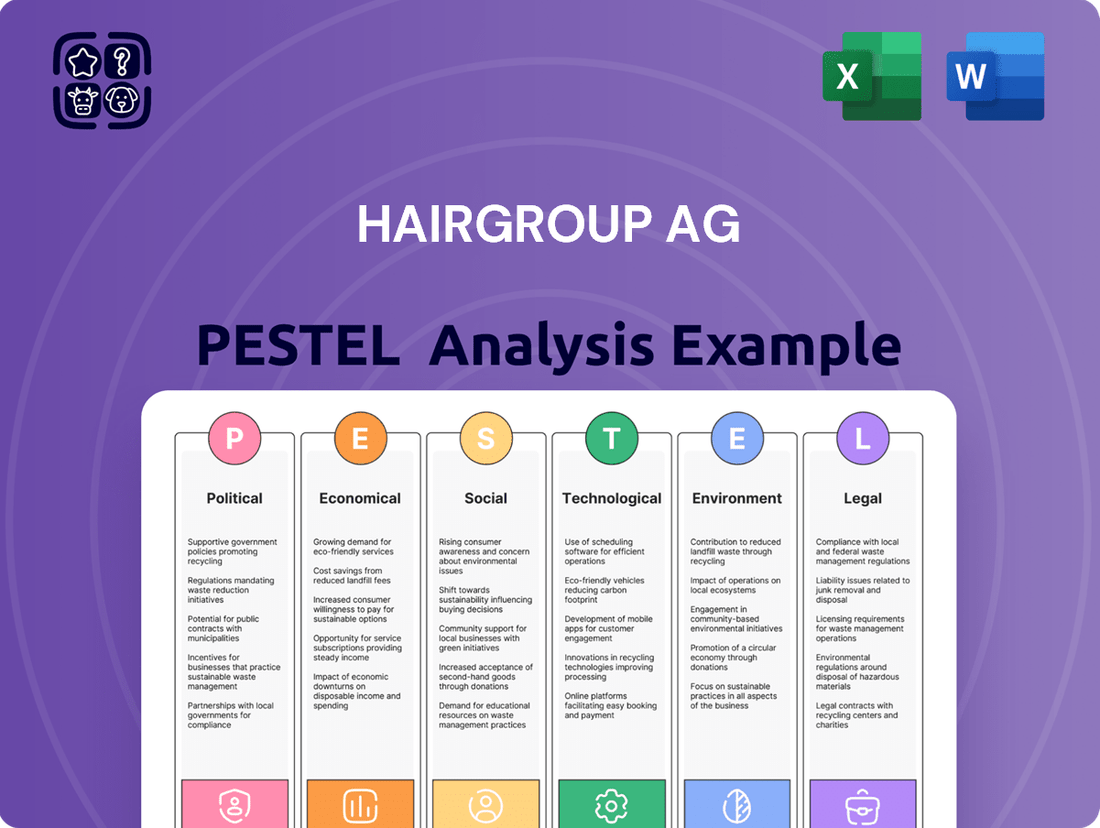

HairGroup AG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HairGroup AG Bundle

Unlock the strategic landscape of HairGroup AG with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are directly impacting the company's operations and future growth. Gain the foresight needed to navigate these external forces and secure your competitive advantage.

Our expert-crafted PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors shaping HairGroup AG. Don't get left behind by market dynamics; equip yourself with actionable intelligence. Download the full version now for a complete understanding of the forces at play.

Political factors

Switzerland's enduring political stability, a hallmark of its governance, creates a highly predictable and secure operating environment for HairGroup AG. This stability is further bolstered by a consistently business-friendly approach from the Swiss government, fostering confidence among investors and businesses.

The Swiss government actively cultivates a supportive ecosystem for enterprises, evidenced by streamlined administrative processes and a robust, transparent legal framework. For instance, in 2023, Switzerland ranked second globally in the World Bank's Ease of Doing Business report, highlighting its efficient regulatory landscape.

Switzerland's regulatory environment for cosmetics aligns closely with the European Union's, ensuring a familiar framework for HairGroup AG. This includes adherence to strict product safety assessments and comprehensive labeling requirements, crucial for consumer trust.

While largely harmonized, Switzerland maintains specific national provisions, particularly concerning professional standards within the hairdressing sector. HairGroup AG must stay abreast of these unique Swiss regulations to maintain compliance and operational integrity.

Labor market regulations in Switzerland, such as those governing employment contracts, minimum wage considerations, and the hiring of foreign talent, directly influence HairGroup AG's operational costs and talent acquisition strategies. For instance, the Swiss Federal Statistical Office reported in May 2025 that the unemployment rate for the first quarter of 2025 stood at 2.1%, indicating a tight labor market where skilled professionals are in demand.

Furthermore, policies related to immigration and work permits for skilled workers are crucial for HairGroup AG, particularly if it seeks to bring in international talent to fill specific roles or expand its expertise. The ongoing recovery of the Swiss labor market in early 2025, with a notable uptick in demand for younger professionals, presents both opportunities and challenges for HairGroup AG in attracting and retaining a competitive workforce.

Taxation Policies and Incentives

Switzerland's cantonal tax systems present a dynamic landscape for HairGroup AG. For instance, Zug and Schwyz historically offered some of the lowest corporate tax rates in Europe, potentially impacting HairGroup AG's profitability and investment decisions. While the nationwide implementation of the OECD/G20 global minimum tax rate of 15% is on the horizon for Switzerland, expected to be effective from 2024, cantons are still permitted to offer specific deductions and incentives that could influence effective tax burdens.

These cantonal variations mean that HairGroup AG's strategic site selection for new facilities or its headquarters could be heavily influenced by tax considerations. For example, a canton offering significant incentives for research and development could attract HairGroup AG's innovation hubs, thereby lowering operational costs. The interplay between the global minimum tax and cantonal flexibility creates a complex but potentially advantageous environment for corporate tax planning.

- Cantonal Tax Rate Variability: Historically, Swiss cantons like Zug have offered competitive corporate tax rates, influencing HairGroup AG's cost structure.

- Global Minimum Tax Impact: The impending 15% global minimum tax rate, expected in Switzerland from 2024, will reshape the tax landscape, though cantonal incentives may persist.

- Incentive Opportunities: Cantons can still offer deductions and preferential tax treatments, providing potential avenues for HairGroup AG to optimize its tax liabilities.

- Strategic Site Selection: Tax policies and incentives directly impact HairGroup AG's decisions regarding facility location and expansion strategies.

Public Health and Safety Regulations

Public health and safety regulations are paramount for hair salons and cosmetic products, directly impacting HairGroup AG's operations. These stringent rules are designed to protect both consumers and employees, covering everything from product safety assessments to the meticulous hygiene standards maintained within salons. Cantonal laboratories play a crucial role in monitoring adherence to these regulations, ensuring HairGroup AG meets all necessary compliance measures.

Adherence to these health and safety frameworks is not merely a procedural requirement but a critical component of brand trust and operational integrity. For instance, in Switzerland, where HairGroup AG operates, the Federal Act on Medicinal Products and Medical Devices (Therapeutic Products Act) and associated ordinances dictate rigorous safety testing for cosmetic ingredients and finished products. Failure to comply can lead to significant penalties, product recalls, and damage to the company's reputation. In 2024, the Swiss Federal Office of Public Health (FOPH) continued its focus on consumer product safety, with reported incidents of non-compliance often stemming from inadequate ingredient traceability or unverified efficacy claims. This underscores the need for HairGroup AG to maintain robust internal quality control systems and stay updated on evolving regulatory interpretations.

- Product Safety: HairGroup AG must ensure all cosmetic products undergo thorough safety assessments, including dermatological testing and allergen declarations, in line with Swiss and EU cosmetic regulations.

- Salon Hygiene: Strict protocols for sanitation of tools, equipment, and salon environments are mandated, with regular inspections by cantonal health authorities.

- Employee Training: Staff must be trained on safe handling of chemicals, infection control, and emergency procedures to comply with workplace safety laws.

- Regulatory Monitoring: Continuous monitoring of updates from bodies like the Swiss Federal Office of Public Health (FOPH) and the European Chemicals Agency (ECHA) is essential for ongoing compliance.

Switzerland's political stability and a business-friendly government provide a secure operating environment for HairGroup AG, supported by a transparent legal framework. The nation's regulatory alignment with the EU for cosmetics simplifies compliance for HairGroup AG, though specific national provisions for the hairdressing sector require attention.

The tight Swiss labor market, with a 2.1% unemployment rate in Q1 2025 according to the Federal Statistical Office, necessitates strategic talent acquisition for HairGroup AG. Immigration policies for skilled workers are also key considerations for the company's workforce planning.

Cantonal tax rate variations in Switzerland, with some offering historically low corporate rates, present opportunities for HairGroup AG's financial planning, even with the upcoming 15% global minimum tax. Strategic site selection will be influenced by these tax landscapes and potential cantonal incentives.

What is included in the product

This PESTLE analysis thoroughly examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting HairGroup AG, providing actionable insights into market dynamics and strategic positioning.

HairGroup AG's PESTLE Analysis acts as a pain point reliever by offering a clear, summarized version of complex external factors, enabling rapid understanding and informed decision-making for strategic planning.

Economic factors

Private consumption is a bedrock of Switzerland's economic resilience. In 2024, Swiss consumer spending showed continued strength, supported by a robust labor market and moderating inflation. Disposable income levels are expected to remain high, providing a solid foundation for continued spending on goods and services.

HairGroup AG's focus on accessible, professional hair care aligns perfectly with the Swiss consumer's high purchasing power and inclination to prioritize personal grooming. This trend is reinforced by data showing a consistent willingness among Swiss households to allocate a significant portion of their income towards personal services, including beauty and wellness.

Switzerland's inflation rate has shown a notable moderation, with the Swiss National Bank (SNB) reporting a year-on-year inflation of 0.8% in May 2024, down from higher levels in previous periods. This easing inflationary pressure, coupled with anticipated interest rate cuts by the SNB in 2024 and potentially further in 2025, creates a more favorable economic environment.

The projected economic expansion for Switzerland in 2025, supported by these lower inflation and interest rate trends, is expected to bolster consumer confidence. This improved sentiment can translate into increased discretionary spending, which directly benefits service-oriented businesses like HairGroup AG, as consumers are more willing to invest in personal care and grooming.

The Swiss hair care market is anticipated to experience steady growth, with projections indicating a modest increase in value. This expansion is largely fueled by a discerning consumer base that prioritizes premium and high-quality products, alongside a growing preference for natural and organic formulations. For HairGroup AG, this presents a clear opportunity to leverage the ongoing trend towards premiumization and to drive innovation within the dynamic hair care sector.

Competition within the Service Sector

The service sector, particularly hair salons, is seeing expansion, but intense competition, especially in metropolitan areas, presents a significant hurdle. HairGroup AG navigates this dynamic environment, contending with established global players and nimble local competitors.

The market for hair salon services is robust, with projections indicating continued growth. However, this attractiveness draws numerous new entrants, intensifying rivalry. For instance, in major European cities, the density of salons can be remarkably high, leading to price pressures and a constant need for differentiation.

- Market Saturation: Many urban areas exhibit high salon density, leading to increased competition for customer acquisition and retention.

- Price Sensitivity: Intense competition can drive down service prices, impacting profit margins for businesses like HairGroup AG.

- International vs. Local: HairGroup AG must compete with both large, internationally recognized brands with significant marketing budgets and smaller, locally entrenched businesses that may have strong community ties.

- Innovation Demands: To stand out, salons are increasingly pressured to offer unique services, employ advanced techniques, and provide exceptional customer experiences.

Impact of E-commerce and Digitalization

The pervasive growth of digitalization and e-commerce is fundamentally reshaping consumer behavior in the hair care sector. Consumers now have unprecedented access to a vast array of hair care products online, often with detailed reviews and competitive pricing. This shift necessitates that businesses like HairGroup AG adapt their strategies to meet these evolving purchasing habits.

While online sales of hair care products are expanding, the market for hair care services remains predominantly anchored in physical locations. For HairGroup AG, this means their established salon network continues to be a vital asset, offering personalized experiences and professional services that digital channels cannot fully replicate. In 2024, the global hair care market was valued at approximately $90 billion, with e-commerce channels accounting for a growing but still secondary portion of the service-based segment.

- E-commerce Growth: Online sales of beauty and personal care products, including hair care, continue to rise, projected to reach over $150 billion globally by 2027.

- Salon Dominance in Services: Despite online product sales, the majority of revenue for hair care services is generated through brick-and-mortar salons.

- Digital Integration: HairGroup AG can leverage digitalization for appointment booking, customer loyalty programs, and targeted marketing to complement its physical salon offerings.

Switzerland's economic landscape in 2024 and 2025 offers a stable environment for HairGroup AG, characterized by resilient consumer spending and moderating inflation. The Swiss National Bank's reported 0.8% inflation in May 2024 and anticipated interest rate adjustments in 2024-2025 further support this positive outlook. This stability is expected to foster continued consumer confidence and discretionary spending, particularly benefiting service-oriented businesses like hair salons.

What You See Is What You Get

HairGroup AG PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This HairGroup AG PESTLE Analysis provides a comprehensive overview of the external factors impacting the company. You can trust that the detailed insights into Political, Economic, Social, Technological, Legal, and Environmental influences are all present and accurate in the final document.

Sociological factors

Beauty standards are constantly shifting, driven by social media influencers and celebrity endorsements, pushing consumers to try new looks. This means salons, like those under HairGroup AG, need to stay on top of the latest trends in hair color, cuts, and treatments to keep customers coming back.

For instance, the rise of "balayage" and "ombré" coloring techniques in the late 2010s and early 2020s significantly impacted demand for specific coloring services. In 2024, emerging trends like "copper blonde" and "dark chocolate brown" are gaining traction, influencing salon service menus and product development for HairGroup AG.

Swiss consumers increasingly seek premium and specialized hair care, with a notable segment willing to invest more for advanced solutions and personalized experiences. This preference is evident in the growing market share of high-end salon brands and specialized treatments, indicating a strong demand for quality over quantity.

HairGroup AG’s strategic alignment with this trend presents a significant opportunity, as the company's emphasis on professional services and advanced hair care solutions directly caters to this discerning consumer base. For instance, the Swiss beauty market saw a 4.5% growth in premium haircare sales in 2024, reaching an estimated CHF 1.2 billion.

There's a noticeable societal shift towards prioritizing wellness and self-care, with consumers increasingly seeing salon services, including hair treatments, as vital components of their overall well-being rather than just cosmetic enhancements. This evolving consumer mindset presents a significant opportunity for HairGroup AG.

HairGroup AG can capitalize on this trend by expanding its service and product portfolio to encompass a broader spectrum of holistic self-care solutions. For instance, by offering specialized scalp treatments designed for stress relief or hair health restoration, the company can directly align with this growing consumer demand for services that nurture both physical and mental health.

The global wellness market was valued at approximately $5.6 trillion in 2023 and is projected to grow, with beauty and personal care being a significant segment. This indicates a strong and expanding consumer base willing to invest in self-care, a trend that HairGroup AG can effectively tap into by marketing its offerings through this lens.

Demand for Natural and Sustainable Products

Swiss consumers are increasingly prioritizing health and environmental well-being, leading to a significant rise in demand for natural, organic, and chemical-free hair care products. This growing preference for 'clean beauty' directly influences purchasing decisions, pushing brands to adopt more sustainable and ethically sourced ingredients and packaging. For HairGroup AG, this trend represents a crucial opportunity to innovate and align its product portfolio with these evolving consumer values.

The market for sustainable beauty products in Switzerland is experiencing robust growth. For instance, a 2023 report indicated that over 60% of Swiss consumers actively seek out eco-friendly and natural ingredients in their personal care items. This societal shift is not merely a fad but a fundamental change in consumer behavior, impacting purchasing power and brand loyalty.

HairGroup AG must consider integrating these consumer demands into its strategic planning. This could involve:

- Expanding product lines to include certified organic and natural hair care options.

- Enhancing supply chain transparency to showcase ethical sourcing and production methods.

- Investing in sustainable packaging solutions, such as recycled materials or biodegradable alternatives.

- Communicating sustainability efforts effectively to build trust and resonance with health-conscious consumers.

Demographic Shifts and Age Groups

Demographic shifts significantly impact the hair care market. For instance, an aging population in many developed nations, including key European markets where HairGroup AG operates, often leads to increased demand for services catering to thinning hair, grey coverage, and specialized scalp treatments. In 2024, the proportion of individuals aged 65 and over in the EU was approximately 22%, a figure projected to rise, directly influencing the types of hair solutions sought.

HairGroup AG's broad customer base, encompassing men, women, and children, necessitates a nuanced understanding of varying demographic needs. While younger demographics might prioritize trendy styling and coloring, older segments often seek restorative and maintenance-focused services. The birth rate trends also play a role; declining birth rates in some regions could mean a smaller future market for children's hair products and services, requiring strategic adjustments.

- Aging Population: Increased demand for anti-aging hair treatments and grey coverage solutions. In 2024, over 22% of the EU population was aged 65+, a demographic segment with specific hair care needs.

- Youth Market: Continued demand for styling, coloring, and trend-driven products among younger age groups.

- Family Services: The need for child-friendly hair products and salon services remains, though birth rate trends in some developed nations require monitoring.

- Gender-Specific Needs: Growing awareness and demand for specialized hair care products and services tailored to both men and women.

Societal trends significantly shape consumer preferences in the hair care industry. The ongoing influence of social media and celebrity culture drives demand for new styles and colors, compelling brands like HairGroup AG to constantly innovate their service offerings and product lines to align with these evolving beauty standards. For example, the popularity of "copper blonde" and "dark chocolate brown" hair colors in 2024 highlights the need for salons to stay current with emerging trends.

A growing emphasis on wellness and self-care positions salon services as integral to overall well-being, not just aesthetics. Consumers are increasingly willing to invest in premium, specialized treatments that offer both physical benefits and stress relief, such as advanced scalp therapies. This shift is reflected in the Swiss beauty market, which saw a 4.5% growth in premium haircare sales in 2024, reaching an estimated CHF 1.2 billion.

Consumer demand for natural, organic, and ethically sourced products is on the rise, driven by a greater awareness of health and environmental impact. Over 60% of Swiss consumers actively seek out eco-friendly ingredients, making sustainability a key factor in purchasing decisions. HairGroup AG is well-positioned to meet this demand by expanding its range of natural hair care options and enhancing supply chain transparency.

Demographic shifts, such as an aging population in Europe, are creating new market opportunities. In 2024, approximately 22% of the EU population was over 65, increasing demand for services like grey coverage and anti-aging hair treatments. HairGroup AG must cater to these diverse age groups, balancing the needs of younger consumers seeking trendy styles with the preferences of older demographics looking for restorative solutions.

| Sociological Factor | Impact on HairGroup AG | 2024/2025 Data/Trend |

|---|---|---|

| Shifting Beauty Standards | Need for trend-responsive services and products. | Emergence of "copper blonde" and "dark chocolate brown" as popular hair colors. |

| Wellness & Self-Care Focus | Opportunity for premium and holistic service offerings. | Swiss premium haircare sales grew 4.5% in 2024, reaching CHF 1.2 billion. |

| Demand for Natural/Organic Products | Requirement for sustainable sourcing and product innovation. | Over 60% of Swiss consumers seek eco-friendly ingredients in personal care. |

| Demographic Shifts (Aging Population) | Increased demand for age-specific hair solutions. | EU population aged 65+ was ~22% in 2024, driving demand for grey coverage and scalp treatments. |

Technological factors

Technology is fundamentally changing how salons operate and interact with clients. For instance, the adoption of AI for personalized consultations and virtual try-ons is becoming more common, allowing customers to visualize styles before committing. Streamlined online booking systems also reduce friction, improving convenience.

HairGroup AG can significantly boost customer satisfaction and operational efficiency by embracing these technological advancements. For example, implementing AI-powered diagnostic tools can help stylists offer more tailored advice, potentially increasing service revenue. A study by Statista in 2024 indicated that 70% of consumers prefer booking appointments online, highlighting the importance of robust digital platforms.

Technological advancements are significantly reshaping the hair care industry. Innovations in ingredients, such as the widespread adoption of natural oils like argan and jojoba, alongside the development of pH-balancing shampoos, are fueling consumer demand for more sophisticated and effective products. These advancements allow companies like HairGroup AG to develop premium offerings that cater to a growing desire for healthier, more manageable hair.

Digitalization and the rise of e-commerce are fundamentally reshaping the hair care industry. Online platforms now offer consumers unparalleled access to a vast array of products, alongside personalized recommendations that cater to individual needs. This shift means that a strong digital marketing strategy and a robust online presence are no longer optional but essential for companies like HairGroup AG to thrive.

By leveraging digital channels, HairGroup AG can significantly boost consumer engagement. In 2024, the global online beauty market was projected to reach over $100 billion, with hair care products being a substantial segment. A well-executed digital marketing campaign, including social media engagement, influencer collaborations, and targeted advertising, can expand HairGroup AG's reach to a much broader and more diverse clientele than traditional brick-and-mortar stores alone.

Data Analytics for Personalized Services

Data analytics is transforming how HairGroup AG can serve its customers. By analyzing detailed information about a client's hair texture, scalp condition, and even their daily routines, the company can move beyond generic advice. This allows for highly specific product suggestions and treatment plans, ensuring each customer gets exactly what their hair needs.

Leveraging these insights empowers HairGroup AG to deliver truly personalized experiences. Imagine a system that recommends a specific shampoo based on your hair's porosity and your exposure to hard water, or a styling product tailored to your hair's natural curl pattern and the humidity levels in your city. This level of customization is becoming increasingly expected by consumers.

For instance, the global market for personalized beauty is booming. Reports from 2024 indicate that consumers are willing to pay a premium for tailored solutions, with market research suggesting a significant portion of customers actively seek out brands offering personalized recommendations. HairGroup AG can capitalize on this trend by integrating advanced data analytics into its service offerings.

- Personalized Product Recommendations: Utilizing AI-powered tools to analyze customer data for tailored product suggestions.

- Bespoke Treatment Plans: Developing customized hair care routines based on individual hair and scalp diagnostics.

- Enhanced Customer Loyalty: Fostering stronger customer relationships through unique, data-driven service experiences.

- Market Trend Alignment: Capitalizing on the growing consumer demand for personalized beauty solutions.

Smart Salon Equipment and Tools

The integration of smart salon equipment, such as mirrors offering virtual hair color and style previews, is revolutionizing the customer experience. This technology not only enhances client satisfaction by allowing them to visualize results before commitment but also streamlines the consultation process. For HairGroup AG, adopting these innovations can significantly differentiate its brand in a competitive market.

Furthermore, the trend towards energy-efficient salon equipment presents a dual benefit: reducing operational costs and improving environmental sustainability. As of early 2025, the global market for smart beauty devices, including salon technology, is projected to see continued growth, with an estimated CAGR of over 15% through 2028, indicating strong consumer and industry adoption. Investing in these advanced tools can therefore offer both immediate operational advantages and long-term strategic positioning.

- Virtual Try-On Technology: Smart mirrors allow clients to digitally experiment with various hair colors and styles, reducing decision time and increasing client confidence.

- Energy Efficiency: Adoption of new, energy-saving equipment, such as LED lighting and low-consumption dryers, can lead to tangible cost savings for HairGroup AG. For instance, upgrading to LED lighting can reduce energy consumption by up to 80% compared to traditional incandescent bulbs.

- Operational Streamlining: Smart tools can automate certain processes, potentially improving stylist efficiency and allowing for more personalized client interactions.

- Competitive Differentiation: Embracing cutting-edge technology positions HairGroup AG as an innovative leader, attracting tech-savvy consumers and enhancing brand perception.

Technological advancements are significantly reshaping the hair care industry, from product development to customer interaction. Innovations in ingredients, like advanced formulations for scalp health, and the increasing use of AI for personalized consultations are key drivers. The global beauty tech market, including salon innovations, is projected for robust growth, with an estimated CAGR of over 15% through 2028, signaling strong industry adoption of new technologies.

Digitalization and e-commerce are essential for HairGroup AG's reach, with the online beauty market exceeding $100 billion in 2024. Leveraging digital channels, including social media and influencer marketing, can expand the company's clientele significantly. Data analytics allows for highly specific product recommendations and treatment plans based on individual hair and scalp diagnostics, a trend consumers increasingly expect and are willing to pay a premium for.

The integration of smart salon equipment, such as virtual try-on mirrors, enhances customer experience and streamlines consultations, differentiating HairGroup AG in a competitive landscape. Furthermore, adopting energy-efficient equipment offers cost savings and improves sustainability. By embracing these technological shifts, HairGroup AG can enhance customer loyalty and align with market trends favoring personalized and convenient beauty solutions.

| Technological Factor | Impact on HairGroup AG | Supporting Data (2024/2025 Projections) |

|---|---|---|

| AI in Consultations | Enhanced personalized advice, improved customer satisfaction | 70% of consumers prefer online booking (Statista 2024) |

| E-commerce & Digital Marketing | Expanded customer reach, increased sales | Global online beauty market projected over $100 billion (2024) |

| Data Analytics | Highly tailored product and treatment recommendations | Consumers willing to pay a premium for personalized solutions |

| Smart Salon Equipment | Improved customer experience, operational efficiency | Beauty tech market CAGR >15% through 2028 |

Legal factors

HairGroup AG must navigate a complex web of Swiss cosmetics regulations, closely mirroring EU standards, which mandate rigorous product safety protocols, ingredient oversight, and comprehensive safety assessments for all formulations. This alignment ensures a consistent approach to consumer protection across major European markets.

Looking ahead to 2025, regulatory scrutiny is intensifying, with anticipated prohibitions on specific cyclic siloxanes, a common ingredient in hair care products. This upcoming change necessitates proactive reformulation and ingredient sourcing strategies to maintain compliance and product efficacy.

Swiss regulations require cosmetic product labeling, including instructions and warnings, to be presented in at least one of the country's official languages: German, French, or Italian. For products with potentially sensitive ingredients or specific usage instructions, using the local language of the target region is strongly advised to ensure consumer understanding and safety.

HairGroup AG must meticulously review and adapt its product labeling to comply with these linguistic mandates, potentially requiring translation services and localized packaging for different Swiss cantons. Failure to adhere to these requirements could lead to product recalls or fines, impacting brand reputation and market access within Switzerland.

Consumer protection laws are a significant legal factor for HairGroup AG, mandating fair business practices, clear pricing, and high-quality service delivery. Adherence to these regulations is paramount for building and sustaining customer confidence, thereby mitigating the risk of legal entanglements. For instance, in 2024, the EU's updated consumer rights directive strengthened requirements for clear service descriptions and cancellation policies, impacting how HairGroup AG communicates its offerings.

Labor Laws and Employment Standards

HairGroup AG must diligently adhere to Switzerland's comprehensive labor laws. These regulations cover critical aspects such as maximum working hours, minimum wage stipulations, mandatory employee benefits, and stringent health and safety standards within the workplace. For instance, the Swiss Federal Act on Labour in Trade and Industry (Art. 10) sets limits on weekly working hours, typically 45 for industrial workers and 50 for others, a framework HairGroup AG's salon operations must respect.

The hairdressing sector, in particular, faces specific legal requirements designed to safeguard both clients and staff. These often include rules on hygiene, chemical handling, and ergonomic practices to prevent occupational hazards. Failure to comply can result in significant fines and reputational damage, impacting HairGroup AG's operational integrity.

Key legal considerations for HairGroup AG include:

- Compliance with Swiss Federal Labour Law: Ensuring all employment contracts and workplace practices align with national legislation regarding wages, working time, and leave entitlements.

- Sector-Specific Regulations: Adhering to specific health, safety, and hygiene standards applicable to the hairdressing industry, as mandated by cantonal and federal authorities.

- Employee Benefits and Social Security: Providing legally mandated benefits, such as accident insurance and contributions to the Swiss social security system (AHV/IV/EO), for all employees.

- Data Protection in Employment: Managing employee data in accordance with Switzerland's Federal Act on Data Protection (FADP), ensuring privacy and security.

Data Protection and Privacy Regulations

HairGroup AG operates under strict Swiss data protection laws, notably the Federal Act on Data Protection (FADP). This legislation mandates responsible handling of customer data, especially as the company increasingly relies on digital booking systems and personalized client experiences. Compliance ensures customer trust and avoids potential penalties for data breaches.

The FADP, revised and in effect since September 1, 2023, emphasizes transparency and security in data processing. For HairGroup AG, this means clearly informing customers about how their data is collected, used, and stored, and implementing robust security measures to protect this information from unauthorized access. Secure online interactions are paramount for maintaining customer confidence in their digital services.

- FADP Compliance: Adherence to the Federal Act on Data Protection (FADP) is mandatory for all data processing activities.

- Customer Data Management: Responsible collection, storage, and use of customer information are critical.

- Digital Security: Implementing strong cybersecurity measures for online platforms and transactions is essential.

- Transparency: Clear communication with customers regarding data usage policies builds trust.

HairGroup AG must navigate stringent Swiss regulations, mirroring EU standards, for product safety, ingredient oversight, and comprehensive safety assessments, a framework that intensifies with anticipated 2025 prohibitions on specific cyclic siloxanes. Labeling must adhere to local languages, requiring meticulous adaptation for different Swiss regions to avoid recalls and fines.

Consumer protection laws demand fair practices and high-quality service, with updated EU directives in 2024 strengthening requirements for service descriptions and cancellations. Labor laws, including the Federal Act on Labour in Trade and Industry, dictate maximum working hours, minimum wages, and mandatory benefits, with the hairdressing sector facing specific hygiene and chemical handling rules.

Data protection is paramount under Switzerland's Federal Act on Data Protection (FADP), revised in September 2023, mandating transparency and security in handling customer data for digital platforms and transactions. This includes clear communication about data usage and robust cybersecurity measures to maintain customer trust.

Environmental factors

The beauty sector is seeing a significant shift towards sustainability, with consumers actively seeking out brands that embrace eco-friendly practices. This includes a rising interest in refillable product options, packaging made from recycled or easily recyclable materials, and salons utilizing energy-efficient equipment. For instance, a 2024 survey indicated that over 60% of consumers consider a brand's environmental impact when making purchasing decisions in the beauty space.

HairGroup AG has a clear opportunity to integrate green initiatives into its operations to resonate with these evolving consumer values and anticipate future environmental regulations. By adopting practices such as offering refillable product lines or investing in energy-saving salon equipment, HairGroup AG can enhance its brand image and potentially capture a larger market share among environmentally conscious individuals.

Hair salons, including those under HairGroup AG, produce diverse waste streams such as hair clippings, chemical byproducts from treatments, and disposable product containers. Effective waste management is crucial for environmental responsibility. For instance, in 2024, the UK's recycling rate for household waste reached approximately 44%, highlighting a growing societal expectation for businesses to engage in similar practices.

HairGroup AG must implement robust recycling and disposal protocols for these materials. This includes exploring partnerships for composting hair waste, a practice gaining traction globally, and ensuring proper handling of chemical waste to prevent environmental contamination. By 2025, many European countries are expected to further tighten regulations on chemical waste disposal, making proactive management a strategic imperative.

Salon operations, a core part of HairGroup AG's business, are inherently water and energy intensive. Washing hair, drying, and styling all require significant resources. For instance, a typical salon wash basin can use up to 2 gallons of water per minute, and professional hairdryers can consume 1500-2000 watts of electricity.

HairGroup AG has a clear opportunity to mitigate its environmental footprint and boost efficiency by adopting water-saving measures. This could include installing low-flow showerheads and optimizing washing processes. Furthermore, investing in energy-efficient equipment, such as LED lighting and modern, lower-wattage styling tools, can lead to substantial reductions in both resource consumption and operational expenses.

Sourcing of Sustainable Ingredients

Consumers are increasingly seeking hair care products formulated with natural, organic, and sustainably sourced ingredients, actively avoiding those containing harsh chemicals. This trend is significantly influencing product development and ingredient sourcing strategies within the beauty industry.

HairGroup AG must therefore evaluate the ecotoxicity of its cosmetic ingredients across the entire product lifecycle. This includes understanding the environmental impact from raw material extraction to disposal, ensuring compliance with evolving regulations and consumer expectations for greener formulations.

Market data from 2024 indicates a substantial shift, with reports showing that over 60% of consumers now prioritize natural or organic ingredients in their personal care purchases. Furthermore, the global market for natural and organic beauty products was valued at approximately $50 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 8-10% through 2028, highlighting the economic imperative of sustainable sourcing.

- Consumer Demand: Growing preference for natural, organic, and chemical-free hair care products.

- Ecotoxicity Assessment: Need for HairGroup AG to analyze ingredient environmental impact throughout the product lifecycle.

- Market Growth: The natural and organic beauty market is expanding rapidly, presenting opportunities for companies prioritizing sustainability.

- Regulatory Landscape: Increasing scrutiny on ingredient safety and environmental impact by regulatory bodies worldwide.

Climate Change and Environmental Regulations

Increasing global sustainability regulations, like the EU's Corporate Sustainability Reporting Directive (CSRD), are compelling companies to disclose environmental impacts. This means HairGroup AG must increasingly scrutinize its supply chain for deforestation risks and ensure transparent reporting on its environmental footprint, a trend that gained significant traction in 2024 and is expected to intensify through 2025.

Anticipating and adapting to these evolving environmental mandates is no longer optional but a strategic imperative. For instance, the growing demand for ethically sourced ingredients, driven by consumer awareness and regulatory pressure, could directly affect the cost and availability of raw materials used in HairGroup AG's product formulations.

- Growing Regulatory Landscape: Expect stricter compliance requirements for environmental impact assessments and reporting by 2025.

- Supply Chain Scrutiny: Increased focus on sustainable sourcing, particularly concerning deforestation and biodiversity, will impact raw material procurement.

- Consumer Demand for Sustainability: Consumers are increasingly favoring brands with demonstrable environmental responsibility, influencing purchasing decisions.

Environmental factors are increasingly shaping consumer choices and regulatory frameworks within the beauty industry. HairGroup AG must navigate growing demands for sustainable products, from refillable options to natural ingredients, as evidenced by over 60% of consumers considering environmental impact in 2024 purchasing decisions.

The company faces the challenge of managing diverse waste streams, including hair clippings and chemical byproducts, with an expectation for robust recycling and disposal protocols, especially as European regulations on chemical waste tighten by 2025.

Salon operations are resource-intensive, with water and energy consumption being key concerns; adopting water-saving measures and energy-efficient equipment can significantly reduce both environmental impact and operational costs.

The market for natural and organic beauty products is experiencing robust growth, projected to expand significantly by 2028, underscoring the strategic advantage of prioritizing ethically sourced and eco-friendly ingredients.

| Environmental Factor | Impact on HairGroup AG | Key Data/Trend (2024-2025) |

|---|---|---|

| Consumer Demand for Sustainability | Increased preference for eco-friendly products and practices. | 60%+ of consumers consider environmental impact in beauty purchases (2024). |

| Waste Management | Need for effective recycling and disposal of salon waste. | UK household waste recycling rate ~44% (2024); tightening chemical waste regulations in Europe by 2025. |

| Resource Consumption | High water and energy usage in salon operations. | Salon wash basins can use up to 2 gal/min; hairdryers consume 1500-2000W. |

| Ingredient Sourcing | Shift towards natural, organic, and sustainably sourced ingredients. | Natural/organic beauty market valued at ~$50B (2023), projected 8-10% CAGR through 2028. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for HairGroup AG is constructed using a comprehensive blend of public and proprietary data, encompassing market research reports, industry publications, and economic indicators. This approach ensures a robust understanding of the macro-environmental factors impacting the beauty and haircare sector.