Hammond Power Solutions Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hammond Power Solutions Bundle

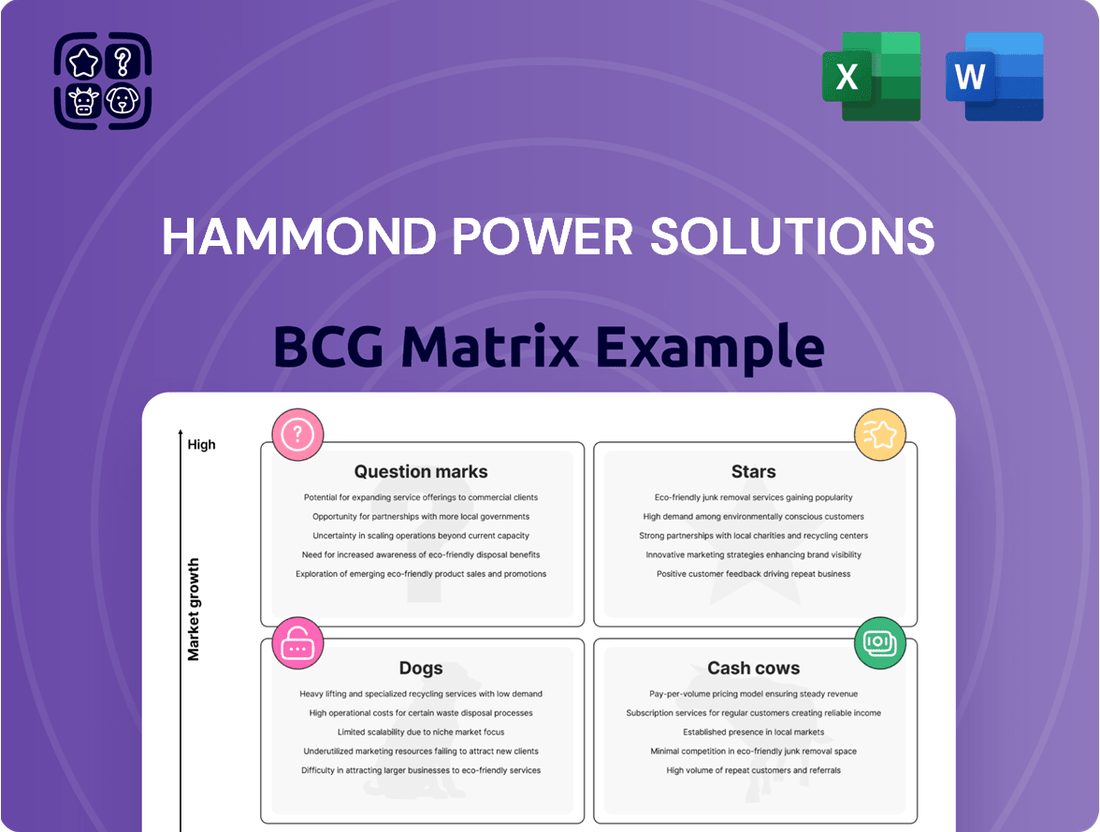

Hammond Power Solutions' BCG Matrix offers a critical snapshot of their product portfolio's market standing. Understand which products are driving growth (Stars), generating consistent revenue (Cash Cows), requiring careful consideration (Question Marks), or potentially hindering progress (Dogs).

Don't miss the opportunity to unlock the full strategic potential of Hammond Power Solutions' BCG Matrix. Purchase the complete report for detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing your investment and product development strategies.

Stars

Custom Power Transformers for Data Centers are a significant growth driver for Hammond Power Solutions (HPS). The company is seeing robust demand for these specialized units, directly linked to the booming data center industry.

The insatiable appetite for cloud services, big data processing, and AI development is fueling a massive increase in electricity consumption by data centers. This trend directly translates into a critical need for reliable and efficient power distribution solutions, a niche HPS is well-positioned to fill.

HPS's expertise in designing and manufacturing custom transformers tailored to the exacting specifications of data centers allows them to capture market share in this high-growth sector. Their ability to deliver these specialized products is key to their success.

The global energy landscape is rapidly transforming, with a strong push towards decarbonization driving unprecedented growth in renewable energy. This shift is directly fueling demand for specialized transformers essential for integrating sources like solar and wind power into the grid. Hammond Power Solutions is strategically positioned to capitalize on this trend, supplying critical components for these burgeoning sectors.

In 2024, the renewable energy sector continued its robust expansion, with global investment in clean energy technologies reaching record highs. Hammond Power Solutions' offerings, particularly their energy-efficient transformer designs, are crucial for ensuring the reliable and stable integration of these intermittent power sources. Their commitment to innovation in this area directly supports the ongoing global effort to build a more sustainable energy infrastructure.

Hammond Power Solutions (HPS) has strategically bolstered its Industrial Control Transformers and Power Quality Products segment. The 2024 acquisition of Micron Industries Corporation significantly expanded their market reach and product offerings in industrial control transformers. This move positions HPS to capitalize on the increasing demand for reliable power solutions in automated industrial environments.

The company's power quality products, particularly their active harmonic filters, are experiencing robust growth. HPS is securing new customers and projects, driven by the critical need for stable and clean power. This surge is directly linked to the expansion of industrial automation and the proliferation of sensitive electronic equipment that requires uninterrupted, high-quality power.

This segment is a key growth driver for HPS, addressing a market that is expanding rapidly due to the critical nature of power quality in mission-critical applications. The demand for such solutions is projected to continue its upward trajectory, supported by ongoing investments in industrial infrastructure and advanced manufacturing technologies.

Large, High-Power Transformers for Infrastructure

Hammond Power Solutions is significantly boosting its production of large, high-power transformers. These are crucial for commercial and industrial sectors, including vital public infrastructure like power grids and the mining industry.

The demand for these transformers is soaring due to widespread efforts to upgrade older power distribution and transmission networks. Additionally, new industrial projects and the expansion of urban infrastructure are creating substantial needs for these critical electrical components.

- Infrastructure Modernization: Aging power grids worldwide require substantial investment, driving demand for new transformers. For instance, the U.S. Department of Energy's Bipartisan Infrastructure Law allocated billions for grid modernization efforts.

- Industrial Growth: New manufacturing facilities and expansions in sectors like data centers and renewable energy projects necessitate high-capacity transformers.

- Mining Sector Needs: The increasing global demand for minerals and metals fuels expansion in the mining industry, requiring robust transformer solutions for heavy-duty operations.

North American Dry-Type Transformer Market Leadership

Hammond Power Solutions (HPS) holds a commanding position in the North American dry-type transformer market, a segment poised for robust expansion. As the largest manufacturer in this region, HPS leverages its substantial market share to its advantage.

The U.S. dry-type transformer market is a key growth driver, with projections indicating a compound annual growth rate exceeding 7.8% from 2025 through 2034. This upward trend is fueled by increasing demand for energy-efficient solutions, a focus on lower operational costs, and the inherent eco-friendly attributes of dry-type transformers.

- Market Dominance: HPS is the largest dry-type transformer manufacturer in North America.

- Market Growth: The U.S. dry-type transformer market is expected to grow at over 7.8% CAGR from 2025-2034.

- Key Drivers: Growth is attributed to energy efficiency, cost-effectiveness, and environmental benefits.

- Competitive Advantage: HPS's leadership allows for enhanced purchasing power and manufacturing flexibility.

Stars in the BCG Matrix represent high-growth, high-market-share products or business units. For Hammond Power Solutions (HPS), their Custom Power Transformers for Data Centers and their dominant position in the North American dry-type transformer market clearly fit this description.

The insatiable demand from the booming data center industry, coupled with the projected 7.8% CAGR for the U.S. dry-type transformer market through 2034, highlights significant growth potential. HPS's established market leadership in dry-type transformers provides them with a strong competitive advantage in this expanding sector.

| Product/Segment | Market Growth | Market Share | BCG Classification |

|---|---|---|---|

| Custom Power Transformers for Data Centers | High (driven by data center expansion) | Significant (due to specialized expertise) | Star |

| North American Dry-Type Transformers | High (projected >7.8% CAGR 2025-2034) | Leader (Largest manufacturer in North America) | Star |

What is included in the product

The Hammond Power Solutions BCG Matrix analyzes its business units based on market share and growth, guiding strategic decisions.

The Hammond Power Solutions BCG Matrix provides a clear, one-page overview, instantly clarifying each business unit's strategic position to relieve decision-making paralysis.

Cash Cows

Hammond Power Solutions' standard dry-type transformers for commercial use are a classic Cash Cow. This product line boasts a substantial market share in a mature industry, meaning they're a reliable source of income.

These transformers are essential for safety-conscious environments like offices, hospitals, and malls, where their reduced fire risk compared to oil-filled alternatives is a major advantage. Their widespread adoption in urban settings underscores their established demand.

While the overall market for these specific transformers might not be experiencing explosive growth, their consistent demand and strong market position ensure a steady and predictable cash flow for Hammond Power Solutions. For instance, the global market for transformers, including dry-type variants, was valued at approximately $50 billion in 2023 and is projected to grow at a CAGR of around 4% through 2030, indicating a stable, albeit not hyper-growth, environment.

Hammond Power Solutions (HPS) benefits from strong, long-standing ties with Original Equipment Manufacturers (OEMs) and a wide-reaching distributor network. These established channels are a consistent source of revenue, especially for their standard, high-volume product lines.

While these channels are in mature markets and not seeing rapid expansion, they represent a dependable and foreseeable income stream. In 2024, these traditional channels continued to be a bedrock for HPS, contributing a substantial portion of the company's overall cash generation, underscoring their role as cash cows.

Hammond Power Solutions' core product lines in Canada represent a significant cash cow, benefiting from a stable growth environment across all its offerings. This mature market consistently delivers predictable cash flow due to steady demand from key sectors like commercial construction, public infrastructure, and utilities.

In 2024, the Canadian market continued to be a bedrock for Hammond Power Solutions, demonstrating resilience and consistent demand. The company's established presence and diversified product portfolio within Canada contribute to its strong financial performance, allowing for reinvestment in growth areas or return to shareholders.

Legacy Products for General Electrical Distribution

The foundational range of dry-type transformers, critical for general electrical power distribution, control, and conversion, represents Hammond Power Solutions’ (HPS) cash cows. These are the workhorses of electrical infrastructure, found everywhere from commercial buildings to industrial facilities.

Their long-standing demand and widespread application guarantee a consistent revenue stream. This stability is further bolstered by relatively low marketing and development expenditures, as these products are well-established in the market.

- Foundational Product Line: Dry-type transformers for general electrical distribution, control, and conversion.

- Market Position: Essential and ubiquitous components in electrical networks with broad end-user application.

- Revenue Generation: Steady and predictable revenue flow due to consistent demand.

- Cost Efficiency: Low marketing and development costs contribute to high profitability.

Vacuum Pressure Impregnated (VPI) Transformers

Vacuum Pressure Impregnated (VPI) transformers represent a mature and stable segment for Hammond Power Solutions (HPS). These transformers are a cornerstone of the dry-type market, valued for their cost-effectiveness and robust performance. Their widespread adoption across numerous industries underscores their dependable nature.

This established technology commands a substantial market share, translating into predictable revenue streams for HPS. The inherent reliability and consistent demand for VPI transformers make them a key contributor to the company's cash flow generation. For instance, the global dry-type transformer market, which includes VPI, was valued at approximately USD 10.5 billion in 2023 and is projected to grow at a CAGR of around 5.2% through 2030, indicating continued demand for these established technologies.

- Established Technology: VPI transformers are a proven and trusted solution in the dry-type market.

- Cost-Effective and Dependable: Their manufacturing process and inherent design lead to lower costs and high reliability.

- Significant Market Share: VPI transformers are widely used, contributing to a stable demand base.

- Consistent Cash Generation: Their maturity and broad adoption ensure a reliable source of revenue for HPS.

Hammond Power Solutions' (HPS) standard dry-type transformers are prime examples of cash cows. These products hold a significant market share within a mature industry, providing a consistent and reliable income stream for the company.

Their widespread use in commercial settings, where fire safety is paramount, ensures a steady demand. The global transformer market, including dry-type variants, was valued at approximately $50 billion in 2023, with a projected compound annual growth rate of about 4% through 2030, highlighting a stable market environment.

HPS benefits from strong relationships with Original Equipment Manufacturers (OEMs) and an extensive distributor network, which consistently drive revenue for their high-volume product lines. In 2024, these established channels remained a crucial source of cash generation for HPS, reinforcing their cash cow status.

| Product Segment | Market Maturity | Market Share | Cash Flow Generation | Growth Outlook |

| Standard Dry-Type Transformers | Mature | High | Strong & Stable | Low to Moderate |

| VPI Transformers | Mature | Significant | Consistent | Moderate (approx. 5.2% CAGR for dry-type) |

| Canadian Operations | Mature | Dominant | Predictable | Stable |

Preview = Final Product

Hammond Power Solutions BCG Matrix

The preview you're currently viewing is the identical, fully formatted Hammond Power Solutions BCG Matrix report you will receive immediately after purchase. This ensures complete transparency, so you know exactly what strategic insights and ready-to-use analysis you're acquiring.

Dogs

Certain Mesta products, particularly those catering to induction heating for electric vehicle (EV) and semiconductor manufacturing, have encountered project delays. This has led to a temporary dip in demand for these specific applications. For instance, in the first quarter of 2024, Hammond Power Solutions (HPS) reported that while overall sales were strong, certain specialized product lines experienced softer demand due to these project timelines.

These delays suggest that this particular segment of Mesta products may currently represent a low-growth area within these niche markets. It’s possible that within these specific applications, HPS might also have a relatively low market share, placing them in a position that could be considered a ‘Dog’ in the BCG matrix.

However, HPS is proactively addressing this by actively seeking to diversify and pivot these sales to new, emerging markets. This strategic move aims to mitigate the impact of the current slowdown and explore new avenues for growth for these specialized Mesta products.

Products heavily reliant on specific, slowing commercial construction sub-sectors, such as those focused on office building retrofits or certain retail spaces, could be considered Dogs in Hammond Power Solutions' BCG Matrix. For instance, if a significant portion of their transformer sales are tied to the declining demand for new large-scale office developments, a trend observed in some urban centers as remote work persists, these product lines might face low growth.

In the transformer market, Hammond Power Solutions (HPS) faces challenges in segments where products are essentially commodities, meaning they offer little differentiation. This intense competition often forces companies to compete primarily on price, which can squeeze profit margins. For HPS, these "Dogs" in their BCG matrix likely represent areas where they have a low market share and the overall market isn't growing much, making significant investment less appealing.

Older Technology Dry-Type Transformers Nearing Obsolescence

Older technology dry-type transformers are increasingly finding themselves in the Dogs quadrant of the BCG matrix. As the market shifts towards more energy-efficient and digitally integrated solutions, these legacy products are experiencing declining demand and market share.

The push for sustainability and operational efficiency is a major driver here. For instance, the global transformer market, which includes dry-type transformers, was valued at approximately USD 60 billion in 2023 and is projected to grow, but the growth is heavily skewed towards newer technologies. Older models, often lacking advanced monitoring or smart grid capabilities, are becoming less attractive to utilities and industrial clients focused on reducing energy losses and improving grid reliability.

- Declining Market Share: Many older dry-type transformer models are being phased out as newer, more efficient designs become standard.

- Low Growth Prospects: The demand for these outdated transformers is stagnant or decreasing as industries upgrade to smarter, more energy-saving alternatives.

- Technological Obsolescence: Advancements in insulation materials and digital integration leave older units behind, making them less competitive and potentially non-compliant with future regulations.

- Focus on Efficiency: The drive for reduced energy consumption means that transformers with lower efficiency ratings, common in older designs, are becoming undesirable.

Geographic Markets with Intense Local Competition and Declining Demand

The India market for Hammond Power Solutions (HPS) experienced a revenue downturn in 2024 compared to the previous year. This decline was primarily attributed to the non-recurrence of a significant project that boosted 2023 figures, coupled with heightened local competition.

This challenging environment, characterized by intense local rivalry and diminishing demand without a distinct competitive edge, positions the India segment as a potential candidate for divestiture or strategic repositioning if these trends persist.

- India Revenue Decline: HPS's India operations saw a revenue decrease in 2024 versus 2023.

- Key Impact Factors: The decline was driven by the absence of a large, one-time project from the prior year and increased competitive pressures.

- Market Conditions: The segment faces intense local competition and declining demand, weakening its competitive advantage.

- Strategic Implication: Sustained poor performance in such markets could warrant divestment or a significant strategic shift.

Products in the Dogs quadrant of the BCG matrix for Hammond Power Solutions (HPS) represent business areas with low market share in low-growth markets. These are typically products that are technologically outdated or cater to niche segments experiencing declining demand. For example, older models of dry-type transformers, which lack the energy efficiency and smart capabilities of newer designs, often fall into this category. The global transformer market, valued around USD 60 billion in 2023, shows growth primarily in advanced technologies, leaving older models with limited appeal and stagnant demand.

These "Dog" products generate low profits and often require significant investment to maintain their position, making them candidates for divestment or careful management to minimize losses. HPS's strategy often involves seeking to pivot sales of these specialized products to emerging markets or new applications to revitalize their performance.

For instance, certain Mesta products, particularly those tied to specific applications like induction heating for EV or semiconductor manufacturing, faced project delays in early 2024, leading to softer demand. This suggests these specialized lines might be in a low-growth phase, potentially with a lower market share for HPS, thus fitting the 'Dog' profile.

Similarly, the India market for HPS experienced a revenue downturn in 2024 due to the non-recurrence of a large project from 2023 and increased local competition. This segment, facing intense rivalry and declining demand, could be considered a 'Dog' if these conditions persist, potentially leading to divestiture.

Question Marks

Hammond Power Solutions' new EV charging distribution transformer positions them within the burgeoning electric vehicle infrastructure sector. This strategic move aligns with the global shift towards electrification, a market projected for substantial expansion in the coming years.

While the EV market itself is a high-growth area, HPS's market share in this specific, newly launched product segment is likely still in its nascent stages. Significant investment will be crucial for achieving broad adoption and establishing a strong market presence.

Hammond Power Solutions (HPS) is actively integrating the Internet of Things (IoT) into its advanced power quality solutions, exemplified by smart transformers featuring IIoT-connected power meters. This technology enables real-time monitoring and facilitates predictive maintenance, offering significant operational advantages. For instance, the global IoT in power quality market was valued at approximately $1.5 billion in 2023 and is projected to grow substantially, driven by the increasing demand for grid stability and energy efficiency.

While the broader power quality equipment market is experiencing robust growth, the specific segment of advanced, IoT-integrated solutions is still in its early stages of adoption. HPS's focus on these smart transformers addresses a growing need for proactive rather than reactive power management. The market for smart grid technology, which underpins these solutions, saw investments exceeding $20 billion globally in 2023, indicating a strong underlying trend.

The widespread acceptance of these sophisticated IoT-enabled systems by customers requires dedicated marketing efforts and comprehensive education. Many organizations are still accustomed to traditional power quality monitoring methods. HPS's strategy aims to bridge this gap by demonstrating the tangible benefits, such as reduced downtime and optimized energy usage, which are crucial for driving market penetration in this evolving landscape.

The demand for custom magnetics in burgeoning fields like AI data centers is skyrocketing, with the global AI market projected to reach $1.8 trillion by 2030. Hammond Power Solutions (HPS) is well-positioned to capture this growth by offering tailored magnetic components essential for the high-power density and efficiency requirements of these advanced facilities. Their expertise in custom design allows them to meet the unique specifications needed for next-generation computing infrastructure.

While HPS's custom solutions are a strong asset, their market share in these highly specialized, fast-moving niches is likely still developing. Continuous investment in research and development is crucial to stay ahead of rapid technological advancements in AI hardware. Strategic partnerships and agile manufacturing processes will be key to solidifying their position in these emerging technology segments.

Expansion into New International Markets (beyond current footprint)

Expanding Hammond Power Solutions into new international markets beyond its current North American and Indian presence signifies a potential high-growth area. These new ventures would likely begin with a relatively low market share, characteristic of a question mark in the BCG matrix, but offer substantial future upside.

Such strategic moves necessitate considerable initial investment. This includes thorough market research to understand local demands and regulations, establishing robust distribution networks, and tailoring product offerings to meet specific regional requirements. For instance, Hammond Power Solutions might need to invest in localized manufacturing or partnerships to effectively serve markets in Europe or Southeast Asia.

- High Growth Potential: Entry into new, untapped international markets offers significant revenue and market share expansion opportunities.

- Initial Low Market Share: As a new entrant, market share in these regions would initially be low, requiring strategic efforts to build brand presence and customer base.

- Significant Upfront Investment: Substantial capital will be required for market analysis, establishing distribution, and product localization.

- Strategic Importance: Diversifying geographic revenue streams can mitigate risks associated with over-reliance on existing markets.

Integration of Energy Storage Solutions with Transformers

The integration of energy storage solutions with transformers represents a burgeoning area for Hammond Power Solutions (HPS). As the global push for renewable energy intensifies, the demand for transformers capable of managing the inherent variability of sources like solar and wind power, and seamlessly interfacing with battery storage systems, is set to climb. For instance, the global energy storage market was valued at approximately USD 200 billion in 2023 and is projected to grow significantly, with forecasts suggesting a compound annual growth rate (CAGR) of over 15% through 2030.

Within the BCG matrix framework, HPS's current position in this nascent market would likely be classified as a question mark. This signifies low current market share, reflecting the early stages of development and adoption of these integrated solutions. However, the substantial growth potential, driven by the accelerating transition to renewables, positions this segment as a high-potential area requiring careful strategic consideration and investment.

- Market Position: Question Mark

- Current Market Share: Low

- Growth Potential: High

- Strategic Implication: Requires investment to capture future growth

Hammond Power Solutions' ventures into new international markets, alongside their development of integrated energy storage solutions, represent classic "question mark" scenarios within the BCG matrix. These areas exhibit low current market share but possess significant growth potential.

The company's expansion into untapped international territories, for example, requires substantial upfront investment for market research and distribution network establishment, mirroring the high investment needs of question marks.

Similarly, the nascent market for energy storage integration, while holding high growth potential driven by renewable energy trends, currently sees HPS with a low market share, necessitating strategic investment to cultivate future success.

| BCG Category | Market Share | Market Growth | Investment Need | HPS Example |

|---|---|---|---|---|

| Question Mark | Low | High | High | New International Markets, Energy Storage Integration |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.