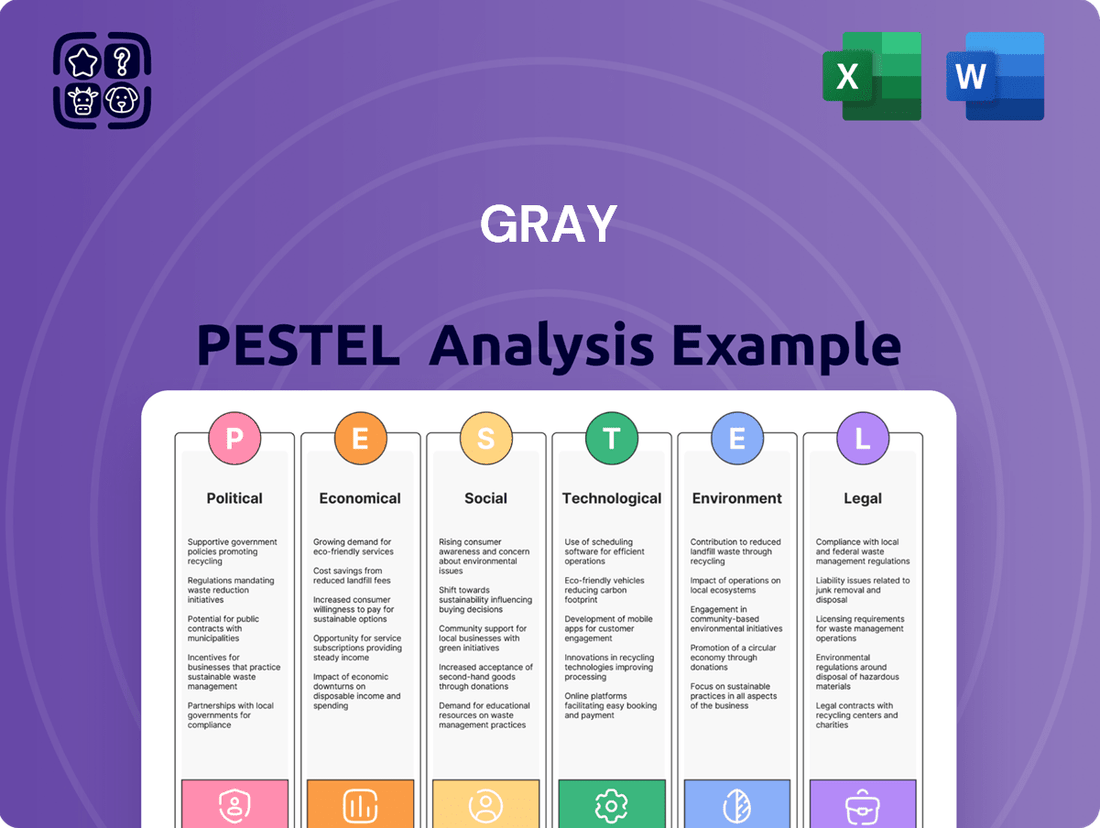

Gray PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gray Bundle

Unlock the secrets to Gray's market position with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces shaping its trajectory. This expertly crafted report provides actionable insights to inform your strategic decisions. Download the full version now and gain a critical competitive advantage.

Political factors

Government infrastructure spending is a significant driver for construction firms like Gray. Increased investment in projects such as roads, bridges, and public utilities directly boosts demand for large-scale construction services. For instance, the U.S. Infrastructure Investment and Jobs Act, enacted in 2021, allocates over $1 trillion towards these areas, with a substantial portion dedicated to transportation and utilities. This legislation is expected to fuel significant project pipelines through 2025 and beyond, creating substantial opportunities for companies with the expertise to handle complex industrial and commercial builds.

Regulatory stability is a cornerstone for businesses, especially in sectors like construction and manufacturing where zoning, building codes, and environmental permits are paramount. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent regulations on industrial emissions, impacting operational costs and investment decisions for many companies.

Shifting political priorities can dramatically reshape market dynamics. A notable trend in 2024 has been the increased government focus on energy security and domestic manufacturing, leading to substantial incentives for renewable energy projects and reshoring initiatives. This has created new opportunities in sectors like solar panel production and advanced manufacturing, while potentially increasing competition for businesses reliant on imported components.

Businesses need to stay agile, monitoring legislative developments and policy shifts to effectively adapt. For example, the Inflation Reduction Act in the U.S., with its significant investments in clean energy, has already spurred billions in new manufacturing capacity, demonstrating the direct impact of policy on market growth and strategic planning.

Trade policies and tariffs significantly shape the construction landscape. For instance, the imposition of tariffs on imported steel and aluminum, as seen in various global markets during 2024, directly increases material costs. This can add millions to large-scale infrastructure projects, potentially delaying critical development.

Protectionist measures, like those potentially enacted by governments aiming to boost domestic manufacturing in 2025, could favor local suppliers of building materials. Conversely, trade agreements that reduce barriers might allow companies like Gray Construction to source specialized equipment more affordably from international markets, fostering greater efficiency.

Political Stability and Geopolitical Risks

Political stability is a cornerstone for any investment. Regions with stable governments and predictable policy environments tend to attract more capital. Conversely, unstable political landscapes can lead to significant disruptions.

Geopolitical risks, such as international disputes or regional conflicts, directly impact business operations. For instance, the ongoing geopolitical tensions in Eastern Europe have led to supply chain disruptions and increased energy costs globally. In 2024, the World Bank’s Ease of Doing Business report, while not directly measuring political stability, often reflects its impact through indicators like regulatory quality and the rule of law, which are crucial for investor confidence.

- Impact on Investment: Political instability can deter foreign direct investment (FDI) by increasing perceived risk.

- Supply Chain Disruptions: Geopolitical events can interrupt the flow of goods and raw materials, escalating costs.

- Regulatory Uncertainty: Frequent changes in government or policy can create an unpredictable operating environment.

- Project Viability: The feasibility of long-term projects is heavily influenced by the political outlook of the host country.

Government Incentives for Industry Growth

Government incentives play a crucial role in shaping construction activity. For instance, the Inflation Reduction Act of 2022 in the United States offers significant tax credits for renewable energy projects, including those for construction, spurring demand for sustainable building practices. These incentives can directly influence a design-build firm's project pipeline by making specific ventures more economically viable for clients.

Staying abreast of these programs is paramount for strategic business development. In 2024, many governments are continuing or expanding programs that support key industries.

- Tax Credits: Incentives like the Investment Tax Credit (ITC) for solar energy projects, which can cover a substantial portion of project costs, directly boost construction demand.

- Grants: Funding programs for advanced manufacturing, such as those supported by the CHIPS and Science Act, can subsidize the construction of new facilities.

- Subsidies: Agricultural subsidies can encourage investment in modern food processing plants, driving construction in that sector.

- Infrastructure Spending: Government commitments to infrastructure upgrades, like the Bipartisan Infrastructure Law, create broad opportunities across various construction specializations.

Political factors significantly influence Gray's operational landscape, from government spending on infrastructure to regulatory frameworks. Shifting political priorities, like the 2024 focus on energy security and domestic manufacturing, directly create new market opportunities and competitive pressures. Furthermore, trade policies and tariffs, such as those on steel and aluminum in 2024, directly impact material costs for large-scale projects, underscoring the need for constant monitoring of legislative developments.

What is included in the product

The Gray PESTLE Analysis systematically examines external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—to understand their specific impact on the Gray.

The Gray PESTLE Analysis provides a structured framework that simplifies complex external factors, easing the burden of comprehensive market research and strategic planning.

Economic factors

Overall economic growth, reflected in Gross Domestic Product (GDP) trends, is a critical driver for Gray Construction. A healthy GDP, such as the projected 2.1% growth for the US in 2024 according to the Congressional Budget Office, typically fuels increased capital expenditure by businesses. This heightened investment often translates directly into more construction projects as companies expand operations.

Sectors vital to Gray Construction, like manufacturing and distribution, tend to flourish during periods of economic expansion. For instance, the US manufacturing sector saw a 0.2% increase in industrial production in April 2024, indicating a stable, albeit moderate, expansion. This growth supports demand for new facilities and infrastructure.

Conversely, economic downturns pose significant risks. A slowdown in GDP growth, or a contraction, can lead to project delays or outright cancellations as businesses re-evaluate their spending and investment plans. For example, if the projected 2.1% US GDP growth for 2024 were to falter, Gray Construction would likely face reduced project pipelines.

Interest rate fluctuations directly affect the cost of borrowing, impacting developers' and clients' capacity for significant construction projects. For instance, the Federal Reserve's benchmark interest rate stood at 5.25%-5.50% as of early 2024, a level that increases the expense of securing loans for new commercial and industrial builds.

When borrowing becomes more costly due to elevated interest rates, investment in new facilities can decelerate. This is because the return on investment must now overcome a higher financing hurdle, potentially making projects less attractive or even unfeasible.

Affordable access to capital is a cornerstone for stimulating new construction in the commercial and industrial sectors. Without it, the pipeline for new development can shrink, impacting economic growth and job creation.

Rising inflation, especially for key construction materials like steel and concrete, presents a significant challenge. For instance, the Producer Price Index for construction materials saw a notable increase in late 2024 and early 2025, impacting project budgets. This surge directly translates to higher operational expenses for Gray Construction, potentially squeezing profit margins if these costs aren't effectively passed on or hedged.

Supply chain disruptions, a persistent issue since 2022, continue to amplify these inflationary pressures. The cost of energy, a critical input for transportation and manufacturing, remains volatile. Gray Construction must therefore prioritize robust procurement strategies and accurate cost estimation to navigate this unpredictable environment and safeguard project profitability.

Labor Market Conditions and Wages

The availability and cost of skilled labor are paramount economic considerations for the construction sector. A constricted labor market often translates to heightened wage expectations, which can strain project budgets and introduce delays stemming from worker scarcity. For instance, in the US, construction unemployment rates hovered around 3.8% in early 2024, indicating a relatively tight market.

Firms are compelled to prioritize investments in workforce development and implement effective retention strategies to navigate these economic challenges. This proactive approach is essential for mitigating the impact of rising labor costs and ensuring project continuity. For example, many construction companies are increasing their training budgets and offering competitive benefits packages to attract and keep talent.

- Skilled Labor Availability: A shortage of skilled tradespeople can significantly impact project timelines and costs.

- Wage Growth: Rising wage demands in a tight labor market directly affect construction project budgets.

- Workforce Development: Investing in training and upskilling programs is crucial for addressing labor shortages and improving productivity.

- Retention Strategies: Offering competitive compensation, benefits, and a positive work environment helps retain skilled workers.

Client Industry Sector Performance

The economic performance of Gray Construction's key client sectors—food and beverage, manufacturing, and distribution—is a critical driver of demand. For instance, the U.S. manufacturing sector saw its industrial production index rise by 0.4% in April 2024 compared to the previous month, indicating a potential uptick in capital expenditure for facility upgrades or expansions. Similarly, consumer spending trends in the food and beverage industry, which saw retail sales increase by 1.1% year-over-year in Q1 2024, directly influence investment in new processing and distribution centers.

Growth in these sectors, fueled by factors like increased consumer spending and technological innovation, directly translates into opportunities for Gray Construction. For example, advancements in automation within manufacturing often necessitate the construction of new, specialized facilities. Monitoring sector-specific economic indicators is therefore paramount for accurate market forecasting and strategic planning.

- Food & Beverage Sector: Continued growth in demand for processed and packaged foods, driven by changing consumer preferences and population growth, is expected to support investment in new production and cold storage facilities.

- Manufacturing Sector: Reshoring initiatives and increased investment in advanced manufacturing technologies are likely to spur demand for new, modernized industrial facilities and distribution hubs.

- Distribution Sector: The ongoing expansion of e-commerce continues to drive the need for larger, more sophisticated warehouses and logistics centers, particularly those incorporating automation and advanced inventory management systems.

Economic growth, as measured by GDP, directly impacts Gray Construction's project pipeline. The Congressional Budget Office projected US GDP growth at 2.1% for 2024, signaling potential for increased business investment and construction demand. This expansion supports sectors like manufacturing, which saw industrial production rise by 0.2% in April 2024, indicating a need for new facilities.

Interest rates significantly influence the cost of capital for construction projects. With the Federal Reserve's benchmark rate at 5.25%-5.50% in early 2024, higher borrowing costs can deter new builds. Inflation, particularly for materials, also strains budgets, as seen in producer price index increases for construction inputs in late 2024 and early 2025, necessitating careful cost management.

The availability of skilled labor remains a critical economic factor, with US construction unemployment rates around 3.8% in early 2024 indicating a tight market. This scarcity drives wage growth and emphasizes the need for workforce development and retention strategies to maintain project timelines and control costs.

| Economic Indicator | Value/Trend (2024-2025) | Impact on Gray Construction |

|---|---|---|

| US GDP Growth Projection | 2.1% (CBO, 2024) | Drives demand for new capital expenditure and construction projects. |

| US Industrial Production (Manufacturing) | +0.2% (April 2024) | Indicates stable expansion, supporting demand for industrial facilities. |

| Federal Reserve Benchmark Interest Rate | 5.25%-5.50% (Early 2024) | Increases borrowing costs, potentially slowing investment in new builds. |

| Construction Unemployment Rate (US) | ~3.8% (Early 2024) | Signifies a tight labor market, leading to wage pressures and potential delays. |

Preview Before You Purchase

Gray PESTLE Analysis

The preview you see here is the exact Gray PESTLE Analysis document you'll receive after purchase, fully formatted and ready to use.

This is a real representation of the product you're buying—delivered exactly as shown, ensuring no surprises for your strategic planning needs.

The content and structure shown in this preview is the same comprehensive Gray PESTLE Analysis you’ll download after payment, providing immediate insights.

Sociological factors

The construction sector faces a significant hurdle with an aging workforce, as many experienced tradespeople are nearing retirement. This demographic shift, coupled with a declining interest in skilled trades among younger generations, creates a widening skill gap. For instance, in the US, the Bureau of Labor Statistics projected a need for 500,000 additional construction workers annually between 2020 and 2029 to meet demand, highlighting the urgency of this issue.

To counter this, Gray Construction must prioritize robust training initiatives, including apprenticeships and partnerships with vocational schools. These programs are vital for developing a pipeline of skilled labor capable of meeting future project demands. Investing in employee development not only addresses skill shortages but also enhances retention rates, a key factor in maintaining a stable and productive workforce.

Societal expectations for health and safety in construction are rising, fueled by increased public awareness and regulatory oversight. For instance, in 2024, the Occupational Safety and Health Administration (OSHA) continued to emphasize robust safety protocols, with a focus on fall protection and hazard communication, reflecting a growing demand for safer work environments.

Meeting and surpassing these evolving health and safety benchmarks is crucial for a construction firm's reputation and its ability to recruit skilled workers. Companies demonstrating a commitment to safety often see lower insurance premiums and fewer project delays, contributing to overall profitability.

Cultivating a strong safety culture is therefore essential in the design-build sector. This involves not just compliance but proactive measures, with many leading firms in 2025 investing heavily in advanced safety training and technology, such as AI-powered hazard detection systems, to proactively mitigate risks.

Public perception and community support are now critical for major construction projects, particularly those affecting local areas. For instance, in 2024, projects facing significant community opposition experienced an average delay of 6-12 months, translating to millions in additional costs.

Proactive engagement, addressing local concerns like noise pollution or traffic disruption, and showcasing social responsibility can smooth the path to project approval. Companies that invested in community outreach programs in 2024 reported a 20% reduction in project delays due to public opposition.

Building trust and demonstrating a commitment to local well-being can foster a social license to operate, mitigating potential roadblocks. A study of infrastructure projects completed between 2023 and early 2025 revealed that those with strong community backing were 30% more likely to stay within budget and on schedule.

Consumer Trends in Food & Beverage and Manufacturing

Consumer preferences are rapidly evolving, with a significant surge in demand for sustainable and ethically sourced food and beverage products. For instance, a 2024 report indicated that over 60% of consumers consider sustainability when making purchasing decisions, directly impacting the design of food processing and distribution centers to accommodate eco-friendly materials and energy-efficient operations.

The convenience offered by e-commerce is also reshaping the industry. The global online grocery market is projected to reach $2.3 trillion by 2027, necessitating the construction of advanced fulfillment centers equipped with automation and specialized temperature-controlled storage to handle increased online orders and faster delivery times.

Furthermore, a growing interest in locally sourced goods means that facilities may need to be strategically located closer to agricultural hubs or designed for flexible production to accommodate smaller, regional supply chains. This shift requires adaptable building designs that can support diverse operational models.

- Sustainable Demand: Over 60% of consumers prioritize sustainability in food purchases (2024 data).

- E-commerce Growth: Online grocery market expected to hit $2.3 trillion by 2027.

- Local Sourcing: Increased consumer interest in regional products influences facility location and flexibility.

Changing Work Lifestyles and Facility Design

The modern workplace is shifting dramatically, with a growing emphasis on employee well-being and flexible work arrangements. This evolution is directly impacting how manufacturing and office facilities are designed, moving towards spaces that foster collaboration and comfort. For instance, a 2024 survey indicated that 78% of employees believe a comfortable work environment boosts productivity, and 65% prefer hybrid work models. Gray Construction's ability to integrate these contemporary needs, such as incorporating biophilic design elements or creating adaptable co-working zones, becomes a key differentiator.

These changing work lifestyles necessitate a facility design that supports not just operational efficiency but also the human element. Features promoting employee health, like ample natural light and ergonomic workstations, are becoming standard expectations. A report from early 2025 highlighted that companies investing in enhanced employee amenities saw a 15% reduction in staff turnover. Therefore, Gray Construction's design expertise must be attuned to these demands, ensuring facilities are attractive, functional, and supportive of a modern workforce.

- Increased Demand for Flexible Workspaces: By 2025, an estimated 60% of companies are expected to offer hybrid work options, requiring adaptable office layouts.

- Focus on Employee Well-being: Investment in wellness amenities, such as on-site fitness centers or quiet zones, is projected to grow by 20% in new construction projects by late 2024.

- Sustainability as a Core Design Principle: Over 70% of businesses now prioritize LEED certification or similar green building standards for new facilities, driven by both environmental concerns and employee preference.

- Integration of Smart Technology: Facilities are increasingly designed to incorporate smart building technology for optimized energy use and enhanced employee experience, with adoption rates climbing steadily.

Societal expectations are increasingly shaping construction, from the demand for safer work environments to the need for community engagement. For instance, in 2024, projects with strong community backing were 30% more likely to stay on schedule. Furthermore, evolving consumer preferences, like the demand for sustainable products, are influencing facility design, with over 60% of consumers considering sustainability in 2024.

The modern workforce's desire for well-being and flexibility is also a significant sociological factor. By 2025, an estimated 60% of companies are expected to offer hybrid work options, necessitating adaptable office layouts. Companies investing in enhanced employee amenities saw a 15% reduction in staff turnover in early 2025.

The aging workforce in construction, coupled with less interest from younger generations, presents a critical skill gap. The US Bureau of Labor Statistics projected a need for 500,000 additional construction workers annually between 2020 and 2029.

Technological factors

The construction industry is seeing a major shift with automation and robotics. Think about prefabrication – building parts of a project off-site in a factory. Robotics are making these components with incredible accuracy. Then, on-site, automated systems are helping with tasks like bricklaying and even drone-based surveying, which can speed things up and reduce errors. For example, in 2024, the global construction robotics market was valued at around $2.5 billion and is projected to grow significantly. This means projects can be completed faster and with fewer safety incidents.

Embracing these advancements directly impacts the bottom line. Automating repetitive or dangerous tasks, like working at heights or heavy lifting, not only cuts down on labor costs but also drastically improves worker safety. Studies in 2024 indicated a potential reduction in project completion times by up to 20% through the strategic use of automation. Gray Construction can capitalize on this by integrating these technologies to deliver projects more efficiently and cost-effectively, while also enhancing the quality of their finished work.

The increasing integration of digital design and Building Information Modeling (BIM) is revolutionizing the construction industry. By 2024, over 70% of construction projects in the UK are expected to utilize BIM to some degree, a significant jump from previous years. This technology fosters a more collaborative environment, allowing for better visualization and planning from the outset.

BIM's capabilities in clash detection and cost estimation are proving invaluable. Studies in 2023 indicated that BIM implementation can reduce project costs by up to 10% through early problem identification and more accurate budgeting. This directly supports Gray Construction's design-build model, ensuring greater efficiency and predictability.

Data analytics is revolutionizing project management by enabling real-time monitoring of performance and the prediction of potential issues, leading to optimized construction processes. For instance, in 2024, construction firms are increasingly adopting AI-powered platforms that analyze vast datasets to forecast delays and cost overruns, improving project delivery timelines.

Predictive maintenance, powered by IoT sensors and advanced analytics, is also a growing trend. This approach anticipates equipment failures before they occur, minimizing downtime and maintenance costs. By 2025, it's projected that the global predictive maintenance market will reach over $20 billion, highlighting its significant value proposition for long-term operational efficiency.

Leveraging these data-driven insights allows for more informed decision-making across all project phases. Companies that effectively integrate data analytics and predictive maintenance are seeing tangible benefits, including an estimated 15-20% reduction in operational costs and a significant improvement in asset lifespan, as reported by industry surveys in late 2024.

Emerging Materials and Sustainable Construction Technologies

Innovation in construction materials is rapidly transforming the industry. For instance, self-healing concrete, which can repair its own cracks, is gaining traction, potentially extending building lifespans and reducing maintenance costs. Advanced insulation materials are also crucial for energy efficiency, with some new products offering R-values significantly higher than traditional options, contributing to lower operational expenses for buildings.

New construction methods are equally impactful. Modular and prefabrication techniques are streamlining project delivery and minimizing waste. In 2024, the global modular construction market was valued at approximately USD 100 billion and is projected to grow substantially, indicating a strong industry shift towards these efficient building strategies. These methods can reduce project timelines by up to 30% and cut waste by as much as 90% compared to traditional on-site construction.

Gray Construction can capitalize on these technological advancements. Integrating innovative materials and methods into their design-build solutions can lead to more sustainable, durable, and cost-effective projects. This strategic adoption positions the company to meet growing client demand for green building practices and efficient construction processes.

- Self-healing concrete is projected to reduce lifetime maintenance costs by up to 20% in certain applications.

- Advanced insulation technologies can improve building energy efficiency by as much as 40%, leading to significant operational savings.

- The global modular construction market is expected to reach over USD 150 billion by 2028, highlighting a robust growth trend.

- Prefabrication can reduce construction waste by up to 90%, aligning with increasing environmental regulations and corporate sustainability goals.

Cybersecurity and Data Protection in Project Management

As project management increasingly moves online and relies on shared digital tools, strong cybersecurity is no longer optional. Protecting sensitive project information, proprietary designs, and the smooth running of operations is paramount. This digital shift means that safeguarding data and ensuring systems can withstand threats are crucial for keeping clients confident and avoiding expensive data breaches.

The complexity of modern projects, often involving multiple interconnected systems and global teams, amplifies these risks. A breach in one area can have cascading effects, impacting timelines, budgets, and the overall success of the venture. For instance, a 2024 report indicated that the average cost of a data breach in the technology sector reached $5.5 million, highlighting the significant financial implications of inadequate cybersecurity.

Key technological factors influencing cybersecurity in project management include:

- Adoption of advanced encryption standards: Implementing robust encryption for data at rest and in transit is vital.

- Regular vulnerability assessments and penetration testing: Proactively identifying and addressing security weaknesses in project platforms and networks.

- Employee training and awareness programs: Educating project teams on phishing, social engineering, and secure data handling practices.

- Implementation of multi-factor authentication (MFA): Adding an extra layer of security to access project management systems and sensitive files.

Technological advancements are fundamentally reshaping construction, driving efficiency and innovation. Automation and robotics, from prefabrication to on-site tasks like bricklaying, are becoming mainstream. By 2024, the global construction robotics market was valued at approximately $2.5 billion, with significant growth anticipated. This technological integration promises faster project completion and enhanced worker safety.

Digital tools like Building Information Modeling (BIM) are also transforming project planning and execution. In 2024, over 70% of UK construction projects were expected to use BIM, fostering collaboration and enabling early clash detection. This technology can reduce project costs by up to 10% through better problem identification and more accurate budgeting, as indicated by 2023 studies.

Data analytics and AI are increasingly used for real-time project monitoring and issue prediction, optimizing construction processes. Predictive maintenance, leveraging IoT sensors, is also on the rise, aiming to minimize equipment downtime. The global predictive maintenance market is projected to exceed $20 billion by 2025, underscoring its value for operational efficiency.

Innovations in materials, such as self-healing concrete and advanced insulation, are improving building durability and energy efficiency. Modular and prefabrication methods are also gaining traction, with the global modular construction market valued at around USD 100 billion in 2024. These methods can significantly reduce project timelines and waste.

| Technology Area | Key Advancement | 2024/2025 Impact/Projection | Benefit |

| Automation & Robotics | On-site bricklaying robots, drone surveying | Construction robotics market ~$2.5B (2024) | Increased speed, accuracy, reduced labor costs, improved safety |

| Digital Design | Building Information Modeling (BIM) | >70% UK projects using BIM (2024) | Enhanced collaboration, reduced clashes, up to 10% cost savings (2023) |

| Data Analytics & AI | AI for delay prediction, IoT for predictive maintenance | Predictive maintenance market >$20B (2025) | Optimized processes, minimized downtime, improved decision-making |

| Materials & Methods | Self-healing concrete, modular construction | Modular construction market ~$100B (2024) | Increased durability, energy efficiency, reduced waste and timelines |

Legal factors

Adherence to local, state, and federal building codes, zoning laws, and land-use regulations is fundamental to any construction project, impacting everything from structural integrity to environmental considerations. For instance, in 2024, the International Code Council (ICC) continued to update its model codes, with significant revisions expected in the 2027 cycle, influencing energy efficiency and seismic resistance standards nationwide.

These regulations dictate crucial aspects like building materials, safety features, occupancy limits, and environmental impact assessments, directly affecting project feasibility and cost. Gray Construction’s ability to successfully navigate these complex legal frameworks is critical for ensuring compliance and avoiding costly delays or penalties, which can amount to millions in lost revenue and fines.

Environmental protection laws significantly shape construction. Regulations on emissions, waste, water use, and land disturbance necessitate thorough permitting. For instance, in 2024, the EPA continued to enforce stringent standards under the Clean Air Act, with significant penalties for non-compliance impacting project timelines and budgets.

Compliance with statutes like the Clean Water Act and endangered species legislation is paramount for securing project approvals. Gray Construction must navigate these complex legal frameworks to ensure all undertakings meet or exceed these environmental mandates, which can add considerable time and cost to development cycles.

Compliance with Occupational Safety and Health Administration (OSHA) standards is critical in construction. In 2023, OSHA reported over 1,100 worker fatalities in construction, highlighting the ongoing need for stringent safety measures. Adherence to regulations like fall protection and proper equipment use directly impacts a company's legal standing and operational costs.

Labor Laws and Employment Regulations

Labor laws concerning wages, working hours, employee benefits, and union relations are critical for human resource management and directly influence operational costs. In 2024, the average hourly wage for production and non-supervisory employees in the US manufacturing sector was around $24.00, with overtime pay mandated for hours exceeding 40 per week, impacting labor expenses significantly.

Compliance with these regulations, including non-discrimination statutes and evolving labor legislation, is paramount to avoid costly legal disputes and maintain a stable workforce. For instance, the Equal Employment Opportunity Commission (EEOC) reported over 60,000 private sector charges of employment discrimination in 2023, highlighting the importance of adherence.

Navigating collective bargaining agreements, which are common in many industries, adds another layer of complexity. For example, unionized workforces often have specific provisions regarding work assignments, grievance procedures, and wage scales that differ from non-unionized environments, requiring careful management.

Key areas of labor law impacting businesses include:

- Minimum Wage and Overtime: Adherence to federal and state minimum wage laws, such as the Fair Labor Standards Act (FLSA), and ensuring proper overtime compensation.

- Employee Benefits: Compliance with regulations governing health insurance (e.g., Affordable Care Act), retirement plans (e.g., ERISA), and paid time off.

- Union Relations: Understanding and engaging with labor unions through collective bargaining, addressing issues like union organizing and unfair labor practices.

- Workplace Safety and Health: Meeting Occupational Safety and Health Administration (OSHA) standards to ensure a safe working environment.

Contract Law and Dispute Resolution

Contract law is foundational in construction, dictating everything from client agreements to supplier terms. In 2023, the U.S. construction industry saw a significant number of contract disputes, with payment disputes being the most common, affecting an estimated 30% of projects. Gray Construction’s legal framework must ensure clarity in all contractual obligations to mitigate these risks.

Effective dispute resolution is paramount. In 2024, alternative dispute resolution methods like mediation and arbitration continue to be favored over costly litigation, with studies showing they can resolve disputes up to 50% faster. Gray Construction’s strategy includes robust internal processes and readily available external expertise to navigate disagreements efficiently.

- Contractual Clarity: Ensuring all agreements, from client contracts to subcontracts, are meticulously drafted to prevent ambiguity.

- Risk Management: Proactively identifying and mitigating contractual risks inherent in construction projects.

- Dispute Resolution: Implementing efficient mechanisms for resolving conflicts to minimize delays and costs.

- Compliance: Adhering strictly to all relevant contract laws and regulations in the jurisdictions where Gray Construction operates.

Legal factors are critical for construction operations, encompassing building codes, environmental regulations, and labor laws. For instance, in 2024, the U.S. Department of Labor announced updates to overtime pay rules, impacting wage structures for many construction roles. Adherence to these evolving legal landscapes is essential for compliance and operational continuity.

Contract law, particularly regarding payment disputes, remains a significant area of concern in the construction sector. In 2023, an estimated 30% of construction projects experienced payment-related disputes, underscoring the need for clear contractual agreements and effective resolution strategies. Gray Construction prioritizes meticulous contract drafting and alternative dispute resolution methods to mitigate these risks.

Workplace safety is heavily regulated, with OSHA standards being paramount. In 2023, construction saw over 1,100 worker fatalities, highlighting the critical need for strict adherence to safety protocols like fall protection. Non-compliance can lead to substantial fines and legal liabilities, impacting project budgets and company reputation.

Environmental laws, such as those governing emissions and water usage, necessitate thorough permitting processes. The EPA's continued enforcement of the Clean Air Act in 2024 means that projects must demonstrate compliance to avoid significant penalties, which can add millions to project costs and cause delays.

Environmental factors

Climate change is driving more frequent and intense extreme weather. This means buildings and infrastructure must be designed to withstand floods, high winds, and temperature swings. For Gray Construction, this translates to careful material selection and robust structural planning to ensure resilience.

The construction industry is seeing a significant uptick in demand for sustainable building practices, with certifications like LEED and BREEAM becoming key differentiators. This trend directly impacts design, material selection, and how waste is handled on projects. For instance, the U.S. Green Building Council reported that over 100,000 LEED certifications were active globally by the end of 2023, indicating strong market adoption.

Clients are now actively seeking buildings that are not only energy-efficient but also contribute to lower carbon emissions and provide healthier living or working spaces. This shift means that companies like Gray Construction can leverage their expertise in sustainable design-build solutions to capture a larger market share. The global green building market was valued at over $2.5 trillion in 2023 and is projected to grow substantially in the coming years.

Growing concerns about resource depletion are pushing the construction industry towards greater material efficiency and the adoption of circular economy principles. This means a focus on recycled content, designing for easier deconstruction, and minimizing waste throughout a project's life. For instance, the European Union aims for a 70% recycling rate for construction and demolition waste by 2030, a significant driver for innovation.

Waste Management and Pollution Control

Environmental regulations concerning construction waste and pollution are becoming increasingly strict, driven by heightened public awareness. This means companies must develop robust strategies for managing everything from waste generation and disposal to controlling air, water, and noise pollution. For instance, in the European Union, the Circular Economy Action Plan aims to reduce construction and demolition waste by 30% by 2030, pushing for more recycling and reuse.

To stay compliant and demonstrate corporate responsibility, firms need to actively implement waste reduction, recycling, and pollution control measures. This isn't just about meeting legal requirements; it's about building a sustainable business model. Many companies are now investing in technologies that enable on-site waste sorting and recycling, significantly cutting down landfill volumes. The global construction waste management market was valued at approximately $150 billion in 2023 and is projected to grow, indicating a strong economic incentive for effective practices.

- Regulatory Landscape: Expect continued tightening of environmental laws, with a focus on landfill diversion and emission standards for construction activities.

- Public Scrutiny: Growing environmental consciousness means companies face more public pressure to adopt sustainable waste and pollution practices.

- Technological Advancements: Innovations in waste processing, recycling, and pollution abatement technologies are becoming essential for compliance and efficiency.

- Economic Impact: Effective waste management can lead to cost savings through material reuse and reduced disposal fees, while also enhancing brand reputation.

Biodiversity and Land Use Impacts

Construction's footprint on biodiversity and land use is substantial. Projects can disrupt local ecosystems, impacting plant and animal life. For instance, in 2024, a major infrastructure project in the UK faced scrutiny over its potential impact on protected species, highlighting the need for rigorous environmental impact assessments.

Meeting legal and social demands for environmental stewardship is paramount. Gray Construction must integrate environmental impact assessments and robust mitigation strategies into every phase of its operations. This includes minimizing habitat disruption and safeguarding natural resources, a growing expectation from stakeholders and regulators alike.

Responsible land development is a core consideration. This involves careful planning to reduce habitat fragmentation and protect biodiversity hotspots. For example, by 2025, many construction firms are adopting advanced GIS mapping to identify and protect ecologically sensitive areas, ensuring that development proceeds with minimal negative environmental consequences.

- Habitat Preservation: Implementing strategies to protect and restore natural habitats affected by construction.

- Resource Management: Ensuring sustainable use of land and natural resources throughout project lifecycles.

- Biodiversity Monitoring: Establishing protocols to monitor and assess the impact of projects on local flora and fauna.

- Regulatory Compliance: Adhering to all environmental laws and regulations concerning land use and biodiversity.

The construction sector faces increasing pressure to adopt sustainable practices, driven by climate change and resource depletion concerns. This includes a focus on energy efficiency, reduced carbon emissions, and circular economy principles in material usage. By 2025, regulatory bodies worldwide are expected to further tighten environmental standards, impacting waste management and pollution control strategies.

Companies are responding by investing in green building technologies and waste reduction initiatives. For example, the global green building market was valued at over $2.5 trillion in 2023, indicating a strong market demand for sustainable construction. This trend is supported by initiatives like the EU's Circular Economy Action Plan, which aims for significant reductions in construction waste by 2030.

Environmental stewardship extends to land use and biodiversity protection. Projects must now undergo rigorous environmental impact assessments to minimize habitat disruption. By 2025, advanced GIS mapping is being adopted by many firms to identify and protect ecologically sensitive areas, ensuring responsible development practices.

| Environmental Factor | Impact on Construction | Industry Response/Trend (2024-2025) | Example/Data Point |

|---|---|---|---|

| Climate Change & Extreme Weather | Need for resilient infrastructure and materials | Increased demand for climate-resilient design and construction methods | Buildings designed to withstand floods, high winds, and temperature swings |

| Sustainability & Green Building | Demand for energy-efficient and low-carbon buildings | Growth in certifications like LEED and BREEAM; adoption of sustainable materials | Global green building market valued over $2.5 trillion in 2023 |

| Resource Depletion & Circular Economy | Emphasis on material efficiency and waste reduction | Focus on recycled content, designing for deconstruction, and waste minimization | EU aims for 70% recycling rate for construction waste by 2030 |

| Environmental Regulations & Pollution | Stricter rules on waste, air, water, and noise pollution | Investment in waste reduction, recycling, and pollution abatement technologies | Global construction waste management market ~ $150 billion in 2023 |

| Biodiversity & Land Use | Minimizing habitat disruption and protecting ecosystems | Integration of environmental impact assessments and land protection strategies | Adoption of GIS mapping to protect ecologically sensitive areas by 2025 |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable market research firms, and leading academic journals. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting your business.