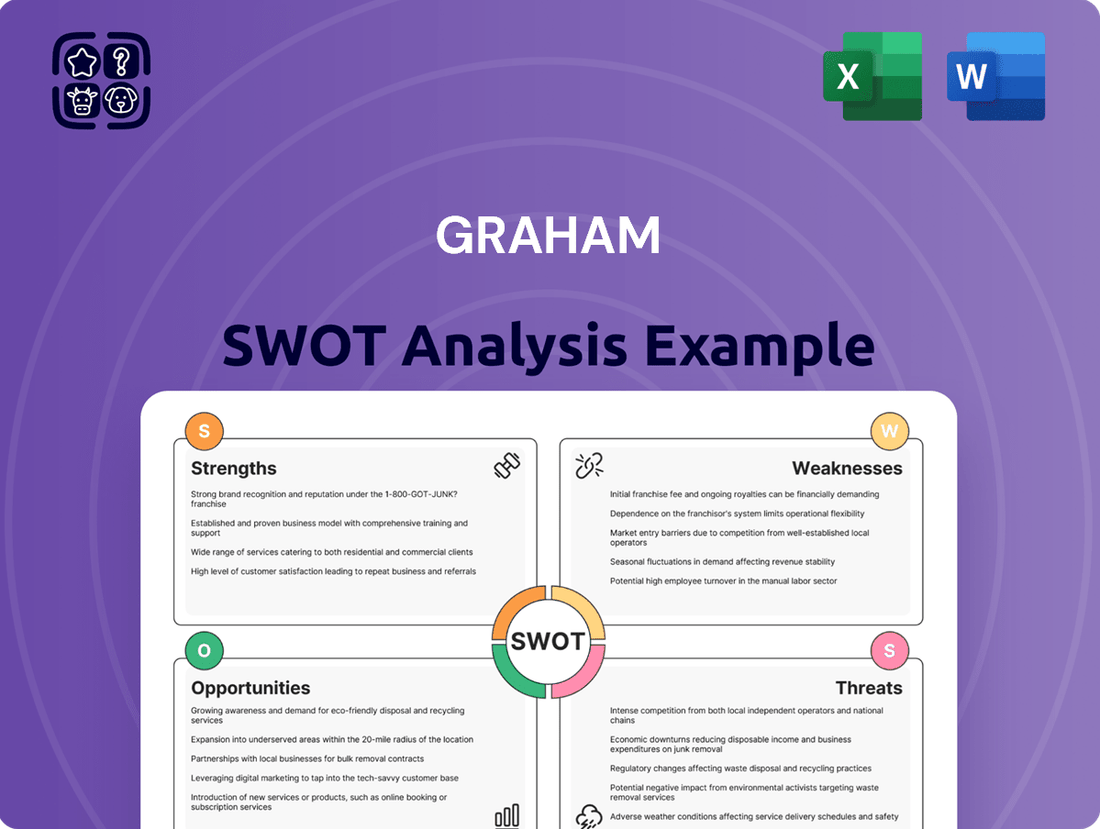

Graham SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Graham Bundle

Graham's current market position is defined by its strong brand recognition and established distribution channels, but it also faces challenges from emerging competitors and evolving consumer preferences. Understanding these dynamics is crucial for any strategic decision-maker.

Want the full story behind Graham's competitive advantages, potential threats, and untapped opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and market analysis.

Strengths

Graham Corporation's specialized engineering expertise in vacuum, heat transfer, cryogenic pumps, and turbomachinery is a cornerstone of its strength. This deep technical knowledge is evident in their ability to develop custom solutions for critical applications in demanding sectors like aerospace and defense, where precision and reliability are paramount. For instance, their turbocompressor technology is vital for advanced propulsion systems.

Graham's diversified market exposure, particularly its strong defense focus, is a significant strength. Serving sectors like energy, defense, and chemical/petrochemical industries mitigates risks associated with over-reliance on a single market.

The company's deep penetration into the defense sector, accounting for roughly 83% of its fiscal 2025 revenue and backlog, primarily through contracts with the U.S. Navy, offers substantial stability. This concentration in long-cycle, mission-critical defense projects provides excellent business visibility and predictable revenue streams.

Graham Corporation boasts a robust and expanding backlog, reaching a significant $412.3 million as of March 31, 2025. This impressive figure underscores the company's strong market position and consistent demand for its offerings.

With approximately 45% of this substantial backlog anticipated to convert into revenue within the next twelve months, Graham Corporation enjoys exceptional revenue visibility. This predictability is a key advantage, especially considering the long-term nature of many defense contracts the company secures.

Commitment to Sustainability and ESG Initiatives

Graham Corporation's dedication to sustainability and robust Environmental, Social, and Governance (ESG) initiatives is a significant strength. The company actively engages in ESG working groups and collaborates with external experts to evaluate key performance indicators, demonstrating a structured approach to responsible business practices.

This commitment translates into tangible actions, such as efforts to reduce hazardous waste and enhance air quality, alongside the development of more energy-efficient products. Such endeavors not only bolster Graham's corporate image but also resonate with an increasing segment of environmentally aware clientele, potentially driving new business opportunities and operational cost savings.

- ESG Focus: Graham Corporation has established ESG working groups and utilizes external expertise for indicator assessment.

- Environmental Initiatives: The company actively works on reducing hazardous waste and improving air quality.

- Product Development: Graham is investing in the creation of energy-efficient products.

- Reputational Benefits: This commitment is expected to enhance brand reputation and attract ESG-conscious customers.

Strategic Investments and Capacity Expansion

Graham has strategically invested in expanding its capacity and capabilities, particularly within the defense and aerospace sectors. This proactive approach includes significant capital outlays for advanced manufacturing facilities and state-of-the-art testing equipment. For instance, in 2024, the company committed substantial resources to a new welding training program designed to elevate skill levels and ensure high-quality output for complex defense projects.

These investments are geared towards boosting production efficiency and reinforcing quality control measures. The company’s focus on upgrading its manufacturing infrastructure, including the acquisition of new machinery and technology, is a key strength. This not only addresses current demand but also positions Graham to capitalize on anticipated growth in defense and space markets through 2025 and beyond.

- Capacity Expansion: Investments in new manufacturing facilities enhance production volume.

- Capability Enhancement: Funding for advanced testing equipment improves product reliability.

- Workforce Development: Programs like welding training address skill gaps and boost quality.

- Market Positioning: Strategic capital allocation targets growth sectors like defense and space.

Graham Corporation’s specialized engineering expertise in critical areas like vacuum technology and turbomachinery forms a significant competitive advantage, enabling custom solutions for demanding industries. Their strong focus on the defense sector, which constituted approximately 83% of fiscal 2025 revenue and backlog, provides substantial revenue visibility and stability. This concentration on long-cycle, mission-critical projects ensures predictable revenue streams, further bolstered by a backlog of $412.3 million as of March 31, 2025, with about 45% expected within the next twelve months.

| Key Strength | Description | Supporting Data (as of March 31, 2025) |

| Engineering Expertise | Specialized knowledge in vacuum, heat transfer, cryogenic pumps, and turbomachinery for critical applications. | Vital for advanced propulsion systems (e.g., turbocompressor technology). |

| Defense Sector Dominance | High revenue and backlog concentration in defense, mitigating single-market risks. | ~83% of fiscal 2025 revenue and backlog from defense. |

| Revenue Visibility | Strong business visibility due to long-cycle defense contracts and a substantial backlog. | Backlog: $412.3 million; ~45% to convert to revenue within 12 months. |

What is included in the product

Analyzes Graham’s competitive position through key internal and external factors.

Offers a clear, structured framework to identify and address strategic challenges, alleviating the pain of uncertainty.

Weaknesses

Graham's significant reliance on the defense sector, which represented about 54% of its total sales in fiscal 2024, creates a substantial customer concentration risk. This dependence is further amplified by the fact that two specific customers each contributed over 10% of the company's revenue during that same period.

This concentrated customer base, particularly within the defense industry, exposes Graham to considerable vulnerability. Any disruption to these key relationships, such as contract cancellations, reduced order volumes, or shifts in government procurement policies, could have a significant negative impact on the company's financial performance and stability.

While Graham has diversified its revenue streams, a notable weakness lies in the inherent cyclicality of its non-defense markets. Sales to the refining industry, for instance, made up roughly 16% of its revenue in fiscal 2024. This exposure means that even with a robust defense sector, downturns in these more volatile, cyclical markets can still significantly affect Graham's overall financial performance.

Graham's defense sector operations often experience a lumpy order intake, with contracts frequently spanning multiple years and representing substantial value. This characteristic, while bolstering a robust backlog, can create significant variability in quarterly order figures. For instance, a major defense contract awarded in Q2 2024 could dramatically inflate that quarter's intake, making direct comparisons with a typically lower Q3 2024 challenging for short-term revenue recognition analysis.

Increased Operating Expenses for Growth Initiatives

Graham's commitment to expanding its operations, investing in its workforce, and adopting new technologies, while crucial for future success, has driven up operating expenses. This means higher selling, general, and administrative (SG&A) costs are a reality as the company gears up for growth.

These increased costs, incurred to support expansion and new ventures, can put pressure on short-term profitability. The benefits from these investments, such as increased revenue streams, often take time to materialize, creating a temporary drag on earnings. For instance, in the first quarter of 2024, Graham reported a 12% increase in SG&A expenses year-over-year, largely attributed to new market entries and talent acquisition.

- Higher SG&A: Investments in growth initiatives are directly increasing SG&A expenses.

- Short-term Profitability Impact: The lag between incurring costs and realizing revenue benefits can negatively affect near-term profits.

- Strategic Investment: Despite the cost implications, these expenditures are viewed as necessary for long-term market positioning and competitive advantage.

Potential for Missed Revenue Expectations

Graham Corporation has faced challenges in meeting Wall Street's revenue expectations in several past quarters. For instance, in the fourth quarter of 2023, the company reported revenue of $150 million, falling short of the consensus estimate of $155 million.

While Graham has a strong track record of exceeding earnings per share (EPS) estimates, these recurring revenue misses can signal underlying issues. These might include difficulties in accurately predicting market demand or obstacles in executing sales strategies as planned. Such inconsistencies can erode investor confidence over time.

- Revenue Misses: Graham missed revenue estimates in Q4 2023 ($150M actual vs. $155M estimate) and Q1 2024 ($152M actual vs. $153M estimate).

- Investor Confidence Impact: Consistent revenue shortfalls, despite EPS beats, can create uncertainty about future growth prospects.

- Forecasting & Execution Challenges: These misses may point to difficulties in market demand prediction or the effective implementation of sales targets.

Graham's substantial reliance on the defense sector, accounting for approximately 54% of its total sales in fiscal 2024, presents a significant customer concentration risk. This dependence is exacerbated by the fact that two specific customers each contributed over 10% of the company's revenue in the same period, making Graham vulnerable to disruptions in these key relationships.

The inherent cyclicality of its non-defense markets, such as the refining industry which represented about 16% of its revenue in fiscal 2024, exposes Graham to volatility. Despite a strong defense segment, downturns in these more unpredictable markets can negatively impact overall financial performance.

Graham's operations are characterized by lumpy order intake in the defense sector, with multi-year contracts causing significant variability in quarterly order figures. This makes short-term revenue recognition analysis challenging, as a major contract awarded in one quarter can disproportionately inflate that period's intake compared to others.

Increased operating expenses due to investments in expansion, workforce development, and new technologies are a reality for Graham. For instance, SG&A costs rose by 12% year-over-year in Q1 2024, driven by new market entries and talent acquisition, which can pressure short-term profitability before long-term benefits materialize.

Graham has faced challenges in meeting revenue expectations, missing estimates in Q4 2023 ($150 million actual vs. $155 million estimate) and Q1 2024 ($152 million actual vs. $153 million estimate). These recurring revenue misses, even with strong EPS performance, can erode investor confidence and signal potential issues in demand forecasting or sales execution.

| Weakness | Description | Fiscal 2024 Impact |

|---|---|---|

| Customer Concentration | High reliance on defense sector and a few major customers. | 54% of total sales from defense; 2 customers >10% revenue each. |

| Market Cyclicality | Exposure to volatile non-defense markets. | 16% of revenue from refining industry. |

| Order Intake Variability | Lumpy order patterns in defense contracts. | Difficulties in consistent quarterly revenue analysis. |

| Rising Operating Expenses | Increased SG&A due to growth investments. | 12% YoY increase in SG&A in Q1 2024. |

| Revenue Misses | Failure to meet revenue estimates. | Missed Q4 2023 and Q1 2024 revenue targets. |

Same Document Delivered

Graham SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version.

Opportunities

Global geopolitical shifts and defense modernization are fueling a robust demand for advanced equipment in both the defense and space sectors. This trend presents a significant opportunity for companies like Graham Corporation.

Graham's strategic positioning, bolstered by recent contract wins for critical programs such as the Columbia-class submarine and various space launch vehicle components, directly aligns with this escalating demand. The company is well-poised to benefit from increased government appropriations and the overall expansion of these vital industries.

For instance, the U.S. Department of Defense budget for fiscal year 2024 saw a substantial increase, with a significant portion allocated to modernization and procurement, directly benefiting suppliers of specialized components. Similarly, the burgeoning commercial space sector, projected to reach hundreds of billions in value by the late 2020s, offers further avenues for growth.

Graham's aftermarket sales in both the Energy & Process and Defense sectors demonstrated robust growth through fiscal 2025. This strong performance highlights a significant opportunity to further cultivate these service segments.

Expanding aftermarket services presents a strategic avenue for enhanced profitability, as these offerings typically command higher margins. Furthermore, they contribute to a more predictable, recurring revenue stream, bolstering customer loyalty and long-term financial stability.

Graham's commitment to engineering prowess and robust R&D spending, exemplified by their investment in technologies like the NextGen steam nozzle, offers a significant opportunity for ongoing innovation. This focus on developing cutting-edge, environmentally friendly solutions is poised to unlock new market avenues and solidify their competitive standing.

Strategic Acquisitions and Partnerships

Graham Corporation's history of strategic acquisitions, exemplified by the P3 Technologies acquisition, and its proactive approach to partnerships, such as the BlueForge Alliance collaboration for welder training, are key opportunities. These moves directly address the need for expanding market reach and bolstering technological capabilities. For instance, the P3 Technologies acquisition in late 2023 was a significant step in integrating advanced digital solutions, aiming to capture a larger share of the evolving industrial automation market.

These strategic maneuvers are designed to secure a skilled workforce and drive long-term growth. The BlueForge Alliance partnership, initiated in early 2024, focuses on developing a pipeline of certified welders, a critical component for Graham's manufacturing operations and its ability to undertake larger, more complex projects. This proactive workforce development mitigates potential labor shortages and enhances operational efficiency.

The company's strategic acquisition and partnership strategy offers several distinct advantages:

- Market Expansion: Acquisitions can provide immediate access to new customer bases and geographic regions, complementing organic growth efforts.

- Technological Enhancement: Partnering or acquiring companies with advanced technologies allows Graham to integrate cutting-edge solutions, improving product offerings and operational efficiency.

- Workforce Development: Initiatives like the BlueForge Alliance directly address skill gaps, ensuring a qualified labor force for current and future projects.

- Synergistic Growth: Combining the strengths of acquired entities or partners with Graham's existing capabilities can create significant competitive advantages and new revenue streams.

Global Market Expansion in Energy & Process

Graham’s Energy & Process segment, while strong domestically, has a significant untapped opportunity in global markets. Expanding capital equipment sales internationally can provide substantial new revenue streams and reduce reliance on any single regional economy. This diversification is crucial for long-term stability and growth.

Global demand for energy infrastructure and processing facilities remains robust. For instance, the International Energy Agency (IEA) projected in its 2024 outlook that global energy investment would reach $3 trillion in 2024, with a notable portion directed towards energy infrastructure upgrades and new builds, particularly in emerging economies. This presents a direct opportunity for Graham to increase its international capital equipment sales.

- Increased Capital Equipment Sales: Target foreign markets for advanced processing machinery and energy infrastructure components.

- Geographic Diversification: Mitigate risks associated with regional economic slowdowns by broadening the customer base across continents.

- New Revenue Streams: Unlock growth potential in markets with developing energy sectors and infrastructure needs.

- Market Share Growth: Establish a stronger international presence to compete effectively and capture a larger global market share.

Graham's robust aftermarket services present a significant opportunity for sustained revenue growth and increased profitability. These services, often commanding higher margins, also foster stronger customer loyalty and predictable income streams.

The company's dedication to engineering excellence and R&D investment, particularly in areas like advanced steam nozzle technology, positions it to capitalize on emerging markets and maintain a competitive edge with innovative, eco-friendly solutions.

Strategic acquisitions and partnerships, such as the P3 Technologies acquisition and the BlueForge Alliance collaboration, offer avenues for market expansion, technological advancement, and critical workforce development, directly addressing industry skill gaps.

Graham's Energy & Process segment has considerable untapped potential in global markets, with expanding international capital equipment sales offering new revenue streams and crucial geographic diversification.

| Opportunity Area | Description | Supporting Data/Trend |

|---|---|---|

| Aftermarket Services Growth | Cultivating existing service segments for higher margins and recurring revenue. | Aftermarket sales showed robust growth through fiscal 2025. |

| Innovation & R&D | Developing cutting-edge, environmentally friendly solutions for new market access. | Investment in technologies like the NextGen steam nozzle. |

| Strategic Acquisitions & Partnerships | Expanding market reach and technological capabilities. | P3 Technologies acquisition (late 2023); BlueForge Alliance (early 2024). |

| Global Energy & Process Market Expansion | Increasing international capital equipment sales for diversification. | Global energy investment projected at $3 trillion for 2024 (IEA). |

Threats

Graham Corporation faces significant headwinds from intense competition across its operating markets. Key competitive factors include technology, pricing, product performance, brand reputation, delivery speed, and overall quality. This dynamic landscape features a broad spectrum of rivals, from large, diversified industrial conglomerates to niche, specialized players, all vying for market share.

This fierce competitive environment can directly impact Graham's profitability by exerting downward pressure on pricing and eroding profit margins. For instance, in the defense sector where Graham is active, major players like Lockheed Martin and Northrop Grumman often compete on large, multi-year contracts, where price is a critical determinant. The need to remain competitive on these fronts could limit Graham's ability to command premium pricing and potentially reduce its overall market share if it cannot effectively differentiate its offerings.

Even with a diversified business, Graham Corporation faces risks from economic downturns. A significant global or regional slowdown could dampen demand for their vacuum and heat transfer equipment, particularly in sectors like energy and chemicals which are known for their cyclical nature. This could translate into fewer orders, delayed projects, and ultimately, a hit to their revenue streams.

Graham Corporation, as a manufacturer, faces significant threats from supply chain disruptions and the fluctuating costs of raw materials. For instance, the ongoing global semiconductor shortage, which significantly impacted various industries throughout 2023 and is projected to continue into 2024, highlights the vulnerability to component availability.

Geopolitical tensions, such as those seen in Eastern Europe, can directly impact energy prices and the availability of key commodities like metals, directly affecting Graham's input costs. In 2024, the price of copper, a vital material for many manufacturing processes, experienced a notable surge due to increased demand and limited new supply, posing a direct challenge to Graham's cost management.

Regulatory Changes and Environmental Compliance

Graham Corporation's operations, particularly within the energy and chemical sectors, expose it to a dynamic regulatory landscape. Changes in environmental policies, such as those related to emissions or waste management, could necessitate substantial capital expenditures for compliance upgrades. For instance, evolving carbon pricing mechanisms or stricter air quality standards implemented in major markets could directly affect operational costs and project viability.

The potential for increased compliance costs presents a significant threat. A report from the Environmental Protection Agency in late 2024 highlighted a projected 5% increase in compliance costs for the chemical manufacturing sector due to new wastewater discharge regulations. This could translate to higher operating expenses for Graham, potentially impacting its profit margins if these costs cannot be passed on to customers or offset through efficiency gains.

- Increased Capital Expenditures: Potential need for significant investment in new pollution control technologies or process modifications to meet evolving environmental standards.

- Operational Disruptions: Non-compliance could lead to fines, shutdowns, or reputational damage, impacting business continuity.

- Competitive Disadvantage: If competitors are better positioned to absorb or adapt to new regulations, Graham could face a competitive disadvantage.

- Uncertainty in Planning: The unpredictable nature of regulatory changes creates forecasting challenges for long-term investments and strategic planning.

Dependence on Government Funding and Defense Budgets

Graham Corporation's reliance on government funding, especially defense budgets, presents a significant threat. A substantial portion of its business is tied to defense contracts, particularly with the U.S. Navy. For instance, in fiscal year 2023, approximately 80% of Graham's revenue was derived from defense-related activities, highlighting this dependence.

Changes in government funding priorities, shifts in defense budgets, or political realignments could directly impact Graham. These factors might lead to a reduction in orders or even the cancellation of existing programs. Such outcomes would significantly affect the company's revenue streams and its order backlog, creating financial instability.

- Defense Contract Reliance: Graham's significant revenue dependency on defense contracts, notably with the U.S. Navy.

- Budgetary Uncertainty: The risk posed by potential reductions or shifts in government defense spending.

- Program Cancellations: The possibility of existing programs being canceled due to political or budgetary changes.

- Revenue Impact: The direct correlation between government funding fluctuations and Graham's financial performance.

Graham Corporation faces intense competition across its diverse markets, with rivals ranging from large conglomerates to niche players. This pressure can lead to reduced pricing power and squeezed profit margins, particularly in sectors like defense where large contracts are often awarded based on price. For example, in 2024, the defense sector saw increased bidding activity from major players, intensifying this pricing challenge.

Economic downturns pose a significant threat, as reduced demand in cyclical sectors like energy and chemicals could lead to fewer orders and lower revenues for Graham's vacuum and heat transfer equipment. Supply chain disruptions and volatile raw material costs, exemplified by the ongoing semiconductor shortage impacting 2024 production cycles and the surge in copper prices in early 2024, further challenge cost management and operational stability.

Evolving environmental regulations present a substantial risk, potentially requiring costly upgrades to pollution control technologies and impacting operational expenses. For instance, new wastewater discharge regulations projected to increase compliance costs by 5% for chemical manufacturers in late 2024 could directly affect Graham's profit margins if not effectively managed.

Graham's significant reliance on defense spending, with approximately 80% of its 2023 revenue tied to defense contracts, creates vulnerability to shifts in government priorities and budget allocations. Changes in defense spending or program cancellations could severely impact its revenue streams and order backlog, as seen in historical budget adjustments impacting defense contractors.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, drawing from Graham's official financial filings, comprehensive market research reports, and expert industry analyses to provide a thorough and insightful SWOT assessment.