Horizon Robotics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horizon Robotics Bundle

Horizon Robotics navigates a dynamic AI chip market, facing intense rivalry and significant threats from substitute technologies. Understanding the influence of powerful suppliers and the constant pressure from new entrants is crucial for their strategic positioning.

The complete report reveals the real forces shaping Horizon Robotics’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Horizon Robotics faces significant supplier bargaining power due to its reliance on a select few advanced semiconductor foundries, like TSMC and Samsung, for its AI chips. These foundries command immense power due to their highly specialized technology, massive capital expenditures, and unique manufacturing processes.

The substantial costs and technical hurdles involved in switching foundries further solidify the suppliers' leverage over Horizon Robotics. For instance, TSMC's leading-edge process nodes, crucial for AI chip performance, represent a significant barrier to entry for potential competitors, concentrating power in the hands of a few.

Intellectual property (IP) providers, such as ARM Holdings for CPU architectures and NVIDIA for GPU designs, wield considerable bargaining power over companies like Horizon Robotics. These foundational IP cores are indispensable for advanced chip development, and the licensing fees charged by these dominant vendors can significantly influence Horizon's cost of goods sold. For instance, ARM's licensing model is a key revenue driver, and their market dominance in mobile and embedded processors makes it challenging and time-consuming for companies to develop in-house alternatives, thereby concentrating power with the IP provider.

Suppliers of highly specialized materials and sophisticated manufacturing equipment for AI chip production, like those used by Horizon Robotics, hold significant power. These vendors often have proprietary technologies and limited competition, meaning Horizon has few alternatives if they choose to change suppliers.

The semiconductor industry, crucial for AI development, relies on extremely complex and often custom-made equipment and rare earth materials. For instance, advanced lithography machines from companies like ASML are essential, and their scarcity and high cost underscore supplier leverage. In 2024, the lead times for such critical equipment could extend for months, directly impacting production schedules and costs for AI chip manufacturers.

Stringent quality control for these specialized inputs also limits Horizon's ability to switch suppliers easily. Any deviation in material purity or equipment calibration can lead to significant production defects, impacting the performance and reliability of Horizon's AI chips. This dependency means suppliers can dictate terms, affecting Horizon's operational efficiency and profitability.

EDA Tool & Software Providers

EDA tool and software providers hold substantial bargaining power over companies like Horizon Robotics. These specialized platforms are crucial for the intricate design, simulation, and verification of AI chips, making them non-negotiable components in the development process. The market for these essential tools is highly concentrated, with a few dominant vendors dictating terms through licensing fees and mandatory technical support packages. This concentration means Horizon's innovation pipeline and time-to-market are directly influenced by these suppliers.

The reliance on a limited number of EDA vendors creates a significant dependency. For instance, Synopsys and Cadence Design Systems are key players in this market, often cited for their comprehensive suites of tools essential for advanced chip design. Their pricing structures and the availability of specific functionalities can directly impact Horizon's R&D budgets and project timelines. In 2024, the EDA market was estimated to be worth tens of billions of dollars, reflecting the high value and critical nature of these software solutions.

- Market Concentration: The EDA software market is dominated by a few major players, limiting choices for chip designers.

- Essential Technology: EDA tools are indispensable for the complex processes of designing, simulating, and verifying AI chips.

- High Licensing Fees: The cost of licensing these specialized software platforms represents a significant operational expense for companies like Horizon Robotics.

- Dependency on Support: Access to critical technical support from EDA vendors is vital for troubleshooting and ensuring the functionality of AI chip designs.

Talent Pool & Expertise

The availability of highly skilled engineers and AI specialists acts as a critical supplier of human capital for Horizon Robotics. In the fiercely competitive landscape for top-tier talent in AI, chip design, and autonomous driving, these professionals can command significant compensation packages, including high salaries and extensive benefits. This scarcity of specialized expertise grants this crucial 'supplier' group substantial bargaining power, directly impacting Horizon's operational expenses and its capacity for ongoing innovation.

The intense demand for AI and robotics talent is a defining characteristic of the current market. For instance, in 2024, the average salary for an AI engineer in China, where Horizon Robotics is based, could range from ¥300,000 to ¥600,000 annually, with senior roles and specialized expertise commanding even higher figures. This wage pressure directly translates to increased costs for Horizon Robotics.

- Talent Scarcity: The limited supply of engineers with deep expertise in areas like neural network optimization and autonomous vehicle software creates a bottleneck for companies like Horizon Robotics.

- Competitive Compensation: To attract and retain top AI and robotics talent, Horizon Robotics must offer competitive salaries and benefits, which are driven up by market demand.

- Innovation Impact: The ability of Horizon Robotics to secure and retain skilled personnel directly influences its pace of product development and its capacity to innovate in the rapidly evolving autonomous driving sector.

Horizon Robotics faces considerable supplier bargaining power from foundries like TSMC and Samsung due to their advanced technology and high capital costs. This concentration of manufacturing capability means Horizon has limited alternatives, allowing suppliers to dictate terms. The semiconductor industry's reliance on specialized equipment, such as ASML's lithography machines, further amplifies supplier leverage, with lead times in 2024 impacting production schedules.

Intellectual property providers, including ARM Holdings and NVIDIA, also exert significant influence. Their essential chip architectures and designs come with substantial licensing fees, directly impacting Horizon's cost of goods sold and development timelines. The dominance of these IP suppliers makes it difficult and time-consuming for Horizon to develop in-house alternatives.

Furthermore, the scarcity of highly skilled AI and robotics engineers, with average annual salaries in China for AI engineers ranging from ¥300,000 to ¥600,000 in 2024, grants this human capital "supplier" group substantial bargaining power. This talent shortage directly increases Horizon's operational expenses and affects its innovation capacity.

What is included in the product

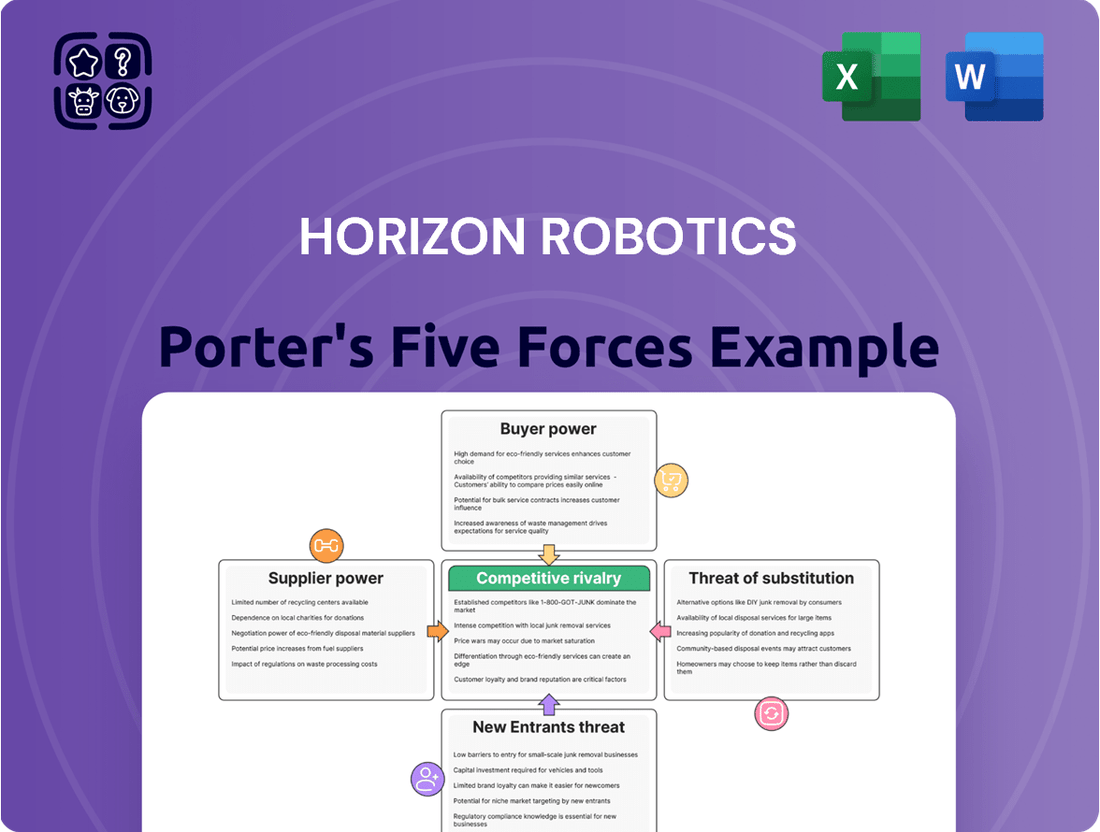

Horizon Robotics' Porter's Five Forces analysis identifies the intensity of competition, buyer and supplier power, threat of new entrants, and the risk of substitutes impacting its AI robotics market position.

Quickly identify and mitigate competitive threats with a visually intuitive Porter's Five Forces analysis, streamlining strategic planning.

Customers Bargaining Power

Major automotive OEMs and Tier 1 suppliers, significant customers for Horizon Robotics' autonomous driving tech, are often large, consolidated entities. Their substantial purchasing power and long-term agreements grant them considerable leverage to negotiate pricing, dictate feature sets, and enforce rigorous quality standards on Horizon Robotics, potentially squeezing profit margins.

While customers hold sway, the deep integration of AI chips into intricate systems, such as autonomous driving platforms, necessitates extensive design, rigorous testing, and thorough validation. This commitment to a specific solution results in substantial switching costs for customers. For instance, a change in AI chip supplier during the development of a new vehicle model could delay market entry by months, if not years, and incur millions in redesign and re-testing expenses.

Customers in autonomous driving and smart IoT frequently demand highly customized, high-performance AI solutions. This need for bespoke products gives them significant leverage, as they can seek out suppliers who meet very specific performance metrics, power consumption targets, or integration requirements. Horizon Robotics' capacity to fulfill these precise needs directly shapes its customer relationships and bargaining power.

Availability of Alternative Suppliers

The availability of alternative suppliers significantly influences the bargaining power of customers for AI computing solutions. Companies like NVIDIA, Qualcomm, and Mobileye offer competing technologies, providing automotive and IoT sector clients with viable choices. This competitive environment allows customers to negotiate more favorable pricing and terms with Horizon Robotics, as they can readily switch to a competitor if demands are not met. For instance, in 2024, the automotive AI chip market was projected to grow substantially, indicating a robust supply base and increased customer leverage.

Customers can effectively use the presence of these alternatives to their advantage. By understanding the capabilities and pricing of other providers, buyers can approach Horizon Robotics with a stronger negotiating position. This dynamic forces Horizon Robotics to continually demonstrate its unique value proposition and competitive edge to retain its customer base and secure favorable contracts.

The bargaining power of customers is amplified by the following factors:

- Multiple Credible Alternatives: The presence of established players like NVIDIA, Qualcomm, and Mobileye in the AI computing space provides customers with readily available substitutes.

- Price Negotiation Leverage: Customers can leverage the competitive landscape to secure better pricing and contract terms from Horizon Robotics.

- Demand for Differentiation: Horizon Robotics must clearly articulate its unique value proposition to mitigate the power of customers who can easily switch to competitors.

- Market Dynamics: The growing automotive AI chip market, with multiple suppliers vying for market share, inherently strengthens customer bargaining power.

Impact on Customer's End Product

Horizon Robotics' AI chips are foundational to their clients' intelligent vehicles and smart IoT devices. The quality and price of these chips directly influence how competitive and profitable the final products are. For instance, in 2023, the automotive sector saw significant demand for advanced driver-assistance systems (ADAS), where Horizon's technology plays a key role. This reliance can empower customers to negotiate better terms, demanding enhanced support and clear future development plans.

Customers' ability to switch suppliers, while potentially challenging due to the specialized nature of AI chip integration, is a factor. If alternative solutions offer comparable performance at a lower cost or with superior features, Horizon faces pressure. For example, the global AI chip market, valued at approximately $25 billion in 2023, features both established players and emerging competitors, offering customers choices.

- Critical Component Dependence: Horizon's AI chips are essential for the core functions of customer end products, such as autonomous driving features in vehicles.

- Impact on Customer Profitability: The performance, reliability, and cost of Horizon's chips directly affect the market competitiveness and profit margins of the final products.

- Leverage for Demands: Customers can use their strategic importance to negotiate for better service, support, and long-term product roadmaps from Horizon.

- Market Alternatives: The availability of competing AI chip solutions, even if requiring integration effort, can provide customers with leverage to seek more favorable terms.

Customers, particularly large automotive OEMs and Tier 1 suppliers, wield significant bargaining power due to their substantial order volumes and the critical nature of Horizon Robotics' AI chips in their final products. The high switching costs associated with integrating new AI solutions, often involving extensive redesign and validation, do provide some counter-leverage for Horizon. However, the presence of multiple credible alternatives like NVIDIA, Qualcomm, and Mobileye in the rapidly expanding AI chip market, projected to see robust growth in 2024, allows customers to negotiate aggressively on price and terms.

| Factor | Impact on Horizon Robotics | Customer Leverage |

|---|---|---|

| Customer Size & Concentration | High | Negotiate pricing, dictate features |

| Switching Costs (Integration) | Moderate | Reduces immediate threat, but long-term pressure |

| Availability of Alternatives | High | Strong price negotiation, potential for supplier diversification |

| Customization Demands | High | Requires tailored solutions, potential for niche market capture |

Full Version Awaits

Horizon Robotics Porter's Five Forces Analysis

This preview showcases the comprehensive Horizon Robotics Porter's Five Forces Analysis, detailing the competitive landscape and strategic implications for the company. The document you see here is the exact, fully formatted report you will receive immediately upon purchase, offering actionable insights without any alterations or placeholder content. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, ready for your strategic planning needs.

Rivalry Among Competitors

The AI chip market, especially for autonomous driving, is dominated by powerful global players like NVIDIA, Qualcomm, and Intel (through its Mobileye division). These companies have significant financial backing, massive R&D investments, and deep-rooted ties with major automakers, creating a highly competitive landscape for Horizon Robotics.

NVIDIA, for instance, reported revenues of $22.6 billion for its fiscal year 2024, with its automotive segment showing strong growth, underscoring its substantial market presence. Similarly, Qualcomm's automotive revenue reached $4.2 billion in its fiscal year 2023, highlighting its established position. These giants continuously push the boundaries of innovation, launching advanced platforms and expanding their product offerings, which makes it difficult for newer entrants like Horizon Robotics to gain significant market share.

The AI computing and autonomous driving industries are moving at a breakneck pace, with innovation happening constantly. Competitors are always coming out with better, faster, and more efficient chips and software. This means Horizon Robotics has to pour a lot of money into research and development just to keep up and not fall behind technologically. This pressure really heats up the competition.

The autonomous driving and smart IoT sectors are poised for substantial growth, creating a highly competitive landscape where companies are willing to invest heavily to capture market share. This lucrative potential drives aggressive strategies, from price wars to strategic alliances, making the environment particularly challenging for players like Horizon Robotics.

Ecosystem Development and Partnerships

Competitive rivalry in the automotive AI chip sector extends far beyond raw processing power. Horizon Robotics, like its peers, faces intense pressure to build comprehensive software ecosystems and provide user-friendly developer tools. This is crucial for attracting automakers and Tier 1 suppliers who need seamless integration and efficient development cycles.

Success hinges on cultivating strong strategic partnerships. These alliances are vital for co-developing solutions and ensuring market adoption. For instance, as of early 2024, many leading automotive AI companies are announcing new collaborations with car manufacturers to integrate their next-generation autonomous driving systems, showcasing the critical nature of these relationships in a highly competitive landscape.

- Ecosystem Strength: Companies are judged not just on their chips, but on the completeness of their software stack, including AI frameworks, middleware, and simulation tools.

- Partnership Value: Strategic alliances with automakers and Tier 1 suppliers are paramount for securing design wins and driving market penetration.

- Developer Accessibility: Easy-to-use development kits and robust documentation are key differentiators in attracting engineering talent and accelerating product deployment.

- Integration Complexity: The ability to offer integrated hardware and software solutions that simplify the automotive development process is a significant competitive advantage.

Intellectual Property and Patent Wars

The AI chip sector thrives on innovation, making intellectual property (IP) a crucial battleground. Companies pour resources into patenting new designs and algorithms, creating a landscape where securing and defending IP is paramount. This intense focus on patents fuels aggressive competition and can lead to costly legal skirmishes. For Horizon Robotics, maintaining a strong IP portfolio and proactively managing potential patent disputes are essential for its continued success and ability to innovate without infringement.

The reliance on IP means that companies like Horizon Robotics are constantly innovating to create unique technologies. For instance, in 2024, the global AI chip market saw significant investments in R&D, with major players filing thousands of new patents related to neural processing units and advanced machine learning algorithms. This aggressive patenting strategy aims to establish market dominance and deter rivals.

- Patent filings in the AI chip sector have seen a steady increase, with key players actively protecting their technological advancements.

- Legal battles over IP infringement are common, impacting market dynamics and R&D strategies.

- Horizon Robotics must maintain a robust IP strategy to safeguard its innovations and compete effectively.

- The high cost of litigation and the need for continuous innovation place significant pressure on companies in this space.

The competitive rivalry in the AI chip market for autonomous driving is exceptionally fierce, marked by the dominance of established giants like NVIDIA and Qualcomm. These players boast massive R&D budgets and deep relationships with automakers, creating high barriers to entry for companies such as Horizon Robotics. The rapid pace of innovation, coupled with the critical need for robust software ecosystems and strategic partnerships, intensifies this rivalry, forcing constant technological advancement and costly patent protection efforts.

| Competitor | Fiscal Year 2023/2024 Revenue (Automotive Segment/Total) | Key Strengths |

|---|---|---|

| NVIDIA | $22.6 billion (FY2024 Total) | Dominant AI platform, extensive ecosystem, strong automotive focus |

| Qualcomm | $4.2 billion (FY2023 Automotive Revenue) | Leading Snapdragon Ride platform, strong connectivity solutions |

| Intel (Mobileye) | Not separately disclosed for automotive segment in FY2023 | Established ADAS technology, strong OEM relationships |

SSubstitutes Threaten

Horizon Robotics' specialized AI chips face a growing threat from general-purpose processors like CPUs and GPUs. These mainstream processors are increasingly incorporating dedicated AI acceleration features, making them more competitive for certain AI tasks.

For less intensive edge AI applications, or scenarios where the balance of performance, cost, and power consumption differs, customers might find these versatile, general-purpose processors a more appealing alternative to a dedicated AI chip. This competitive pressure necessitates that Horizon clearly articulates and proves its superior value proposition in terms of performance, efficiency, or cost-effectiveness.

Field-Programmable Gate Arrays (FPGAs) present a flexible alternative for specific edge AI applications, enabling reconfigurability and custom logic. While generally not matching the peak performance or power efficiency of ASICs for dedicated tasks, their adaptability makes them appealing for niche or rapidly evolving use cases. This adaptability can pose a substitute threat in certain market segments where customization outweighs raw processing power.

Cloud-based AI solutions present a significant threat of substitution for edge AI processing, especially in IoT applications where ultra-low latency isn't paramount. As cloud AI capabilities grow, they can handle complex tasks that might otherwise necessitate on-device processing, potentially shrinking the market for edge AI chips. For instance, the global cloud AI market was projected to reach over $100 billion by 2024, highlighting its substantial presence and growing influence.

Alternative AI Algorithms and Software Optimizations

Advances in AI algorithms and neural network architectures can lead to more efficient processing on general-purpose hardware. For instance, breakthroughs in model compression and quantization techniques allow complex AI models to run on less powerful chips, potentially reducing demand for specialized AI accelerators. This trend could lessen the competitive advantage of dedicated hardware solutions if software innovations deliver comparable performance at a lower cost. In 2023, the global AI chip market was valued at approximately $25.1 billion, with a significant portion attributed to specialized hardware, but the increasing sophistication of software optimization presents a viable alternative for many AI applications.

Software optimizations, such as improved compiler technologies and efficient inference engines, can significantly boost the performance of AI workloads on existing hardware. If these software advancements enable less specialized chips to achieve satisfactory AI task execution, the perceived necessity and value proposition of Horizon Robotics' dedicated AI chips might be diluted. This threat is amplified as more companies invest in developing these software-centric AI solutions, aiming to democratize AI deployment across a wider range of devices and platforms.

- Software-driven AI efficiency: Innovations in AI algorithms and neural network design are enabling more computation to be performed on less specialized hardware.

- Reduced reliance on dedicated AI chips: As software becomes more capable, the unique selling proposition of highly specialized AI hardware may diminish.

- Cost-effectiveness of alternatives: Optimized software running on general-purpose processors could offer a more cost-effective solution for many AI tasks compared to dedicated AI chips.

- Market impact: A significant shift towards software-based AI acceleration could impact Horizon Robotics' market share and pricing power for its specialized hardware.

In-House Development by Large Tech Firms

Large technology firms and automotive original equipment manufacturers (OEMs) with substantial financial backing and engineering talent pose a significant threat by developing their own AI chips. For instance, in 2024, major players like NVIDIA continued to invest heavily in their internal R&D for AI accelerators, with their revenue reaching approximately $60.9 billion for their fiscal year ending January 28, 2024, demonstrating their capacity for innovation. This vertical integration means these potential customers could bypass external suppliers like Horizon Robotics altogether.

This shift towards in-house development directly curtails the market opportunity for third-party AI solution providers. When these large entities become self-sufficient, they effectively transition from being customers to competitors, diminishing the addressable market for companies like Horizon Robotics. The ongoing advancements in custom silicon development, driven by the pursuit of optimized performance and cost efficiencies, underscore this evolving competitive landscape.

- Vertical Integration by Tech Giants: Major tech companies are increasingly designing proprietary AI hardware, reducing reliance on external chip manufacturers.

- Automotive OEM Self-Sufficiency: Leading car manufacturers are also exploring in-house AI chip development to gain greater control over their autonomous driving and infotainment systems.

- Market Share Erosion: As these large entities develop their own solutions, the market share available for specialized AI chip providers like Horizon Robotics is potentially reduced.

- Competitive Landscape Shift: Potential customers becoming competitors creates a more challenging environment, requiring Horizon Robotics to differentiate its offerings significantly.

The threat of substitutes for Horizon Robotics’ specialized AI chips is multifaceted, encompassing general-purpose processors, FPGAs, cloud AI solutions, and in-house chip development by major players.

General-purpose processors like CPUs and GPUs are becoming more adept at AI tasks, particularly with advancements in AI acceleration features, offering a viable alternative for many applications. For instance, NVIDIA's fiscal year 2024 revenue of approximately $60.9 billion highlights the significant investment and capability in this area.

Cloud AI services also pose a threat, as their growing sophistication can handle complex tasks without requiring dedicated edge hardware, especially where low latency isn't critical. The global cloud AI market's projected growth to over $100 billion by 2024 underscores its competitive reach.

Furthermore, large technology firms and automotive OEMs are increasingly developing their own AI chips, reducing their need for external suppliers and effectively becoming competitors. This trend, exemplified by ongoing heavy R&D investments from industry leaders, directly impacts the market available for specialized AI chip providers.

Entrants Threaten

Developing advanced AI chips, particularly for demanding sectors like autonomous driving, demands substantial capital. This includes significant investment in research and development, sophisticated design software, and access to advanced fabrication facilities. For instance, the global semiconductor industry saw capital expenditures exceeding $130 billion in 2023, a figure that underscores the immense financial commitment required.

These high upfront costs act as a considerable deterrent for potential new players looking to enter the AI chip market. Horizon Robotics, by establishing its presence and investing heavily in these areas, benefits from this inherent barrier, making it more challenging for newcomers to compete effectively.

The AI chip sector demands highly specialized knowledge in semiconductor engineering, AI algorithms, and sophisticated software development. This deep technical expertise, combined with substantial intellectual property (IP) portfolios, creates a significant hurdle for newcomers. For instance, companies like Horizon Robotics have invested years in building these capabilities, making it incredibly difficult for new players to match their foundational strengths.

The automotive sector, a key market for Horizon Robotics, presents particularly long product development cycles for advanced chips, often stretching over several years. This extended timeline, coupled with stringent testing and certification requirements for safety and reliability, creates a substantial barrier to entry. For instance, achieving automotive-grade certification can take years and millions of dollars, deterring new players from quickly entering the market.

Need for Ecosystem and Customer Relationships

Success in the competitive AI chip market, particularly for autonomous driving, hinges on more than just advanced hardware. Horizon Robotics, like other established players, has invested heavily in cultivating a comprehensive software ecosystem and developer tools. This ecosystem is crucial for attracting and retaining customers, enabling seamless integration and ongoing innovation.

New entrants face a significant hurdle in replicating this established ecosystem and the deep-seated customer relationships that come with it. Building trust and demonstrating value to key automotive original equipment manufacturers (OEMs) requires substantial time, resources, and a proven track record. For instance, by the end of 2023, Horizon Robotics had secured partnerships with over 20 automotive brands, a testament to the years of effort invested in these relationships.

The difficulty in establishing these critical elements means potential new entrants must overcome a steep barrier. They need not only technological parity but also the ability to rapidly develop a robust software suite and forge equally strong ties with OEMs. This dual challenge significantly limits the immediate threat of new, disruptive players entering the market.

- Ecosystem Development: Building a comprehensive AI software stack and developer tools requires significant R&D investment and time.

- Customer Relationships: Automotive OEMs prioritize reliability and long-term support, making it difficult for new entrants to displace established partners.

- Time and Resource Intensive: Creating both a robust ecosystem and strong customer loyalty can take many years and substantial capital, acting as a significant barrier.

Intense Competition from Incumbents

The threat of new entrants for Horizon Robotics is significantly shaped by the intense competition already present. Established players in the AI and robotics sector, such as Nvidia and Qualcomm, command substantial market share and possess strong brand loyalty. These incumbents benefit from significant economies of scale, allowing them to invest heavily in research and development and offer competitive pricing. For instance, Nvidia's automotive segment revenue reached $3.1 billion in fiscal year 2024, demonstrating its scale and market penetration.

Newcomers would struggle to match the established players' extensive distribution networks and deep pockets. These incumbents can easily absorb initial losses or engage in aggressive pricing strategies to deter new competition. Horizon Robotics, while innovative, faces the challenge of carving out market space against entities that have years of experience and deeply entrenched customer relationships.

- Dominant Incumbents: Companies like Nvidia and Qualcomm hold significant market share in AI chip manufacturing, a core area for robotics.

- Economies of Scale: Large players can produce components at lower costs, making it difficult for new entrants to compete on price.

- Brand Recognition and Loyalty: Established brands have built trust and customer relationships over time, a barrier for new companies.

- Resource Advantage: Incumbents have greater financial and human resources for R&D, marketing, and market penetration.

The AI chip market, particularly for automotive applications, is characterized by extremely high capital requirements. Developing cutting-edge AI processors involves massive investments in R&D, specialized design tools, and access to advanced manufacturing, with global semiconductor capital expenditures exceeding $130 billion in 2023. This financial barrier significantly limits the number of potential new entrants capable of matching Horizon Robotics' scale and technological sophistication.

The threat of new entrants is further mitigated by the deep technical expertise and extensive intellectual property (IP) portfolios held by established players like Horizon Robotics. Building a comparable foundation in AI algorithms, semiconductor engineering, and software development requires years of dedicated effort and substantial investment, making it a formidable challenge for newcomers to achieve parity.

Furthermore, the automotive sector's long product development cycles, coupled with rigorous safety and reliability certification processes, create substantial time and cost hurdles for new entrants. The extensive validation required for automotive-grade chips can deter companies unwilling or unable to commit the necessary resources and patience, thereby protecting incumbents like Horizon Robotics.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Horizon Robotics leverages data from industry-specific market research reports, financial filings of key players, and technology trend analyses to understand competitive dynamics.