Hexaom PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hexaom Bundle

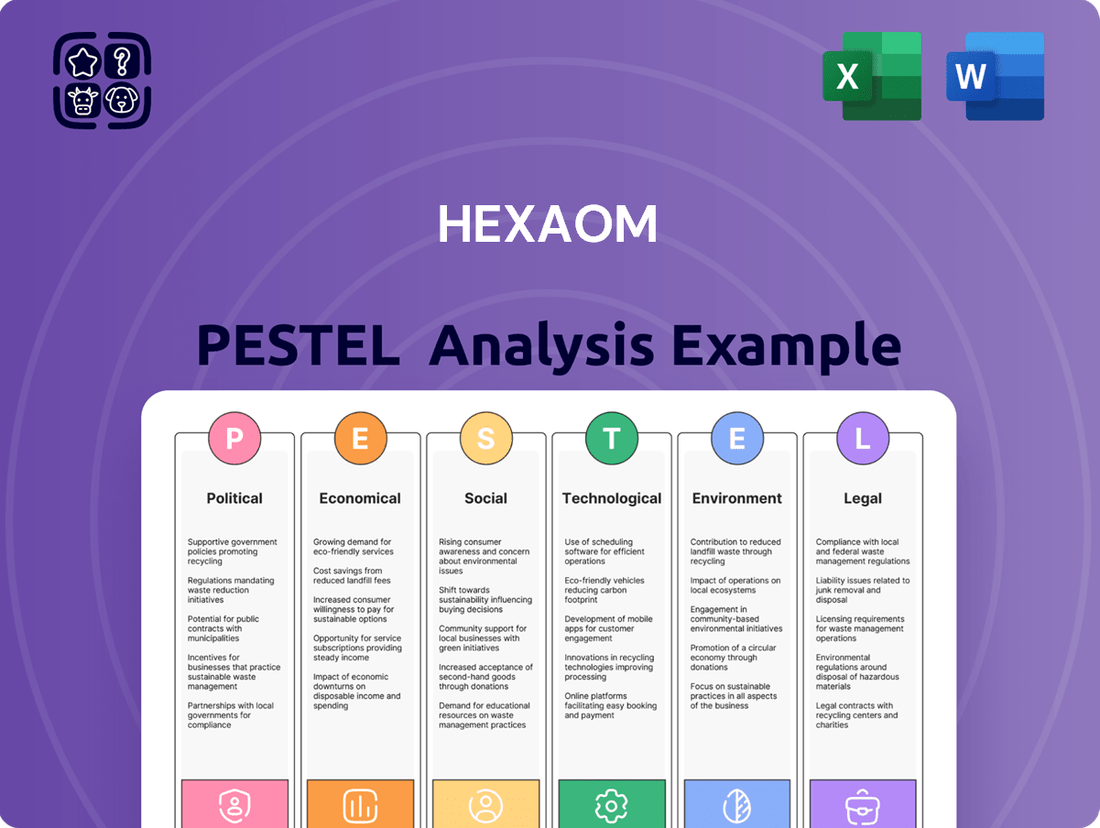

Navigate the complex external forces shaping Hexaom's future with our meticulously crafted PESTLE Analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing its operations and strategic direction. This comprehensive report is your key to identifying opportunities and mitigating risks. Gain a competitive advantage by leveraging these expert insights. Download the full Hexaom PESTLE Analysis now and empower your strategic decision-making.

Political factors

The French government's proactive housing policies are a significant political factor for Hexaom. The extension of the Zero-Rate Loan (PTZ) for new properties, starting April 1, 2025, is a key initiative aimed at boosting homeownership. This policy makes purchasing new homes more affordable, directly influencing Hexaom's potential sales volume.

Further governmental support is anticipated with proposed tax exemptions on gifts for new home purchases. Such measures are designed to stimulate demand within the housing market, creating a more favorable environment for construction companies like Hexaom. These incentives are crucial for driving market activity.

Changes in urban planning codes, like the Bioclimatic Local Urban Plan adopted in November 2024, are imposing stricter environmental standards. These new regulations directly influence construction costs and project timelines, potentially increasing expenses for developers.

A notable trend is the continued decline in new housing permits, a pattern observed throughout 2024. While projections suggest this slowdown might moderate by 2025, the environment for new construction remains challenging due to these evolving regulatory landscapes.

Political uncertainty and the government's push to reduce the budget deficit, targeting 5.4% of GDP in 2025, could impact funding for local authorities and ecological transition initiatives. This might lessen support for public works and renovation incentives.

However, the recently approved 2025 Budget outlines a modest rise in net expenditure, which could provide a degree of financial relief and ongoing program support.

Land Use and Zoning Laws

Land use and zoning laws, including France's local development plans (PLU) and national urban planning regulations (RNU), significantly shape Hexaom's ability to undertake land development and new construction projects. These regulations dictate what can be built, including building heights and the allocation of green spaces, directly impacting Hexaom's real estate ventures.

The increasing integration of stricter environmental regulations within these planning documents adds layers of complexity and cost to the permit acquisition process for Hexaom. For instance, recent updates to French environmental codes in 2024 have emphasized biodiversity protection and sustainable building materials, potentially extending approval timelines and increasing project expenses for developers like Hexaom.

- PLU and RNU Impact: Define permissible construction types, heights, and green space requirements for Hexaom's projects.

- Environmental Regulations: Stricter rules, often integrated into land use plans, can heighten permit complexity and associated costs.

- Permit Delays: Evolving environmental standards can lead to longer approval processes, affecting project timelines.

- Cost Implications: Compliance with new zoning and environmental mandates may necessitate higher upfront investment for Hexaom.

Government Support for Renovation

While the MaPrimeRénov' program's budget for 2025 was reduced to €1.6 billion, down from €2.4 billion in 2024, government support for energy-efficient renovations remains a significant driver for companies like Hexaom. These initiatives, including tax credits and subsidies, continue to incentivize homeowners and building owners to invest in improvements that enhance energy performance. This sustained focus on eco-friendly upgrades creates a robust and ongoing market for renovation services.

The European Union's directives, particularly those aimed at improving the energy performance of buildings, mandate stricter standards for existing structures. This regulatory push directly translates into increased demand for renovation projects that address insulation, heating systems, and ventilation. Hexaom, as a key player in the renovation sector, is well-positioned to capitalize on this regulatory-driven market growth.

- Budgetary Shift: MaPrimeRénov' budget reduced for 2025, but still substantial at €1.6 billion.

- EU Mandates: Directives enforcing energy performance improvements in existing buildings are a constant market catalyst.

- Market Opportunity: Continued government incentives and regulations create sustained demand for renovation services.

Government housing policies, like the extended Zero-Rate Loan (PTZ) for new builds from April 2025, directly support Hexaom by making homeownership more accessible. Proposed tax exemptions on gifts for new home purchases further stimulate the market. However, stricter urban planning codes, such as the November 2024 Bioclimatic Local Urban Plan, increase construction costs and project complexity due to new environmental standards.

The French government's budget deficit target of 5.4% of GDP for 2025 could potentially reduce funding for local initiatives, impacting support for public works. Despite this, the 2025 Budget allows for a slight increase in net expenditure, offering some program stability. Land use regulations (PLU, RNU) and evolving environmental codes, emphasizing biodiversity and sustainable materials, continue to influence project viability and approval timelines.

While the MaPrimeRénov' budget for 2025 is reduced to €1.6 billion from €2.4 billion in 2024, government support for energy-efficient renovations persists. European Union directives mandating improved energy performance in existing buildings also create ongoing demand for renovation services, benefiting Hexaom.

| Policy/Factor | Impact on Hexaom | Data Point |

|---|---|---|

| Zero-Rate Loan (PTZ) Extension | Boosts new home affordability and sales | Effective April 1, 2025 |

| Proposed Gift Tax Exemptions | Further stimulates housing demand | Anticipated for new home purchases |

| Bioclimatic Local Urban Plan | Increases construction costs and complexity | Adopted November 2024 |

| MaPrimeRénov' Budget | Sustains renovation market, though reduced | €1.6 billion for 2025 (down from €2.4 billion in 2024) |

| EU Energy Performance Directives | Drives demand for renovation projects | Ongoing regulatory requirement |

What is included in the product

The Hexaom PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Hexaom, providing a comprehensive overview of the external landscape.

Hexaom's PESTLE Analysis provides a clear, summarized version of complex external factors, easing the pain of information overload during strategic planning.

Economic factors

Declining mortgage interest rates are significantly boosting housing affordability in France. By April 2025, average rates for long-term loans have stabilized around the 3% mark. This makes it easier for potential buyers to secure financing, thereby stimulating demand in the property market.

These easing credit conditions are a crucial element in the ongoing recovery of the French real estate sector. The lower cost of borrowing directly translates into more accessible homeownership, encouraging a broader range of individuals to enter the market. This trend is expected to continue supporting property sales and potentially price appreciation.

Consumer purchasing power significantly influences the housing market. In early 2024, many households saw their purchasing power bolstered by relatively stable interest rates and a growing labor market, leading to increased demand for new homes. For instance, the median household income in the US continued its upward trend, reaching an estimated $84,803 in 2023, according to the Census Bureau, providing a stronger foundation for housing investments.

However, consumer confidence can be a fickle indicator. While initial optimism in 2024 suggested robust spending, a shifting economic outlook, including concerns about inflation and potential job market cooling, introduced a note of caution. This tempered confidence can lead consumers to delay significant purchases like homes, impacting the pace of new construction and sales.

High construction costs, fueled by persistent inflation in materials and labor, remain a significant hurdle for the real estate sector. For instance, the Producer Price Index (PPI) for construction inputs saw a notable increase in early 2024, impacting project budgets across the board. This trend directly pressures companies like Hexaom, potentially squeezing their profit margins.

Despite these inflationary headwinds, Hexaom has demonstrated resilience. The company has successfully navigated the challenging real estate market, maintaining profitability through astute cost management strategies. This ability to control expenses while managing projects effectively is crucial in the current economic climate, especially with ongoing supply chain volatility contributing to material cost fluctuations.

Overall Market Activity and Transaction Volumes

The French property market, after a challenging period in 2024, is demonstrating a notable stabilization and a promising uptick in transaction volumes as 2024 concludes and 2025 begins. This resurgence suggests a potential easing of previous headwinds.

While new housing construction is still projected to contract in 2025, the rate of this decline is anticipated to moderate, hinting at a slow but steady recovery in the sector. This indicates a shifting landscape with improving market sentiment.

Key indicators point towards this recovery:

- Transaction volumes are expected to increase in late 2024 and early 2025.

- The pace of decline in new housing starts is decelerating.

- Market activity is showing signs of bottoming out after earlier downturns.

Availability of Credit and Financial Services

The availability of credit is seeing a positive shift, with banks showing renewed interest in lending. This is particularly beneficial for the housing market, as evidenced by the expansion of government-backed loan programs. For instance, programs like PTZ are making it easier for people to secure mortgages.

Hexaom's own financial services are well-positioned to capitalize on this trend. By offering complementary services, Hexaom can further support its clients in achieving homeownership, aligning with the broader improvement in credit accessibility. This synergy between external financial support and Hexaom's offerings is a key economic factor.

- Increased Lending: Banks are becoming more willing to extend credit, boosting overall financial liquidity.

- Government Support: Programs like PTZ are actively expanding, providing crucial financial avenues for homebuyers.

- Hexaom's Role: Hexaom's financial services integrate with these positive credit trends, enhancing client support.

- Market Impact: This improved credit availability directly fuels demand in sectors like real estate.

Economic factors significantly shape the real estate landscape for companies like Hexaom. Declining mortgage rates, stabilizing around 3% by April 2025 in France, enhance housing affordability and stimulate demand. Despite a projected contraction in new housing construction for 2025, the rate of decline is moderating, indicating a sector bottoming out.

Consumer purchasing power, bolstered by a stable labor market in early 2024, initially drove demand, though concerns about inflation and potential job cooling introduced caution. Persistent inflation in construction materials and labor continues to pressure profit margins, yet Hexaom has demonstrated resilience through effective cost management amidst supply chain volatility.

Improved credit availability, with banks showing renewed lending interest and government programs like PTZ expanding, further supports the market. Hexaom's financial services are strategically positioned to leverage these positive credit trends, enhancing client support and capitalizing on increased demand.

| Economic Indicator | Value/Trend | Impact on Hexaom |

|---|---|---|

| French Mortgage Rates (Apr 2025) | ~3% | Boosts affordability, increases demand |

| New Housing Starts (2025 Projection) | Contracting, but moderating decline | Slowing recovery, potential for future growth |

| Construction Input PPI (Early 2024) | Notable Increase | Pressures profit margins, necessitates cost control |

| Consumer Confidence (2024) | Tempered by inflation/job concerns | Potential delay in major purchases, cautious spending |

| Credit Availability | Expanding, increased bank lending | Supports market demand, Hexaom can leverage |

Preview the Actual Deliverable

Hexaom PESTLE Analysis

The preview shown here is the exact Hexaom PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same Hexaom PESTLE Analysis document you’ll download after payment.

The file you’re seeing now is the final version of the Hexaom PESTLE Analysis—ready to download right after purchase.

Sociological factors

Demographic shifts are significantly reshaping housing demand. In 2024, the US saw a continued trend of smaller average household sizes, with many opting for single-person or two-person units, particularly in urban centers. This is driving demand for apartments and smaller homes, away from the larger single-family dwellings favored by previous generations.

Urbanization remains a powerful force, with cities like Austin, Texas, and Boise, Idaho, experiencing robust population growth in 2024, largely fueled by younger professionals and tech workers. This influx strains existing housing stock and pushes rental prices higher, while also increasing the need for diverse housing options to accommodate varying income levels and family structures.

The aging population is another key demographic factor influencing housing. By 2025, it's projected that over 20% of the US population will be 65 or older. This demographic is increasingly seeking accessible, low-maintenance living environments, including retirement communities and single-story homes, which presents both challenges and opportunities for the real estate and construction sectors.

Consumer preferences are significantly shifting towards housing that is both energy-efficient and environmentally conscious. Buyers are actively seeking properties with superior energy ratings and features like solar panels or recycled materials, reflecting a growing awareness of sustainability. For instance, in the UK, surveys in early 2024 indicated that over 70% of potential homebuyers consider energy efficiency a crucial factor when choosing a property.

This evolving demand presents a direct opportunity for Hexaom, whose traditional and timber frame construction methods can be readily adapted to incorporate these eco-friendly elements. Timber frame homes, in particular, are known for their inherent thermal insulation properties, contributing to lower energy consumption and utility bills for homeowners. This alignment with market trends allows Hexaom to cater to a segment of the market that is willing to invest in greener living solutions.

The widespread adoption of remote work, accelerated by events in recent years, has fundamentally altered how people live and work. This trend has seen a notable migration away from densely populated urban cores towards more affordable and spacious suburban and rural locations. For instance, data from the U.S. Census Bureau in late 2023 indicated a continued net outflow from major metropolitan areas, with many citing the flexibility of remote work as a primary driver.

This shift in lifestyle directly impacts real estate demand, with individuals now prioritizing properties that offer a blend of tranquility, ample living space, and convenient access to local amenities rather than proximity to central business districts. This evolving preference could significantly influence Hexaom's strategic decisions regarding land acquisition and the types of residential projects it undertakes.

In 2024, companies continue to refine their remote and hybrid work policies, with many, like major tech firms, announcing plans to maintain hybrid models long-term. This suggests that the demand for properties outside of traditional urban centers is likely to persist, creating new opportunities for developers like Hexaom to cater to this demographic. The focus is shifting towards creating communities that support a balanced lifestyle, integrating home workspaces and outdoor recreational facilities.

Homeownership Aspirations and Affordability

The enduring desire for homeownership in France continues to be a significant sociological factor, even amidst economic headwinds. Government support programs and a more stable interest rate environment, which saw the average mortgage rate hover around 3.8% in early 2024, bolster this aspiration.

Hexaom strategically addresses this by offering a diverse portfolio of housing options. This approach allows them to serve various income brackets, from first-time buyers seeking more accessible properties to those looking for larger family homes. For example, in 2023, Hexaom reported a strong performance in its affordable housing segment, indicating a robust demand.

- Strong Homeownership Desire: Despite economic pressures, French citizens maintain a high aspiration for owning a home.

- Government Incentives: Various state-backed schemes continue to encourage property acquisition.

- Stabilizing Interest Rates: Mortgage rates, which averaged approximately 3.8% in early 2024, have become more predictable, aiding affordability calculations.

- Hexaom's Market Segmentation: The company's diverse product range caters to a wide spectrum of buyer affordability levels, supporting demand across different market segments.

Social Housing Needs and Government Initiatives

Governments worldwide are increasingly focused on addressing social housing needs. For instance, in the UK, the government has pledged significant investment to boost social housing supply. By mid-2024, it's estimated that over 100,000 new social homes will be delivered through a combination of council building programs and partnerships with housing associations.

These initiatives often involve direct government intervention, such as purchasing units from private developers to convert them into affordable or social housing. This strategy creates direct opportunities for large homebuilders like Hexaom to participate in fulfilling these vital housing targets, potentially securing substantial contracts.

- Government commitment to social housing: Increased funding and targets for new social and intermediary rental homes.

- Developer partnerships: Opportunities for construction firms to supply units directly to government bodies or housing associations.

- Market impact: Potential for steady demand in the affordable housing sector, benefiting companies with the capacity to deliver at scale.

- Hexaom's potential role: As a major homebuilder, Hexaom is well-positioned to leverage these government programs for growth.

Societal attitudes towards homeownership and living arrangements are evolving. In 2024, the trend of smaller households and a preference for urban living continues, especially among younger demographics. This shift influences demand for diverse housing types beyond traditional single-family homes.

The aging population in many developed nations is a significant factor, with a growing segment seeking accessible, low-maintenance housing solutions. By 2025, over 20% of the US population is projected to be 65+, driving demand for specific types of residences that cater to their needs.

Consumer preferences are increasingly leaning towards sustainability and energy efficiency in homes. Data from early 2024 in the UK shows over 70% of potential buyers prioritizing energy-efficient features, indicating a strong market pull for environmentally conscious construction.

The sustained adoption of remote and hybrid work models continues to reshape residential location choices. This trend, evident in late 2023 US Census Bureau data showing net outflows from major cities, suggests a persistent demand for housing in suburban and rural areas that offer more space and a different lifestyle.

| Sociological Factor | Trend/Observation (2024/2025) | Impact on Housing Demand | Hexaom Opportunity |

|---|---|---|---|

| Household Size | Decreasing average household size, rise in single-person/two-person households | Increased demand for apartments and smaller homes | Adaptation of designs for smaller units, focus on urban developments |

| Aging Population | Projected 20%+ of US population aged 65+ by 2025 | Demand for accessible, low-maintenance housing, retirement communities | Development of senior-friendly housing options, single-story designs |

| Sustainability Focus | Over 70% of UK buyers consider energy efficiency crucial (early 2024) | Preference for energy-efficient homes, solar panels, recycled materials | Leveraging timber frame's thermal properties, offering eco-friendly features |

| Remote Work | Continued net outflow from major cities (late 2023 US data) | Demand for spacious homes in suburban/rural areas | Expansion into new geographic markets, development of communities supporting remote work |

Technological factors

The construction industry is seeing a significant shift towards digital technologies. Building Information Modeling (BIM) adoption, for instance, is becoming standard, with a projected global market size of over $15 billion by 2027, reflecting its growing importance in enhancing project precision and coordination for firms like Hexaom. This digital transformation streamlines workflows and optimizes resource allocation, leading to substantial efficiency improvements.

Prefabrication and modular construction are also on the rise, driven by the need for faster project delivery and reduced waste. These methods are particularly relevant for companies like Hexaom, especially given their expertise in timber frame construction. This approach allows for greater quality control and can significantly shorten on-site assembly times, potentially offering Hexaom a competitive edge in 2024 and 2025.

The increasing consumer appetite for smart home features, projected to grow significantly by 2025, offers Hexaom a prime opportunity to embed these innovations into its properties. This integration, encompassing automated energy management, advanced security systems, and enhanced convenience, directly addresses the demand for connected living. For instance, the global smart home market was valued at over $100 billion in 2023 and is expected to see robust compound annual growth rates in the coming years, making this a strategic area for Hexaom to capture market share and command premium pricing.

The push for energy-efficient materials in construction is accelerating, fueled by global efforts to combat climate change. For instance, the building sector's energy consumption accounts for about 35% of global final energy use, making material innovation a critical leverage point. Companies like Hexaom must adapt to these shifts, as demand for sustainable building solutions, such as advanced insulation and low-carbon concrete, is projected to grow significantly in the coming years. This innovation directly impacts operational costs and market competitiveness.

Digitalization of Sales and Customer Experience

Digital transformation is reshaping how companies like Hexaom interact with customers. The sales process, from initial contact to final transaction, is increasingly moving online. This includes virtual property tours, online consultations, and streamlined digital payment systems, all of which enhance the customer journey and broaden market access. In 2024, global e-commerce sales are projected to reach over $6.3 trillion, demonstrating the significant shift towards digital channels.

Hexaom can capitalize on this trend by investing in robust digital platforms. These platforms can support everything from product design visualization to online sales portals and direct client communication tools. This digital-first approach not only improves efficiency but also allows for more personalized customer experiences. For instance, by Q3 2024, companies with strong digital customer engagement strategies reported an average of 15% higher customer retention rates compared to those with less developed digital presences.

- Virtual Showrooms: Allowing clients to explore properties remotely, increasing accessibility and reducing the need for physical visits.

- Online Design Portals: Enabling clients to customize designs and view real-time renderings, fostering collaboration and speeding up the design phase.

- Digital Sales Platforms: Offering secure online transaction capabilities and personalized sales experiences.

- Enhanced Client Communication: Utilizing chat bots, video conferencing, and dedicated client portals for seamless interaction and support.

Renovation Technologies and Solutions

Technological advancements are significantly reshaping the renovation landscape, directly benefiting Hexaom's core services. Innovations in building materials, like advanced insulation with higher R-values and phase-change materials, are making structures more energy-efficient. For example, the market for high-performance insulation is projected to grow substantially, with demand driven by stricter energy codes and consumer desire for reduced utility bills. The global building insulation market was valued at approximately USD 45 billion in 2023 and is expected to reach over USD 65 billion by 2030, showcasing a compound annual growth rate (CAGR) of around 5.5%.

Smart home technology is another key driver. Integrated smart heating, ventilation, and air conditioning (HVAC) systems, along with intelligent energy management platforms, allow for optimized energy consumption and greater comfort. These systems can learn occupant behavior and adjust settings automatically, leading to significant energy savings. The global smart home market size was valued at USD 101.2 billion in 2023 and is anticipated to expand at a CAGR of 13.4% from 2024 to 2030. This growth indicates a strong consumer appetite for connected and efficient home solutions.

The integration of renewable energy solutions directly into renovation projects presents a major opportunity. Solar panels, geothermal systems, and energy storage solutions are becoming more accessible and efficient, allowing homeowners to achieve net-zero energy status. Government incentives and tax credits, often tied to the adoption of these technologies, further bolster their appeal. For instance, in 2024, many regions continue to offer substantial rebates for solar installations and energy-efficient upgrades, making these investments more attractive.

These technological shifts enable Hexaom to offer more comprehensive and value-added renovation packages. By incorporating these cutting-edge solutions, Hexaom can help clients not only improve their property's aesthetic appeal and structural integrity but also significantly reduce their environmental footprint and operational costs. This alignment with technological progress ensures Hexaom remains competitive and responsive to evolving market demands and regulatory landscapes.

Technological advancements are significantly enhancing efficiency and client engagement in the construction sector, with Building Information Modeling (BIM) adoption projected to exceed $15 billion globally by 2027. Prefabrication and modular construction methods are also gaining traction, offering faster project completion and reduced waste, which is particularly beneficial for timber frame construction expertise. The increasing consumer demand for smart home features, a market valued at over $100 billion in 2023, presents a prime opportunity for integrated innovations.

The push for energy-efficient materials is accelerating, with the building sector consuming approximately 35% of global final energy. This necessitates adaptation to sustainable solutions like advanced insulation and low-carbon concrete. Digital transformation is also reshaping client interactions through virtual tours and online sales platforms, with global e-commerce sales expected to surpass $6.3 trillion in 2024. Investing in digital platforms can boost customer retention by an estimated 15% by Q3 2024.

The renovation landscape is being reshaped by innovations in advanced insulation, with the global market projected to grow from approximately USD 45 billion in 2023 to over USD 65 billion by 2030. Smart home technology, including intelligent HVAC and energy management, is also expanding, with the market valued at USD 101.2 billion in 2023 and an anticipated CAGR of 13.4% from 2024 to 2030. The integration of renewable energy solutions like solar panels and energy storage is further enhanced by government incentives, making net-zero energy projects more accessible.

These technological integrations allow Hexaom to offer enhanced renovation packages that improve property value, reduce environmental impact, and lower operational costs. Keeping pace with these advancements ensures Hexaom remains competitive and responsive to evolving market demands and regulatory frameworks, solidifying its position in the construction industry through 2024 and 2025.

| Technology Area | Market Size/Growth (2023/2024-2025) | Impact for Hexaom |

| Building Information Modeling (BIM) | Global market over $15 billion by 2027 | Enhanced project precision, coordination, and workflow streamlining |

| Prefabrication/Modular Construction | Increasing adoption | Faster project delivery, reduced waste, quality control, competitive edge |

| Smart Home Technology | Global market >$100 billion (2023), strong CAGR | Opportunity for integrated innovations, premium pricing, increased property appeal |

| Energy-Efficient Materials | Building sector consumes ~35% global final energy | Demand for advanced insulation, low-carbon concrete; reduced operational costs |

| Digital Sales & Client Engagement | Global e-commerce >$6.3 trillion (2024), 15% higher retention | Improved customer journey, broader market access, personalized experiences |

Legal factors

France's RE2020 environmental regulation significantly impacts construction, including for companies like Hexaom. This regulation sets ambitious goals for reducing carbon emissions related to both the energy used in buildings and the materials employed in their construction. Compliance is mandatory for new building projects, influencing everything from the types of insulation used to the manufacturing processes of building components.

These stringent building codes directly affect Hexaom's material selection and construction methodologies. For instance, RE2020 mandates specific performance levels for thermal insulation and limits the embodied carbon of materials. This means Hexaom must prioritize low-carbon concrete, sustainable timber, and energy-efficient window systems, potentially increasing upfront material costs but aligning with long-term environmental goals and avoiding future regulatory penalties.

Hexaom faces evolving environmental regulations, such as France's Climate and Resilience Law, which targets energy efficiency and emissions for buildings. This legislation, along with schemes like the Tertiary Eco Energy Scheme, imposes stringent reduction targets, requiring significant investment in compliance for Hexaom's operations and product development. Failure to adhere can lead to penalties, impacting financial performance and brand reputation.

The company must actively adapt its building management solutions to meet these mandates, potentially creating new market opportunities for Hexaom's energy-saving technologies. For instance, the French government aims to reduce final energy consumption by 40% by 2030 and by 50% by 2050, a clear directive for companies like Hexaom to align with.

Consumer protection laws are a significant legal factor for Hexaom, particularly concerning regulations that safeguard homebuyers and individuals undertaking renovation projects. These laws often mandate specific guarantees and outline contractual obligations, which are crucial for Hexaom to foster customer trust and prevent costly legal disputes. For instance, in 2024, the UK's Trading Standards reported a 15% increase in complaints related to home improvement services, underscoring the importance of robust consumer protection adherence.

Adherence to quality standards and timely project delivery are paramount under these legal frameworks. Failure to meet these expectations can result in significant penalties, damage to reputation, and potential lawsuits. Hexaom must ensure its contracts clearly define project scope, materials, and completion timelines, aligning with legislative requirements to mitigate risks and build a strong customer relationship.

Land Acquisition and Development Regulations

Regulations surrounding land acquisition and development significantly impact Hexaom's operational capacity. Zoning laws dictate permissible land use, directly influencing where Hexaom can establish new facilities or expand existing ones. Environmental impact assessments are crucial for ensuring compliance and mitigating potential ecological disruptions, often requiring extensive study and adherence to strict guidelines before development can commence.

Development taxes also play a vital role in the financial planning for any land-based project. For 2025, updated development tax values have been released, which Hexaom must factor into its budget. These taxes can vary considerably by region and project scale, affecting the overall cost-effectiveness of land acquisition and subsequent development.

- Zoning Laws: Stringent zoning in key urban areas can limit the availability of suitable land for Hexaom's infrastructure projects.

- Environmental Regulations: Compliance with environmental impact assessments might necessitate costly mitigation strategies or project redesigns.

- Development Tax Rates (2025): For instance, a hypothetical 5% increase in development taxes in a target region could add millions to a large-scale project's expenditure.

- Permitting Processes: Lengthy and complex permitting processes can introduce significant delays, impacting project timelines and increasing holding costs for acquired land.

Labor Laws and Employment Regulations

Changes in labor laws, affecting employment conditions, worker safety, and social contributions, directly influence Hexaom's operational expenses and human resource strategies. For instance, shifts in minimum wage laws or new regulations on benefits can increase labor costs, impacting profitability.

The construction sector, a key area for Hexaom, is projected to experience employment declines. Data from the Bureau of Labor Statistics indicates a potential contraction in construction employment by 2025, which could lead to labor shortages and increased competition for skilled workers, driving up wages and recruitment costs.

- Worker Safety Regulations: Stricter enforcement of safety protocols may necessitate additional investments in training and equipment, potentially raising operating costs.

- Social Contribution Mandates: Adjustments to employer-provided benefits or social security contributions can directly impact the overall cost of employing staff.

- Employment Trends: Projections of job losses in the broader construction industry for 2025 suggest a tightening labor market, which could affect Hexaom's ability to attract and retain talent.

- Labor Law Compliance: Ensuring adherence to evolving labor legislation is crucial to avoid penalties and maintain a stable workforce.

Legal frameworks encompassing environmental standards, consumer protection, land use, and labor practices significantly shape Hexaom's operational landscape and strategic planning. Stricter environmental regulations like France's RE2020 directly influence material choices and construction methods, demanding a focus on low-carbon alternatives and energy efficiency. Consumer protection laws necessitate robust guarantees and clear contractual obligations to maintain customer trust and avoid legal repercussions, especially given increasing complaint rates in the home improvement sector as seen in the UK's 2024 data. Furthermore, evolving labor laws and projected employment trends in construction for 2025 highlight the need for proactive human resource strategies to manage costs and secure skilled talent.

Environmental factors

France's RE2020 regulation is significantly impacting Hexaom, mandating strict limits on embodied carbon in new constructions. This means Hexaom must prioritize lower-carbon materials and building techniques, a shift already underway as the industry adapts to these environmental imperatives. For instance, the regulation sets maximum limits for the lifecycle carbon footprint of new residential buildings, driving innovation in material sourcing and construction processes.

The overarching EU Energy Performance of Buildings Directive (EPBD) further reinforces this trend, setting an ambitious goal for a fully decarbonized building stock across the EU by 2050. This long-term vision compels companies like Hexaom to integrate sustainability deeply into their strategic planning, anticipating future market demands and regulatory evolution. By 2030, the EPBD aims for all new buildings to be nearly zero-energy buildings, with a strong focus on reducing the carbon footprint of the construction sector itself.

Mandatory energy efficiency standards for new and existing buildings, including targets for renovating the worst-performing structures, are driving a significant market for energy-efficient homes and renovation services. For instance, the European Union's Energy Performance of Buildings Directive (EPBD) sets ambitious goals for nearly zero-energy buildings (NZEB) for new constructions and mandates renovations for existing ones. In 2024, many member states are implementing stricter energy performance certificate requirements and offering incentives for deep renovations, aiming to reduce energy consumption in the building sector by a substantial percentage by 2030.

Hexaom's strategic emphasis on sustainable housing and renovation projects directly aligns with these evolving regulatory landscapes. By focusing on energy-efficient building materials and practices, Hexaom is well-positioned to capitalize on the growing demand for retrofitting older buildings and constructing new ones that meet stringent environmental benchmarks. This focus is not just about compliance; it's about addressing the significant portion of energy consumption attributed to buildings, estimated to be around 40% in many developed economies, thereby creating a clear market advantage.

Hexaom faces increasing pressure to source construction materials sustainably, a trend reflected in growing global demand for eco-friendly building products. For instance, the market for green building materials was projected to reach $250 billion by 2025, indicating a significant shift in industry standards. This focus on sustainability directly impacts Hexaom's supply chain, requiring a review of supplier practices and material origins to align with environmental goals.

Efficient waste management is also becoming a critical operational factor. In 2023, the construction industry in many developed nations generated millions of tons of waste, with significant portions potentially recyclable or reusable. Hexaom’s ability to implement robust waste reduction and recycling programs can not only lower disposal costs but also enhance its environmental credentials, potentially offering a competitive edge in bids and client relationships.

Biodiversity Protection and Land Development

Environmental regulations designed to protect biodiversity and preserve green spaces significantly influence land development. These rules can reduce the amount of land available for construction and increase overall project expenses due to requirements for mitigation or habitat restoration. For instance, the Bioclimatic Local Urban Plan in Paris, implemented to promote sustainable urban development, mandates greener construction practices, impacting how new projects are designed and built.

These regulations often translate into tangible financial impacts. Developers might face higher costs for land acquisition, environmental impact assessments, and the implementation of biodiversity-friendly features like green roofs or wildlife corridors. In 2023, construction projects in urban areas with stringent environmental laws reported an average increase of 5-10% in development costs directly attributable to compliance measures.

Key considerations for land development in light of biodiversity protection include:

- Compliance with zoning laws that designate specific areas for conservation or limit development in ecologically sensitive zones.

- Investment in ecological surveys to identify protected species and habitats, informing project design and mitigation strategies.

- Adoption of sustainable building materials and techniques that minimize environmental footprint.

- Potential for increased project timelines due to the need for regulatory approvals and the implementation of environmental management plans.

Water Management and Resource Scarcity

Water scarcity is a growing concern, directly impacting the construction industry. Regulations on water usage in building projects, especially in water-stressed regions, are tightening. This is pushing developers to incorporate water-saving technologies in new home designs, such as low-flow fixtures and rainwater harvesting systems. For instance, by 2025, some municipalities are expected to mandate stricter water efficiency standards for new construction, potentially increasing upfront costs but yielding long-term operational savings for homeowners.

Responsible resource management is no longer a niche concern; it's a fundamental environmental consideration for the entire industry. The financial implications are significant, as companies demonstrating strong water stewardship can benefit from improved brand reputation and potentially lower insurance premiums. The global construction market, valued at trillions, faces increasing pressure to adopt sustainable practices, with water management being a key component. Failure to adapt could lead to project delays or increased operational expenses due to fines or water purchase costs.

- Regulatory Push: Expect more stringent regulations on water consumption in construction by 2025, impacting design choices.

- Technological Adoption: Increased investment in water-saving technologies like greywater recycling systems is anticipated.

- Financial Impact: Water scarcity can lead to higher project costs and operational expenses if not managed proactively.

- Industry Reputation: Companies prioritizing water management will likely see a boost in their environmental, social, and governance (ESG) ratings and public perception.

Hexaom is navigating a landscape increasingly shaped by environmental regulations, such as France's RE2020, which mandates lower embodied carbon in new constructions. This drives a need for sustainable materials and practices, aligning with the EU's ambitious 2050 decarbonization goals for buildings. The company's focus on energy efficiency and sustainable housing positions it to benefit from these evolving market demands and stricter environmental standards.

The push for sustainable sourcing and efficient waste management directly influences Hexaom's supply chain and operations. With the green building materials market projected for significant growth, and construction waste remaining a major issue, Hexaom's commitment to eco-friendly practices can enhance its competitive edge and reputation. This includes careful consideration of material origins and robust waste reduction programs.

Biodiversity protection and water scarcity are also critical environmental factors impacting land development for Hexaom. Stricter zoning laws and the need for ecological surveys can increase project costs and timelines, while water usage regulations necessitate the adoption of water-saving technologies. Proactive management of these resources is essential for compliance, cost control, and maintaining a positive ESG profile.

| Environmental Factor | Impact on Hexaom | Key Data/Trend (2024-2025) |

|---|---|---|

| Embodied Carbon Regulations (e.g., RE2020) | Requires lower-carbon materials, influencing sourcing and design. | RE2020 sets lifecycle carbon footprint limits for new residential buildings. |

| Energy Efficiency Mandates (e.g., EPBD) | Drives demand for energy-efficient homes and renovations; necessitates NZEB compliance. | EU aims for fully decarbonized building stock by 2050; 2030 target for nearly zero-energy new buildings. |

| Sustainable Material Demand | Impacts supply chain; necessitates review of supplier practices. | Green building materials market projected to reach $250 billion by 2025. |

| Waste Management | Drives need for reduction and recycling programs; impacts operational costs and credentials. | Construction waste is a significant environmental challenge, with millions of tons generated annually. |

| Biodiversity Protection | Increases land acquisition costs, requires environmental impact assessments, and can extend project timelines. | Urban projects in areas with stringent laws saw 5-10% cost increases in 2023 due to compliance. |

| Water Scarcity & Usage | Requires water-saving technologies in new designs and renovations. | Municipalities expected to mandate stricter water efficiency standards for new construction by 2025. |

PESTLE Analysis Data Sources

Our Hexaom PESTLE Analysis is meticulously crafted using data from reputable sources including government publications, international organizations, and leading market research firms. We ensure each insight is grounded in current economic indicators, regulatory updates, and technological advancements.