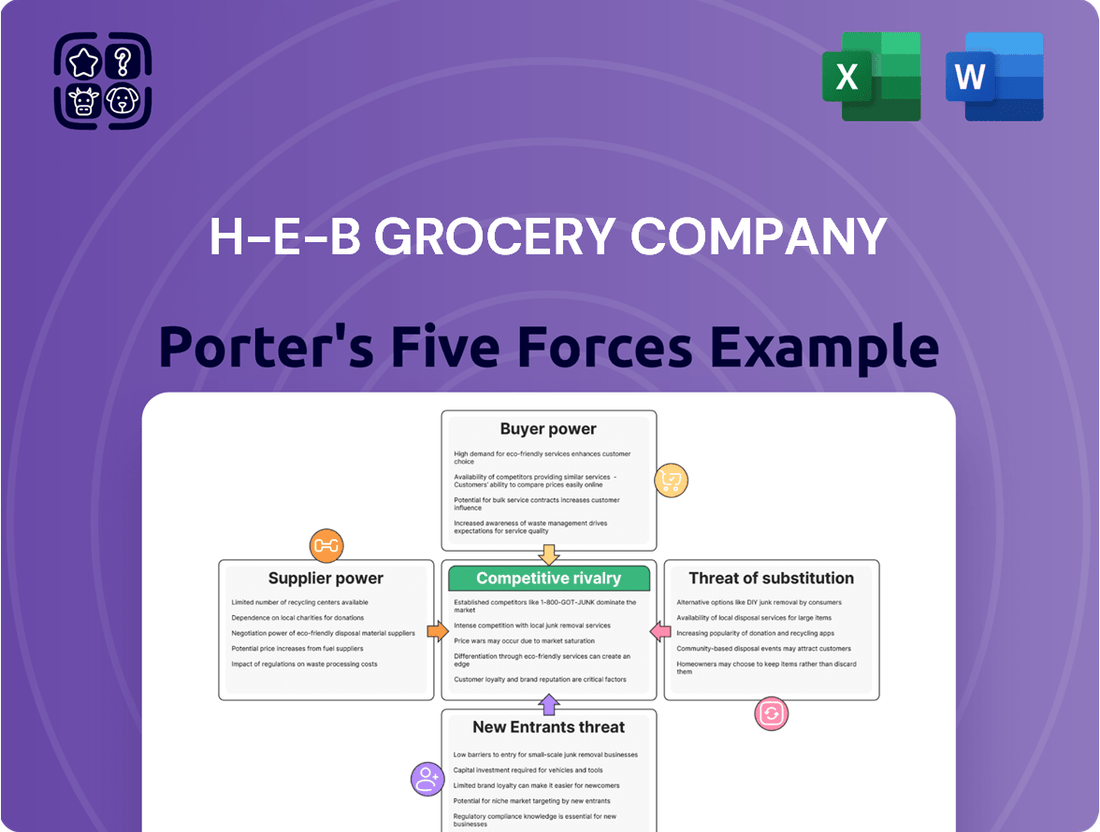

H-E-B Grocery Company Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H-E-B Grocery Company Bundle

H-E-B Grocery Company navigates a competitive landscape shaped by moderate buyer power and significant rivalry among existing players. While supplier power is relatively low due to H-E-B's scale, the threat of new entrants is a constant consideration in the grocery sector.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore H-E-B Grocery Company’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

H-E-B's vast retail footprint, with over 435 stores, translates to substantial purchasing power, typically diminishing supplier leverage. However, the company's commitment to local sourcing means that for niche or unique Texas-based products, a concentrated group of suppliers could wield greater influence.

H-E-B's significant private label program, representing over 25% of its 2024 sales, generally lowers supplier bargaining power for many products. If a supplier of a standard item increases prices, H-E-B has the flexibility to switch to alternative suppliers or ramp up its own private label manufacturing.

However, for specialized ingredients crucial to H-E-B's unique product lines, switching costs can be considerably higher. This is especially true if there are few alternative suppliers available or if the ingredient is a key differentiator for H-E-B's exclusive offerings.

While many grocery items are standard, H-E-B actively cultivates unique products, notably through its Quest for Texas Best initiative and a strong emphasis on local sourcing. Suppliers providing these exclusive or regionally distinct goods often wield more bargaining power because their offerings are less easily replicated, aligning with H-E-B's strategy to cater to local preferences and differentiate itself from larger, national competitors.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into retail operations, like opening their own grocery stores, is generally quite low for most food and beverage producers. This is because establishing and running a grocery chain requires massive capital for real estate, inventory, and complex logistics, which are significant barriers to entry.

While a few very large, dominant food manufacturers might theoretically have the resources to consider such a move, it's not a common strategy in the grocery industry. The established players, like H-E-B, benefit from economies of scale and existing customer relationships that are difficult for suppliers to replicate. For instance, in 2024, the average cost to build a new supermarket can range from $5 million to $10 million, a substantial investment for a supplier focused on production.

- Low Likelihood: Most food suppliers lack the capital and expertise to effectively compete in the retail grocery space.

- High Capital Requirements: Opening and operating grocery stores demands significant investment in infrastructure and operations.

- Logistical Challenges: Managing perishable goods, diverse product lines, and a large workforce presents complex operational hurdles for potential new entrants.

Importance of H-E-B to Suppliers

H-E-B's considerable market presence in Texas, with annual sales surpassing $34 billion, makes it a crucial partner for many suppliers. This substantial customer base grants H-E-B significant negotiating power, as losing such a large volume of business could severely impact a vendor's financial stability.

Furthermore, H-E-B's investment in a large distribution campus bolsters its supply chain efficiency. This operational advantage can translate into greater control over its relationships with suppliers, potentially strengthening its bargaining position.

- Market Dominance: H-E-B's significant market share in Texas provides substantial leverage.

- Revenue Dependence: Suppliers' revenue can be heavily reliant on their business with H-E-B.

- Supply Chain Control: Enhanced distribution capabilities give H-E-B more influence over its supplier network.

H-E-B's substantial purchasing volume, driven by over 435 stores and 2024 sales exceeding $34 billion, generally gives it considerable leverage over suppliers. This scale allows H-E-B to negotiate favorable terms and pricing, reducing the bargaining power of most suppliers. The company's extensive private label program, accounting for over 25% of sales in 2024, further strengthens its position by offering alternatives to branded products.

However, for specialized or unique Texas-sourced products, particularly those cultivated through initiatives like Quest for Texas Best, certain suppliers can command more influence. These suppliers provide differentiated goods that are harder for H-E-B to replicate, increasing their bargaining power in those specific instances. The threat of suppliers integrating forward into retail is low due to the high capital investment required, estimated at $5 million to $10 million per new supermarket in 2024.

| Factor | H-E-B's Position | Supplier Bargaining Power |

|---|---|---|

| Purchasing Volume | High (over 435 stores, $34B+ sales in 2024) | Low |

| Private Label Program | Strong (over 25% of 2024 sales) | Low (for standard items) |

| Unique/Local Sourcing | Cultivated for differentiation | Potentially High (for exclusive items) |

| Forward Integration Threat | Very Low (high capital barriers) | Low |

What is included in the product

This analysis delves into the competitive forces impacting H-E-B Grocery Company, examining the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the availability of substitutes within the grocery sector.

H-E-B's Porter's Five Forces analysis provides a clear, one-sheet summary of all five forces, perfect for quick decision-making regarding competitive pressures.

Customers Bargaining Power

Customers in the grocery sector, particularly with inflation impacting food prices, demonstrate significant price sensitivity. They are constantly on the lookout for deals and better value for their money.

H-E-B counters this by maintaining competitive pricing and leveraging its robust private label brands. These store-brand items provide comparable quality at a more accessible price point, fostering customer retention even when competing with deep discounters.

Furthermore, H-E-B's strategic offerings, such as lower fuel prices and consistent pricing on staples like ice cream, directly appeal to budget-conscious shoppers, reinforcing their loyalty.

The grocery sector is highly competitive, with customers easily switching to alternatives if prices rise or satisfaction dips. In 2024, the average US household spent approximately $5,700 on groceries annually, highlighting the significant expenditure and customer sensitivity to value. This abundance of choice inherently strengthens customer bargaining power.

H-E-B counters this by cultivating a unique value proposition. They focus on an exceptional in-store experience, a broad and deep product selection, and a robust private label strategy. These elements aim to reduce customer price sensitivity and foster loyalty, thereby diminishing the impact of readily available substitutes.

Customers today are incredibly informed, with easy access to price comparisons, product reviews, and competitor deals, often via their smartphones. This transparency significantly influences their purchasing decisions.

H-E-B actively counters this by enhancing the customer experience through its My H-E-B app, offering personalized deals and valuable shopping tools. In 2023, H-E-B reported strong sales growth, indicating its strategies are effective in fostering loyalty, with over 3 million active users on its app by the end of the year.

Switching Costs for Customers

While the direct financial costs of switching between grocery stores are minimal, H-E-B effectively builds significant non-monetary switching costs. This is achieved through cultivating robust brand loyalty, offering a highly personalized shopping experience, and demonstrating deep commitment to community involvement. These factors make it more than just a place to buy groceries; it becomes a preferred destination.

H-E-B's investment in convenient digital services, such as online ordering, curbside pickup, and delivery, further solidifies customer retention. These services consistently garner high customer satisfaction, making it inconvenient for shoppers to transition to competitors offering less integrated or less reliable options. For instance, in 2024, H-E-B's curbside pickup usage saw a notable increase, reflecting its growing importance in customer shopping habits.

Furthermore, H-E-B's distinctive product assortment plays a crucial role in customer stickiness. By offering unique, locally sourced, and private-label items that are not readily available elsewhere, H-E-B creates a compelling reason for customers to remain loyal, even when other options might be geographically closer or perceived as slightly cheaper on staple goods.

- Brand Loyalty: H-E-B's strong brand recognition and positive reputation contribute to a loyal customer base.

- Personalized Experience: Tailored shopping experiences and customer service foster deeper connections.

- Convenience Services: Online ordering, curbside pickup, and delivery options enhance ease of shopping.

- Unique Product Offerings: Exclusive and local products differentiate H-E-B from competitors.

Customer Loyalty and Brand Strength

H-E-B cultivates remarkable customer loyalty and brand strength, particularly within its home state of Texas. This deep-seated preference, a cornerstone of its market position, significantly dampens the bargaining power of its customers. In 2024, H-E-B continued to be recognized as a leading grocery retailer, underscoring this strong customer connection.

The company's success in fostering loyalty stems from a multi-faceted approach. H-E-B consistently delivers on quality products, maintains competitive pricing, and offers outstanding customer service. Furthermore, its extensive community involvement strengthens its brand image and customer relationships.

- Brand Recognition: H-E-B is a household name in Texas, synonymous with quality and value.

- Customer Loyalty: A significant portion of Texas shoppers consistently choose H-E-B, demonstrating a strong preference.

- Competitive Edge: H-E-B's commitment to quality, price, and service reduces customers' incentive to seek alternatives.

- Reduced Bargaining Power: This loyalty means customers are less likely to switch for minor price variations, limiting their leverage.

Customers possess considerable bargaining power due to the highly competitive grocery landscape and their price sensitivity, especially with food inflation. In 2024, the average U.S. household spent approximately $5,700 on groceries, highlighting the significant impact of pricing on consumer choices and their propensity to switch for better value.

H-E-B effectively mitigates this by fostering deep brand loyalty through a superior in-store experience, unique product offerings, and convenient digital services like curbside pickup, which saw increased usage in 2024. These strategies create non-monetary switching costs, making customers less inclined to defect for minor price differences.

The company's robust private label brands and competitive pricing on staples, alongside initiatives like discounted fuel, further solidify customer retention. By offering a compelling value proposition that extends beyond price, H-E-B successfully reduces the bargaining power of its customer base.

| Factor | H-E-B's Response | Impact on Customer Bargaining Power |

|---|---|---|

| Price Sensitivity | Competitive pricing, strong private label brands, fuel discounts | Reduced; customers find value and are less likely to switch solely on price. |

| Availability of Substitutes | Unique product assortment, exceptional in-store experience | Reduced; differentiation makes alternatives less appealing. |

| Switching Costs (Non-Monetary) | Brand loyalty, personalized service, community involvement, digital convenience | Reduced; creates emotional and practical barriers to switching. |

| Customer Information | My H-E-B app with personalized deals and shopping tools | Reduced; H-E-B provides value and convenience, lessening the impact of external price comparisons. |

Preview the Actual Deliverable

H-E-B Grocery Company Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of H-E-B Grocery Company details the competitive landscape, including the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products, and the intensity of rivalry among existing competitors. Understanding these forces provides critical insights into H-E-B's strategic positioning and future opportunities.

Rivalry Among Competitors

H-E-B operates in a fiercely competitive Texas grocery market, facing a broad spectrum of rivals. National powerhouses like Walmart and Kroger, along with discount retailers such as Aldi and Dollar General, present significant challenges across various price points. Specialty grocers, including Trader Joe's and Sprouts, also vie for market share, demanding a nuanced approach from H-E-B to retain its strong standing.

The Dallas-Fort Worth Metroplex exemplifies this intense competition, experiencing a notable surge in grocery store development. This expansion means H-E-B must continually adapt its strategies to address the growing presence of both established and emerging competitors in key markets.

The grocery industry in Texas is booming, largely fueled by a surging population. For instance, North Texas alone welcomed over 500,000 new residents in just five years. This demographic shift is a magnet for both new players entering the market and existing grocers looking to enlarge their presence. Consequently, competition heats up as companies battle for customers in these growing communities.

H-E-B carves out a distinct market position through robust product differentiation. Its brand identity is anchored in quality, competitive pricing, and a significant private label program, which represents 25-34% of its sales. This focus on unique offerings and a tailored customer experience, including its hyper-local approach catering to Texan preferences, makes it challenging for rivals to directly counter its appeal.

Exit Barriers

The grocery sector, including companies like H-E-B, faces considerable exit barriers. These are largely driven by the substantial fixed costs tied to real estate, extensive distribution networks, and maintaining significant inventory levels. These high upfront and ongoing investments make it economically challenging for companies to simply walk away from the market, even if they are not performing well.

Consequently, even struggling competitors often remain in the marketplace, continuing to apply competitive pressure on established players like H-E-B. This persistence means H-E-B must always contend with a full field of rivals, some of whom may be operating with lower cost structures or different strategic priorities due to their continued presence.

The ongoing development and expansion of grocery-anchored retail properties further underscore this point. For instance, in 2024, retail construction spending in the US saw continued investment, with a significant portion allocated to new shopping centers and expansions often featuring grocery stores as anchor tenants. This signals a long-term commitment from multiple market participants, reinforcing the idea that exiting is not a readily available option for many.

- High Fixed Costs: Real estate, distribution, and inventory represent substantial capital commitments in the grocery industry.

- Persistence of Underperformers: Significant exit barriers keep less successful competitors in the market, intensifying rivalry.

- Continued Retail Development: Ongoing construction of grocery-anchored retail centers in 2024 indicates sustained long-term investment and commitment by various players.

Strategic Commitments of Competitors

Competitors such as Walmart and Kroger are demonstrating substantial strategic commitments to gain market share. This includes aggressive expansion of their online grocery services, with Walmart aiming to reach over 80% of Americans with same-day delivery in 2024, and Kroger investing heavily in its "Kroger Delivery" network.

These rivals are also innovating with new store formats designed to cater to specific demographics, like Kroger's introduction of 'Asian Experience' and 'Hispanic Experience' stores, reflecting a deep understanding of consumer preferences and a targeted approach to customer acquisition.

H-E-B counters these moves with its own robust strategies, including a steady expansion of its store count across Texas, with plans for several new locations in 2024. Furthermore, H-E-B is enhancing its e-commerce infrastructure by investing in dedicated fulfillment centers and integrating advanced payment technologies to streamline the customer experience.

- Walmart's 2024 online grocery expansion aims to serve over 80% of the U.S. population with same-day delivery.

- Kroger is piloting specialized store formats like 'Asian Experience' and 'Hispanic Experience' to attract diverse customer bases.

- H-E-B is committed to physical store growth, with new Texas locations planned throughout 2024.

- Investment in e-commerce fulfillment centers and payment technology is a key strategic response by H-E-B to maintain competitiveness.

H-E-B faces intense rivalry from national chains like Walmart and Kroger, alongside discount grocers and specialty stores, all competing for Texas consumers. The state's rapid population growth, with over 500,000 new residents in North Texas alone in five years, fuels this competition by attracting new entrants and encouraging existing players to expand.

Competitors are making significant investments, such as Walmart's 2024 goal to offer same-day grocery delivery to over 80% of Americans and Kroger's introduction of specialized store formats like 'Asian Experience' and 'Hispanic Experience'. H-E-B actively counters these moves with its own expansion plans for new Texas stores in 2024 and enhancements to its e-commerce infrastructure.

The grocery sector's high exit barriers, including substantial fixed costs for real estate and distribution networks, mean even underperforming rivals often remain in the market, maintaining competitive pressure. This is further evidenced by continued investment in grocery-anchored retail development, with significant retail construction spending in the US throughout 2024.

| Competitor | 2024 Strategy Focus | H-E-B Counter-Strategy |

|---|---|---|

| Walmart | Expand same-day grocery delivery to >80% of US population | Expand store count, enhance e-commerce fulfillment |

| Kroger | Pilot specialized store formats (e.g., Asian, Hispanic) | Focus on private label sales (25-34% of sales), hyper-local approach |

| Discount Grocers (e.g., Aldi) | Low-price strategy | Maintain competitive pricing, focus on quality and unique offerings |

SSubstitutes Threaten

Consumers have a wide array of food purchasing options beyond traditional supermarkets. Farmers' markets, specialty grocers, convenience stores, and the booming meal kit delivery sector all offer alternatives. In 2024, the U.S. restaurant industry saw sales projected to reach $1.1 trillion, highlighting the significant draw of dining out as a substitute for home cooking and grocery shopping.

H-E-B addresses this competitive landscape by providing a broad selection of goods, from fresh produce and in-house baked items to ready-to-eat meals, often at competitive price points. This strategy aims to capture consumer spending by offering convenience and variety that can rival external dining and other food sourcing methods.

The threat of substitutes for H-E-B Grocery Company is influenced by the price-performance ratio of alternatives. For instance, dollar stores are increasingly offering perishable goods, and restaurants provide convenient prepared meals, both of which can divert customer spending from traditional grocery shopping.

While H-E-B strives for competitive pricing, the convenience and perceived value offered by these substitutes can erode H-E-B's market share. For example, a prepared meal from a restaurant might offer a time-saving benefit that outweighs a slightly higher price point compared to buying groceries and cooking.

H-E-B's robust private label program is a key strategy to counter this threat. By offering high-quality store-brand products, H-E-B can provide value that is competitive with national brands, thereby mitigating the price advantage some substitutes might otherwise hold.

Switching costs for consumers to move from H-E-B to alternative food sources like other grocery chains or restaurants are typically quite low. Trying a new eatery or a different supermarket often involves little more than a change in habit and a short trip.

H-E-B actively works to raise these perceived switching costs. By emphasizing a superior customer experience, offering convenient services such as curbside pickup and home delivery, and cultivating strong loyalty through its various programs, H-E-B encourages customers to remain with them. For instance, H-E-B’s 2024 initiatives continue to focus on personalized digital offers, which can make switching feel less rewarding for the customer.

Furthermore, H-E-B's deep roots and strong community engagement in Texas foster a sense of loyalty that transcends mere price comparisons. This connection makes customers less likely to switch to competitors, even when faced with minor price differences or new offerings from other stores.

Consumer Propensity to Substitute

Consumer propensity to substitute is a key factor in the grocery industry, driven by evolving lifestyles, income levels, and the ever-present desire for convenience. As consumers seek easier ways to manage their food needs, they become more open to alternatives to traditional grocery store visits.

The increasing popularity of online grocery ordering and delivery services, alongside the growing appeal of ready-to-eat meals, clearly indicates a rising propensity to substitute traditional in-store grocery shopping. For instance, the online grocery market in the US saw significant growth, with sales reaching an estimated $106 billion in 2023, up from $90 billion in 2022, reflecting this shift. This trend is further amplified by the continued appeal of dining out, which represents a direct substitute for home-prepared meals.

H-E-B is actively responding to this trend by strengthening its digital offerings. The company's robust online platform and its strategic acquisition of Favor Delivery position it well to capture the growing demand for convenient grocery solutions. Furthermore, H-E-B’s investment in in-store meal solutions, such as its H-E-B Meal Simple line, directly addresses the consumer's desire for quick and easy meal options, thereby mitigating the threat of substitutes.

- Consumer Propensity Drivers: Lifestyle changes, income fluctuations, and the demand for convenience significantly influence how readily consumers switch from traditional grocery shopping.

- Evolving Shopping Habits: The surge in online grocery orders and the popularity of ready-to-eat meals demonstrate a clear shift towards substituting conventional grocery store visits.

- H-E-B's Strategic Response: H-E-B counters this threat through its advanced online platform, Favor Delivery integration, and its in-store H-E-B Meal Simple product line, catering to convenience-seeking shoppers.

- The Dining Out Factor: The persistent trend of consumers choosing to dine out rather than cook at home also represents a significant substitute for traditional grocery purchasing.

Innovation in Substitute Industries

Innovation in industries offering substitute food sources, like the growth of meal kit services, ghost kitchens, and advanced food delivery platforms, presents an ongoing threat to traditional grocers like H-E-B. These alternatives offer convenience and unique culinary experiences, directly competing for consumer dining budgets and preferences. For instance, the global meal kit delivery services market was valued at approximately $15 billion in 2023 and is projected to grow significantly.

H-E-B's proactive investment in technology, including tap-to-pay and advanced cart-scanning systems, alongside a strong focus on digital transformation, is vital for maintaining its competitive edge against these evolving substitutes. This commitment to innovation helps H-E-B adapt to changing consumer behaviors and preferences, ensuring it remains a relevant and attractive option in the food retail landscape.

The company's ingrained innovation culture is a key enabler of its ability to pivot and respond to new market trends and competitive pressures. This allows H-E-B to not only defend its market share but also to explore new avenues for growth in response to the dynamic nature of the food industry.

- Meal Kit Market Growth: The global meal kit delivery services market was valued at approximately $15 billion in 2023, indicating a substantial and growing substitute for traditional grocery shopping.

- Ghost Kitchen Expansion: Ghost kitchens, operating solely for delivery, are expanding rapidly, offering a wider variety of prepared meals directly to consumers' homes, bypassing the need for grocery purchases.

- H-E-B's Tech Investments: H-E-B's commitment to digital transformation, including innovations like tap-to-pay and futuristic cart-scanning, aims to enhance the in-store and online shopping experience, directly addressing convenience factors offered by substitutes.

- Innovation Culture: H-E-B's focus on fostering an innovation culture allows it to adapt swiftly to emerging trends and competitive threats from substitute food sources, ensuring long-term relevance and customer loyalty.

The threat of substitutes for H-E-B is significant, as consumers have numerous alternatives for acquiring food. These include other grocery chains, specialty food stores, farmers' markets, convenience stores, and the rapidly growing restaurant and meal kit delivery sectors. In 2024, the U.S. restaurant industry alone was projected to achieve $1.1 trillion in sales, underscoring the substantial appeal of dining out as a substitute for home preparation.

H-E-B counters this by offering a wide product selection, competitive pricing, and convenient in-store options like its Meal Simple line. However, the low switching costs for consumers to try alternatives, coupled with the increasing demand for convenience, mean H-E-B must continuously innovate. For example, the online grocery market reached an estimated $106 billion in 2023, a clear indicator of evolving consumer habits.

| Substitute Category | 2023/2024 Data Point | Impact on H-E-B |

| Restaurants | $1.1 trillion projected U.S. sales (2024) | Directly competes for consumer dining spend, reducing grocery purchases. |

| Online Grocery | $106 billion U.S. market (2023) | Represents a shift in shopping habits, requiring H-E-B to enhance its digital offerings. |

| Meal Kit Services | ~$15 billion global market (2023) | Offers convenience and unique culinary experiences, diverting consumer budgets. |

Entrants Threaten

The grocery industry demands significant upfront investment, a major hurdle for potential newcomers. Building new stores, stocking shelves, and developing efficient logistics all require vast sums of money. For instance, H-E-B's strategic acquisition of 500 acres for a new distribution center in 2024 underscores the scale of capital commitment necessary to operate effectively and compete in this sector.

H-E-B leverages significant economies of scale, a formidable barrier for new entrants. Its vast network of stores, coupled with advanced supply chain management, including its state-of-the-art distribution campus, allows for substantial cost advantages. For instance, H-E-B's purchasing power enables it to secure better deals from suppliers, a feat difficult for newcomers to replicate.

These scale efficiencies translate into optimized logistics and the ability to offer highly competitive pricing, a key differentiator in the grocery sector. A new competitor would require massive upfront investment to even approach H-E-B's operational cost efficiencies, making market entry exceptionally challenging.

H-E-B's century-long presence in Texas has cultivated an exceptionally strong brand loyalty and recognition. This deep connection, fostered through community involvement and tailored local products, creates a significant barrier for newcomers aiming to quickly gain market traction. New entrants struggle to replicate the established trust and emotional bond H-E-B shares with its Texas customer base.

Access to Distribution Channels

Access to distribution channels presents a significant barrier for new entrants in the grocery sector. H-E-B's robust and continuously improving supply chain, including its investment in centralized distribution, provides a distinct competitive edge. For instance, in 2024, H-E-B continued to expand its network of distribution centers, enhancing its ability to efficiently stock its numerous stores across Texas.

Newcomers would struggle to replicate H-E-B's established logistics infrastructure and secure advantageous agreements with suppliers and transportation providers, especially for perishable and niche products. This reliance on sophisticated supply chain management makes it difficult for less established players to compete effectively on availability and cost.

- H-E-B's extensive distribution network allows for rapid replenishment and reduced spoilage.

- New entrants would face substantial capital investment and time to build comparable logistics capabilities.

- Securing favorable terms with transportation and warehousing providers is a major hurdle for aspiring grocery retailers.

Government Policy and Regulations

Government policy and regulations can act as a significant barrier to entry in the grocery sector. While general business regulations apply, specific zoning laws, stringent health and safety standards, and intricate local permitting requirements often pose considerable challenges for new grocery retailers aiming to establish a presence. H-E-B, with its deep roots in Texas, possesses extensive experience in navigating these complex regulatory environments, a process that can be both time-consuming and resource-intensive for nascent competitors.

Furthermore, environmental regulations and the necessity of conducting community impact assessments can add further layers of complexity and cost to new store development projects. For instance, in 2024, Texas continued to enforce detailed environmental impact studies for large-scale retail developments, potentially delaying or altering store designs for new entrants. These factors collectively elevate the threat of new entrants by increasing the initial investment and operational hurdles.

- Zoning Laws: Local ordinances dictating where and how large retail establishments can be built.

- Health and Safety Standards: Compliance with food safety, sanitation, and building codes.

- Permitting Processes: Navigating municipal approvals for construction and operation.

- Environmental Regulations: Adherence to rules concerning waste management, energy efficiency, and land use.

The grocery industry presents substantial barriers to entry, primarily due to the immense capital required for store development, inventory, and sophisticated logistics. For example, H-E-B's continued investment in its distribution network, including significant 2024 expansions, highlights the scale of investment needed to compete effectively. New entrants must overcome these high initial costs and establish efficient supply chains to even approach H-E-B's operational capabilities and cost advantages.

Economies of scale achieved through H-E-B's vast store network and purchasing power create a significant cost advantage that new competitors find difficult to match. This scale allows H-E-B to negotiate better terms with suppliers, a crucial factor in maintaining competitive pricing. Building a comparable infrastructure and achieving similar efficiencies would demand years of operation and substantial investment, making rapid market penetration challenging.

Brand loyalty, cultivated over decades of community engagement and tailored product offerings, acts as another formidable barrier. H-E-B's deep connection with its Texas customer base, built on trust and local relevance, is not easily replicated. Newcomers face the challenge of not only offering competitive prices but also building equivalent brand recognition and customer affinity.

| Barrier Type | Description | H-E-B's Advantage | Impact on New Entrants |

|---|---|---|---|

| Capital Requirements | High costs for stores, inventory, and logistics. | Established infrastructure and economies of scale. | Requires significant upfront investment and time to build comparable operations. |

| Economies of Scale | Cost advantages from large-scale operations and purchasing. | Strong supplier relationships and efficient supply chain. | Difficult for new entrants to match pricing and cost efficiencies. |

| Brand Loyalty | Deep customer relationships and community trust. | Centuries of operation and local market focus. | Challenging to build comparable brand recognition and customer affinity quickly. |

| Distribution Networks | Efficient and extensive supply chain capabilities. | Advanced logistics and distribution centers. | Requires substantial investment and time to establish reliable and cost-effective distribution. |

Porter's Five Forces Analysis Data Sources

Our H-E-B Porter's Five Forces analysis is built upon a foundation of comprehensive data, including H-E-B's annual reports, industry-specific publications from organizations like the Food Marketing Institute, and publicly available financial disclosures.