Gannett Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gannett Bundle

Curious about Gannett's product portfolio performance? This glimpse into their BCG Matrix reveals the strategic positioning of their key offerings, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly understand how Gannett can optimize its investments and drive future growth, dive into the full BCG Matrix for a comprehensive breakdown and actionable insights.

Stars

USA TODAY's digital-only subscriptions represent a significant growth area for Gannett. In 2024, the company reported a notable uptick in paid digital subscriptions, underscoring a robust demand for its online content. This expansion highlights USA TODAY's strong standing in the competitive digital news sector, successfully cultivating an audience committed to paying for quality journalism.

The average revenue per user (ARPU) for these digital subscriptions has also seen positive movement, signaling effective monetization strategies. Gannett's strategic investment in enhancing its sports coverage and developing more video journalism content is directly contributing to this upward trend. These initiatives are designed to further solidify USA TODAY's appeal and drive sustained growth within the dynamic digital media market.

Gannett's LocaliQ, providing digital marketing services to small and medium-sized businesses, is positioned as a star in the BCG matrix. This classification stems from its high growth potential within the continually expanding digital advertising sector.

LocaliQ is strategically built to attract and retain increasing client investments in digital marketing solutions. The brand leverages advanced AI-powered platforms, aiming to deliver robust and effective marketing strategies for its clientele.

The significant emphasis on growth within LocaliQ highlights its critical role in Gannett's strategy for future revenue diversification. This segment is key to expanding the company's market share in the competitive digital landscape.

The USA TODAY Network, powered by Gannett, is a star in the BCG matrix due to its vast digital audience. Reaching millions of monthly unique visitors across USA TODAY and its numerous local news outlets, Gannett commands a significant share of the digital news market, excluding aggregators.

This substantial digital footprint, estimated to reach over 100 million adults monthly in 2024, provides a robust platform for revenue generation through digital advertising and subscriptions. The growing trend of digital consumption further solidifies its position as a high-growth, high-market-share entity.

Strategic Partnerships (e.g., Reuters, BetMGM)

Gannett's strategic partnerships, like its content bundling agreement with Reuters, are key growth drivers. These collaborations are designed to broaden the company's audience reach and unlock new revenue opportunities.

The company's ventures with entities such as BetMGM highlight a strategic move to monetize its sports content effectively. These partnerships leverage emerging technologies, including AI, to create fresh income streams in rapidly expanding markets.

These alliances significantly boost Gannett's market presence and the value of its offerings. They represent avenues for substantial growth, positioning Gannett to capitalize on evolving consumer demands and industry trends.

- Reuters Partnership: Expands content distribution and reach, enhancing Gannett's news offerings.

- BetMGM Collaboration: Monetizes sports content and taps into the growing sports betting market.

- AI Integration: Leverages artificial intelligence to improve content delivery and operational efficiency.

- Revenue Diversification: Creates new income streams by entering adjacent markets and offering bundled services.

AI-Driven Content and Engagement Initiatives (e.g., DeeperDive)

Gannett's investment in AI-driven content initiatives, exemplified by its DeeperDive AI answer engine, clearly marks it as a star within its BCG matrix. This strategic focus on innovation is designed to significantly enhance audience engagement. By providing more intelligent content delivery, Gannett aims to capture a larger share of the digital audience.

These AI technologies are pivotal in unlocking new revenue streams. Enhanced advertising capabilities, driven by more personalized content experiences, are a key benefit. Furthermore, the potential for premium subscription models built around superior AI-powered content discovery and delivery is substantial. For instance, in 2024, digital advertising revenue for many media companies saw a notable uptick, and AI-driven personalization is a significant contributor to this trend.

- Innovation Driver: DeeperDive AI positions Gannett at the forefront of content technology.

- Engagement Enhancement: Aims to provide users with more relevant and deeper content experiences.

- Revenue Generation: Opens avenues for improved advertising effectiveness and new subscription tiers.

- Market Positioning: Signals a strong commitment to adapting and leading in the evolving digital media landscape.

Stars represent business units with high market share in high-growth industries. For Gannett, USA TODAY's digital subscriptions and LocaliQ are prime examples. These segments are experiencing robust growth and hold significant market positions, indicating strong future potential.

USA TODAY's digital-only subscriptions are a key star, driven by increasing demand for quality online journalism. In 2024, Gannett saw a notable rise in these subscriptions, reflecting a successful strategy to cultivate a paying digital audience.

LocaliQ, Gannett's digital marketing arm, is also classified as a star due to its high growth potential in the expanding digital advertising sector. Its AI-powered platforms are designed to attract and retain clients, contributing to revenue diversification.

The broader USA TODAY Network, with its extensive digital reach of over 100 million adults monthly in 2024, functions as a star. This vast audience base provides a strong platform for digital advertising and subscription revenue, capitalizing on the growing trend of digital content consumption.

Gannett's AI-driven content initiatives, such as the DeeperDive AI answer engine, also position it as a star. These innovations enhance audience engagement and unlock new revenue streams through improved advertising and premium subscription models.

| Business Unit | Market Share | Industry Growth | Gannett's Position |

|---|---|---|---|

| USA TODAY Digital Subscriptions | High | High (Digital News) | Star |

| LocaliQ | High | High (Digital Marketing) | Star |

| USA TODAY Network (Digital Reach) | High | High (Digital Media) | Star |

| AI-Driven Content Initiatives | Growing | High (AI in Media) | Star |

What is included in the product

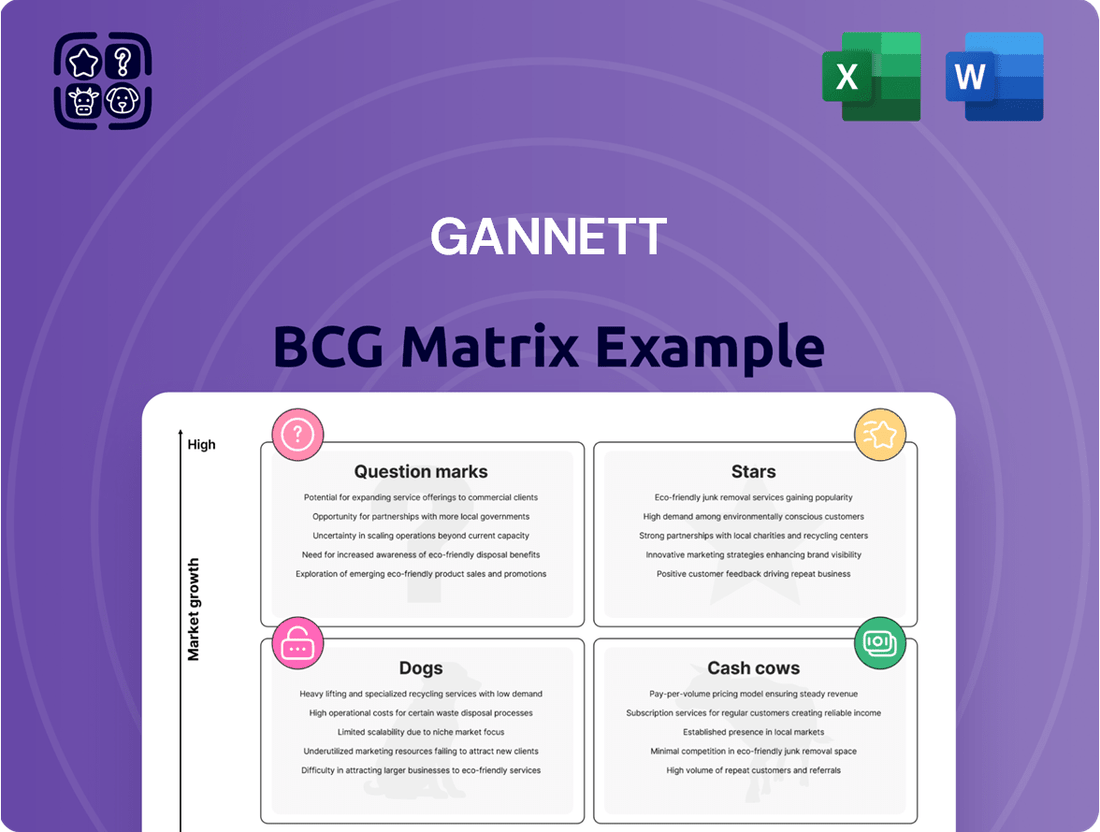

The Gannett BCG Matrix analyzes its portfolio by market share and growth, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

This framework guides strategic decisions on investment, divestment, and resource allocation for each business unit.

A clear, one-page Gannett BCG Matrix overview instantly clarifies business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

Print subscription revenue from Gannett's established local media, while declining, remains a significant cash cow. This segment, as of early 2024, still provides a substantial and stable revenue stream from a loyal subscriber base in mature markets. These long-term readers contribute consistent income with minimal need for aggressive marketing spend, underpinning its cash cow status.

Despite a secular decline, Gannett's legacy print advertising continues to be a cash cow. In 2023, Gannett reported total advertising revenue of $1.5 billion, with a significant portion still derived from print. These established revenue streams require minimal new investment, allowing Gannett to focus on efficiency and advertiser retention to maximize profitability.

Gannett's commercial printing and distribution services function as cash cows within its portfolio. These operations effectively leverage the company's established printing infrastructure, generating consistent revenue streams with manageable costs. For instance, in 2023, Gannett's total revenue from its publishing segment, which includes commercial printing, was approximately $2.4 billion, showcasing the ongoing financial contribution of these services.

Newsquest (UK Subsidiary)

Newsquest, Gannett's UK subsidiary, is positioned as a Cash Cow within the company's portfolio. Operating in a more mature media market, it generates consistent, predictable revenue streams. This stability allows it to contribute significant cash flow to Gannett without demanding substantial reinvestment for growth.

The UK's print media sector, while facing challenges, still offers a base of loyal readers and advertisers for established entities like Newsquest. Its digital transformation efforts are focused on optimizing existing assets and audience engagement rather than pioneering new, high-risk ventures.

- Mature Market Operation: Newsquest functions within the United Kingdom's established media landscape, characterized by stable, though not rapidly expanding, revenue streams.

- Steady Cash Flow Generation: The subsidiary is a reliable source of cash for Gannett, benefiting from its established brand recognition and operational efficiencies.

- Low Investment Requirement: Unlike high-growth potential businesses, Newsquest's cash cow status implies minimal need for significant capital expenditure, allowing its earnings to be readily deployed elsewhere within Gannett.

- Focus on Efficiency: The strategy for Newsquest centers on maintaining market share and maximizing operational effectiveness to ensure continued profitability.

Syndication and Licensing of Content

Gannett's syndication and licensing of its extensive content library, which includes USA TODAY and numerous local news outlets, represents a significant cash cow. This strategy allows the company to monetize its existing intellectual property, generating revenue with very low incremental production costs. It’s a prime example of a low-growth, high-margin business activity that provides consistent cash flow.

In 2023, Gannett continued to emphasize these revenue streams as part of its broader strategy to optimize returns. While specific figures for syndication and licensing revenue are often embedded within broader segment reporting, the company has consistently highlighted these activities as key to its diversified income model. For instance, Gannett's focus on digital subscriptions and advertising, alongside content licensing, aims to build a resilient revenue base.

- Leveraging Existing Assets: Monetizes a vast library of news and feature content.

- Low Marginal Cost: Generates revenue with minimal additional investment in content creation.

- Consistent Cash Flow: Provides a stable, predictable income stream for the company.

- Strategic Diversification: Supports exploration of new licensing and syndication partnerships to maximize value.

Gannett's established print subscription base, though facing secular decline, continues to act as a cash cow. This segment provides a stable, predictable revenue stream from loyal readers in mature markets. The low marketing expenditure required to maintain these subscriptions allows for consistent cash generation, reinforcing its cash cow status.

Print advertising, despite its overall downturn, remains a significant cash cow for Gannett. In 2023, advertising revenue contributed substantially to the company's top line, with print still holding a notable share. These mature revenue streams require minimal new investment, enabling Gannett to focus on operational efficiency and advertiser retention to maximize profitability.

Commercial printing and distribution services leverage Gannett's existing infrastructure, functioning as valuable cash cows. These operations generate consistent revenue with manageable costs. In 2023, Gannett's publishing segment, which encompasses these services, reported approximately $2.4 billion in total revenue, highlighting the ongoing financial contribution from these established operations.

| Gannett Cash Cow Segments (Illustrative) | Approximate Revenue Contribution (2023 Estimates) | Key Characteristics |

|---|---|---|

| Print Subscriptions | Significant portion of legacy revenue | Loyal customer base, low marketing costs |

| Print Advertising | Substantial share of total advertising | Mature market, focus on retention |

| Commercial Printing & Distribution | Part of $2.4B publishing segment | Leverages existing infrastructure, stable income |

| Syndication & Licensing | Embedded in overall revenue | Monetizes existing content, low marginal cost |

What You See Is What You Get

Gannett BCG Matrix

The Gannett BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive analysis is ready for immediate integration into your strategic planning, offering clear insights into market share and growth potential without any hidden surprises or demo content.

Dogs

Certain print publications within Gannett's portfolio, especially those in declining local markets with low circulation and shrinking ad revenue, fit the description of dogs in the BCG matrix. These publications often require ongoing investment but yield minimal returns, making them prime candidates for divestiture or discontinuation. For instance, Gannett has been actively managing its print assets, with reports indicating a continued focus on optimizing its portfolio through strategic sales or closures of underperforming titles during 2024 and into 2025.

Gannett's digital offerings that are not resonating with users, characterized by minimal traffic and poor monetization, fall into the 'Dogs' category of the BCG Matrix. These underperforming digital assets, despite their online presence, represent a drain on resources without generating significant revenue or expanding market reach.

For instance, certain niche content sites or legacy digital products might be experiencing declining user engagement, with some reporting less than 10,000 monthly unique visitors in early 2024. These platforms often carry ongoing maintenance costs, such as hosting and software updates, while failing to contribute meaningfully to Gannett's overall digital revenue, which saw a modest 2% year-over-year increase in Q1 2024, largely driven by more successful digital subscriptions.

The company's strategic focus on improving user experience and engagement across its digital portfolio implicitly signals an intention to either phase out these underperforming 'dog' assets or undergo a significant transformation to improve their viability. This approach aims to reallocate resources towards more promising digital ventures, ensuring that investments are aligned with growth objectives and user demand.

Assets like the Austin American-Statesman, identified by Gannett as non-strategic, are classic examples of 'dogs' in the BCG Matrix. Gannett's decision to sell these properties signals a clear move away from businesses that no longer fit its long-term vision, aiming to streamline operations and boost financial health.

These divestitures are driven by the understanding that such assets possess low growth potential and offer minimal strategic advantage to the company's core operations. For instance, in 2023, Gannett continued its portfolio rationalization, with non-strategic asset sales contributing to its overall financial strategy, though specific figures for individual asset sales like the Austin American-Statesman are often bundled in broader financial reporting.

Traditional Classified Advertising

Traditional classified advertising, especially in print, is a classic example of a 'dog' in the BCG matrix. Its market is shrinking, with very little potential for future growth. This is largely because people now prefer digital platforms for finding jobs, selling items, or looking for services.

The shift to online has severely impacted this segment. For instance, in 2024, print advertising revenue continued its downward trend, with classifieds being a major contributor to this decline. Many legacy media companies have seen their classified ad revenue plummet by double digits year-over-year.

- Declining Market Share: Print classifieds have lost significant market share to online competitors.

- Low Growth Prospects: The segment faces minimal to negative growth expectations.

- Reduced Investment Returns: Investments in traditional classifieds yield very low returns, often negative.

- Strategic Focus: Companies often look to divest or minimize investment in this area to reallocate resources.

Legacy Operational Infrastructure

Legacy operational infrastructure, especially concerning print production and distribution, can be viewed as a 'dog' within the Gannett BCG Matrix due to its significant resource drain. These operations, while supporting current cash cows, are characterized by low growth potential and high associated costs if not actively managed for efficiency or reduction.

Gannett's strategic decisions, such as consolidating printing facilities and evaluating office space utilization, demonstrate a clear initiative to divest from these less efficient legacy assets. For instance, in 2023, Gannett continued its print facility consolidation, impacting several locations to streamline operations and reduce overheads associated with its legacy print business.

- Print Facility Consolidation: Gannett has been actively reducing its physical print plant footprint to cut down on high operational and maintenance costs.

- Office Space Optimization: The company is also reassessing its office space needs, moving towards more flexible and cost-effective work arrangements, reflecting a broader trend in the media industry.

- Cost Reduction Initiatives: These moves are directly tied to lowering the cost base of legacy operations, which are often burdened by aging technology and infrastructure.

- Focus on Digital Transition: By shedding these legacy burdens, Gannett aims to reallocate resources towards higher-growth digital initiatives, aligning with market shifts.

Gannett's 'Dogs' are assets with low market share and low growth potential, often draining resources without significant returns. These include underperforming print publications in declining markets and digital products with minimal user engagement. For example, certain niche content sites reported less than 10,000 monthly unique visitors in early 2024, incurring maintenance costs without substantial revenue generation.

The company's strategy involves divesting or minimizing investment in these 'dog' assets to reallocate capital towards more promising ventures. This includes selling non-strategic print properties, like the Austin American-Statesman, and phasing out legacy digital products. Traditional classified advertising in print, facing steep declines due to digital migration, is also a clear 'dog' category, with print ad revenue continuing its downward trend in 2024.

Legacy operational infrastructure, particularly print production and distribution facilities, also falls into the 'dog' category due to high costs and low growth potential. Gannett's consolidation of print facilities in 2023 exemplifies the effort to shed these inefficient legacy assets and reduce overheads.

The company's financial reports for 2024 indicate a continued focus on portfolio optimization, with strategic sales and closures of underperforming titles. This proactive management of 'dog' assets is crucial for improving overall financial health and enabling investment in growth areas.

Question Marks

Gannett's new digital content verticals, exemplified by Studio IX's focus on women's sports, are classified as question marks in the BCG matrix. These ventures operate in burgeoning markets with substantial growth potential, yet they currently hold a modest market share.

Significant capital infusion is necessary to foster audience growth and establish a strong market presence for these initiatives. For instance, in 2024, digital advertising spending in the sports sector saw a notable increase, indicating a favorable market environment for content like Studio IX.

The trajectory of these question marks hinges on achieving robust user engagement and implementing successful monetization plans. This strategic approach aims to transform them into future cash cows for Gannett.

Gannett's push to revitalize smaller newsrooms and launch new hyperlocal digital news projects falls squarely into the question mark category of the BCG matrix. While the demand for local news remains robust, securing a significant digital footprint and generating consistent revenue in these often-saturated local markets presents a considerable challenge, demanding considerable financial input and a well-defined monetization strategy.

These ventures boast considerable growth potential, reflecting the ongoing need for community-focused journalism. However, the inherent risks associated with building sustainable digital revenue streams in fragmented local markets cannot be overstated, making their long-term success uncertain without strategic execution and adaptation.

Gannett's question mark category highlights the potential in underserved niche digital audiences. While these segments represent a growth opportunity, their current low market share necessitates strategic investment and experimentation to identify effective monetization strategies. For instance, if Gannett can successfully develop specialized content and advertising packages for a niche like sustainable living enthusiasts or local history buffs, it could unlock new revenue streams.

New Digital Advertising Products and Technologies

Gannett's exploration into new digital advertising products and technologies, particularly those powered by artificial intelligence for enhanced targeting and operational efficiency, places them squarely in the question mark category of the BCG Matrix. The digital advertising market itself is experiencing robust growth, with global digital ad spending projected to reach over $700 billion in 2024. However, the success of these nascent Gannett offerings hinges on their ability to demonstrate tangible results and secure widespread adoption among advertisers.

These innovative products face the challenge of proving their value proposition in a competitive landscape. While the potential for AI-driven precision and cost savings is significant, initial investments in research, development, and market penetration are substantial. Without a clear path to significant market share, driven by advertiser buy-in, these ventures carry inherent risk.

- AI-Powered Targeting: Gannett is investing in AI to refine audience segmentation and ad delivery, aiming to improve return on ad spend for clients.

- New Ad Formats: Development includes interactive and video ad units designed for mobile-first consumption, targeting younger demographics.

- Data Analytics Platforms: The company is building tools to offer deeper insights into campaign performance, justifying the value of their digital advertising solutions.

- Market Acceptance Risk: Despite market growth, advertiser willingness to adopt unproven technologies is a key factor determining future success and market share.

International Digital Expansion (beyond Newsquest)

Expanding Gannett's digital presence into new international markets beyond its existing Newsquest operations in the UK presents a significant question mark within the BCG matrix. While these markets theoretically offer substantial growth potential, Gannett would be entering with minimal to no existing market share.

The challenges are considerable, including navigating diverse competitive landscapes and overcoming unique cultural nuances that impact consumer behavior and advertising effectiveness. For instance, a successful digital strategy in Germany might require a completely different approach than one in Brazil.

- High Growth Potential, Low Market Share: Emerging digital markets often exhibit rapid user adoption and revenue growth, but Gannett would likely start from a negligible position.

- Competitive and Cultural Barriers: Established local players and differing consumer preferences necessitate tailored strategies, increasing complexity and risk.

- Substantial Investment Required: Building brand recognition, localizing content, and establishing distribution channels demand significant capital outlay.

- Strategic Clarity is Crucial: A well-defined plan for market entry, scaling, and achieving profitability is essential for success in these uncertain ventures.

Gannett's investment in new digital content verticals, like Studio IX focusing on women's sports, and its efforts to revitalize smaller newsrooms and launch hyperlocal digital news projects are classified as question marks. These initiatives operate in high-growth potential markets but currently hold low market share, requiring substantial capital to build audience and revenue. For example, digital ad spending in sports saw a significant rise in 2024, indicating a favorable market for such content. The success of these ventures depends on effective monetization and user engagement to transition them into future cash cows.

Gannett's exploration of AI-powered advertising products and expansion into new international markets also fall into the question mark category. While the global digital ad market is projected to exceed $700 billion in 2024, these new products need to prove their value and gain advertiser adoption. International expansion presents opportunities but also significant challenges due to competition and cultural differences, demanding considerable investment and strategic planning.

| Initiative | Market Growth Potential | Current Market Share | Capital Requirement | Risk Factor |

|---|---|---|---|---|

| Digital Content Verticals (e.g., Studio IX) | High | Low | High | Medium |

| Revitalizing Small Newsrooms/Hyperlocal Digital | Medium to High | Low | High | High |

| AI-Powered Advertising Products | High | Low | High | High |

| International Market Expansion | High | Very Low | Very High | Very High |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from company financial statements, comprehensive market research reports, and industry-specific growth projections to provide a clear strategic overview.