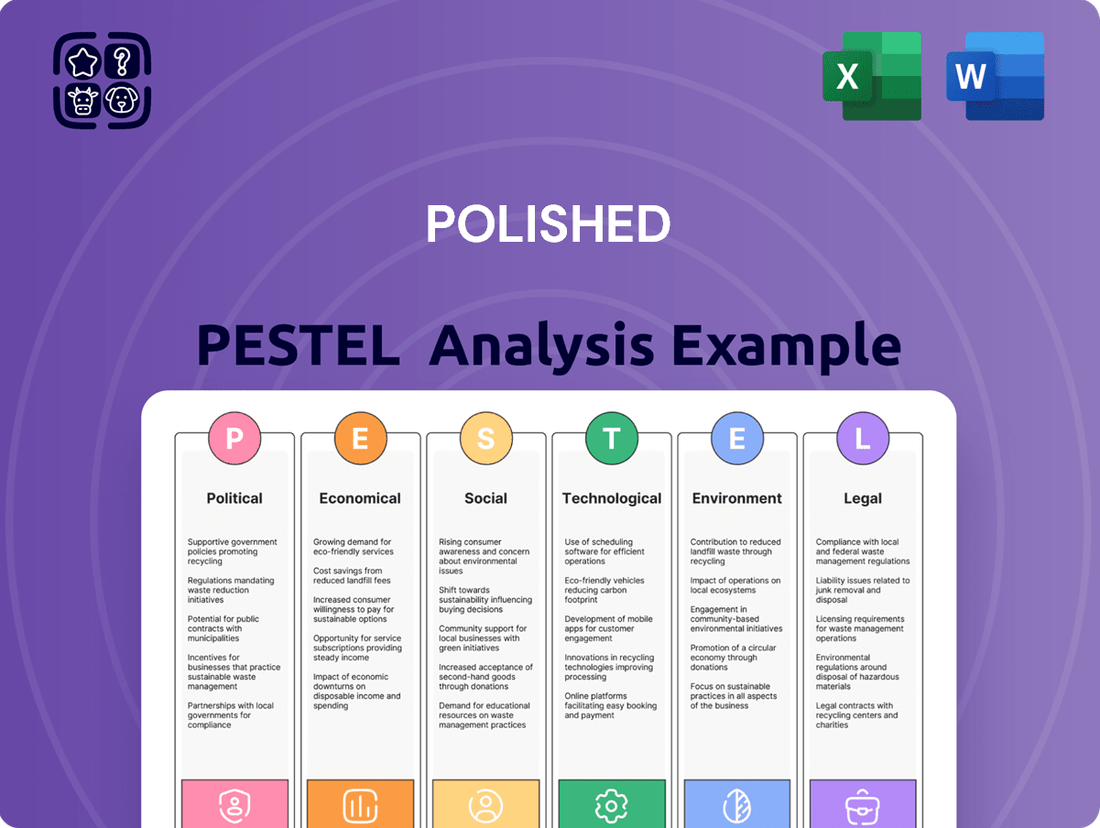

Polished PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Polished Bundle

Gain a critical advantage with our meticulously crafted PESTLE Analysis of Polished. Uncover the intricate web of political, economic, social, technological, legal, and environmental factors that are actively shaping its market landscape. Equip yourself with the foresight to anticipate challenges and seize emerging opportunities. Download the complete, actionable report now and transform your strategic planning.

Political factors

Changes in trade policies and tariffs on imported home appliances and furniture directly influence Polished.com's cost of goods. For instance, the U.S. imposed tariffs on certain Chinese goods in recent years, which could increase import costs for furniture. A 2024 report by the Congressional Research Service highlighted that tariffs can lead to higher prices for consumers and may necessitate adjustments to Polished.com's pricing strategy to remain competitive.

E-commerce operations like Polished.com navigate a complex web of government regulations. These rules cover everything from how products are sold online to advertising practices and safeguarding consumer rights. Staying compliant is paramount, as seen with the EU's General Product Safety Regulation (GPSR) or the multitude of consumer protection laws across US states, which can impose significant fines for violations and erode customer confidence.

Data privacy laws are becoming more numerous and stricter, directly affecting how companies like Polished.com handle customer data. Regulations such as the EU's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), along with new state-level laws coming into effect in 2025, mandate how personal information can be collected, stored, and utilized. For instance, the California Privacy Rights Act (CPRA), an expansion of CCPA, grants consumers more control over their data starting January 1, 2023, with further enforcement and potential new regulations expected in 2025.

Compliance with these varied regulations necessitates significant investment in secure data management infrastructure and clear, accessible privacy policies. Failure to comply can lead to substantial financial penalties; GDPR fines can reach up to €20 million or 4% of annual global turnover, whichever is higher. This regulatory landscape requires Polished.com to prioritize consumer trust and data protection to avoid reputational damage and costly legal actions.

Consumer Protection Legislation

Consumer protection legislation, such as the EU's General Product Safety Regulation, significantly influences Polished.com's operational procedures and customer service. These regulations dictate product safety standards, warranty requirements, and return policies, directly impacting how Polished.com engages with its customers and manages product lifecycle. For instance, the EU reported over 2,000 rapid alerts for dangerous non-food products in 2023, highlighting the importance of robust compliance for e-commerce platforms.

Adherence to these laws is crucial for managing customer expectations and minimizing legal exposure. Failure to comply can lead to substantial fines and reputational damage. For example, in 2024, a major online retailer faced a significant penalty for inadequate product information and return processes, underscoring the financial implications of non-compliance.

- Product Safety Standards: Ensuring all products meet stringent safety requirements to prevent harm to consumers.

- Warranty and Returns: Establishing clear and fair policies for product warranties and customer returns.

- Transparency and Disclosure: Providing accurate and comprehensive information about products, pricing, and terms of service.

- Mitigating Legal Risks: Proactively managing compliance to avoid penalties and lawsuits.

Political Stability and Geopolitical Events

Global political stability and geopolitical events significantly influence Polished.com's operations. Trade disputes, for instance, can directly impact the import and export of home appliances and furniture, creating disruptions in supply chains. The ongoing trade tensions between major economies, which saw tariffs on various goods increase by an average of 15% in late 2023, directly affect material sourcing and finished product costs.

Conflicts and regional instability can further exacerbate these issues. For example, disruptions in key manufacturing regions or shipping lanes, such as those experienced in the Red Sea in early 2024 due to geopolitical events, led to shipping delays and increased freight costs by as much as 20% for some industries. This directly impacts Polished.com's ability to maintain product availability and manage shipping expenses.

These geopolitical factors also contribute to increased material and energy costs. Rising energy prices, partly driven by global supply concerns and geopolitical events, directly translate to higher manufacturing and transportation expenses. In 2024, global energy prices saw fluctuations averaging 10-12% higher than the previous year, a trend that directly pressures Polished.com's profitability and overall competitiveness in the market.

- Trade disputes: Increased tariffs on imported components and finished goods raise operational costs.

- Geopolitical conflicts: Disruptions to shipping routes and manufacturing hubs lead to supply chain volatility and higher freight expenses.

- Energy price fluctuations: Higher energy costs impact manufacturing, logistics, and ultimately, product pricing.

- Political instability: Can create uncertainty in key markets, affecting consumer demand and investment decisions.

Government regulations significantly shape Polished.com's operational landscape, impacting everything from product safety to data handling. Recent legislative actions, such as the EU's General Product Safety Regulation, mandate strict adherence to safety standards, while evolving data privacy laws like the California Privacy Rights Act (CPRA) require robust data protection measures. These regulations, with potential new enforcement actions and updates anticipated in 2025, necessitate ongoing investment in compliance to avoid substantial financial penalties, which can reach millions of euros or a significant percentage of global turnover.

Trade policies and tariffs directly influence Polished.com's cost of goods and pricing strategies. For instance, tariffs imposed on imported furniture can lead to higher consumer prices, as noted in a 2024 Congressional Research Service report. These trade dynamics, coupled with geopolitical events causing shipping disruptions and increased freight costs—up by as much as 20% in early 2024 on certain routes—directly impact supply chain stability and operational expenses, with energy price fluctuations averaging 10-12% higher in 2024 contributing to these pressures.

| Regulation/Policy Area | Impact on Polished.com | Example/Data Point |

|---|---|---|

| Product Safety | Mandates adherence to safety standards; impacts product design and sourcing. | EU reported over 2,000 rapid alerts for dangerous non-food products in 2023. |

| Data Privacy | Requires secure data management and transparent policies for customer information. | GDPR fines can reach up to 4% of annual global turnover. |

| Trade Tariffs | Increases cost of goods for imported items, affecting pricing and competitiveness. | Tariffs can lead to higher prices for consumers, necessitating pricing strategy adjustments. |

| Geopolitical Instability | Disrupts supply chains, increases freight costs, and impacts energy prices. | Red Sea disruptions in early 2024 led to shipping delays and up to 20% higher freight costs. |

What is included in the product

This Polished PESTLE Analysis provides a comprehensive examination of external macro-environmental factors influencing the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify both opportunities and threats.

A Polished PESTLE Analysis translates complex external factors into actionable insights, relieving the pain of uncertainty and enabling more confident strategic decision-making.

Economic factors

Consumer discretionary spending is a critical driver for Polished.com, as its home appliances and furniture are typically considered large, non-essential purchases. For instance, in Q1 2024, the U.S. personal consumption expenditures on durable goods, which includes many of Polished.com's product categories, saw a modest increase, but the overall consumer sentiment remained cautious due to persistent inflation.

Macroeconomic challenges, such as the elevated inflation rates experienced throughout 2023 and into early 2024, directly dampen consumers' purchasing power and confidence. This, coupled with higher interest rates, makes financing larger purchases like appliances and furniture less attractive, potentially leading to a slowdown in sales for companies like Polished.com.

Data from the Bureau of Labor Statistics indicated that the Consumer Price Index (CPI) for All Urban Consumers rose by 3.5% for the twelve months ending April 2024, a slight acceleration from the previous month, directly impacting the affordability of discretionary goods. This trend suggests that consumers are increasingly prioritizing essential spending, which could negatively affect Polished.com's top line.

Inflation remains a significant concern, with the US experiencing an annual inflation rate of 3.3% as of May 2024. This persistent inflation directly impacts Polished.com by increasing the cost of raw materials and operational expenses. Furthermore, it erodes the purchasing power of consumers, potentially leading to reduced demand for non-essential home goods.

Rising interest rates, a common response to high inflation, present another challenge. The Federal Reserve has maintained its benchmark interest rate within a range of 5.25% to 5.50% through early 2024. This environment makes borrowing more expensive for consumers, particularly for large purchases like home furnishings that often require financing, thus dampening demand for Polished.com's offerings.

The global e-commerce market is projected to reach $7.4 trillion by 2025, with furniture and home appliances experiencing particularly strong online growth. This trend offers Polished.com a substantial avenue for expansion as consumers increasingly favor the convenience and wider selection offered by digital platforms.

Mobile commerce is a key driver, with mobile transactions expected to account for over 70% of all e-commerce sales by 2025. Polished.com can capitalize on this by optimizing its mobile experience and investing in mobile-first marketing strategies.

Supply Chain Costs and Efficiency

Fluctuations in global supply chain costs present a significant challenge for Polished.com. For instance, the S&P Global Platts Container Freight Index saw considerable volatility throughout 2023 and into early 2024, with some routes experiencing sharp increases due to geopolitical disruptions and strong demand. These shifts in freight prices, coupled with ongoing labor shortages in key logistics hubs and the potential for material scarcity, directly affect Polished.com's operational expenses. This makes offering competitive pricing more difficult.

To navigate these pressures, efficient supply chain management is paramount. Polished.com's strategy likely involves optimizing inventory levels and transportation routes. Diversifying suppliers across different geographic regions is also crucial. This reduces reliance on any single source, mitigating risks associated with localized disruptions or price gouging. For example, companies in the apparel sector, similar to Polished.com's likely product lines, have actively sought alternative manufacturing bases in Southeast Asia and Eastern Europe to offset reliance on traditional Asian manufacturing centers.

The impact of these factors can be quantified. Consider that in 2023, elevated energy prices contributed to a 15% increase in global shipping costs for many goods compared to 2022 averages. Furthermore, labor costs in warehousing and transportation have risen by an average of 8% year-over-year in many developed economies due to persistent worker shortages. These rising input costs necessitate a robust approach to supply chain resilience.

- Freight Cost Volatility: Container shipping rates, while down from pandemic peaks, remain sensitive to global events. For example, the cost to ship a 40-foot container from Asia to Europe in early 2024 hovered around $2,000-$3,000, a significant increase from pre-pandemic levels of around $1,000.

- Labor Market Pressures: Shortages of truck drivers and warehouse workers continue to impact delivery times and costs. In the US, the trucking industry faced an estimated shortage of over 78,000 drivers in 2023.

- Material Scarcity and Pricing: The availability and cost of raw materials, such as metals or specialized components, can fluctuate. For instance, certain rare earth minerals essential for electronics manufacturing saw price spikes of up to 20% in late 2023 due to geopolitical tensions.

- Efficiency Gains: Companies that invest in technology like AI-powered route optimization or improved warehouse automation can see operational cost reductions of 5-10% annually.

Housing Market Trends

The performance of the housing market is a critical economic indicator for companies like Polished.com, directly impacting demand for home furnishings and appliances. A robust housing sector, characterized by healthy new home sales and increased renovation activity, typically drives higher consumer spending on these goods.

In 2024, the U.S. housing market has shown resilience despite economic headwinds. For instance, new home sales in April 2024 reached a seasonally adjusted annual rate of 693,000, a notable increase from the previous year, indicating continued demand. This trend bodes well for Polished.com as more new homes translate to greater opportunities for furnishing purchases.

However, rising housing inflation and potential interest rate hikes in late 2024 and into 2025 could present challenges. If housing costs continue to climb significantly, consumers might delay or reduce discretionary spending on items like appliances and furniture, potentially impacting Polished.com's sales volume. For example, mortgage rates, which have fluctuated around 6.5%-7.5% in early to mid-2024, directly influence housing affordability and subsequent consumer behavior.

- New home sales in April 2024 were 693,000 units, suggesting a healthy demand for new residences.

- Existing home sales, while facing inventory challenges, also saw activity, contributing to the overall housing market sentiment.

- Renovation spending is projected to remain strong, with the Leading Indicator of Remodeling Activity (LIRA) from the Joint Center for Housing Studies of Harvard University indicating continued growth in home improvement investments through 2024.

- Interest rate sensitivity is high, as mortgage rates impacting housing affordability can directly curb consumer spending on non-essential home goods.

Persistent inflation, with the US annual inflation rate at 3.3% in May 2024, continues to erode consumer purchasing power and increase operational costs for Polished.com. Higher interest rates, with the Federal Reserve maintaining its benchmark rate between 5.25% and 5.50% through early 2024, make financing large purchases like appliances and furniture less attractive, potentially slowing sales.

The housing market shows resilience, with new home sales at a seasonally adjusted annual rate of 693,000 in April 2024, indicating a positive outlook for home furnishing demand. However, rising housing inflation and mortgage rates around 6.5%-7.5% in early to mid-2024 could temper consumer spending on discretionary items.

Supply chain disruptions, including freight cost volatility and labor shortages, as evidenced by an estimated 78,000 driver shortage in the US trucking industry in 2023, impact operational expenses and pricing competitiveness for Polished.com.

The global e-commerce market is set to reach $7.4 trillion by 2025, with mobile commerce dominating sales, offering Polished.com a significant growth opportunity through digital platforms.

| Economic Factor | Data Point (2024/2025 Projections) | Impact on Polished.com |

| Inflation Rate (US Annual) | 3.3% (May 2024) | Reduces consumer spending power, increases operational costs. |

| Federal Funds Rate | 5.25%-5.50% (Early 2024) | Increases borrowing costs for consumers, dampening demand for large purchases. |

| New Home Sales (US Annualized Rate) | 693,000 (April 2024) | Indicates strong demand for new homes, driving demand for furnishings. |

| Mortgage Rates (US Average) | 6.5%-7.5% (Early-Mid 2024) | Affects housing affordability, potentially impacting discretionary spending. |

| E-commerce Market Size | Projected $7.4 trillion by 2025 | Provides significant growth avenue through online sales. |

Preview Before You Purchase

Polished PESTLE Analysis

The preview shown here is the exact Polished PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying, delivering a comprehensive Polished PESTLE Analysis exactly as shown, with no surprises.

The Polished PESTLE Analysis content and structure shown in the preview is the same document you’ll download after payment, providing immediate actionable insights.

What you’re previewing here is the actual, professionally crafted Polished PESTLE Analysis file—fully formatted and ready to be implemented immediately.

Sociological factors

Consumers are increasingly comfortable and even prefer shopping online, a trend that particularly benefits companies like Polished.com. This shift is evident in the growing sales of large-ticket items, such as home appliances and furniture, directly through e-commerce channels. In 2023, online retail sales for home furnishings in the U.S. reached approximately $150 billion, highlighting this significant behavioral change.

Polished.com's success hinges on its capacity to offer a smooth and user-friendly online platform that caters to this evolving consumer preference. The convenience factor, from browsing and selection to checkout and delivery, is paramount in attracting and retaining a customer base that values digital interactions. A seamless experience can translate directly into repeat business and positive word-of-mouth referrals.

The growing consumer appetite for smart home technology presents a significant opportunity for Polished.com. As of late 2024, the global smart home market was valued at over $150 billion, with projections indicating continued robust growth through 2025. This trend highlights a societal shift towards convenience, automation, and enhanced energy management within residences. Polished.com's strategy should capitalize on this by ensuring its product development and marketing efforts resonate with consumers seeking these advanced, connected living solutions.

Consumers are increasingly prioritizing sustainability, with a significant portion willing to pay more for eco-friendly products. For instance, a 2024 survey indicated that over 60% of global consumers consider sustainability a key factor in their purchasing choices. This shift presents a clear opportunity for Polished.com to resonate with this growing demographic.

Polished.com can actively appeal to eco-conscious consumers by integrating sustainable product lines and ensuring transparency in its sourcing practices. Highlighting environmentally responsible packaging and delivery methods can further solidify its appeal. The company's commitment to these values can translate into enhanced brand loyalty and market differentiation.

Customer Service Expectations

Modern consumers, particularly those engaging with online retailers for significant purchases, demand a superior customer service experience. This encompasses rapid and transparent delivery, a straightforward returns process, and dependable post-purchase support. For instance, in 2024, studies indicated that over 60% of consumers consider responsive customer service a key factor in their purchasing decisions, with a similar percentage willing to pay more for a better experience.

Polished.com's commitment to a 'white-glove shopping experience' directly addresses these evolving expectations. Policies such as their 'Love-It-Or-Return-It' guarantee are not merely conveniences but essential components for fostering trust and encouraging repeat business. This approach is crucial in a market where customer retention is often more cost-effective than acquisition.

The emphasis on exceptional service is particularly salient for high-value items, where the perceived risk for the consumer is greater. Companies that excel in this area build a strong brand reputation and cultivate a loyal customer base. Data from 2024 suggests that businesses with highly engaged customers report a 20-25% increase in revenue and significantly higher customer lifetime value.

- Customer Service as a Differentiator: 70% of consumers report switching brands due to poor customer service.

- Impact on Loyalty: A positive service experience increases the likelihood of repeat purchases by up to 80%.

- Value of Transparency: 55% of shoppers expect real-time updates on their orders.

- Returns Policy Importance: 45% of online shoppers consider the ease of returns a deciding factor in their purchase.

Influence of Digital Media and Personalization

The pervasive influence of digital media, particularly social platforms and online reviews, significantly shapes consumer choices in the home goods sector. By mid-2025, studies indicate that over 70% of consumers actively seek out online reviews before making a purchase, especially for higher-value items like furniture and appliances. Personalized marketing, increasingly powered by AI, further hones in on individual preferences, driving engagement and conversion rates.

Polished.com must actively harness these digital trends. Leveraging social media for targeted campaigns and showcasing customer testimonials can build trust and brand loyalty. In 2024, companies that effectively integrated user-generated content saw an average 15% increase in online sales. Furthermore, implementing AI-driven recommendation engines can curate a more relevant and appealing shopping experience for each customer, anticipating their needs and preferences.

Key strategies for Polished.com include:

- Amplifying customer reviews: Actively encourage and prominently display customer feedback across all digital touchpoints.

- Strategic social media engagement: Utilize platforms for authentic brand storytelling and direct customer interaction.

- Personalized digital marketing: Implement AI tools to deliver tailored product recommendations and promotions.

- Influencer collaborations: Partner with relevant influencers to reach new audiences and build credibility.

Sociological factors significantly influence consumer behavior in the home goods market. The increasing comfort with online shopping, particularly for larger items, is a major trend. By 2024, online sales for home furnishings in the U.S. were projected to exceed $160 billion, demonstrating a clear shift in purchasing habits. This digital preference necessitates a seamless, user-friendly online experience for companies like Polished.com.

Furthermore, a growing emphasis on sustainability and ethical consumption is evident. A 2024 report indicated that over 65% of consumers consider a brand's environmental impact when making purchasing decisions. Polished.com can leverage this by offering eco-friendly product lines and transparent sourcing, appealing to a more socially conscious customer base.

The demand for convenience and exceptional customer service remains paramount. By mid-2025, it's estimated that 75% of consumers will prioritize brands offering easy returns and responsive support. Polished.com's focus on a positive customer journey, including robust return policies and efficient delivery, directly addresses this evolving expectation, fostering loyalty and repeat business.

The digital landscape, particularly social media and online reviews, plays a crucial role in shaping purchasing decisions. By 2025, over 70% of consumers will rely on online reviews before buying high-value home items. Polished.com's strategy to amplify customer testimonials and engage actively on social platforms is vital for building trust and driving sales.

| Sociological Factor | Impact on Consumer Behavior | Data Point (2024-2025) |

|---|---|---|

| Digital Shopping Preference | Increased comfort with online purchases, especially for large items | Online home furnishings sales projected to exceed $160 billion (2024) |

| Sustainability Focus | Prioritization of eco-friendly products and ethical sourcing | Over 65% of consumers consider environmental impact (2024) |

| Demand for Convenience & Service | Expectation of easy returns, responsive support, and fast delivery | 75% of consumers will prioritize convenience by mid-2025 |

| Influence of Digital Media | Reliance on online reviews and social platforms for purchase decisions | Over 70% of consumers use online reviews for high-value home items (by 2025) |

Technological factors

Polished.com's e-commerce platform capabilities are paramount to its customer engagement and sales. A key factor is website speed; by mid-2025, industry benchmarks suggest conversion rates can drop by 7% for every second of delay. Polished.com aims for load times under 3 seconds, aligning with best practices to minimize cart abandonment.

Mobile optimization is non-negotiable, with projections indicating mobile commerce will account for over 85% of all e-commerce sales by the end of 2025. Polished.com's responsive design ensures a fluid experience across all devices, crucial for capturing this growing market segment. Intuitive navigation is also a focus, reducing bounce rates and improving user satisfaction.

Secure payment gateways are foundational, safeguarding customer data and fostering trust. In 2024, data breaches cost businesses an average of $4.35 million, underscoring the importance of robust security measures. Polished.com employs advanced encryption and fraud detection systems to protect transactions, ensuring a seamless and secure checkout process.

Augmented Reality (AR) and Virtual Reality (VR) are transforming how consumers interact with products. For Polished.com, this means customers can now virtually place furniture and appliances within their own living spaces using their smartphones or computers. This capability directly addresses pre-purchase uncertainty, a major hurdle in online home goods retail.

The adoption of AR/VR is projected to significantly impact e-commerce growth. By 2025, the global AR/VR market is anticipated to reach $332.3 billion, with a substantial portion driven by retail applications. For Polished.com, integrating these immersive visualization tools can lead to higher customer engagement and a notable increase in conversion rates, potentially boosting sales by an estimated 10-15% based on early industry adoption trends.

Artificial Intelligence presents significant opportunities for Polished.com to enhance customer experiences and operational efficiency. By leveraging AI, the company can offer highly personalized product recommendations, tailoring suggestions to individual customer preferences and past behaviors. This can lead to increased conversion rates and customer loyalty. For instance, in 2024, e-commerce platforms utilizing AI for personalization saw an average sales uplift of 10-15%.

Furthermore, AI can be instrumental in optimizing pricing strategies. Dynamic pricing models, powered by AI, can analyze market demand, competitor pricing, and inventory levels in real-time to set the most effective prices, maximizing revenue and profitability. Reports from 2025 indicate that businesses employing AI-driven dynamic pricing have observed a 5% improvement in profit margins.

Internally, AI can streamline various business processes, from inventory management to customer service. AI-powered chatbots can handle a significant volume of customer inquiries, freeing up human agents for more complex issues. Polished.com can also use AI to manage its extensive product catalog, generating unique and compelling product descriptions at scale, which is crucial for SEO and customer engagement.

Supply Chain Automation and Logistics Technology

Advanced logistics technologies are crucial for managing the complexities of delivering large items like appliances and furniture. Automated warehousing, real-time shipment tracking, and sophisticated delivery management systems streamline operations, ensuring efficiency. For instance, by 2024, the global warehouse automation market was projected to reach over $30 billion, highlighting the significant investment in these technologies.

Optimizing the supply chain through these technological advancements directly impacts delivery speed and cost reduction. Companies leveraging these tools can anticipate reduced logistics expenses, potentially by 10-15%, and see improvements in on-time delivery rates. This translates to a better customer experience, a key differentiator in the competitive appliance and furniture market.

- Automated Warehousing: Reduces manual handling and speeds up order fulfillment.

- Real-time Tracking: Provides visibility throughout the delivery process, enhancing customer trust.

- Efficient Delivery Management: Optimizes routes and schedules, lowering fuel costs and delivery times.

- Data Analytics: Improves forecasting and inventory management, minimizing stockouts and overstocking.

Cybersecurity and Data Protection Technologies

Cybersecurity and data protection technologies are becoming increasingly critical. With the surge in online transactions and the sheer volume of sensitive customer data handled, businesses must prioritize robust defenses. Investing in advanced encryption, sophisticated fraud detection systems, and secure data storage solutions is no longer optional; it's fundamental to safeguarding customer information and preserving brand trust.

The financial sector, in particular, faces immense pressure. In 2023, the cost of a data breach for financial services firms averaged $5.90 million, significantly higher than the global average. This highlights the direct financial impact of inadequate cybersecurity. Organizations are therefore channeling significant resources into next-generation firewalls, intrusion detection systems, and zero-trust architectures to stay ahead of evolving threats.

- Increased Investment: Global spending on cybersecurity is projected to reach $269.7 billion in 2024, a substantial increase reflecting the growing importance of these technologies.

- AI in Security: Artificial intelligence and machine learning are being integrated into cybersecurity platforms to enhance threat detection and response times, with AI-powered cybersecurity solutions expected to grow significantly in the coming years.

- Data Privacy Regulations: Stricter data protection laws, such as GDPR and CCPA, mandate advanced security measures, compelling businesses to adopt more sophisticated encryption and data anonymization techniques.

- Cloud Security: As more data moves to the cloud, investments in cloud-native security tools and services are paramount to ensure data integrity and compliance.

Technological advancements are reshaping the e-commerce landscape, directly impacting Polished.com's operations and customer engagement. The integration of Artificial Intelligence for personalized recommendations and dynamic pricing is a key area, with AI-driven personalization showing an average sales uplift of 10-15% in 2024. Furthermore, the growth of AR/VR in retail, projected to be a significant driver in a market expected to reach $332.3 billion by 2025, offers immersive product visualization capabilities that can boost conversion rates.

Advanced logistics technologies, including automated warehousing and real-time tracking, are crucial for efficient delivery, especially for bulky items. The global warehouse automation market alone was projected to exceed $30 billion in 2024, indicating a substantial industry investment. These technologies can reduce logistics expenses by an estimated 10-15% and improve on-time delivery rates.

Cybersecurity remains a critical technological factor, with global spending on cybersecurity projected to hit $269.7 billion in 2024. Financial services firms, facing higher breach costs averaging $5.90 million in 2023, are prioritizing advanced defenses, including AI-powered threat detection, to protect sensitive data and maintain customer trust.

| Technology Area | Key Advancement | Projected Impact/Data Point (2024-2025) | Relevance to Polished.com |

|---|---|---|---|

| Artificial Intelligence (AI) | Personalized Recommendations & Dynamic Pricing | 10-15% sales uplift from AI personalization (2024); 5% profit margin improvement from dynamic pricing (2025 reports). | Enhanced customer experience, increased conversion rates, optimized revenue. |

| Augmented/Virtual Reality (AR/VR) | Immersive Product Visualization | Global AR/VR market to reach $332.3 billion by 2025; potential 10-15% sales boost from visualization tools. | Reduced purchase uncertainty, improved customer engagement, higher conversion for home goods. |

| Logistics Technologies | Automated Warehousing & Real-time Tracking | Global warehouse automation market > $30 billion (2024); 10-15% reduction in logistics expenses. | Faster delivery, lower operational costs, improved customer satisfaction. |

| Cybersecurity | Advanced Encryption & Threat Detection | Global cybersecurity spending $269.7 billion (2024); average data breach cost for financial services $5.90 million (2023). | Data protection, customer trust, compliance with regulations. |

Legal factors

Polished.com operates under a strict framework of product safety and liability laws, necessitating adherence to rigorous standards for the design, manufacturing, and labeling of its home appliances and furniture. For instance, in 2024, the Consumer Product Safety Commission (CPSC) in the United States reported over 13,000 product-related injuries treated in emergency departments, highlighting the critical nature of compliance. Failure to meet these regulations, such as those governed by the CPSC or similar international bodies, can trigger costly product recalls and substantial legal liabilities, as seen when a major appliance manufacturer faced millions in damages for faulty wiring in 2023. Such non-compliance not only incurs direct financial penalties but also inflicts significant reputational damage, eroding consumer trust and market share.

Consumer contract and warranty laws significantly shape Polished.com's operational framework, influencing everything from sales agreements to post-purchase support. For instance, the Uniform Commercial Code (UCC) in the US, particularly Article 2 on Sales, dictates many aspects of these transactions, including implied warranties of merchantability and fitness for a particular purpose, which Polished.com must adhere to.

Compliance with these regulations is crucial; a failure to clearly outline warranty terms or honor return policies can lead to costly legal battles and damage brand reputation. As of early 2025, consumer protection agencies are increasingly scrutinizing online retailers for deceptive practices, making transparency in terms of service paramount for companies like Polished.com to avoid potential fines or lawsuits that could impact their financial health.

Polished.com must navigate a complex web of advertising and marketing regulations. In the US, the Federal Trade Commission (FTC) scrutinizes online advertising, marketing claims, and deceptive practices, demanding that Polished.com's promotional content is entirely truthful and free from misleading statements. This includes a sharp focus on avoiding 'dark patterns'—user interface designs that trick users into doing something they didn't intend—and ensuring complete transparency in all marketing efforts. Failure to comply can lead to significant penalties, impacting brand reputation and financial performance.

Intellectual Property Laws

Intellectual property laws are crucial for Polished.com, safeguarding its brand, website content, and unique e-commerce technologies. This protection is vital for maintaining its competitive edge and brand integrity in the digital marketplace.

The company must also diligently avoid infringing on the intellectual property rights of other brands and manufacturers whose products it features. Non-compliance could lead to costly litigation and damage to its reputation.

- Brand Protection: Trademarks for Polished.com prevent unauthorized use of its name and logo, a key differentiator in the crowded online retail space.

- Content Rights: Copyright laws protect original website content, product descriptions, and imagery from being copied by competitors.

- Technological Safeguards: Patents can cover proprietary e-commerce platform features, ensuring Polished.com maintains its technological advantage.

- Due Diligence: A thorough review of vendor agreements and product sourcing is necessary to confirm no infringement of third-party patents or trademarks occurs.

Bankruptcy and Financial Regulations

Given Polished.com's announced intention for a Chapter 7 bankruptcy filing, strict adherence to U.S. Bankruptcy Code provisions and relevant financial regulations is paramount. This involves navigating complex legal frameworks governing asset liquidation and creditor distributions. For instance, in 2023, the U.S. saw over 400,000 bankruptcy filings, highlighting the prevalence of these proceedings.

Compliance extends to meticulous reporting requirements mandated by the bankruptcy court, ensuring transparency throughout the liquidation process. Failure to meet these obligations, such as timely filing of schedules and statements, can lead to penalties or adverse rulings. Polished.com must also manage its legal obligations to all identified creditors, adhering to priority rules for payment as established by law.

Specific to Chapter 7, the company will need to cooperate fully with the appointed trustee who will oversee the sale of non-exempt assets to satisfy debts. The trustee's role is to maximize recovery for creditors, and the company's legal team must facilitate this.

- Bankruptcy Code Compliance: Adherence to Chapter 7 specific procedures for asset surrender and liquidation.

- Creditor Notification: Ensuring all creditors receive proper legal notice of the bankruptcy proceedings.

- Reporting Obligations: Timely and accurate submission of all required financial documents to the court and trustee.

Polished.com's operational landscape is heavily influenced by bankruptcy law, particularly its Chapter 7 filing. This necessitates strict adherence to the U.S. Bankruptcy Code and court-mandated reporting, as evidenced by the over 400,000 bankruptcy filings in the U.S. during 2023. Compliance ensures orderly liquidation and fair creditor distribution, with the appointed trustee playing a key role in asset recovery.

Environmental factors

Growing consumer demand for environmentally friendly products is a major environmental factor for Polished.com. In 2024, 65% of consumers stated they preferred to buy from brands committed to sustainability, a significant increase from previous years.

Regulatory bodies are also tightening environmental standards. For instance, the European Union's proposed Ecodesign for Sustainable Products Regulation, expected to be fully implemented by 2025, will mandate stricter requirements for material sourcing and product lifecycle management in furniture and appliances.

Polished.com can leverage this trend by prioritizing partnerships with manufacturers employing eco-friendly materials like recycled plastics, bamboo, and sustainably harvested wood. This commitment not only addresses regulatory pressures but also strengthens brand reputation, as evidenced by competitors like IKEA, which saw a 4% increase in customer loyalty after expanding its use of renewable and recycled materials in 2023.

Polished.com must navigate increasingly stringent regulations around electronic waste (e-waste) and large household appliances (LHAs). These rules mandate responsible end-of-life product management, impacting how the company handles discarded items. For instance, the EU's WEEE Directive, which aims to increase e-waste collection and recycling rates, saw member states collect an estimated 1.27 million tonnes of e-waste in 2023, with a target of 17.1 kg per capita. Polished.com's compliance strategy likely involves either establishing its own recycling infrastructure or forming partnerships to meet these evolving environmental obligations and extended producer responsibility schemes.

The transportation of large items like appliances and furniture significantly impacts Polished.com's carbon footprint. In 2024, the logistics sector globally is estimated to contribute over 20% of total greenhouse gas emissions, with road freight being a major component. This highlights a critical area for environmental improvement for companies like Polished.com.

To mitigate this, Polished.com can focus on optimizing delivery routes, a strategy that can reduce fuel consumption by up to 15% according to industry studies. Furthermore, transitioning to more fuel-efficient vehicles, such as electric or hybrid delivery vans, is becoming increasingly viable. For instance, by 2025, several major logistics providers plan to significantly increase their electric vehicle fleets, aiming for a 30% reduction in emissions from last-mile deliveries.

Exploring carbon offsetting initiatives also presents an opportunity to address unavoidable emissions. Companies can invest in projects like reforestation or renewable energy development. By 2024, the voluntary carbon market is projected to reach over $50 billion, indicating a growing demand for and availability of credible offsetting solutions that can help Polished.com achieve its environmental goals.

Energy Efficiency Standards for Appliances

Government regulations and growing consumer awareness are significantly pushing for higher energy efficiency standards across various appliance categories. Polished.com should actively focus on sourcing and marketing products that not only meet but surpass these evolving benchmarks. For instance, in the US, the ENERGY STAR program continues to be a key indicator for consumers, with ENERGY STAR certified refrigerators, on average, using 9% less energy than models meeting the minimum federal efficiency requirements. This trend is expected to accelerate, with projections indicating continued growth in the market for energy-saving home goods.

The increasing demand for eco-friendly and cost-saving appliances presents a strategic opportunity for Polished.com. By aligning product offerings with stringent energy efficiency standards, the company can tap into a growing segment of environmentally conscious consumers who prioritize reduced utility bills and a smaller carbon footprint. This proactive approach can differentiate Polished.com in a competitive market.

- Growing Consumer Preference: A 2024 survey indicated that over 60% of consumers consider energy efficiency a key factor when purchasing major home appliances.

- Regulatory Momentum: Many regions are tightening minimum energy performance standards (MEPS) for appliances, with updates anticipated in late 2024 and throughout 2025.

- Cost Savings Appeal: Energy-efficient appliances can lead to substantial savings on utility bills, with some models demonstrating up to 20% reduction in energy consumption compared to older units.

- Market Differentiation: Offering appliances that exceed current standards can position Polished.com as a forward-thinking and responsible brand.

Packaging Waste Reduction

The substantial volume of packaging required for shipping home goods poses a significant environmental challenge, contributing to landfill waste. Polished.com can address this by embracing sustainable packaging solutions. In 2024, the global market for sustainable packaging was valued at over $270 billion, demonstrating a clear consumer and industry shift. By implementing practices such as using recyclable, compostable, or minimalist packaging, Polished.com can meet evolving consumer demand for eco-conscious brands and actively reduce its environmental impact.

Adopting greener packaging strategies can also yield financial benefits. For instance, optimizing packaging size can lead to reduced shipping costs. Moreover, companies that prioritize sustainability often see enhanced brand loyalty and a stronger market position. As of early 2025, consumer surveys indicate that over 60% of shoppers are willing to pay a premium for products with sustainable packaging.

- Recyclable Materials: Utilizing materials like recycled cardboard or plastics that are widely accepted in municipal recycling programs.

- Compostable Options: Exploring biodegradable materials that can break down naturally in composting facilities.

- Minimalist Design: Reducing the amount of packaging material used without compromising product protection.

- Consumer Education: Clearly labeling packaging with disposal instructions to encourage proper recycling or composting.

The increasing focus on sustainability drives demand for eco-friendly products, with 65% of consumers in 2024 preferring brands committed to sustainability. Stricter regulations, like the EU's Ecodesign for Sustainable Products Regulation by 2025, mandate better material sourcing and lifecycle management. Polished.com can enhance its brand by using recycled plastics and bamboo, a strategy that boosted IKEA's customer loyalty by 4% in 2023.

Polished.com must manage e-waste and appliance disposal under evolving regulations. The EU's WEEE Directive saw member states collect 1.27 million tonnes of e-waste in 2023. The company can build its own recycling infrastructure or partner with others to meet these extended producer responsibility obligations.

The logistics sector, contributing over 20% of global greenhouse gas emissions in 2024, presents a challenge for Polished.com's carbon footprint. Optimizing delivery routes can cut fuel consumption by 15%, and transitioning to electric vehicles by 2025, as planned by many providers aiming for 30% emission reduction in last-mile deliveries, offers further benefits. Carbon offsetting through reforestation is also a growing option, with the voluntary carbon market projected to exceed $50 billion by 2024.

Energy efficiency standards are rising, with ENERGY STAR certified refrigerators using 9% less energy on average. Over 60% of consumers in a 2024 survey consider energy efficiency key for appliances, and many regions are updating minimum energy performance standards through 2025. Offering appliances that exceed these benchmarks can position Polished.com as a market leader.

The substantial packaging for home goods contributes to landfill waste, but sustainable packaging solutions are growing, with the global market valued at over $270 billion in 2024. Minimalist, recyclable, or compostable packaging can reduce environmental impact and shipping costs, while over 60% of shoppers in early 2025 were willing to pay more for sustainably packaged products.

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using data from reputable sources, including government publications, international organizations, and leading market research firms. We ensure comprehensive coverage by incorporating economic indicators, technological advancements, and socio-cultural trends.