized by limited growth potential, which naturally constrains opportunities for substantial expansion. For instance, the UK pub sector, a key area for Inspired, has seen a steady decline in the number of establishments over the past decade, with fewer new openings to offset closures.

The company's strategy in these mature segments centers on retaining and nurturing existing customer relationships and contracts rather than pursuing aggressive market share acquisition. This approach is common in industries where market saturation and established competition make significant inroads difficult. Inspired's focus is on optimizing its offerings within these established channels, ensuring continued revenue streams through reliable service and product delivery.

The Leisure segment within Inspired Entertainment's business portfolio demonstrates a limited contribution to the company's overall growth and revenue, especially when contrasted with more dynamic areas like Interactive.

Its performance is often modest and can be inconsistent, suggesting it's not a prime candidate for substantial investment aimed at driving future expansion for the company.

In 2024, Inspired Entertainment reported that its Leisure segment generated a smaller portion of its total revenue compared to other segments, highlighting its secondary role in the company's strategic focus.

The primary function of the Leisure segment appears to be the maintenance of existing operations rather than serving as a significant engine for new business development or market share gains.

Focus on Cost Optimization

Inspired Entertainment's Leisure segment saw improved EBITDA margins in Q4 2024, a common indicator of cost optimization strategies applied to 'Dogs' in a BCG matrix. This focus suggests a move to extract maximum value from a mature or declining asset with minimal additional investment.

This strategy is about efficiency, not expansion. For instance, by streamlining operations and reducing overhead in the Leisure segment, Inspired Entertainment aims to ensure this part of the business remains profitable, even if it's not a growth driver.

- Focus on Cost Optimization: The Leisure segment's improved EBITDA margins in Q4 2024 highlight a strategic shift towards maximizing efficiency.

- 'Dog' Product Management: This approach typically signals the management of a 'Dog' product, aiming to extract value rather than invest in growth.

- Capital Efficiency: The strategy prioritizes minimizing further capital outlay while still generating positive returns from the segment.

- Profitability from Stagnation: The goal is to maintain or improve profitability from a stable or declining market share through operational improvements.

Potential for Divestiture (Conceptual)

Inspired Entertainment's Leisure segment, if it were to be classified as a 'Dog' in the BCG Matrix, could be a candidate for divestiture. This often happens when a business unit consistently underperforms, consuming valuable resources without yielding substantial returns. For example, if the Leisure segment's revenue trends continue to decline, as they have in recent periods, and it struggles to generate positive cash flow, the company might consider selling it off.

The strategic rationale behind divesting a 'Dog' is to free up capital and management focus for more promising ventures. In 2023, Inspired Entertainment reported a slight decrease in its Interactive segment revenue, while its Gaming segment saw growth. If the Leisure segment were to mirror the underperformance of other struggling units, a divestiture would be a logical step to improve overall company efficiency and profitability.

- Underperformance Risk: Continued revenue decline in the Leisure segment could signal a need for divestiture.

- Resource Allocation: Divesting a 'Dog' allows for reallocation of capital and management attention to higher-growth areas.

- Financial Health: A segment failing to generate sufficient cash flow becomes a drain on company resources.

- Strategic Re-evaluation: Persistent underperformance necessitates a critical look at the segment's long-term viability.

Inspired Entertainment's Leisure segment, characterized by its presence in mature UK markets like pubs and family entertainment centers, aligns with the 'Dog' classification in the BCG Matrix. This segment exhibits low market share and low growth potential, as evidenced by a 4% revenue drop in Q1 2025, contrasting with earlier growth. The company's strategy here focuses on cost optimization and extracting value rather than aggressive expansion, as seen in improved EBITDA margins in Q4 2024.

| Segment | Market Share | Market Growth | BCG Classification |

|---|---|---|---|

| Leisure | Low | Low | Dog |

Question Marks

Inspired Entertainment is making a bold move into Brazil's burgeoning gaming sector, focusing on mobile and slot game distribution. This strategic expansion targets a high-growth market where Inspired aims to establish a strong presence. The company's investment reflects confidence in Brazil's potential for significant market share gains in the coming years.

Inspired Entertainment's NHL licensing agreement positions its sports content within a potentially high-growth niche. This move into developing NHL-themed gaming content taps into the passionate fan base of one of the major professional sports leagues, suggesting strong market demand.

As a relatively new venture within Inspired's portfolio, its current market share in this specific segment is likely modest. However, the association with the NHL brand, coupled with the growing popularity of sports betting and iGaming, points to significant future growth potential.

For context, the global sports betting market was valued at over $70 billion in 2023 and is projected to grow substantially, with North America being a key driver of this expansion. Inspired's strategic entry into NHL-branded content aligns with this trend, aiming to capture a share of this expanding market.

Inspired's expansion of V-Lottery Virtual Sports with the Virginia Lottery, through its renewed partnership with Aristocrat Interactive, positions it to capitalize on the growing demand for innovative lottery offerings. This move targets a nascent but promising sector where Inspired aims to solidify its market presence.

The Virginia Lottery's virtual sports program, launched in 2022, has shown steady growth, with player engagement metrics indicating a positive reception to these digital entertainment products. Inspired's continued involvement suggests confidence in the long-term revenue potential of this segment.

New Hybrid Dealer Game Variants

Inspired Entertainment's focus on new hybrid dealer game variants, such as the planned Roulette 4 Ball Extra Bet for H2 2025, highlights a strategic move to expand its interactive offerings.

This continuous innovation aims to capture new market segments and capitalize on the increasing demand for engaging hybrid gaming experiences.

The introduction of these novel game types signifies a high-growth potential, directly contributing to the company's market share expansion within the dynamic interactive gaming sector.

- New Variants Drive Growth: The upcoming Roulette 4 Ball Extra Bet is a prime example of Inspired Entertainment's commitment to evolving its hybrid dealer game portfolio.

- Market Share Expansion: These new offerings are designed to attract a broader player base, thereby increasing the company's penetration in the lucrative interactive gaming market.

- High-Growth Potential: By introducing innovative products that cater to emerging player preferences, Inspired Entertainment is positioning itself for significant revenue growth in the coming years.

Rush Street Interactive Partnership Expansion

Inspired Entertainment's expanded partnership with Rush Street Interactive (RSI) to offer online content in Mexico and Delaware positions these ventures as potential stars within its BCG matrix. These markets represent new geographical frontiers for Inspired, signaling substantial growth opportunities where the company is actively building its presence.

This strategic expansion into Mexico and Delaware, where Inspired is establishing or growing its initial footprint, aligns with the characteristics of a 'Star' product. These are markets with high growth potential, even if Inspired's current market share is nascent compared to more mature regions.

- Mexico and Delaware represent emerging markets for Inspired's interactive gaming content.

- The partnership with RSI facilitates entry into these new jurisdictions.

- These markets exhibit high growth potential, characteristic of 'Stars' in a BCG matrix.

- Inspired's initial market share in these regions is lower, indicating room for significant expansion.

Inspired Entertainment's foray into Brazil, its NHL licensing, and its expansion of V-Lottery Virtual Sports in Virginia all represent potential question marks. These ventures are in emerging or developing markets, meaning they require significant investment to gain market share. While the potential for high returns exists, the current market share and revenue generation may be limited, making their future success uncertain. The company's strategic focus on these areas indicates a belief in their long-term growth prospects, but they carry inherent risks common to new market entries and product developments.

BCG Matrix Data Sources

Our Inspired Entertainment BCG Matrix is built on a foundation of robust data, incorporating financial reports, market share analysis, and industry growth projections.