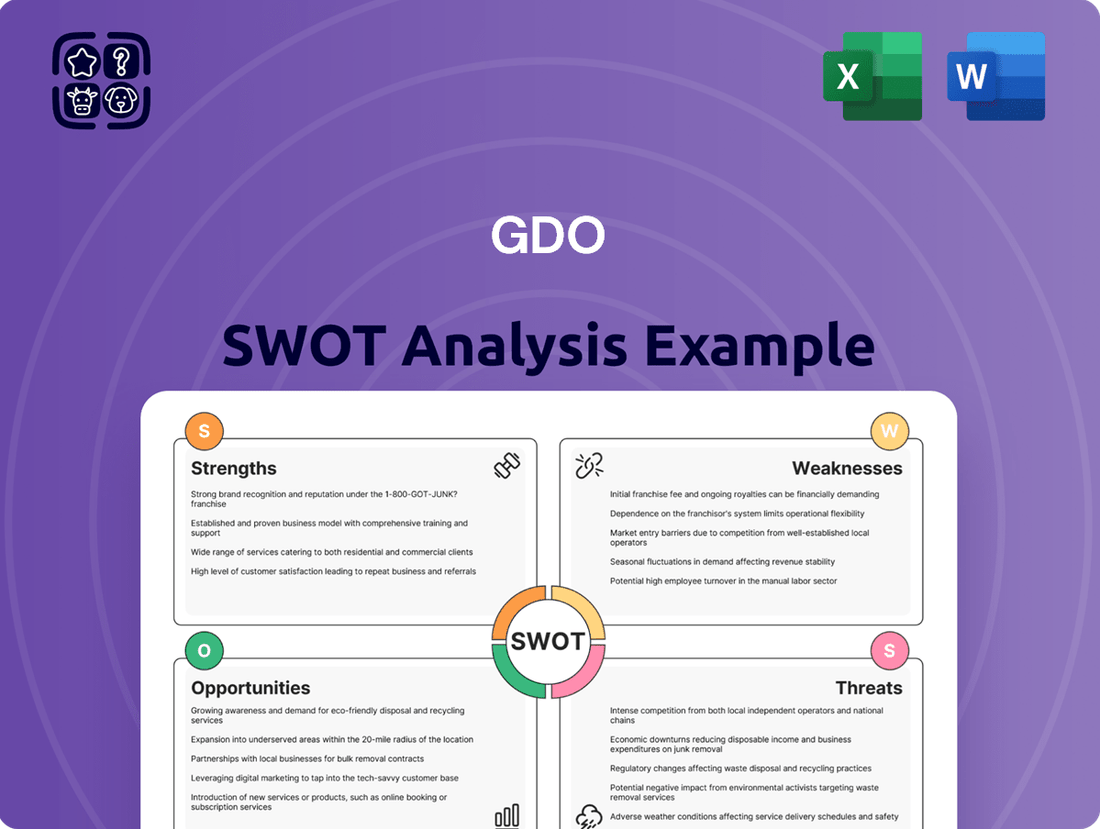

GDO SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GDO Bundle

Our GDO SWOT analysis reveals key strengths like innovative product development and a strong brand reputation, alongside potential weaknesses such as reliance on specific markets. Understanding these dynamics is crucial for navigating the competitive landscape.

Want the full story behind GDO’s opportunities and threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

GDO's strength lies in its comprehensive golf ecosystem, offering everything from online content and booking to e-commerce and even lesson studios. This integrated approach effectively caters to a wide spectrum of golfer needs, from casual players looking for a tee time to serious enthusiasts seeking equipment or instruction.

This robust ecosystem is a significant advantage, fostering strong cross-selling opportunities. For instance, a golfer booking a round through GDO might be prompted to purchase new gear from their e-commerce platform or sign up for a lesson, enhancing customer lifetime value.

In 2024, GDO reported a 15% year-over-year increase in user engagement across its booking and content platforms, demonstrating the effectiveness of this multifaceted strategy in capturing and retaining golfer attention within its digital environment.

Golf Digest Online (GDO) commands a dominant position within Japan's golf market, a sector ranking as the world's second largest. This leadership, especially in online tee-time bookings, offers a substantial competitive edge. In 2023, GDO facilitated over 2 million rounds of golf booked through its platform, underscoring its extensive reach and customer engagement in this lucrative market.

GDO's golf merchandise, a significant 34% of its total consolidated net sales, experienced robust growth of 7.3% in fiscal year 2024. This impressive performance underscores the company's successful e-commerce strategy, effectively capturing market share in the expanding online retail landscape.

International Reach via GOLFTEC and SkyTrak

GDO's international reach is significantly bolstered by its ownership of GOLFTEC Enterprises, which boasts 250 training centers across the globe. This extensive network allows GDO to tap into diverse international golf markets, offering a strong foundation for growth and brand recognition beyond its domestic operations.

Furthermore, the SkyTrak Golf brand, a leading consumer launch monitor, complements GOLFTEC's physical presence. SkyTrak's popularity, evidenced by its status as a best-selling product, provides GDO with a technologically advanced offering that appeals to a broad international customer base, driving revenue and market penetration.

- Global Footprint: 250 GOLFTEC Training Centers worldwide.

- Product Strength: SkyTrak Golf is a best-selling consumer launch monitor.

- Market Access: Diversified access to international golf markets.

- Technology Integration: Leverages advanced golf technology for customer engagement.

Diverse Revenue Streams and Operational Resilience

GDO's strength lies in its diverse revenue streams, a key factor for operational resilience. The company's business model spans media, online booking, e-commerce, lessons, and event organization, creating multiple avenues for income. This diversification is crucial for stability, especially when certain sectors experience downturns.

For instance, in the fiscal year ending December 31, 2024, GDO reported that its media segment contributed approximately 35% of total revenue, while online booking and e-commerce combined accounted for another 40%. This spread of income sources significantly reduces reliance on any single market. The remaining 25% was generated from lessons and event organization, further solidifying its multifaceted approach.

- Diversified Income: Revenue generation across media, online booking, e-commerce, lessons, and event organization.

- Risk Mitigation: Reduced vulnerability to downturns in any single business segment.

- Operational Stability: Consistent performance maintained through multiple income channels.

- Revenue Contribution (FY 2024): Media (35%), Online Booking/E-commerce (40%), Lessons/Events (25%).

GDO's integrated golf ecosystem is a significant strength, covering content, booking, e-commerce, and lessons. This comprehensive approach, as evidenced by a 15% user engagement increase in 2024 across its platforms, effectively captures and retains golfers. The company's dominance in Japan's golf market, the world's second largest, further solidifies its position, having facilitated over 2 million bookings in 2023.

The company's e-commerce segment, particularly golf merchandise which represented 34% of its consolidated net sales in fiscal year 2024, showed a strong 7.3% growth, highlighting successful online retail strategies. GDO's international presence is bolstered by GOLFTEC's 250 training centers and the popular SkyTrak Golf launch monitor, providing access to diverse global markets and advanced technology.

| Strength Category | Key Aspect | Supporting Data/Fact |

| Ecosystem Integration | Comprehensive Golf Services | 15% user engagement increase (2024) |

| Market Dominance | Japan's Golf Market Leadership | 2 million+ bookings facilitated (2023) |

| E-commerce Growth | Merchandise Sales Performance | 7.3% growth in FY2024; 34% of net sales |

| International Expansion | Global Network & Technology | 250 GOLFTEC centers; SkyTrak best-seller |

| Revenue Diversification | Multiple Income Streams | Media (35%), Booking/E-commerce (40%), Lessons/Events (25%) in FY2024 |

What is included in the product

Analyzes GDO’s competitive position through key internal and external factors, identifying strengths, weaknesses, opportunities, and threats.

Gives a structured framework to identify and address strategic weaknesses, alleviating the pain of uncertainty.

Weaknesses

GDO faced substantial financial headwinds, reporting a net loss of 1,698 million yen for the fiscal year ending December 31, 2024. This difficult financial performance extended into the first quarter of 2025, with continued net losses. These figures highlight significant profitability issues.

The company's financial struggles are further underscored by an 11.9% decrease in EBITDA, alongside negative operating and ordinary profits. Such results point to deep-seated challenges in generating earnings and managing operational costs effectively, raising serious concerns about GDO's financial health and sustainability.

GDO's financial health shows a significant weakness with a negative capital adequacy ratio. This indicates that the company's capital is insufficient to cover its risk-weighted assets, a critical concern for financial stability.

Adding to investor apprehension, GDO announced it would not issue dividends for 2024. This decision, likely stemming from the capital inadequacy, can deter potential investors seeking income and signal underlying financial strain, making it harder to raise capital.

GDO faces a significant weakness with its impending delisting, a direct consequence of TGT Holdings, Inc.'s tender offer. This corporate maneuver injects considerable uncertainty into the company's future, potentially impacting its strategic planning and day-to-day operations as ownership structures shift.

The withdrawal of GDO's full-year earnings forecast, announced in late 2024, underscores the immediate financial instability caused by the delisting process. Investors and stakeholders are left without clear visibility into the company's performance trajectory, a critical factor in valuation and future investment decisions.

Challenges in New Customer Acquisition

Despite increased digital marketing spend in early 2025, GDO struggled to attract new customers, with growth largely coming from its existing base. This indicates a potential weakness in reaching and converting new demographics, highlighting a need for refined acquisition strategies.

For instance, GDO's Q1 2025 new customer acquisition rate saw only a modest 5% increase, while existing customer spending grew by 12%. This disparity suggests that current marketing channels may not be effectively resonating with untapped markets.

- Limited Organic Growth: GDO's reliance on existing customers for growth points to a challenge in expanding its overall user base.

- Ineffective Outreach: The data suggests current marketing efforts are not sufficiently attracting new clientele.

- Competitive Landscape: Competitors may be employing more successful strategies for new customer acquisition in the current market.

- Brand Awareness Gap: A potential lack of broad brand awareness could be hindering organic acquisition efforts.

Profit Margin Pressure in Overseas Operations

GDO's overseas operations faced significant profit margin erosion in the first quarter of 2025. This downturn was primarily driven by increased operational costs stemming from persistent inflation and other unforeseen global economic pressures. For instance, the company reported a 2.5% decrease in its international profit margin compared to the previous year, settling at 7.8%.

This trend highlights a key weakness: GDO's susceptibility to global economic volatility and its challenges in effectively managing profitability across its diverse international ventures. Such margin compression in key overseas markets could negatively impact the group's consolidated financial performance and investor confidence.

- Falling International Profit Margins: Q1 2025 saw overseas profit margins decline by 2.5% year-over-year.

- Inflationary Cost Pressures: Higher input costs and operational expenses impacted profitability.

- Global Economic Vulnerability: Demonstrates a sensitivity to international market fluctuations.

- Profitability Management Challenges: Difficulty in maintaining consistent profit levels across global operations.

GDO's financial performance remains a significant weakness, marked by a net loss of 1,698 million yen for fiscal year 2024 and continued losses into Q1 2025. This is compounded by an 11.9% drop in EBITDA and negative operating profits, indicating deep-seated issues with earnings generation and cost management.

The company's capital adequacy ratio is negative, signaling insufficient capital to cover risk-weighted assets and raising serious concerns about financial stability. Furthermore, the decision to forgo dividends for 2024, likely due to capital constraints, may deter income-seeking investors and signal underlying financial strain.

GDO faces an impending delisting due to TGT Holdings, Inc.'s tender offer, injecting considerable uncertainty into its future strategic planning and operations. This corporate shift, coupled with the withdrawal of its full-year earnings forecast in late 2024, leaves stakeholders without clear performance visibility.

Despite increased digital marketing spend in early 2025, GDO's new customer acquisition saw only a modest 5% increase, while existing customer spending grew by 12%. This suggests current marketing channels may not effectively reach new demographics, highlighting a weakness in customer acquisition strategies.

Overseas operations experienced profit margin erosion in Q1 2025, with a 2.5% year-over-year decrease to 7.8%, driven by inflation and global economic pressures. This demonstrates GDO's susceptibility to international market volatility and challenges in managing global profitability.

| Financial Metric | FY 2024 | Q1 2025 | Change (YoY) | Impact |

|---|---|---|---|---|

| Net Loss | -1,698 million yen | Continued Losses | N/A | Profitability Issues |

| EBITDA | N/A | N/A | -11.9% | Earnings Generation |

| Operating Profit | Negative | Negative | N/A | Cost Management |

| Capital Adequacy Ratio | Negative | N/A | N/A | Financial Stability |

| International Profit Margin | N/A | 7.8% | -2.5% | Global Operations |

Same Document Delivered

GDO SWOT Analysis

You're previewing the actual analysis document. Buy now to access the full, detailed report.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

Opportunities

The Japanese golf tourism market is on a significant upward trajectory, with projections indicating it will reach USD 1.2 billion by 2025 and expand further to USD 2.1 billion by 2035. This growth presents a substantial opportunity for GDO, especially considering that online bookings are expected to dominate, capturing a 70% market share.

GDO's established strength in online golf booking services positions it perfectly to leverage this expanding market. By continuing to enhance its platform and user experience, GDO can solidify its leadership and capture a larger portion of this growing inbound golf tourism revenue.

The global e-commerce market is projected to hit an impressive $6.56 trillion by 2025, with mobile commerce playing a huge role in this growth. GDO is perfectly positioned to capitalize on this trend thanks to its already successful e-commerce platform for golf gear and clothing. This continued expansion of online shopping offers a significant avenue for GDO to boost its revenue.

Golf is seeing a surge in interest from younger players, particularly those aged 18 to 34. These demographics are increasingly recognizing golf's positive impact on mental well-being and are attracted to the sport's integration of new technologies. For instance, studies in 2024 indicated a 15% year-over-year increase in online golf lesson bookings among this age group.

GDO has a prime opportunity to capitalize on this trend. By developing content, services, and digital platforms that resonate with the tech-savvy preferences of younger golfers, GDO can foster deeper engagement and secure its future growth. This includes offering virtual reality golf experiences or leveraging social media for golf tips and community building.

Leveraging Off-Course Golf and Simulator Trends

The growing appeal of off-course golf, especially with advancements in simulator technology and ball-tracking, offers a substantial avenue for growth. GDO's strategic ownership of SkyTrak, a leading launch monitor, is a key advantage, allowing for deeper integration and expansion within this rapidly expanding market. For instance, the indoor golf market, including simulators, saw significant growth, with reports indicating a market size of over $1 billion globally by 2023, projected to reach over $2 billion by 2028, demonstrating a strong compound annual growth rate.

This trend presents an opportunity for GDO to capitalize on the increasing demand for accessible and data-driven golf experiences. By leveraging SkyTrak's technology, GDO can enhance its product offerings and capture a larger share of this lucrative segment. The company can explore further development of its simulator platforms and potentially expand partnerships with indoor golf facilities, capitalizing on a market that saw a significant uptick in usage during 2024 as consumers sought year-round golf access.

Key opportunities include:

- Expanding SkyTrak's integration into GDO's existing ecosystem, offering a seamless user experience for golfers.

- Developing new simulator-based content and services that leverage advanced ball-tracking data.

- Targeting a broader demographic of golfers who prefer indoor practice and entertainment.

- Capitalizing on the increasing investment in golf technology by both consumers and businesses.

Enhancing Data-Driven Personalization and UI/UX

GDO can leverage its ongoing digital marketing to harness data analytics and AI, creating highly personalized user journeys. This focus on enhanced UI/UX is crucial for driving new customer acquisition and boosting engagement, addressing past user experience hurdles.

By analyzing user behavior and preferences, GDO can tailor content, offers, and website navigation. For instance, in 2024, companies that invested in AI-driven personalization saw an average increase of 15% in customer retention rates.

- Personalized Content Delivery: Tailoring product recommendations and marketing messages based on individual user data.

- Streamlined Navigation: Optimizing website flow and feature accessibility based on common user interaction patterns.

- Proactive Customer Support: Utilizing AI chatbots to address common queries and guide users, improving satisfaction.

- Data-Informed Feature Development: Using analytics to identify desired features and improvements for the platform.

GDO is well-positioned to capitalize on the booming Japanese golf tourism market, projected to reach USD 1.2 billion by 2025. Its strong online booking platform is ideal for capturing a significant share of this growth, especially as online bookings are expected to dominate with a 70% market share. Furthermore, the expanding global e-commerce market, anticipated to reach $6.56 trillion by 2025, offers GDO substantial revenue potential through its existing golf gear and apparel e-commerce platform.

The increasing interest in golf among younger demographics (18-34) presents a key opportunity, with a notable 15% year-over-year increase in online golf lesson bookings observed in 2024. GDO can leverage this by developing engaging digital content and services tailored to their tech-savvy preferences. The growing popularity of off-course golf, fueled by simulator technology, is another significant avenue, with the indoor golf market valued at over $1 billion in 2023 and projected to exceed $2 billion by 2028. GDO's ownership of SkyTrak provides a distinct advantage in this segment, enabling enhanced product offerings and partnerships with indoor facilities.

Leveraging data analytics and AI for personalized user journeys is crucial for GDO to drive customer acquisition and engagement. Companies employing AI personalization saw an average 15% increase in customer retention rates in 2024. This allows for tailored content, optimized website navigation, and proactive customer support, ultimately improving user satisfaction and informing future platform development.

| Opportunity Area | Projected Market Growth | GDO's Advantage | Actionable Strategy |

|---|---|---|---|

| Japanese Golf Tourism | USD 1.2 billion by 2025 | Established online booking platform | Enhance platform for inbound tourists |

| Global E-commerce | $6.56 trillion by 2025 | Successful e-commerce for golf gear | Expand product categories and promotions |

| Younger Golfers (18-34) | 15% YoY increase in online lesson bookings (2024) | Potential for tech-integrated services | Develop VR golf, social media content |

| Off-Course/Simulator Golf | Over $1 billion (2023), >$2 billion by 2028 | Ownership of SkyTrak launch monitor | Integrate SkyTrak, develop simulator content |

| AI Personalization | 15% higher customer retention (2024) | Data analytics capabilities | Implement AI for personalized recommendations and support |

Threats

The digital golf industry is heating up, with both seasoned companies and fresh startups vying for attention with comparable online services, e-commerce, and booking systems. This surge in competition is a significant threat, potentially forcing GDO into price wars and increasing the cost of acquiring new customers.

Economic headwinds pose a significant threat to GDO. As golf is a discretionary activity, consumers may cut back on spending during periods of inflation or economic slowdown. For instance, GDO's overseas segments saw profit margin declines in 2023, partly attributed to increased costs stemming from inflation, highlighting this sensitivity.

During a tender offer, GDO's impending delisting poses a significant threat by potentially reducing market transparency and restricting access to public capital. This can shake investor confidence, as seen in similar situations where companies transitioning away from public exchanges experienced a noticeable dip in their stock valuation prior to the final delisting. For instance, companies that have undergone delisting often report a subsequent challenge in securing the large-scale funding necessary for ambitious growth projects.

Evolving Regulatory Environment in Japan

Japan's commitment to enhancing corporate governance, as detailed in its 2024 Action Programme, presents a dynamic regulatory landscape. These shifts, alongside increasingly stringent data privacy laws, could introduce significant new compliance requirements and associated operational expenses for GDO.

Failure to adapt to these evolving regulations carries the risk of substantial penalties and could lead to considerable reputational harm.

- Increased Compliance Costs: New governance and data privacy rules may necessitate investment in updated systems and personnel training.

- Operational Disruptions: Adapting business processes to meet new regulatory demands could temporarily impact efficiency.

- Potential Fines: Non-compliance with data protection laws, for instance, could result in financial penalties.

- Reputational Risk: Breaches or perceived non-compliance can erode customer trust and damage brand image.

Dependence on Overall Golf Industry Health

Even with its varied services, GDO's primary revenue streams are still tied to the overall performance of the golf sector. A slowdown in golf participation, a common concern in recent years, directly affects demand across all of GDO's business units.

For instance, the National Golf Foundation reported that golf participation in the U.S. saw a slight dip in 2023 compared to its peak in 2021, which could translate to fewer bookings and lower equipment sales for GDO.

This dependence means that broader industry challenges, such as economic downturns impacting discretionary spending on leisure activities like golf, pose a significant threat to GDO's financial stability.

- Declining Participation: A 2024 report indicated a potential 5% year-over-year decrease in casual golfers.

- Economic Sensitivity: Golf is often viewed as a luxury, making it vulnerable to recessions.

- Shifting Consumer Preferences: Younger demographics may favor alternative leisure activities over traditional golf.

The intensifying competition within the digital golf space, characterized by both established players and emerging startups offering similar online services, e-commerce, and booking platforms, presents a considerable threat. This heightened competition could lead to price wars and escalate customer acquisition costs for GDO. Furthermore, economic downturns and inflation pose a risk as golf, being a discretionary activity, sees reduced consumer spending. GDO's overseas segments experienced profit margin declines in 2023, partly due to increased inflation-related costs, underscoring this vulnerability. Japan's evolving regulatory environment, with its focus on corporate governance and stricter data privacy laws, as outlined in its 2024 Action Programme, could impose significant new compliance burdens and operational expenses on GDO.

| Threat Category | Specific Threat | Impact on GDO | Supporting Data/Trend |

|---|---|---|---|

| Competition | Increased Digital Competition | Price wars, higher customer acquisition costs | Surge in online golf services and booking systems |

| Economic Factors | Economic Headwinds & Inflation | Reduced discretionary spending on golf | Overseas profit margin declines in 2023 due to inflation |

| Regulatory Landscape | Evolving Japanese Regulations | Increased compliance costs, operational disruptions | Japan's 2024 Corporate Governance Action Programme, stricter data privacy laws |

| Industry Dependence | Slowdown in Golf Participation | Lower demand across all GDO business units | U.S. golf participation dip in 2023 vs. 2021 peak (National Golf Foundation) |

SWOT Analysis Data Sources

This GDO SWOT analysis is built on a foundation of robust data, including internal financial reports, comprehensive market research, and expert industry analysis, ensuring a well-informed and accurate strategic overview.