Hilmar Cheese Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hilmar Cheese Bundle

Hilmar Cheese operates in a dynamic market shaped by powerful competitive forces. Understanding how buyer power, supplier leverage, and the threat of new entrants influence pricing and profitability is crucial for strategic success.

The complete report reveals the real forces shaping Hilmar Cheese’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hilmar Cheese Company's core input is raw milk, making the bargaining power of its suppliers a critical factor. The U.S. dairy sector experienced a modest uptick in dairy cow numbers in 2025, with milk production projected to increase by 0.5%.

Despite overall stable supply, the geographic concentration of dairy farms can create leverage for local milk producers. If Hilmar faces limited alternative sourcing options in a particular region, these concentrated suppliers may gain significant bargaining power.

Fluctuating milk prices significantly impact the bargaining power of suppliers for cheese producers like Hilmar Cheese. Global supply and demand dynamics, coupled with the cost of feed and governmental policies, create inherent volatility in milk commodity markets. For instance, while the U.S. dairy sector saw favorable feed prices at the start of 2025, the projected all-milk price was anticipated to be slightly lower than in 2024, indicating market adjustments.

This price instability, alongside the rising operational costs faced by dairy farmers, can amplify their leverage. When farmers experience squeezed profit margins due to these fluctuations, they are more inclined to demand better terms, potentially increasing the cost of raw milk for cheese manufacturers and strengthening their position in negotiations.

Labor availability is a critical issue for dairy farms, especially larger ones. In 2024, labor costs represent about a quarter of all operating expenses for dairy producers, making it a substantial factor in their overall financial health.

The dairy sector relies heavily on a workforce that includes many non-U.S. workers. Any shifts in immigration policies that limit this labor pool could intensify existing shortages. This would likely drive up wages for farm workers, a cost that could then be passed on to milk processors and ultimately to consumers.

Specialized Ingredients and Quality Standards

While raw milk itself can be viewed as a commodity, Hilmar Cheese's need for specialized ingredients and adherence to rigorous quality standards can shift bargaining power towards certain suppliers. For instance, if Hilmar requires specific organic or grass-fed milk for premium product lines, or unique processing aids, suppliers capable of consistently meeting these demands gain leverage. This is particularly relevant for ingredients like whey protein and lactose, where specific purity and functional properties are critical for Hilmar's diverse product portfolio.

- Specialized Inputs: Suppliers providing unique or hard-to-source ingredients for Hilmar's specialized product lines, such as high-purity lactose or specific organic milk components, can command higher prices.

- Quality Assurance: Suppliers who consistently meet Hilmar's stringent quality control measures, including certifications and traceability for ingredients like whey protein, possess an advantage.

- Supplier Concentration: If only a limited number of suppliers can reliably provide these specialized or high-quality inputs, their bargaining power increases significantly.

- Impact on Production: Disruptions from suppliers unable to meet Hilmar's quality or specialization needs could impact production efficiency and product consistency, further empowering compliant suppliers.

Sustainability Commitments

Hilmar Cheese Company's dedication to sustainability, including targets for reducing greenhouse gas emissions and water usage, influences its supplier relationships. For instance, by 2024, many large food companies are setting ambitious Scope 1 and 2 emission reduction goals, often requiring suppliers to align with these targets.

Dairy farmers who have proactively invested in and can verify sustainable farming practices, such as improved manure management or enhanced water efficiency, may find themselves in a stronger negotiating position. This leverage stems from their ability to meet Hilmar's evolving environmental criteria and capitalize on growing consumer demand for sustainably sourced dairy products.

- Sustainability Goals: Hilmar Cheese often aligns with industry-wide sustainability targets, which can influence raw material sourcing strategies.

- Farmer Investment: Farmers investing in sustainable practices, like precision agriculture or renewable energy on farms, can differentiate themselves.

- Consumer Demand: A significant portion of consumers, estimated to be over 60% in recent surveys, express a willingness to pay more for products with clear sustainability credentials.

The bargaining power of milk suppliers for Hilmar Cheese is influenced by factors like milk price volatility and labor costs. In 2024, labor costs represented about a quarter of dairy producers' operating expenses, a significant factor in their leverage. The projected all-milk price for 2025 was expected to be slightly lower than in 2024, impacting supplier margins.

Suppliers who can meet Hilmar's stringent quality and specialization needs, such as for organic milk or high-purity whey protein, gain leverage. Consumer demand for sustainable products also empowers dairy farmers who have invested in eco-friendly practices, with over 60% of consumers willing to pay more for sustainable goods.

| Factor | Impact on Supplier Bargaining Power | Supporting Data/Trend (as of mid-2025) |

|---|---|---|

| Milk Price Volatility | Increases power when prices are low for suppliers, forcing them to seek better terms. | Projected all-milk price slightly lower in 2025 vs. 2024. |

| Labor Costs | Increases power as farms pass on rising labor expenses. | Labor costs ~25% of dairy producer operating expenses in 2024. |

| Specialized Inputs Demand | Increases power for suppliers meeting specific quality or organic needs. | Growing consumer preference for organic and premium dairy components. |

| Sustainability Practices | Increases power for farmers demonstrating verifiable eco-friendly operations. | >60% of consumers willing to pay more for sustainable products. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Hilmar Cheese, analyzing the intensity of rivalry, buyer and supplier power, and the threat of substitutes and new entrants.

Hilmar Cheese's Porter's Five Forces analysis is a pain point reliever by offering a clear, one-sheet summary of all five forces—perfect for quick decision-making.

Customers Bargaining Power

Hilmar Cheese Company's customer base is dominated by large food manufacturers, who are significant players in the global food and beverage industry. These manufacturers, by virtue of their immense scale, often procure cheese and dairy ingredients in substantial quantities.

This high-volume purchasing grants these large customers considerable bargaining power. They can leverage their order sizes to negotiate more favorable pricing and contract terms, as suppliers like Hilmar are keen to secure such substantial business. For instance, in 2024, major food conglomerates continued to consolidate their supply chains, further amplifying the purchasing leverage of the largest entities.

Food manufacturers, particularly those in the consumer packaged goods sector, often face intense price sensitivity. This is driven by highly competitive markets and a consistent consumer demand for cost-effective products. This sensitivity directly translates into increased customer bargaining power, as these buyers look to control their own expenses.

For companies like Hilmar Cheese, this means ingredient purchasers may exert pressure on pricing, especially for products that are perceived as more commoditized, such as certain dairy ingredients. In 2024, for instance, the global food and beverage market continued to grapple with inflation, with many manufacturers seeking to pass on some of these increased costs downstream, or conversely, demanding lower input prices to maintain their own margins.

Hilmar Cheese boasts a diversified product line, encompassing various cheeses, whey protein, and lactose. These ingredients find applications across numerous industries, from food manufacturing to nutritional supplements. This broad product range can mitigate the bargaining power of individual customers by reducing Hilmar's reliance on any single buyer.

Customer's Ability to Substitute Ingredients

While dairy ingredients are fundamental to many food items, a growing number of customers are exploring plant-based alternatives. This shift means that some food manufacturers using cheese might consider substituting certain dairy components with ingredients derived from soy, almonds, or oats. This potential for substitution, even if it's only for a portion of the product, can grant customers more leverage by giving them cost-effective or trend-aligned options.

The expanding plant-based food market directly impacts the bargaining power of customers for dairy ingredients. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162 billion by 2030, showcasing a significant consumer shift. This growth means that food companies that are heavily reliant on dairy might face pressure from buyers seeking to incorporate or increase the use of these alternative ingredients to meet consumer demand or manage costs.

- Growing Plant-Based Market: The global plant-based food market's expansion signifies a tangible shift in consumer preferences, creating a viable alternative for manufacturers.

- Cost and Trend Alignment: Customers can leverage the availability of plant-based options to negotiate better terms for dairy ingredients or to align their products with emerging dietary trends.

- Partial Substitution: Even if a complete switch isn't feasible, the ability to substitute a portion of dairy ingredients can still empower customers in their negotiations.

Customer's Own Supply Chain and Production

Large food manufacturers might possess the capability or a strategic inclination to integrate backward, meaning they could produce some of their own dairy ingredients. This can significantly bolster their negotiating leverage with Hilmar Cheese. For instance, a major dairy processor might invest in its own milk sourcing operations or develop alternative ingredient production methods, thereby lessening their dependence on external suppliers like Hilmar.

The potential for these large buyers to develop their own supply chains or diversify their supplier base acts as a potent threat. This capability, or even the credible threat of it, empowers customers. They can then reduce their reliance on any single provider, including Hilmar, which naturally strengthens their bargaining position when negotiating terms and pricing.

- Backward Integration Potential: Major food manufacturers have the financial capacity to invest in their own dairy ingredient production, reducing reliance on external suppliers.

- Supplier Diversification: Buyers can spread their sourcing across multiple providers, diminishing the influence of any single supplier like Hilmar Cheese.

- Negotiating Leverage: The ability or threat of backward integration empowers customers to demand more favorable pricing and contract terms.

Hilmar Cheese's customers, primarily large food manufacturers, wield significant bargaining power due to their substantial order volumes and the competitive nature of the food industry. This power is amplified by their sensitivity to input costs, as demonstrated by ongoing efforts in 2024 to manage inflationary pressures by seeking lower ingredient prices.

The increasing availability of plant-based alternatives provides customers with a viable substitution option, further strengthening their negotiating position. For example, the global plant-based food market's projected growth to $162 billion by 2030 highlights this trend, allowing food companies to potentially reduce their reliance on dairy ingredients.

Furthermore, the potential for backward integration by major food manufacturers poses a considerable threat. By investing in their own ingredient production or diversifying their supplier base, these large buyers can reduce their dependence on suppliers like Hilmar, thereby enhancing their leverage in pricing and contract negotiations.

| Factor | Impact on Hilmar Cheese | Supporting Data (2024/Recent Trends) |

|---|---|---|

| Customer Concentration | High bargaining power for large buyers | Dominance of major food conglomerates in procurement |

| Price Sensitivity | Pressure on pricing, especially for commoditized products | Manufacturers' efforts to manage inflation by seeking lower input costs |

| Availability of Substitutes | Reduced reliance on dairy, increased customer leverage | Projected growth of plant-based market to $162 billion by 2030 |

| Backward Integration Potential | Customers can reduce dependence on external suppliers | Strategic investments by food manufacturers in supply chain control |

Preview Before You Purchase

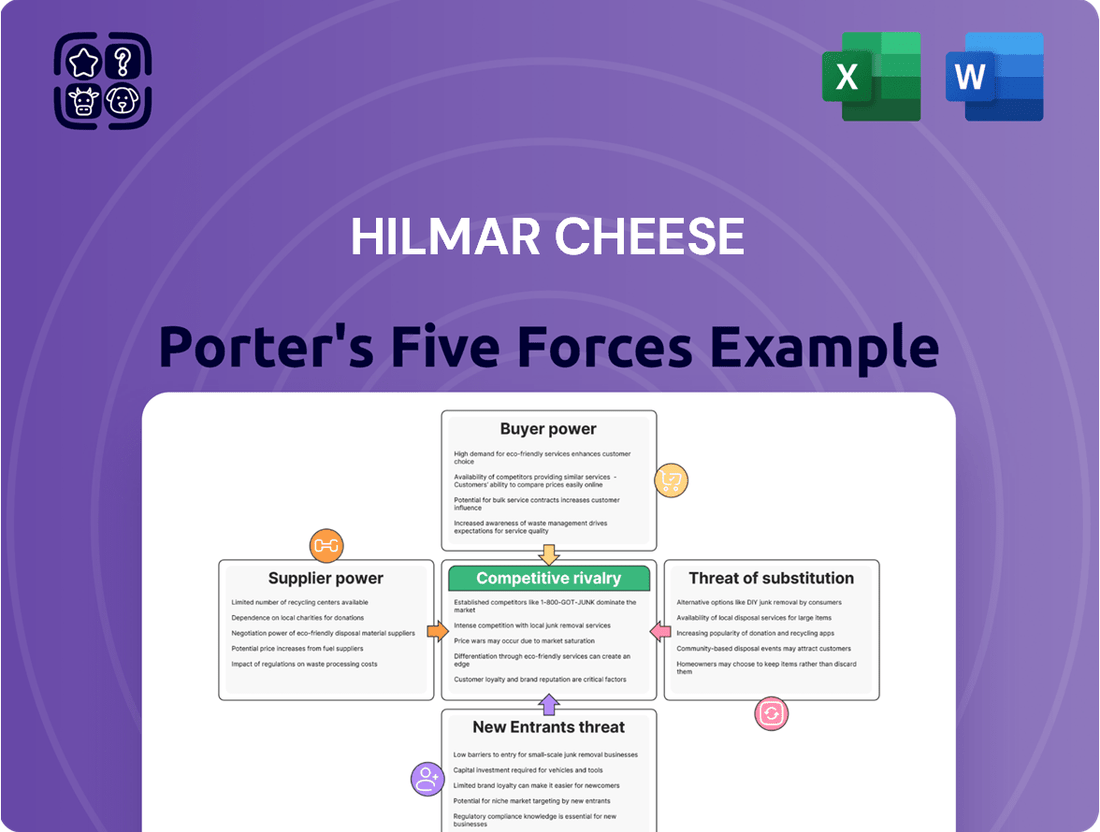

Hilmar Cheese Porter's Five Forces Analysis

This preview showcases the complete Hilmar Cheese Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape within the dairy industry. You're looking at the actual document; once your purchase is complete, you'll gain instant access to this exact, professionally formatted file, ready for immediate use and strategic application.

Rivalry Among Competitors

The global dairy ingredients market is a vast arena, estimated at USD 72.1 billion in 2025, with expectations of robust future growth. This expansive market is characterized by a high degree of fragmentation, featuring a mix of large, established multinational corporations and many smaller, niche producers. This diverse player base fuels a highly competitive environment.

Hilmar Cheese Company navigates this intensely competitive landscape, contending with rivals across a wide spectrum of dairy ingredient categories. These competitors range from global giants with extensive supply chains and product portfolios to specialized firms focusing on specific high-value ingredients.

Competitive rivalry in the dairy ingredients sector often hinges on product differentiation. Companies strive to stand out by offering specialized items, like high-demand whey proteins tailored for the nutrition industry or distinct cheese varieties. Hilmar Cheese, with its broad portfolio encompassing various cheeses, whey protein, and lactose, carves out a degree of differentiation. However, the landscape is dynamic, as competitors are also heavily investing in innovation and new product development to secure and grow their market share.

The dairy processing sector is experiencing a surge in investment, with new facilities and capacity expansions becoming commonplace. For instance, Hilmar Cheese's significant investment in its Dodge City plant, which commenced operations in 2025, exemplifies this trend. This widespread increase in processing capabilities across the industry heightens competitive rivalry.

As more companies boost their processing capacity, the competition for essential milk supply intensifies. This scramble for raw materials can lead to upward pressure on milk prices. Simultaneously, the increased output from these expanded facilities means companies are vying more aggressively for market share, potentially driving down product prices and squeezing profit margins.

Geographic Reach and Distribution Networks

Hilmar Cheese Company operates as a global dairy ingredient manufacturer, extending its supply chain to food manufacturers across the world. This extensive geographic reach, supported by facilities strategically located in California, Texas, and Kansas, is a significant factor in its competitive standing.

A broad geographic reach and robust distribution networks are vital for a competitive edge. They enable companies like Hilmar to cater to a wide array of customers and effectively manage variations in regional supply and demand. For instance, in 2023, the global cheese market was valued at approximately $137.5 billion, highlighting the scale of operations where widespread distribution is key.

- Global Supplier: Hilmar serves food manufacturers worldwide, demonstrating a significant international presence.

- Domestic Footprint: Facilities in California, Texas, and Kansas enhance its ability to serve the North American market efficiently.

- Competitive Advantage: A wide geographic reach and strong distribution networks allow for better customer service and risk mitigation against regional market volatility.

Sustainability and Brand Reputation

In today's market, how a company handles sustainability and its reputation is a big deal. Hilmar Cheese shows this with its LEED Platinum certified headquarters and its involvement in the U.S. Dairy Stewardship Commitment. These actions set it apart from competitors who might not prioritize environmental efforts as much.

This focus on sustainability isn't just good for the planet; it's a strategic advantage. For instance, in 2023, consumer spending on sustainable products saw continued growth, with reports indicating a significant portion of shoppers willing to pay more for eco-friendly options. Hilmar's proactive approach can attract these environmentally conscious consumers, potentially boosting sales and market share.

- LEED Platinum Certification: Hilmar's headquarters demonstrates a commitment to green building standards.

- U.S. Dairy Stewardship Commitment: Participation signals adherence to responsible dairy farming practices.

- Consumer Preference: Growing demand for sustainable products favors companies with strong environmental credentials.

- Competitive Edge: Differentiates Hilmar from rivals lacking similar sustainability initiatives.

The dairy ingredient sector is highly competitive, with numerous players vying for market share. Companies differentiate themselves through specialized products, innovation, and expanded processing capabilities. For example, increased investment in dairy processing, like Hilmar Cheese's Dodge City plant expansion in 2025, intensifies the competition for milk supply and finished product sales.

This heightened competition can lead to price volatility for raw milk and finished goods. Companies with broad geographic reach and strong distribution networks, such as Hilmar Cheese with its presence in California, Texas, and Kansas, are better positioned to manage these market dynamics. The global cheese market, valued at approximately $137.5 billion in 2023, underscores the scale at which distribution efficiency matters.

Furthermore, sustainability initiatives are becoming a key differentiator. Hilmar Cheese's LEED Platinum headquarters and participation in the U.S. Dairy Stewardship Commitment appeal to a growing segment of consumers willing to pay more for eco-friendly products, a trend evident in 2023 consumer spending patterns.

| Competitive Factor | Hilmar Cheese's Position | Market Impact |

|---|---|---|

| Product Differentiation | Offers diverse cheese, whey protein, lactose; invests in innovation. | Attracts specific customer segments; requires ongoing R&D to maintain edge. |

| Processing Capacity | Expanding capacity (e.g., Dodge City plant, 2025). | Intensifies competition for milk supply; increases output pressure. |

| Geographic Reach & Distribution | Global supplier with domestic facilities (CA, TX, KS). | Enhances customer service, mitigates regional risk; crucial in large markets like global cheese ($137.5B in 2023). |

| Sustainability & Reputation | LEED Platinum HQ, U.S. Dairy Stewardship Commitment. | Appeals to eco-conscious consumers; builds brand loyalty in a growing market segment. |

SSubstitutes Threaten

The burgeoning plant-based milk market, anticipated to reach US$36.18 billion by 2033, presents a significant threat of substitution for traditional dairy ingredients. This growth is fueled by increasing consumer demand for healthier, ethically sourced, and diet-specific food options.

As food manufacturers increasingly incorporate plant-based proteins and dairy alternatives into their product formulations, Hilmar Cheese, a major dairy ingredient producer, faces a direct challenge. This shift away from dairy could impact demand for Hilmar's core offerings, necessitating strategic adaptation to remain competitive.

The threat of substitutes for traditional dairy ingredients, like those Hilmar Cheese produces, is intensifying. Beyond just plant-based milks, there's a burgeoning market for functional ingredients sourced from non-dairy origins that can mimic dairy's protein and texture in food products. For instance, pea protein isolates and fava bean proteins are increasingly used in everything from yogurt alternatives to baked goods, offering comparable nutritional profiles and functional benefits.

Innovations in food science are making these non-dairy alternatives more sophisticated and cost-effective. Companies are developing advanced processing techniques to extract and refine proteins and fats from sources like algae, fungi, and even precision fermentation, creating ingredients that can directly replace dairy components in many recipes. This trend was particularly evident in 2024, with significant venture capital funding flowing into plant-based and alternative protein startups focused on ingredient development.

Consumer dietary shifts, driven by a growing emphasis on health and wellness, present a significant threat of substitutes for Hilmar Cheese. For instance, the rising popularity of plant-based diets, with an estimated 10% of Americans identifying as vegan or vegetarian in 2024, directly impacts dairy consumption. This trend encourages food manufacturers to explore non-dairy alternatives for products traditionally made with cheese, potentially reducing demand for Hilmar's offerings.

Cost-Effectiveness of Substitutes

The cost-effectiveness of dairy substitutes significantly impacts their threat to traditional cheese. If plant-based alternatives become more economically viable for food manufacturers, their adoption will likely increase. For instance, a 2024 report indicated that the average price difference between conventional dairy cheese and popular plant-based alternatives in the US ranged from 15% to 30% higher for the latter, but this gap is narrowing as production scales up.

Rising dairy ingredient prices directly enhance the attractiveness of substitutes. As of early 2024, global dairy commodity prices experienced volatility, with some reports showing a 5-10% increase in butterfat costs compared to the previous year, making cheese production more expensive and potentially pushing manufacturers toward more stable-priced alternatives.

- Price Sensitivity: Food manufacturers are highly sensitive to ingredient costs, especially in competitive markets.

- Economies of Scale: As the production volume of plant-based ingredients grows, their per-unit cost is expected to decline, further challenging dairy's cost advantage.

- Ingredient Innovation: Advancements in food science are creating plant-based ingredients that more closely mimic the taste and texture of dairy cheese, reducing the perceived trade-off for manufacturers.

- Market Trends: Consumer demand for plant-based options, driven by health and environmental concerns, is also a factor that encourages manufacturers to explore cost-effective substitutes.

Regulatory and Labeling Environment for Alternatives

The regulatory and labeling environment plays a significant role in how readily consumers accept and adopt alternative products. For instance, clear labeling that accurately represents plant-based ingredients can boost consumer confidence, thereby increasing the threat of substitution for traditional dairy ingredients. As of early 2024, many regions are still refining these guidelines, creating a dynamic landscape for ingredient manufacturers.

Favorable regulations and transparent labeling for plant-based alternatives can accelerate their market penetration. This can directly impact companies like Hilmar Cheese, as it influences consumer choice and the competitive positioning of substitutes. The market for plant-based dairy alternatives saw significant growth, with global sales estimated to reach over $20 billion in 2023, indicating a strong consumer pull that regulatory clarity could further amplify.

- Regulatory Clarity: Evolving regulations around plant-based product naming and ingredient disclosure can either facilitate or hinder market acceptance.

- Labeling Requirements: Strict or misleading labeling on alternatives can create a barrier, while clear and honest labeling can boost consumer trust and adoption.

- Market Acceptance: Favorable regulatory environments can accelerate the adoption of substitutes, increasing the competitive pressure on traditional dairy ingredient providers.

- Growth of Alternatives: The plant-based food market is projected to continue its upward trajectory, with some estimates suggesting it could reach $160 billion by 2030, underscoring the growing threat of substitutes.

The threat of substitutes for dairy ingredients like those Hilmar Cheese produces is significant and growing. Plant-based alternatives are becoming more sophisticated and cost-effective, directly challenging traditional dairy's market share. Consumer preferences are shifting towards these alternatives due to health, ethical, and environmental concerns, further amplifying this threat.

| Substitute Category | 2024 Market Share (Est.) | Projected Growth (CAGR) | Key Drivers |

|---|---|---|---|

| Plant-Based Milks | 15% | 12% | Health, Ethics, Lactose Intolerance |

| Plant-Based Proteins (for cheese alternatives) | 8% | 15% | Innovation, Cost Reduction, Dietary Trends |

| Precision Fermentation Dairy Proteins | 2% | 25% | Sustainability, Novelty, Performance |

Entrants Threaten

The threat of new entrants in the dairy processing industry is significantly limited by the immense capital required to establish operations. For instance, Hilmar Cheese's recent investment of $600 million in a new processing plant in Dodge City, Kansas, highlights the substantial financial commitment necessary for building a large-scale, competitive facility. This includes acquiring land, purchasing specialized machinery, and developing essential infrastructure, creating a formidable barrier for potential new competitors.

Newcomers face significant hurdles in securing a consistent and high-quality supply of raw milk, a fundamental requirement for dairy ingredient production. Establishing robust relationships with dairy farmers and negotiating long-term supply contracts can be a substantial barrier, particularly in areas where established players like Hilmar Cheese have already cultivated strong ties with local producers.

The dairy industry, including companies like Hilmar Cheese, faces substantial barriers to entry due to stringent regulatory requirements, particularly concerning food safety and quality control. New companies must meticulously adhere to regulations set by bodies like the FDA, which mandate rigorous testing, traceability, and sanitation protocols. For instance, the Food Safety Modernization Act (FSMA) places a significant emphasis on preventative controls, requiring substantial investment in compliance infrastructure and personnel.

Navigating these complex compliance landscapes and obtaining necessary certifications can be a significant hurdle for potential new entrants. This includes achieving certifications such as SQF (Safe Quality Food) or BRC (British Retail Consortium) Global Standard for Food Safety, which demand robust quality assurance systems and can take considerable time and resources to implement. The substantial upfront investment in quality assurance and regulatory compliance acts as a deterrent, effectively raising the cost of entry.

Established Brand Reputation and Customer Relationships

Hilmar Cheese Company, founded in 1984, boasts a deeply entrenched brand reputation and robust customer relationships, particularly with global food manufacturers. This long-standing presence means new entrants face a significant hurdle in replicating the trust and reliability that Hilmar has cultivated over decades. These established ties often translate into long-term contracts and preferred supplier status, making it difficult for newcomers to gain a foothold.

The challenge for new entrants is amplified by the fact that food manufacturers typically prioritize suppliers with proven track records and consistent quality. Building this level of confidence and securing comparable relationships requires substantial time, investment, and a demonstrated ability to meet stringent industry standards. For instance, in 2023, the global cheese market was valued at over $130 billion, indicating a competitive landscape where established players like Hilmar have a distinct advantage.

- Established Brand Loyalty: Hilmar's decades of operation have fostered deep customer loyalty, a difficult asset for new entrants to acquire.

- Supplier Relationships: Food manufacturers often prefer long-term partnerships with proven suppliers, creating barriers for new companies.

- Reputation for Quality: A strong brand reputation for consistent quality and reliability is a significant deterrent to new competitors.

- Global Reach: Hilmar's established global supply chain and customer base present a formidable challenge for any new entrant aiming for international market share.

Economies of Scale and Operational Efficiency

The threat of new entrants in the cheese processing industry, particularly for companies like Hilmar Cheese, is significantly mitigated by substantial economies of scale. Established players benefit from lower per-unit costs in raw material procurement, manufacturing, and logistics. For example, in 2024, major dairy processors often operate plants with capacities exceeding 100 million pounds of cheese annually, enabling them to negotiate better prices for milk and packaging.

New entrants face a considerable hurdle in achieving comparable operational efficiency. Building and scaling production facilities to compete on cost requires immense capital investment. Without the volume to spread fixed costs, a new competitor would likely have higher production costs, making it difficult to match the pricing strategies of incumbents.

- Economies of Scale: Large processors leverage bulk purchasing power for milk, ingredients, and packaging, reducing input costs.

- Operational Efficiency: High-volume production allows for optimized manufacturing processes and lower overhead per unit of output.

- Distribution Networks: Established companies have built extensive and cost-effective distribution channels, a significant barrier for newcomers.

- Capital Intensity: The dairy processing sector requires substantial upfront investment in specialized equipment and facilities, deterring smaller players.

The threat of new entrants in the cheese processing industry is low due to significant capital requirements, regulatory hurdles, and established supplier relationships. Hilmar Cheese's $600 million investment in a new plant exemplifies the high cost of entry. Newcomers struggle to secure consistent, high-quality milk supplies and must navigate complex food safety regulations like FSMA, demanding substantial investment in compliance and certifications such as SQF.

Hilmar's long-standing reputation, built since 1984, and strong customer ties create a formidable barrier. The global cheese market, valued at over $130 billion in 2023, favors established players with proven track records. Furthermore, economies of scale allow companies like Hilmar to achieve lower per-unit costs, with major processors in 2024 operating plants with capacities exceeding 100 million pounds annually, making it difficult for new entrants to compete on price.

| Barrier Type | Description | Example/Data Point |

| Capital Requirements | High investment needed for facilities and equipment. | Hilmar Cheese's $600 million plant investment. |

| Raw Material Access | Difficulty securing consistent, high-quality milk supply. | Established relationships with dairy farmers. |

| Regulatory Compliance | Adherence to stringent food safety and quality standards. | FSMA, SQF, BRC certifications require significant investment. |

| Brand Reputation & Customer Loyalty | Decades of building trust and relationships. | Hilmar's established ties with global food manufacturers. |

| Economies of Scale | Lower per-unit costs due to high-volume production. | 2024 plants with >100 million lbs annual capacity. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hilmar Cheese is built upon a foundation of comprehensive data, including industry-specific market research reports from firms like IBISWorld, financial disclosures from publicly traded competitors, and USDA dairy market reports. This blend of primary and secondary sources ensures a robust understanding of the competitive landscape.