Griset PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Griset Bundle

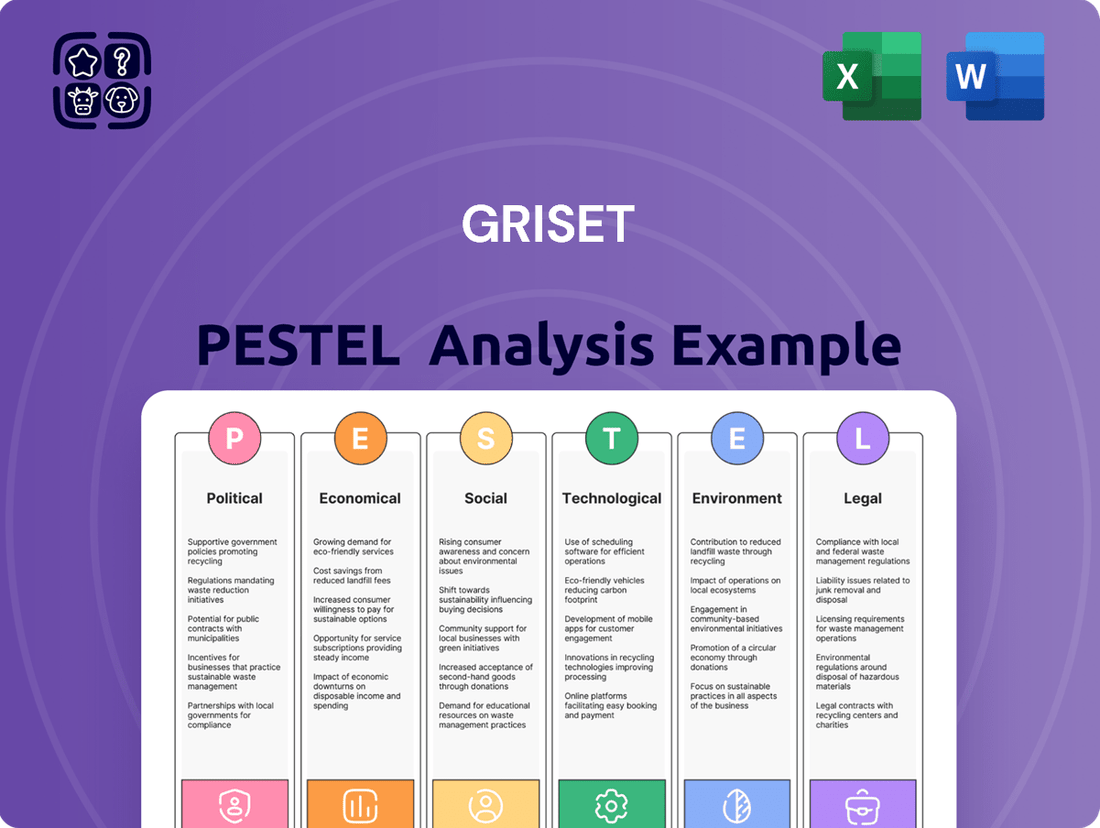

Unlock the forces shaping Griset's future with our comprehensive PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors are creating opportunities and challenges. Equip yourself with critical insights to navigate the evolving landscape and make informed strategic decisions. Download the full analysis now to gain a competitive edge.

Political factors

Geopolitical tensions, especially between the US and China, are a major force shaping the semiconductor landscape. These aren't just abstract political discussions; they translate directly into tangible business challenges. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) has been actively implementing export controls. In late 2023, these controls were further tightened, impacting the sale of advanced AI chips and manufacturing equipment to China. This directly affects companies like GRISET by potentially limiting their ability to sell to or source from key markets.

Trade policies, including tariffs and export controls, create significant disruptions. Consider the ongoing trade disputes that have seen tariffs imposed on various goods, including electronics components. These tariffs increase the cost of doing business, affecting both GRISET's sourcing of raw materials and its ability to export finished products. The semiconductor industry, with its complex global supply chains, is particularly vulnerable to such measures, forcing companies to re-evaluate where they manufacture and where they sell their products to remain competitive.

Government subsidies and incentives are significantly reshaping the semiconductor landscape. The US CHIPS and Science Act, for instance, allocates over $52 billion to boost domestic chip production and research, with companies like Intel and TSMC announcing substantial investments in new fabrication plants. Similarly, Europe's European Chips Act aims to mobilize €43 billion in public and private investment by 2030 to double its market share in semiconductors. These initiatives create fertile ground for companies like Griset in regions actively supporting the industry, potentially opening doors for new partnerships and market access, but also signaling a trend towards increased localization demands and intensified competition as more players enter these incentivized markets.

Regulatory stability is crucial for Griset's investment and operational planning. For instance, the World Bank's 2020 Ease of Doing Business report ranked France, a key European market, 32nd out of 190 economies, indicating a relatively stable but complex regulatory landscape. Frequent shifts in trade agreements or technology transfer policies could introduce volatility and raise operational expenses.

Intellectual Property Protection

GRISET's reliance on proprietary socket designs and manufacturing techniques makes robust intellectual property (IP) protection paramount. Weak enforcement of IP laws globally can expose GRISET to the risk of its innovations being copied, directly impacting its competitive edge and the return on its research and development investments. For instance, countries with lax IP laws may see unauthorized production of GRISET's specialized sockets, eroding market share.

The global landscape of IP protection is dynamic. As of early 2024, organizations like the World Intellectual Property Organization (WIPO) continue to advocate for stronger international IP frameworks. However, enforcement varies significantly; a 2023 report indicated that while patent applications globally saw a modest increase, the actual enforcement of these patents in emerging markets remained a challenge for many tech firms.

- Global IP Enforcement Disparities: GRISET must navigate varying levels of IP protection and enforcement across its target markets, with some regions offering stronger safeguards than others.

- R&D Investment Risk: Weak IP protection directly threatens the recoupment of GRISET's significant investments in developing its specialized socket technologies.

- International Treaties and National Laws: The effectiveness of GRISET's IP strategy hinges on the strength and implementation of international IP agreements and the specific IP laws within each operating country.

- Competitive Advantage Vulnerability: Unauthorized replication of GRISET's unique designs and processes by competitors in less-regulated markets poses a direct threat to its market position.

International Standards and Alliances

Griset's engagement with international standards, particularly in semiconductor testing and manufacturing, is heavily shaped by political dynamics and industry groups. For instance, the push for unified standards in areas like advanced packaging, crucial for next-generation chips, is often driven by geopolitical considerations and the desire for technological leadership among major economies. Adherence to these evolving global benchmarks is non-negotiable for Griset to ensure its products can seamlessly integrate into global supply chains and gain widespread market acceptance.

Political cooperation or friction between key nations directly influences the pace and direction of technical standard harmonization. A collaborative environment can accelerate the development of widely adopted standards, benefiting companies like Griset by reducing fragmentation and compliance costs. Conversely, geopolitical tensions can lead to divergent national standards, creating significant hurdles for international market access and potentially increasing R&D expenses for Griset to cater to multiple, incompatible specifications.

- Global Semiconductor Alliance (GSA) initiatives often reflect political leanings, impacting standard setting.

- The US CHIPS and Science Act of 2022, for example, aims to bolster domestic semiconductor manufacturing and R&D, potentially influencing international collaboration on standards.

- European Union efforts towards digital sovereignty also contribute to the evolving landscape of semiconductor standards and alliances.

- Divergence in data privacy regulations, influenced by political ideologies, can also indirectly affect the interoperability requirements for semiconductor testing equipment.

Government stability and policy consistency are critical for Griset's long-term planning. For instance, the 2023 political landscape in many Western nations saw shifts in economic priorities, potentially impacting R&D funding and trade agreements relevant to the semiconductor sector. Unforeseen policy changes can disrupt supply chains and investment strategies.

International relations and geopolitical stability directly influence market access and operational risks for Griset. Tensions between major economic blocs, such as the ongoing trade disputes impacting the tech sector, can lead to increased tariffs or export restrictions, as seen with US controls on advanced chip technology sales to China. This necessitates careful market diversification.

Regulatory frameworks governing technology transfer and data privacy are increasingly shaped by political considerations. The European Union's General Data Protection Regulation (GDPR), for example, sets stringent standards that impact how companies like Griset handle data, influencing product design and market entry strategies. Compliance with these varied regulations is a significant operational factor.

Government support through subsidies and incentives, like the US CHIPS Act or Europe's Chips Act, actively reshapes the competitive landscape. These policies encourage domestic production and innovation, potentially creating new opportunities but also intensifying competition as more players enter incentivized markets.

What is included in the product

The Griset PESTLE Analysis meticulously examines the external macro-environmental forces impacting the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Griset PESTLE Analysis offers a structured framework that alleviates the pain of navigating complex external environments by providing a clear, actionable overview of critical factors impacting business strategy.

Economic factors

The global semiconductor market is experiencing robust growth, with projections indicating a rise to approximately $680 billion by 2024, and further expansion to over $1 trillion by 2030, according to industry analysts like SIA and McKinsey. This upward trend is fueled by surging demand from key sectors such as consumer electronics, the rapidly expanding automotive industry, and the critical need for advanced infrastructure in data centers and artificial intelligence. For GRISET, this translates directly into increased demand for their specialized test and burn-in sockets, as more semiconductors require rigorous testing before deployment.

Economic fluctuations in these end markets have a pronounced impact on GRISET's financial performance and strategic initiatives. For instance, a slowdown in smartphone sales or electric vehicle production could dampen the need for new chip manufacturing, thereby reducing GRISET's order volumes. Conversely, accelerated adoption of AI technologies and the build-out of 5G networks in 2024 and 2025 are expected to provide significant tailwinds, driving higher revenue and supporting GRISET's expansion plans.

The semiconductor industry is inherently cyclical, experiencing significant swings between periods of high demand and subsequent slowdowns. For instance, the global semiconductor market saw robust growth in 2021, reaching an estimated $553 billion, but faced headwinds in 2023 due to inventory corrections and softening consumer electronics demand, with projections indicating a slight contraction or flat growth for that year.

These cycles are heavily influenced by broader economic trends, such as inflation rates and consumer spending power, alongside internal industry factors like the build-up and depletion of chip inventories. Technological shifts, like the move to new process nodes or the rise of AI, can also trigger demand surges or create temporary gluts.

GRISET needs to be agile, balancing its production capacity and research and development spending to weather these fluctuations. This means investing strategically in R&D during downturns to be ready for the next upswing, while carefully managing inventory levels to avoid being caught with excess stock when demand cools.

Inflationary pressures are a significant concern for Griset, directly impacting the cost of essential inputs like metals, plastics, and electronic components. For instance, the Producer Price Index for manufactured goods in the US saw a notable increase in early 2024, reflecting higher material and energy costs. This trend necessitates careful management of Griset's supply chain to mitigate the impact on profitability and pricing strategies.

The global semiconductor industry, where Griset operates, is particularly susceptible to material cost volatility. The price of key metals like copper and gold, crucial for high-performance test sockets, can fluctuate based on geopolitical events and global demand. For example, copper prices in early 2024 traded at multi-year highs, directly affecting manufacturing expenses for companies like Griset.

Managing these rising input costs is paramount for Griset to maintain its competitive edge. The ability to absorb or pass on increased material and energy expenses without alienating customers is a key determinant of profitability. In 2024, many manufacturing sectors reported challenges in balancing these cost increases with market price sensitivity, a dynamic Griset must navigate.

Currency Exchange Rate Fluctuations

Griset, as a global supplier to semiconductor manufacturers and test houses, faces significant exposure to currency exchange rate fluctuations. A strengthening of Griset's domestic currency, for instance, would make its products more expensive for international buyers, potentially dampening export revenue. Conversely, a weaker domestic currency could lower the cost of imported components essential for Griset's operations.

For example, if Griset's primary operating currency is the US Dollar and a major market like the Eurozone experiences a significant depreciation against the USD, Griset's European sales would translate into fewer dollars. This could impact profitability if not hedged. In 2024, major currency pairs like EUR/USD saw notable volatility, with the dollar strengthening at various points, impacting trade balances globally.

Effective currency risk management is therefore crucial for Griset's financial health. This involves implementing strategies to mitigate the impact of adverse currency movements, ensuring greater predictability in earnings and managing the cost of goods sold.

- Impact on Exports: A stronger domestic currency makes Griset's products pricier for international customers, potentially reducing sales volume.

- Impact on Imports: A weaker domestic currency increases the cost of raw materials and components sourced from abroad.

- Financial Predictability: Volatile exchange rates can create uncertainty in revenue and profit forecasts, making financial planning more challenging.

- Hedging Strategies: Griset likely employs financial instruments like forward contracts or options to lock in exchange rates for future transactions.

Research and Development Investment Trends

The semiconductor industry's commitment to research and development is a critical driver for companies like GRISET. As chip manufacturers push boundaries with technologies like 2nm and 3nm nodes, the demand for sophisticated testing solutions escalates. For instance, global R&D spending in the semiconductor sector is projected to reach over $100 billion annually by 2025, highlighting the intense innovation cycle.

GRISET's own R&D investment must mirror these industry trends to remain competitive. Developing test sockets capable of handling new materials and advanced packaging, such as chiplets, is paramount. This ensures their offerings align with the evolving needs of their clientele.

- Semiconductor R&D Spending: Expected to exceed $100 billion annually by 2025.

- Key Innovation Areas: 2nm/3nm nodes, advanced materials, and chiplet packaging.

- GRISET's Imperative: Continuous R&D to develop compatible and advanced test sockets.

- Market Signal: Industry R&D trends directly indicate future demand for specialized testing solutions.

Economic factors significantly shape the semiconductor landscape Griset operates within. Robust global demand for chips, projected to exceed $680 billion in 2024 and surpass $1 trillion by 2030, fuels the need for Griset's testing solutions. However, economic downturns, like the inventory corrections seen in 2023, can temper this demand, impacting Griset's order volumes. Inflationary pressures, evidenced by rising producer prices in early 2024, directly increase Griset's material and energy costs, necessitating careful price and supply chain management.

Currency exchange rate volatility presents another key economic consideration for Griset. A strengthening domestic currency can make its products more expensive for international buyers, impacting export revenue, while a weaker currency increases the cost of imported components. For instance, the notable volatility in the EUR/USD pair during 2024 highlights this risk. Griset's financial predictability and profitability are thus tied to effective currency risk management strategies.

The semiconductor industry's intense R&D focus, with spending expected to exceed $100 billion annually by 2025, creates a direct demand for Griset's advanced testing sockets. Innovations in areas like 2nm/3nm nodes and chiplet packaging require Griset to continuously invest in its own R&D to develop compatible solutions, ensuring it remains competitive and aligned with evolving client needs.

Preview the Actual Deliverable

Griset PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Griset PESTLE Analysis provides a comprehensive overview of the external factors impacting the business, allowing for informed strategic planning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to the complete Griset PESTLE Analysis, including detailed breakdowns of Political, Economic, Social, Technological, Legal, and Environmental influences.

The content and structure shown in the preview is the same document you’ll download after payment. This Griset PESTLE Analysis is designed to be a practical tool for understanding market dynamics and identifying opportunities and threats.

Sociological factors

The semiconductor sector, critical for specialized manufacturing like test and burn-in sockets, demands a highly skilled workforce. This includes engineers, materials scientists, and precision technicians, whose availability directly impacts companies like Griset.

A scarcity of this specialized talent in key regions can significantly hinder Griset's expansion, driving up operational expenses and potentially compromising product standards. For instance, reports from the Semiconductor Industry Association (SIA) in late 2024 highlighted a growing global deficit in semiconductor engineers, a trend expected to persist into 2025.

To counter these challenges, Griset's strategic focus must include robust investment in training initiatives and effective talent retention strategies. Proactive measures in workforce development are essential to ensure a consistent supply of qualified personnel, thereby safeguarding operational efficiency and competitive positioning.

Societal adoption rates for new consumer electronics are accelerating, with global smartphone penetration reaching approximately 70% by early 2024. This growing reliance on interconnected devices, including the burgeoning Internet of Things (IoT) market projected to exceed 29 billion connected devices by 2026, directly fuels the demand for the semiconductors that power them, and by extension, the test sockets needed for their quality assurance.

Consumer preferences are evolving, with a notable trend towards sustainability in electronics. This is evidenced by a growing consumer willingness to pay a premium for eco-friendly products, with studies in 2024 indicating over 60% of consumers consider sustainability when making electronics purchases. Concurrently, the demand for high-performance computing, driven by AI advancements and immersive gaming experiences, is reshaping chip design and consequently, the specialized testing requirements that companies like GRISET must address.

Societal expectations are increasingly prioritizing diversity, equity, and inclusion (DEI) within organizations. This trend directly influences Griset's corporate culture, how it recruits talent, and ultimately, how satisfied its employees are. For instance, in 2024, companies with strong DEI initiatives reported a 2.3 times higher cash flow per employee compared to those with low DEI, according to a McKinsey report.

Griset's capacity to foster a diverse workforce can significantly boost its innovative capabilities, improve problem-solving approaches, and deepen its understanding of various market segments. A recent study by Deloitte found that diverse companies are 6 times more likely to be innovative and 8 times more likely to achieve better business outcomes.

Furthermore, a genuine commitment to DEI can bolster Griset's brand image among both consumers and prospective employees. In the current competitive talent landscape, where 76% of job seekers consider diversity an important factor when evaluating companies, a strong DEI reputation is a critical differentiator for attracting and retaining top talent.

Corporate Social Responsibility Expectations

Societal expectations for Corporate Social Responsibility (CSR) are rapidly evolving, influencing how companies like Griset are perceived beyond just their financial results. Consumers and investors are increasingly scrutinizing ethical conduct, environmental stewardship, and community involvement. For instance, a 2024 report by TriplePundit indicated that 70% of consumers consider a company's social and environmental impact when making purchasing decisions.

Griset's commitment to fair labor practices, sustainable manufacturing processes, and operational transparency directly addresses these growing expectations. This proactive approach can significantly enhance its brand reputation, making it more attractive to a segment of the market that prioritizes ethical business operations. A study by Nielsen in 2023 found that brands with strong sustainability claims saw a 15% increase in sales compared to those without.

This focus on CSR can also attract socially conscious investors. For example, the global sustainable investment market reached an estimated $35.3 trillion in 2024, according to the Global Sustainable Investment Alliance. Companies demonstrating robust CSR initiatives, such as Griset's efforts in reducing its carbon footprint by 10% year-over-year through renewable energy adoption, are better positioned to capture this growing capital flow.

- Growing Consumer Demand: 70% of consumers consider social/environmental impact (TriplePundit, 2024).

- Sales Impact: Brands with sustainability claims saw 15% higher sales (Nielsen, 2023).

- Investor Attraction: Sustainable investment market valued at $35.3 trillion (GSIA, 2024).

- Environmental Progress: Griset reduced carbon footprint by 10% annually.

Education and STEM Focus

The increasing global emphasis on Science, Technology, Engineering, and Mathematics (STEM) education is a critical sociological factor for the semiconductor industry. This societal push directly influences the availability of skilled professionals, ensuring a robust talent pipeline for companies like GRISET. For instance, in 2023, the U.S. Bureau of Labor Statistics projected a 9% growth for computer and mathematical occupations through 2032, highlighting the demand for STEM expertise.

Strong national and regional STEM initiatives are vital for cultivating a workforce adept in microelectronics and advanced manufacturing. Countries that invest heavily in these areas, such as South Korea and Taiwan, consistently produce graduates with the specialized knowledge required by the semiconductor sector. This focus on foundational scientific and technical skills underpins GRISET's capacity for future innovation and operational excellence.

- Growing STEM Enrollment: Many nations are reporting increased enrollment in STEM programs at both university and K-12 levels, directly feeding the talent pool.

- Government Investment in Education: Significant government funding is being allocated to STEM education and research, aiming to bolster domestic technological capabilities.

- Industry-University Partnerships: Collaborations between semiconductor firms and academic institutions are becoming more prevalent, creating specialized curricula and internship opportunities.

- Demand for Specialized Skills: The semiconductor industry requires highly specialized skills in areas like materials science, electrical engineering, and computer science, making STEM education paramount.

Societal trends significantly impact Griset by shaping consumer demand and ethical expectations. The increasing adoption of electronics, with global smartphone penetration around 70% in early 2024, directly boosts the need for semiconductors and, consequently, Griset's testing solutions. Furthermore, a growing consumer preference for sustainability, with over 60% considering eco-friendliness in electronics purchases in 2024, pushes companies like Griset to adopt greener practices.

Diversity, equity, and inclusion (DEI) are now paramount, influencing talent acquisition and company culture. Companies with strong DEI initiatives, such as those reporting 2.3 times higher cash flow per employee in 2024 (McKinsey), are more attractive to talent. Griset's commitment to DEI can enhance innovation and brand image, crucial as 76% of job seekers in 2024 consider diversity when choosing an employer.

Corporate Social Responsibility (CSR) is another key factor, with 70% of consumers in 2024 considering a company's social and environmental impact. Griset's focus on ethical practices and sustainability, like its 10% annual carbon footprint reduction, enhances its brand and attracts socially conscious investors in the $35.3 trillion global sustainable investment market (GSIA, 2024).

The emphasis on STEM education is vital for Griset's talent pipeline. Projected growth in computer and mathematical occupations (9% through 2032, BLS) highlights the demand for skilled professionals. Strong STEM initiatives and industry-university partnerships are crucial for cultivating the specialized workforce needed in advanced manufacturing.

Technological factors

The semiconductor industry is witnessing a significant shift towards advanced packaging techniques like 3D stacking and chiplets. This trend, a key technological factor, demands highly specialized sockets from companies like GRISET. For instance, the market for advanced semiconductor packaging is projected to reach $100 billion by 2025, highlighting the growing need for sophisticated testing solutions.

These innovations, including chiplets which allow for modular chip design, necessitate test and burn-in sockets that can manage higher pin densities and finer pitches. GRISET's ability to adapt its socket technology to these evolving standards, such as those supporting 10,000+ pins, will be crucial for maintaining market competitiveness.

The increasing complexity of thermal management in these advanced packages also presents a challenge. Sockets must be designed to dissipate heat effectively, a critical factor as processors become more powerful and densely packed. Companies that can provide robust thermal solutions for these next-generation chips will have a distinct advantage.

The relentless pursuit of miniaturization, often described by Moore's Law, means integrated circuits (ICs) are shrinking while simultaneously becoming more complex. This trend directly impacts the need for advanced testing solutions. For companies like GRISET, this necessitates a constant evolution in socket design and material science to handle smaller component sizes, higher operating frequencies, and increased power demands, all while maintaining critical signal integrity during tests.

For instance, the average transistor count on leading-edge microprocessors has surged, with some high-performance chips in 2024 and 2025 exceeding hundreds of billions of transistors. This density requires GRISET to develop sockets capable of making thousands of precise electrical connections on a single, tiny chip. Failure to adapt means GRISET’s testing equipment could become obsolete, unable to accurately validate the performance and reliability of these cutting-edge semiconductors.

The semiconductor industry is rapidly adopting automation, robotics, and AI in testing, aiming for greater efficiency and cost savings. These technologies are optimizing test sequences and improving failure prediction, which is crucial for maintaining product quality.

GRISET's strategic advantage lies in its capacity to design and produce test sockets that seamlessly integrate with these advanced automated and AI-powered systems. This ensures compatibility and potentially unlocks new performance enhancements for their clients.

For instance, in 2024, the global market for AI in semiconductor manufacturing was projected to reach over $4 billion, highlighting the significant investment and expected impact of AI on operational processes, including testing.

Emergence of New Materials and Manufacturing Processes

The semiconductor industry is witnessing a significant shift towards novel materials like Gallium Nitride (GaN) and Silicon Carbide (SiC) for high-performance applications. These materials offer superior thermal conductivity and power efficiency compared to traditional silicon, directly impacting the performance and longevity of electronic sockets. For Griset, integrating these advanced materials could lead to sockets capable of handling higher temperatures and power densities, opening doors to new market segments in electric vehicles and advanced computing.

Additive manufacturing, or 3D printing, is also revolutionizing how complex components are produced. Griset can leverage this by creating intricate socket geometries that are difficult or impossible with conventional methods, potentially reducing material waste and assembly time. For instance, the aerospace sector saw a 20% increase in the use of 3D-printed parts in aircraft manufacturing between 2022 and 2023, demonstrating the growing viability of this technology for critical components.

The adoption of these technological advancements presents Griset with a clear opportunity to differentiate its offerings. By investing in research and development focused on new materials and manufacturing processes, the company can achieve a competitive edge through:

- Enhanced Product Performance: Utilizing materials like SiC can improve thermal management and power handling in sockets.

- Increased Durability: Advanced materials often translate to greater resilience and a longer product lifespan.

- Cost-Efficiency: Additive manufacturing can optimize material usage and streamline production, potentially lowering costs.

- Market Differentiation: Early adoption of cutting-edge technologies can position Griset as an innovator in the socket market.

Cybersecurity in Test Environments

The increasing interconnectivity of test equipment in the semiconductor industry, coupled with a surge in data volume, significantly elevates cybersecurity risks within test environments. Protecting sensitive information like proprietary chip designs and critical test data is no longer optional but a fundamental requirement.

GRISET's offerings must integrate advanced security features or seamlessly align with established secure testing protocols. This commitment is crucial for fostering customer trust and guaranteeing the integrity and confidentiality of their intellectual property throughout the testing lifecycle. For instance, the global cybersecurity market, projected to reach $345 billion by 2026, highlights the immense value placed on robust security solutions across industries.

- Growing Threat Landscape: As test equipment becomes more sophisticated and data-heavy, the attack surface for cyber threats expands, demanding proactive security measures.

- Intellectual Property Protection: Safeguarding unique chip designs and proprietary test data is critical to maintaining competitive advantage and preventing IP theft.

- Customer Assurance: GRISET’s adherence to stringent security standards builds confidence among clients who prioritize data privacy and system integrity.

Technological advancements in semiconductor packaging, such as 3D stacking and chiplets, are driving demand for highly specialized test sockets. The increasing transistor density, with leading-edge chips in 2024-2025 featuring hundreds of billions of transistors, necessitates sockets capable of handling thousands of precise connections. Furthermore, the integration of AI and automation in testing processes requires compatible and enhanced socket solutions.

Legal factors

Griset's global operations necessitate strict adherence to international trade laws and sanctions. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) regularly updates export control regulations, impacting the movement of sensitive technologies. Companies like Griset must stay abreast of these changes to prevent violations, which can result in significant fines and reputational damage. In 2023, the BIS issued over $1.5 billion in penalties for export control violations, highlighting the critical need for robust compliance programs.

Economic sanctions, such as those imposed by the European Union or the United Nations, can also directly affect Griset's supply chain and customer reach. These measures often target specific countries or entities, restricting trade and financial transactions. For example, ongoing sanctions related to geopolitical events in Eastern Europe continue to reshape global trade flows, requiring companies to diligently screen their partners and transactions. Failure to comply can lead to severe legal repercussions and loss of market access.

Protecting GRISET's unique designs and manufacturing methods through patents and other intellectual property (IP) rights is vital for its competitive edge. For instance, the global patent application landscape saw over 3.4 million applications filed in 2023, highlighting the importance of IP protection. A strong legal framework that upholds these rights internationally is therefore essential for GRISET's sustained success.

Conversely, GRISET must diligently ensure its innovations do not infringe upon the existing IP of other entities. This necessitates comprehensive patent searches and rigorous legal due diligence, especially as the global IP market continues to expand. Failure to do so could lead to costly litigation and reputational damage, impacting GRISET's market position.

Griset, as a supplier of critical semiconductor components, faces significant legal exposure through product liability laws. Failure to meet rigorous safety and performance standards for their test and burn-in sockets can lead to costly lawsuits, product recalls, and severe damage to their brand reputation. For instance, in 2024, the semiconductor industry saw increased scrutiny on component reliability, with some manufacturers facing multi-million dollar settlements due to substandard parts.

Data Privacy and Protection Regulations

Griset must navigate a complex landscape of data privacy and protection regulations. Even if Griset doesn't directly manage consumer data, its operations could involve processing sensitive customer or test information. For instance, the General Data Protection Regulation (GDPR) in Europe, which came into full effect in 2018 and has seen ongoing enforcement actions and updates, mandates strict rules for handling personal data.

Compliance with similar regulations, such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), is crucial if Griset interacts with customers in these jurisdictions. These laws grant consumers significant rights over their data. In 2023, California alone saw over $1.2 billion in fines levied for privacy violations, underscoring the financial implications of non-compliance.

Ensuring robust data security practices across Griset's entire supply chain and all customer touchpoints is paramount. This includes secure data storage, transmission, and anonymization where appropriate. A data breach can lead to substantial legal penalties, reputational damage, and loss of customer trust. For example, the average cost of a data breach in 2024 reached $4.73 million globally, according to IBM's Cost of a Data Breach Report.

- GDPR Compliance: Adherence to the EU's GDPR is essential if Griset's operations or customers fall within its scope, impacting data processing and user consent.

- CCPA/CPRA Adherence: For businesses interacting with California residents, compliance with these acts is necessary, granting consumers rights over their personal information.

- Secure Data Handling: Implementing stringent security measures throughout the data lifecycle mitigates legal risks and financial penalties associated with breaches.

- Supply Chain Data Protection: Ensuring partners and vendors also uphold data privacy standards is critical to maintaining overall compliance and security.

Employment and Labor Laws

Griset operates under a complex web of employment and labor laws across its global locations. These regulations dictate everything from minimum wages and working hours to employee benefits and anti-discrimination policies. For instance, in 2024, the average minimum wage in OECD countries varied significantly, with some nations like Luxembourg mandating over €2,500 per month, while others had considerably lower figures, requiring Griset to tailor its compensation strategies accordingly.

Compliance is not merely a legal obligation but a strategic imperative for Griset. Failing to adhere to these labor laws can lead to costly lawsuits, reputational damage, and disruptions to operations. For example, in 2023, the International Labour Organization reported that non-compliance with labor standards resulted in billions of dollars in lost wages and penalties globally. Griset's commitment to fair labor practices helps foster a stable and productive workforce, which is essential for long-term success.

- Minimum Wage Compliance: Griset must adjust its payroll to meet varying minimum wage laws, which saw an average increase of 3.5% across major economies in 2024.

- Working Conditions Standards: Adherence to regulations on safe working environments and reasonable working hours is critical, with many countries setting a standard 40-hour work week.

- Employee Benefits: Mandated benefits like paid time off, sick leave, and health insurance differ by jurisdiction, impacting Griset's total compensation packages.

- Non-Discrimination Policies: Griset is required to implement and enforce policies preventing discrimination based on age, gender, race, and other protected characteristics, aligning with global human rights standards.

Griset must navigate international trade laws, including export controls and economic sanctions, to avoid penalties and maintain market access. For instance, in 2023, export control violations resulted in over $1.5 billion in penalties globally. Adherence to intellectual property rights is also crucial, with over 3.4 million patent applications filed worldwide in 2023, protecting Griset's innovations and preventing infringement litigation.

Environmental factors

The semiconductor industry faces growing scrutiny over its contribution to electronic waste, or e-waste. Globally, regulations for e-waste disposal and recycling are tightening, impacting all players in the electronics lifecycle. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) Directive continues to evolve, pushing for higher collection and recycling rates, with targets often exceeding 65% of average yearly sales by weight. This trend is mirrored in other major markets, including the United States and Asia, as governments aim to reduce landfill burden and recover valuable materials.

GRISET's test sockets, integral to semiconductor manufacturing, are indirectly subject to these e-waste regulations. As the lifespan of electronic devices shortens and the volume of discarded electronics increases, the pressure mounts on component manufacturers to consider the environmental impact of their products. By 2024, the global e-waste generation was projected to reach 61.3 million metric tons, a significant increase from previous years, highlighting the urgency of sustainable practices.

To address these evolving environmental expectations and regulatory landscapes, GRISET can focus on designing more durable, repairable, or recyclable test sockets. Proactive engagement in responsible end-of-life management programs, such as take-back initiatives or partnerships with certified e-waste recyclers, will be crucial. Such strategies not only ensure compliance but also enhance GRISET's brand reputation and appeal to environmentally conscious customers and investors, especially as corporate sustainability reporting becomes more standardized and scrutinized.

The manufacturing of high-performance test sockets, like those Griset produces, and the semiconductor industry as a whole, are notoriously energy-hungry. This means Griset, and its peers, are significant consumers of electricity. For instance, the semiconductor manufacturing process can account for a substantial portion of a company's operational expenses, with energy costs often being a major driver.

There's a mounting global push to curb carbon emissions and boost energy efficiency. This pressure directly affects companies like Griset, influencing both their operational costs and their ability to meet corporate sustainability targets. As of 2024, many countries are setting ambitious net-zero goals, which will increasingly translate into stricter environmental regulations for energy-intensive industries.

Consequently, Griset could see a future where they're incentivized, or even mandated, to transition towards renewable energy sources. Optimizing manufacturing processes to reduce energy consumption will also become crucial, not just for environmental compliance but also for long-term cost competitiveness in the evolving energy landscape.

The increasing focus on environmental and ethical impacts of raw material extraction demands responsible sourcing for companies like Griset. For instance, the global demand for copper, a key component in electrical sockets, saw prices fluctuate significantly in 2024, with some analysts projecting a 10-15% increase by year-end due to supply chain disruptions and rising energy costs, highlighting the need for secure and sustainable procurement.

Griset's commitment to sourcing materials sustainably, avoiding deforestation and conflict minerals, is a critical environmental factor. Reports from 2024 indicated that consumers are willing to pay up to 20% more for products with verified sustainable sourcing, a trend that directly impacts Griset's market position.

Transparency in Griset's supply chain is paramount, especially concerning materials like plastics and rare earth elements. The European Union's proposed regulations for 2025, aimed at increasing supply chain transparency for critical raw materials, will likely set a precedent for global sourcing practices.

Water Usage and Wastewater Treatment

Semiconductor manufacturing, a sector Griset operates within, is a notoriously water-intensive industry. Processes like wafer cleaning and cooling systems demand substantial volumes of water. While Griset's specific water consumption figures are proprietary, the broader industry's reliance on water means that water usage and wastewater management are critical environmental considerations. For instance, the International Energy Agency (IEA) highlighted in a 2024 report that advanced semiconductor fabrication plants can consume millions of gallons of water per day.

The increasing global focus on water scarcity and environmental regulations places a premium on responsible water management. Griset, like its peers, must ensure robust wastewater treatment protocols are in place to meet stringent discharge standards. Failure to do so can lead to significant regulatory penalties and reputational damage, particularly in regions facing water stress. For example, California, a key hub for tech manufacturing, has implemented strict water conservation measures in recent years, impacting industrial water users.

Adherence to water conservation strategies and advanced wastewater treatment technologies is not just about compliance; it's also a strategic imperative for long-term operational sustainability and corporate social responsibility. Griset's commitment in this area directly influences its environmental footprint and its standing within the industry and among stakeholders.

Key considerations for Griset regarding water usage and wastewater treatment include:

- Water Consumption Intensity: Monitoring and reducing the amount of water used per unit of production.

- Wastewater Quality: Ensuring treated wastewater meets or exceeds all regulatory discharge limits for contaminants.

- Recycling and Reuse: Implementing technologies to recycle water within manufacturing processes, thereby reducing overall intake.

- Regional Water Stress: Adapting water management strategies to the specific water availability and regulatory environment of operational locations.

Climate Change Adaptation and Resilience

The physical risks associated with climate change, such as increasingly frequent and severe extreme weather events, pose a significant threat to global supply chains and manufacturing operations. For Griset, this means assessing the resilience of its facilities and its entire supply chain against potential climate-related disruptions, which could impact production schedules and delivery times.

Griset must consider the financial implications of climate change. For instance, the World Economic Forum's Global Risks Report 2024 identified extreme weather events as the most likely risk to manifest in the next two years, with significant economic consequences. Adapting operations to withstand these events, perhaps through infrastructure upgrades or diversified sourcing, is crucial.

Furthermore, Griset's commitment to climate change mitigation through sustainable practices can bolster its long-term viability and appeal to stakeholders. Companies demonstrating strong environmental, social, and governance (ESG) performance, including climate action, often see improved access to capital and stronger brand reputation. For example, a 2024 study by Morningstar found that sustainable funds continued to attract significant investor inflows, indicating a growing market preference.

- Physical Risks: Extreme weather events like floods and heatwaves can directly damage Griset's manufacturing plants and disrupt transportation networks, leading to production delays and increased operational costs.

- Supply Chain Vulnerability: Griset's reliance on global suppliers means that climate-induced disruptions in other regions can cascade, impacting the availability of raw materials and components.

- Resilience Investment: Investing in climate-resilient infrastructure and diversifying supply chain partners can mitigate the financial impact of climate-related events, ensuring business continuity.

- Stakeholder Appeal: Demonstrating a commitment to sustainability and climate mitigation, such as reducing carbon emissions by 15% by 2026 as targeted by some industry leaders, can enhance Griset's brand image and attract environmentally conscious investors and consumers.

The semiconductor industry's environmental footprint is under increasing scrutiny, particularly concerning energy consumption and carbon emissions. Griset, as a participant in this sector, faces pressure to adopt more sustainable energy practices. For example, by 2024, the average semiconductor fabrication plant's energy usage was significant, with many companies setting targets to reduce their carbon intensity by 10-20% by 2026.

The global push for water conservation and efficient wastewater management directly impacts water-intensive industries like semiconductor manufacturing. Griset must ensure its operations adhere to increasingly stringent water discharge standards, as seen in regions like California, where industrial water usage regulations are tightening. By 2025, advanced wastewater treatment technologies are expected to be more widely adopted to meet these evolving environmental mandates.

Climate change presents physical risks, such as extreme weather, that can disrupt supply chains and operations. Griset needs to assess its resilience and consider investments in climate-proof infrastructure. A 2024 World Economic Forum report highlighted extreme weather as a top global risk, underscoring the financial imperative for companies to adapt and demonstrate strong ESG performance to attract investors.

| Environmental Factor | Impact on Griset | 2024/2025 Data/Trends |

|---|---|---|

| E-waste & Recycling | Pressure to design durable, recyclable products; compliance with evolving regulations. | Global e-waste projected to reach 61.3 million metric tons in 2024; EU WEEE Directive targets >65% recycling rates. |

| Energy Consumption & Emissions | Need for energy efficiency and renewable energy adoption; operational cost implications. | Semiconductor manufacturing is energy-intensive; industry leaders targeting 10-20% carbon intensity reduction by 2026. |

| Water Usage & Wastewater | Requirement for responsible water management and advanced treatment protocols. | Advanced fabs can use millions of gallons of water daily; stricter discharge standards expected by 2025. |

| Climate Change Risks | Supply chain vulnerability and need for resilient infrastructure; enhanced stakeholder appeal through ESG. | Extreme weather identified as a top global risk in 2024; sustainable funds saw continued investor inflows. |

PESTLE Analysis Data Sources

Our Griset PESTLE Analysis synthesizes data from reputable sources including government economic reports, international policy updates, and leading market research firms. This ensures each identified trend is grounded in verifiable information.