Hansen Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hansen Bundle

Understanding the competitive landscape is crucial for any business, and Porter's Five Forces provides a robust framework to do just that. This analysis dissects the forces that shape profitability and strategic positioning within an industry. By examining these forces, you can uncover hidden opportunities and potential threats.

The complete report reveals the real forces shaping Hansen’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hansen Technologies' reliance on highly specialized software components for its core operations, including billing and customer care, is a significant factor in the bargaining power of its suppliers. The uniqueness and complexity of these essential intellectual properties can grant suppliers considerable leverage.

This leverage is amplified when there are few alternative providers for these critical software solutions, or when the financial and operational costs associated with switching suppliers are prohibitively high for Hansen. For instance, the integration of specialized billing software often requires extensive customization and data migration, making transitions costly and time-consuming.

Consequently, suppliers of these specialized components can potentially dictate terms, leading to increased costs for Hansen or a reduction in its operational flexibility. This situation directly impacts Hansen's ability to innovate and adapt its service offerings efficiently.

Hansen Porter's reliance on technology infrastructure providers for cloud hosting, data storage, and network services presents a significant factor in its operational landscape. The concentration of major cloud providers, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, means these suppliers can wield considerable bargaining power. In 2024, the global cloud computing market was valued at over $600 billion, with these top three providers holding a dominant market share, indicating limited alternatives for Hansen.

The increasing adoption of cloud-based solutions by businesses globally, including Hansen, further amplifies the importance of these infrastructure providers. Their ability to offer differentiated services, such as specialized AI capabilities or enhanced security features, can also strengthen their negotiating position. This dependence means Hansen must carefully manage its relationships and contracts with these critical technology partners to mitigate potential cost increases or service disruptions.

The creation, deployment, and upkeep of sophisticated enterprise software demand a workforce possessing specialized expertise, encompassing engineers, developers, and sector-specific professionals. In 2024, the demand for cloud computing specialists, for instance, remained exceptionally high, with reports indicating a shortage of qualified candidates, potentially pushing salaries up by 15-20% in key tech hubs.

Data and Analytics Tool Providers

Hansen's reliance on specialized data and analytics tools positions these suppliers with considerable bargaining power. If these tools, such as advanced AI platforms or unique datasets, are fundamental to Hansen's ability to offer competitive solutions and if there are limited alternatives, suppliers can dictate terms. For instance, Hansen's strategic investment in Dial AI in early 2024 for AI-driven customer engagement underscores the critical nature of such specialized technology providers.

The bargaining power of data and analytics tool providers is amplified when their offerings are highly differentiated and difficult to replicate. This can include proprietary algorithms, vast and specialized data repositories, or unique analytical capabilities that directly contribute to Hansen's value proposition. The scarcity of comparable solutions in the market means Hansen may face higher costs or less favorable contract terms.

- Criticality of Technology: Hansen's solutions, particularly those leveraging advanced data management and analytics, depend heavily on specialized tools.

- Limited Alternatives: The availability of few comparable AI platforms or large, specialized datasets significantly increases supplier leverage.

- Strategic Partnerships: Hansen's investment in Dial AI in 2024 demonstrates the strategic importance and potential dependency on such technology suppliers for competitive edge.

- Differentiation Factor: Suppliers offering unique algorithms or data sets that are hard to replicate can command higher prices and exert greater influence.

Regulatory Compliance Information and Expertise

Hansen Porter's software solutions are critical for clients operating in heavily regulated sectors such as energy, water, and telecommunications. This necessitates strict adherence to a complex and ever-changing landscape of regional and country-specific regulations. Suppliers offering specialized regulatory intelligence, legal counsel, or compliance software can wield significant bargaining power if their services are indispensable for Hansen to maintain market access and avoid costly penalties.

The bargaining power of these suppliers is amplified by the potential financial repercussions of non-compliance. For instance, in the European Union, the General Data Protection Regulation (GDPR) carries fines of up to 4% of annual global turnover or €20 million, whichever is higher. This creates a strong incentive for companies like Hansen to secure reliable compliance expertise, thereby increasing supplier leverage.

- Regulatory Expertise as a Differentiator: Suppliers with deep and current knowledge of complex regulatory frameworks, such as those governing data privacy or environmental standards, can command higher prices for their services.

- Essential Compliance Tools: Providers of specialized software that automates compliance checks or generates regulatory reports are vital. If Hansen's offerings depend heavily on these tools, the suppliers gain considerable influence.

- Market Access Dependence: Failure to comply with regulations can lead to market exclusion. Suppliers who facilitate this compliance therefore hold power over Hansen's ability to operate and grow.

Suppliers of essential, specialized components or services can exert significant bargaining power over Hansen Porter. This is particularly true when these suppliers have few competitors, their offerings are critical to Hansen's operations or value proposition, and switching costs are high.

For instance, Hansen's reliance on specialized software for billing and customer care, coupled with the high costs of integration and data migration, grants its software providers considerable leverage. Similarly, the dominance of a few major players in the cloud computing market, valued at over $600 billion in 2024, means infrastructure providers like AWS, Azure, and Google Cloud can dictate terms.

| Supplier Type | Hansen's Dependency | Supplier Leverage Factors | 2024 Market Context |

|---|---|---|---|

| Specialized Software Providers | Core operations (billing, customer care) | Uniqueness, high switching costs | N/A (specific to Hansen's contracts) |

| Cloud Infrastructure Providers | Data hosting, network services | Market concentration, differentiated services | Global market > $600 billion |

| AI/Data Analytics Tool Providers | Competitive solutions, customer engagement | Proprietary algorithms, specialized data, limited alternatives | Hansen's Dial AI investment |

| Regulatory Compliance Experts | Market access, avoiding penalties | Essential expertise, financial impact of non-compliance | GDPR fines up to 4% global turnover |

What is included in the product

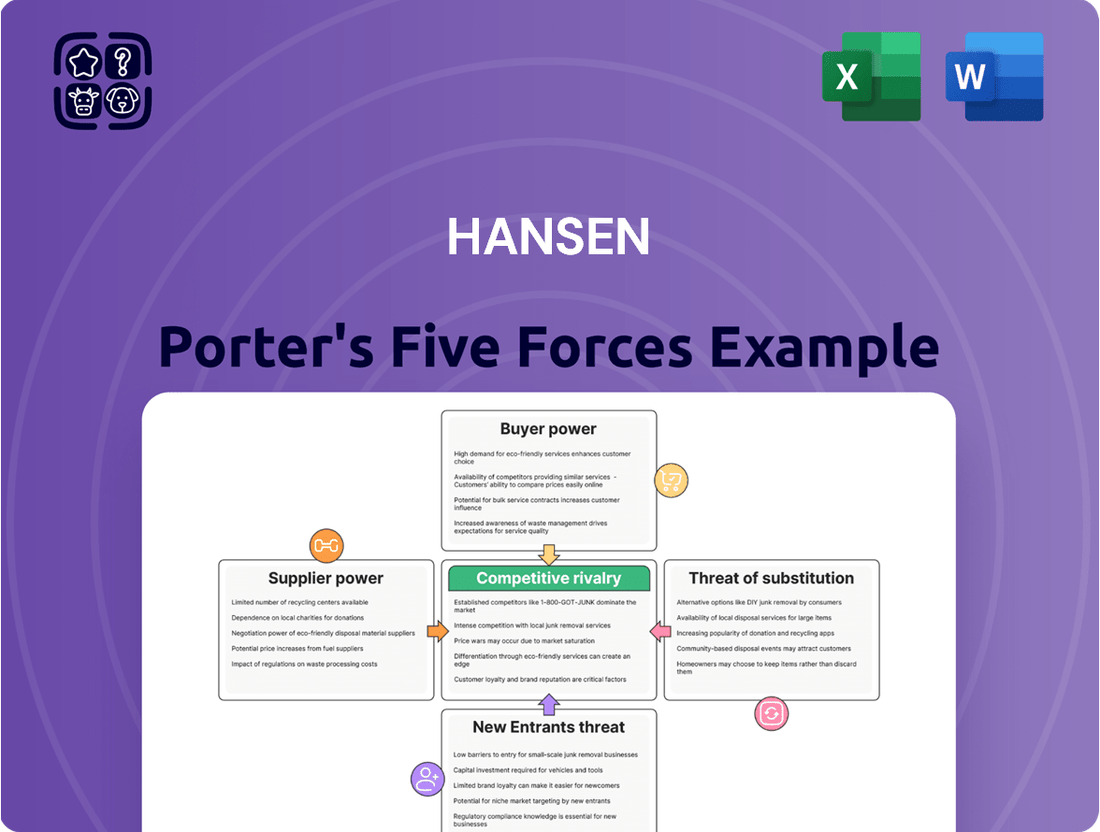

Hansen Porter's Five Forces Analysis dissects the competitive intensity and profitability of Hansen's industry by examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Instantly visualize and address competitive pressures with an intuitive, color-coded dashboard.

Customers Bargaining Power

Hansen's primary customers, including major energy, water, telecommunications, and pay-TV providers, encounter significant expenses and operational disruptions when considering a switch from their current billing and customer care solutions. These high switching costs directly diminish their ability to negotiate better terms or demand concessions from Hansen.

The intricate integration of Hansen's software into the foundational systems of these utility and communication giants creates a substantial barrier to entry for competitors. For instance, a typical energy company might have years of customer billing data, complex tariff structures, and regulatory compliance rules embedded within their Hansen system, making data migration a costly and time-consuming endeavor.

Beyond the technical hurdles, the need for extensive staff retraining on new platforms and the potential for service interruptions during a transition further amplify the costs associated with changing vendors. This operational inertia effectively locks customers into Hansen's ecosystem, significantly reducing their bargaining leverage.

Hansen Porter's mission-critical software is deeply embedded in clients' daily operations, directly impacting their revenue streams. This profound reliance significantly limits customers' ability to exert extreme pricing pressure or demand unfavorable terms, as doing so could destabilize their core business functions.

For instance, a major financial services firm relying on Hansen's trading platform for 90% of its daily transactions will be hesitant to switch vendors or demand steep discounts that might introduce instability. In 2024, the average cost for businesses to migrate critical enterprise software is estimated to be between $15,000 and $300,000, a substantial barrier that reinforces customer dependence on established, reliable providers like Hansen.

Hansen Porter's customer base, while global, shows a notable concentration with Tier 1 and 2 utility and communications clients contributing a substantial revenue share. This concentration, even with no single client exceeding 8% of total revenue, can still grant these major customers a degree of bargaining power. The sheer volume and value of their contracts, coupled with the potential financial and reputational impact of losing such a client, mean their demands can influence pricing and terms.

Long-Term Contracts and Recurring Revenue

Hansen benefits significantly from long-term contracts and a substantial portion of recurring revenue. This indicates strong customer loyalty and established relationships, which inherently reduces the annual pressure from customers to negotiate significant price changes or demand concessions.

The stability provided by these long-term agreements directly limits customers' immediate power to force substantial price reductions. This contractual framework reinforces Hansen's bargaining position by locking in revenue streams and minimizing the frequency of open negotiations.

- Contractual Stability: Long-term contracts, often spanning multiple years, create a predictable revenue base for Hansen.

- Recurring Revenue Model: A high percentage of recurring revenue, common in subscription-based or service models, means customers are committed over time, reducing their leverage for spot price negotiations.

- Reduced Negotiation Frequency: The need for annual price renegotiations is minimized, lessening customer power to extract concessions.

- Customer Retention: The very nature of these contracts fosters customer retention, making it more difficult for customers to switch and exert immediate bargaining pressure.

Industry-Specific Solutions and Expertise

Hansen Technologies' deep industry-specific knowledge and tailored solutions for sectors like energy, water, telecommunications, and pay-TV significantly reduce customer bargaining power. This specialization means clients needing highly customized billing and customer care systems have limited alternatives, strengthening Hansen's position.

For instance, in the utility sector, where regulatory compliance and complex billing structures are paramount, customers are less likely to switch to a generalist provider. This focus allows Hansen to command better pricing and terms.

- Reduced Alternatives: Hansen's expertise in niche areas like smart metering for utilities or complex subscription management for pay-TV limits the number of viable competitors for specific customer needs.

- High Switching Costs: Migrating complex billing and customer management systems is costly and time-consuming, further deterring customers from seeking alternative providers.

- Industry-Specific Value: Customers value Hansen's ability to understand and address the unique challenges of their industries, making them less sensitive to price alone.

Hansen's customers, particularly large utility and telecommunications firms, face substantial switching costs due to the deep integration of Hansen's software into their core operations. These costs, often including data migration, retraining, and potential service disruptions, significantly limit their ability to negotiate favorable terms. For example, the average cost to migrate critical enterprise software in 2024 ranged from $15,000 to $300,000, a considerable deterrent for clients.

While Hansen serves a diverse global client base, a concentration of revenue from Tier 1 and 2 clients, despite no single client exceeding 8% of total revenue, can still afford these major customers some leverage. Their significant contract value and the potential impact of their departure mean their demands can influence pricing. Furthermore, Hansen's long-term contracts and recurring revenue model foster customer loyalty, reducing the frequency of price renegotiations and thus diminishing annual customer bargaining power.

Hansen's specialized, industry-specific solutions for sectors like utilities and telecommunications reduce customer bargaining power by limiting viable alternatives. Clients requiring tailored billing and customer care systems find it difficult to switch to generalist providers, allowing Hansen to maintain favorable pricing and terms. This deep industry knowledge is a key factor in retaining clients and minimizing their leverage.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Reasoning |

| Switching Costs | Lowers | 2024 estimates for enterprise software migration range from $15,000-$300,000, making switching costly. |

| Customer Concentration | Moderate | While no single client exceeds 8%, significant revenue share from Tier 1/2 clients grants some negotiation leverage. |

| Contractual Stability & Recurring Revenue | Lowers | Long-term contracts and recurring revenue models reduce the need for frequent price renegotiations. |

| Industry Specialization | Lowers | Limited alternatives for specialized utility/telecom billing solutions strengthen Hansen's pricing power. |

Preview Before You Purchase

Hansen Porter's Five Forces Analysis

This preview showcases the complete Hansen Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within an industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning needs.

Rivalry Among Competitors

The utility billing software market, while robust and growing, presents a dynamic competitive landscape. It's not a market dominated by a single giant, but rather one with a moderate concentration of established players alongside numerous smaller, niche providers. This means Hansen Porter faces competition from a variety of sources, from established software companies to more agile, specialized firms.

This fragmentation, however, is not static. We're observing a trend of consolidation, where larger companies are actively acquiring smaller competitors. This strategy aims to expand market share, acquire new technologies, and eliminate potential rivals. For instance, in 2023, several mid-sized utility software providers were acquired by larger industry players, signaling a clear move towards fewer, but more dominant, entities. This consolidation intensifies the competitive pressure on companies like Hansen Porter, requiring them to innovate and adapt swiftly.

Hansen faces significant competitive rivalry from major global software providers. Companies like Oracle Energy and Water offer comprehensive solutions that can compete directly with Hansen's offerings, leveraging their vast resources and established market share.

Furthermore, specialized billing and invoicing platforms such as SAP Concur and Recurly present a competitive threat. These firms often focus on specific niches and can provide highly tailored solutions, forcing Hansen to continuously innovate and differentiate its services to maintain its market position.

Hansen Porter faces intense rivalry, but it carves out a distinct space by prioritizing innovation and specialization. The company's commitment to developing AI-powered solutions, for instance, sets it apart from competitors relying on more traditional approaches. This forward-thinking investment strategy is crucial in a market where technological advancement is a key differentiator.

Furthermore, Hansen Porter's deep expertise in specific sectors like energy, utilities, and communications allows it to offer tailored solutions that generic competitors struggle to match. This specialization fosters strong customer loyalty by addressing unique industry challenges. For example, in 2024, companies within the energy sector increasingly sought specialized analytics to navigate fluctuating market demands, a need Hansen Porter is well-positioned to meet.

High Switching Costs as a Barrier

High switching costs for Hansen's existing customers create a significant barrier for competitors seeking to gain market share. This means that once a client is integrated with Hansen's systems, the effort and expense involved in moving to an alternative provider are substantial, effectively locking in current business.

This situation intensifies competition for new customer acquisition, as rivals must offer compelling value propositions to overcome the inertia of established relationships. For instance, in the enterprise software market, where Hansen operates, the average cost to switch ERP systems can range from hundreds of thousands to millions of dollars, depending on the complexity and scale of the implementation. This high financial hurdle makes it challenging for new entrants or smaller competitors to lure away Hansen's clientele.

- Customer Retention: Hansen benefits from a sticky customer base due to the significant investment clients have made in its solutions.

- Competitive Challenge: Competitors must overcome substantial barriers to attract Hansen's existing customers, focusing their efforts on acquiring new clients or targeting specific unmet needs.

- Market Dynamics: The high switching costs foster a competitive environment where differentiation and superior value are crucial for winning new business, rather than simply undercutting prices.

Regulatory and Market Changes Driving Demand

The energy and utilities sector is experiencing a digital overhaul, fueled by advancements in renewable energy, smart grid technologies, and shifting regulatory landscapes. This transformation is a double-edged sword, opening doors for innovation while simultaneously heightening competitive pressures as firms battle to capture market share in these burgeoning areas.

Companies must demonstrate remarkable agility and a commitment to ongoing product development to succeed. For instance, the global smart grid market was valued at approximately $30 billion in 2023 and is projected to reach over $80 billion by 2030, indicating a substantial growth trajectory and the intense competition within this space.

- Digital Transformation: The push towards renewables and smart grids necessitates new digital solutions, intensifying rivalry.

- Market Growth: The smart grid market's projected expansion highlights the lucrative opportunities attracting more competitors.

- Agility Requirement: Companies need to adapt quickly to evolving technologies and regulations to stay competitive.

- Product Development: Continuous innovation in offerings is crucial to meet the demands of this transforming sector.

Competitive rivalry in the utility billing software market is robust, characterized by a mix of large, established players like Oracle Energy and Water and specialized firms such as SAP Concur. Hansen Porter must differentiate itself through innovation, such as its AI-powered solutions, and deep industry expertise to stand out.

High switching costs for existing customers create a "sticky" client base, making new customer acquisition the primary battleground for competitors. This necessitates compelling value propositions to overcome the inertia of established relationships.

The digital transformation within the energy and utilities sector, driven by smart grids and renewables, is intensifying competition. The global smart grid market, valued at around $30 billion in 2023, illustrates the significant growth and the influx of competitors seeking to capture market share.

| Competitor Type | Key Players | Competitive Strategy Example | Market Share Impact (Est.) |

| Large Software Providers | Oracle Energy and Water | Leveraging vast resources and established market presence. | Significant, often dominating segments. |

| Specialized Billing Platforms | SAP Concur, Recurly | Focusing on niche markets with tailored solutions. | Growing, particularly in specific functional areas. |

| Emerging Tech Firms | Various AI/IoT solution providers | Developing cutting-edge, disruptive technologies. | Nascent but rapidly expanding in specific verticals. |

SSubstitutes Threaten

Large utility and telecommunication firms often maintain deeply embedded, in-house legacy systems for billing and customer care. These systems, though potentially outdated, represent a significant substitute for Hansen Porter's offerings.

The sheer cost and operational upheaval associated with replacing these established, customized legacy platforms can be a substantial barrier. For instance, a major utility company might have invested tens of millions over decades in developing and maintaining its proprietary billing infrastructure, making a switch to a new vendor solution a daunting prospect.

This inertia, driven by the high switching costs and the risk of disrupting critical operations, means that many potential clients may opt to continue with their existing in-house systems rather than migrating to a new software solution, even if the new solution offers superior functionality or efficiency.

While not a perfect fit, some large companies might try to repurpose general Enterprise Resource Planning (ERP) or Customer Relationship Management (CRM) systems for their billing and customer service needs. These systems, however, often fall short when it comes to the specific features and regulatory adherence needed for intricate utility and telecom billing processes.

For instance, in 2024, many businesses found that adapting generic CRM solutions for complex billing scenarios required significant customization, often costing more than specialized software. The lack of built-in industry-specific workflows and compliance modules in these generic systems makes them a less potent threat to dedicated billing solutions.

Companies can choose to outsource their billing and customer care to Business Process Outsourcing (BPO) firms, bypassing the need to purchase software directly. These BPO providers leverage their own technology, acting as a substitute for Hansen's software offerings by providing a complete service package. The global outsourcing market, including BPO, was valued at over $260 billion in 2023 and is projected to grow further, indicating a significant competitive pressure.

New Cloud-Native Billing Platforms

The emergence of new cloud-native billing platforms presents a significant threat. These platforms are often built with agility and scalability at their core, allowing for rapid deployment and adaptation to evolving market needs. While Hansen Porter is investing in cloud solutions, these newer entrants could offer more attractive pricing models or specialized features that appeal to specific customer segments, particularly smaller utility retailers looking for cost-effective and flexible solutions.

For instance, the global cloud billing market was valued at approximately $2.5 billion in 2023 and is projected to grow substantially. New platforms entering this space may leverage advanced technologies like AI and machine learning for more sophisticated billing analytics and customer management, potentially outmaneuvering established players like Hansen Porter if they fail to innovate at a similar pace.

Consider the following:

- Agility and Scalability: Cloud-native platforms can scale resources up or down more easily, offering potential cost savings and faster response times compared to legacy systems.

- Specialized Features: Some new platforms may focus on niche markets or offer advanced functionalities like real-time usage tracking and dynamic pricing, which could be disruptive.

- Cost-Effectiveness: For smaller utility retailers, the subscription-based or pay-as-you-go models of some cloud-native solutions might present a lower barrier to entry than upgrading or integrating with existing Hansen Porter systems.

- Market Penetration: As of early 2024, several cloud-native billing providers have secured significant funding rounds, indicating strong investor confidence and a drive for market share expansion.

Manual Processes and Basic Spreadsheet Management

For extremely small utility providers or very simple billing needs, manual processes or spreadsheet management might seem like an alternative. However, these methods quickly become impractical for larger organizations.

Hansen Porter primarily serves mid-sized to large utility and telecommunication companies. These entities handle a massive volume and intricate nature of transactions, making rudimentary manual or spreadsheet systems entirely unworkable. For instance, a typical large utility provider might process millions of customer accounts and billing cycles monthly, a task far beyond the capacity of manual tracking.

- Limited Scalability: Manual and spreadsheet systems cannot scale to accommodate the growth and complexity of large utility operations.

- High Error Potential: The sheer volume of data increases the likelihood of human error in manual data entry and calculations.

- Inefficiency: These methods are time-consuming and resource-intensive, diverting staff from more strategic tasks.

- Lack of Integration: They often fail to integrate with other critical business systems, leading to data silos and operational bottlenecks.

The threat of substitutes for Hansen Porter's solutions primarily stems from deeply embedded legacy systems, repurposed generic software, and outsourcing. While these alternatives may not offer the same specialized functionality, the high cost and operational disruption of switching from existing systems deter many potential clients.

The significant investment in and reliance on in-house legacy billing systems by large utility and telecom firms presents a substantial barrier to adoption for new software. For example, replacing a decade-old, customized billing platform can easily run into millions of dollars in development, integration, and training costs, making inertia a powerful force.

Generic ERP or CRM systems can also act as substitutes, though they often lack the specific features and regulatory compliance required for utility billing. Adapting these systems in 2024 frequently necessitates extensive customization, potentially exceeding the cost of specialized software, and still leaves gaps in industry-specific workflows.

Business Process Outsourcing (BPO) firms offer a complete service package, including billing and customer care, thereby acting as a substitute for Hansen Porter's software by eliminating the need for direct software purchase. The global BPO market, valued at over $260 billion in 2023, demonstrates the scale of this competitive pressure.

Entrants Threaten

Developing sophisticated, industry-tailored billing and customer care software demands considerable upfront capital and continuous research and development. For instance, a new entrant aiming to match the capabilities of established platforms might need to invest millions in software development, infrastructure, and talent acquisition, mirroring the substantial R&D budgets of existing leaders.

Newcomers face a steep climb, requiring substantial financial resources to even begin challenging incumbents. This high barrier to entry, driven by the need for significant R&D and capital, effectively deters many potential competitors from entering the market.

The energy, water, and telecommunications industries are exceptionally complex and heavily regulated. New companies entering these sectors must possess profound, specialized knowledge and successfully navigate a labyrinth of intricate regulations that vary significantly by region. This steep learning curve and compliance burden present a formidable obstacle.

Hansen Porter's deep-rooted relationships with its Tier 1 and Tier 2 clientele represent a significant barrier to new entrants. These established connections are not easily replicated, and the loyalty fostered over years creates a formidable hurdle for newcomers attempting to gain a foothold.

The substantial switching costs associated with migrating away from Hansen's existing systems further solidify this advantage. For these key customers, the financial outlay and operational disruption involved in changing providers are often prohibitive, effectively locking them into Hansen's offerings and diminishing the attractiveness of alternative solutions for potential new competitors.

Data Integration and Scalability Challenges

New entrants into the utility and telecommunications sectors would grapple with formidable hurdles in integrating their offerings with the complex, often outdated IT infrastructures of established players. For instance, the average age of IT infrastructure in the utility sector can exceed 15 years, making seamless integration a costly and time-consuming endeavor.

Furthermore, any new entrant must prove its platform can scale efficiently to manage millions of customer accounts and the intricate billing processes inherent in these industries. In 2024, major telecommunications providers reported handling upwards of 100 million subscriber connections, underscoring the immense scalability demands.

- Integration Complexity: Legacy systems in utilities and telecom require specialized middleware and extensive customization, increasing initial investment.

- Scalability Demands: Handling peak loads, diverse service offerings, and massive data volumes necessitates robust, proven architectures.

- High Capital Expenditure: Building out the necessary IT infrastructure and integration capabilities requires significant upfront capital, potentially billions of dollars for large-scale operations.

- Regulatory Compliance: New entrants must navigate stringent data privacy and operational regulations, adding another layer of complexity and cost to system design.

Brand Reputation and Trust

In mission-critical software sectors, brand reputation and trust are non-negotiable. Hansen has cultivated a strong reputation over many years, positioning itself as a reliable provider. For instance, in 2024, cybersecurity incidents affecting critical infrastructure saw a 15% increase, highlighting the heightened importance of trusted vendors.

New entrants face a significant hurdle in replicating Hansen's established credibility. Building that level of trust, especially in industries where system failures can have severe consequences, requires substantial time and investment. This is particularly true as many organizations in these fields are inherently risk-averse, prioritizing proven solutions over unproven alternatives.

- Brand Longevity: Hansen's decades-long presence fosters deep-seated trust.

- Industry Risk Aversion: Critical sectors demand proven reliability, making new entrants' propositions harder to accept.

- Reputational Investment: New players need significant capital and time to build equivalent credibility.

The threat of new entrants for Hansen Porter is considerably low due to substantial capital requirements and the need for specialized knowledge in complex, regulated industries like utilities and telecommunications. For example, developing and integrating sophisticated billing software for these sectors can cost millions, a significant barrier for newcomers.

Established relationships with key clients and high switching costs further solidify Hansen's market position, making it difficult for new companies to gain traction. The effort and expense involved for customers to transition from Hansen's proven systems are often prohibitive, effectively locking in existing business.

Additionally, the significant investment in brand reputation and trust, especially critical in sectors prone to operational risks, acts as a powerful deterrent. New entrants must dedicate considerable time and resources to build comparable credibility, a challenge compounded by the inherent risk aversion of many clients in these essential services.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront investment in R&D, infrastructure, and talent. | Deters new entrants due to the sheer financial outlay needed to compete. |

| Industry Complexity & Regulation | Navigating intricate regulations and specialized knowledge in utilities/telecom. | Creates a steep learning curve and compliance burden, increasing entry costs. |

| Customer Relationships & Switching Costs | Deep-rooted client loyalty and the expense/disruption of switching providers. | Makes it difficult for new entrants to acquire established customers. |

| Brand Reputation & Trust | Cultivated credibility as a reliable provider in critical sectors. | Requires significant time and investment for new players to build equivalent trust. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of comprehensive data, including publicly available financial statements, industry-specific market research reports, and expert commentary from financial analysts.